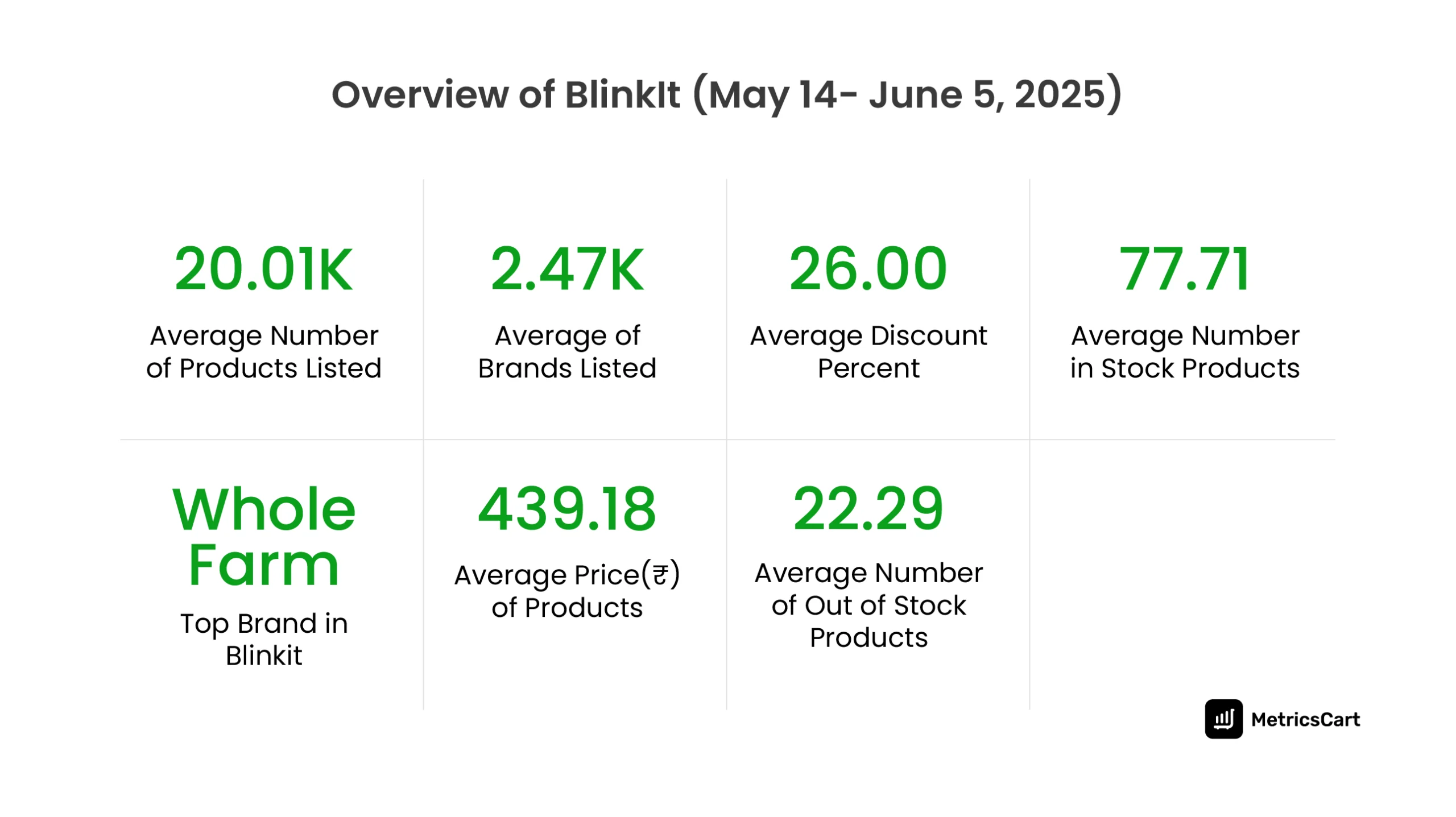

About the report: This Digital Shelf Insights (DSI) Report offers a comprehensive snapshot of Blinkit’s performance between May 14 and June 5, 2025. It analyzes over 20,000 listed products and 2470 brands, tracking top-performing brands, pricing trends, discount strategies, and stock availability.

