About the Report: This research report provides an in-depth analysis of L’Oréal’s e-commerce strategy on Amazon UK from October 16 to October 29, 2025. With over 4,426 products listed, L’Oréal maintains a strong presence across categories such as skincare, haircare, and makeup.

By leveraging MetricsCart’s digital shelf analytics software, we’ve examined L’Oréal’s product performance, pricing strategy, customer feedback, and the role of sponsored ads in driving product visibility.

Introduction

The global beauty industry is highly competitive, fragmented, and driven by fast-changing consumer preferences. Yet one company continues to set the pace across categories, channels, and markets: L’Oréal.

With operations in 150+ countries, a portfolio covering mass, professional, and dermatological beauty, and €43.48 billion in revenue in 2024, L’Oréal remains the largest beauty company in the world.

What makes L’Oréal critical to the industry is not just its size, but its marketing execution. L’Oréal marketing strategy has steadily shifted from broad, mass-reach campaigns to data-led, personalized marketing powered by digital platforms, AI, and beauty tech.

L’Oréal is a reference case for how legacy consumer brands can modernize without losing scale or brand equity.

This strategic evolution is clearly reflected in Amazon UK with strong review volume, disciplined pricing, and selective use of sponsored visibility rather than aggressive discounting.

Highlights

- L’Oréal has 4,426 products listed, with an average price of £14.24. It has garnered 14.3 million reviews, highlighting the brand’s deep customer trust.

- L’Oréal Paris dominates with 3,062 products, while L’Oréal Professionnel and L’Oréal Men Expert focus on premium salon products and men’s grooming, respectively.

- L’Oréal’s pricing strategy caters to both affordable and premium segments, offering products ranging from £1.32 to £211.65.

- The brand enjoys positive customer feedback, with an average rating of 4.44, showing high levels of customer satisfaction.

- A significant portion of L’Oréal’s products rely on organic visibility, with only 142 of 4,426 products being sponsored.

From “Beauty for All” to “Beauty for Each”: Overview of L’Oréal’s Marketing Strategy

L’Oréal’s shift from “Beauty for All” to “Beauty for Each” is not just a slogan change. It’s a structural change in how the company is moving from winning on distribution and reach to winning on relevance and personalization at scale.

“Beauty for All” (Universalization): How L’Oréal Built Scale

“Beauty for All” is the classic mass-market playbook: be present everywhere, at multiple price points, across multiple needs, for as many people as possible. In practice, this meant broad product portfolios, wide retailer coverage, and marketing designed to appeal across demographics.

This made sense because beauty historically scaled through distribution + brand recall. If you were the brand people recognized in-store and you were priced within reach, you won. The goal wasn’t to tailor the experience to each person. It was to make sure anyone could find a L’Oréal product that fit their budget and basic needs.

Why “Beauty for All” Hit a Ceiling?

The internet changed the consumer buying process. Shoppers now research, compare, and validate through reviews and creator content. Choice exploded. And when choice explodes, “one-size-fits-most” messaging gets weaker.

Two things started to matter more than ever:

- Fit (Is this right for me?)

- Confidence (Will it work, and can I trust it?)

That’s where personalization becomes commercial, not cosmetic. If you help shoppers choose better, you reduce friction, reduce returns, and increase repeat purchases. L’Oréal’s next phase is built around that idea.

“Beauty for Each” (Singularization): How L’Oréal Wins on Relevance

“Beauty for Each” is L’Oréal’s move from mass reach to personalization, leveraging technology and data to ensure the experience feels tailored, even as the business operates at a massive global scale.

This approach is closely tied to “Beauty Tech,” in which L’Oréal uses digital tools to mimic what a beauty advisor or salon professional would do: diagnose, recommend, and guide. Virtual try-on experiences let shoppers test looks digitally, which can increase engagement and improve purchase confidence, especially in categories like foundation shades or lipstick.

Moreover, in 2025, L’Oréal launched Beauty Genius, a 24/7 personal beauty assistant (available on WhatsApp) that personalizes routines based on facial scans and customer input, helping users discover products matched to their skin tone, hair type, and concerns.

Many beauty brands can do one of these well:

- be affordable and everywhere (scale), or

- be premium and specialized (focus), or

- be digital-first and techy (innovation)

L’Oréal’s edge is doing all three at once. This strategy is evident in marketplace behavior, as Amazon experiences the highest level of choice overload. On Amazon, “Beauty for Each” translates into:

- sharper segmentation (who each sub-brand is for),

- better conversion tools (content, shade/routine confidence, trust signals),

- and review intelligence (listening at scale to learn what’s working and what’s failing).

Let’s look into how the L’Oréal business model has enabled their success on Amazon UK.

