Did you know that Americans spend around $28 billion on toys every year? That’s some serious spending power, but it’s just the tip of the iceberg.

The global toy market is on fire, racing from USD 206.6 billion in 2024 to a projected USD 295.2 billion by 2029. That’s a compound annual growth rate (CAGR) of 9.91%. And guess what? The US online toy industry is a massive player in this boom.

After an 8% dip in 2023, toy retail sales in the US stabilized in 2024. Why? Because smarter tech, greener designs, rising disposable income, and pop culture are reshaping how, where, and why people buy toys.

If you’re in the business and not leveraging these trends, you’re toying with a golden opportunity. MetricsCart’s digital shelf analytics can help you track trends and identify winning strategies for your brand.

Major Players in the US Online Toy Industry

The toy industry in the US is shaped by two main forces: leading manufacturers who innovate and set trends and major online toy retailers who make these products accessible to millions of consumers. Together, they create a thriving ecosystem where innovation meets demand.

Top brands in the US toy market:

- LEGO Group

- Hasbro

- MGA Entertainment

- Mattel

- Jakks Pacific

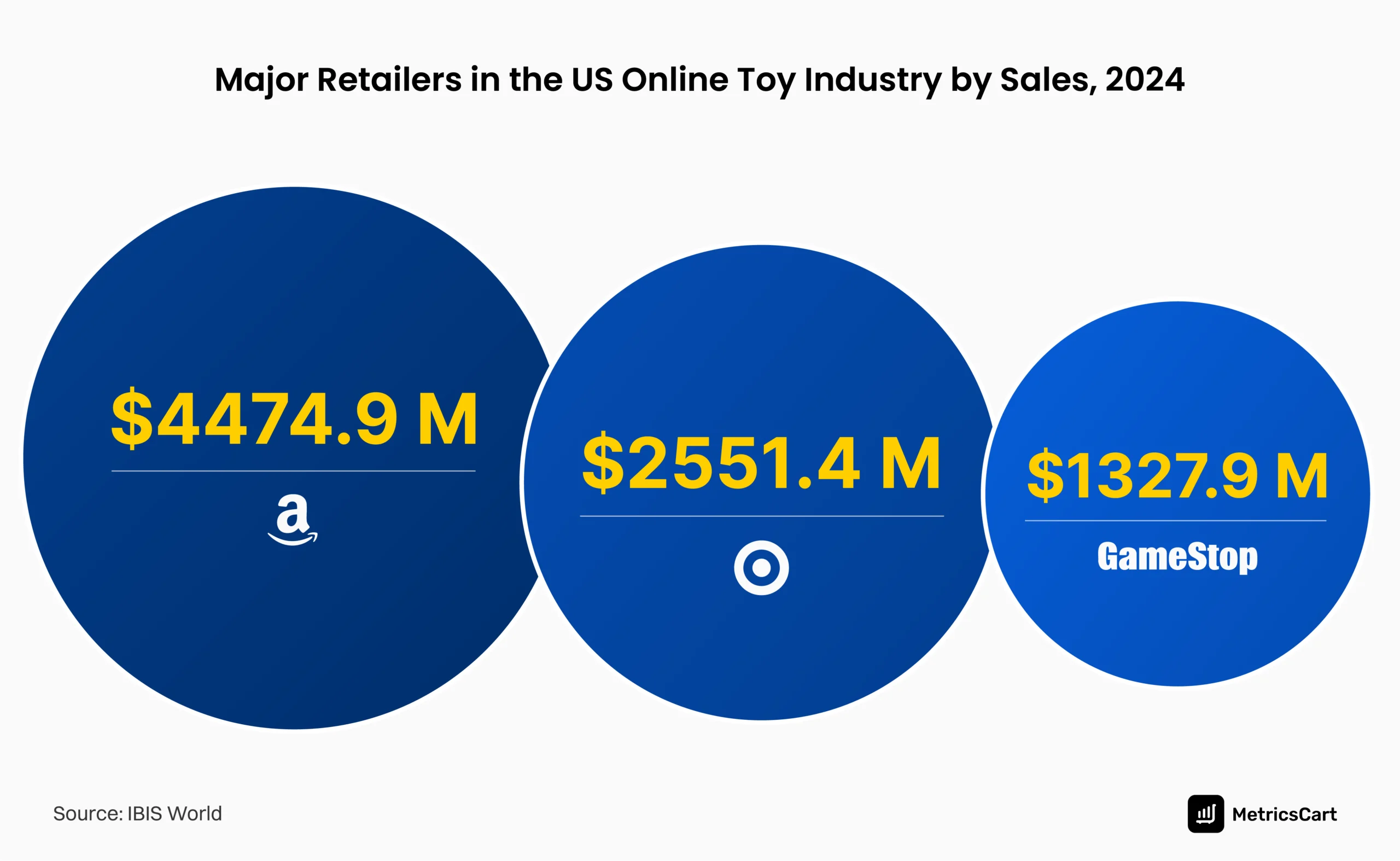

Here’s a quick look at the major toy retailers currently dominating the US online toy industry:

READ MORE| Want to keep up your e-commerce game in 2025? Read E-Commerce Business in 2025: 10 Strategies for Thriving in a Competitive Market.

Trends Shaping The US Online Toy Industry

AI-Powered Smart Toys

Smart toys powered by AI are leading the charge, revolutionizing how children play and learn. These toys don’t just beep and buzz; they adapt, evolve, and interact in ways that captivate kids and impress parents.

Take CogniToys’ Dino, for example. This AI-powered interactive toy doesn’t just respond to commands; it holds full conversations, adapts to a child’s language level, and remembers past interactions to personalize responses.

It tailors engagement to developmental needs while blending fun with cognitive growth. That’s the kind of innovation parents are eager to invest in.

Beyond individual products, augmented reality (AR) and virtual reality (VR) are redefining group play. AR board games overlay digital content onto physical play spaces, creating an immersive experience that blurs the gap between the real and virtual worlds. VR setups, meanwhile, transport kids into entirely new environments, turning imaginative play into a fully interactive adventure.

READ MORE| Explore how the toy industry is going phygital! Read Exploring Phygital In E-commerce with Industry Examples.

Growing Preference for Educational Toys

