The promise of quick commerce is simple: tap now, get it in 10–20 minutes. For shoppers, it’s the most convenient way to buy essentials. For brand managers, retailers, and category heads, it’s a constant balancing act, keeping shelves stocked without slipping into costly overstocks.

To succeed in this ecosystem, accurate and efficient quick commerce stock monitoring is essential. When done right, it helps brands prevent outages, ride customer demand smoothly, and never miss out on those impulsive, high-intent purchases that make quick commerce most lucrative.

In this article, we’ll explore what quick commerce stock monitoring really means, why it’s such a game-changer, and which tools can actually help you stay ahead of the chaos.

What is Quick Commerce Stock Monitoring?

Quick commerce stock monitoring is the practice of tracking product availability, stock levels, and movement in near real time across hyperlocal fulfillment networks. Unlike traditional retail, where inventory might update daily or weekly, quick commerce demands updates by the hour or even the minute.

Think of it as a live dashboard that tells you:

- Which SKUs are running low

- Which items are overstocked and eating up dark-store space

- When competitor products go out of stock, giving you an opportunity to capture demand.

Benefits of Doing Stock Monitoring for Quick Commerce

Quick commerce stock monitoring isn’t just about counting what’s on the shelf. It’s about staying ahead of demand spikes, keeping costs under control, and knowing when to act before the customer notices a gap. Here are the key benefits of doing quick commerce data monitoring for your inventory.

Avoid Overstock/understock Losses

Stock imbalance is costly. Overstocking consumes limited warehouse space, ties up working capital, and often forces brands to discount just to clear inventory. For categories such as dairy, beverages, and fresh produce, the losses are even sharper because expired goods result in pure write-offs.

Understocking is equally damaging. In the US alone, retailers lose an estimated $144.9 billion in sales annually due to stockouts, according to the IHL Group. They also note that customers who experience stockouts are 40% more likely to switch brands for their future purchases, indicating that stockouts also impact customer retention.

Stock monitoring enables brands to strike a balance by forecasting demand more accurately and replenishing stock at the right pace. Think of an energy drink brand preparing for the IPL season. Instead of guessing and overloading stores, stock monitoring helps them plan better, send the right quantities, and avoid heavy discounts later.

Enhance Visibility

You can’t manage what you can’t see. Real-time monitoring gives brands a clear view of what’s happening across cities and stores. You can spot fast-moving SKUs, idle products, or even promotions that fail simply because the product isn’t available locally.

For example, if oat milk runs out midweek in Tier 1 cities, a live quick commerce stock monitoring dashboard will quickly surface this trend. That gives managers enough time to adjust supply before it becomes a recurring gap. This visibility also helps brands learn when demand peaks, when it slows down, and how local preferences shift. These are insights you’ll never catch in a monthly report.

Ensure Better Supplier Coordination

Quick commerce depends on tight supply chains. Stock monitoring tools provide early alerts, allowing suppliers to replenish products before they disappear from the shelf. This reduces emergency logistics costs and ensures stores stay stocked during peak hours.

It also improves collaboration. Suppliers know precisely when and where demand is rising, and brands avoid the blame game of missed deliveries. A grocery brand, for instance, can alert suppliers midweek if fresh produce is running low in metro stores, preventing weekend stockouts that frustrate shoppers.

Monitor Competitor Stockouts

Stock monitoring isn’t only about tracking your own products. It can also reveal opportunities when competitors stumble. If a rival’s energy drink is frequently sold out on weekends in Tier 2 cities, your brand can use that signal to push availability and promotions at the right time.

Competitor stockouts also serve as a signal of emerging demand patterns. If multiple rival brands in a category are consistently unavailable, it suggests the category itself is growing faster than expected. For example, if plant-based milk SKUs are frequently out of stock in metro stores, it’s a clear cue to ramp up supply before the trend becomes mainstream.