READ MORE | Top Selling Beauty Products on Amazon Best Sellers 2024

Three Pillars of L’Oréal’s Portfolio: Brand Architecture and Market Segmentation

L’Oréal on Amazon UK is divided into three main categories: L’Oréal Paris, L’Oréal Professionnel, and L’Oréal Men Expert. These brands serve distinct market segments, each with its own unique value proposition.

| Brand | Product Count | Avg. Price (£) | Avg. Rating | Total Reviews | Avg. Discount |

| L’Oréal Paris | 3,062 | 10.95 | 4.40 | 11.6M | 18.89% |

| L’Oréal Professionnel | 975 | 25.52 | 4.52 | 1.8M | 13.73% |

| L’Oréal Men Expert | 389 | 11.64 | 4.56 | 910K | 19.09% |

L’Oréal Paris acts as the engine of reach and volume. It is the flagship, mass-market brand designed for everyday beauty and skincare needs. With 3,062 products listed on Amazon UK, it accounts for the majority of L’Oréal’s digital shelf presence. The 11.6 million reviews and an average rating of 4.40 show consistent shopper trust across a wide range of SKUs.

At an average price of £10.95, L’Oréal Paris sits firmly in the affordable zone, making it the default choice for routine purchases like moisturisers, foundations, mascaras, and cleansers.

L’Oréal Professionnel is positioned around expertise and performance rather than accessibility. With 975 products, it has a much tighter range, focused primarily on advanced haircare, including shampoos, conditioners, treatments, and professional tools.

Despite a smaller catalogue, it generates 1.8 million reviews and averages 4.52, signaling strong confidence among a more discerning audience. The higher average price of £25.52 reinforces its salon-quality positioning. On Amazon UK, this brand attracts shoppers willing to pay more for specific outcomes, such as curl definition, damage repair, or professional styling results at home.

L’Oréal Men Expert completes the portfolio by addressing a focused but growing segment: men’s grooming and skincare. With 389 products, it has the smallest range, yet it has 910K reviews and the highest average rating of 4.56, suggesting strong approval among buyers once they enter the category.

Priced at an average of £11.64, Men Expert sits close to L’Oréal Paris in terms of affordability but differentiates itself through purpose-built products for men, such as moisturisers, cleansers, shower gels, deodorants, and antiperspirants.

