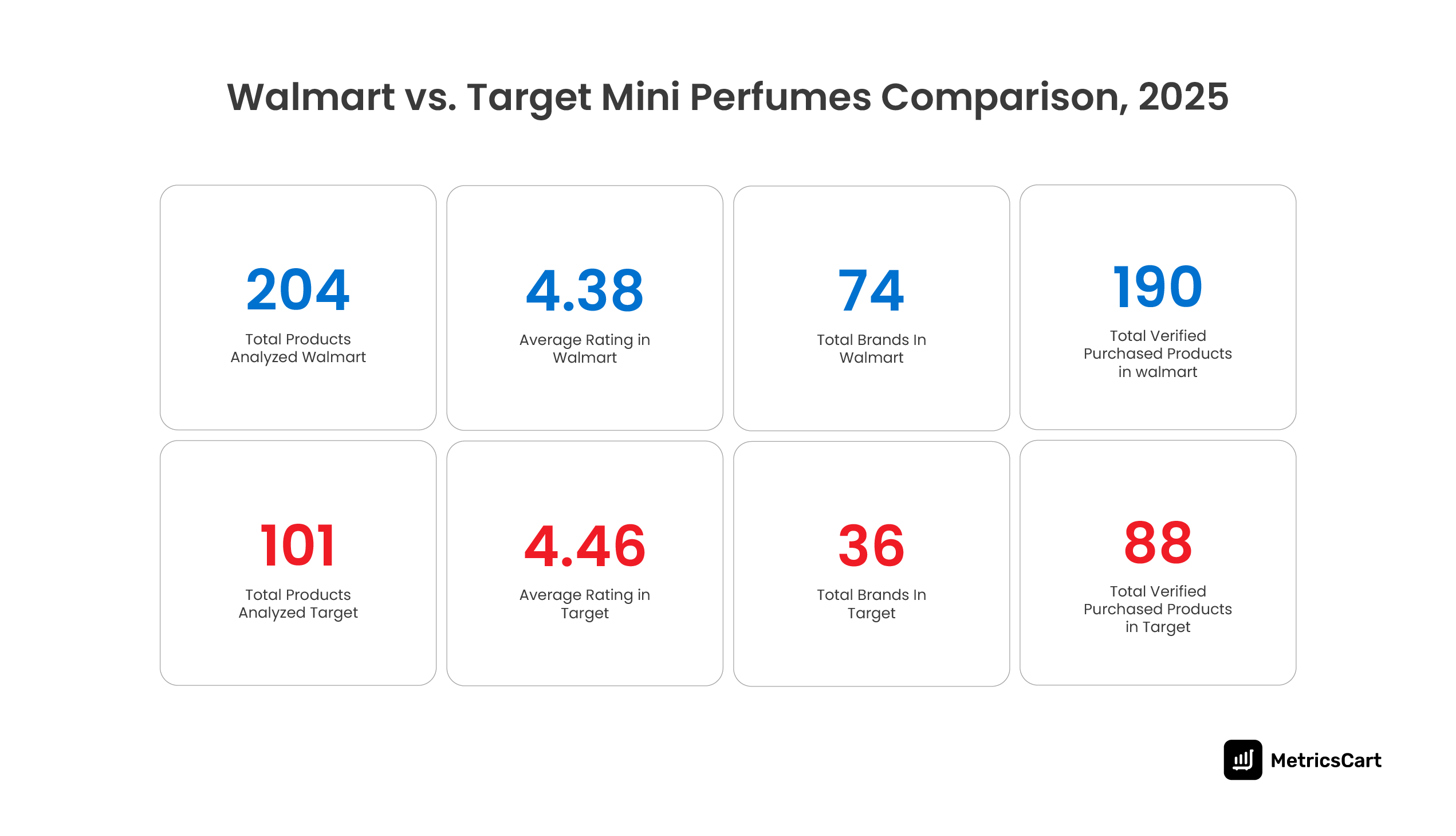

About the Report: This Digital Shelf Insights (DSI) report analyzes Mini Perfumes on Walmart and Target between September 22 and October 4, 2025. Across the study period, 204 mini perfumes were analyzed on Walmart and 101 on Target, covering 74 and 36 brands, respectively.

The report further delves into verified purchase reviews, top-rated and most upvoted products, and a sentiment analysis that highlights what truly drives consumer preferences.

Rise of Mini Perfumes in the Gifting and Travel Segments

Once viewed as an affordable luxury or travel essential, mini perfumes have become one of the fastest-growing segments of the fragrance industry. Compact, portable, and priced for experimentation, they appeal to a wide range of shoppers, from fragrance enthusiasts seeking variety to younger consumers exploring premium scents without committing to full-sized bottles.

As a result, the global mini perfume bottle market is projected to reach $22.63 billion by 2030.

For travelers, compact perfumes are a practical essential. TSA-friendly packaging, spill-proof designs, and long-lasting scents make them ideal for quick getaways or daily commutes. The same portability makes them a favorite in self-care kits and gifting bundles, especially during festive seasons and holidays.

Beyond convenience, mini perfumes also cater to the “try-before-you-buy” mindset. With premium fragrances often priced high, shoppers use these smaller bottles to experiment with new scents before committing to full-size purchases.

This has led brands to expand their travel-size and sampler collections, often pairing them with exclusive deals or limited-edition packaging to drive repeat purchases.

Retailers like Walmart and Target have capitalized on this trend by expanding their mini perfume assortments by offering everything from established brands like Bath & Body Works and Adidas to niche players like Dossier and NatureWell.

