About the Report:

Between April 11, 2025, and April 23, 2025, MetricsCart tracked 2123 Blink listings on Amazon. With a total monthly sales estimate of 5.17 million units, Blink is clearly a high-demand brand in the smart home security category. This report breaks down the top-selling products, pricing strategy, customer feedback, and key sales drivers for Blink on Amazon.

Introduction

The global smart home security market size is projected to grow from $33.20 billion in 2025 to $93.14 billion by 2032.

The market’s growth is driven by rising awareness and concerns about home security, as well as developments in connectivity and IoT technologies. Since homeowners can access and control their security systems via their mobile phones or tablets from any location, the demand for smart home security devices continues to grow.

Additionally, the rapid adoption of DIY solutions, driven by their ease of installation and affordability, also contributes to their growth. One of the top brands is Blink by Amazon.

It offers affordable, easy-to-install smart home security devices. Their product line includes indoor and outdoor cameras, video doorbells, and accessories, all designed for DIY setup and integration with Alexa.

Highlights

- The total monthly sales for these Blink products on Amazon are 5,169,200 units.

- Blink on Amazon has an average rating of 4.40 stars, based on a total of 28,628,210 ratings.

- The most rated Blink products are the Blink Mini cameras, with over 299,000 ratings.

- Most affordable products are the Blink Mini camera stand and USB cable, priced at $4.99.

Blink Products Records More than 10K Average Daily Sales on Amazon

A smart home security system is an automated unit that monitors all potential threats, including home invasions, break-ins, fires, floods, or other environmental disasters. As one of the top smart home security brands on Amazon, Blink records a total monthly sales of 5,169,200 units.