Read more | Benefits of Monitoring Out of Stock in E-Commerce

Tools and Technologies for Quick Commerce Stock Monitoring

Quick commerce platforms in India receive approximately 4 million orders daily. Manually tracking these orders is impossible.

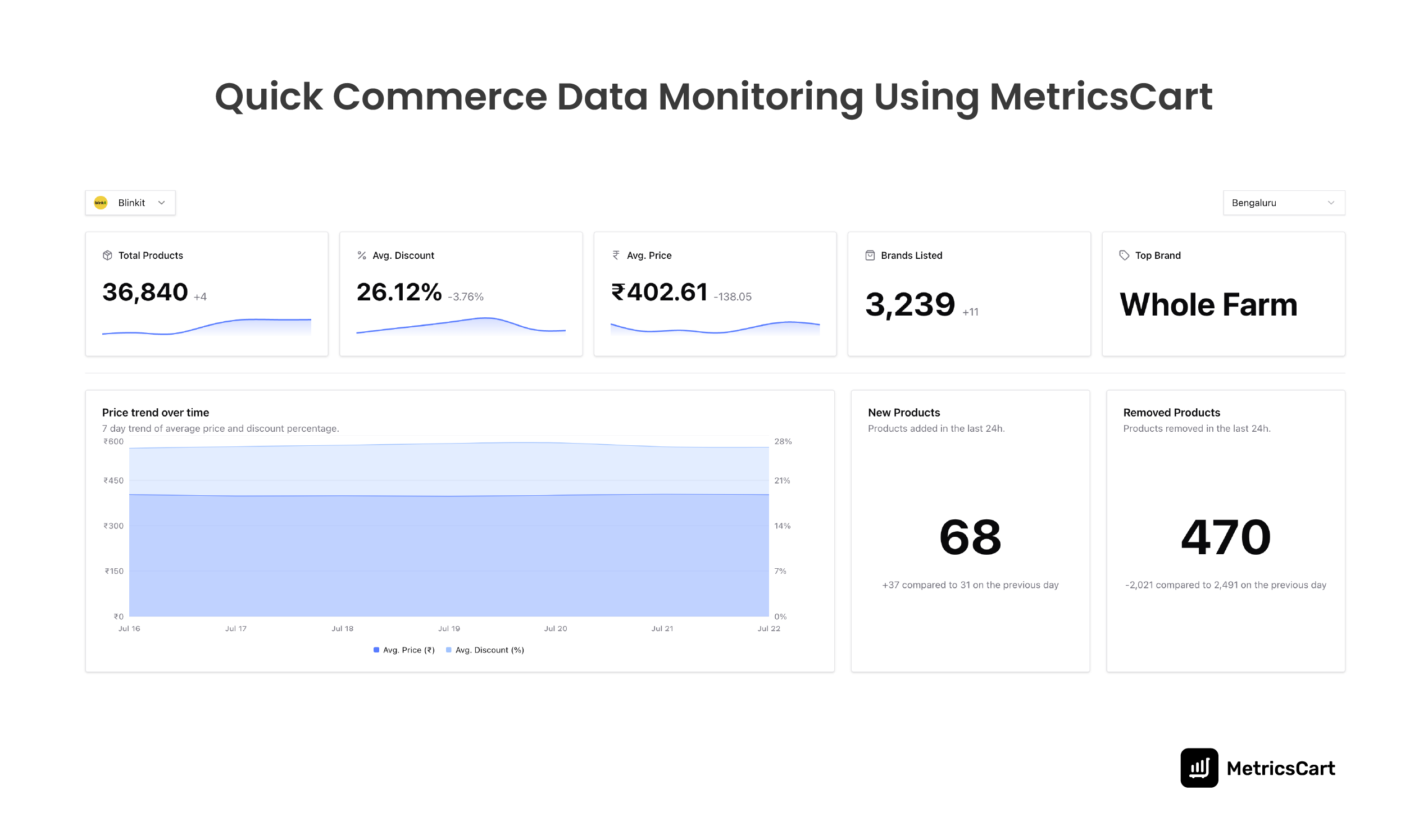

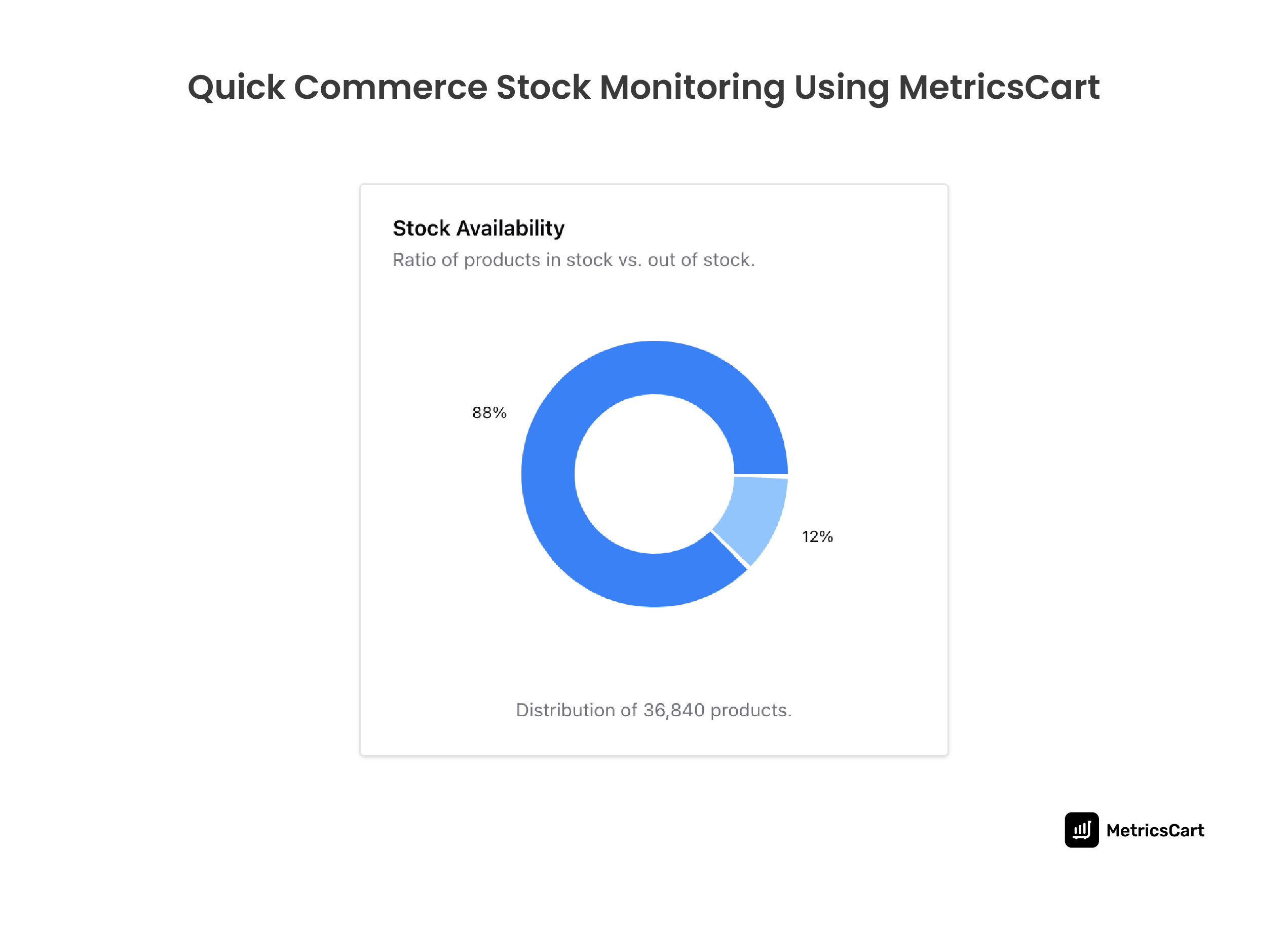

To efficiently and accurately monitor data, you need smart quick commerce monitoring tools like MetricsCart. This quick commerce data monitoring tool provides you with live, city-level visibility into stock levels, availability, and competitor movements across platforms such as Zepto, Blinkit, and Swiggy Instamart.

