Nestlé’s brand journey is more than a century and a half of disciplined reinvention. The company’s roots go back to 1866-1867, when Anglo-Swiss Condensed Milk and Henri Nestlé’s infant cereal laid the foundation for a global food leader.

By 1905, the two businesses merged; over the decades, the portfolio now spans beverages, confectionery, nutrition, dairy, and petcare. The company has consistently moved where consumer value flows.

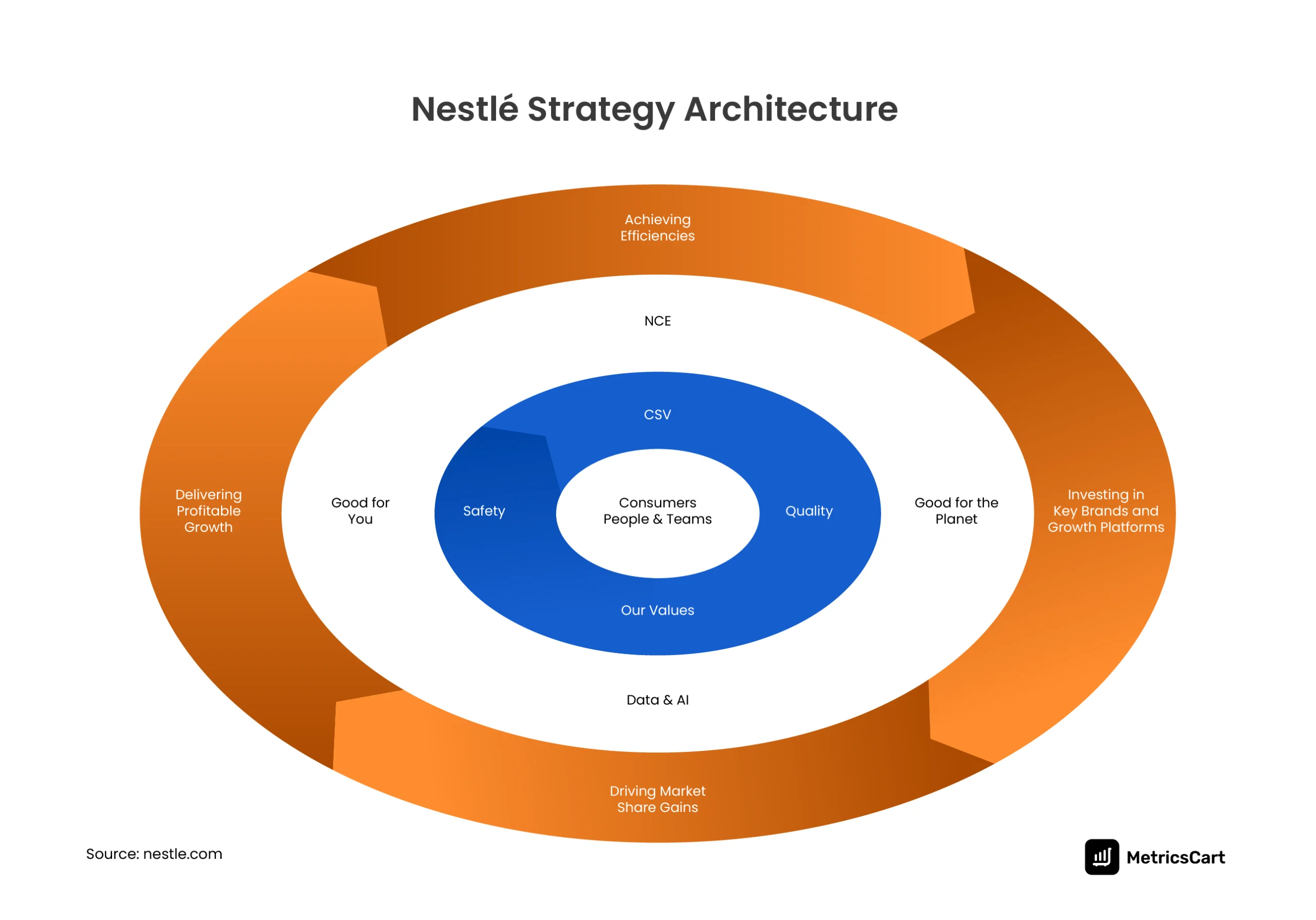

Today, it positions growth on three pillars: operational efficiency, focused capital allocation, and continuous investment behind priority brands and platforms. It is explicit in its strategy narrative and underpins how Nestlé’s e-commerce strategy treats the digital shelf as a core revenue engine rather than a side channel.

And Q1 2025 makes that clear.

Nestlé’s Q1 2025 Numbers

Q1 2025 was a clean read on the digital engine. Group organic growth was +2.8% (RIG +0.7%, pricing +2.1%). Crucially, e-commerce grew +15.1% organically and reached 20.1% of total Group sales, far outpacing retail (+2.5%) and out-of-home (+6.6%).

