Many of today’s revenue management challenges in CPG stem from the way revenue growth was traditionally handled. Pricing reviews were periodic, promotions were planned well in advance, and decisions were based mainly on historical sales data. That approach worked when retail environments were stable and channels were limited, which is no longer the case. Modern trade and omnichannel retail have added layers of complexity that traditional RGM models were never designed to handle.

According to POI’s State of the Industry report, 78% of CPG manufacturers struggle to manage modern trade and omnichannel pricing, and 61% struggle to execute planned promotions due to a lack of real-time visibility and analytics. As a result, revenue decisions are often made with incomplete information, leading to margin erosion that goes unnoticed until it is too late.

In this article, we break down the three biggest revenue management challenges in CPG today and explain how brands can tackle them effectively for long-term success.

Top 3 Revenue Management Challenges in CPG

The revenue management landscape for CPG brands has drastically changed over the past few years. Traditional models that rely on broad, high-level revenue insights and past performance no longer account for the dynamic nature of modern marketplaces. And so, many revenue management failures today are not strategic mistakes, but execution blind spots.

In a broader perspective, CPG revenue management failures are happening due to:

- Rising cost pressures from suppliers and logistics. The World Bank reports commodity prices remain 30-40% higher than their 2015-2019 averages.

- Stagnant growth in mature product categories, especially in CPG staples like packaged foods and beverages, where the market growth rate is only 4.1%.

- Increasing retailer power, especially as e-commerce and marketplaces like Amazon and Walmart drive more of the consumer experience. Amazon, for instance, now captures over 40% of total US e-commerce sales.

- Shifting consumer preferences that are harder to predict without real-time insights, with millennials and Gen Z accounting for 32% in consumer spending, especially through social media platforms like TikTok.

And while these issues appear across organizations in different ways, most CPG revenue management failures can be traced back to the same three operational gaps, challenges that consistently prevent CPG brands from translating strategy into sustained revenue impact.

And these gaps are becoming harder to ignore, especially with the rise of channel-less shoppers, who no longer care where they shop and expect everything they see about a product to be consistent across every touchpoint. And when revenue decisions are made in silos, these inconsistencies surface immediately, leading to lost trust and margin erosion.

Here are the top 3 RGM challenges modern-day brands are facing.

Challenge 1: No SKU-Level Visibility Into Revenue Performance

One of the biggest reasons why CPG revenue initiatives fail today is the lack of granular, SKU-level visibility. Most CPG brands continue to rely on broad, category-level metrics that offer little insight into individual product performance.

As a result, brands often miss critical information about which products are driving incremental growth and which are underperforming, leading to inefficient pricing and promotional strategies.

How to Fix It:

To address this, CPG brands must move beyond category-level reporting and operationalize SKU-level revenue management. This requires integrating pricing, availability, promotions, reviews, and marketplace signals at the individual SKU level. Also, it’s essential to note that visibility alone is not enough. This SKU-level data must be tied to clear ownership and decision workflows. Without this, teams see the problem but cannot act on it.