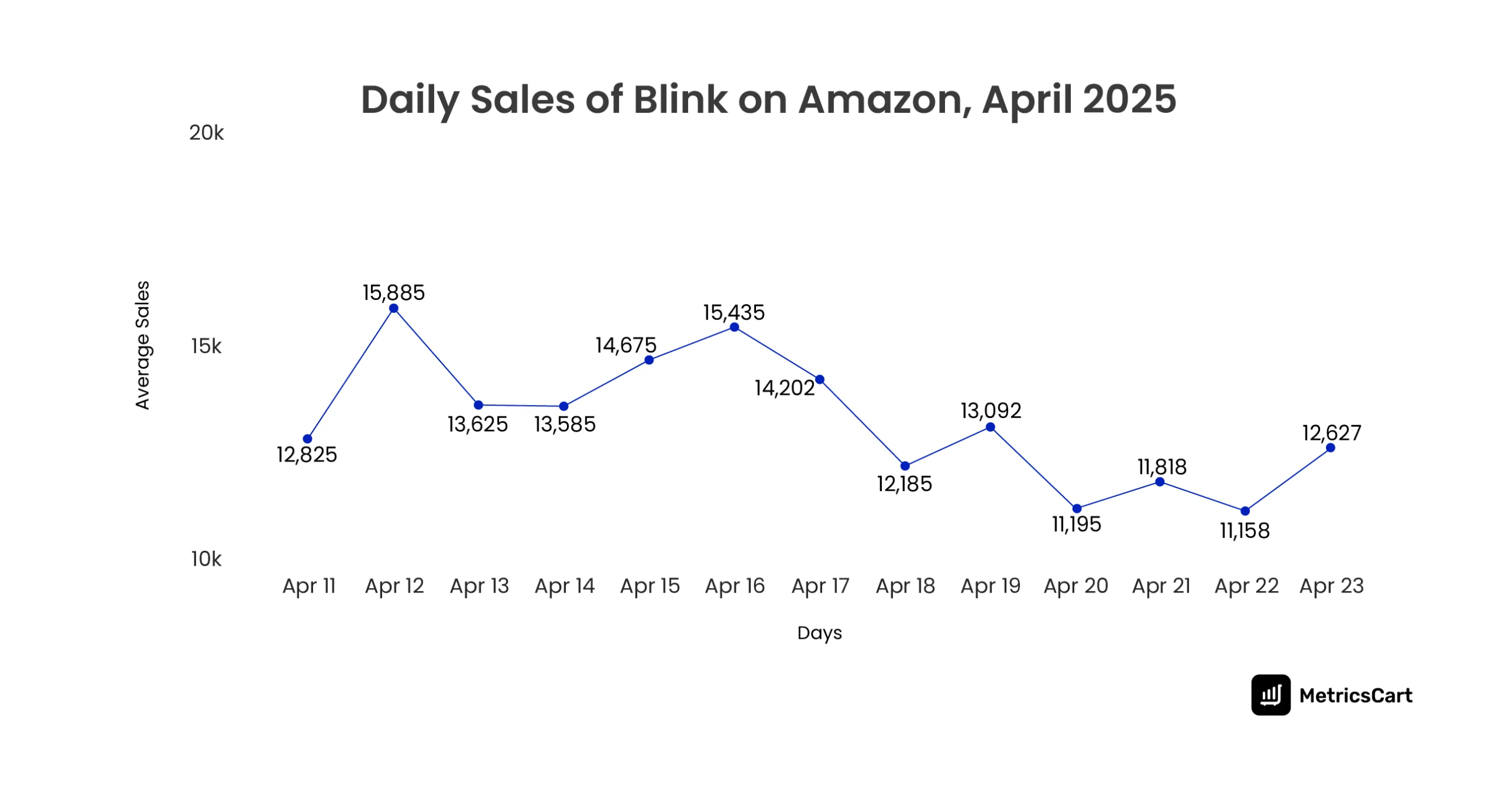

Let’s take a look at the daily sales of Blink on Amazon from Apr 11, 2025 to Apr 23, 2025.

According to MetricsCart data intelligence, the highest sales occurred on April 12 with 15,885 units sold. This is also the same day Blink had the highest product count at 190 units.

The lowest sales were on April 22 with 11,158 units. Overall, sales ranged between 11,158 and 15,885 units, with consistent demand throughout the period, though slight dips and peaks were observed on certain days.

Moreover, MetricsCart sales data analysis shows that Blink products with the Amazon Best Seller badge have the highest sales at 1,771,000 during the tracking period, followed by those with the Overall Pick badge at 499,000.

Products with the Sponsored badge have the lowest sales at 99,000, indicating that the Best Seller badge has the most substantial impact on sales.