Category contributions were led by confectionery (+8.9%) and coffee (+5.1%). The Q1 disclosure directly ties growth actions to price discipline in cocoa/coffee categories and to on-track delivery of big bet innovations like Nescafé Espresso Concentrate.

That momentum carried into H1 and 9M 2025: H1 e-commerce +12.3%, 20.2% mix; 9M e-commerce +13.2%, 20.2% mix. H1 also shows advertising and marketing stepped up to 8.6% of sales, and management reiterates a “four-times Group OG” pace in the categories where incremental investments are targeted.

What Nestlé Figured Out Early

Nestlé recognized two truths sooner than most legacy CPGs. First, digital is a category growth accelerator, not just another distribution channel.

Second, discipline beats sporadic campaigns; weekly visibility on price, content, availability, ratings, and search fuels faster execution loops.

This is consistent with the company’s strategy architecture: invest in key brands and platforms, drive market-share gains, and deliver profitable growth through efficiencies and reinvestment.

READ MORE | Why CPG Brands Fail: 5 Common Mistakes and How To Fix Them

How Nestlé’s E-Commerce Strategy Built Digital Advantage

Nestlé’s digital commerce strategy compounds because it connects digital shelf data, category logic, and test-and-scale operating cadence. Below, we break down the specific motions that showed up in Q1-9M performance and the broader 2025 narrative.

1. Lead Where Consumers Already Have Loyalty (Coffee & Nutrition)

High-frequency, high-loyalty categories monetize digital best. In Q1, coffee and confectionery were the largest OG (organic growth) contributors; coffee continued as a pillar through H1/9M with sustained pricing power and improving RIG as elasticities normalized.

Nestlé explicitly called out pricing actions in coffee/cocoa and strong consumer traction for their “big bet” coffee innovations; the exact pattern that favors D2C ecosystems, retailer.com replenishment, and marketplace discovery.

At 9 months into 2025, management again cites coffee and confectionery as the biggest OG contributors, with e-commerce maintaining a ~20.2% mix on +13.2% organic growth; clear evidence that repeat-centric categories compound online when supported by steady content, availability, and search execution.

2. Treat Marketplaces Like Premium Real Estate

The Nestlé marketplace strategy reflected in 2025 disclosures is methodical: broad-based growth across zones with price actions to recover input cost inflation, while moderating elasticities over time; category engines (coffee, confectionery) supported by market-share gains and SKU innovation; and organizational simplification to speed rollouts.

The core of the Nestlé marketplace strategy is rooted in discipline: keep content current, defend price integrity, eliminate duplication, capture reviews, and invest in retail media where conversion signals are strong. Q1 and H1 commentary make clear that price actions were taken to offset cocoa and coffee inflation while maintaining momentum, and as elasticities eased, RIG improved.

The result: e-commerce is growing 4-5x faster than Group OG, a clear signal that search, availability, and brand control matter more today than mere shelf presence did a decade ago.

READ MORE | Price Pack Architecture for CPG Brands: A Strategic Deep Dive

3. Continuous Digital Shelf Visibility

Nestlé’s e-commerce strategy operates on a continuous signal feedback on all digital shelf metrics. You see the effect in how the performance compounds.

Developed markets delivered +1.6% OG with +1.4% RIG, while emerging markets posted +4.5% OG, driven primarily by pricing (+4.8%), clear proof that Nestlé calibrates price-pack strategy, media, and availability by market elasticity, then enforces weekly guardrails on search rank, stock status, pricing compliance, and review quality to protect conversion.

That focus becomes even clearer in later disclosures. By H1, retail was +2.6% and out-of-home +5.8%, with digital continuing to outperform and support market-share gains in North America, especially in frozen and creamers. Through nine months, Europe’s improving RIG was explicitly linked to e-commerce strength, and retail held +3.1% against +6.2% out-of-home.

This disciplined visibility loop and digital shelf optimization, signal → action → mix improvement, enables Nestlé to scale innovation and reinvest gains into digital execution.

4. Omnichannel That Actually Means Omnichannel

The Nestlé omnichannel strategy is visible in channel breakouts and segment commentary: retail grew modestly, out-of-home strengthened, and e-commerce posted double digits while mix reached one-fifth of sales by Q1 and held through H1/9M.

That balance of D2C signals, retailer.com replenishment, marketplace reach, and brick-and-mortar reinforced by digital insight, shows omnichannel as a system, not a mere slogan. Zone narratives (Americas, AOA, Europe) also highlight market-share gains in coffee/petcare and targeted pricing to protect value without stalling penetration, which is again, classic omnichannel governance.

5. A Portfolio Built for Today’s Shopper, Not Yesterday’s

Nestlé’s Amazon strategy is shaping its portfolio around categories that win online. Its six global “big bets”; Nescafé Espresso Concentrate, Maggi air-fryer meals, chocobakery, NAN Sinergity, Purina gourmet pyramid-shaped cat food, and Dolce Gusto Neo, generated CHF 200 million in H1 2025 across 65 launches, each targeted to cross CHF 100 million annually within three years.