L’Oréal Leads Amazon UK with Skincare and Makeup Essentials

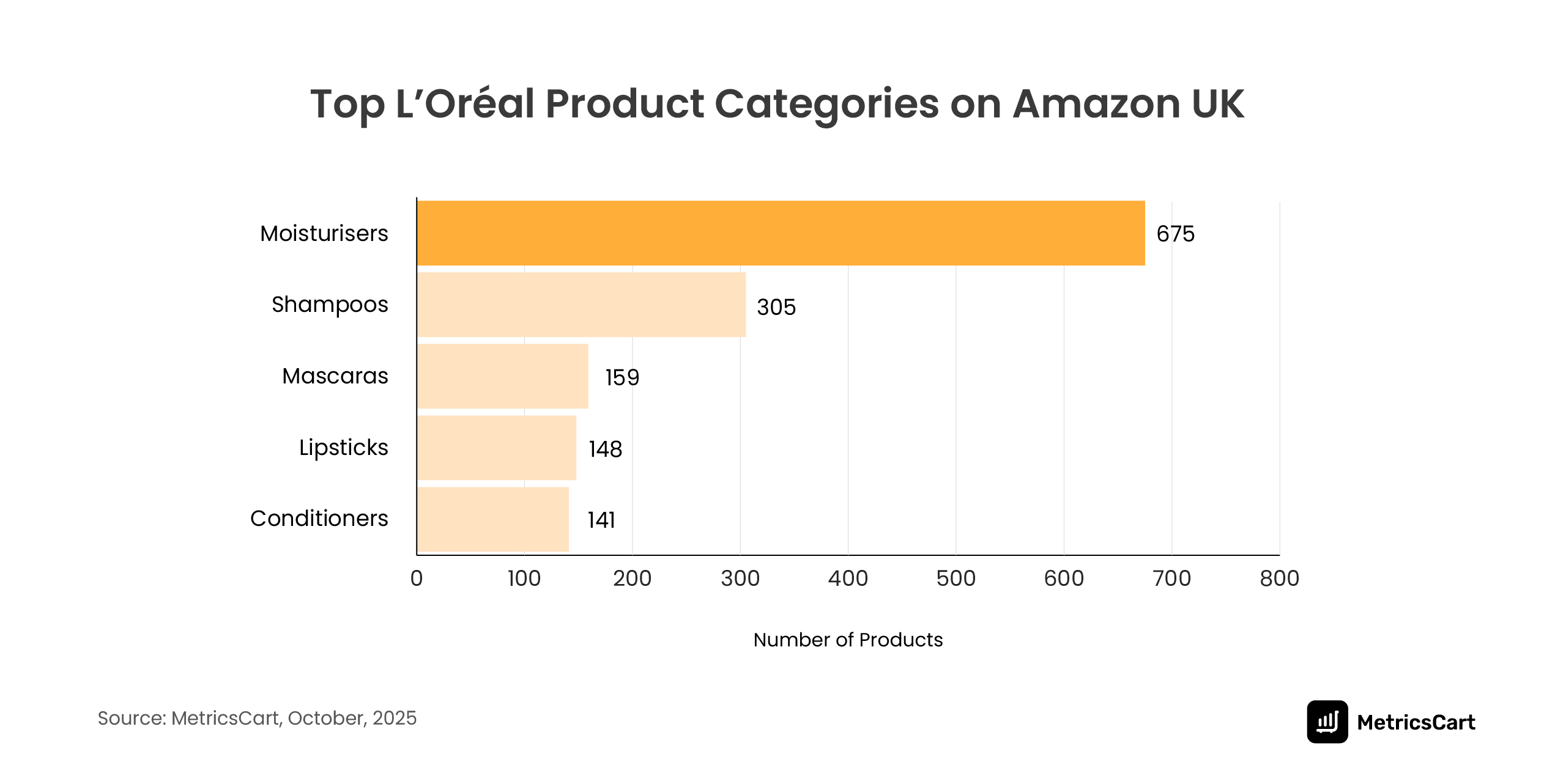

Across L’Oréal’s 4,426 product listings on Amazon UK, skincare dominates the brand’s e-commerce shelf, led by moisturisers (675 products) and shampoos (305). This reflects L’Oréal’s core strength in everyday beauty and self-care categories—segments that attract repeat purchases and consistent online demand.

The MetricsCart research team found that among the three sub-brands, L’Oréal Paris drives visibility through its skincare portfolio, with 587 moisturisers listed, supported by high-volume categories such as mascaras, lipsticks, and foundations.

This mix highlights the brand’s strategy of balancing skincare credibility with makeup variety, appealing to both daily users and trend-driven beauty shoppers.

Meanwhile. L’Oréal Professionnel, the haircare-focused line, shows its dominance in shampoos (246) and conditioners (79), followed by deep treatments and styling products. Professionnel targets salon-quality results at home.

The broad shampoo assortment aligns with Amazon’s large search traffic for specialized care, such as color protection, frizz control, and repair, showing how L’Oréal adapts professional-grade products for e-commerce audiences.

Among men’s grooming products, moisturisers (88) and shower gels (56) lead listings, reinforcing the brand’s focus on simplified, functional skincare. The emphasis on moisturisers reflects increased awareness of hydration and anti-fatigue benefits, which are among the common concerns of urban male consumers.

Targeted Ad Spending: L’Oréal Prioritizes High-Value SKUs for Sponsored Visibility

