About the Report:

This report presents a detailed data study of Amazon’s non-alcoholic beverage category. We have considered key metrics, including top brands, top subcategories, pricing, discounts, customer ratings, and reviews. For this analysis, we considered 5,259 products from Amazon’s non-alcoholic beverages category on February 12, 2025.

Introduction

If you’re managing a beverage brand, you’ve probably noticed: non-alcoholic beverages aren’t just a health fad anymore- they’re a fast-evolving category with real staying power in 2025.

The global non-alcoholic beverage market was valued at $1.8 trillion in 2024 and is expected to more than double, hitting $3.8 trillion by 2034, rising at a CAGR of 7.75%.

The category spans everything from soft drinks and bottled water to functional beverages, teas, juices, and coffees, and it’s drawing in a health-focused audience: one in four shoppers say they buy non-alcoholic drinks for general wellness reasons.

Moreover, brands are introducing innovative products that cater to diverse consumer preferences. This includes non-alcoholic spirits that mimic traditional alcoholic beverages, plant-based waters, and beverages infused with adaptogens and probiotics, which attract younger millennials and Gen Z customers.

Highlights

- Cocktail mixers top the non-alcoholic beverage category with 993 products.

- Lyre’s offers the largest selection of non-alcoholic beverages on Amazon, featuring 482 products.

- The cheapest non-alcoholic beverage sub-categories are powdered drink mixes at $13

- Water and energy drinks are the most reviewed non-alcoholic beverages on Amazon.

Cocktail Mixers are the Non-Alcoholic Beverage Sub-Category with the Most Products on Amazon

