Beauty remains one of the largest global consumer categories, sustaining growth even as consumer spending becomes more selective.

The global beauty and personal care market was projected to grow toward nearly $692 billion by 2029 at a compound annual growth rate of more than 5.5%, driven by digital commerce expansion, wellness integration, and rising consumer sophistication.

McKinsey forecasts roughly 5% annual growth through 2030, with skin care comprising a significant portion of value. Consumer demand is broadening beyond traditional cosmetic categories into wellness‑oriented beauty solutions, personalization, and digital engagement; trends that are mirrored in Walmart’s marketplace dynamics.

These patterns raise much bigger questions. Are customers flocking to big, popular brands? Are they sticking to familiar products? And what does this tell us about how beauty bestsellers on Walmart operate?

Let’s get a data-driven look at it.

About The Report

This report zooms in on beauty bestsellers on Walmart over a 7-day period (October 22-29, 2025), covering a total of 75,796 beauty products. Our research geeks examined data from product listings, review volumes, ratings, pricing, and category dynamics.

By examining bestseller insights alongside broader beauty market trends, the MetricsCart report highlights the signals that drive visibility, shopper trust, and engagement, and what these patterns indicate about the future direction of Walmart’s beauty shelf.

Highlights

- Walmart’s beauty shelf is predominantly value-oriented, with premium products appearing mostly in bulk packs, not single high-end SKUs.

- Pricing remained remarkably stable, fluctuating only by $1.28 throughout the week, indicating low promotional volatility and steady demand.

