Scroll through TikTok today, and you’ll notice a familiar theme: maxxing. Career maxxing, health maxxing, looks maxxing, productivity maxxing. The vocabulary keeps changing, but the underlying belief is remarkably consistent. In an uncertain world, the safest place to put your money, time, and energy is yourself.

At first, it is tempting to dismiss this as internet culture reframing anxiety as ambition. But the more you watch, the more it feels like a rational response to the economic environment people believe they are living in. This fixation on self-optimization is not emerging in a stable, evenly growing economy. It is emerging in a deeply uneven one.

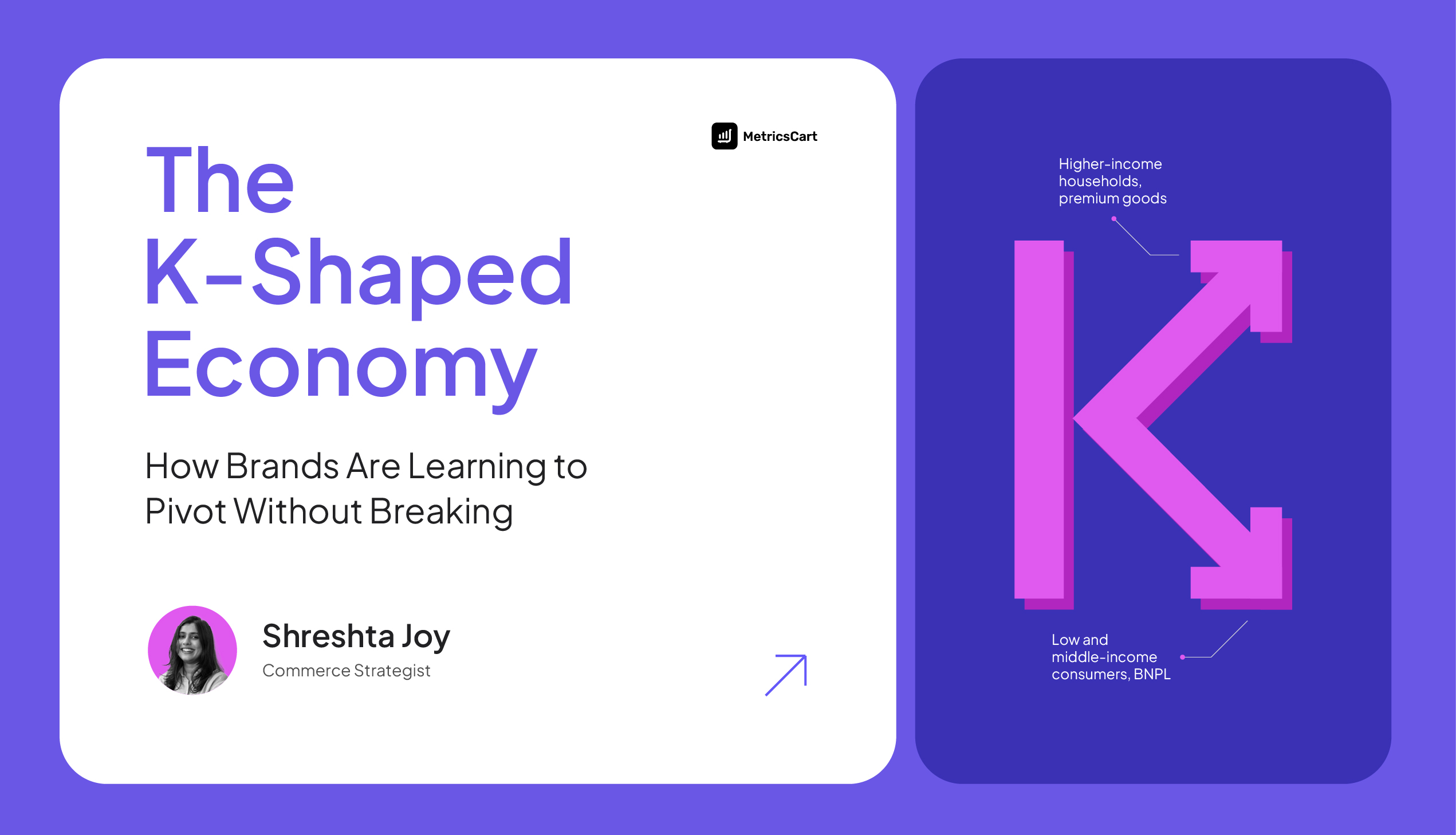

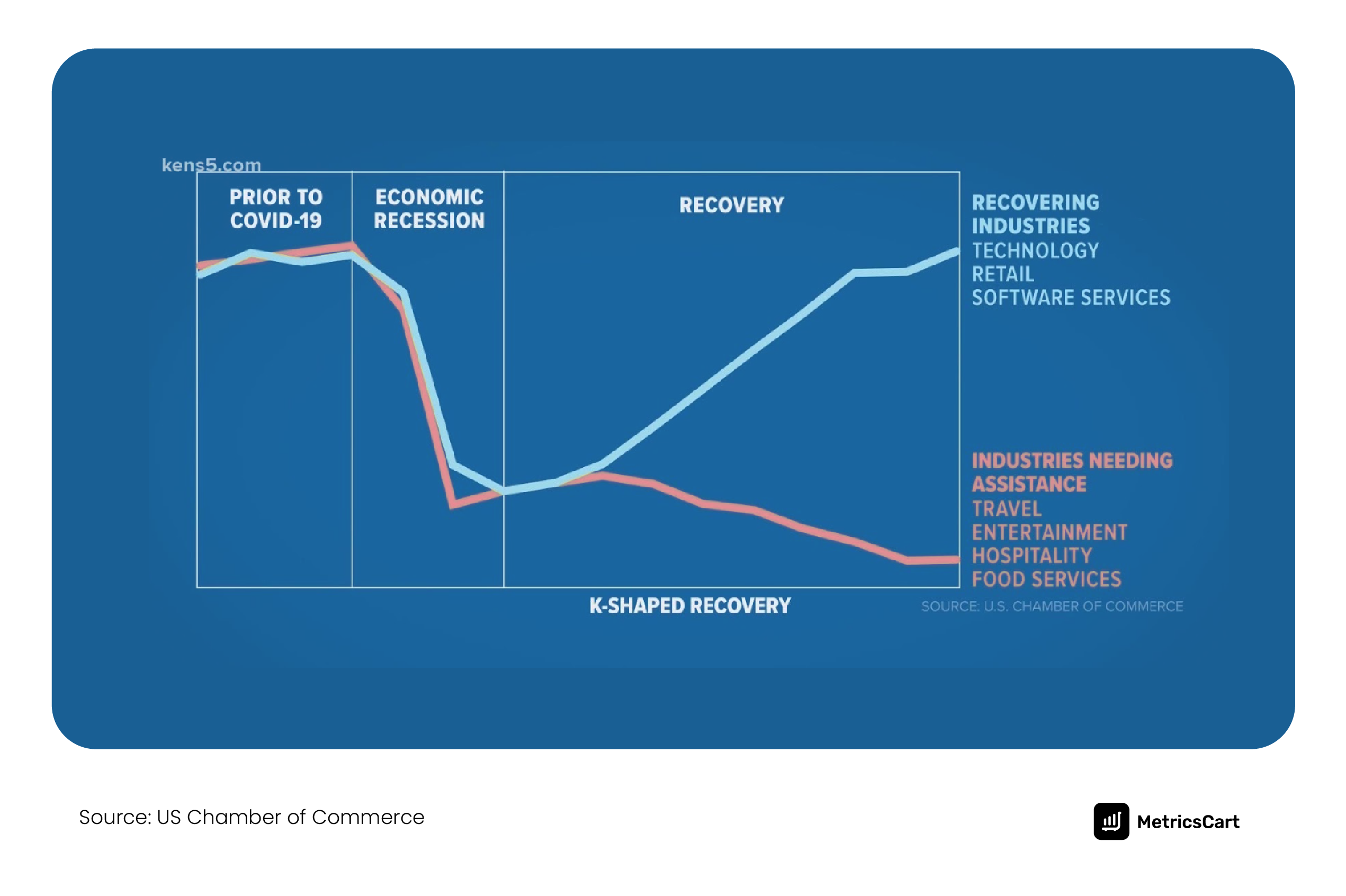

That unevenness is what economists describe as a K-shaped economy. The other terms are more fancy: the ‘windchill economy’ or the ‘two lane economy’ – makes me think we’re talking about a love that’s gone cold?!

