Ever noticed how the same parent company sells multiple brands in the same category? Procter & Gamble offers Tide, Gain, and Ariel, while Unilever owns Dove, Lux, and Lifebuoy, and this isn’t by chance. These conglomerates design their brand portfolios in a way so that the shift in consumer confidence toward one product doesn’t automatically impact the rest of the business.

So,

- What is consumer confidence?

- How does it impact markets and spending?

- What are the KPIs of consumer confidence?

- What are the latest consumer confidence trends in e-commerce?

This blog answers it all.

What is Consumer Confidence?

Consumer confidence is a measure of how comfortable people feel about spending money. It reflects whether consumers believe their income is stable, their jobs are secure, and their financial situation is likely to improve or worsen in the near future.

When confidence is high, consumers are more willing to spend on non-essential items, try new brands, and make bigger purchases. When confidence is low, they become cautious. Spending shifts toward essentials, purchases are delayed, and price sensitivity increases.

What makes consumer confidence important is timing. It doesn’t describe what consumers already did; it signals what they are likely to do next. That’s why businesses track it closely. Changes in confidence often appear weeks or months before shifts in sales, demand, or market performance become visible.

In simple terms, consumer confidence helps explain why spending changes before the numbers actually change.

How Consumer Confidence Impacts Markets and Spending

Consumer confidence directly shapes how money moves through the economy. In fact, almost 70% of the US GDP comes from personal consumption expenditures (PCE). So when households feel good (or bad) about jobs, prices, and income, it shows up quickly in sales, profits, and market prices.

Spending Expands or Contracts Based on Perceived Risk

When consumers feel secure about their jobs, income, and future economic conditions, they spend more freely. When this confidence is high, discretionary categories such as apparel, electronics, dining out, travel, and home upgrades benefit first. Big-ticket purchases like cars and appliances also see a lift because consumers feel confident committing to long-term payments.

When confidence weakens, behavior flips quickly. Households delay large purchases, reduce non-essential spending, and trade down to lower-priced brands or private labels. In this scenario, staples hold up better, but even then, shoppers look more for value packs, discounts, and promotions.

Low confidence also increases precautionary saving. Consumers hold cash, pay down debt, and avoid impulse purchases because they are uncertain about future income or employment stability.

Research from the Federal Reserve and academic studies shows that sharp moves in consumer sentiment often precede changes in consumption, especially during periods of economic stress or recovery.

READ MORE | Understanding the Consumer Behavior at Walmart: Expectations and Implementations