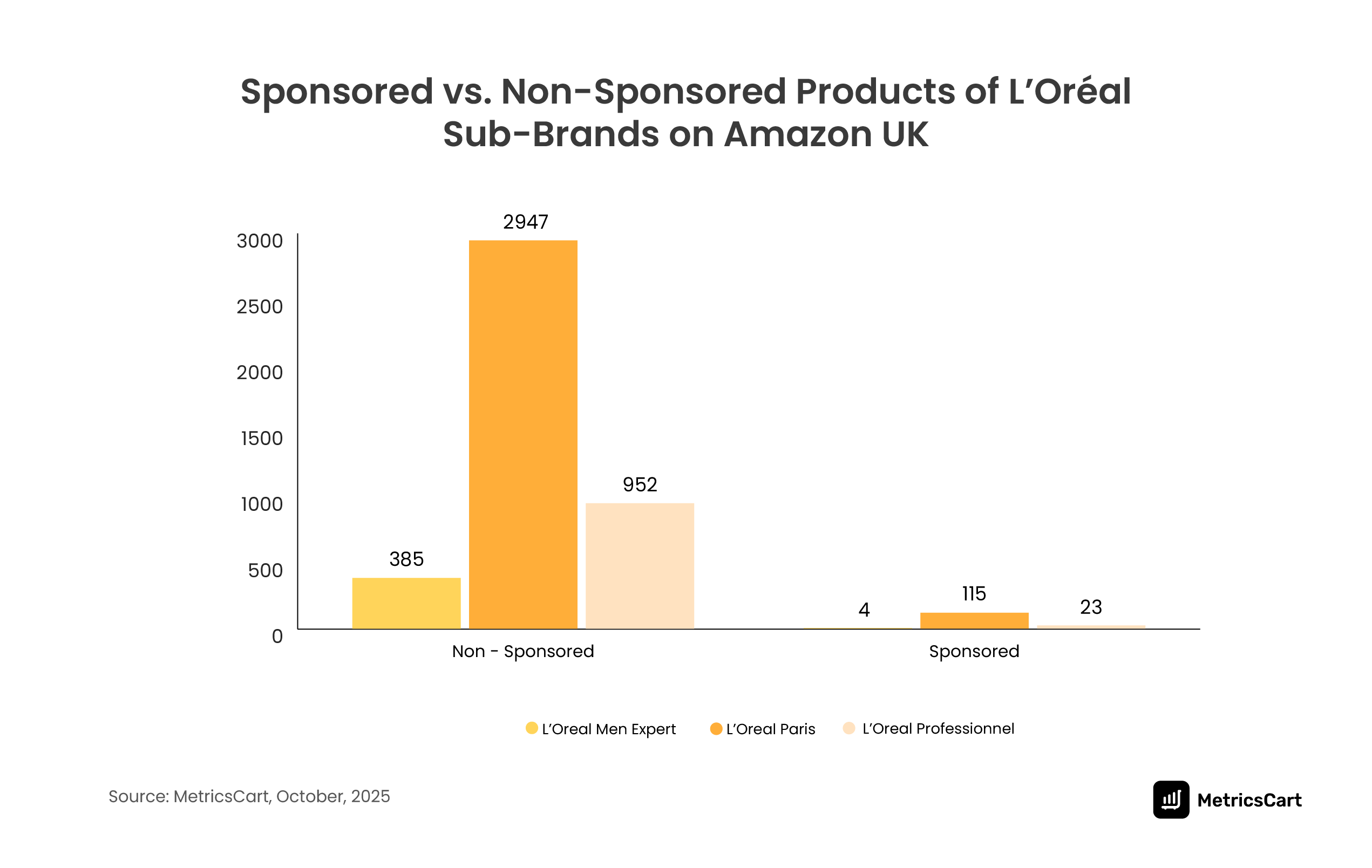

L’Oréal’s marketing strategy on Amazon UK shows a highly selective approach to sponsored listings. MetricsCart research reveals that of the over 4,400 total products, only 142 were sponsored, indicating that the brand allocates ad spend to specific, high-value SKUs rather than broad-scale promotion.

While L’Oréal Paris dominates the overall catalog with 2,947 non-sponsored and 115 sponsored listings, L’Oréal Professionnel and Men Expert show far fewer ads. This reflects a deliberate focus on hero products and high-margin ranges, particularly premium skincare and salon-grade haircare.

L’Oréal’s diverse portfolio enables it to prioritize categories where advertising delivers the highest return, such as anti-aging creams, serums, and professional shampoos. Rather than boosting every product, the brand invests in SKUs that anchor category visibility and reinforce brand equity.

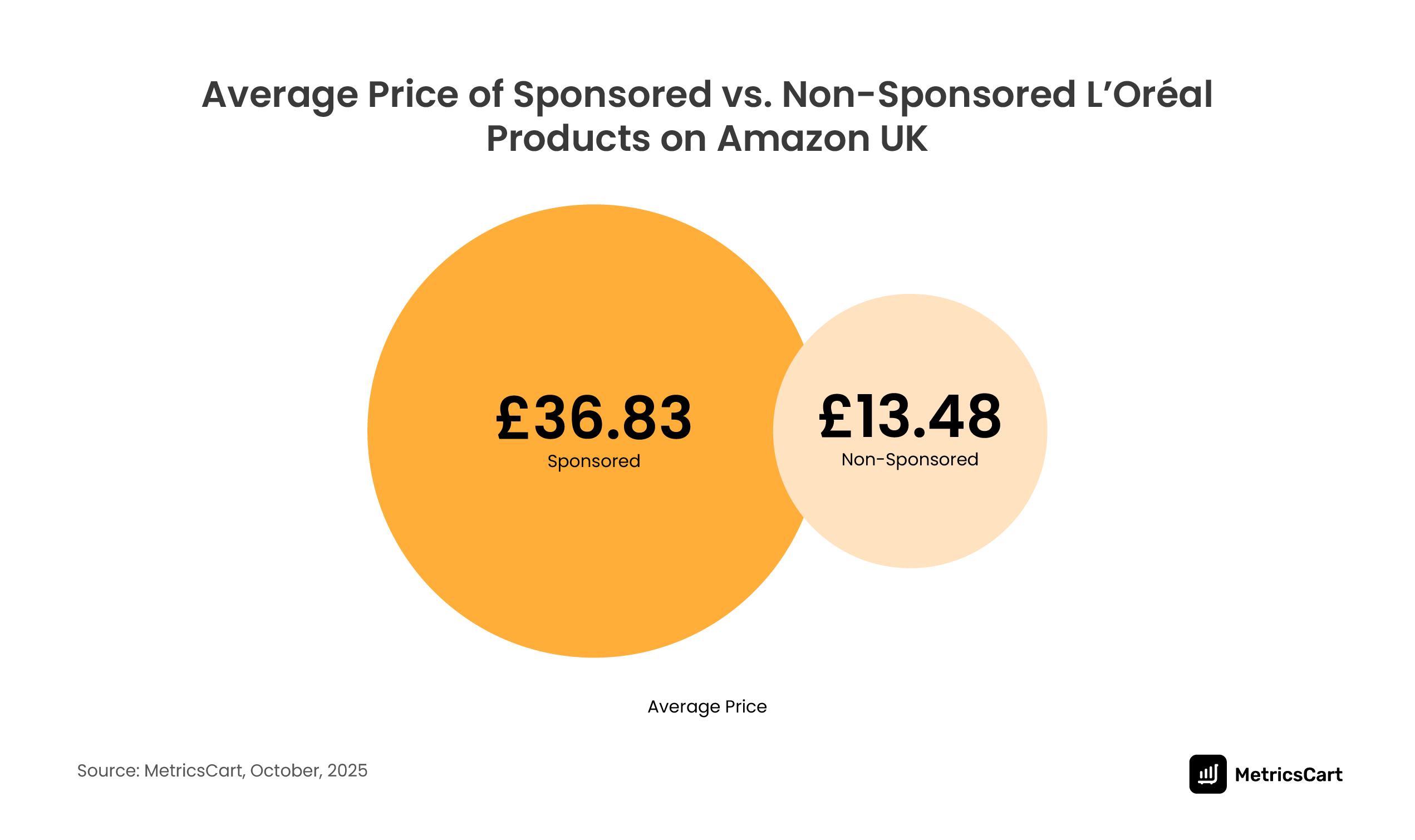

MetricsCart data reveals that sponsored items average £36.83, nearly 3x the price of non-sponsored products (£13.48). Ads are primarily allocated to premium or professional lines, where higher margins justify advertising spend.