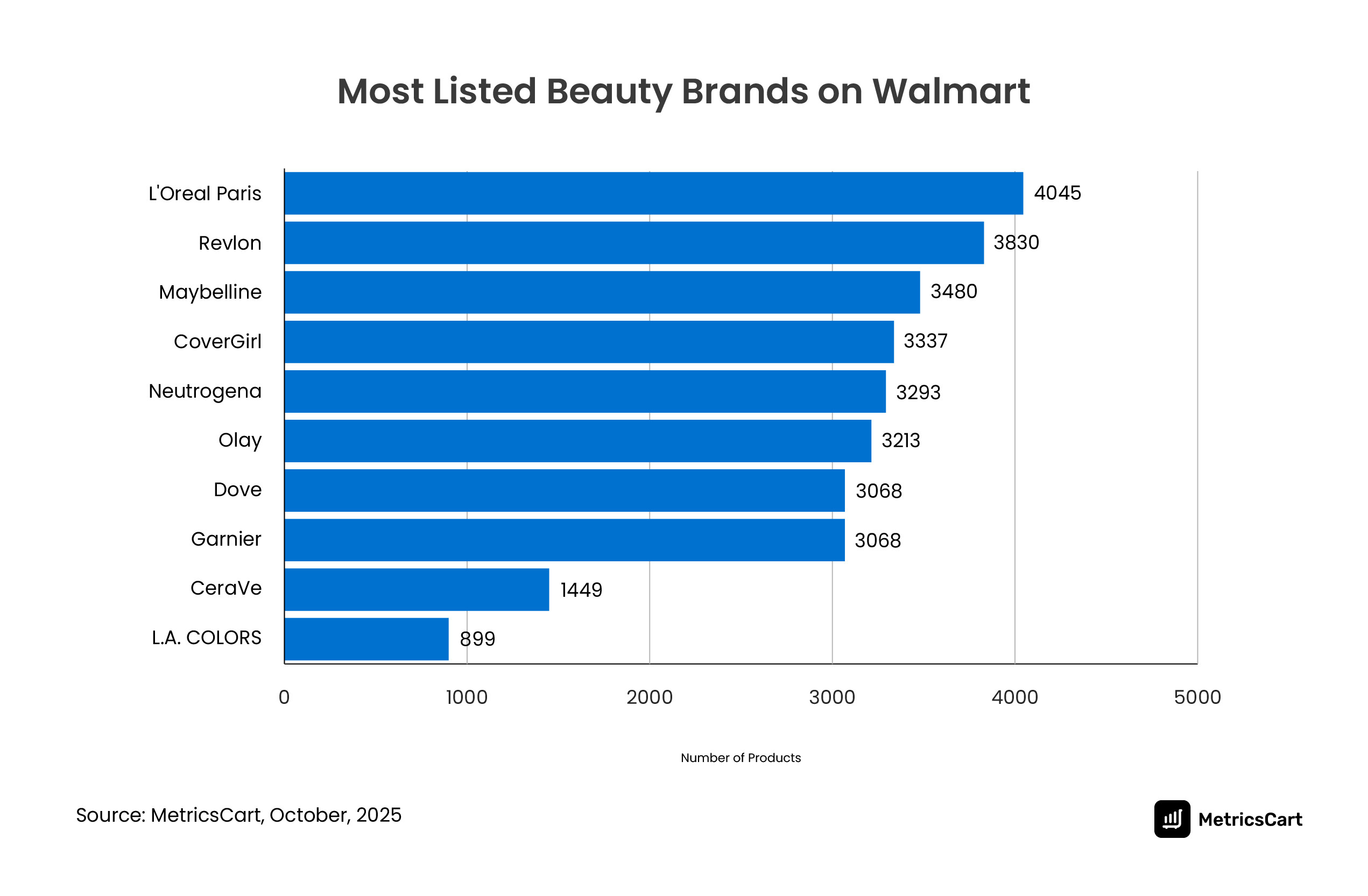

- The brands that dominate visibility are those with wide assortments; L’Oréal Paris, Revlon, and Maybelline list over 3,000 products each, while smaller brands like CeraVe maintain a more focused catalog (~1,400 products).

- Review volume is heavily concentrated in replenishable categories like body wash and deodorants, which accumulate significantly higher review totals than categories like makeup or skincare.

