About the Report

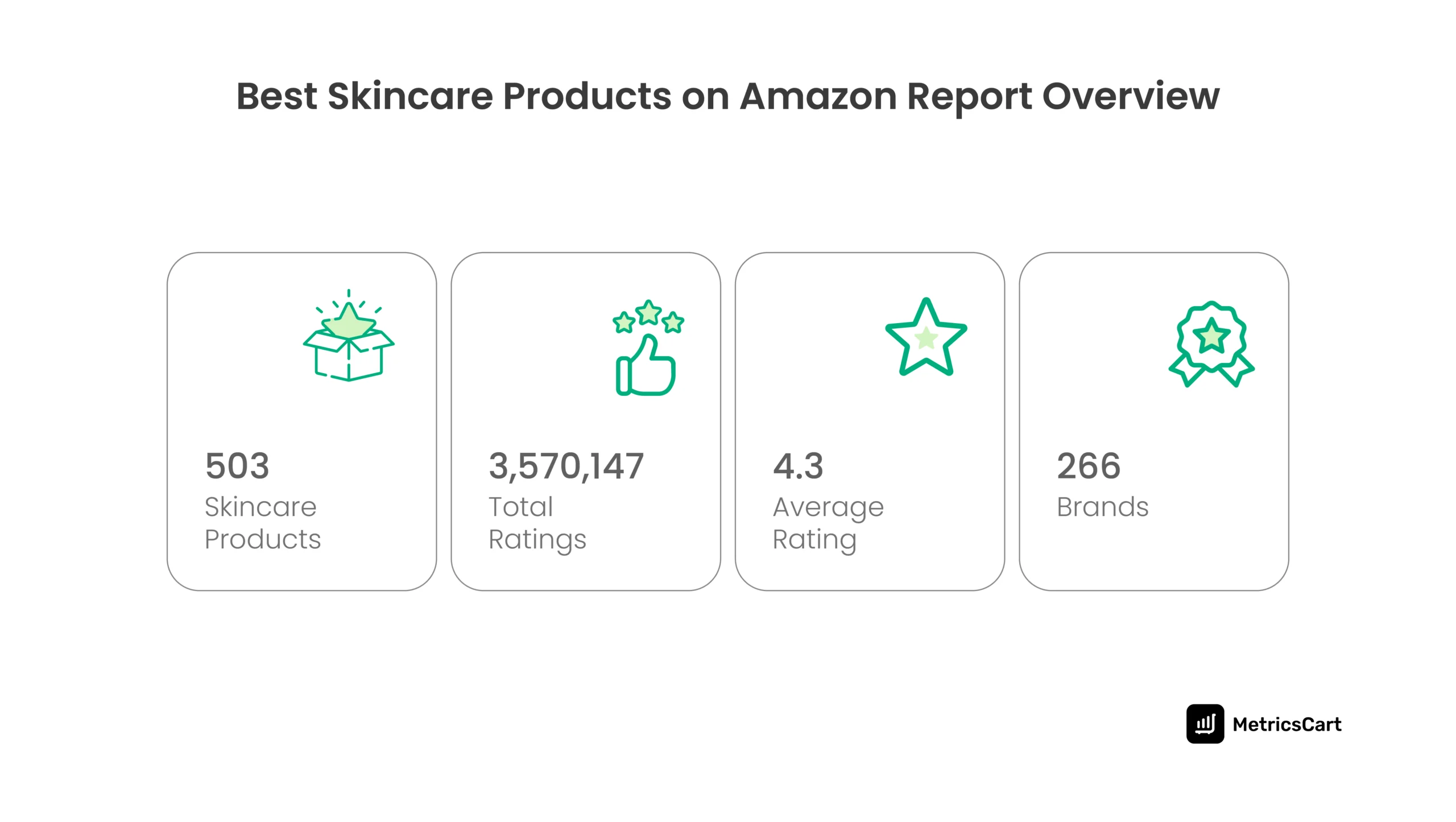

This report is based on data from 503 skincare products across 266 brands listed on Amazon, collected on October 4, 2024. It highlights actionable insights into current consumer preferences, pricing trends, top-selling products, and brand performance in the competitive skincare category.