L’Oréal leverages sponsored placements to push products with stronger profit potential and aspirational positioning, often from the Revitalift, Age Perfect, or Professionnel Série Expert ranges.

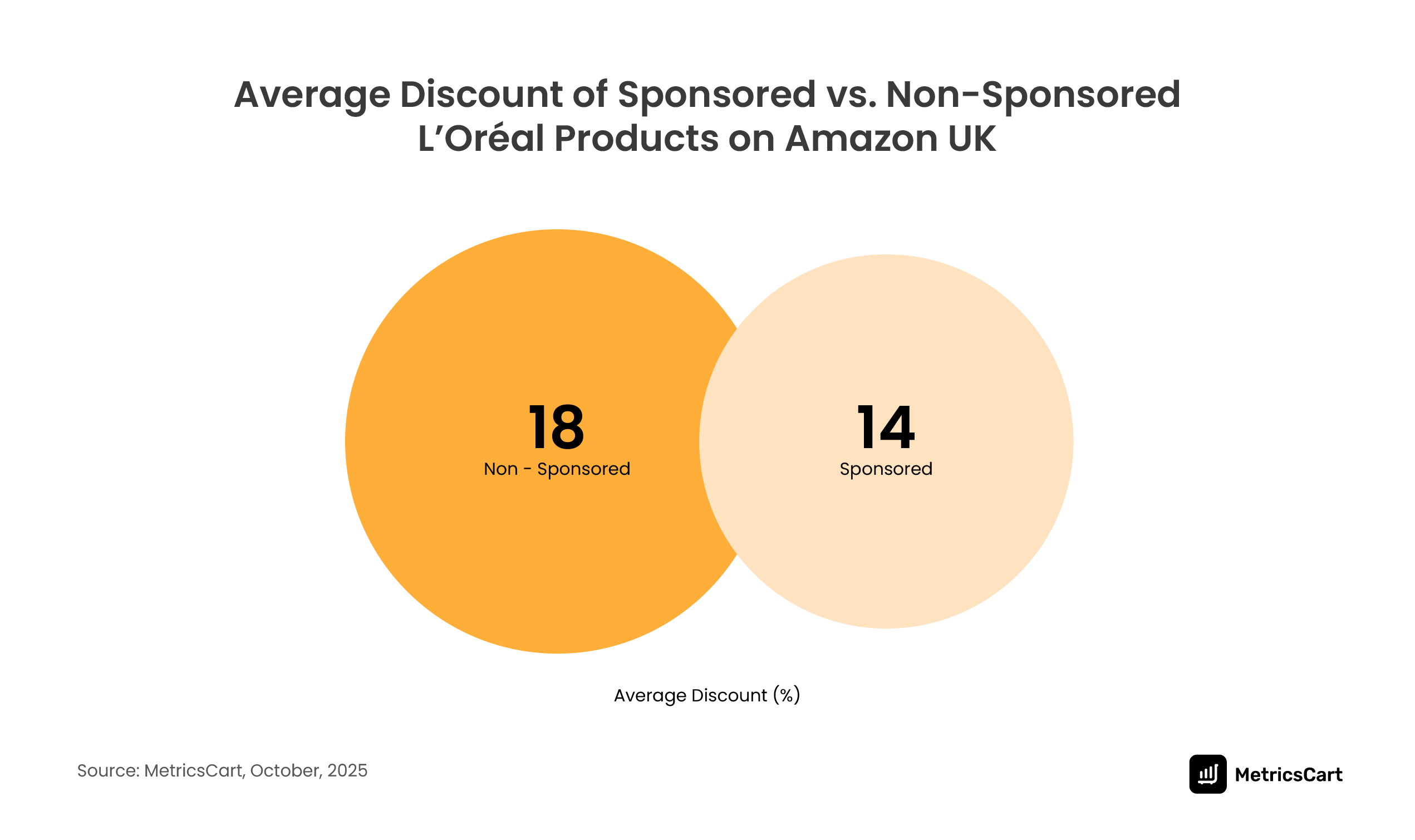

Interestingly, non-sponsored products offer slightly higher discounts (18%) than sponsored products (14%). L’Oréal uses discounts as the visibility lever for its mass-market products like shampoos and basic skincare, while relying on sponsorships for brand storytelling and premium product exposure.

This two-pronged strategy helps maintain price integrity for high-end SKUs while driving volume through affordable lines.