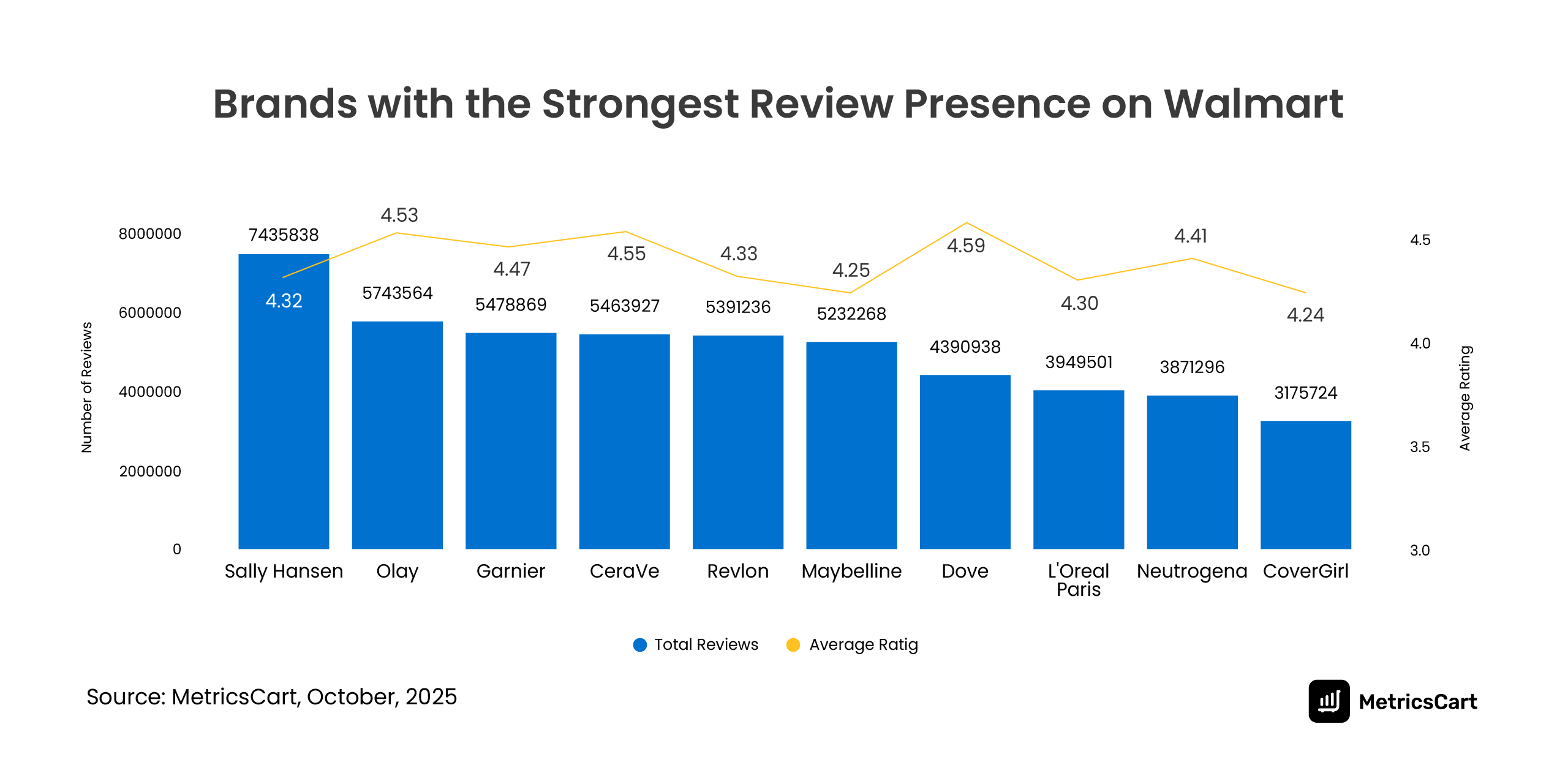

- Sally Hansen leads in review volume, with over 7.4 million reviews, even though it has a smaller assortment than L’Oréal Paris, showing that loyalty and routine-driven categories create stronger long-term consumer engagement.

Assortment Depth Is the Primary Driver of Brand Visibility on Walmart

When we examined the most-listed brands using MetricsCart, we saw a direct correlation between assortment depth and visibility. The top 3 brands, L’Oréal Paris (4,045 SKUs), Revlon (3,830 SKUs), and Maybelline (3,480 SKUs), dominate the shelf because they cover a wide variety of categories (skin, hair, makeup, etc.).

Smaller brands like CeraVe (1,449 SKUs) and L.A. COLORS (899 SKUs) have fewer listings, but they still manage to stay visible by focusing on popular product categories.

The more categories a brand can cover, the more entry points it has for shoppers to find it. This gives brands with wide portfolios a visibility advantage because Walmart’s search algorithms and product recommendation engines tend to favor brands that have higher assortment depth.

This is consistent with beauty bestsellers trends on Walmart, where visibility depends as much on how many times a product can appear across the shelf as it does on specific product performance.