Introduction

Did you know that 49% of Gen Z shoppers in the US have a skincare regimen? With an increasing shift toward self-care practices, skincare is the largest category, accounting for 44% of the market. The US skincare market is predicted to reach an estimated value of USD 30.42 billion by 2032.

In this best skincare products on Amazon report, we will comprehensively discuss the top-performing brands, bestsellers, pricing insights, and customer ratings.

As of Q3 2024, driven by diverse consumer demands and innovative product offerings, Amazon has seen significant growth in beauty and personal care products. Of the top 25 beauty and personal care products, 48% belong to the skincare category. The average price point of skincare products was $15.26, 15% less than that of Q2.

READ MORE | Want to know more about Amazon’s beauty and personal care category? Check out Digital Shelf Insights: Amazon Best Sellers in the Beauty & Personal Care Category.

Highlights

- The most expensive skincare product on Amazon is iS CLINICAL Youth Intensive Crème priced at $235, followed by SkinMedica TNS Recovery Complex at $230.

- Biodance Bio-Collagen Real Deep Mask and COSRX Snail Mucin 96% Power Repairing Essence are the top-selling skincare products, dominating monthly sales with 100,000 units each.

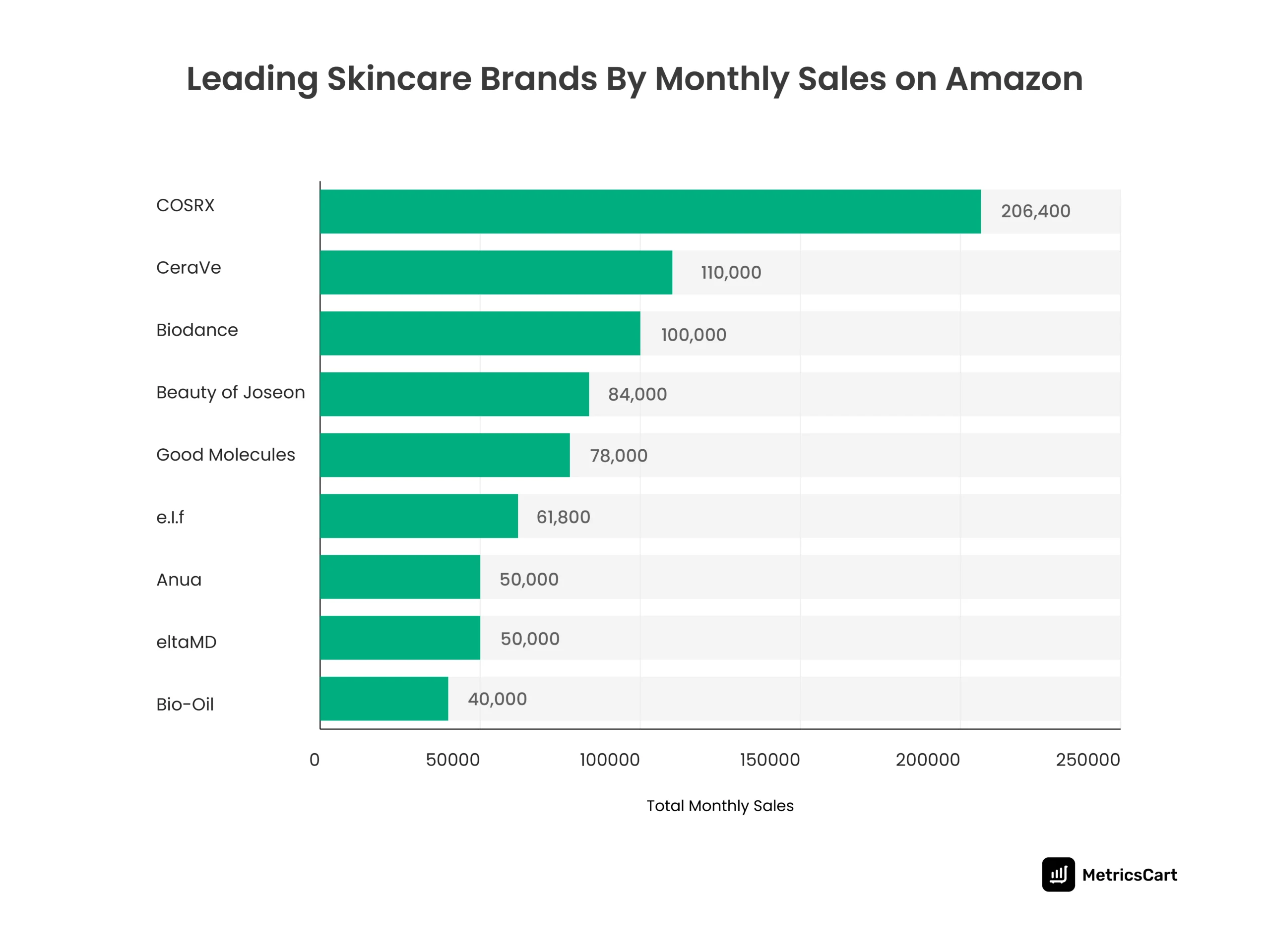

- COSRX is the top-performing brand, with a monthly sales volume of 206,400 units, followed by CeraVe at 110,000 units.