Introduction

As India’s leading quick-commerce platform, Blinkit continues to redefine the shopping experience for everyday essentials, offering unmatched speed, scale, and assortment.

Backed by Zomato (now Eternal Ltd), Blinkit commands an estimated 45% market share in India’s ₹29,000 crore quick-commerce sector, processing more than 600,000 daily orders. Its expansive dark-store network (with over 1,600 locations) ensures 10-minute deliveries in more than 30 cities.

This report offers a closer examination of Blinkit’s performance across various product categories, pricing, discounts, and stock availability, highlighting leading brands and fast-moving categories in India’s most dynamic e-commerce channel.

Highlights

- The top brand on Blinkit is Whole Farm.

- The average price of products on BlinkIt is $439.18

- An average of 2.47K brands have listed their products on BlinkIt

- Personal Care and Home & Office are the leading categories on BlinkIt

Overview of BlinkIt Performance from May 14 to June 5, 2025

Between May 14 and June 5, 2025, Blinkit demonstrated strong marketplace health and depth of assortment across its platform. The quick commerce player maintained an average of 20,010 products listed daily, supported by a robust catalog of 2,470 unique brands.

This assortment reflects Blinkit’s commitment to delivering a diverse range of products across essential and impulse categories, ensuring shoppers have ample choice within the platform’s 10-minute delivery promise.

Pricing remains a focal point for Blinkit, with the platform offering an average discount of 26% across all products during this period. This aggressive discounting strategy helps Blinkit maintain a competitive edge, driving conversions while supporting basket building.

The average price of listed products stood at ₹439.18, suggesting a healthy mix of value and premium SKUs in the catalog.

From a stock availability perspective, Blinkit maintained an average of 77.71 in-stock products and 22.29 out-of-stock products. This balance indicates efficient inventory and demand forecasting practices.

Notably, Whole Farm emerged as the top brand on Blinkit during the tracking period, highlighting strong demand for staples such as dry fruits, masalas, and cooking oils. The top sub-categories of Whole Farm will be discussed in detail below.

With the platform’s ongoing investments in dark store infrastructure and category expansion, Blinkit continues to position itself as a frontrunner in India’s fast-growing quick commerce space.

READ MORE | Wondering about Quick Commerce Performance in India? Check out Rise of Quick Commerce in India: How Instant Gratification is Redefining Urban Retail