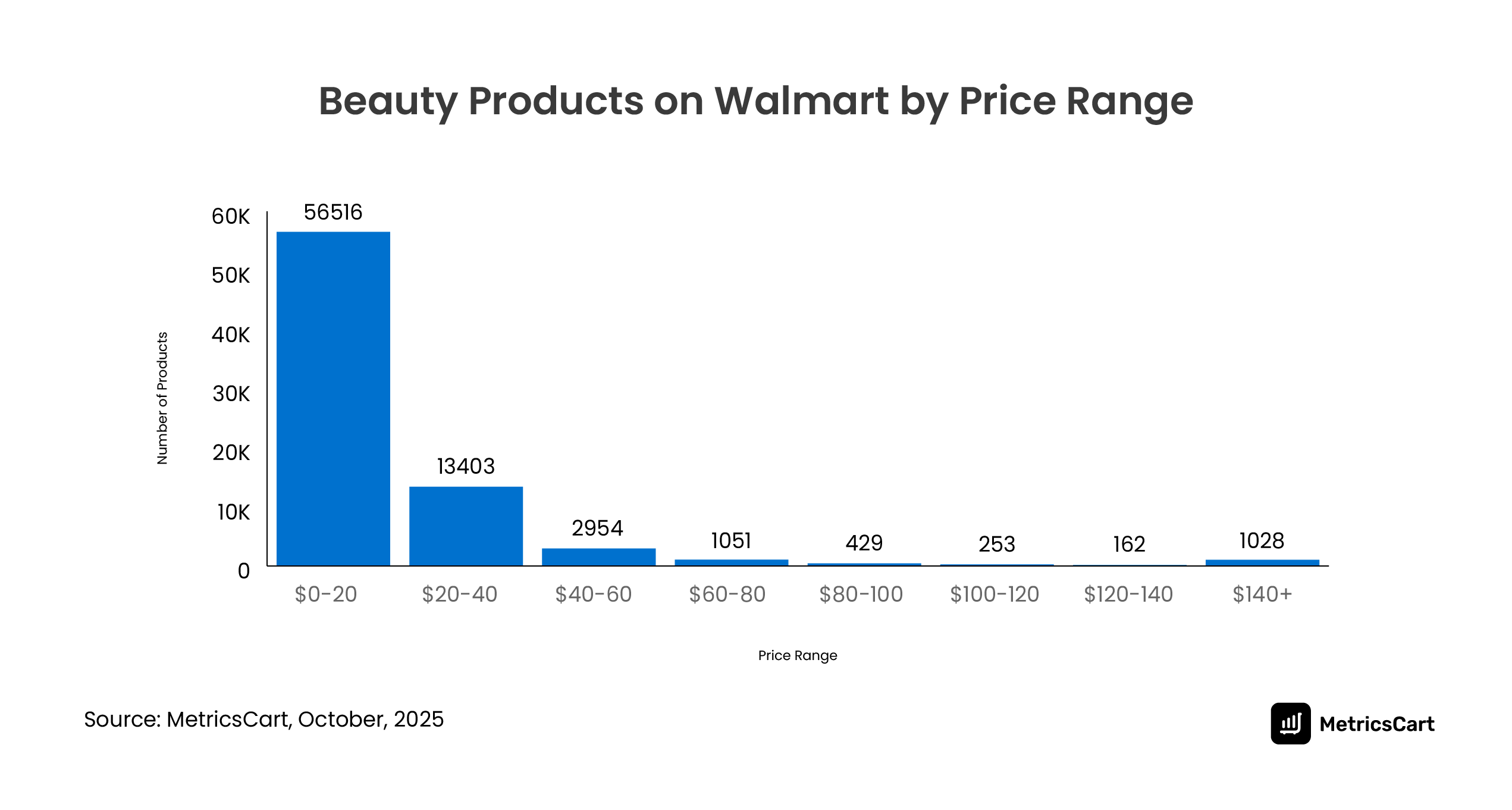

Walmart’s Beauty Shelf Is Heavily Concentrated Below $20, With Rapid Drop-Off Beyond Mid-Price

The price-range distribution makes one thing unmistakably clear: Walmart’s beauty demand is highly value-led. Out of the entire beauty assortment, 56,516 products fall within the $0-$20 range, and that’s not a mild skew.

Once prices cross $20, the assortment drops sharply. The $20-$40 band holds 13,403 products, which is already less than a quarter of the lowest band. Beyond that, the decline accelerates. The $40-$60 range contains just 2,954 products, followed by 1,051 products in the $60-$80 band. From $80 onward, the shelf becomes extremely thin.

This distribution confirms that Walmart’s beauty shelf is structurally designed for budget and mid-range consumption. The steep fall-off after $20 suggests that higher price points are exceptions and are likely supported by specific use cases such as bulk packs, professional quantities, or niche premium SKUs rather than mainstream demand.

The slight rebound in the $140+ range reinforces an earlier signal seen across the dataset: premium pricing on Walmart is often tied to bulk economics, not just prestige positioning. These are not impulse luxury buys. They are high-ticket purchases justified by quantity, frequency of use, or resale logic.

Consumer behavior on Walmart aligns with broader beauty market trends where shoppers prioritize affordability and functional value, especially on mass platforms. It also explains why beauty bestsellers on Walmart skew toward routine categories. When most of the shelf is below $20, repeat purchase and trust become stronger conversion drivers than aspiration.

Walmart’s Beauty Shelf Is Price-Accessible, With Premium Showing Up Mostly in Bulk

Expensive Products

|

Products |

Price |

| Olay Regenerist Hyaluronic + Peptide 24 Hydrating Moisturizer (Pack of 32) | $855.34 |

| Olay Serum 30 mL (Pack of 24) | $828.91 |

| Olay 2376425 Olay Ultra Moisture Body Wash – Case of 184 | $726.57 |

| Dove Body Wash Deep Moisture Cleanser 22 oz (Pack of 48) | $633.81 |

| Olay Moisture Ribbons Plus Shea Lavender Oil 18 oz (Pack of 48) | $546.92 |

Affordable Products

|

Products |

Price |

| L.A. COLORS Ultra-Pigmented Eyeliner Pencil, Black, 0.035 fl oz | $0.81 |

| L.A. COLORS Color Craze Nail Polish, Intimate, 0.44 fl oz | $0.94 |

| Via Natural Ultra Care Moisturizing Coconut Oil for Hair, Scalp & Body Treatment, 1.5 fl oz, | $0.97 |

| L.A. COLORS 2pc.Precision Pencil Eyeliner & Ultra-fine Detailing Brow Pencil – Dark Brown | $0.98 |

| Taste Beauty, Fluffy Stuff Flavored Lip Balm, .12 oz. | $0.98 |

Looking at the pricing spread of beauty bestsellers on Walmart, the MetricsCart research team found an interesting pattern. The lowest-priced beauty products hover around $0.81, with brands like L.A. COLORS offering entry-level products for under $1. These items show the importance of low entry prices to drive traffic, particularly in categories like makeup, where frequent repurchase behavior is common.

