Urban India has a new norm. The last-minute run for essentials has now become an instant tap-and-deliver habit with quick commerce platforms like Zepto. In March 2025 alone, Zepto recorded between 1.45 and 1.55 million orders per day, showing how deeply instant delivery is embedded in daily consumption.

Within this, products listed in the categories of dairy and breakfast on Zepto are the most popular. And unlike other essentials, these items are mostly bought on demand rather than in bulk by everyday consumers, fitting perfectly into Zepto’s ‘need it now’ model.

This report analyzes the performance of products listed in the breakfast and dairy categories on Zepto from June 1 – 20. It examines more than 31 million customer ratings received across 18,286 products to see which brands are leading, where consumers are spending, and how pricing and availability influence digital shelf success.

Dairy and Breakfast on Zepto: The Big Picture

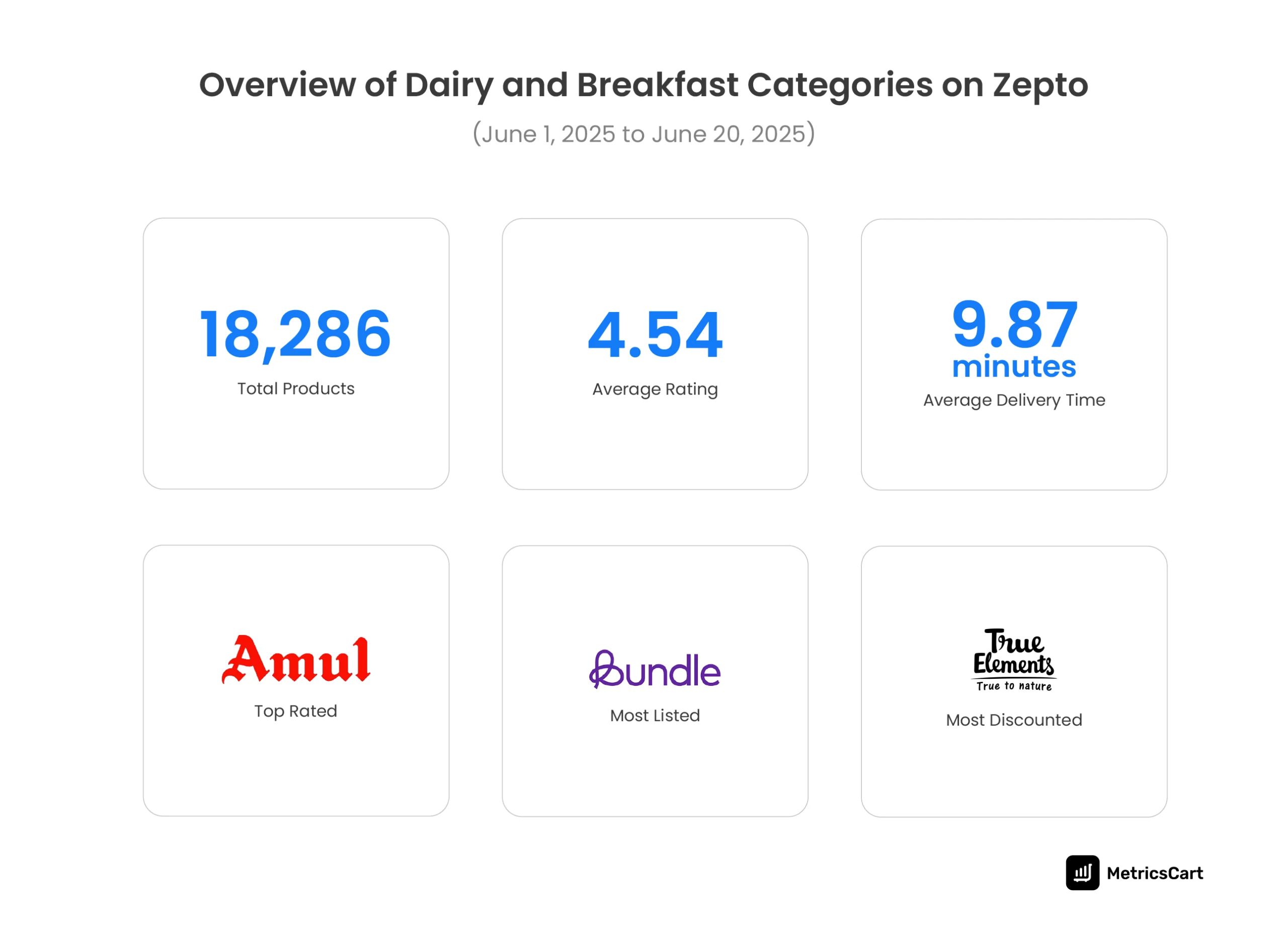

18,286 products were listed in the breakfast and dairy categories on Zepto from June 1 to 20. Together, these products attracted 31,392,696 ratings, with an impressive average rating of 4.54, signaling both high customer engagement and strong satisfaction in this category.