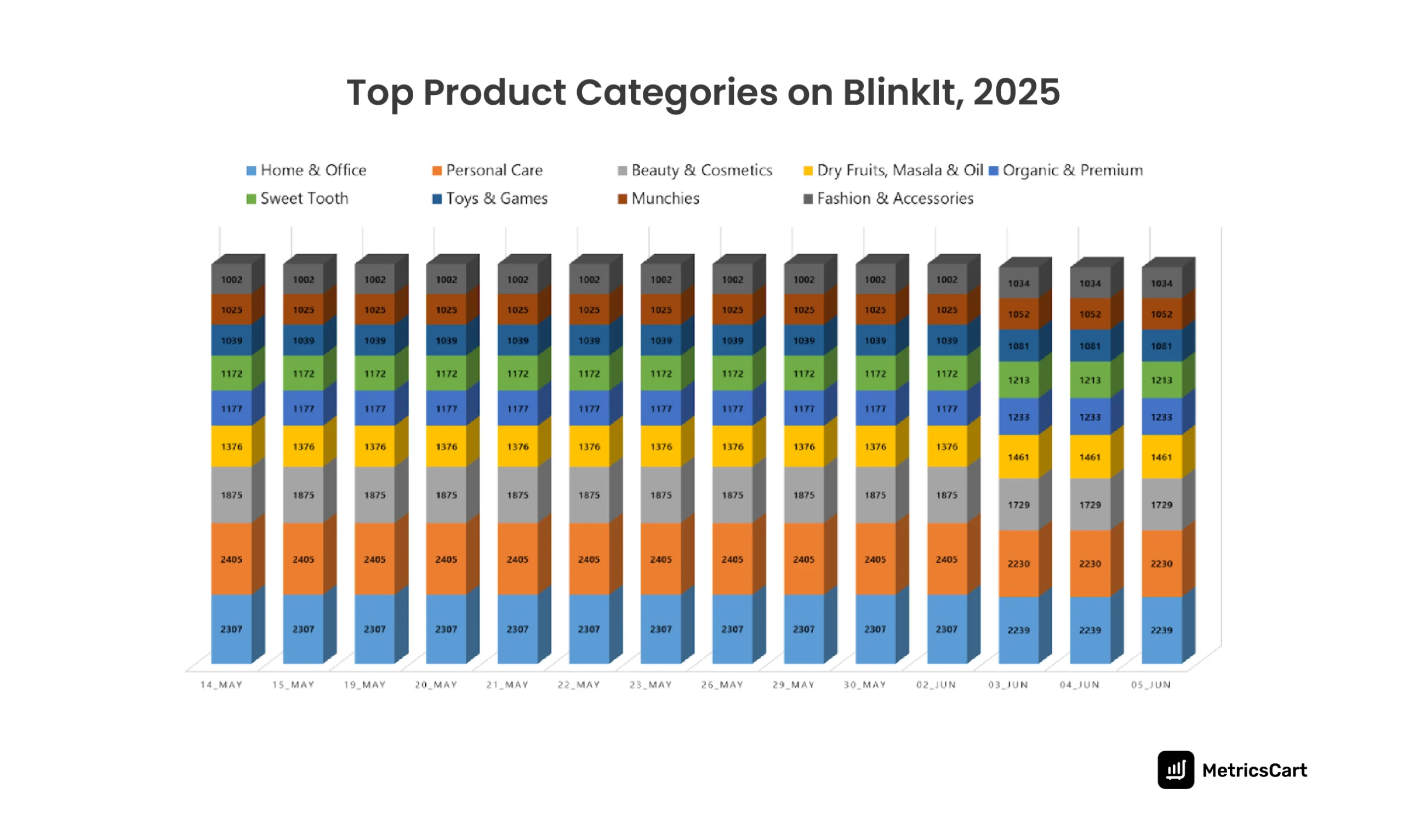

Personal Care and Home & Office are the Leading Categories on BlinkIt

The personal care category has the highest number of products on Blinkit. From May 14 to June 2, 2025, this category had 2405 products, and on June 3rd, 4th, and 5th, there were 2230 products.

This is followed by home and office products. From 2307 listings on May 14 to 2239 by June 5, the category consistently retains the second position. This suggests high consumer demand for home essentials and organizational products, potentially boosted by Blinkit’s partnerships with brands like Kurkhi and OBOK.

The beauty and cosmetics category also remained stable across the three weeks. The daily listings hovered above 1800 from May 14 to June 2nd. The number of beauty & cosmetics products slightly reduced to 1729 on June 3rd, 4th, and 5th.