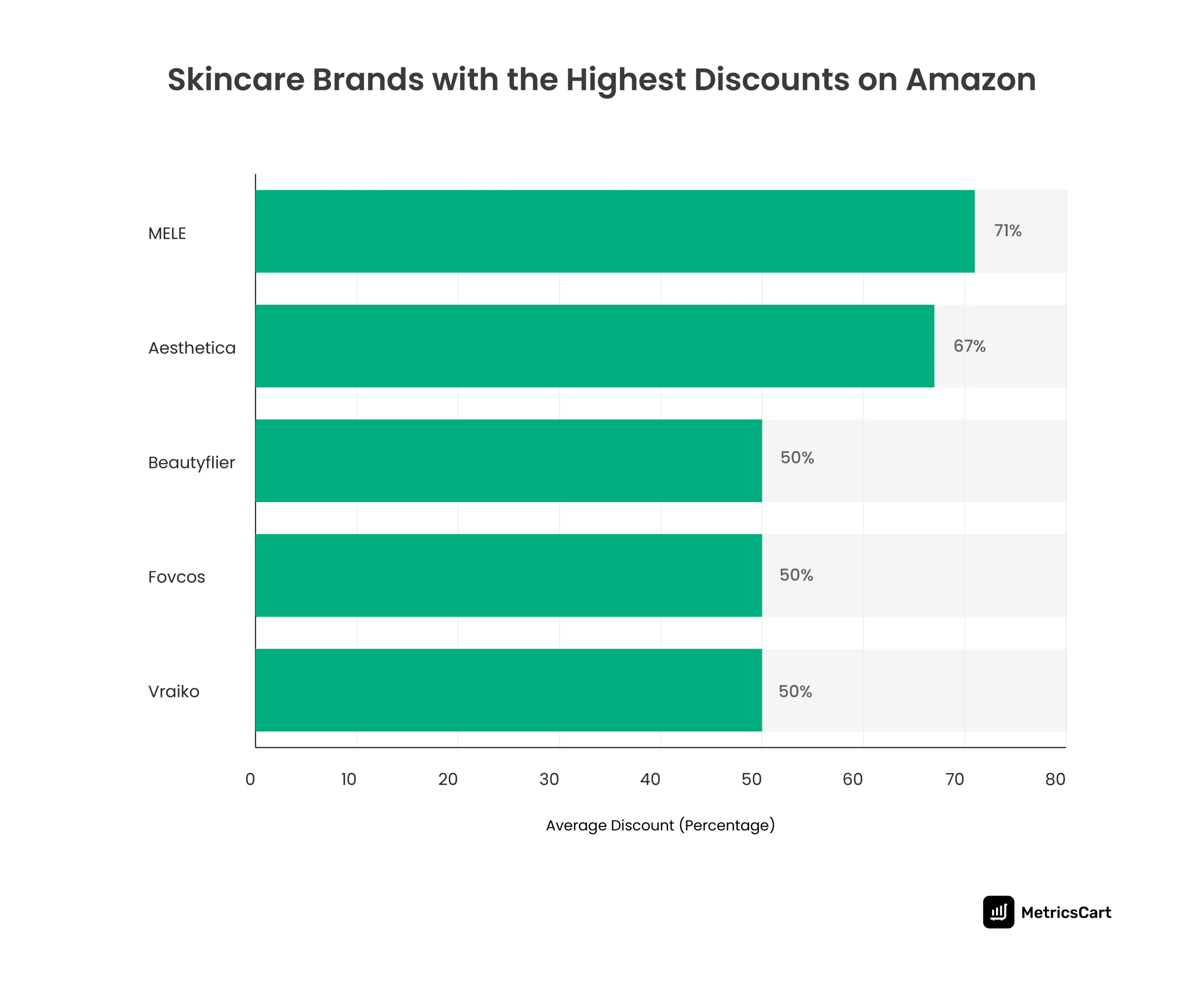

- The Mele Even Dark Spot Serum has the highest discount at 71%, followed by Aesthetica Cosmetics Beauty Sponge Blender, with a 67% discount.

- Maybelline leads in customer engagement with the highest rating count of 234,593.

Biodance Biocollagen Real Deep Mask and COSRX Snail Mucin 96% Power Repairing Essence Are the Top Selling Beauty Products on Amazon

The Biodance Bio-Collagen Real Deep Mask and the COSRX Snail Mucin 96% Power Repairing Essence are the top monthly-selling skincare products, both reaching 100,000 units. The CeraVe Foaming Facial Cleanser follows with 60,000 units.

With the growing popularity of K-beauty, Biodance Bio-Collagen Real Deep Mask saw a 1,900% surge in Amazon searches in Q2. It gained traction through nonbranded searches for “collagen face mask” and “Korean face mask” and branded searches for “Biodance.”

Similarly, COSRX Snail Mucin 96% Power Repairing Essence is a hero product that gained immense popularity through influencer marketing and word-of-mouth on TikTok US, becoming the #1 selling Korean brand on Amazon.

With MetricsCart’s LIVE content compliance analyzer, know exactly where to use the right keywords and optimize your product listings to appear for what your customers are actively looking for.

COSRX and CeraVe Are the Top Performing Skincare Brands on Amazon

COSRX leads the chart of top selling brands listed on Amazon with a significant volume of 206,400 units sold, followed by CeraVe at 110,000 and Biodance at 100,000.

While CeraVe is a long-standing household name that offers affordability and quality gentle skincare, COSRX and Biodance are relatively new entrants in the US beauty market.

Both brands have gained popularity, especially among Gen Z, leveraging on the steady rise in K-beauty trends.

READ MORE| Want to know how to bring Gen Z to your Amazon PDPs? Check out our blog Decode How Gen Z Shops on Amazon: Supercharge Your Brand’s Sales Today.

The Top Selling COSRX Products Are Snail Mucin 96% Power Repairing Essence and Snail Mucin 92% Repair Cream

COSRX’s product lineup consistently outperforms competitors. Its #1 bestseller, Snail Mucin 96% Power Repairing Essence, has 100,000 monthly sales, marking its position as a customer favorite.

This was followed by the Snail Mucin 92% Repair Cream, which achieved 40,000 monthly sales, and Hyaluronic Acid Moisturizing Cream, Niacinamide 15% Face Serum, and Snail Peptide Eye Cream, each with 10,000 monthly sales.