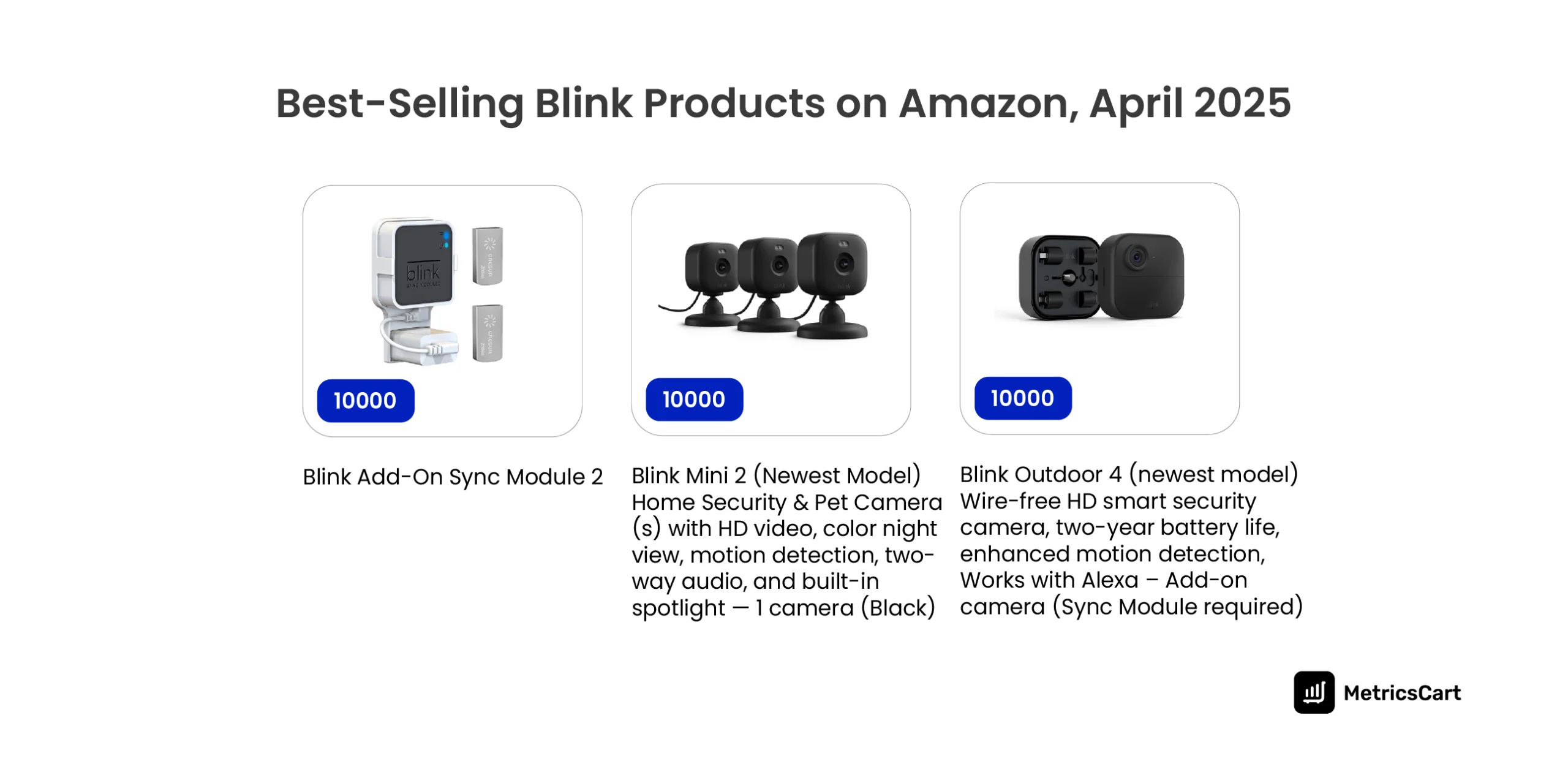

Blink Add-on Sync Module 2 and Blink Mini 2 Dominate Monthly Sales on Amazon

Now let’s look at the Blink products with the most sales on Amazon between April 11 and April 23, 2025.

The five highest-selling Blink SKUs, ranging from the Blink Mini 2 to multiple models of the Blink Outdoor 4, each recorded 10,000 monthly sales on Amazon.

The success of these SKUs can be attributed to a shared feature set: HD video, motion detection, two-way audio, long battery life, and Alexa compatibility. These core features resonate with consumers seeking reliable and connected home security solutions.

