After years of watching e-commerce brands grow, stall, and sometimes quietly disappear from online marketplaces, one pattern keeps repeating. The winners are not the ones with the loudest ads or claims. They are the ones who listen better to what their customer are saying.

Customers leave clues everywhere. Reviews on marketplaces. Long YouTube breakdowns. TikTok hauls. Reddit threads that read like unpaid focus groups. Even rage clicks and abandoned carts tell a story. The challenge is not access to data. It is making sense of the unstructured data before the opportunity passes.

And, no wonder there’s a growing understanding among brands about the need for robust consumer insights software.

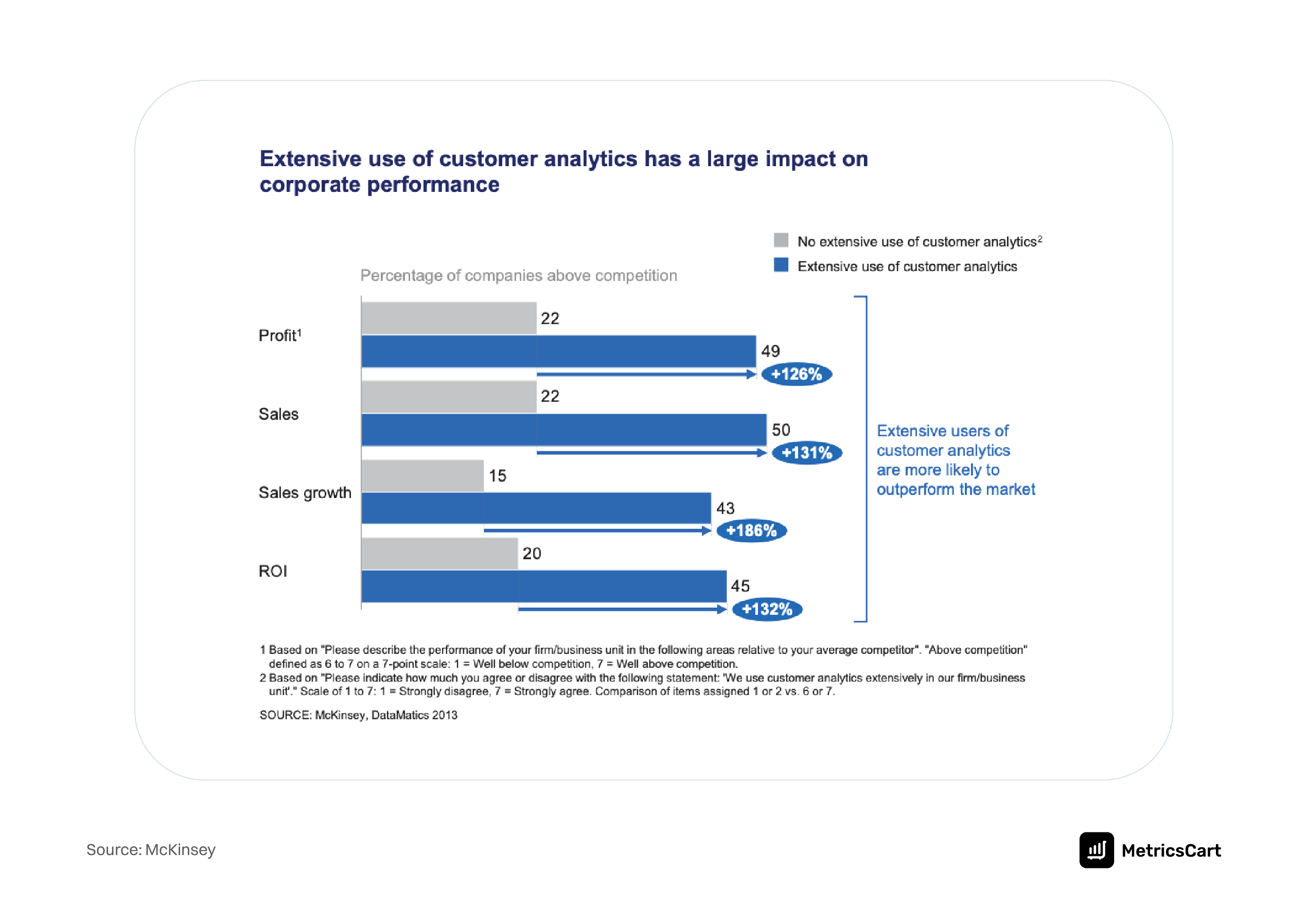

McKinsey’s long-running research shows that companies that lead in customer analytics are 23x more likely to outperform competitors in customer acquisition and 19x more likely to be profitable.

At the same time, PwC reports that 73% of consumers say experience is a key factor in purchasing decisions, often outweighing price.

The implication is simple. If you understand customers better, you sell better.