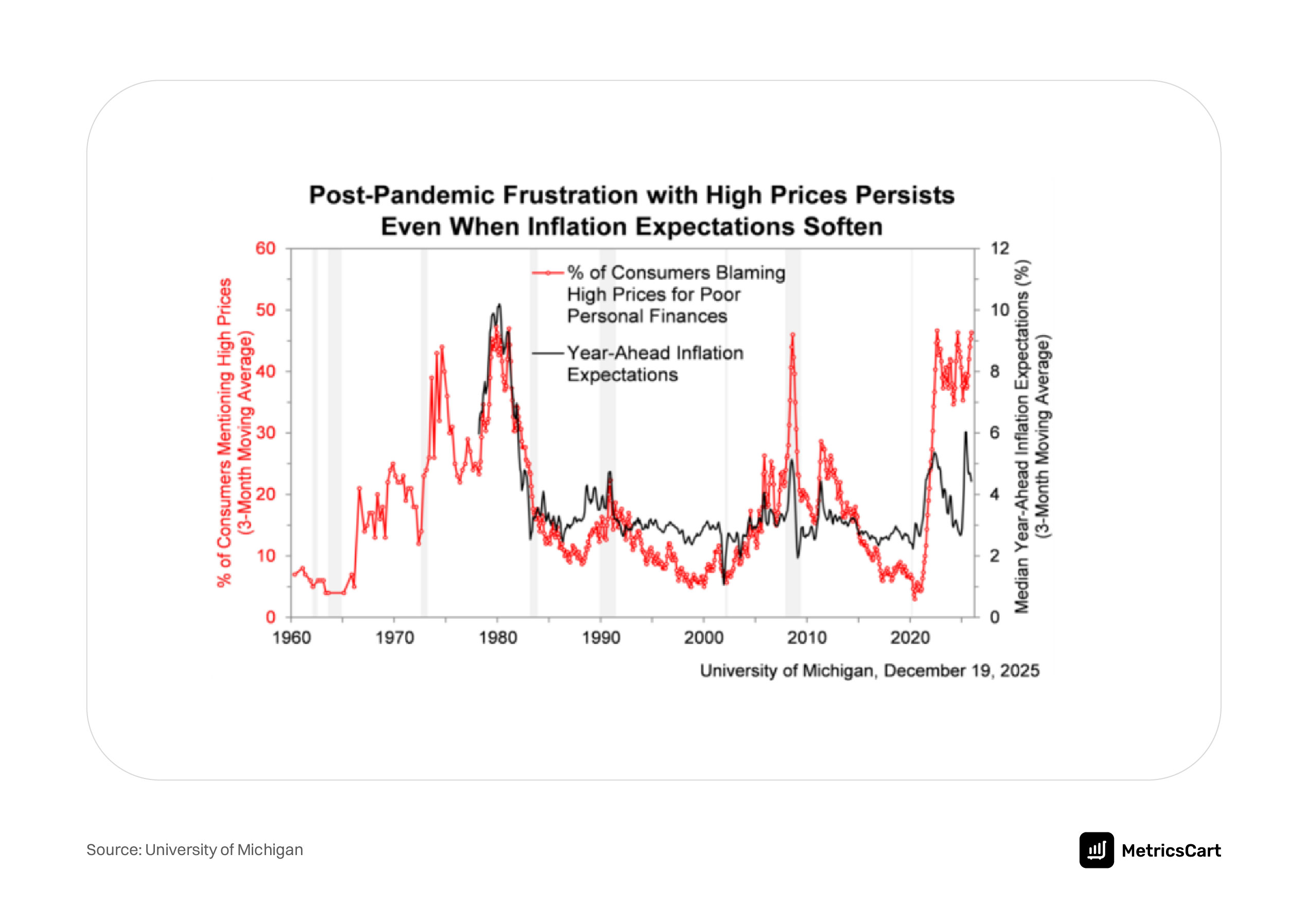

Inflation Expectations Change How and When People Spend

When consumers believe prices will keep rising, they may pull forward purchases for essentials. However, if they believe wages will not keep pace with inflation, spending slows instead.

This tension between price expectations and income confidence plays out clearly in retail. Brands often see higher price sensitivity, shorter decision windows, and stronger promotion response when confidence is weak but inflation remains elevated.

Markets React Because Confidence Affects Earnings and Interest Rates

Lower confidence signals softer demand and potential margin pressure, especially in consumer-driven sectors like retail, travel, and restaurants. In that case, investors adjust their growth expectations and, as the risk of a slowdown rises, their interest-rate outlooks change as well. Central banks watch these signals closely because confidence shapes future demand, not just current activity.

The impact doesn’t stop with consumers and markets. Businesses react to confidence trends by slowing hiring, tightening inventory plans, increasing promotions, and reassessing pricing strategies. These decisions can reinforce spending slowdowns, creating a feedback loop between consumer behavior and market performance.