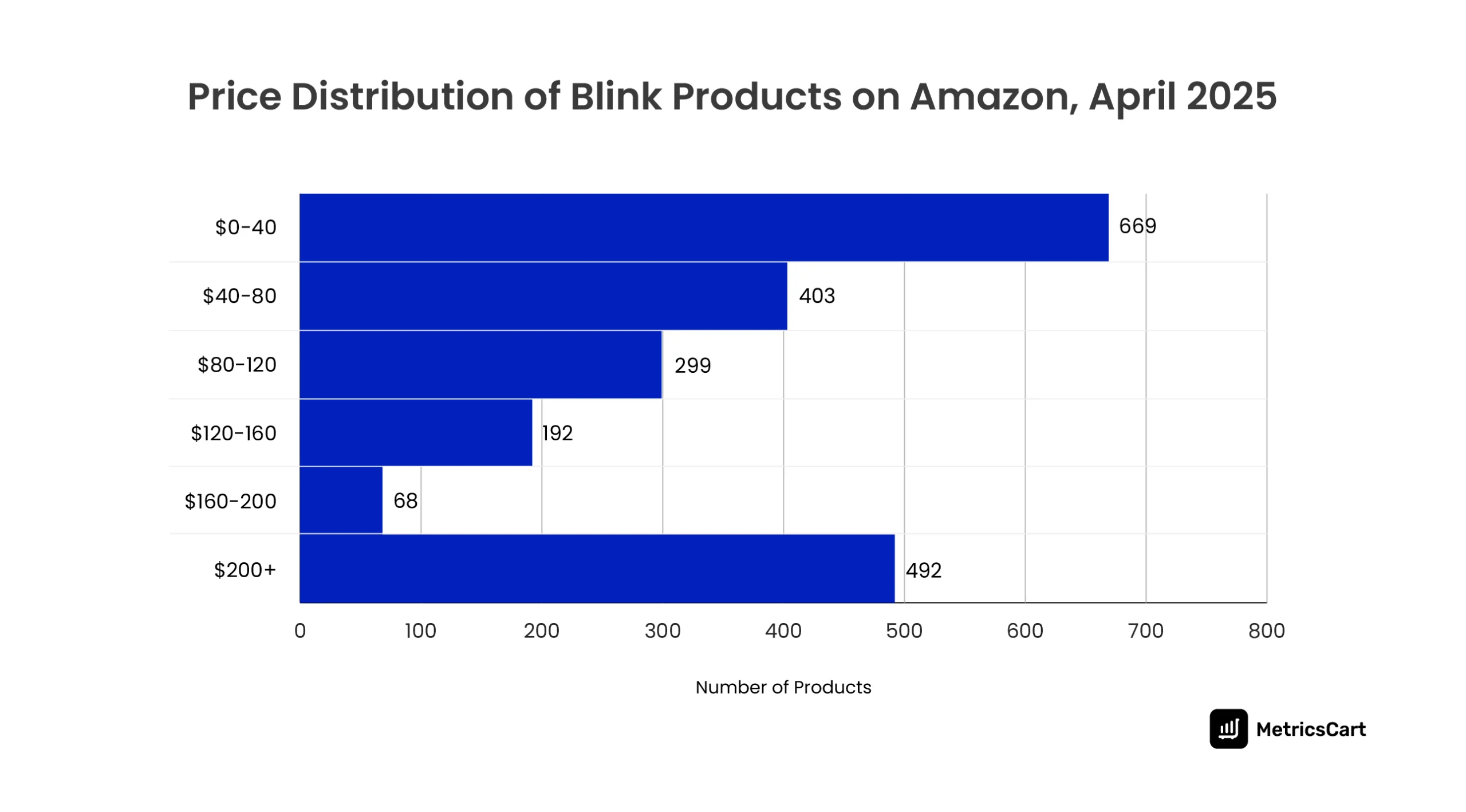

Price Trends of Blink Products on Amazon

The pricing landscape of Blink’s product assortment on Amazon skews heavily toward affordability, with a significant concentration in the $0–$40 range.

With 669 SKUs priced under $40, Blink clearly targets budget-conscious shoppers. This range includes accessories like mounts, stands, cables, and add-on devices that are essential for expanding or customizing a security setup.

The $40–$120 segment, typically where bundled cameras and home security kits are found, holds a moderate number of SKUs (702 in total). These are likely to be the primary revenue drivers, striking a balance between affordability and feature-rich offerings such as HD video, motion detection, and Alexa integration.

Finally, 492 products fall in the $200+ bracket, outpacing all other ranges except the lowest. This segment likely includes multipacks, high-end bundles, or price-inflated third-party listings.

