“Alcohol may not solve your problems, but neither will water or milk.”

This old saying resonates differently in 2026. Americans aren’t giving up alcohol, but they are rethinking what, how much, and why they drink. As health consciousness grows and digital commerce reshapes access, the beverage alcohol trends in the US face a fundamental shift.

The US alcohol market remains robust but complex. As of 2024, it was valued at $543.13 billion and is projected to climb to $806.44 billion by 2033, growing at an annual rate of 4.99%.

However, a closer look reveals that the growth is driven more by price increases and premiumization than by higher consumption volumes.

Regionally, alcohol consumption rates show striking disparities. States like New Hampshire have per capita consumption as high as 4.67 gallons annually, while more conservative states, such as Utah, report just 1.35 gallons. These differences reflect not only cultural attitudes but also regulatory environments and demographic profiles.

Overall, the landscape suggests that while Americans continue to value alcoholic beverages, the reasons for drinking and the types of products they seek are shifting fundamentally.

Let’s get into the US beverage alcohol trends reshaping how Americans drink!

What Alcoholic Beverage Do Americans Prefer?

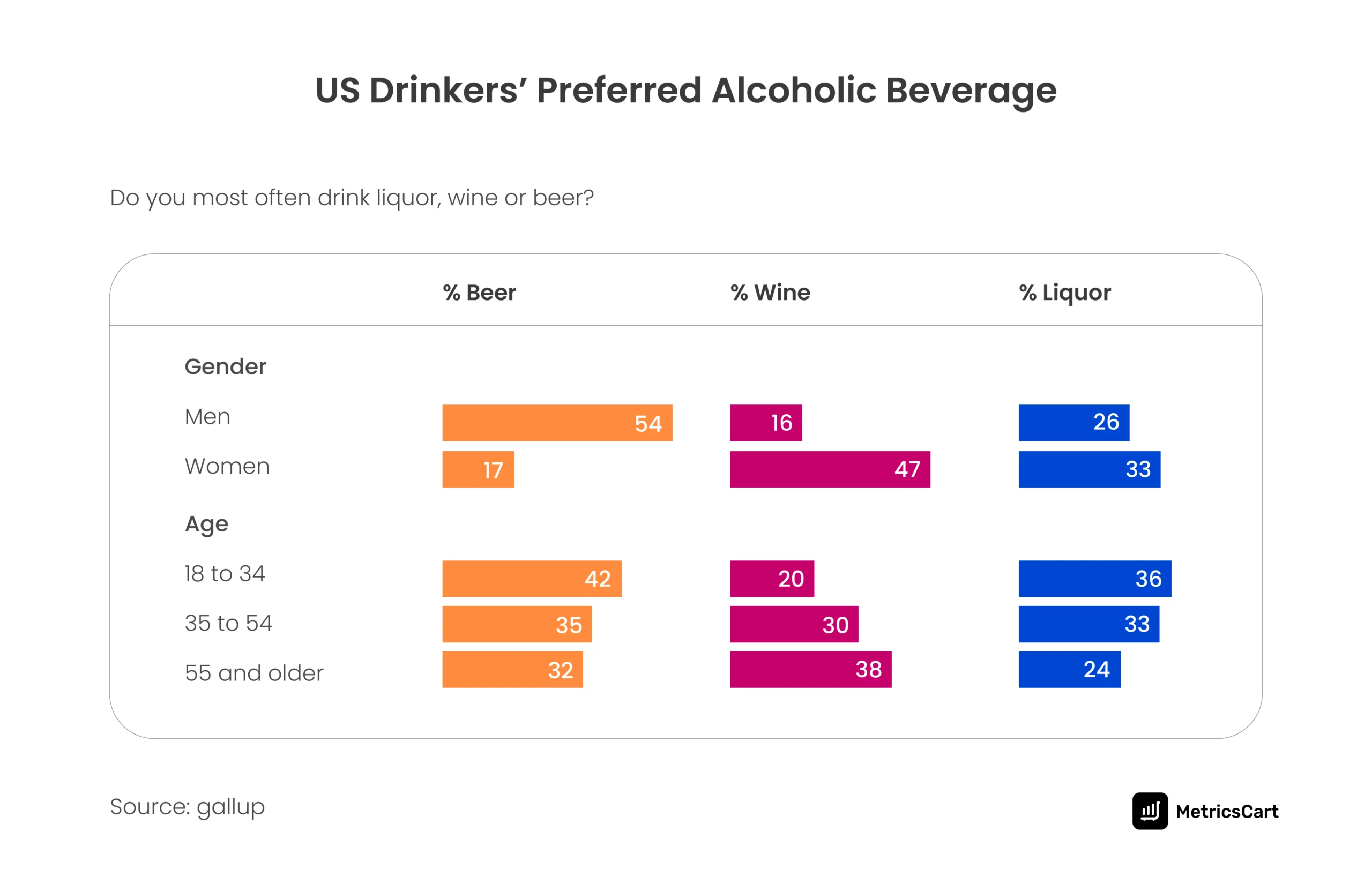

Consumer preferences reveal important insights into how the US alcohol market trends are evolving. Beer maintains its historic lead, capturing 34% of preferences, with wine close behind at 33%, and liquor at 29%. However, these top-line numbers mask important age and gender differences.

Among men, beer continues to dominate, rooted in both tradition and social norms. For women, however, wine and spirits have become the beverages of choice.

This shift suggests that alcoholic beverage marketing can no longer rely on broad generalizations about “what Americans like”; gendered tastes, health consciousness, and lifestyle identity are increasingly at play.

Age differences also offer important clues. Americans aged 18–34 show a stronger tilt toward beer (42% preference) and spirits (36%), while wine lags behind at 20%.

Older demographics tend to split their preferences more evenly between beer and wine. The younger preference for spirits likely ties into their association with innovation, mixology, and new consumption experiences compared to the traditional beer and wine models.

Are Alcohol Sales Declining And Why?

Despite a growing market value, per capita alcohol consumption is declining in the US. The primary reasons are rooted in a combination of health consciousness, economic factors, and shifting cultural norms.

Recent data shows that 45% of Americans now believe moderate drinking is unhealthy. This perception directly impacts consumption patterns, as consumers opt to drink less frequently or switch to lower-alcohol alternatives.