Highlights

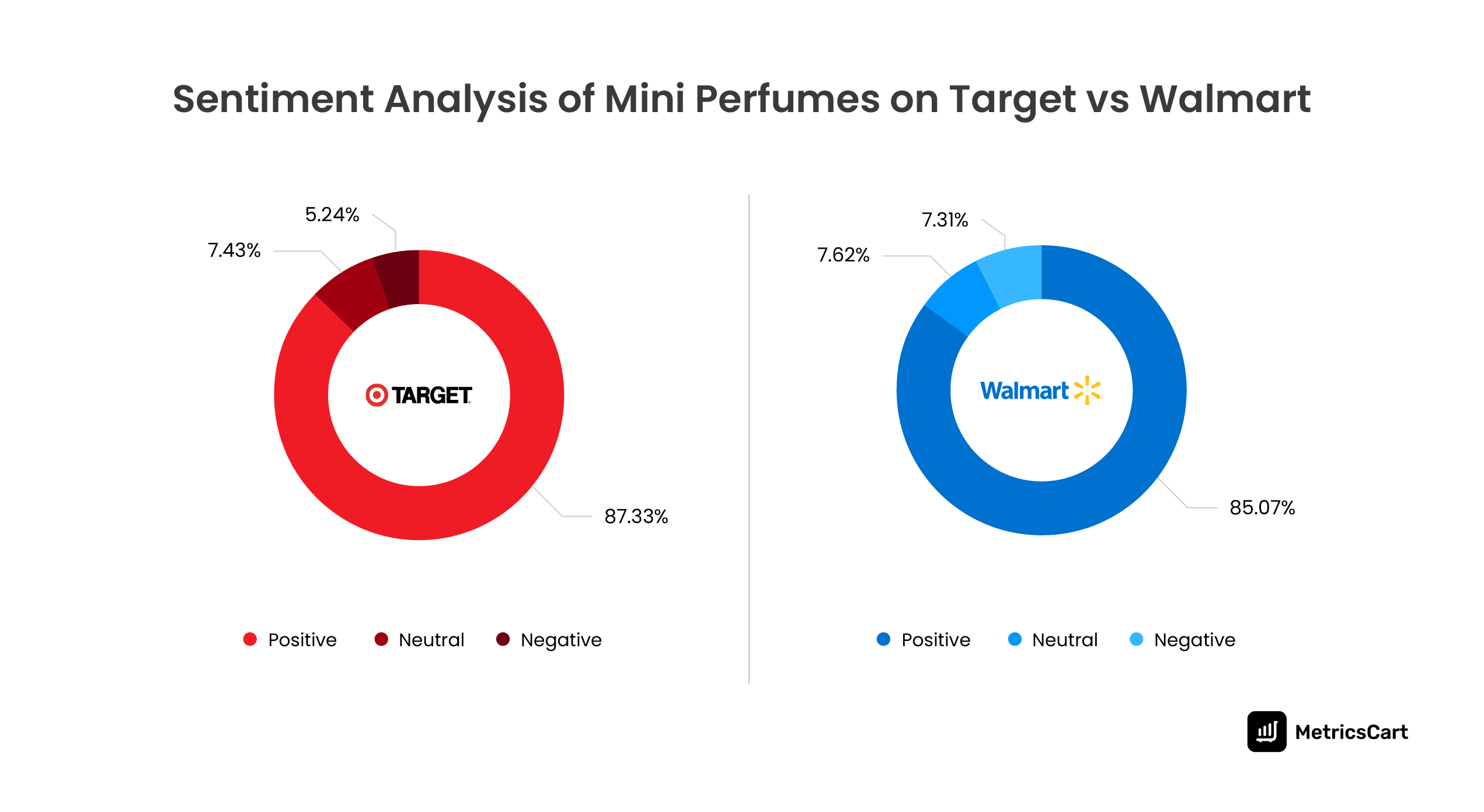

- Target shoppers showed stronger positivity with 87.33% positive sentiment, slightly higher than Walmart’s 85.07%.

- Finery leads Target’s assortment (16 SKUs), but Dossier and Sol De Janeiro achieve the highest satisfaction (4.8–4.6 ratings).

- Walmart has deeper assortment saturation from luxury brands like Versace (38 SKUs), though ratings vary significantly.

- NatureWell’s Blissy mist is the most upvoted mini perfume on Target, while Bath & Body Works dominates Walmart’s upvote charts.

- Themes like fragrance and value drive the bulk of conversations across both retailers, indicating price–scent performance drives conversion.

Mini Perfumes on Walmart and Target: An Overview

Between September 22 and October 4, 2025, the MetricsCart research team analyzed mini perfumes on Walmart and Target, uncovering notable differences in assortment size, customer engagement, and satisfaction levels.

Walmart featured a broader range of 204 mini perfume products spanning 74 brands, making it the most extensive marketplace in terms of selection. The platform also recorded 190 verified purchased products, suggesting strong transactional activity and brand discoverability.

However, despite its larger catalog, Walmart’s average rating was 4.38, slightly below Target’s. This indicates that while Walmart attracts higher product volume and visibility, customer satisfaction consistency varies across its listings, most likely due to a mix of premium and value-oriented brands.

In comparison, Target offered a smaller but more curated assortment, with 101 mini perfumes across 36 brands. Its average rating of 4.46 reflects higher consumer satisfaction, driven by a narrower selection of trusted or trending brands that closely align with Target’s audience preferences.