This split economy is reshaping not just consumer confidence, but also the way brands compete, communicate, and create value.

What It Feels Like to Live in a K-Shaped Economy

In the US, different groups of consumers are experiencing growth and pressure at the same time. Higher-income households, cushioned by asset appreciation and wage growth, continue to spend on travel, wellness, premium goods, and experiences. Inflation is inconvenient, but not destabilizing.

Meanwhile, lower- and middle-income consumers face rising housing costs, food inflation, healthcare expenses, and debt repayments that increasingly crowd out discretionary spending. Even when wages rise, they rarely rise fast enough to restore confidence.

What makes the K-shaped economy particularly difficult to read is that aggregate spending numbers still look healthy. Growth continues, but it is concentrated. According to AP News, a growing share of consumer spending is driven by wealthier households, while a large portion of consumers feel economically stalled or slipping backward. The economy moves forward, but not everyone moves with it.

The challenge for brands is that both groups shop in the same places. They use the same apps, see the same ads, and browse the same shelves. Aggregate demand looks stable, but behavior underneath is fragmenting. As coverage from AP News and CNN shows, consumer spending growth is increasingly driven by higher-income households, while many others feel stuck or left behind.

Brands can no longer design for an “average” consumer, because that consumer no longer exists.

Why “Investing in Yourself” Has Become a Default Strategy

This is where the obsession with self-investment culture starts to make sense. In a K-shaped economy, external stability feels fragile and upward mobility feels conditional, so people look for leverage where they can find it.

They cannot control interest rates, housing supply, or the pace of automation. They can control their skills, health, appearance, and perceived employability. Spending on self-improvement becomes less about aspiration and more about risk management. A gym membership, a certification, or a skincare routine is not an indulgence; it is a way to stay competitive in an economy that feels increasingly unforgiving.

Investing in yourself isn’t about indulgence anymore; it is defensive. It is how consumers attempt to future-proof themselves inside a polarized economy.

So, how does a K-shaped economy impact brands? For them, this matters because it reshapes how value is interpreted. Products are no longer evaluated solely on desirability. They are evaluated on outcomes.

Does this help me stay competitive? Does it reduce risk? Does it earn its place in my budget?

Brands that fail to answer those questions clearly struggle to hold attention. Self-optimization, in this context, is not vanity. It is a hedge.

Polarized Consumer Spending: Growth at the Top, Pressure at the Bottom

Recent consumer sentiment data helps explain why spending patterns look stable on the surface but fractured underneath. The University of Michigan’s consumer sentiment index was revised up to 56.4 in January 2026, from a preliminary 54.0 and December’s 52.9.

It marks the second consecutive monthly increase and the highest reading since August. Gains were modest, but notably broad-based, cutting across income levels, education, age groups, and political affiliations.

And yet, context matters. Overall sentiment remains more than 20% below where it stood a year ago. Consumers continue to cite pressure on purchasing power from elevated prices, along with growing concern about a potential softening in labor market conditions. Inflation expectations have eased slightly, with year-ahead expectations declining to 4.0%, the lowest since January 2025, while longer-run expectations edged slightly higher to 3.3%. The mood has improved, but confidence has not fully returned.

This tension shows up directly in how people spend. Consumers are not uniformly trading down, nor are they freely splurging. Instead, they are becoming more selective about where money feels justified. Certain categories remain protected because they promise improvement, protection, or progress. Others are scrutinized, delayed, or quietly dropped.