You can use MetricsCart to:

- Real-time SKU Tracking: Get real-time quick commerce stock alerts about which products are available and which are marked out of stock across all platforms and cities.

- Competitor Benchmarking: Track when rival SKUs go out of stock and identify opportunities for your brand to capture demand.

- Trend Detection: Identify daily and hourly demand shifts, such as beverage sales surging on weekends or dairy supplies depleting in the mornings.

- Actionable Insights: Turn monitoring into execution by feeding alerts directly into your supply chain planning, so replenishments happen before customers face empty shelves.

- Reduce Emergency Logistics Costs: With better foresight, avoid last-minute shipments that drive up transportation costs and strain supply chains.

- Enable Hyperlocal Planning: Demand in Mumbai differs significantly from demand in Jaipur. Use the real-time monitoring to fine-tune inventory city by city, avoiding a one-size-fits-all approach.

- Strengthen Category Strategy: Identify which categories are trending or slowing down to reallocate investments toward fast-growing categories.

Read more | 5 Best Quick Commerce Monitoring Tools in India

Here’s an example of how you can use MetricsCart:

Imagine you own a beverage brand and your flagship energy drink keeps vanishing from dark stores every Friday evening on Blinkit, Zepto, and Instamart. By Saturday morning, shelves are empty, and competitors take over weekend sales in cities like Bengaluru and Pune.

With MetricsCart’s stock monitoring, you’d see this trend clearly. The platform would flag that inventory dips sharply late on Fridays in Tier 1 cities. Instead of waiting until Monday to restock, you could adjust shipments and schedule replenishments on Thursday nights.

The impact would be immediate:

- Fewer weekend stockouts, keeping your products available during high-demand hours

- Stronger sales as weekend demand is captured instead of being lost to competitors

- Lower last-minute logistics costs since replenishments are planned in advance

- Happier customers who can consistently find your brand when they need it most

Over time, this kind of availability doesn’t just prevent losses, it builds trust and helps your brand stand out in a crowded quick commerce shelf.

Quick Commerce Stock Monitoring isn’t just a Backend Task

It is the front line of keeping customers happy and revenue flowing. Done right, it lets you spot demand spikes before they happen, restock smartly, and even step in when a competitor runs out.

Tools like MetricsCart make this easier by giving you live visibility into what’s actually happening across platforms and cities. At the end of the day, the brands that win in quick commerce are those that keep their shelves stocked when and where it matters most.

Make Smart Q-Commerce Decisions using MetricsCart.

FAQs

Quick commerce relies on speed. If inventory data updates only once a day, brands miss demand spikes and lose sales. Real-time stock monitoring provides accurate visibility across micro-fulfillment centers, enabling brands to avoid both overstocking and stockouts.

Hyperlocal demand varies city by city. Using tools like MetricsCart, brands can track SKU availability at a local level, align supply with specific neighborhoods, and prevent outages in high-demand zones without overloading slower stores.

Automated replenishment uses stock alerts and demand signals to trigger supplier orders before shelves go empty. For quick commerce, this reduces emergency logistics costs and keeps high-demand SKUs available during peak hours.

Best practices include monitoring real-time SKU availability, tracking competitor stockouts, coordinating with suppliers on replenishment cycles, and using AI-driven forecasting to optimize stock levels in dark stores.

AI-powered monitoring systems learn demand patterns, predict spikes, and balance stock across multiple fulfillment nodes. This reduces waste from overstocking and ensures shoppers always find products available when they need them.