These findings point to a key distinction between the two retailers:

- Walmart leverages its broad assortment to reach a wide consumer base, including value-seeking shoppers.

- Target focuses on curated brand partnerships and higher satisfaction levels, appealing to a more quality-conscious demographic.

Understanding these differences helps brands determine where their products fit best and how review performance can influence sales. As competition in the mini perfume segment intensifies, ratings and reviews remain critical indicators of consumer trust, making continuous review monitoring essential for optimizing marketplace performance.

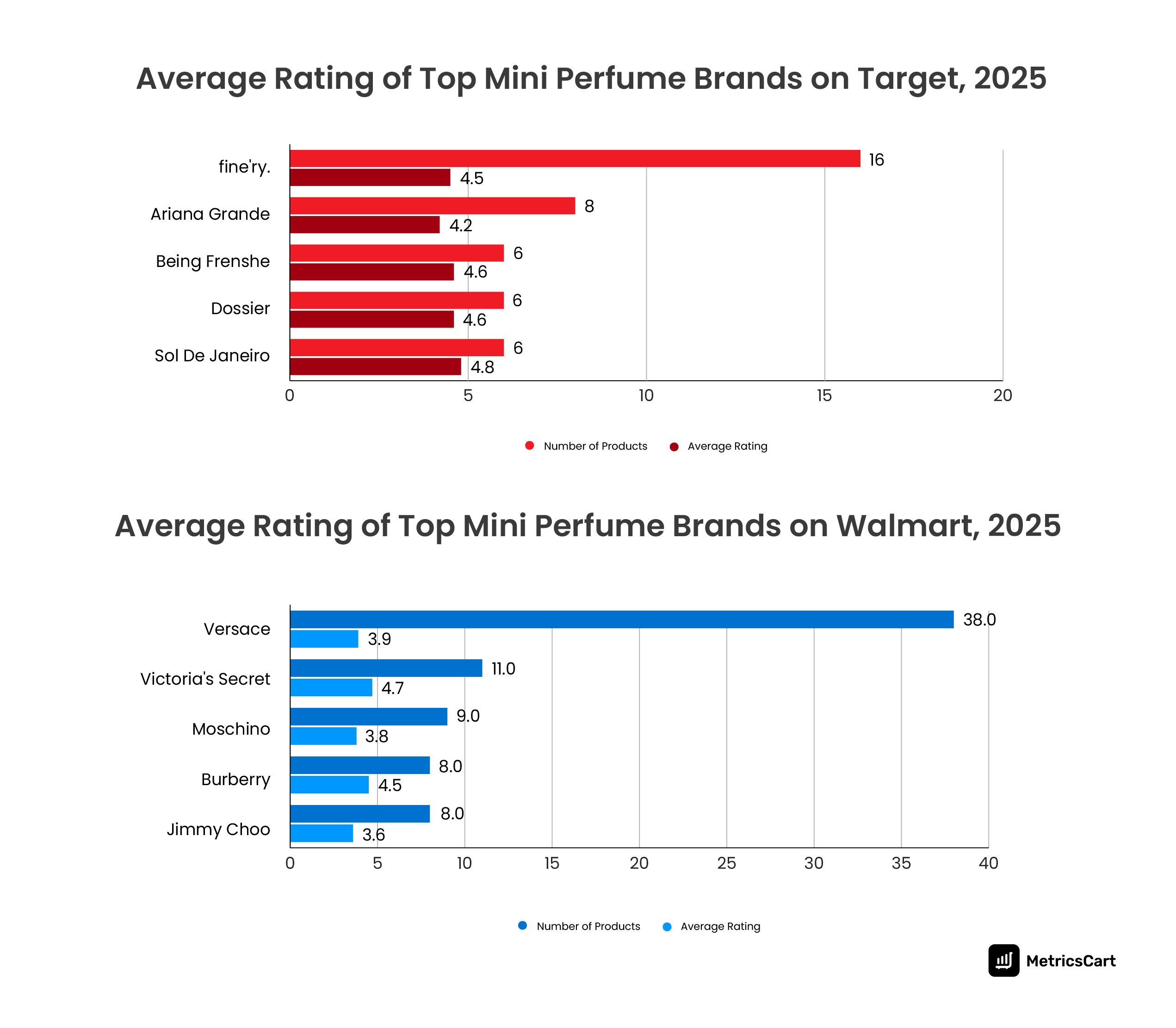

Walmart vs Target: Average Rating Comparison of Top Mini Perfume Brands

MetricsCart’s data experts analyzed the top mini perfume brands on Target and Walmart to identify the top-rated ones. Below are the findings of the study:

The top mini perfume brand on Target is Fine’ry, with 16 products, and a strong average rating of 4.5. For a brand carrying that many SKUs, holding ratings above 4.5 indicates that most launches are landing well with shoppers.

Ariana Grande ranks second in product count (8 products) but has an average rating of 4.2, suggesting mixed customer satisfaction despite wide availability.

This is followed by Being Frenshe and Dossier, each offering six products and enjoying a high average rating of 4.6. Across multiple SKUs, they maintain very high shopper satisfaction, a strong signal of clear targeting and product–promise alignment.

On Walmart, the pattern shifts. Versace is the volume leader with 38 mini-perfume products, but its average rating is only 3.9. It indicates a significant share of lukewarm or disappointed buyers across the portfolio. High brand equity alone is not translating into uniformly strong mini-format experiences.