On the other end, the most expensive items are bulk packs of products; Olay Regenerist Hyaluronic + Peptide 24 (Pack of 32) at $855.34 or Dove Deep Moisture Body Wash (Pack of 48) at $633.81.

This price distribution tells us something crucial: Walmart’s beauty shelf is driven by affordability.

Premium products on Walmart are predominantly multi-pack, bulk-buy items, rather than single luxury units. Shoppers buying premium beauty are likely doing so for family needs, replenishment, or stock-ups, indicating that value-based pricing is a top priority.

From a consumer behavior standpoint, this makes perfect sense. Shoppers on Walmart tend to purchase products they’ll use frequently, and in large quantities, which also explains the pricing patterns for premium goods. It’s not about paying for luxury; it’s about getting more value per unit.

READ MORE | Strategies for Winning the Walmart Buy Box: The Essential Guide for Brands

Pricing Remained Stable Throughout the Week, Indicating Low Promotional Volatility

Over the course of the week, the average price of beauty products fluctuated only by about $1.28, staying within the $20-$21 range.

- Oct 22: $20.11

- Oct 28 (peak): $21.39

- Oct 29 (end): $20.88

This low volatility signals low reliance on promotions or discounts to drive sales. It’s a clear sign that Walmart beauty shoppers don’t need steep markdowns to convert; they’re coming for the everyday essentials that they trust. The stable price point aligns with consumer demand for predictability and value, and it reflects a broader trend of consumers looking for consistent value rather than short-term deals.

Olay, Dove, and Cetaphil Lead Among The Most Reviewed Beauty Products on Walmart

Most Reviewed Beauty Products on Walmart (Oct, 2025)

|

Products |

Reviews |

| Olay Ultra Moisture Body Wash with Shea Butter, 33 fl oz | 100032 |

| Dove Advanced Care Long Lasting Women’s Antiperspirant Deodorant Dry Spray, Cool Essentials, 3.8 oz | 62069 |

| Olay Ultra Moisture Body Wash with Shea Butter, All Skin Types, 3 fl oz | 58959 |

| Olay Fresh Outlast Women’s Body Wash, White Strawberry & Mint, 22 fl oz | 54000 |

| Cetaphil Moisturizing Face and Body Lotion for Normal to Dry Skin, Hydrating Fragrance Free, 16 fl oz | 33304 |

Olay clearly leads the pack. Three of the top five most-reviewed products come from Olay, with the Ultra Moisture Body Wash (33 fl oz) crossing 100,032 reviews, the highest for any single product in the dataset. What stands out is not just the volume, but the consistency.

The same core formulation appears in multiple sizes and variants, each generating tens of thousands of reviews. This indicates strong product-level trust, not one-off success. Shoppers are not experimenting with Olay; they are sticking with it across formats and replenishment cycles.

Dove follows closely, with its antiperspirant dry spray accumulating 62,069 reviews. Deodorant is one of the most habit-driven categories in beauty. Once a shopper finds a product that works, switching costs feel high. Dove’s presence here reflects deep penetration into daily routines, especially in personal care categories where comfort and reliability outweigh novelty. High review volume in deodorant also signals a broad and diverse user base, which further strengthens credibility on the digital shelf.

Cetaphil rounds out the list with its moisturizing face and body lotion at 33,304 reviews. While this is lower than Olay and Dove in absolute terms, it is still significant given Cetaphil’s positioning. Cetaphil products are often chosen for sensitive skin and dermatologist-recommended use cases, which tend to have longer usage lifecycles and fewer impulsive switches. The review volume here reflects trust built over time rather than rapid churn.

- High review counts cluster around replenishable personal care, not trend-driven beauty.

- Brands that win here do so by embedding themselves into daily behavior, not by chasing novelty.

- Review leadership at the product level translates into long-term digital shelf advantage, as high review volume improves conversion, search visibility, and shopper confidence.

They are leading because they are the default choices. That distinction is critical for understanding what drives beauty bestsellers on Walmart and the wider beauty categories trends shaping mass retail today.