Pricing Strategy: How L’Oréal Balances Accessibility and Premium Value

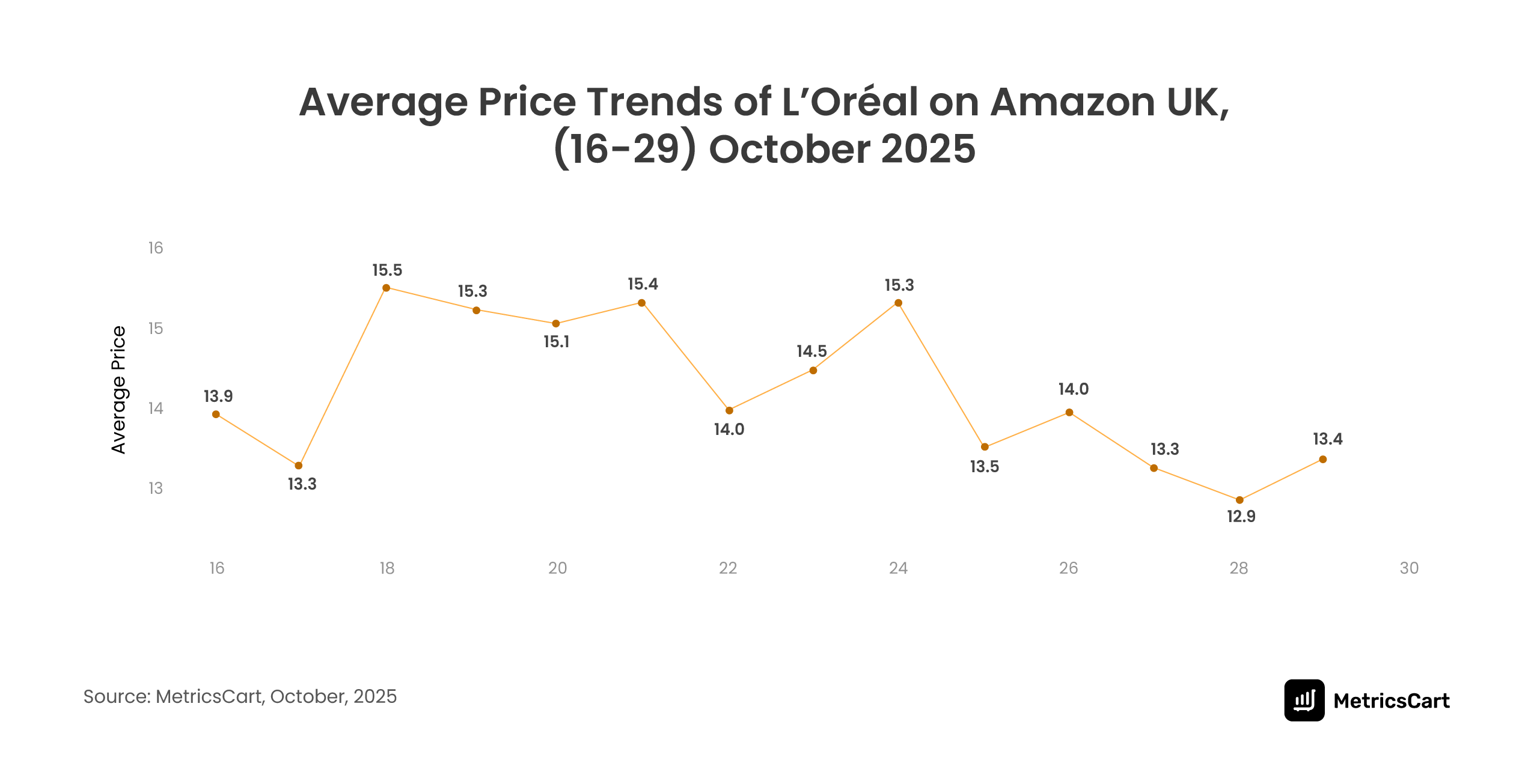

Between October 16 and 29, 2025, L’Oréal maintained a stable average price range of £12.9 to £15.5 on Amazon UK, with only minor fluctuations. The absence of sharp price drops or heavy promotional dips suggests a controlled pricing strategy- a hallmark of L’Oréal’s approach to balancing mass-market accessibility with premium brand perception.

L’Oréal’s steady pricing signals consistent value positioning across its extensive portfolio. Rather than relying on aggressive markdowns, the brand emphasizes product credibility and trust, especially in its skincare and haircare categories, which dominate Amazon listings.

An average price around £14 positions L’Oréal as affordable luxury—premium enough to signal quality but within reach for everyday shoppers. On Amazon UK, L’Oréal faces competition from both high-end skincare (like Clinique, The Ordinary) and budget options (like Garnier, Simple).

Maintaining mid-range pricing enables L’Oréal to straddle both ends of the spectrum, appealing to aspirational buyers without alienating value-conscious ones.