Victoria’s Secret, with 11 products and an impressive 4.7 rating, shows how a focused assortment can outperform larger portfolios on perceived quality. Moschino (9 products, 3.8 rating) and Jimmy Choo (8 products, 3.6 rating) both reflect more polarized performance, where some SKUs may delight while others pull down the average.

This Walmart vs Target mini-perfumes comparison suggests that Target’s category structure encourages greater consistency across brands, whereas Walmart’s deeper, designer-led assortment introduces greater variability.

READ MORE | Decoding Consumer Behavior at Walmart: A Seller’s Perspective

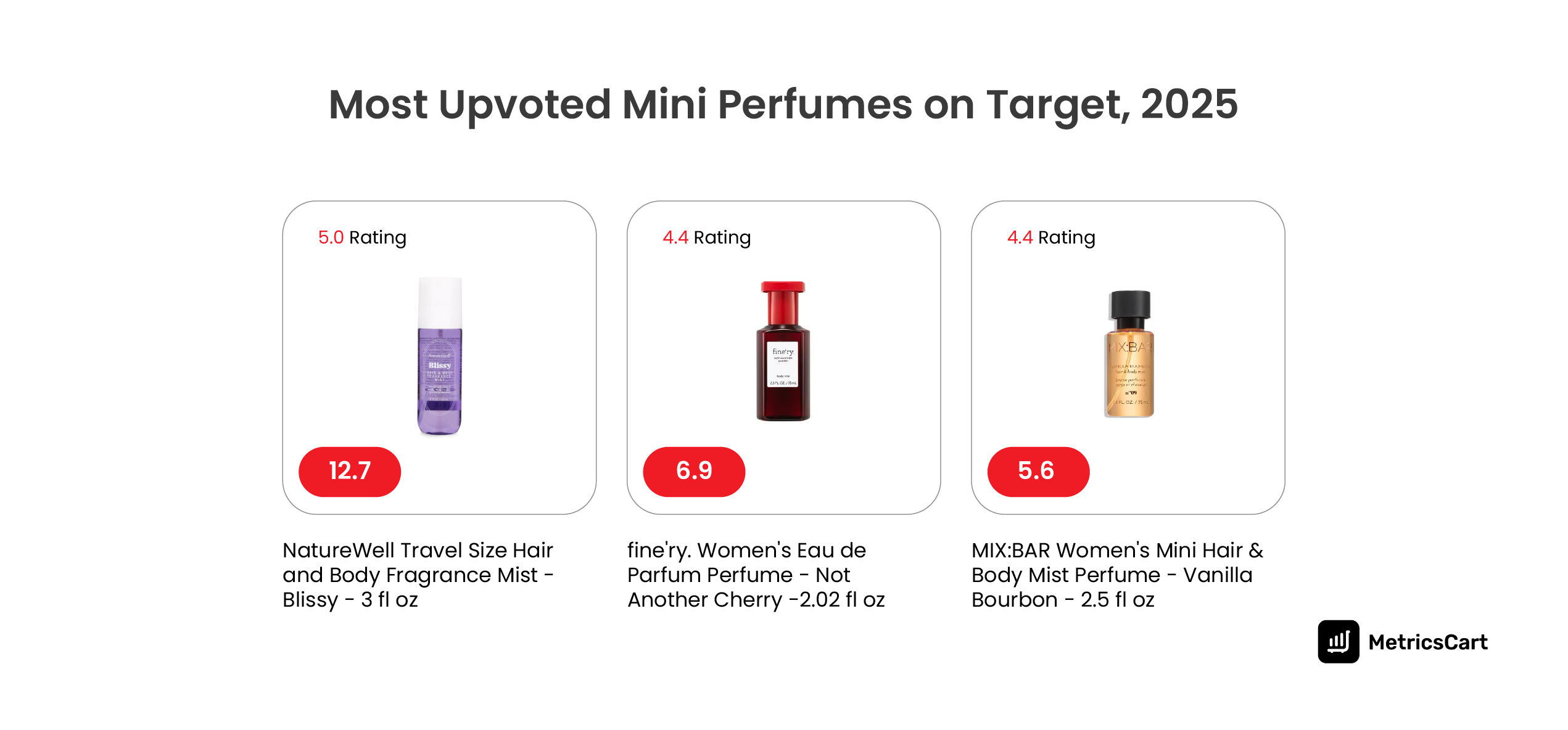

NatureWell Travel Size Body is the Most Upvoted Mini Perfume on Target

Within Mini Perfumes on Target, NatureWell’s Travel Size Hair and Body Fragrance Mist – Blissy is the clear engagement winner. It has 12.7 upvotes with a perfect 5.0 rating. It signals not just one-off delight but strong advocacy: buyers are not only satisfied; they are willing to endorse the product.

Its popularity can be attributed to:

- Multipurpose use (hair + body mist appeals to convenience-driven shoppers).

- Clean ingredients and travel-friendly packaging align with Target’s wellness-oriented audience.

- Affordable pricing and accessibility, which help drive repeat purchases and positive reviews.

The combination of practical utility and strong fragrance performance positions NatureWell as a consumer favorite in the mini perfume category on Target.

Several Fine’ry fragrances, such as Not Another Cherry, Magnetic Candy, and Before the Rainbow, appear multiple times among the top upvoted products, each averaging 4.3–4.6 ratings and strong upvote counts.

Products with more upvotes generally align with strong emotional appeal or perceived value, even if not always the highest-rated.