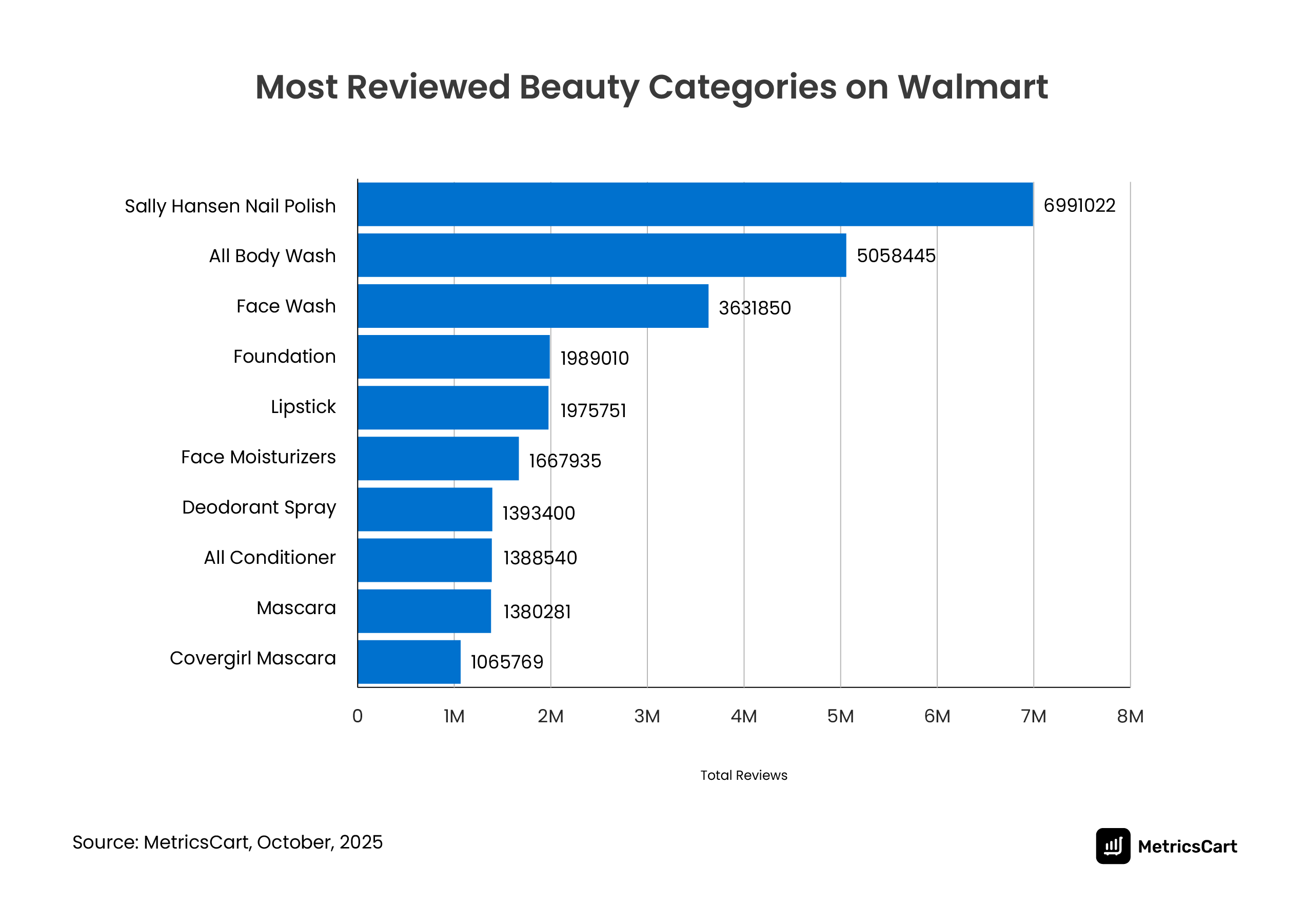

Review Volume Is Concentrated in Replenishable, Everyday Beauty Products

When we drill into reviews by category, the data clearly shows that replenishable beauty products (like body wash and face wash) have a higher review volume compared to makeup and skincare.

At the top of the chart sits Sally Hansen Nail Polish with 6,991,022 reviews, making it the single most reviewed beauty category on Walmart. This level of review volume is not driven by assortment size alone. It reflects high purchase frequency, strong brand recall, and a well-established habit loop. Nail care, especially at mass price points, is both accessible and repeatable, which accelerates review accumulation over time.