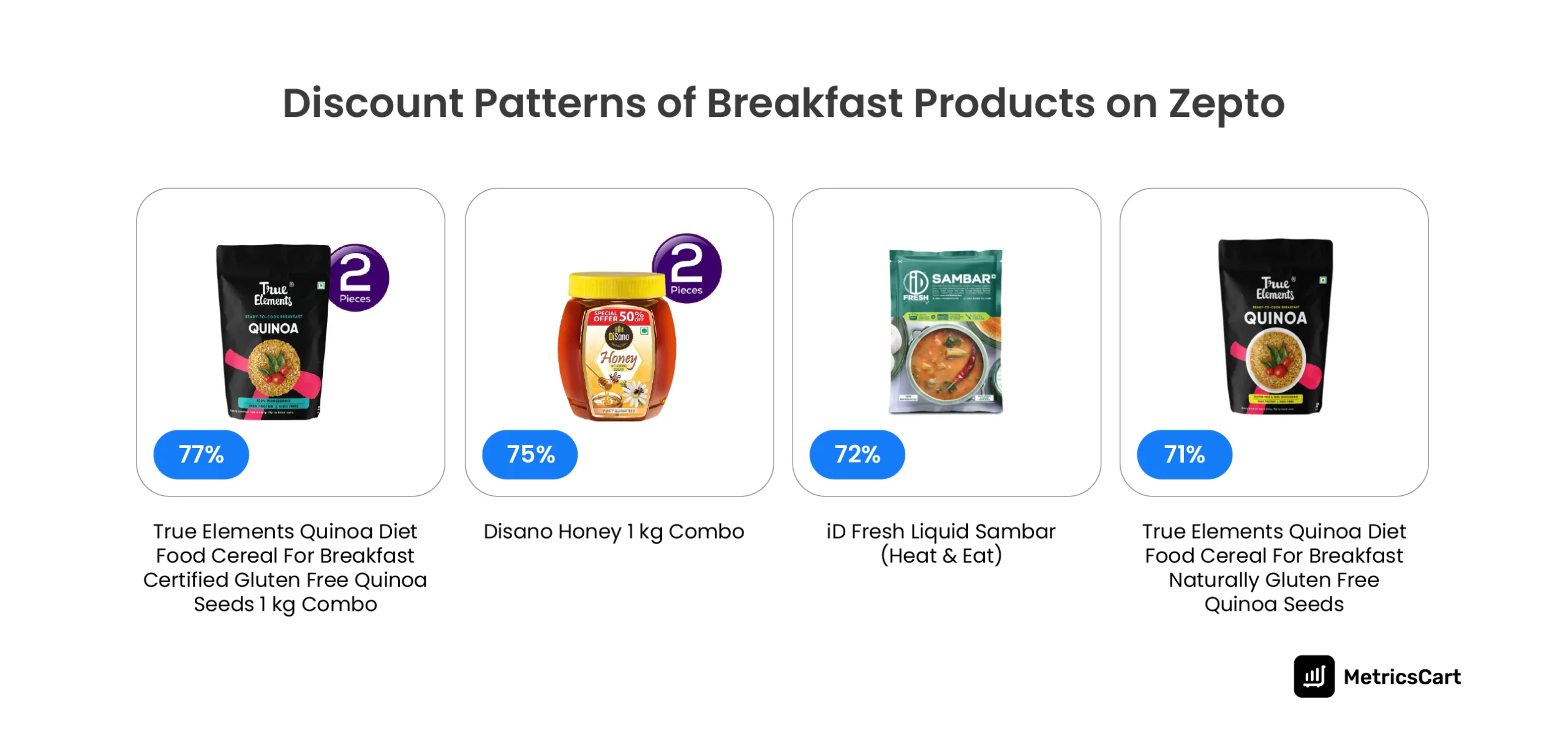

The top products and discount patterns observed are:

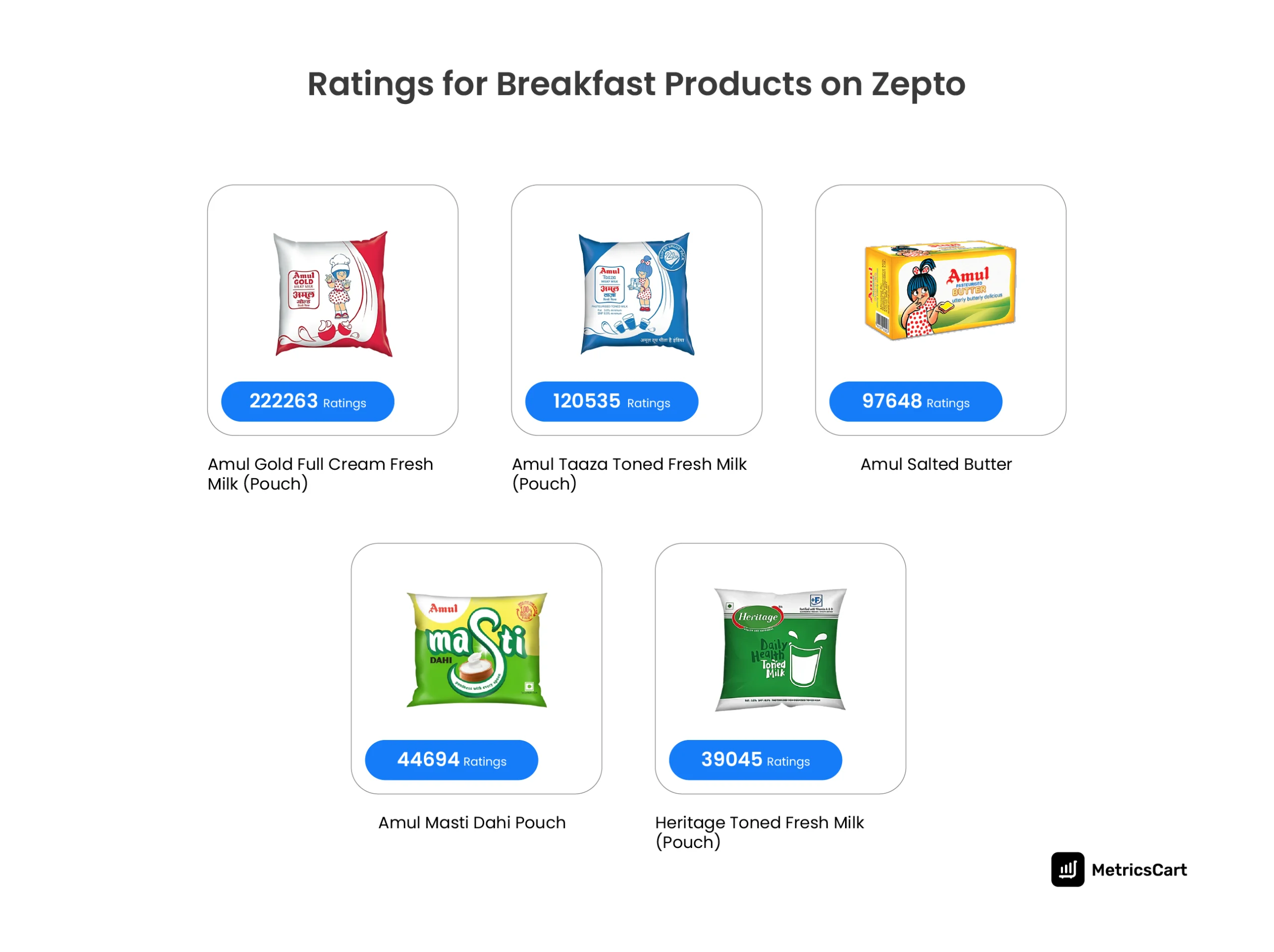

- Amul leads in trust and ratings, with its Gold Full Cream Milk topping the chart at 222,263 reviews.

- BUNDLE dominates in volume, with 4,714 product listings.

- Deep discounts were observed with True Elements offering up to 77% off, followed by Disano giving 75%, and iD Fresh, 72%.

- Farmley topped brand-level discounts at 53.64%, while Healthy India and Disano both offered nearly 50% off.

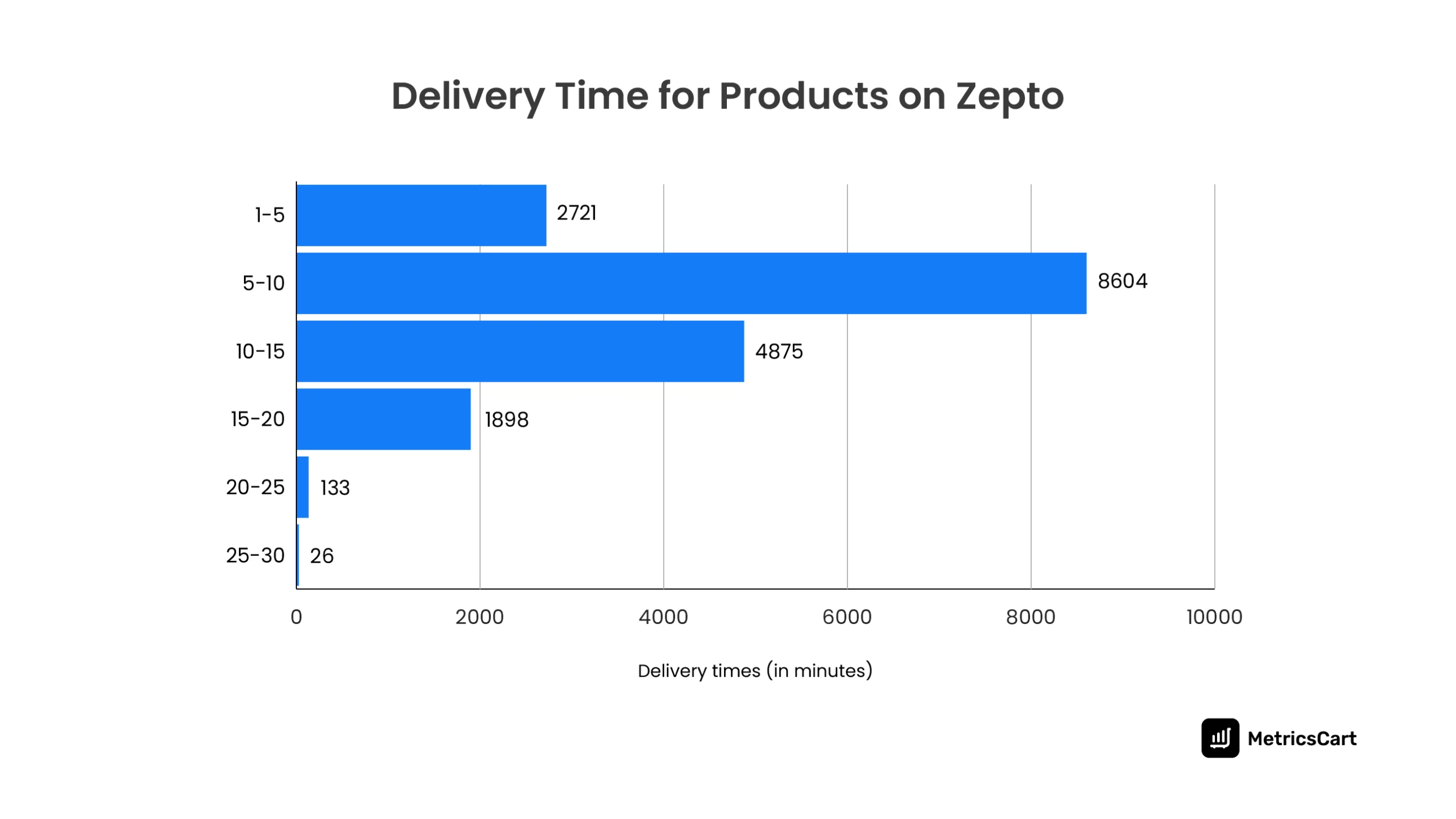

Speed is central to the quick commerce model. Dairy and breakfast products on Zepto were delivered in an average of 9.87 minutes, with more than half arriving within 5–10 minutes and 15% in under 5 minutes. Delivery times rarely stretched beyond 20 minutes, reinforcing Zepto’s promise of near-instant access to daily essentials.