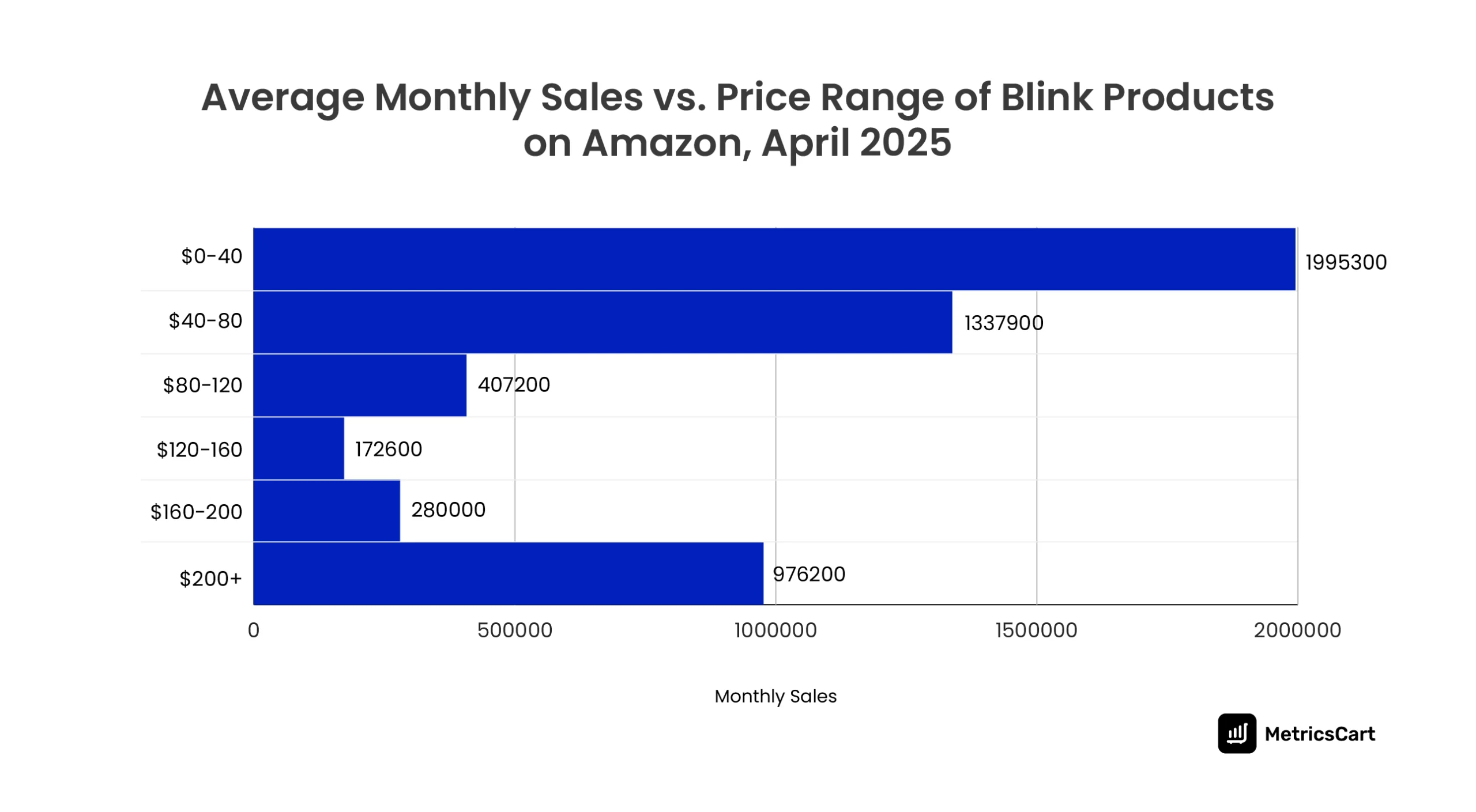

Blink Products with Less Than $40 Had the Highest Average Monthly Sales on Amazon

Blink’s product and pricing strategy hinges on a low-friction entry point, encouraging customers to start small and scale. By pairing high accessibility with wide brand recognition, they’ve built an ecosystem where accessories, add-ons, and premium bundles all contribute meaningfully to revenue.

With nearly 2 million units sold monthly, the entry-level tier ($0–$40) isn’t just wide in assortment (669 SKUs)—it dominates in sales. This includes accessories and low-cost standalone units, such as the Blink Mini, a customer favorite in the smart home category.

Products in this range average 1.3 million units in monthly sales, likely comprising single-camera bundles with enhanced features such as motion alerts and HD video. This shows Blink’s mid-range offerings are resonating with users seeking quality on a budget.

Surprisingly, products priced at $200 or more generate 976,200 units in monthly sales, despite being premium-priced. This suggests that multi-camera kits and full-home systems are still appealing to users upgrading their setups or investing in them for the long term.

