The global non-alcoholic drinks industry is projected to grow to exceed $1.65 trillion by 2025, driven by health-conscious consumption, functional formulations, and premium positioning.

In the US alone, sales of non-alcoholic beer, wine, and spirits increased by 26% year-over-year, surpassing $800 million, underscoring the category’s shift from niche to mainstream.

Gen Z and younger millennials are leading the non-alcoholic beverage adoption, with more than 60% of Gen Z consumers preferring alcohol-free options in social settings, reshaping traditional drinking occasions.

The rise of “sober-curious” lifestyles, demand for cleaner labels, and a push toward mindful consumption are reshaping how brands approach product innovation and messaging.

This is where digital shelf analytics becomes essential. Tracking what consumers search, click, and buy online reveals early signals of demand shifts, ingredient trends, and format preferences.

In this blog, we’ll explore the key non-alcoholic beverages trends shaping the category and what brands can learn to stay ahead.

Rise of Non-Alcoholic Beverages: Key Reasons

The rise of non-alcoholic beverages in 2025 is the result of intersecting health, cultural, and demographic forces reshaping consumer behavior.

Health and Wellness Drivers

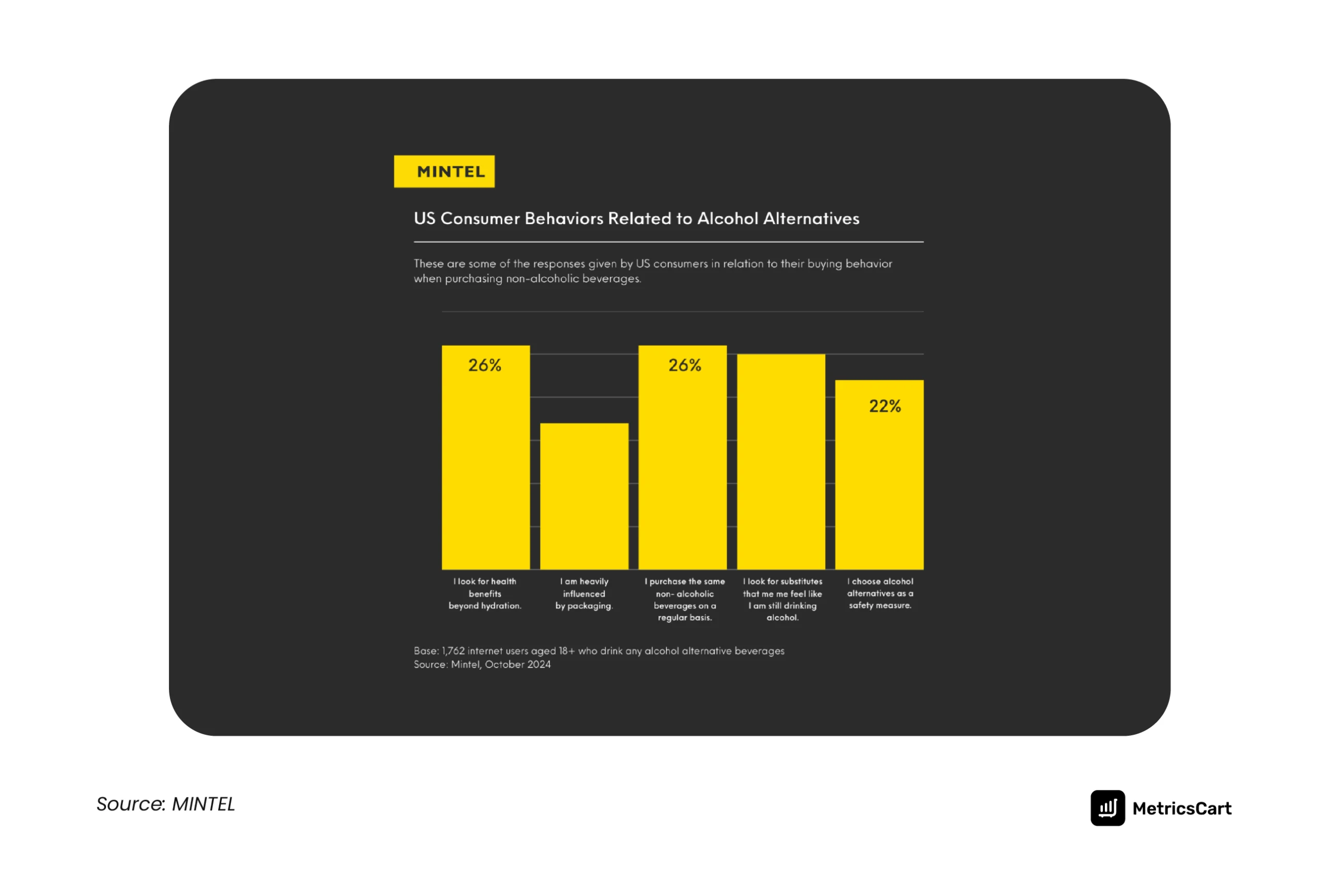

Health is the number one purchase driver in the non-alcoholic drinks industry. In the US, 41% of shoppers cite health benefits as the main reason for choosing alcohol-free options. This demand is pushing functional beverages into the mainstream.

Changing Preferences of Gen Z and Millennials

Gen Z and younger millennials are redefining social drinking. Only 39% Gen Z say alcohol is their go-to social drink, compared with 57% of Gen X. This generational gap highlights a cultural pivot away from alcohol as a default social lubricant.

Shoppers are experimenting with new formats like ready-to-drink functional sodas, sparkling teas, and plant-based alternatives.

Sober-Curious Movement