Product listings rose sharply in the latter half of the review period. Between June 16 and 20, Zepto added 14,892 products, more than 80% of the total for the month, with products having pricing as low as ₹170.51. An intentional push in both variety and affordability is observed in this surge.

READ MORE | Behind 10-Minute Delivery: Zepto Business Model Explained

The Top Brands in Breakfast and Dairy Categories on Zepto

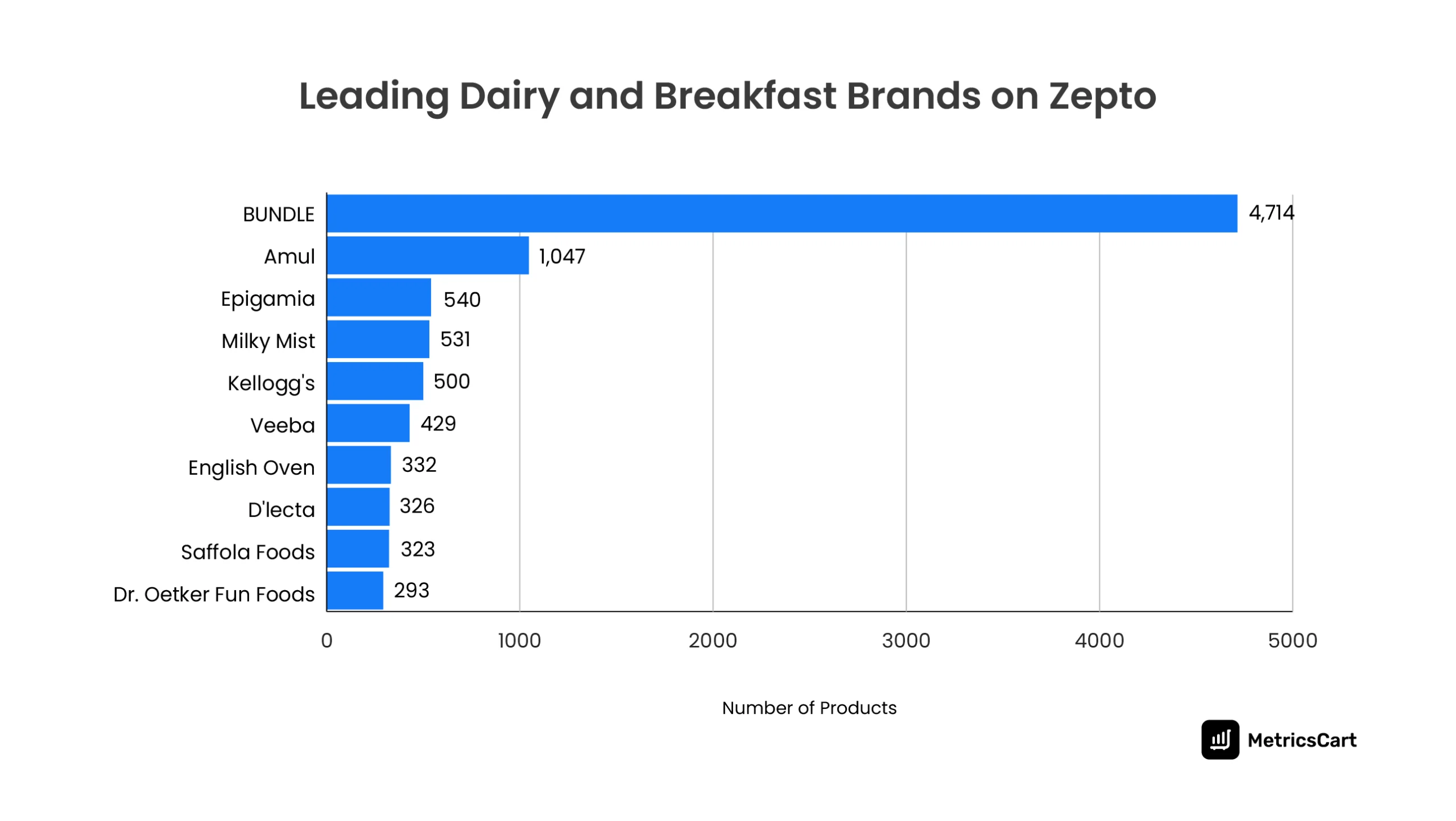

There are 211 brands in the breakfast and dairy categories on Zepto from June 1 to June 20. Of them, BUNDLE leads with 4,714 products, giving it the widest assortment on the platform, which in turn provides the brand with higher visibility in search and better odds of winning shopper attention.

Amul follows with 1,047 listings. But unlike BUNDLE, Amul’s edge lies in repeat demand, not assortment breadth. The long-term trust and legacy of the brand can also be a reason for the repeat orders.

Mid-sized brands like Epigamia, Milky Mist, and Kellogg’s have a balanced portfolio. They maintain enough range to stay visible while positioning themselves in niche sub-categories like Greek yogurt (Epigamia) or cereals (Kellogg’s).