Coca-Cola and the Art of Playing Both Sides of the K

Brands are responding to polarization, sometimes deliberately and sometimes by necessity. Coca-Cola is one of the clearest examples of how legacy CPG brands adapt to a K-shaped economy simultaneously.

On one end, Coca-Cola remains an affordable, familiar product that still fits into a constrained budget. It continues to function as an everyday indulgence that does not require explanation or justification. A small pleasure that survives even when wallets tighten.

On the other end, the brand keeps layering in premium signals. Limited editions, smaller pack formats with higher per-unit pricing, and lifestyle-led positioning around products like Coke Zero Sugar all push the brand upward, signaling choice, identity, and control rather than mere refreshment.

This dual strategy reflects what many large brands are attempting right now: holding value-conscious consumers while extracting more margin from those who can afford it. The danger, as Mark Ritson has pointed out, is that this approach can quietly slide into “maximinflation” territory, where brands raise prices, reduce pack sizes, and add premium cues all at once, assuming consumers will absorb the shift.

In a K-shaped economy, that assumption only holds for part of the market.

Coca-Cola’s challenge is not choosing between affordability and premiumization. It is ensuring that these two narratives do not collide. Affordable must still feel generous. Premium must still feel earned. If the value story blurs, consumers on both sides of the K notice quickly, either through price sensitivity or trust erosion.

What Coca-Cola illustrates is not just flexibility, but fragility. Playing both sides of the K can be powerful, but it leaves little room for missteps. In a polarized economy, consumers are more aware of shrinkflation, more skeptical of premium claims, and more willing to switch when value feels distorted.

That is the trade-off brands are navigating now. The ability to stretch across the K can protect scale, but only if the brand remains disciplined about what it asks each consumer to pay, and why.

READ MORE | Inside Coca-Cola Marketing Strategy and Amazon Success

What the Private Label Peak in 2025 Is Really Telling Us

At the same time, private label brands have become one of the clearest signals of how consumers are adapting. Private label sales peaked in 2025, reflecting a strong shift toward affordable but value-driven options.

This is not simply a story about consumers chasing lower prices. Retailers have improved packaging, quality consistency, and shelf presentation, making private labels feel intentional rather than inferior. For many shoppers, private label now represents control and pragmatism, not compromise.

In a K-shaped economy, private label wins because it minimizes regret. It delivers function and reliability without asking consumers to overpay for brand equity they no longer feel compelled to fund.

Why Premium Is Narrowing, Not Disappearing

Premium demand has not collapsed. It has become more selective. Consumers who can afford higher prices are more critical of what those prices represent.

Vague lifestyle branding, inflated claims, and superficial differentiation struggle to hold attention. Premium works when it is tied to outcomes, performance, longevity, or identity. This is why categories like wellness, nutrition, beauty, and productivity tools continue to show resilience, even as more discretionary categories face pressure.

In this economy, premium must earn trust, not assume it.

The Middle Is Where Brands Get Stuck

The most fragile position right now is the middle. Products that are neither clearly affordable nor clearly premium struggle to articulate their role in a polarized market.

Consumers are no longer drifting. They are making sharper choices. They trade down to something efficient and defensible, or they trade up to something that feels meaningful and future-facing. The broad middle, once the engine of mass consumption, is where uncertainty now concentrates.

How Brands Adapt to a K-Shaped Economy

Income alone no longer predicts behavior. Two consumers with similar salaries can behave very differently depending on debt, security, and outlook. That emotional divergence is why topline economic data often fails to explain what is happening on digital shelves and in carts.

The most important question for brands is no longer how to drive growth in general. It is how to remain relevant inside a polarized consumer landscape.

- Does the brand help consumers feel stable?

- Does it help them feel ahead?

- Does it reduce friction, risk, or mental load?

Consumers are optimizing themselves because the margin for error feels smaller. Brands are being asked to do the same.

In a K-shaped economy, clarity beats coverage. Brands that understand which arm of the K they serve, or how to credibly operate across both, are the ones that will continue to earn trust. The rest risk drifting in the middle that consumers are steadily leaving behind.

Ready to Decode Consumer Behavior Shifts with Accurate Insights?