The “sober-curious” movement has moved from the margins into mainstream culture. More than 49% of US consumers say they plan to reduce alcohol consumption. Customers are trading up to sophisticated, well-crafted alternatives such as sparkling teas, functional mocktails, and craft zero-proof spirits.

Non-Alcoholic Beverage Trends of 2025

The non-alcoholic beverage category is evolving rapidly, driven by consumer demand for health, innovation, and premium experiences. Digital shelf data reveals not only what products are being purchased but also the non-alcoholic beverage industry trends shaping new launches, online visibility, and shopper engagement.

Growing Preference for Functional Ingredients

Consumers are increasingly expecting drinks to offer tangible health benefits, such as gut support, immunity, mental clarity, and stress relief. Brands that emphasize functionality are seeing strong adoption: for example, non-alcoholic beverages fortified with magnesium, ashwagandha, or CBD are capturing attention.

Functional ingredients are also driving trial among younger consumers, particularly Gen Z and millennials, who prioritize wellness benefits in their beverage choices.

Studies reveal that 68% of consumers are aiming to reduce sugar intake and are shifting towards zero-calorie and naturally sweetened beverages. Products such as Celsius and Alani Nu succeed due to their low/no sugar and calorie contents.

According to MetricsCart data analysis, Celsius is the most reviewed brand in the non-alcoholic beverages category on Amazon with 768,107 reviews, highlighting the growing demand for functional drinks.

Expansion of Alcohol-Adjacent Categories

Non-alcoholic beer, wine, and spirits are expanding rapidly, moving beyond early adopters to mainstream audiences. Non-alcoholic beer alone accounts for over 80% of total NA drink sales, while the non-alcoholic spirits segment is projected to reach $1.2 billion by 2034.

E-commerce platforms reflect this growth. Retailers report that non-alcoholic alternatives to premium spirits and cocktails now appear in top search results for alcohol-related queries, increasing visibility and trial.