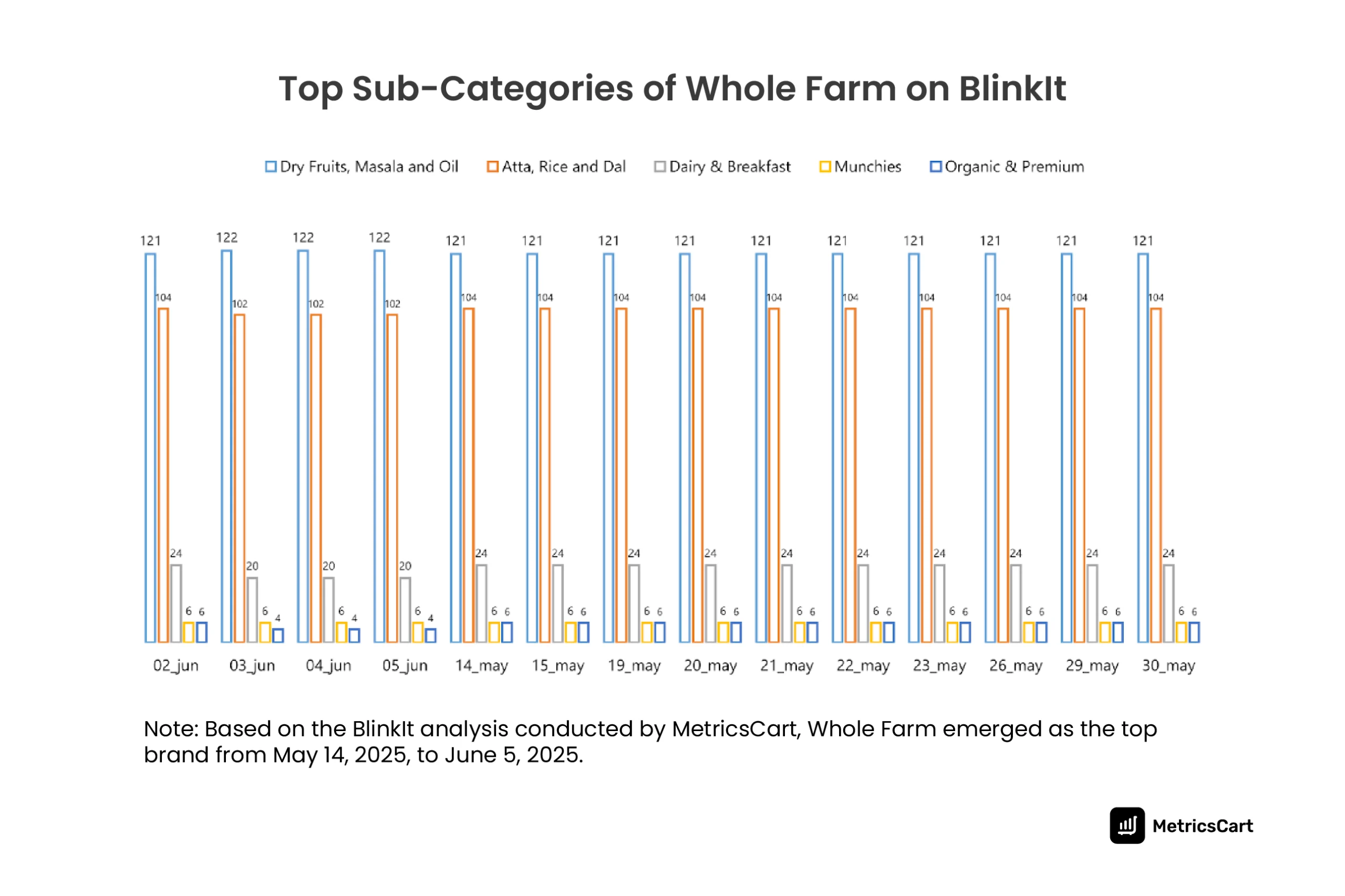

Dry Fruits, Masala & Oil Lead Whole Farm’s Assortment on Blinkit

Whole Farm is cementing its position as a category leader in essential groceries on Blinkit, especially in dry pantry items. This aligns with Blinkit’s business model, where replenishment categories such as rice, pulses, oil, and spices exhibit high repeat purchase behavior.

From May 14 to June 5, 2025, Whole Farm’s assortment has been consistently led by the ‘Dry Fruits, Masala & Oil’ category, which maintained a stronghold with 121–122 products listed each day. This reflects the brand’s deep presence in pantry staples that are frequently purchased and regularly restocked in urban households.

The second-largest category for Whole Farm is ‘Atta, Rice & Dal’, hovering at around 102–104 products. This indicates that the brand isn’t just focused on niche products like dry fruits but is also making a strong play in essential grains, demonstrating its strategy to become a go-to brand for kitchen staples.

Dairy & Breakfast is the third most prominent category, with a steady listing of 20–24 products throughout the period. Categories like ‘Munchies’ and ‘Organic & Premium’ remain consistently small, each at just 4 to 6 products.