They’re formats built for the digital shelf: photogenic SKUs, premium storytelling, and high-repeat usage patterns. In coffee, Nestlé strengthened digital velocity with Nespresso Vertuo, Momento systems, a new app rolled out in 21 markets, and Starbucks D2C launches, while confectionery and waters advanced lifestyle-driven platforms like Maison Perrier and Sanpellegrino.

Nestlé is engineering a portfolio designed for digital discovery, repeat, and premium mix.

So, What’s Nestlé’s Real Edge?

Three levers explain why the Nestlé ecommerce strategy compounds growth and why Q1 wasn’t a lucky spike but the result of a system that keeps reinforcing itself.

Signal-led growth + digital shelf strategy.

Nestlé builds growth where it sees demand signals first. Strong digital shelf execution; search rank control, pricing integrity, availability discipline, and review velocity, feeds faster decisions, which then feed volume. That’s why e-commerce consistently ran ahead of the company: Q1 +15.1% to 20.1% mix, H1 +12.3% to 20.2%, 9M +13.2% at 20.2%.

Category economics + pricing discipline.

Nestlé leaned into categories that reward digital behavior, powering OG in coffee and confectionery, even while executing deliberate price increases to offset coffee and cocoa inflation, and then navigating elasticities back toward positive RIG. Growth followed where category loyalty and repeat dynamics aligned with online behavior.

Investment flywheel.

Big bets don’t scale without backing. Nestlé lifted advertising and marketing to 8.6% of sales in H1, funded innovation platforms, and executed Fuel for Growth to redeploy capital into the categories and digital engines that matter. When a legacy giant invests in digital instead of defending the past, momentum compounds.

What CPG Operators Can Learn

Well, the takeaway for CPG brands isn’t “go digital”! Especially for challenger brands, it wouldn’t be wise to simply mirror what legacy giants do.

But here’s what Nestlé’s digital commerce strategy teaches:

Build category-specific digital playbooks

Coffee shoppers subscribe and replenish. Confectionery spikes on impulse and seasonality. Nutrition buyers research and trust-check. Nestlé adapted pack sizes, content frameworks, search strategy, and review velocity by category. One playbook does not win for all categories; precision does.

Treat marketplaces as brand infrastructure, not distribution

Marketplaces are no longer “extra shelves.” They are brand stages and margin protectors. Nestlé’s disciplined approach to content freshness, pricing integrity, and retail media execution helped sustain double-digit e-commerce growth while balancing pricing actions and elasticity. When platforms get governance, not guesswork, brands scale profitably.

Make visibility operational, not a dashboard

Digital shelf wins happen when availability, share of search, reviews, and pricing signals are monitored and actioned regularly. Not just reported monthly. Operators who treat digital shelf analytics like a system, not just a pretty dashboard, win.

Fund the winners and simplify the structure

Higher A&M spend and a cost-efficiency engine powered rapid “big bet” launches and cross-market velocity. Nestlé simplified zones and aligned capital where digital behavior and category depth converge. When structure and investment align, growth accelerates.

Want an action plan as sharp as Nestlé’s e-commerce strategy? Turn your digital shelf into a growth engine with MetricsCart. See how MetricsCart’s digital shelf analytics helps CPG brands grow. Book a demo and make your digital shelf your biggest growth channel.

Step Up Your Brand Game and Outshine the Competition!

FAQs

Nestlé’s growth strategy focuses on profitable, category-led expansion supported by continuous brand investment, innovation, and disciplined execution. It prioritizes high-growth segments like coffee, nutrition, and pet care, while using operational efficiencies to reinvest in marketing and digital acceleration. The Nestlé ecommerce strategy strengthens growth by scaling digital-ready products, expanding online penetration, and increasing repeat behavior across markets.

Nestlé uses a transnational model that blends global scale with local relevance. Core capabilities: supply chain, R&D, technology, and digital platforms are centralized, while product formats, communication, and pricing are tailored to local consumer needs. This agile, market-backed approach supports the Nestlé omnichannel strategy across regions.

Nestlé’s strategic pillars include building category leadership, driving profitable growth, investing in innovation and brand equity, achieving operational efficiencies, and accelerating digital transformation. The company also emphasizes sustainability and portfolio optimization. Digital commerce sits at the center of execution, reinforcing the Nestlé digital commerce strategy.

Nestlé adapts messaging, pack architecture, and media strategy by region to reflect cultural preferences, price sensitivity, and shopper behavior. It leverages local insights to personalize promotions and product positioning while maintaining global brand consistency. This includes tailoring formats for online marketplaces and retail partners as part of the broader Nestlé marketplace strategy.

Nestlé’s marketing strategy prioritizes brand trust, product superiority, and consumer-first communication with heavy investment in digital, content, and retail media. It focuses on consistent execution across touchpoints, utilizing data, personalization, and performance marketing to reinforce loyalty and accelerate trial. This approach strengthens the Nestlé Amazon strategy and omnichannel presence globally.