Culturally, the idea of “mindful drinking” is gaining ground. USA Today reported that 49% of adults plan to drink less in 2025 than they did in previous years. Sobriety is no longer seen as a stigmatized choice; it’s increasingly a badge of honor among younger generations, especially when connected to wellness and mental clarity.

Economic pressures are also playing a role. Inflation has pushed alcohol prices higher, especially in the premium categories. This price sensitivity encourages consumers to drink less but better, choosing higher-quality beverages while reducing overall intake.

In Episode 6 of MetricsCart’s Digital Shelf Insider Podcast, Amanda Wolff, CRO at Jenda, highlights the challenges and opportunities brands face as they navigate the evolving digital and physical retail landscapes. Listen to the full episode here:

Need to keep a closer eye on competitive pricing shifts as drinking behavior changes? MetricsCart’s pricing intelligence tool offers real-time price monitoring, MAP monitoring, and pricing strategy action points to help brands stay competitive without eroding margins.

Gen Z and Alcohol: What’s Shaping Their Choices?

Gen Z is the generation to watch when it comes to understanding the future of alcohol in America. Data shows that 21.5% of Gen Z abstain from alcohol completely, while 39% drink only occasionally.

Their preferences are shaped by a deep focus on health, transparency, and personal branding. For Gen Z, alcohol consumption must align with their broader lifestyle choices, which often emphasize wellness, authenticity, and social responsibility.

Importantly, Gen Z’s decisions aren’t simply about abstinence; they are about intention. When they choose to drink, they seek experiences that are curated, premium, and tied to clear functional or emotional benefits.

This generation’s embrace of “sober curiosity” and their preference for low- and no-alcohol options indicate that brands must innovate beyond traditional product offerings to stay relevant.

READ MORE| Curious how Gen Z is reshaping shopping behavior on Amazon? Check out Decode How Gen Z Shops on Amazon: Supercharge Your Brand’s Sales Today.

Top 5 Upcoming Beverage Alcohol Trends In The US

As consumer behavior shifts and market dynamics evolve, let’s decode the important alcohol industry trends that brands need to watch closely. The ones who adapt first will have plenty to toast to.

1. Low and No-Alcohol Beverages Surge

The strongest growth category in beverage alcohol is the no- and low-alcohol segment. Forecasts project a 4% CAGR through 2028, adding approximately $4 billion in new value.

Products like non-alcoholic beer, which already accounts for 81% of the category, and non-alcoholic ready-to-drink (RTD) beverages, growing at 36% annually, demonstrate that consumers are not just seeking alternatives, they’re embracing them.