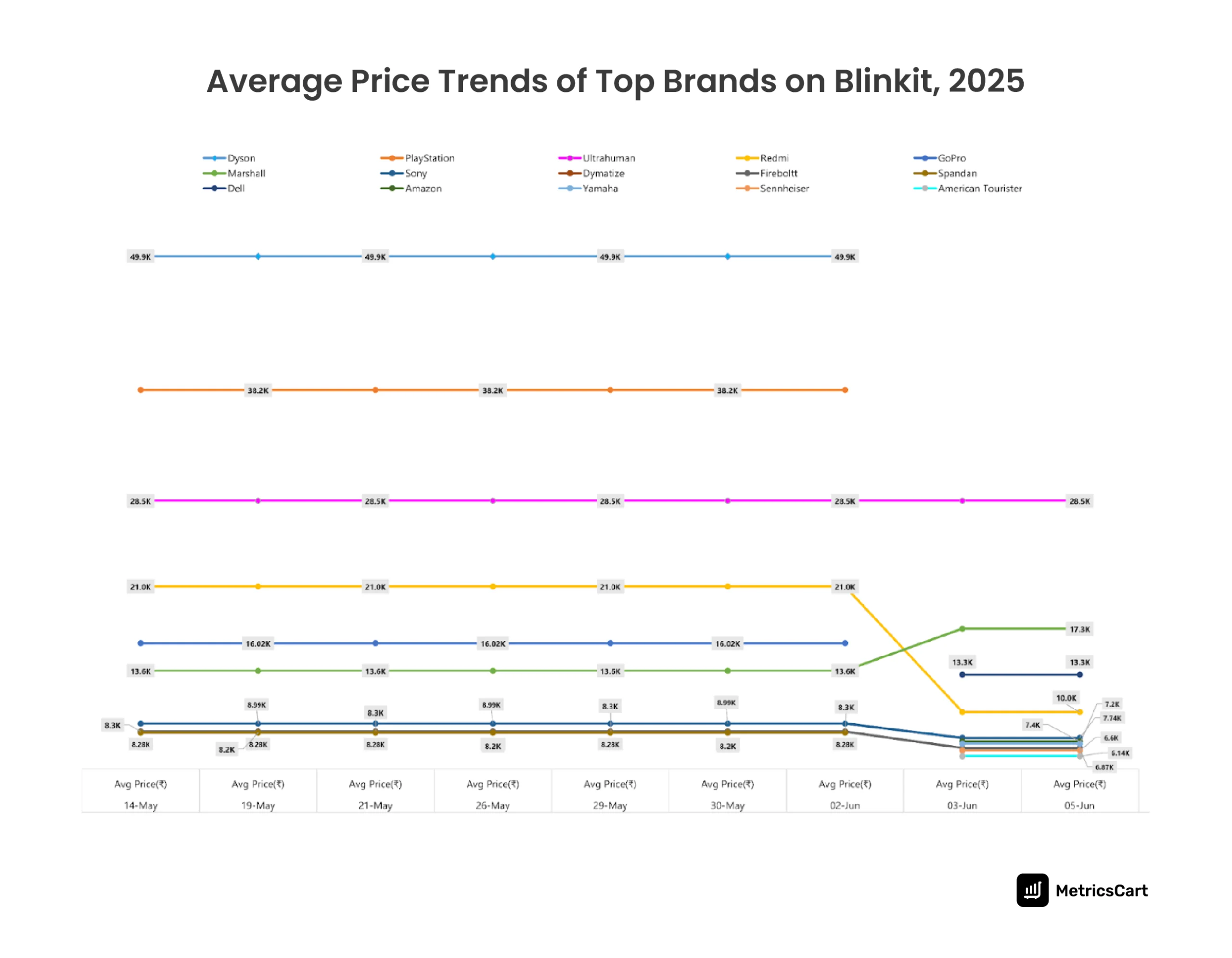

Dyson & PlayStation Dominate Average Prices of Top Brands on Blinkit

Based on the analysis conducted by MetricsCart, between May 14 and June 5, 2025, Blinkit’s top-performing brands demonstrated distinct pricing patterns, highlighting a balance between premium positioning and promotional agility.

Several premium and mid-tier brands maintained consistent pricing throughout the period, while value and electronics brands experienced sharp price movements, suggesting active discounting or changes in assortment mix.

Dyson held steady at ₹49.9K for the entire period, making it the highest-priced brand on Blinkit. PlayStation (₹38.2K) and Ultrahuman (₹28.5K) also maintained uniform pricing, signaling a high-value, low-volume approach with minimal discount activity. These brands likely rely on consistent product positioning rather than promotional levers.

Additionally, GoPro maintained a consistent pricing of ₹16,020 from May 14 to June 2, 2025.

While prices were mostly stable until June 2, starting June 3, several brands experienced abrupt and sharp average price declines:

- Redmi dropped from ₹21K to ₹10K on June 3 and maintained this price till June 5.

- Dell had slight price variations throughout the tracking period, fluctuating between ₹8.3K and ₹8.3K until June 2nd, after which it dropped to ₹7.4 K.

- Spandan declined from ₹8.28K to ₹ 6.6 K.