Bath & Body Works Luminous Spray is the Most Upvoted Mini Perfume on Walmart

On Walmart, Bath & Body Works is the engagement engine for mini perfumes. The Luminous Mini Perfume Spray (3.2 oz travel size) leads with 9.3 upvotes and a 4.2 average rating. That rating is solid rather than stellar, but combined with top engagement, it shows strong pull and repeat interest.

Other high-performing Bath & Body Works minis include:

- Calypso Clementine Perfume Spray (2.3 oz) with 6.2 upvotes and a 4.8 rating – a standout mix of high satisfaction and strong engagement.

- Mini Perfume Gingham Fresh with 4.6 upvotes and a 4.5 rating, again signalling consistency in shopper delight.

Where Target’s high-engagement items skew toward modern and indie fragrance narratives, Walmart’s upvoted products lean into familiar, accessible fragrance experiences from a mass-premium brand with strong offline recognition.

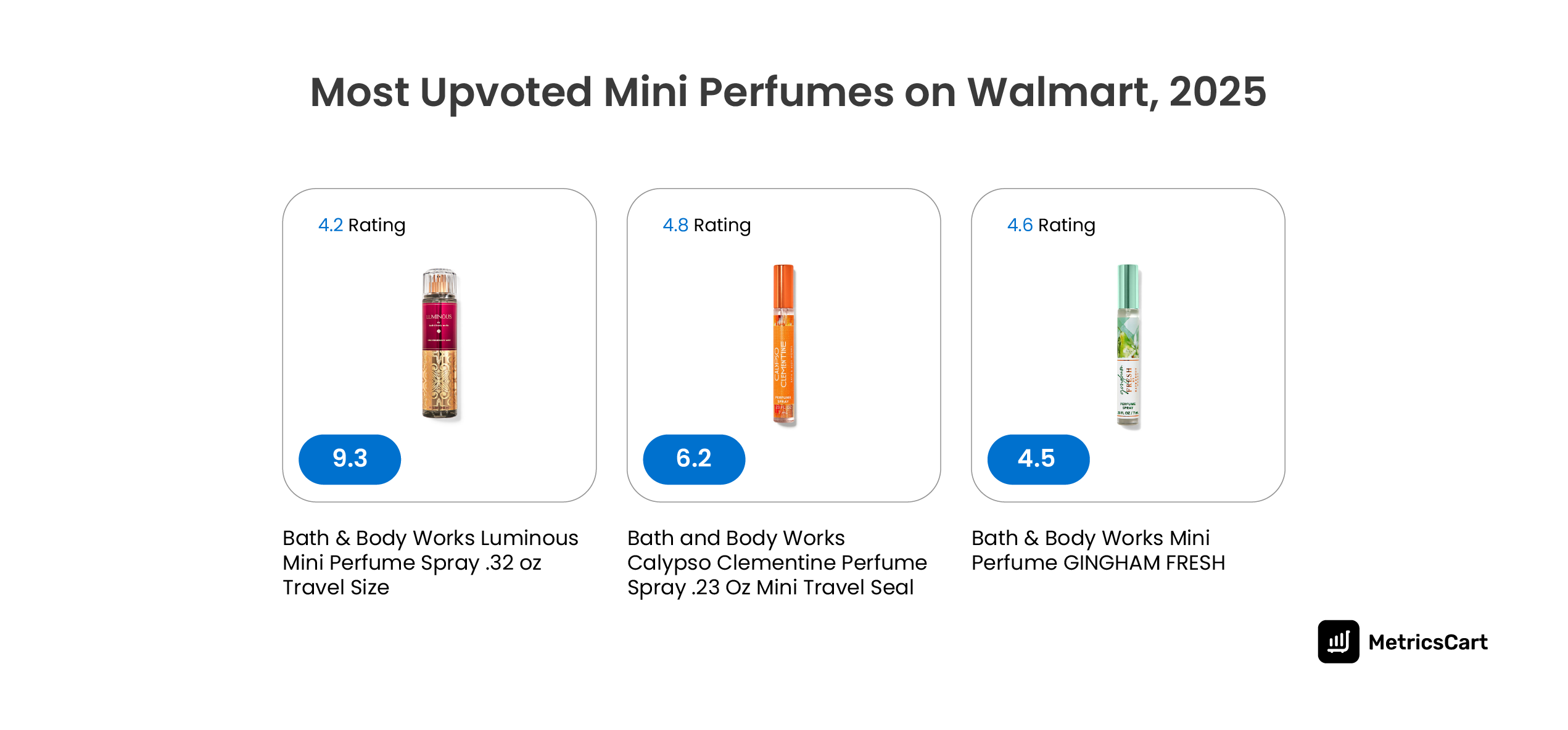

Dossier IT Factor Perfume and Women’s Perfume are the Top-Rated Mini Perfumes on Target

When we look at the top-rated mini perfumes on Target, a different pattern emerges – one that is less about raw engagement and more about pure satisfaction.

MetricsCart research team found that the highest-rated mini perfumes on Target, all at a 5.0 average rating, include:

- Dossier IT Factor Perfume – 50ml

- Dossier Women’s Perfume – Ambery Vanilla – 50ml

- Giorgio Armani My Way Eau de Parfum – 0.5 oz

- Jo Philippe So Smoochie Eau de Parfum – 10 ml

- NatureWell Blissy Hair and Body Mist – 3 fl oz

For an e-commerce seller, these 5.0-rated SKUs are your “proof points” in Mini Perfumes on Target. They show which product attributes and propositions are resonating perfectly with shoppers: familiar yet modern scent profiles, clear value narratives, and formats that match how people actually use fragrance (travel, layering, top-up during the day).