Rounding out the mix, Saffola Foods and Dr. Oetker Fun Foods offer just around 300 items, adding diversity across spreads, cereals, and packaged breakfast options. Their target is buyers seeking variety in breakfast.

Breakfast Brands Winning Customer Ratings

Milk, butter, and dahi products dominate the top-rated list, indicating them as the top-selling dairy products on Zepto. Of them, Amul alone holds the first four spots, showing the brand’s long-standing legacy as well as its ability to adapt successfully to quick commerce trends.

Following Amul, Heritage Toned Fresh Milk (Pouch), secures the top spot with over 39K rating, showing how regional dairy players can break into Zepto’s leaderboard. They rely on strong loyalty points that come with the general trust in local sources and those that encourage green e-commerce.

The success of Heritage also shows how quick commerce helps regional brands scale visibility in par with national heavyweights like Amul.

BUNDLE Brings Volume, Amul Brings Loyalty

On Zepto’s dairy and breakfast shelf, BUNDLE and Amul stand out for very different reasons.

BUNDLE dominates the aisle for breakfast and dairy on Zepto in sheer volume, with 4,714 products listed; more than four times that of Amul. Its strategy is clear: maximize visibility by flooding the platform with options across sub-categories.

Amul, on the other hand, has only 1,047 products listed, but its consumer pull is unmatched. Amul products together have over 485,140 ratings, dwarfing the numbers of most competitors. This stronghold is a reflection of the brand’s smart assortment plus its deep-rooted customer trust built over decades.

The contrast highlights two approaches to quick commerce success: BUNDLE plays the scale game, while Amul converts trust into repeat purchases and category leadership.