COSRX achieved remarkable growth of over 1,000% year over year, with viral social media mentions and influencer collaborations being pivotal factors in amplifying brand recognition and driving engagement and sales.

READ MORE | To find out the bestselling Neutrogena products on Amazon, check out Digital Shelf Insights: Neutrogena Best Sellers on Amazon for May 2024

iS Clinical Youth Intensive Crème and Skinmedica Recovery Complex Face Serum Are the Most Expensive Skincare Products

Amazon caters to luxury skincare consumers with high-end products. The most expensive skincare product is iS Clinical Youth Intensive Crème, priced at $235, followed by SkinMedica TNS Recovery Complex at $230 and Naked & Thriving Restorative Night Routine at $208.

The high price points reflect their appeal to consumers who prioritize top-tier skincare solutions, results, and exclusivity, often influenced by dermatologist recommendations and targeted marketing campaigns.

READ MORE | Want to learn more about competitive pricing strategies? Check out A Guide to Competitive Pricing

Mele and Aesthetica Offer the Highest Discounts on Amazon

Mele offers the highest average discount at 71%, followed by Aesthetica with 67%. Brands like Beautyflier, Fovcos, and Vraiko each provide an average discount of 50%.

The Mele Even Dark Spot Serum offers the highest discount, at 71%, though it has relatively low sales, at 400 units. Meanwhile, the Aesthetica Cosmetics Beauty Sponge Blender, with a 67% discount, has a significantly higher sales volume, at 8,000 units.