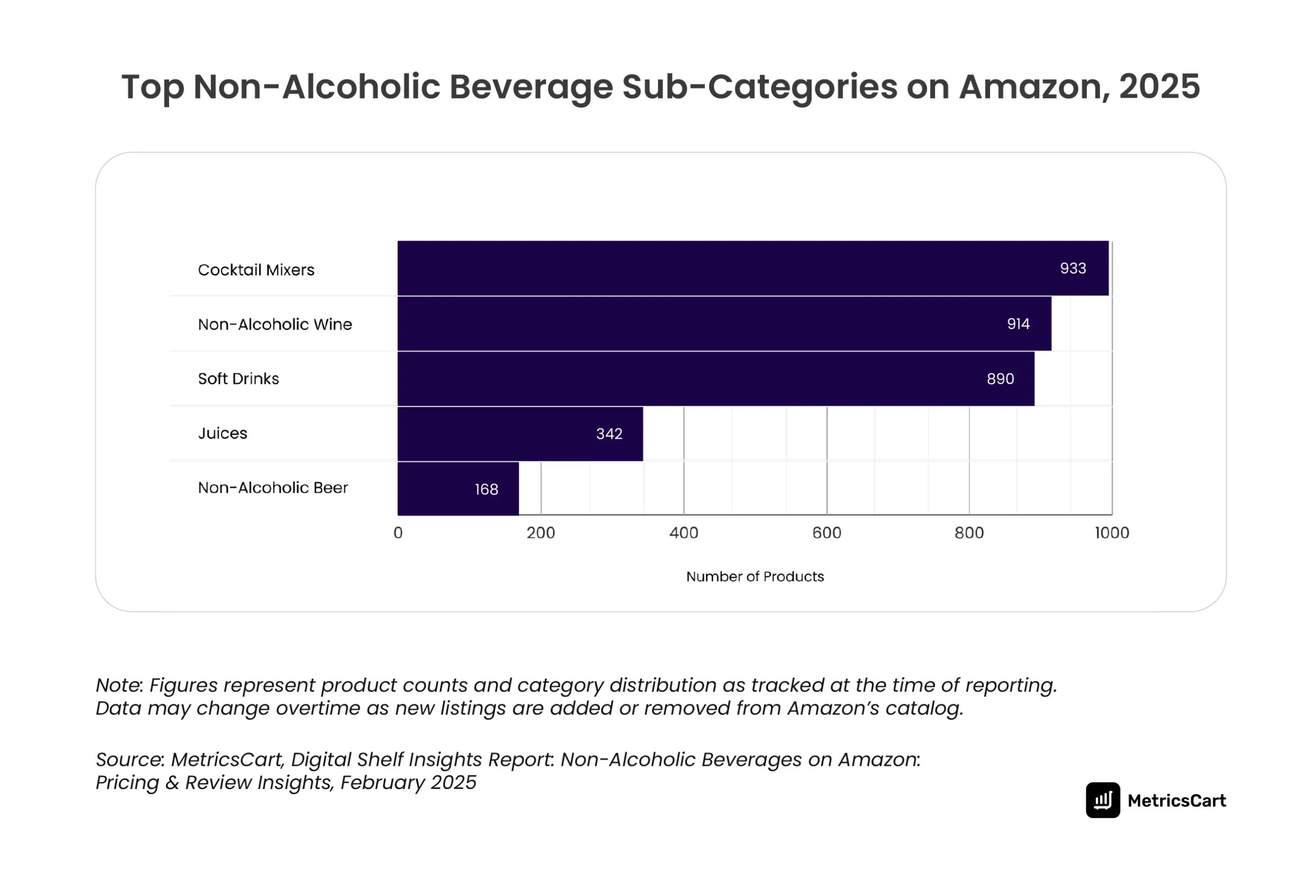

Moreover, in early 2025, cocktail mixers and non-alcoholic wine appeared as the top non-alcoholic beverage subcategory on Amazon.

This expansion demonstrates that consumers are not just seeking alcohol-free substitutes; they are demanding high-quality, category-equivalent options that replicate the social and sensory experiences of traditional alcoholic beverages.

Rise of “Mindful Drinking” and Alcohol-Free Lifestyles

The sober-curious movement and mindful consumption trends are shaping purchasing behavior. Globally, 55% of consumers plan to reduce alcohol intake, with Gen Z leading the shift. This has increased the demand for zero-proof cocktails, functional mocktails, and wellness-oriented sparkling beverages.