How Pricing Shapes the Breakfast & Dairy Battle on Zepto

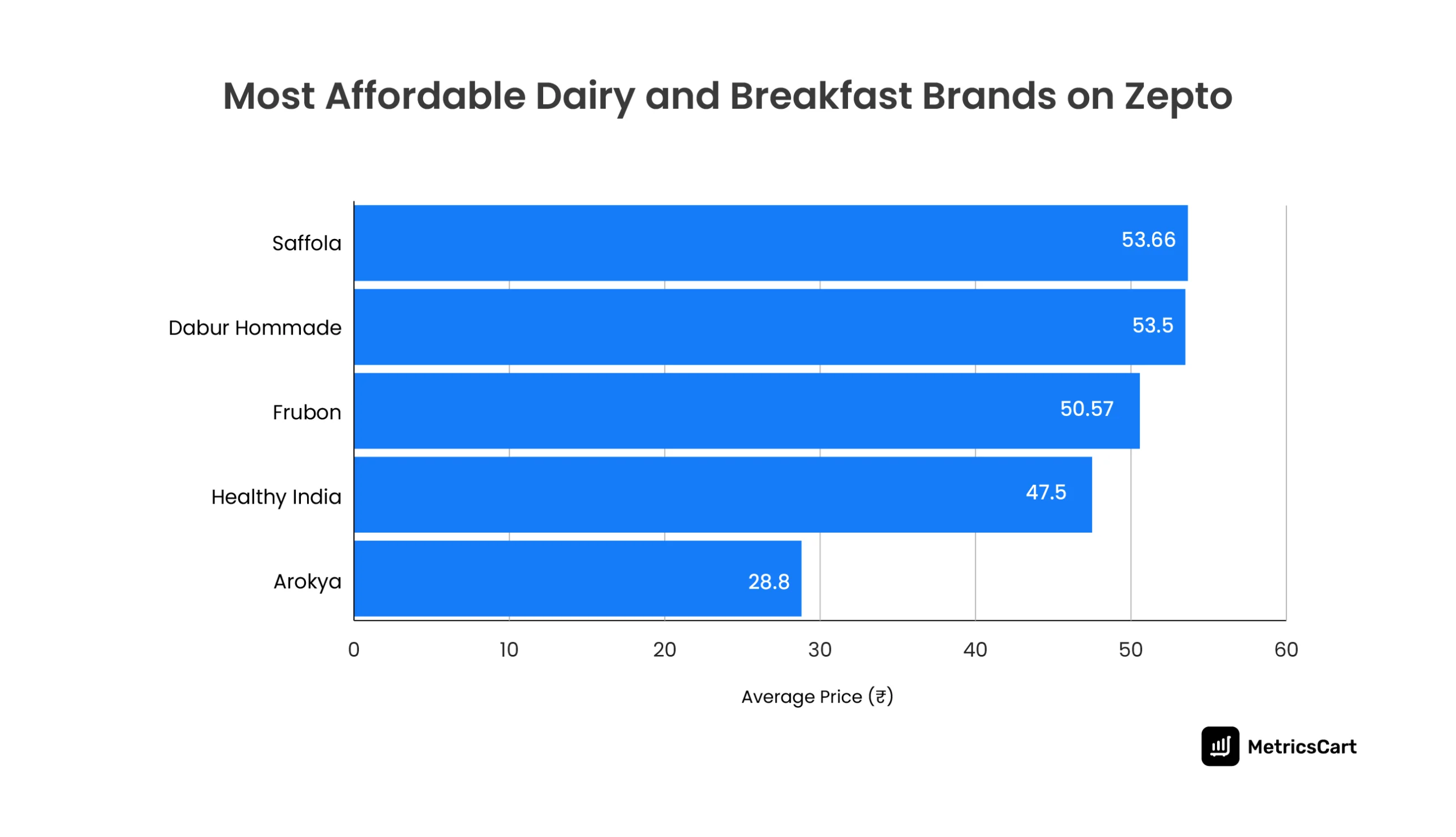

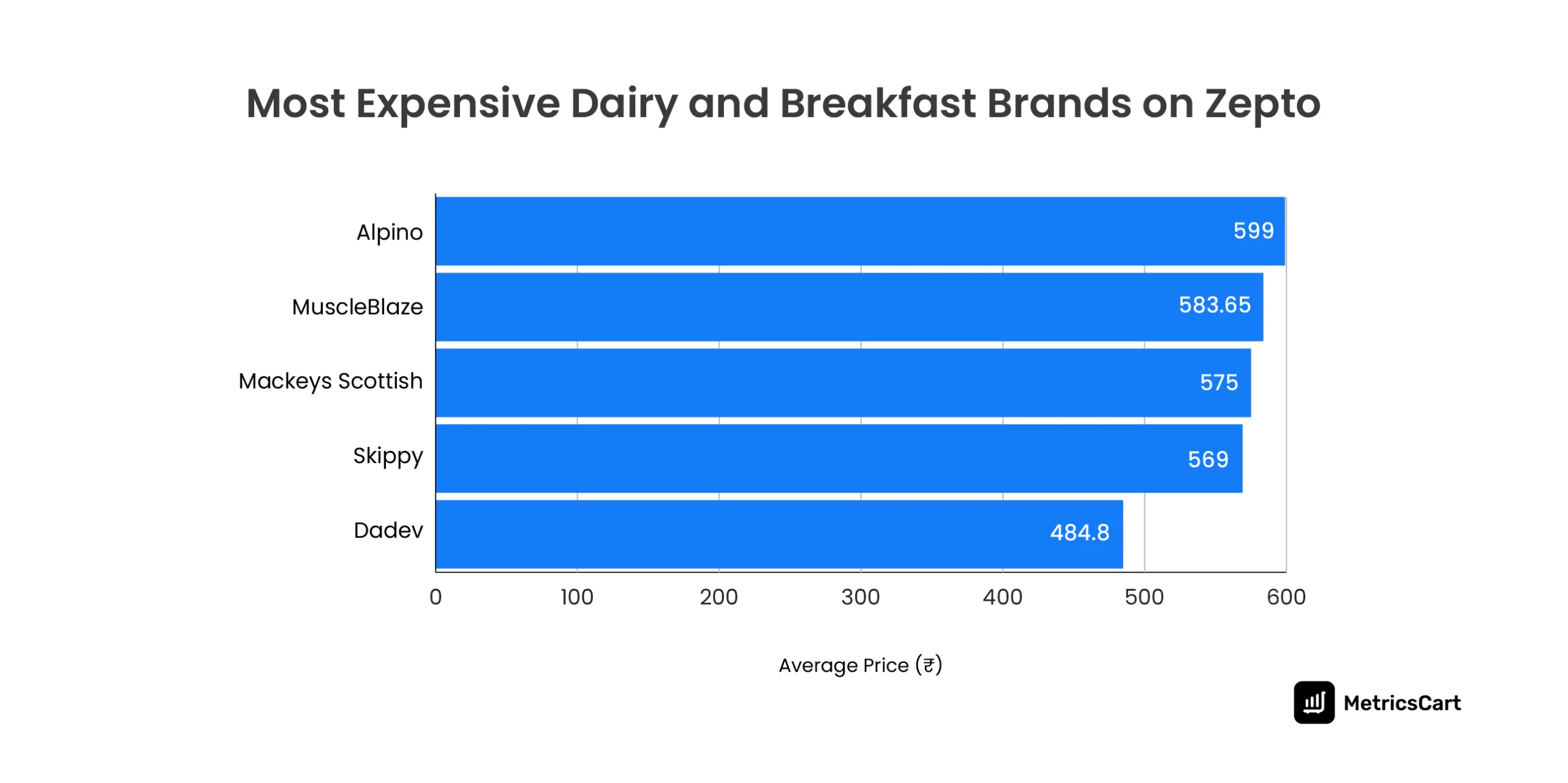

The breakfast and dairy categories on Zepto show a clear divide between value-focused brands that attract high-frequency shoppers and premium players that target niche, health-conscious buyers.

Affordable Breakfast and Dairy Brands on Zepto

Arokya, with products starting as low as ₹28.8, is the cheapest and most affordable dairy and breakfast brand on Zepto. Healthy India (₹47.5) and Frubon (₹50.6) also compete strongly to become the most feasible option for daily shoppers. These brands cater to frequent purchases, where affordability directly drives order volume.

On the premium side, Alpino (₹599) holds the highest price point, followed by MuscleBlaze (₹583.6) and Mackeys Scottish (₹575). These players focus on protein-rich products, nut butters, and specialty categories, appealing to affluent buyers willing to pay for health and lifestyle benefits.

Discount Drama: Where the Price Wars Are Happening

On average, breakfast and dairy products on Zepto were discounted by 15.71%, but some items were offered at far steeper cuts.

True Elements, offering heavy discounts for multiple products alongside other new-age brands like iD Fresh and Disano Honey, signal a shift in key dynamics like:

- New-age brands used heavy discounting to gain visibility and drive trial purchases.

- Established players like Amul and Mother Dairy maintained consistent pricing but benefited from the surge in demand created by the broader price drop.

- Premium brands saw temporary pressure, as the influx of lower-priced alternatives shifted consumer attention toward value buys.

While trusted names like Amul and Mother Dairy continue to thrive on loyalty and consistent pricing, the sharper battles for attention are being fought by newer brands willing to trade margin for market share.