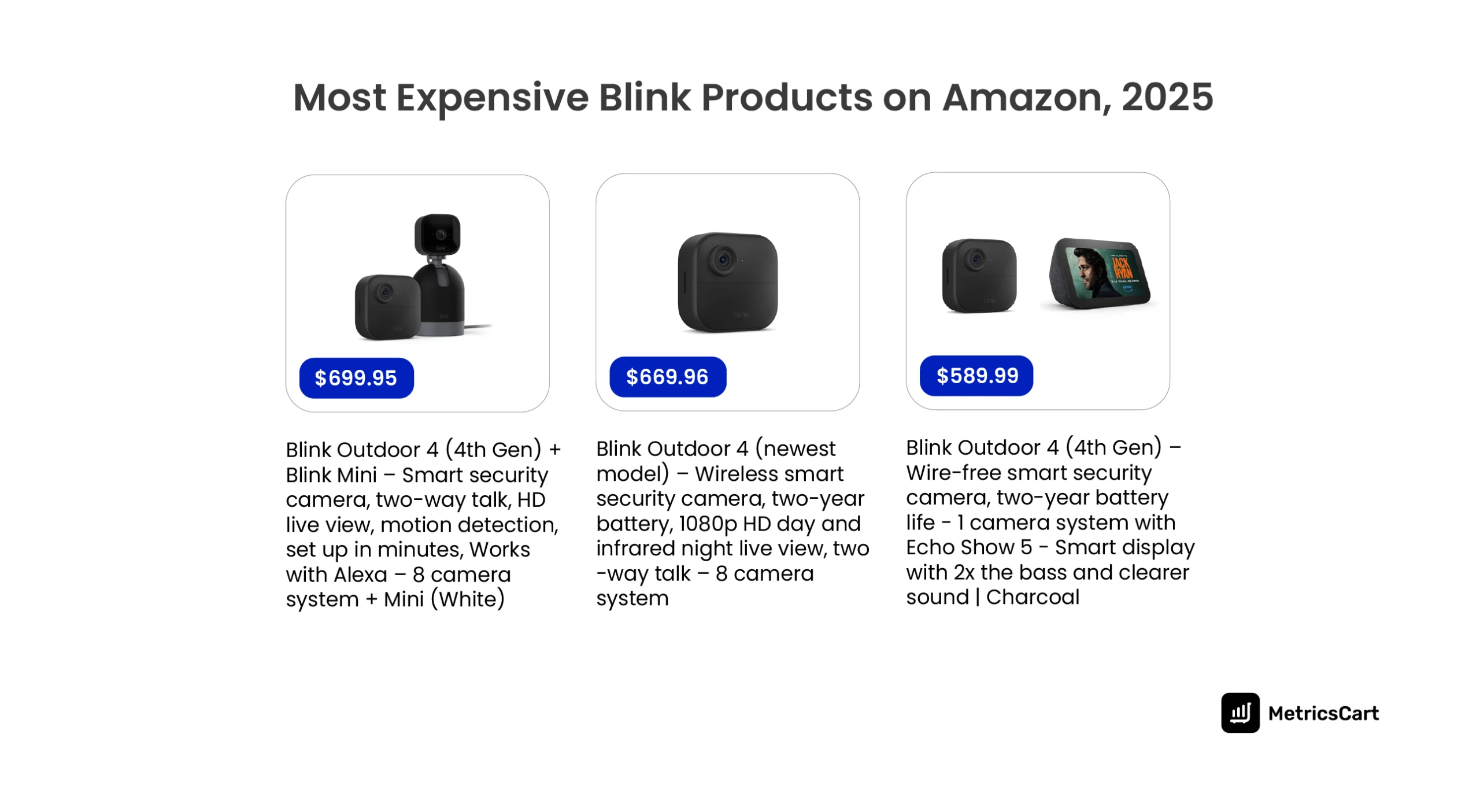

Blink Mini – Smart Security Camera is the Most Expensive Blink Product

The most expensive Blink product listed on Amazon is Blink Outdoor 4 (4th Gen) + Blink Mini – Smart security camera, priced at $699.95. This is followed by Blink Outdoor 4 (newest model) – Wireless smart security camera and Blink Outdoor 4 (4th Gen) – Wire-free smart security camera, priced at $669.96 and $589.99, respectively.

These are multi-camera bundles and hardware combos (with Echo Show 5), aimed at:

- Larger homes or businesses that need broader surveillance coverage

- Smart home enthusiasts who prefer seamless Alexa integration

Blink’s pricing strategy relies heavily on bundle pricing, offering multi-camera systems with smart home integrations at a discounted rate per unit. This not only increases perceived value but also encourages customers to make higher-order purchases in a single transaction.