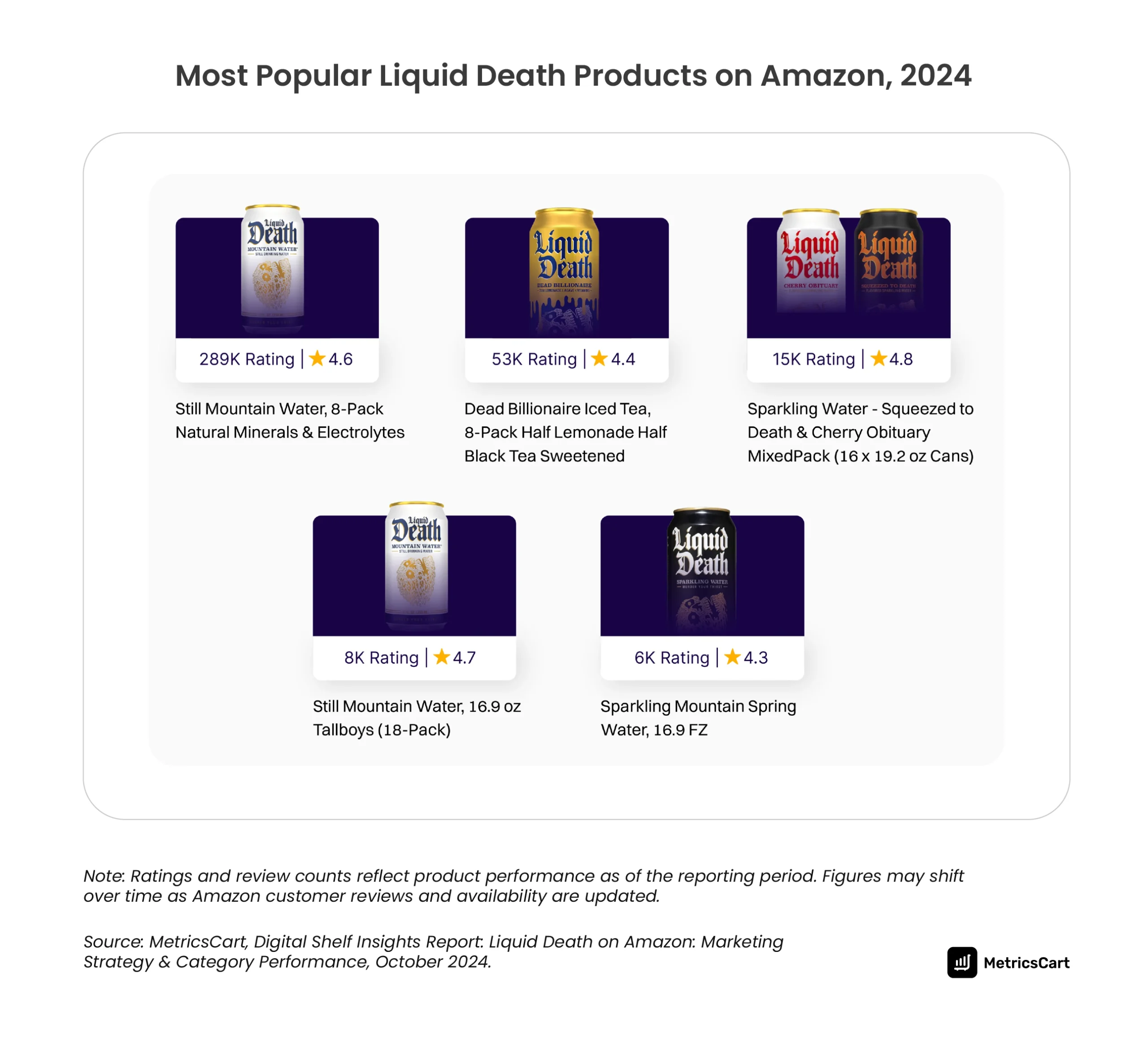

Brands that highlight moderation, balance, and functional benefits are resonating strongly with health-conscious and socially aware consumers. For example, Liquid Death, positioned initially as premium canned water, has captured the attention of Gen Z by combining edgy, irreverent branding with a purpose-driven ethos.

According to MetricsCart, Still Mountain Water, 8-Pack Natural Minerals & Electrolytes is the most popular Liquid Death product on Amazon, with 289K total reviews and an average rating of 4.6. Its marketing resonates with the sober-curious audience, offering a non-alcoholic alternative that is both socially shareable and aligned with wellness-conscious choices.