So when teams ask for the best customer insight tools, they are often asking for one thing: a way to turn scattered signals into decisions that improve trust, conversion, and growth. This listicle covers the top 5 customer analytics platforms you can count on.

READ MORE | How Can Sentiment Analysis Help Improve Customer Experience?

5 Best Tools for Customer Insights

The tools below represent different approaches to customer insight, from behavior analytics and social listening to commerce-driven UGC analysis, each solving a distinct problem teams face when trying to understand customers at scale.

1. MetricsCart’s Consumer Insights Platform

At its core, MetricsCart’s Consumer Insights platform is built for commerce-first teams who need to understand why shoppers choose a product before they ever hit “Add to Cart.” That matters because buying decisions are often formed outside your product page, in creator videos, comment sections, and community threads that function like distributed salespeople.

What it does:

MetricsCart provides commerce-driven UGC analytics across YouTube, TikTok, and Reddit to surface product narratives, trust drivers, objections, and intent signals.

How it works:

On YouTube and TikTok, it pulls the transcripts of videos such as reviews, hauls, routines, comparisons, and first impressions and analyzes them to identify recurring themes, sentiment, and common formats. On Reddit, it analyzes brand and product mentions across main threads and sub-threads to surface repeated pain points, confusion, experience sharing, and early buying intent with social listening.

Key features:

- Transcript-based analysis of YouTube and TikTok content

- Reddit thread and sub-thread intelligence

- UGC theme and sub-theme analysis across video and forum content

- Customer sentiment tracking to identify shifts early on

- AI-powered assistant that turns analytics into digestible insights

- Trend detection to identify what is gaining or losing trust

- Social listening for monitoring brand mentions

- Competitive product perception analysis beyond star ratings

MetricsCart turns UGC into a measurable input for decisions. Marketing teams see which UGC themes, narratives, and creator formats drive shoppers closer to purchase, not just engagement. PR and brand reputation teams detect early sentiment shifts before they escalate. Product teams identify recurring feature requests, customer triggers, and friction points described in customer language. Digital shelf managers connect perception directly to conversion, availability, and competitive positioning.

Among the best customer analytics tools, MetricsCart is particularly valuable because it connects what customers say to how products perform, where revenue is actually decided. Along with MetricsCart’s ratings and reviews analysis software, it becomes a 360-degree insider into customer experience and behavior.

2. Hotjar

Hotjar is one of the most widely used customer behavior analytics tools, especially for understanding the on-site experience.

What it does:

Hotjar visualizes how users interact with websites and apps through heatmaps, session recordings, funnels, and feedback tools.

Key features:

- Heatmaps showing clicks, scroll depth, and attention

- Session recordings to replay real user journeys

- Funnel analysis to identify drop-off points

- On-page surveys to add qualitative context

Hotjar helps teams fix friction that quietly suppresses conversion. It makes issues visible that traditional analytics often miss, such as unclear layouts, missed information, or confusing interactions. UX teams, product managers, and CRO specialists rely on Hotjar to translate “conversion dropped” into specific, fixable problems.

3. Talkwalker

Talkwalker is a social listening and media intelligence platform that tracks brand mentions, sentiment, and trends across social networks, forums, blogs, and news sites.

What it does:

Talkwalker tracks and analyzes brand and category conversations across social and web sources and helps teams understand sentiment shifts, misinformation, and emerging narratives.

Key features:

- Broad coverage across social and web sources, including multi-network monitoring

- Real-time monitoring and alerts for spikes in volume or sentiment

- Sentiment analysis and conversation insights to understand “what changed.”

- Competitive and category monitoring to benchmark narratives

- Support for social listening workflows used by PR and marketing teams

For PR and brand reputation managers, Talkwalker acts as an early warning system. It helps teams identify emerging issues before they become crises. Marketing teams also use it to understand how campaigns influence conversation beyond owned channels. In categories where trust drives conversion, Talkwalker plays a critical role in protecting long-term brand equity.

READ MORE | How To Turn Customer Reviews Into Sales: A Complete Guide

4. Brandwatch

Brandwatch sits in the consumer intelligence category, often used by consumer insights, marketing, and strategy teams that need a deeper view of audiences and long-range trends.

What it does:

BrandWatch collects and analyzes large volumes of online conversations and helps teams segment, study, and act on audience-level insights.

Key features:

- Audience profiling and identity-level views using audience cards

- Segmentation workflows to avoid “one big bucket” insights

- Consumer intelligence process covering search, segmentation, analysis, and action

- Topic and narrative analysis for category and competitor understanding

- Support for customer segmentation research and planning

Brandwatch helps teams understand who is driving a narrative, what different segments value, and how conversation shifts over time. That directly improves positioning, content strategy, influencer selection, and campaign planning.