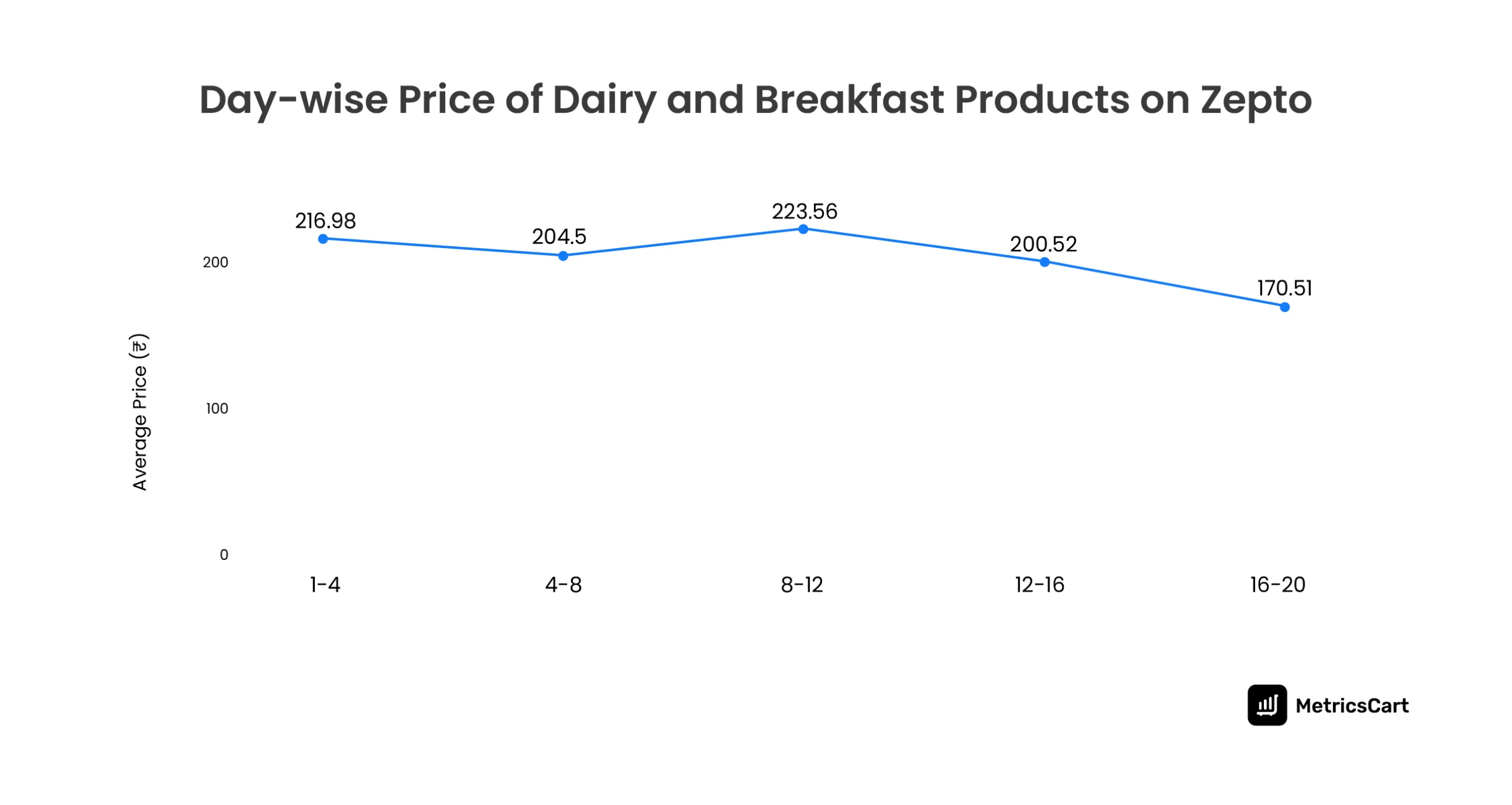

Product & Price Spikes in June

From June 1 to 16, average prices for breakfast and dairy products on Zepto held steady between ₹200 and ₹223, highlighting a stable pricing phase where brands maintained consistent positioning.

But between June 16–20 period, the listings jumped to 14,892 products, accounting for more than 80% of the month’s total, while the average price dropped to ₹170.51, the lowest in June.

This surge in assortment, paired with lower prices, signals a deliberate volume play, likely tied to mid-month restocking cycles.

READ MORE | Zepto Price Tracker: A Complete Guide for FMCG Brands

Zepto’s Promise of Quick Delivery

Speed is at the heart of quick commerce, and Zepto kept it intact with an average delivery time of just 9.87 minutes, well within the under-10-minute benchmark that urban shoppers now expect. From June 1, 2025, to June 20, 2025,

- Nearly 47% of products were delivered in 5–10 minutes.

- Around 15% reached customers in under 5 minutes.

- Only a small fraction, less than 2%, took longer than 20 minutes.

This efficiency is the core reason why quick commerce is becoming the default option for daily essentials. For consumers, it eliminates the need to plan ahead. For brands, it creates more frequent purchase cycles and greater opportunities to win repeat orders.