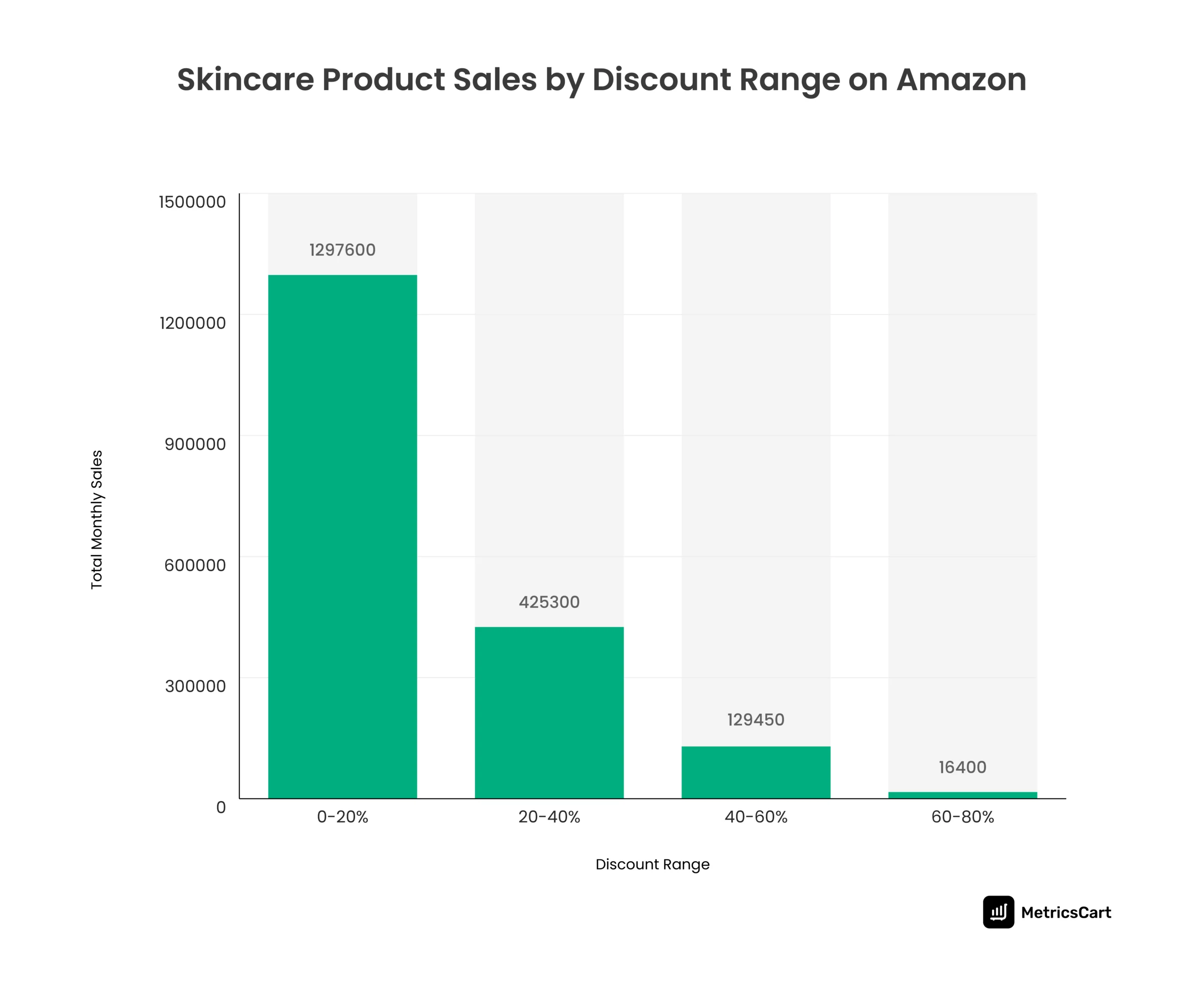

This discount trend data indicates that products with discounts of 0-20% have the highest monthly sales, totaling 1,297,600. On the other hand, products with steep discounts between 60-80% have the lowest monthly sales, at only 16,400.

This disparity suggests that consumers tend to associate excessive discounts with reduced product quality or lesser value. Hence, offering bigger discounts does not guarantee higher sales.

Get in touch with MetricsCart to gain insights on how to balance and optimize your pricing strategies for maximum profitability on Amazon.