All Body Wash follows closely with 5,058,445 reviews, reinforcing the role of everyday hygiene products as the backbone of Walmart’s beauty engagement. Body wash is a true replenishment category. Products are used daily, replaced frequently, and evaluated quickly, making shoppers far more likely to leave feedback.

Face Wash, with 3,631,850 reviews, continues this pattern. As skincare routines become more standardized and widely adopted, face wash has moved from an occasional purchase to a daily essential. Its position in the top three reflects both growing skincare awareness and strong repeat usage behavior.

Once we move beyond these routine-driven categories, review volume drops sharply. Foundation and Lipstick, both sitting just under 2 million reviews, are still highly engaged categories, but they operate on a different consumption cycle. These products are replaced less often, are more shade-dependent, and involve more trial and hesitation, which naturally slows review velocity.

Categories with higher purchase frequency generate higher review volumes, reinforcing that trust and routine play a big role in shaping Walmart’s beauty ecosystem. Products in these categories tend to have a higher reorder rate because they are integral to shoppers’ daily lives.

This pattern strongly supports broader beauty bestsellers categories trends, where consumer loyalty is increasingly anchored in products that fit seamlessly into daily routines rather than one-off beauty experiments.

Reviews can reveal much more about your brand performance than just customer engagement scores! With MetricsCart’s ratings and reviews analysis software, unlock nuanced insights into consumer demand, and feed your product R&D efforts to get ahead of competitors.