5. Sprinklr

Sprinklr is built for scale and cross-team execution. It is often used by enterprises that need consumer intelligence, workflow, and governance in one place.

What it does:

Sprinklr provides consumer, competitor, and market intelligence across many channels and supports operational workflows so insights do not stay trapped in dashboards.

Key features:

- Enterprise-grade consumer intelligence across 30+ channels

- AI-powered insight surfacing via Smart Insights, including anomaly and trend detection

- Scale claims around historical message analysis across channels

- Audience insights and segmentation for targeted understanding

- Operational readiness for large teams through integrated workflows

When organizations are large, growth often depends on consistency. Sprinklr supports faster coordination between marketing, PR, customer care, and operations. That helps brands respond quickly, maintain message discipline, and reduce the kind of cross-team misalignment that customers notice instantly.

How To Choose The Right Customer Insights Software?

If you are evaluating the best customer insight tools, treat the purchase like infrastructure. Start with a decision, map the signal, demand “why,” and ensure insights turn into action fast.

Here’s a step-by-step approach you can take:

Step 1: Write down the decision you need to improve

Do not start with “we need more insight.” Start with the decision that keeps showing up every week.

Examples your teams will recognize:

- PR and ORM: “Is this complaint pattern isolated, or the start of a reputation issue?”

- Product: “Which feature request is real demand, and which is a loud minority?”

- UX and e-commerce: “Where is conversion leaking, and what is causing it?”

- Marketing: “Which message will build trust, not just clicks?”

- Digital shelf managers: “Which signals actually influence purchase on the shelf?”

If a tool cannot help you make that decision faster or better, it will become shelfware. Not the good kind.

Step 2: Match the signal to the channel where it is born

Different problems require different signals.

- If your pain is conversion, you need behavioral signals like replays, heatmaps, and funnels.

- If your pain is trust and narrative, you need social listening signals like sentiment shifts, topic clusters, and spikes.

- If your pain is product-market fit, you need customer language at scale, including reviews, forums, and content that reveals real use-cases.

- If your pain is competitive positioning, you need category-level conversation and audience segmentation.

Your job is to avoid listening in the wrong room.

Step 3: Demand “why,” not just “what”

A dashboard that tells you “negative sentiment increased” is not enough. You need to know:

- What themes drove it?

- Which product attributes are being discussed?

- Which audience segment is amplifying it?

- Is it tied to a specific event, launch, or competitor move?

This is where modern customer behavior analytics tools are heading. Your reference list reflects that trend, including AI-driven analysis and automated insight workflows.

Step 4: Check whether insights can move into action

This is where many implementations fail.

Ask practical questions:

- Can the tool convert analytics into digestible bits?

- Can it route insight into workflows your team already uses?

- Can you tag, categorize, and track so insights do not die in Slack?

Without actionability, what you get is a weather report. It looks impressive and changes nothing.

READ MORE | Search Listening In Marketing: How Brands Can Unlock Consumer Intent

From Conversation to Conversion

Customer conversations already shape buying decisions. The difference is whether brands can measure and act on them in time.

MetricsCart’s Consumer Insights Platform helps brands turn commerce-driven UGC from YouTube, TikTok, and Reddit into clear, actionable insight. By connecting customer sentiment to real outcomes like consideration, conversion, and repeat intent, MetricsCart enables teams to scale what builds trust and stop investing in what does not.

If growth matters, start listening where purchase decisions actually begin.

Let Your Customers Guide Your Next Move.

FAQs

Consumer insights help brands move from assumption-based decisions to evidence-based ones. By understanding what customers value, where they struggle, and why they choose one product over another, teams can improve product design, messaging, pricing, and experience.

Customer insights software that combines multiple data sources is the most effective. Platforms that analyze reviews, user-generated content, behavior data, and conversation trends provide a fuller picture than any single data type. MetricsCart is a strong example because it brings together commerce-driven UGC, sentiment, and digital shelf signals to show how customer voice connects to real purchase outcomes.

Customer behavior analytics tools and voice-of-customer platforms are commonly used to understand customer needs. They surface friction points, unmet expectations, and recurring requests through real behavior and language. MetricsCart helps here by analyzing how customers and communities describe problems, use cases, and objections across videos, forums, and reviews, often before a purchase happens.

Audience analysis tools help brands segment customers into meaningful groups and understand how each group behaves, thinks, and communicates. These tools analyze factors such as interests, sentiment, language, and engagement patterns to show how different audiences perceive a brand or category. This allows marketing, product, and PR teams to tailor messaging, positioning, and strategy based on real audience behavior rather than generic personas.

MetricsCart provides clear insight into customer expectations by tracking how shoppers describe products, compare alternatives, and react to first impressions across high-intent platforms. By combining sentiment, theme analysis, and trend detection, it helps brands see how expectations are forming and changing, well before those expectations show up in conversion or reviews.