READ MORE | Amazon Pricing Strategy: A Complete Guide for 2025

Magic Skin Beautifier Bb Cream and Age Perfect Vitamin C Refreshing Toner are the Most Affordable L’Oreal Products on Amazon UK

| Products | Price (£) |

| L’Oreal Paris Magic Skin Beautifier Bb Cream – Anti-Redness | 1.32 |

| L’Oreal Paris Age Perfect Smoothing and Anti Fatigue Vitamin C Refreshing Toner, Black, 200 ml (Pack of 1) | 1.32 |

| L’Oreal Deep Beige Touche Magique Twist Up Concealer | 2.36 |

L’Oréal’s lowest-priced products on Amazon UK—such as the Magic Skin Beautifier BB Cream (£1.32), Age Perfect Vitamin C Toner (£1.32), and Touche Magique Concealer (£2.36)—highlight the brand’s strategy of maintaining entry-level accessibility within its portfolio.

L’Oréal leverages affordable hero products to introduce new consumers to the brand. Low-priced SKUs in familiar formats (such as BB creams or toners) act as trial drivers, encouraging repeat purchases across higher-value categories like serums, foundations, and hair treatments.

Steam Hair Straightener and Curl Expression Shampoo, Cream, Jelly & Oil are the Most Expensive L’Oreal Products on Amazon UK

| Products | Price (£) |

| L’Oréal Professionnel Steam Hair Straightener & Styling Tool, For All Hair Types, SteamPod 3, UK Plug | 211.65 |

| L’Oréal Professionnel Curl Expression Shampoo, Cream, Jelly & Oil, For Curly & Coily Hair, For Hydrated, Defined & Frizz Free Curls | 78.64 |

| L’Oréal Professionnel Curl Expression Shampoo, Cream, Jelly & Oil, For Curly & Coily Hair, For Hydrated, Defined & Frizz Free Curls | 50.83 |

At the upper end of L’Oréal’s pricing spectrum, products such as the SteamPod 3 Hair Straightener (£211.65) and Curl Expression kits (£78.64 and £50.83) from L’Oréal Professionnel highlight the brand’s premium, salon-grade positioning within the e-commerce marketplace.

The SteamPod 3 is positioned as a salon-quality styling tool featuring advanced steam technology, temperature control, and ionic plates- features typically found in high-end haircare devices. Its high price reflects not just the cost of innovation but also L’Oréal’s effort to bridge professional salon experiences with at-home styling.

The Curl Expression range, priced between £50 and £78, includes multi-step routines (shampoo, cream, jelly, and oil) designed specifically for curly and coily hair types. These are bundled sets that combine multiple products, increasing both the perceived and actual value. These collections target niche segments seeking expert-level care—consumers willing to invest more in performance-driven, science-backed formulations.

As part of the L’Oréal Professionnel line, these products are marketed under a “pro salon” identity that emphasizes craftsmanship, ingredient innovation, and efficacy. Unlike mass-market products under L’Oréal Paris, this sub-brand commands premium pricing due to its association with hair professionals and salon use.