READ MORE | How to Get More Reviews: 7 Tips to Improve Product Ranking

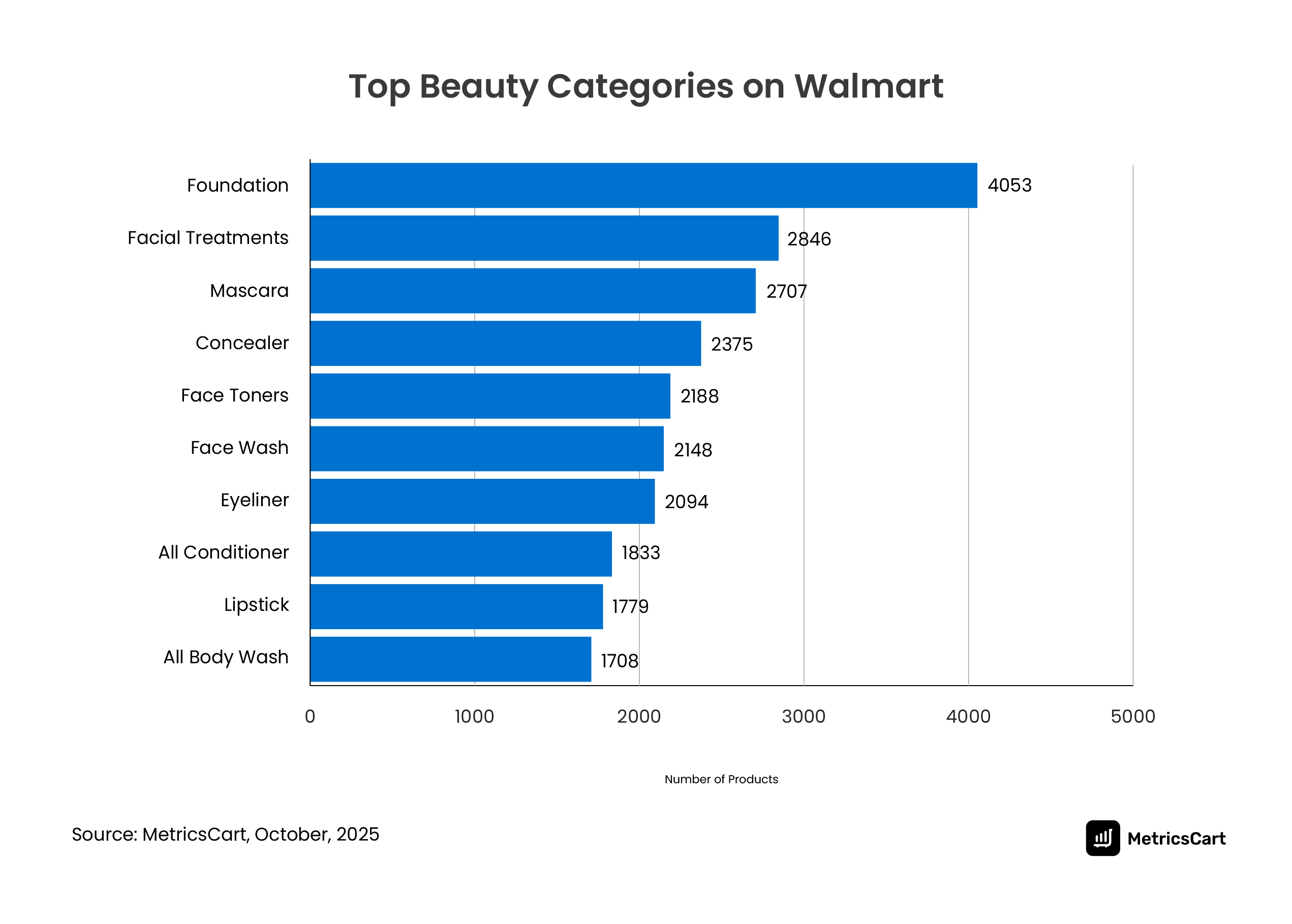

Makeup Commands Shelf Space, While Daily-Use Categories Capture Engagement

The category listing distribution on Walmart makes one thing immediately clear: makeup dominates shelf real estate. Foundation alone leads with 4,053 listed products, making it the single most expansive beauty category on the platform. This is followed by facial treatments (2,846) and mascara (2,707), reinforcing how color cosmetics and appearance-driven categories rely on breadth and variation to compete.

Makeup categories naturally require more SKUs due to shade ranges, undertones, finishes, and formulation differences. A single foundation line can easily multiply into dozens of listings, each serving a specific skin tone or preference. On Walmart’s digital shelf, this translates into higher visibility because more SKUs mean more chances to surface in search results and category filters.

However, when we move down the list, a shift starts to appear. Categories such as face wash (2,148 products), all conditioner (1,833), and all body wash (1,708) have fewer listings, yet they remain consistently present across the shelf. They are routine-led categories, where shoppers return to familiar products rather than browse endlessly for options.

From a strategic perspective, this is a critical signal for brands navigating beauty bestsellers on Walmart. Expanding assortment makes sense in categories where choice and personalization matter. In contrast, daily-use categories benefit more from clarity, consistency, and social proof.

READ MORE | From Vaseline to CeraVe: Best-Selling Body Lotions on Walmart

Reading Tomorrow’s Beauty Playbook From Today’s Shelf

When you step back from the charts and look at Walmart’s beauty shelf as a system, a playbook starts to emerge. Beauty bestsellers on Walmart point to a clear shift in how beauty demand is forming and how winning brands are preparing for what comes next.

- Value is no longer just about low price: More than 56,000 beauty products sit below the $20 mark, confirming that Walmart remains a value-led platform. But the strongest performers are not the cheapest. They are the products that deliver consistent results and earn repeat trust. This aligns with how beauty leaders are redefining value as performance and reliability, not discounting.

- Premium will grow only when it fits into everyday routines: Higher price points on Walmart appear mainly through bulk and multipack formats, not single prestige SKUs. This shows that premium beauty scales on Walmart when it improves daily routines, not when it relies on aspiration alone. Beauty leaders echo this approach, focusing expansion on practical, usage-led innovation rather than symbolic luxury.

- Review density is becoming a stronger signal than assortment size: Brands like Olay, Dove, Cetaphil, and Sally Hansen show that sustained reviews on Walmart create long-term advantage. Large assortments still drive visibility, but loyalty is built through repeat use. Industry leaders are prioritizing consumer connection and retention over constant SKU expansion, and Walmart’s data reflects the same shift.

- Assortment strategy is becoming more precise: Makeup dominates shelf space, while replenishable categories dominate engagement. This split reinforces that brands must decide where breadth is necessary and where focus drives better outcomes. Winning brands are narrowing in on categories they can truly own rather than spreading across the shelf.

Is your brand looking to win on Walmart? That means tracking review velocity, monitoring price consistency, understanding category-level engagement, and knowing where assortment depth actually drives results.

MetricsCart helps brands turn these shelf signals into action by providing real-time visibility into pricing trends, review performance, and category dynamics. In a shelf where consistency beats noise, the brands that win are the ones that see the signals first and act on them faster.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Step up Your Brand Game and Become The Next Bestseller!