Here’s the thing: parents aren’t just buying toys for fun anymore. Their increasing awareness of the benefits of early childhood development is driving the demand for educational toys.

The US educational toy market is projected to grow at a blazing CAGR of 9.30% through 2034. Why? Because parents and educators are prioritizing play with purpose; toys that focus on learning and skill building.

Nearly two-thirds of parents (65%) actively consider how a toy contributes to building essential skills for their children. And 51% of parents consider whether a toy promotes mental well-being when choosing toys for their kids.

This demand is fueled by the rise of STEAM education (science, technology, engineering, arts, and mathematics). Toys that align with these principles, like Snap Circuits coding sets and LEGO Education kits, are gaining traction because they combine fun with hands-on learning.

Sustainability and Eco-Friendly Toys

Sustainability is no longer a buzzword; it’s a major buying factor for today’s parents. According to a report by Toy Association, 45% of parents under the age of 40 consider a toy’s environmental impact before making a purchase.

Toy manufacturers are responding in 2025 by prioritizing eco-friendly materials and adopting sustainability as a core business value. But sustainability isn’t just about being environmentally friendly. Eco-conscious parents care about durability—toys that last and provide extended play value.

According to Deloitte’s 2023 Sustainable Consumer Report, 58% of consumers value durability over quantity, and this is driving a shift toward high-quality, heirloom-style toys that can stand the test of time.

Beyond being green, these toys emphasize craftsmanship, adaptability, and their ability to grow with children as they age. Mattel’s commitment to using 100% recycled or bio-based plastics by 2030 is just one example of how brands are stepping up.

Anime Mania and Pop Culture Influence

Toys and pop culture have always had a powerful connection. Popular movies like “Barbie,” “The Little Mermaid,” and “Teenage Mutant Ninja Turtles” aren’t just driving box office sales; they’re moving serious toy inventory.

Nearly 38% of parents expressed interest in buying toys inspired by movies and popular entertainment franchises. And 26% of parents are likely to buy toys based on gaming or anime content.

Anime is no longer a niche—it’s a cultural juggernaut, and in 2025, it’s rewriting the rules for the toy industry. From “Demon Slayer” to “One Piece,” anime fandom is fueling a toy revolution that’s impossible to ignore. It’s about a global community of fans who are all in—buying, collecting, and engaging like never before.