Top Performing SKUs: What Amazon Shoppers Review Most

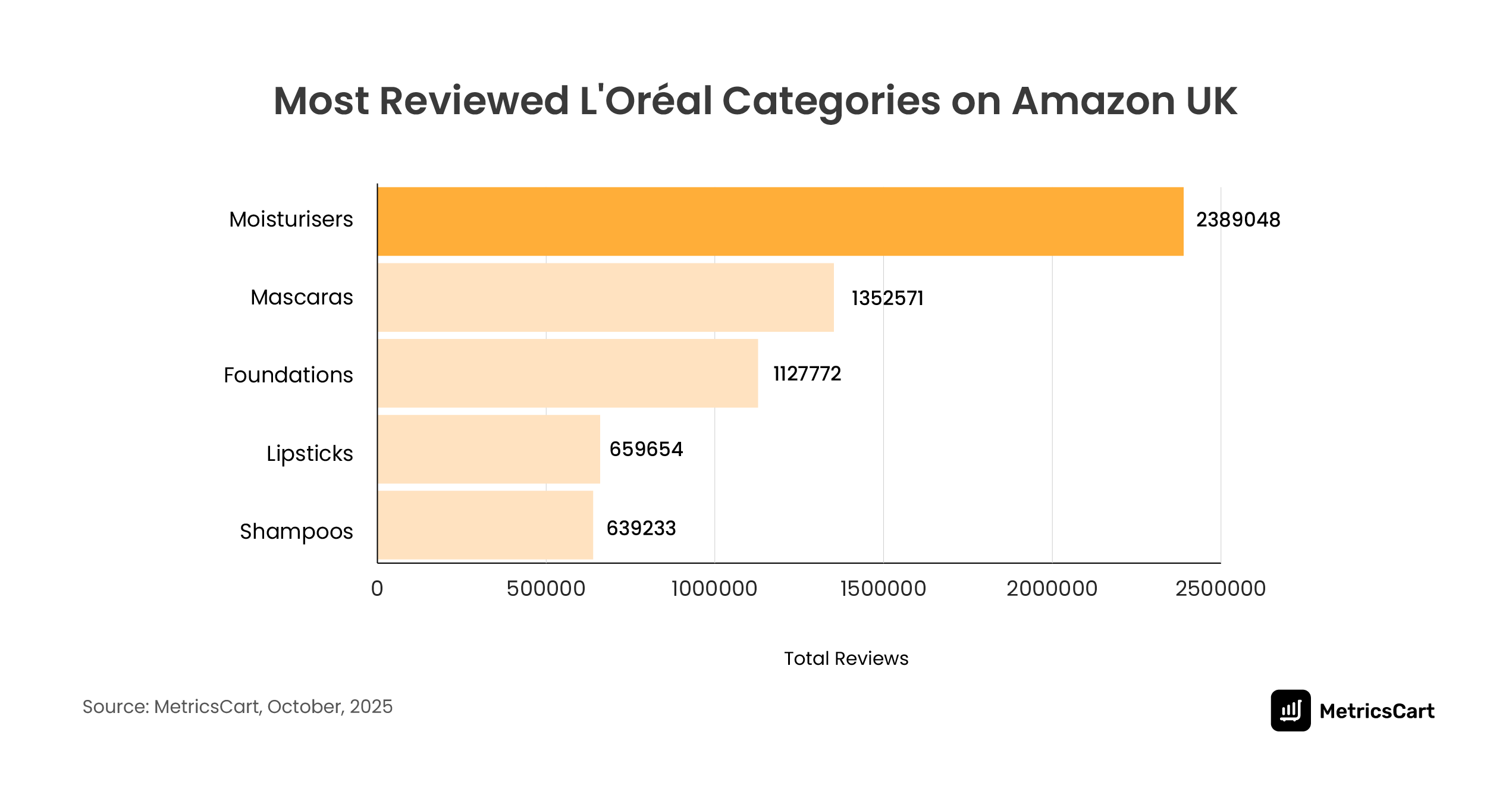

Moisturisers lead customer engagement for L’Oréal on Amazon UK, generating 2.39 million reviews, followed by mascaras (1.35 million) and foundations (1.12 million). This pattern underscores how L’Oréal’s core skincare and beauty essentials drive the highest shopper interaction—categories that naturally encourage frequent repurchase and habitual use.

The high review volume for moisturisers highlights their daily-use relevance and broad consumer penetration. These products cater to diverse skin needs, such as hydration, anti-aging, and brightening, making them a constant in shoppers’ carts.

High review counts not only signal popularity but also amplify conversion rates on Amazon’s digital shelf.

| Products | Reviews |

| L’Oréal Paris Magic Retouch Instant Root Concealer Spray, Quick Grey Coverage, Easy Application, Shade: Dark Brown, 75ml | 38662 |

| L’Oreal Paris True Match Liquid Foundation, Skincare Infused With Hyaluronic Acid, Spf 17, Available In 40 Shades,2.C Cool Rose, 30 Ml | 38089 |

| L’Oréal Paris Foundation for Face, Skincare Infused with Hyaluronic Acid, True Match Hydrating Liquid Foundation for All Skin Tones, SPF 16, 2N Vanilla,30 ml | 38071 |

| L’Oréal Paris Intense Volume Mascara, Volumising and Lengthening, Infused with Castor and Floral Oils to Condition Eyelashes, Suitable for Sensitive Eyes, Soft Fibre Brush, Lash Paradise, Black | 29152 |

| L’Oreal Paris Magic Skin Beautifier Bb Cream – Anti-Redness | 26170 |

L’Oréal’s most reviewed products on Amazon UK reveal a strong consumer preference for versatile, results-oriented beauty essentials. Leading the list is the L’Oréal Paris Magic Retouch Instant Root Concealer Spray with 38,662 reviews, followed closely by two True Match foundations and the Lash Paradise mascara—all consistent top performers in their respective categories.

The Magic Retouch Root Concealer Spray stands out for its problem-solving appeal—a quick, affordable solution for grey coverage between salon visits. The True Match Foundation range secures two of the top three spots, with over 38,000 reviews each, reflecting L’Oréal’s success in shade diversity and hybrid skincare formulas.

L’Oréal’s most reviewed products share three traits: visible results, daily-use relevance, and hybrid functionality. By blending affordability with innovation, L’Oréal successfully drives engagement in both skincare and makeup categories—turning everyday beauty needs into sustained digital shelf leadership.

READ MORE | Strategies To Get More Reviews on Amazon in 2024

Conclusion: Data-Led Beauty Dominance

L’Oréal’s strength on Amazon UK lies in its ability to balance premium innovation with everyday accessibility. Skincare and makeup remain its core engines, fueled by consistent pricing, targeted ad visibility, and product lines that encourage habitual repurchase. The result is a brand that commands attention not just through volume, but through precision and consistency across its digital shelf.

Winning in e-commerce today means more than listing products—it requires continuous optimization across pricing, promotions, visibility, and consumer sentiment.

MetricsCart enables brands like L’Oréal to track these dynamics in real time—monitoring pricing shifts, review trends, ad presence, and stock health to uncover what truly drives digital shelf growth.

With data-led insights powering every decision, brands can stay visible, stay competitive, and sustain leadership in fast-moving online marketplaces

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready to Win the Beauty Aisle on Amazon UK?