How to Dominate Zepto’s Fast-Moving Dairy and Breakfast Category

Success in Zepto’s dairy and breakfast aisle depends on more than just listing products. With thousands of SKUs competing for attention, brands need to align strategy with consumer behavior and platform dynamics. The data reveals three clear levers:

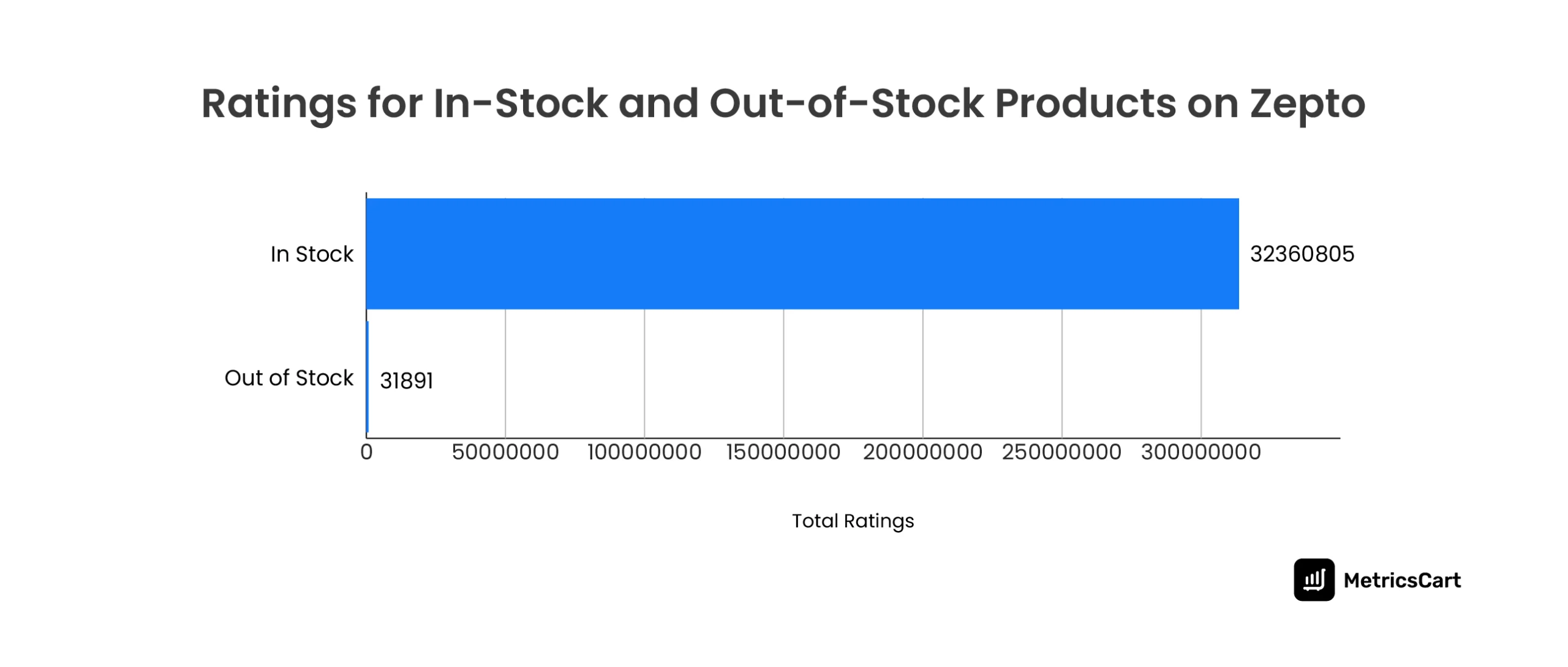

Stay in Stock to Stay Visible

Products that remain consistently available on Zepto capture far more attention. In June 2025, in-stock products received over 31.3 million ratings, compared to just 31,891 for out-of-stock items.

The platform clearly prioritizes reliable supply, rewarding it with better visibility and higher engagement. For brands, avoiding stockouts is critical to maintaining shopper trust and digital shelf presence.

Build Loyalty Through Trust and Quality

Amul’s dominance in Zepto’s breakfast and dairy category proves that loyalty is not won by shelf space alone. It is earned through consistent quality and consumer trust.

For brands, the action point is clear: focus on delivering consistency across every SKU. In quick commerce, where impulse drives the first purchase, trust is what secures the second, third, and every order after. Building credibility through dependable quality and strong recall is the fastest path to long-term leadership.

Use Pricings and Promotions Strategically

Brands like True Elements and Disano slash prices by more than 70 percent to capture visibility on Zepto and drive trial purchases. However, this steep discount, when used without a balance, risks eroding margins and positioning the brand as a discount-only player.

The smarter path is to treat promotions as an entry point, sparking discovery, then lock in repeat orders with quality and consistency. It is also advisable to pair it with limited-time offers, value packs, or product bundles to boost basket size.

Discounts and price cuts must be given in a way that highlights savings without undermining brand perception.

READ MORE | Plugging Into Zepto’s Strategy for Electronics and Appliances: June 2025

Final Note

The aisle for dairy and breakfast on Zepto is the perfect example of how quick commerce is reshaping consumer behavior. With 18,286 products, more than 31 million ratings, and delivery times averaging under 10 minutes, the category is both competitive and fast-moving. Amul’s trust-driven dominance, BUNDLE’s scale-first approach, and the discount-heavy plays of emerging brands all highlight the different levers being used to win the shelf.

For brands, the challenge is not just to participate but to lead. That requires consistent availability, smart pricing strategies, and a clear understanding of what drives consumer choice in real time.

This is where MetricsCart makes a difference. By tracking pricing, availability, discounts, and promotions across quick commerce platforms like Zepto, MetricsCart gives brands the visibility they need to act fast and compete smarter.

In a market where every minute and every tap matters, MetricsCart ensures that brands are not just present on the digital shelf but positioned to win.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready To See How Your Brand Is Performing On Zepto And Other Quick Commerce Platforms? Explore MetricsCart Now for Free.