In 2025, expect to see more crossover partnerships and brands leveraging the distinct storytelling and visuals of anime to create toys that are setting sales records and reshaping the industry.

READ MORE| Want to capitalize on impulse buys but don’t know how? Read Online Impulse Buying: Reasons and How Retailers Can Incentivize

Blind Box Toys

Blind box toys are sold in sealed packaging, meaning buyers have no idea what they’re getting until they open it. That little jolt of mystery! Consumers love the thrill of the unboxing experience, and the format keeps them coming back for more as they work to complete their collectible sets.

The blind box trend taps into the “surprise economy,” the “loneliness economy,” and even the “social economy,” as they become a focal point for entertainment, communication, and connection among young adults.

The global blind box toys market is projected to hit $21428.5 million by 2031, growing at a steady CAGR of 6% from 2024 to 2031.

What’s fueling this growth? Social media, influencer marketing, and viral unboxing videos are driving massive engagement. Limited-edition releases and collaborations with big-name franchises or artists? They’re creating a sense of urgency and exclusivity that collectors can’t resist.

Brands are taking notice, with major players doubling down on this category to capture its high growth and high profit margins.

Toy Subscription Services

Here’s a fact! The average American family spends $6,500 on toys over a child’s lifetime.

Toy subscription services are a sustainable alternative to traditional toy buying. Parents love them because they’re eco-friendly and easy on their wallets.

Whether it’s returning, exchanging, or purchasing toys outright, subscription services like Lovevery and Green Piñata Toys are rewriting the rules.

Here’s the kicker: these services don’t just reduce waste by encouraging toy reuse—they align perfectly with today’s eco-conscious consumers. It’s all about promoting a circular economy that’s good for the planet and parents.

Google searches for “Toy Subscription” have more than doubled in the last decade —a clear sign that this trend isn’t slowing down. With features like curated monthly boxes and toys that grow with kids, these services are dominating the toy industry in the US.

The Rise of Kidults

Did you know kidults are responsible for approximately $9 billion in annual toy market sales? But, who are “kidults”? It refers to a rapidly growing demographic of adults who enjoy and collect toys.

These aren’t casual buyers; many kidults are dedicated hobbyists who collect toys for their rarity, aesthetic appeal, or connection to beloved franchises and characters. Limited-edition collectibles and customizable products are hitting the sweet spot for this market segment.

Millennials and Gen Z, who make up the majority of this demographic, are in their prime earning years. Rising disposable incomes mean they’re more willing to spend on toys and collectibles driven primarily by nostalgia.

Kidults have helped stabilize the U.S. toy industry by compensating for softer sales in traditional categories. Toy brands and manufacturers are creating entire product lines tailored to this group, focusing on design, craftsmanship, and storytelling.

Summing Up

From smart toys to pop culture crossovers to the rise of kidults, the US online toy industry is booming. Because toys aren’t just child’s play anymore—they’re for anyone who wants to have a little fun.

We’re talking about a market that’s redefining what toys mean in the digital age. If you’re in the toy or e-commerce game, the time to act is now. Get creative, embrace innovation, and go all in on what consumers want. Because let’s face it—this isn’t just about selling toys. It’s about selling experiences and memories.Get in the game with MetricsCart, your go-to solution for analyzing and optimizing your digital shelf strategy.

Every Second Counts! Strengthen Your Business With Our Digital Shelf Solutions.

FAQ

Technology has revolutionized toys, introducing AI-powered interactive companions, AR-enhanced games, and IoT-enabled playsets, transforming the way kids play and learn.

In 2025, the US toy industry is expected to lead in revenue generation with an estimated $41.68 billion. Globally, the toy market is projected to reach $295.2 billion by 2029, with the US playing a pivotal role.

Online sales have become the dominant channel for toy retail in the United States. In 2023, online sales in the toys & hobbies category accounted for 65.3% of the entire category’s sales.

The future of the toy industry is defined by innovation in technology, sustainability, and the growing influence of kidults and pop culture-driven trends.

The best toy brands in the US include LEGO, Mattel, Hasbro, MGA Entertainment, and Jakks Pacific.