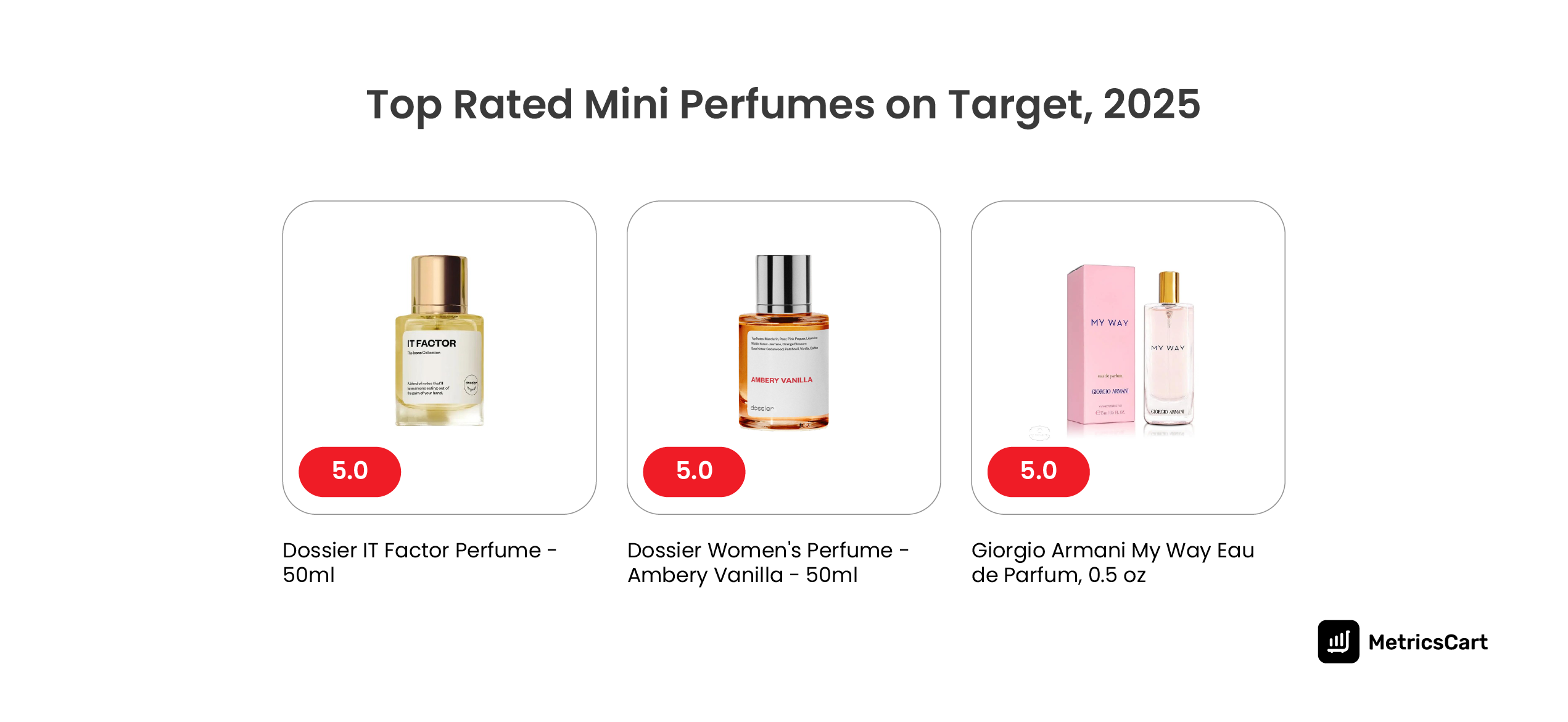

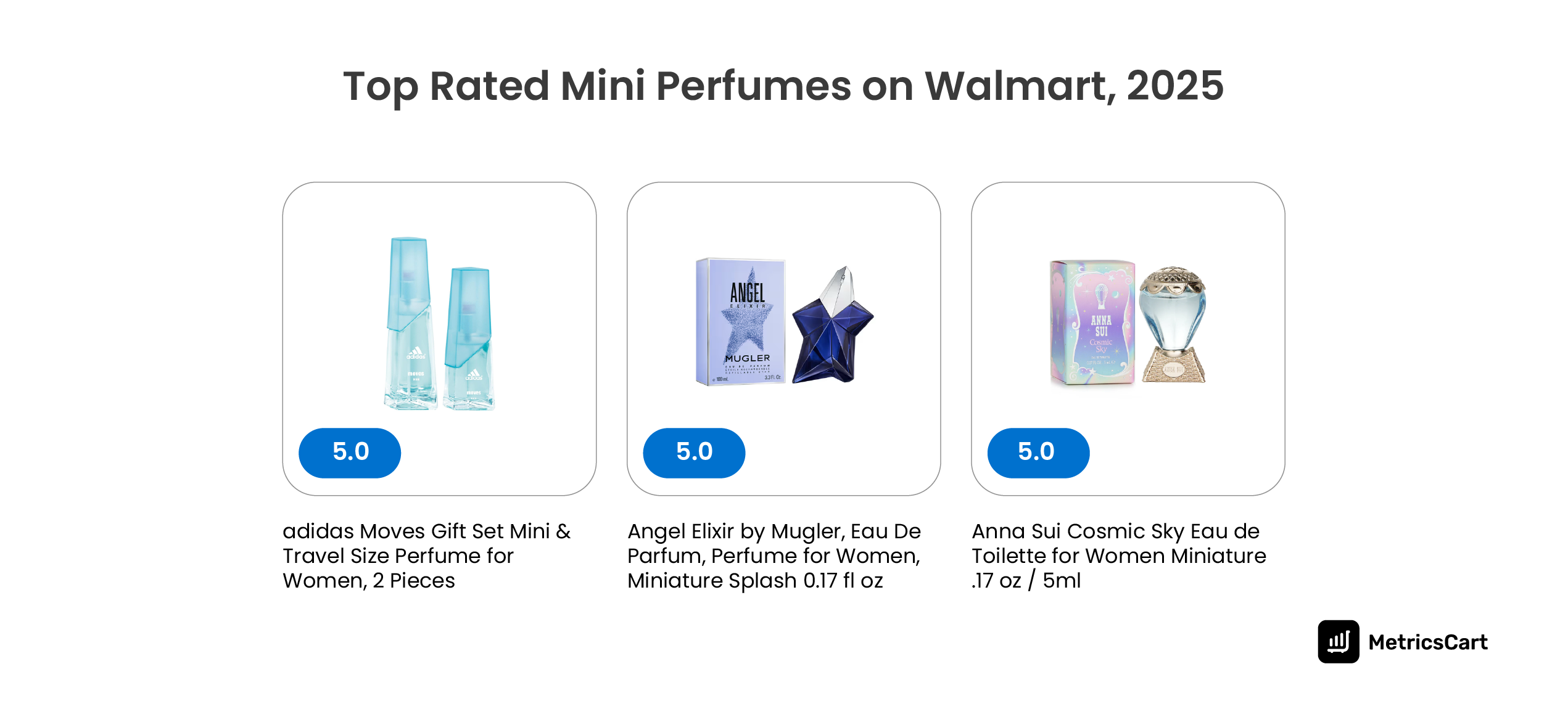

Adidas Moves Gift Set Mini and Angel Elixir are the Top Rated Mini Perfumes on Walmart

The top-rated mini perfumes on Walmart – all holding 5.0 ratings – form a different mix:

- Adidas Moves Gift Set Mini & Travel Size Perfume for Women (2-piece)

- Angel Elixir by Mugler, Eau de Parfum, mini splash 0.17 fl oz

- Anna Sui Cosmic Sky Eau de Toilette mini 0.17 oz

- ANNE KLEIN Women’s Perfume Splash Mini (rare)

- Boucheron Jaipur Bracelet Eau De Parfum mini

Here we see strong performance from a sportswear brand (Adidas), high-fashion and niche fragrance (Mugler, Anna Sui), a heritage fashion label (Anne Klein), and classic jewellery-house fragrance (Boucheron). For Walmart shoppers, the common theme is premium or distinctive brand stories compressed into accessible mini formats.

These products are a reminder that on Walmart, minis are not just add-ons to basket-building, they are a way for shoppers to access aspirational brands at lower absolute price points. For brand managers, holding a 5.0 rating in Mini Perfumes on Walmart is a strong indicator that your fragrance story, packaging, and perceived value are all working well for this audience.

READ MORE | 7 Tips to Increase Product Reviews in E-Commerce

Sentiment Analysis of Mini Perfumes on Target vs Walmart

The customer sentiment analysis conducted by MetricsCart on mini perfumes across both marketplaces reveals that consumer perception is mainly positive, with shoppers expressing satisfaction with fragrance quality, value for money, and packaging. However, subtle differences between Target and Walmart highlight variations in customer experience and brand positioning.

Target’s mini perfume reviews have a strong positive sentiment of 87.33%, the highest between the two retailers. Only 5.24% of reviews are negative, underscoring high customer satisfaction and strong alignment with audience expectations.

This positivity can be attributed to a curated brand selection that aligns with Target’s wellness and aesthetic positioning, and to a focus on modern, clean, and sensorially pleasing products that cater to younger consumers seeking affordable self-care luxuries.

Walmart maintains a strong positive sentiment of 85.07%, but also shows a higher negative sentiment (7.31%) compared to Target.

The broader assortment, spanning 204 products across 74 brands, likely introduces variability in product quality, packaging standards, and delivery experience, which can contribute to the sentiment gap.