These sudden dips indicate either lower-priced SKUs entering the catalog, high-priced items going out of stock, or deep discounting applied to select products. The timing and clustering suggest a campaign-wide price shift or catalog reset.

On the other hand, Marshall prices increased from ₹13.6K to ₹17.3K on June 3rd. 2025.

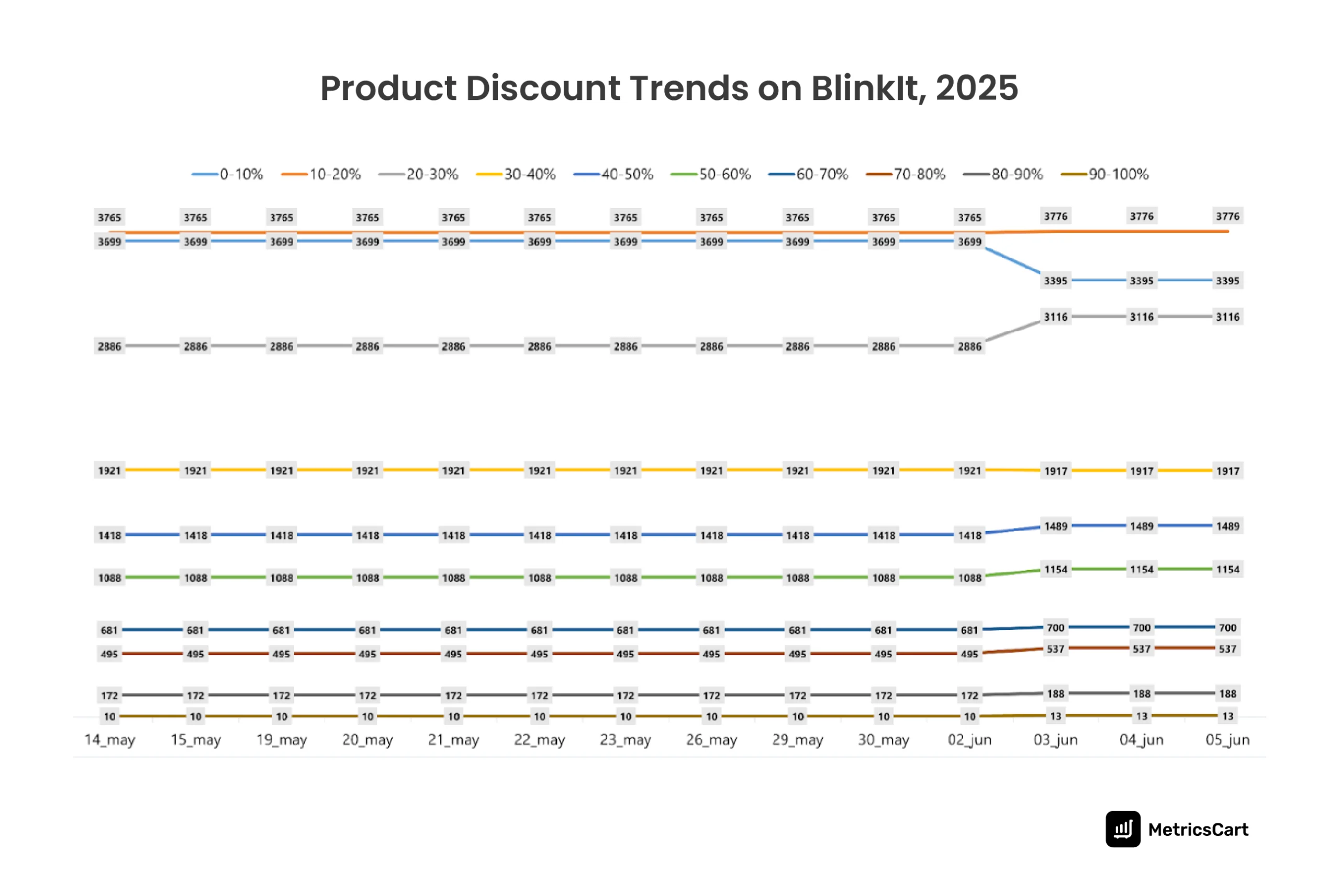

0–20% Discount Range Covers Most Products on Blinkit

During the observed period, Blinkit maintained a steady product distribution across most discount ranges until a noticeable strategic shift emerged in early June. The 0–10% discount bucket, which initially contained 3699 products, experienced a significant decline starting on June 2.