Premiumization & Sophisticated NA Spirits

Non-alcoholic beverages are increasingly positioned as premium experiences. Approximately 90% of non-alcoholic spirits are sold in premium or ultra-premium tiers, reflecting consumer willingness to pay more for elevated taste, packaging, and craftsmanship.

Sophisticated flavor profiles such as botanical blends, barrel-aged zero-proof spirits, and craft mocktails are gaining traction. Digital shelf monitoring shows that products with premium positioning often achieve higher visibility and conversion rates online, suggesting that quality and presentation are critical drivers of both trial and repeat purchase.

Demand for Plant-Based & Natural Ingredients

Plant-based and naturally derived ingredients are becoming essential differentiators in the non-alcoholic category. In addition, almost 52% customers now analyze product labels to avoid drinks with artificial sweeteners, preservatives, and colors.

Beyond traditional oat or almond milks, consumers are exploring beverages made from pistachio, barley, or botanical infusions like hibiscus and lavender.

E-commerce insights indicate that products highlighting natural ingredients and clean labels see higher engagement and review volumes. This trend aligns with growing consumer expectations for transparency, sustainability, and functional nutrition, making plant-based formulations a strategic avenue for both product development and marketing.

What Can Brands Learn from These Non-Alcoholic Beverage Trends

The non-alcoholic beverage industry in 2025 presents both opportunities and challenges for brands. Insights derived from digital shelf data, e-commerce trends, and consumer behavior reveal several actionable strategies to drive growth and maintain relevance.

- Prioritize Functional and Health-Forward Offerings: Evaluate your portfolio for opportunities to reformulate or highlight functional ingredients, emphasizing wellness benefits in both online and offline marketing channels.

- Capitalize on Alcohol-Adjacent Expansion: Invest in premium NA options that deliver a comparable sensory experience to alcoholic beverages. Monitor competitor launches and optimize product listings with keywords to improve discoverability.

- Align with Mindful Drinking and Lifestyle Trends: Position products around lifestyle narratives, balance, wellness, and moderation, and integrate these messages into social campaigns and e-commerce content to resonate with health-focused shoppers.

Conclusion

The rise of the non-alcoholic drinks market insights shows a fundamental shift in how people drink, socialize, and engage with brands. Health-focused innovation, shifts in generational preferences, and a cultural shift toward moderation have transformed the category from niche to mainstream.

Consumers aren’t simply looking for substitutes; they’re demanding functional, flavorful, and premium experiences that rival or even surpass traditional alcohol.

For brands, the key takeaway is clear: success in this category requires a strategic, data-informed approach. Leveraging digital shelf analytics software like MetricsCart allows companies to identify emerging trends, track competitor activity, optimize e-commerce visibility, and anticipate shifting consumer preferences.

By aligning product innovation, marketing, and portfolio strategy with these insights, brands can create offerings that resonate with modern consumers, particularly the socially aware, health-focused Gen Z and millennial audiences, driving the growth of sober-curious lifestyles.

Optimize your Product Portfolio for the Non-Alcoholic Beverage Boom.

FAQs

Health-conscious consumers, Gen Z adoption, the sober-curious movement, functional ingredients, and premiumization are the main drivers shaping category growth.

Consumers increasingly prefer drinks that offer tangible benefits like immunity support, gut health, stress relief, or mental clarity. Functional ingredients now appear in over 20% of new beverage launches.

Gen Z leads the sober-curious movement, with over 60% preferring non-alcoholic options in social settings, driving innovation and demand for functional, premium, and lifestyle-aligned products.

The sober-curious movement involves consumers choosing to reduce or abstain from alcohol for health, wellness, or lifestyle reasons. Gen Z and millennials are the primary drivers, seeking mindful drinking alternatives in social and daily settings.

The No-Lo market refers to beverages containing either zero or minimal alcohol. It includes non-alcoholic beers, wines, spirits, and ready-to-drink mocktails, catering to those who want the experience of drinking without the effects of alcohol.