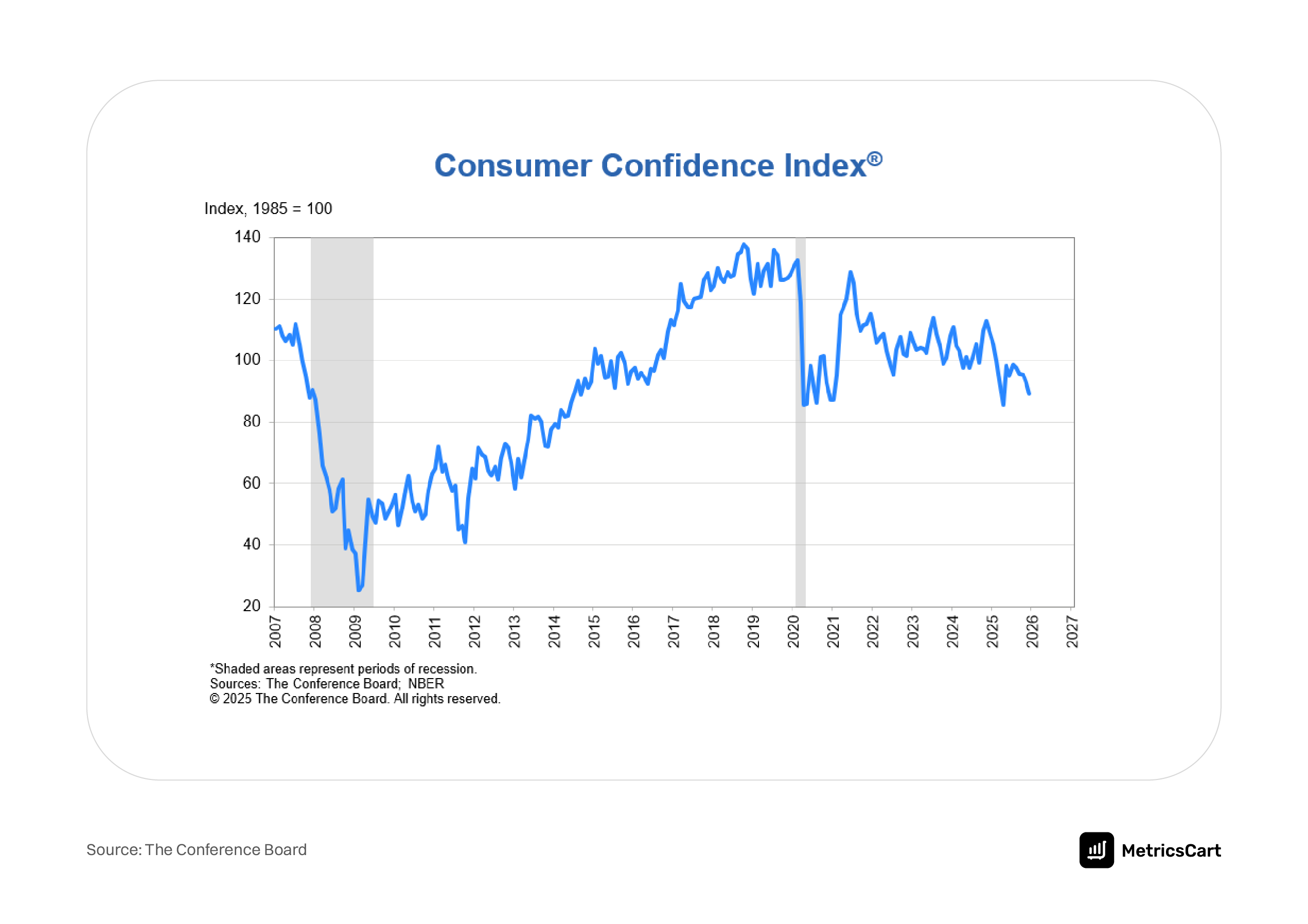

A recent example shows how quickly this plays out. In December 2025, the Conference Board’s Consumer Confidence Index fell to 89.1, with the Expectations Index near 70, a level often associated with recession risk. The decline reflected concerns about jobs and prices and reinforced expectations of continued pressure on discretionary spending.

In practice, confidence is less about how consumers feel today and more about what they will do next. When confidence shifts, spending patterns, business decisions, and market expectations follow, often before the numbers make it obvious.

READ MORE | Optimizing Consumer Buying Process: What Every E-Commerce Brand Needs to Know

KPIs of Consumer Confidence

Consumer confidence is not a vague feeling. It is tracked through well-defined indicators that help businesses, investors, and policymakers anticipate shifts in spending behavior. Two KPIs matter most because they capture both current conditions and future expectations.

The Consumer Confidence Index, published by The Conference Board, measures how optimistic or pessimistic consumers feel about the economy. It is based on a monthly survey that asks households about current business conditions, job availability, and expectations for income, employment, and economic conditions over the next six months.

What makes CCI valuable is its structure. It separates confidence into two components:

- Present Situation Index, which reflects how consumers feel about the economy right now

- Expectations Index, which captures how they expect conditions to change

The Expectations Index is especially important. Historically, when it drops below the mid-70 range, it has often preceded periods of economic slowdown. For businesses, this component acts as an early warning system. Declining expectations usually show up first as reduced discretionary spending, increased deal-seeking behavior, and hesitation around big-ticket purchases.

For e-commerce and retail teams, tracking CCI alongside sales data helps explain why demand softens even when pricing or promotions remain unchanged. It often signals that consumer hesitation is macro-driven, not execution-driven.

Consumer Sentiment Index

The Consumer Sentiment Index, published by the University of Michigan, focuses more directly on how consumers feel about their personal finances and purchasing power. It measures perceptions around income, inflation, and whether now is a good time to make major purchases.

This index is particularly sensitive to:

- Inflation expectations

- Interest rate concerns

- Changes in real income and affordability

Because of this, sentiment tends to move quickly in response to price increases, fuel costs, or interest rate changes. Even when employment remains stable, declining sentiment often leads to reduced discretionary spend and stronger price sensitivity.