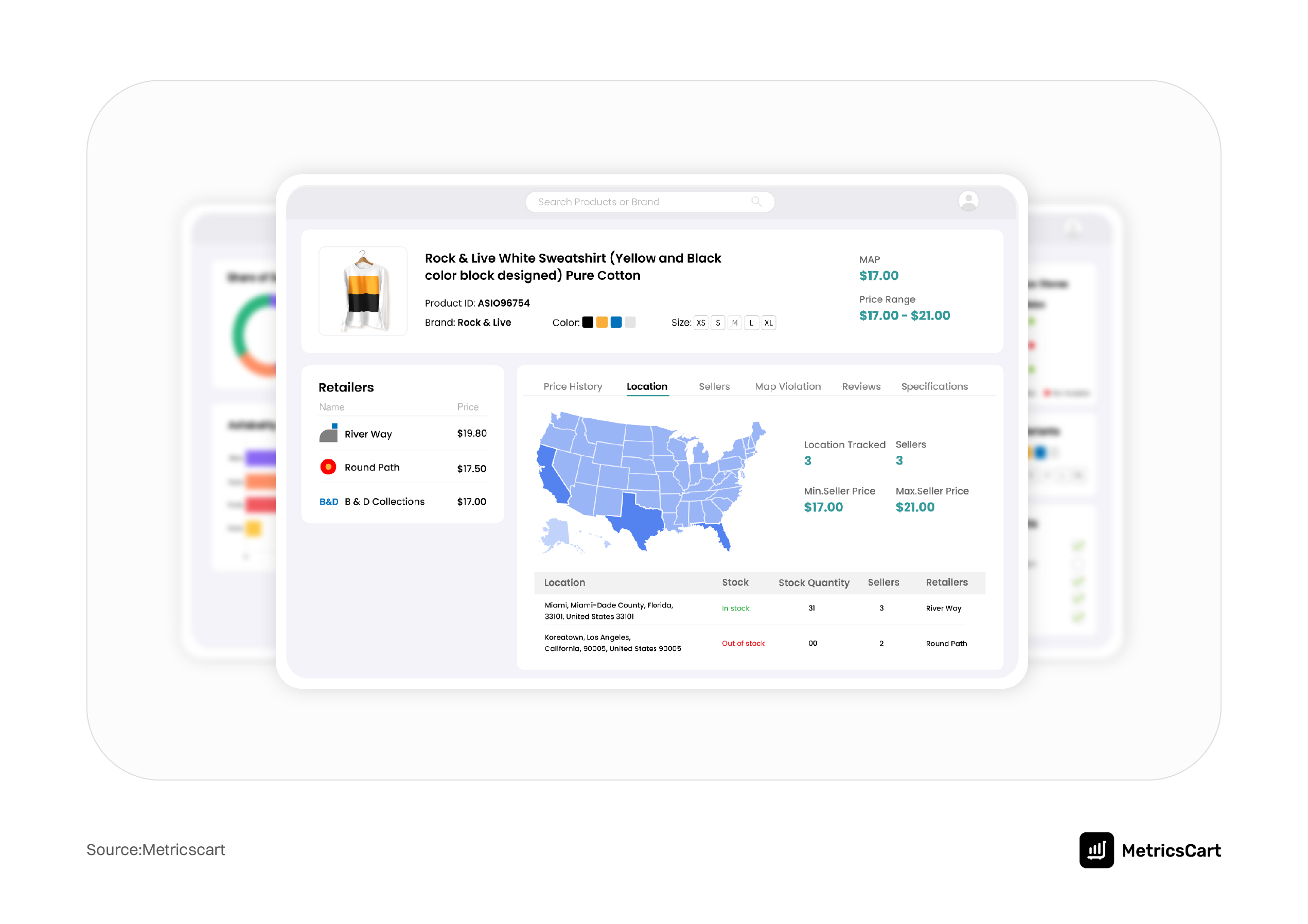

Digital shelf analytics platforms like MetricsCart help enable this shift by providing real-time SKU-level tracking across Amazon, Walmart, and other marketplaces. This allows teams to:

- Monitor how price changes, stockouts, reviews, and promotions impact individual SKU performance.

- Identify which products are truly driving incremental revenue versus those quietly eroding margins.

- Make pricing and assortment decisions using live shelf signals rather than delayed summaries.

With SKU-level visibility anchored to execution, brands can stop reacting to symptoms and start addressing root causes.

Challenge 2: Reactive Pricing in Algorithm-Driven Marketplaces

Most CPG pricing decisions are still reactive. Teams wait for reports, notice a dip in sales or share, and then respond with a price change or a promotion. That lag didn’t matter much in the past. In algorithm-driven marketplaces, it does.

On platforms like Amazon and Walmart, pricing directly affects Buy Box ownership, visibility, and conversion. As it is said, Amazon’s A10 algorithm evaluates not just price, but also reviews quality, sales velocity, search ranking, and availability. And even if only one of these weakens, visibility often drops before revenue teams even see the warning signs.

This creates a common RGM failure pattern. Brands respond to declining performance with discounts, without addressing the underlying issue. Pricing becomes a reaction to lost visibility rather than a lever used to protect it.

READ MORE | Amazon A9 vs. A10 Algorithm: Mastering the Transition to Boost Rankings

How to Fix It:

For fixing CPG revenue management issues in algorithm-driven marketplaces, CPG brands need to move from reactive pricing to pricing that reflects how marketplace algorithms actually work. This requires an RGM model that is grounded in real-time digital shelf signals, not delayed reports.