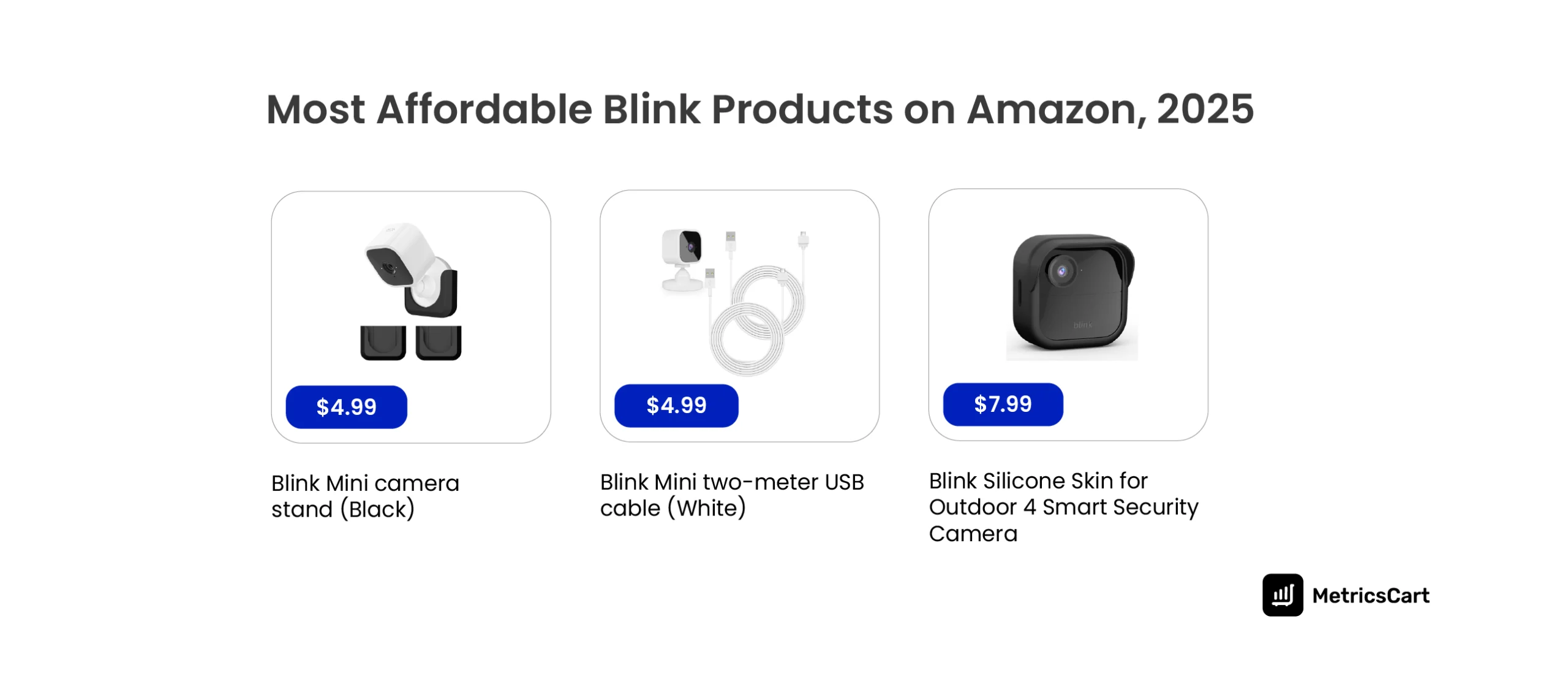

Blink Mini Camera Stand (Black) is the Most Affordable Blink Product on Amazon

Blink’s lowest-priced listings demonstrate how the brand builds an ecosystem around its core devices by offering affordable add-ons and accessories.

The lowest-priced Blink products on Amazon are the Blink Mini camera stand and the Blink Mini two-meter USB cable, both priced at $4.99 each. The third affordable product is the Silicon Skin for the outdoor 4 smart security camera, at $7.99.

These accessories are designed to support or enhance the main product (such as the Blink Mini camera) and are not intended to function independently. They’re priced low to encourage add-on purchases. Blink likely uses these products to drive repeat orders and attach rates.