This trend stems from consumers’ desire for moderation without sacrificing social rituals. Brands that innovate around flavor, mouthfeel, and premium presentation will be best positioned to capture this growing demand.

Planning your next product innovation? Use MetricsCart’s ratings and reviews analysis solution to decode what consumers love (or dislike) and get actionable insights for robust product development strategies.

2. Ready-to-Drink (RTD) Products Expand

RTDs have shifted from being a novelty to a major growth engine. In 2023 alone, spirits-based RTDs surged 26.8% to reach $2.8 billion. Much of this growth is driven by younger consumers, particularly women, who value the convenience, portion control, and ingredient transparency these products offer.

In a culture increasingly oriented toward immediacy and authenticity, RTDs offer a way to enjoy craft-quality cocktails without the effort of home mixology. As innovation continues in flavor profiles and health-conscious formulations, RTDs will likely continue to redefine casual drinking occasions.

3. Premiumization Across All Segments

While overall spending on alcohol rises, consumers are becoming more selective about when and how they trade up.

Premiumization is no longer just about status; it’s about perceived value and authenticity. Craftsmanship, storytelling, and ethical production processes are now just as important as the brand name itself.

This subtle shift explains why premium beer and cider volumes are climbing even as luxury spirits growth slows. Consumers want products that feel meaningful and justified, not just expensive for the sake of prestige.

READ MORE| Want to know how leading brands use prestige pricing to elevate their value and stay competitive? Check out Scaling With High Prices: Prestige Pricing Explained With 5 Brand Examples.

4. Functional Alcoholic Drinks

Health-conscious innovation is leading to the rise of functional alcoholic beverages, products infused with botanicals, adaptogens, nootropics, and vitamins.

These drinks promise mood enhancement, relaxation, or energy boosts, blurring the line between indulgence and self-care.

However, brands must tread carefully: while consumers are curious, regulatory scrutiny around health claims remains high. Success will depend on transparent marketing and substantiated ingredient benefits rather than exaggerated promises.

5. Sustainably Sourced Alcohol

Environmental responsibility has shifted from niche concern to mainstream expectation. Sustainability now directly influences brand loyalty and purchase decisions.

Alcohol brands employing regenerative farming practices, eco-friendly packaging, and ethical labor sourcing are finding stronger consumer resonance.

READ MORE| Want to understand how Gen Z’s focus on sustainability is influencing brand loyalty? Check out Gen Z Sustainability Trends: How E-Commerce Brands Can Stay Relevant.

Future of Alcohol E-Commerce

The rise of e-commerce in alcohol is not just a byproduct of the pandemic; it’s a structural shift. By 2028, alcohol e-commerce is projected to surpass $36 billion globally, fueled by omnichannel expansions and D2C innovations.

Direct-to-consumer (D2C) channels offer brands a chance to control storytelling, build direct customer relationships, and capture valuable first-party data, advantages previously unavailable in the three-tier system.

Subscription services like Firstleaf leverage predictive AI to curate individual wine selections, increasing loyalty and lifetime value. These models also allow for better inventory planning and margin protection.

Sustainability remains a theme even in e-commerce operations. Consumers increasingly favor brands that minimize carbon footprints through local production, eco-friendly shipping, and recyclable packaging.

The Final Sip

Alcohol trends in the US show one thing clearly: 2026 isn’t about pouring the same old strategies into new glasses. It’s about adapting to health-first consumers, winning Gen Z’s loyalty, and building direct-to-consumer relationships that stick.

For brand managers, e-commerce leads, and insights teams, staying tuned into the important alcohol industry trends is no longer optional; it’s your best shot at keeping competitors under the table.

The brands that sip the trends early will have plenty to raise a glass to.

At MetricsCart, we help you tap into real-time consumer insights, digital shelf data, and actionable trends so your brand doesn’t just keep up, it leads. Contact us today to book a walkthrough of our digital shelf analytics solutions.

Struggling To Boost Sales on Major Online Retailers? Scale Better With Our Digital Shelf Solutions!

FAQs

Yes. While total market value is increasing due to premiumization, per-capita consumption rates are falling, driven by health awareness and shifting cultural attitudes.

Low/no-alcohol beverage growth, RTD expansion, selective premiumization, functional ingredient innovation, and sustainability leadership.

Spirits remain the most popular, followed closely by beer, but non-alcoholic options are gaining ground fast.

Mindful drinking and low-to-no-alcohol options dominate, with emphasis on health, authenticity, and functional benefits.

Beer retains a slight lead, although the gap with wine and spirits continues to narrow.