READ MORE | Performing Review Sentiment Analysis: A Step-by-Step Guide

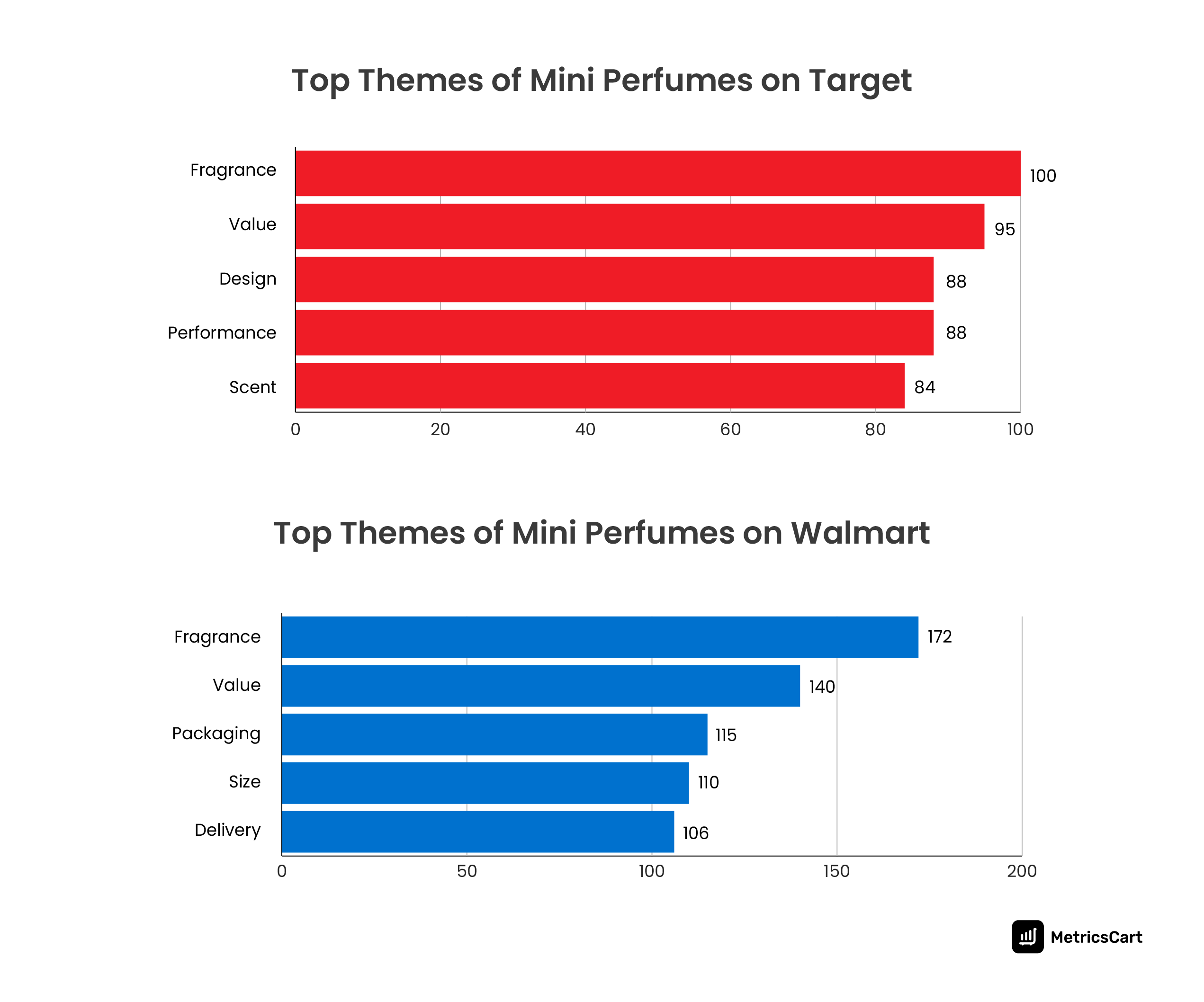

Fragrance and Value are the Top Themes of Mini Perfumes on Walmart and Target

Across both Walmart and Target, “Fragrance” and “Value” emerge as the most-discussed themes, showing that consumers on both platforms evaluate mini perfumes through two main lenses:

- How good the scent is (fragrance, scent, performance)

- Whether it’s worth the price (value, affordability, size)

Target’s shoppers focus on aesthetic, design, and sensorial experience, with top themes including Fragrance, Value, Design, Performance, Scent, and Packaging. The strong presence of Design (88) and Performance (88) signals that Target customers care about how the product looks and feels as much as how it performs.

Meanwhile, Walmart’s mini perfume discussions center on practicality and purchase satisfaction rather than emotional appeal or design. Fragrance (172) and Value (150) dominate, but Packaging (115), Size (110), and Delivery (106) indicate a strong focus on logistics and utility.

Shoppers discuss whether the product arrived on time, matched its description, and was priced appropriately, pointing to Walmart’s mass-market, value-oriented audience.

Mentions of Size and Packaging reflect the common expectation gaps in online shopping. Buyers want to ensure the mini perfume’s volume and appearance match what’s shown online. The high frequency of Delivery mentions suggests fulfillment experience significantly influences satisfaction, making logistics and reliability key factors in Walmart’s ratings.

The thematic review analysis shows that Target’s reviews are emotionally charged; Walmart’s are practically driven. Target customers talk about how the perfume makes them feel, while Walmart customers talk about what they received and how well it worked.

Scentiments That Sell: Decoding Reviews with MetricsCart

This mini perfume dataset is a good example of how ratings and reviews, when analyzed properly, become a strategic asset rather than just a vanity metric.

MetricsCart’s review monitoring and analysis platform is built to handle exactly this kind of Mini perfumes Walmart vs Target use case. It enables brands and marketplace sellers to:

- Monitor ratings, review recency and volume, upvotes, and sentiment across Mini Perfumes on Walmart and Mini Perfumes on Target in one place.

- Drill into themes like fragrance, value, packaging, size, and delivery at both the brand and SKU levels, rather than guessing why scores are moving.

- Run a granular Walmart vs. Target mini-perfume comparison to see where a portfolio over- or underperforms by retailer.

- Identify outliers such as highly upvoted but poorly rated products and decide whether to fix, re-position, or delist.

- Feed these insights back into pricing, assortment, creative, and product development decisions.

In a category where a 0.3–0.5 rating difference can decide who wins the top row of search results, “scentiments” are not soft signals. They are hard, quantifiable levers. With MetricsCart, brands don’t just read reviews; they treat them as structured data that can be tracked, compared, and acted on across Mini Perfumes on Walmart and Target.

Want to Transform Reviews into Smarter Category Decisions?