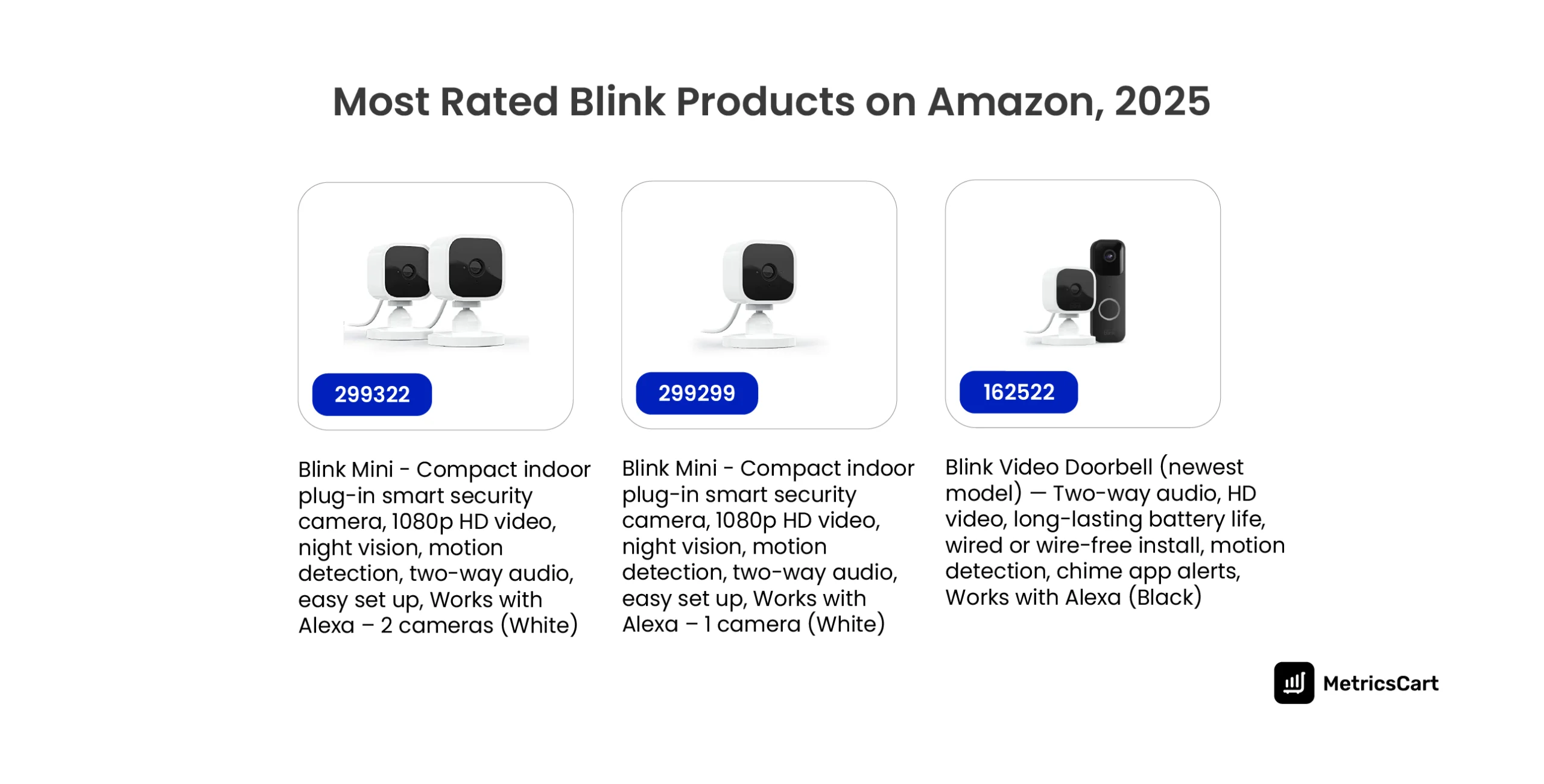

Blink Mini Compact Indoor Plug-In Smart Security Camera is the Most Rated Blink Product on Amazon

The Blink Mini indoor cameras lead the pack with nearly 300K customer ratings each, making them Blink’s most reviewed products on Amazon. The Blink Mini is Blink’s most affordable camera, featuring core smart features such as HD video, night vision, motion detection, and Alexa compatibility. That makes it a popular choice for first-time buyers.

Its consistently low price and compact design have helped the Blink Mini rack up high-volume sales, which naturally leads to more customer reviews.

Conclusion

Blink’s performance on Amazon demonstrates a well-balanced pricing strategy, pairing affordable accessories and entry-level cameras with higher-value bundles to appeal to a wide range of shoppers. Its top-rated and top-selling products reflect strong consumer trust, driven by smart pricing, reliable features, and Amazon-first visibility.

To compete in this space, brands must go beyond intuition and embrace data-driven insights. With MetricsCart’s digital shelf analytics, monitor real-time pricing trends, benchmark reviews, and track what drives sales on Amazon.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Want To Skyrocket Your E-Commerce Sales? Get the Best Digital Shelf Analytics Solution!