At a minimum, brands should:

- Monitor pricing alongside reviews, search rank, and availability to understand how each SKU is performing in context.

- Evaluate pricing and promotion impact using competitive benchmarks and live market signals rather than historical averages.

- Adjust pricing with an understanding of Buy Box dynamics and visibility thresholds, not just short-term volume goals.

When pricing decisions are informed by digital shelf fundamentals, brands can protect visibility, reduce unnecessary discounting, and make revenue management more predictable.

And remember, not every signal requires an immediate action. The goal is not faster reactions, but better-informed ones that reduce unnecessary discounting.

READ MORE | Strategies for Winning the Walmart Buy Box: The Essential Guide for Brands

Challenge 3: Revenue Management Without Digital Shelf Alignment

Many CPG brands still run revenue management in isolation from how products actually perform online. Pricing, promotions, and assortment decisions are often made without considering digital shelf signals such as content quality, reviews, search visibility, and availability, and this disconnect creates execution gaps.

A price change may look right on paper, but fail to improve conversion because the product is out of stock or losing search visibility because the content is bad. Promotions fail to show the expected impact, as they may be planned without factoring in weak reviews or poor content. And like that, revenue decisions are made, but the shelf is not ready to support them.

This problem becomes more visible during new product launches. New SKUs often enter marketplaces without sufficient visibility, review volume, or content optimization. And in that case, even with competitive pricing, these products struggle to gain traction because the digital shelf fundamentals are not in place.

How to Fix It:

To fix this, brands need to integrate digital shelf performance directly into their revenue management strategy. Here’s how:

- Start with shelf readiness: Ensure your pricing and promotion decisions are gated by clear thresholds for availability, content completeness, and review health. If a product is not ready to convert, increasing spend or discounting will only accelerate margin loss.

- Leverage digital shelf data for proactive decision-making: Instead of reacting to sales drops or inventory issues, use real-time data to anticipate problems and adjust strategies before they affect revenue.

- Cross-functional collaboration: Revenue management should not work in isolation. Pricing, marketing, and e-commerce teams must align on digital shelf metrics, ensuring that every department is working towards the same goal: optimal product visibility and conversion.

- Treat new product launches as revenue programs: Measure early success by shelf traction rather than just shipments or initial sell-in. This allows teams to identify and address execution issues before scaling pricing or promotions.

When digital shelf readiness becomes a prerequisite for revenue action, CPG brands stop treating execution problems as pricing problems. Revenue management becomes more disciplined, more predictable, and easier to scale.

READ MORE | Amazon Product Launch Strategy: Everything You Need to Know

Fix Revenue at the Shelf, Not After the Fact

Revenue management in CPG has evolved, and brands must adapt to stay competitive. The three challenges highlighted here stem from outdated practices: a lack of SKU-level visibility, reactive pricing, and a disconnect from digital shelf performance. These issues create gaps in strategy and hinder revenue growth.

To close these gaps, brands need a tech stack built for real-time execution. Digital shelf optimization tools like MetricsCart provide SKU-level visibility across Amazon, Walmart, and other marketplaces. With live data on pricing, availability, reviews, and promotions, teams can measure the incremental growth each SKU delivers and quickly spot which SKUs are tanking.

And when revenue decisions are grounded in what is actually happening on the shelf, brands stop fixing problems after margins are lost. They protect visibility, reduce wasted discounts, and make revenue growth more predictable.

Don’t Let Hidden Revenue Gaps Drain Your Growth.

FAQs

SKU-level visibility means having granular insights into the performance of each individual product. This is crucial for identifying which products are driving growth and which are underperforming, enabling brands to make data-driven decisions and optimize their revenue strategies.

MetricsCart provides real-time, SKU-level insights into pricing, availability, reviews, and promotions across major marketplaces like Amazon and Walmart. This allows brands to track product performance, identify growth opportunities, and adjust strategies before issues affect revenue.

Reactive pricing is a short-term solution that responds to issues after they’ve impacted performance. By using tools like MetricsCart, brands can track marketplace signals in real time, allowing them to make proactive pricing and promotional decisions that protect visibility and maintain revenue.

Digital shelf optimization ensures that products are ready to convert by monitoring factors like content quality, reviews, and stock availability. When pricing and promotional decisions are based on these signals, brands can avoid execution gaps and drive sustainable revenue growth.