For brands, the Consumer Sentiment Index helps explain shifts in conversion rates, basket sizes, and promotion performance. When sentiment weakens, shoppers may still browse and compare but delay checkout or wait for discounts.

READ MORE | Search Listening In Marketing: How Brands Can Unlock Consumer Intent

Consumer Confidence Trends E-commerce Brands Must Know

Here are the top 5 trends shaping consumer confidence in e-commerce today:

- Value-aware shoppers dominate spend decisions. During the 2025 holiday season, Brand Equity cites that sales rose modestly despite low confidence, and consumers focused on essentials and gifts while avoiding non-essentials, indicating tighter priorities in online purchase decisions.

- Channel-less shopping is the default. Consumers switch seamlessly between Amazon, D2C sites, quick commerce apps, social platforms, and stores. Confidence depends on consistent pricing, availability, and experience across all of them.

- Mobile and AI are shaping confidence online. Mobile commerce drove nearly 55% of online transactions, and AI-powered shopping tools sharply increased traffic and conversions, reinforcing shopper trust in digital discovery and deal-finding.

- Gen Z and younger cohorts amplify omnichannel behavior. Millennials and Gen Z show strong omnichannel and online orientation, engaging with brands across platforms, evidence that confidence is tied to seamless experiences, not single channels.

- Planned, not impulse, purchases are rising. Consumers are researching products more deeply before buying, often referring to multiple sites and reviews. This indicates cautious, confidence-tied decision patterns.

READ MORE | Impact of Online Reviews & Ratings on Consumer Purchasing Decisions

Three Pillars Brands Must Develop to Win Consumer Confidence

In a channel-less, comparison-first buying environment, consumer confidence is earned through execution, not claims. Brands that win trust do three things consistently.

Transparency

Shoppers expect accurate pricing, clear product information, and honest delivery promises. Studies show misleading pricing, unclear availability, or inflated claims are among the fastest reasons consumers abandon a purchase and lose trust in a brand.

Reliability

Confidence is built when brands deliver what they promise, every time. Consistent in-stock availability, on-time delivery, stable pricing, and responsive support matter more than novelty. Research from PwC shows that a single bad experience is enough for 32% of consumers to walk away from a brand.

Consistency across channels

Channel-less shoppers expect the same experience everywhere. Pricing gaps, review mismatches, missing content, or stock issues on one platform can undermine confidence across all channels. Salesforce reports that 73% of consumers expect companies to understand and meet their needs consistently across touchpoints.

Together, these three pillars determine whether shoppers feel confident enough to buy, return, and buy again. And brands that invest in transparency, reliability, and consistency don’t just protect trust, they create sustained demand that is unshattered by fluctuating confidence index values.

Wrapping Up with Confidence

Consumer confidence is a leading indicator of how shoppers will behave next, where demand will shift, and which brands will win or lose at the shelf. Brands that rely only on sales data react too late. Confidence gaps show up earlier in declining conversions, rising price sensitivity, uneven review sentiment, and demand volatility across channels.

This is where MetricsCart becomes critical. By giving brands real-time visibility into pricing, promotions, availability, reviews, content, and competitive movements across marketplaces and quick commerce platforms, MetricsCart helps teams spot confidence risks before they impact revenue. Instead of guessing why performance changed, brands can see it, fix it, and stay ahead.

Winning consumer confidence today isn’t about messaging harder. It’s about monitoring smarter, acting faster, and staying consistent wherever your shoppers choose to buy. MetricsCart helps brands do exactly that.

See Confidence Shifts at the Digital Shelf in Real-time with MetricsCart Insights

FAQs

The Consumer Confidence Index (CCI) focuses on perceptions of the overall economy, jobs, and business conditions. The Consumer Sentiment Index focuses more on personal finances, inflation, and affordability. Together, they explain both macro confidence and household-level stress.

Beyond macro indices like CCI and Consumer Sentiment, brands should track conversion rates, promotion lift, price elasticity, review sentiment, availability gaps, and demand volatility across channels to detect confidence shifts early.

When consumers expect prices to rise faster than income, confidence weakens. This leads to delayed discretionary purchases, stronger deal-seeking, and tighter budget control—even if employment remains stable.

Brands can’t control macro conditions, but they can reduce uncertainty. Transparent pricing, accurate content, reliable availability, strong reviews, and consistent execution all help maintain confidence even during economic volatility.

MetricsCart gives brands real-time visibility into pricing, promotions, availability, reviews, content, and competitor activity across marketplaces and quick commerce platforms. This helps teams spot confidence risks early, understand why performance is shifting, and act before revenue is impacted.