By June 3, this category had lost over 300 SKUs, with a corresponding increase in the 20–30% discount range, which grew by nearly the same volume.

This movement indicates a deliberate repositioning of discounts to boost conversions. Blinkit appears to have shifted a significant portion of low-discount products into more attractive price brackets without compromising assortment volume.

The 10–20% discount category, meanwhile, remained the most dominant, consistently holding 3765 products throughout the period, suggesting it is the platform’s default promotional zone.

Other ranges, including 30–40%, 50–60%, and 60–70%, showed slight upward trends post-June 2, reinforcing the idea of a broader discount realignment. Notably, deep discount ranges (70–100%) held minimal product counts and saw only marginal movement, signaling Blinkit’s intent to protect margins and avoid undervaluing SKUs.

This data reveals Blinkit’s agile approach to discounting, using targeted markdowns rather than blanket price cuts. For digital shelf managers, this signals the importance of monitoring not just price points but the spread and volume across discount brackets to stay competitive and align promotional strategies with Blinkit’s pricing dynamics.

Khadi Essentials Rose Water Handmade Herbal Soap is the Highest Discounted Product on BlinkIt

Highest Discounted Products on BlinkIt, 2025

| Date | Products | Brand | Discount |

|---|---|---|---|

| 02-Jun | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 03-Jun | Ohonesty moto g85/50 fusion ultra hd Tempered Glass | Ohonesty | 92% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| QIBOX Universal Mobile Stand | QIBOX | 91% | |

| 04-Jun | Ohonesty moto g85/50 fusion ultra hd Tempered Glass | Ohonesty | 92% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| QIBOX Universal Mobile Stand | QIBOX | 91% | |

| 05-Jun | Ohonesty moto g85/50 fusion ultra hd Tempered Glass | Ohonesty | 92% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| QIBOX Universal Mobile Stand | QIBOX | 91% | |

| 14-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 15-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 19-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 20-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 21-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 22-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 23-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 26-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 29-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% | |

| 30-May | Khadi Essentials Rose Water Handmade Herbal Soap with Rose Extracts | Khadi Essentials | 96% |

| Kuber Industries Non-Woven Cloth Organizer For Wardrobe (Maroon) | Kuber Industries | 92% | |

| Turkish Blue Evil Eye Ganesha Hangings (Dark Blue) - Tied Ribbons | Tied Ribbons | 92% |

A close examination of Blinkit’s highest discounted products between May 14 and June 5 reveals a consistent high markdown strategy centered around a handful of SKUs and brands. Products from Khadi Essentials, Kuber Industries, and Tied Ribbons dominated the top of the discount leaderboard, with discounts ranging from 91% to 96% throughout the entire monitoring period.

Khadi Essentials’ Rose Water Herbal Soap remained the top-discounted product, at 96% off consistently across multiple dates. This could indicate either a clearance strategy for aging inventory or a lead-generation tactic leveraging a deep discount on a personal care essential to drive basket-building behavior.

Similarly, Kuber Industries’ Non-Woven Wardrobe Organizer held steady at a 92% discount, suggesting a saturation-level push on home organization SKUs—likely aimed at increasing visibility for under-penetrated categories.

Another striking pattern is the unchanged product set, with Tied Ribbons’ Evil Eye Hangings and QIBOX’s Universal Mobile Stand also repeatedly appearing on the list. This suggests that Blinkit is not cycling through discount leaders but is heavily relying on a fixed roster of deeply discounted products to create perceived value.

Conclusion

Blinkit’s fast-moving catalog reflects a sharp understanding of consumer demand and the dynamics of quick commerce. With over 20K products and 2.47K brands listed on average, and a 26% average discount, the platform balances a wide assortment with aggressive promotional strategies to attract and retain urban consumers.

By continuously analyzing pricing, stock status, and top-performing categories, Blinkit demonstrates how a data-first strategy can shape consumer behavior in a hyper-competitive space.

With MetricsCart’s digital shelf solutions, brands can uncover actionable insights on Blinkit—track price changes, flag stockouts, benchmark competitor discounts, and fine-tune their strategy for rapid execution. Win every quick commerce moment with MetricsCart.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Want To Skyrocket Your Quick Commerce Sales?