Maybelline and Vitafusion Lead in Customer Engagement With Highest Rating Count

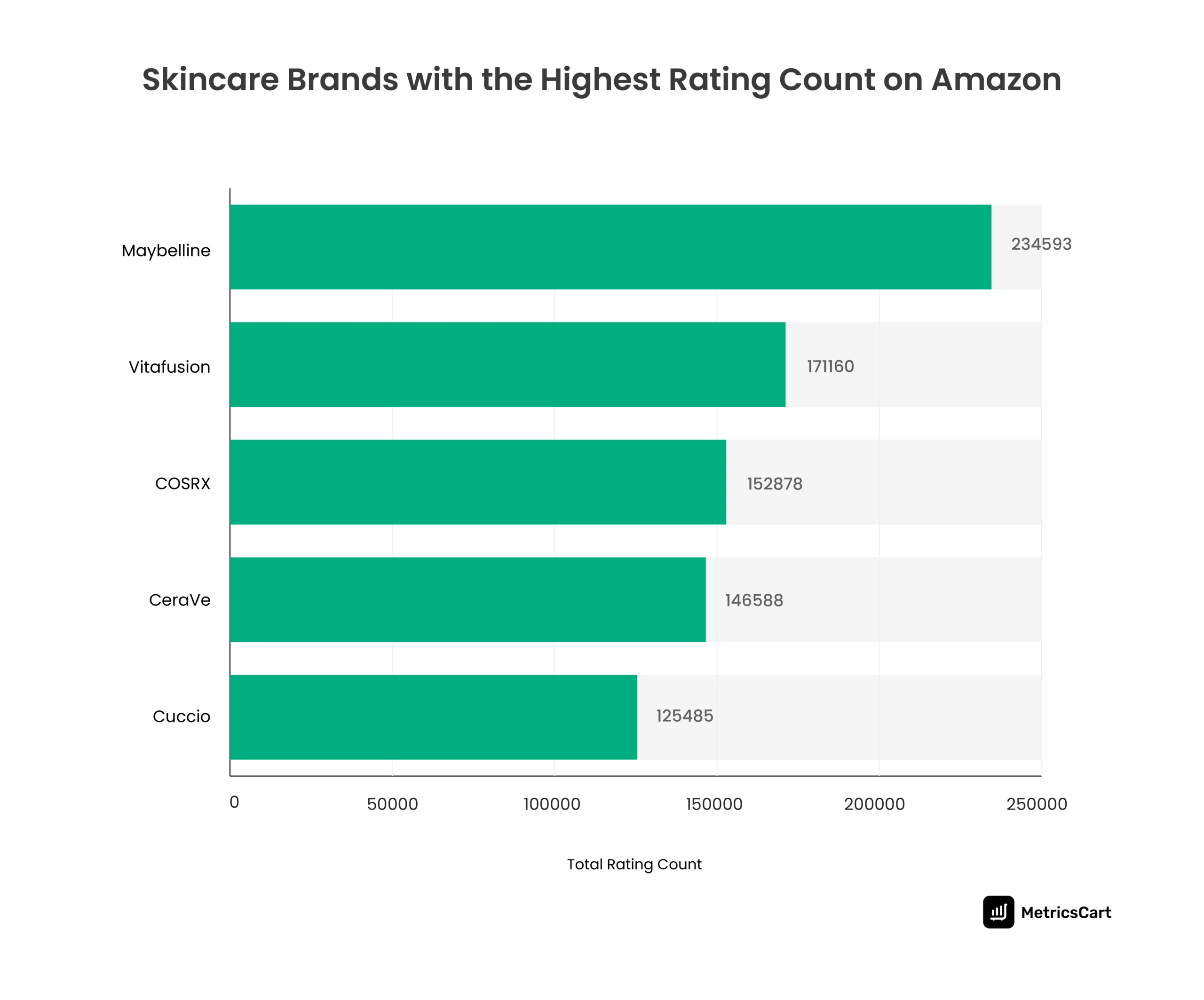

Maybelline leads with the highest rating count of 234,593, followed by Vitafusion with 171,160 ratings. COSRX and CeraVe also demonstrate significant engagement, with 152,878 and 146,588 ratings, respectively.

The top skincare product with the most 5-star ratings on Amazon is Vitafusion Multivitamin Plus Beauty, which has 171,160 ratings. Following closely is Cuccio Naturale Cuticle Oil, with 125,485 ratings, and Paula’s Choice SKIN PERFECTING 2% BHA Liquid Salicylic Acid Exfoliant, which has 102,620 ratings.

Customer engagement is a strong indicator of brand success. The high rating counts seen across these brands indicate consistent quality, effective marketing, and responsive customer feedback integration.

With MetricsCart’s ratings and review analysis, dive deeper into consumer feedback trends and identify actionable areas for boosting customer engagement and loyalty.

READ MORE | Want to know more about how to leverage customer feedback for brand growth? Check out How Can Sentiment Analysis Help Improve Customer Experience?

Conclusion

Amazon continues to solidify its position as a beauty retail giant. It leads the chart of skincare sellers with a commanding 496,100 monthly sales in the skincare category.

With millennial and Gen Z customers growing more informed about skincare trends, the emphasis on clean beauty, transparency, and efficacy is consistently growing. Skincare products that address specific concerns, such as acne, pigmentation, and aging, were particularly in demand.

A key takeaway from our best skincare products on Amazon report is that viral social media trends play a pivotal role in brand awareness and driving purchase decisions. Thus, strong branding strategies and effective product results have become crucial to brand success.

Ready to optimize your brand’s performance on Amazon? Explore how MetricsCart’s tailored solutions can empower your brand success strategy. Visit MetricsCart to learn more.

Disclaimer: MetricsCart is the exclusive owner of data used in the DSI reports. Any kind of third-party usage entails due credit to the source material.

Ready To Take Control of Your Brand Performance? Strategize With Our Digital Shelf Solutions!