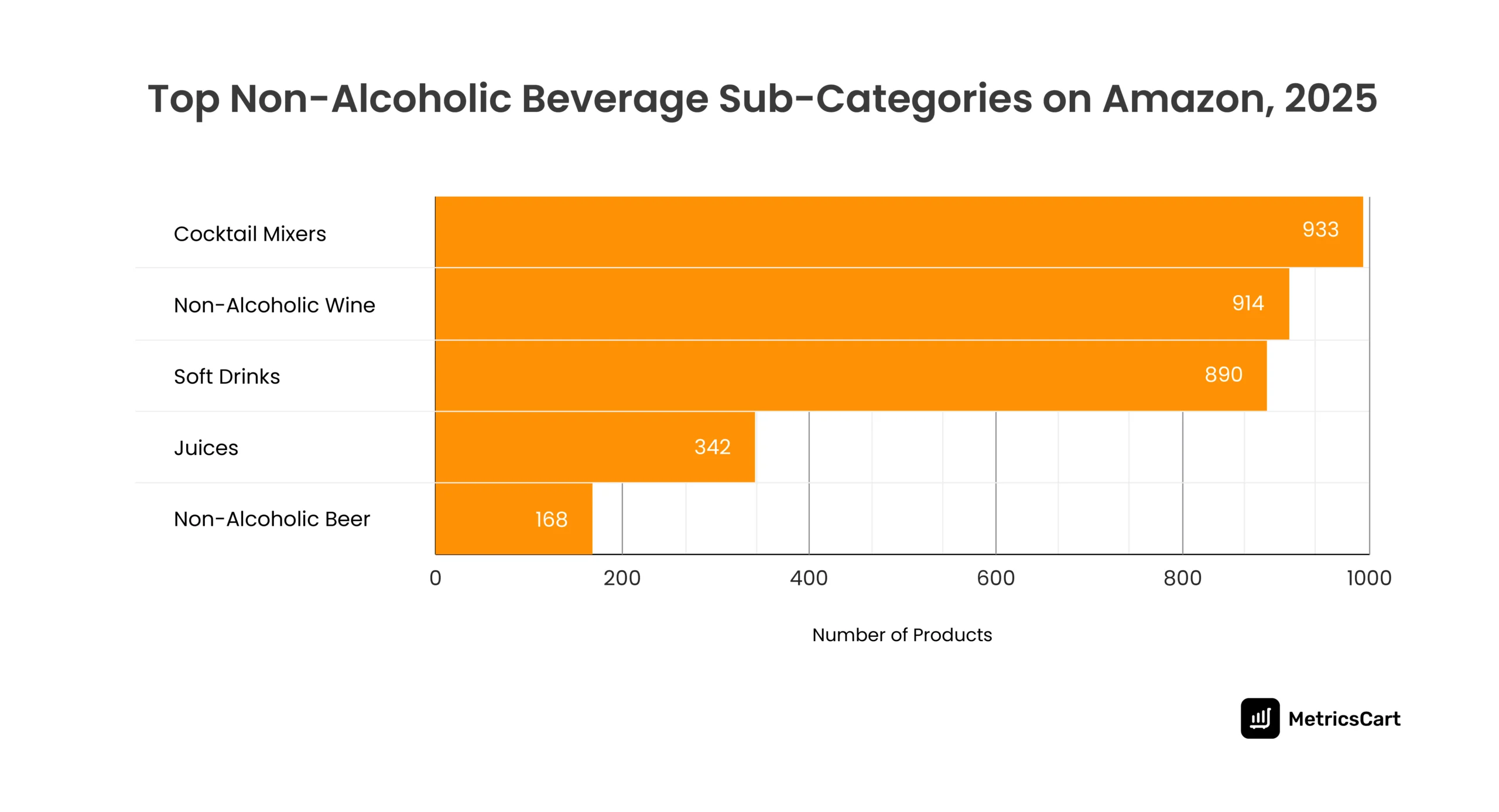

The non-alcoholic drinks category on Amazon includes several popular subcategories.

Cocktail Mixers have the most products with 993, followed by Non-Alcoholic Wine with 914 products. Cocktail mixers encompass a wide variety of products, including margarita, mojito, and Moscow mule mixes, as well as syrups and bitters. This diversity enables brands to offer a wide range of SKUs, resulting in a higher product count.

In Cocktail Mixers specifically, Bitters dominate in SKU count (536), but Margarita mixers outperform in reviews (129,427 vs. 92,205), suggesting higher purchase frequency or greater satisfaction with flavor and quality.

Moreover, this reflects a broader market trend. While health and wellness remain key motivators, there is a growing interest in alcohol alternatives that maintain a social or indulgent experience, particularly evident in the rise of non-alcoholic wines and mixers.

Lyre’s Offers the Most Non-Alcoholic Beverage Brands on Amazon

The non-alcoholic drinks category on Amazon features a variety of brands, with Lyre’s offering the largest selection, comprising 264 products. Lyre’s is a global leader in non-alcoholic spirits, known for replicating traditional alcohol flavors (gin, rum, vermouth, etc.) without the alcohol.

This is followed by brands such as Recess (86 products) and Ritual Zero-Proof, with 76 products.

Recess is a brand that blends wellness with refreshment, positioning itself as a functional beverage that helps people relax, without relying on alcohol. Their drinks often include ingredients like hemp extract and adaptogens, appealing to health-conscious consumers.

Ritual Zero-Proof focuses on offering non-alcoholic alternatives to core spirits like whiskey, gin, tequila, and rum. Unlike brands that simply remove alcohol from traditional drinks, Ritual creates zero-proof products that mimic the flavor profile and experience of their alcoholic counterparts.

Shots and Non-Alcoholic Vodka are the Most Discounted Non-Alcoholic Beverage Sub-Categories on Amazon

Non-alcoholic spirits are a fast-growing but crowded market on Amazon. Brands are using discounts as a lever to capture market share and enhance visibility in search results.

The most discounted non-alcoholic drink categories on Amazon, by average percentage discount, include shots and non-alcoholic vodka at 10.01% and 8.5%, respectively. Shots and Vodka substitutes have lower brand loyalty and high novelty appeal, so price drops can be used to entice trial.

The third most discounted category is non-alcoholic whiskey & scotch at 7.83%. In most cases, customers remain uncertain about achieving taste parity with traditional alcoholic versions of whiskey and scotch. Discounts help reduce the perceived risk in trying the non-alcoholic alternative, especially whiskey and scotch, where taste expectations are high.

Brands like TEAZEN (29.97% discount) and Arizona (24.24%) offer high discounts to drive traffic and conversions. Deep discounts serve two purposes:

- They incentivize first-time purchases, especially in crowded or competitive subcategories.

- They boost visibility via Amazon’s promotional algorithms.

Notably, premium brands like Trejo’s Spirits are also leveraging discounts, signaling that affordability is increasingly important, even at the higher end of the market.

Powdered Drink Mixes & Flavorings are the Most Affordable Non-Alcoholic Beverage Sub-Categories on Amazon

At $13.01, powdered mixes and flavorings are the most affordable non-alcoholic beverages on Amazon. These products are typically sold in bulk or as concentrates, offering more servings per dollar. They also have longer shelf lives and lower shipping weights—both key advantages for e-commerce.

This pricing structure makes them attractive to consumers seeking value and convenience, particularly for daily use or fitness purposes.

This is followed by sports drinks and non-alcoholic vodka with an average price of $20.41 and $21.56, respectively. Sports drinks are a staple for fitness-focused consumers, often bought in multi-packs. Non-alcoholic vodka is priced to match consumer expectations for alcohol substitutes while remaining more accessible than traditional spirits.

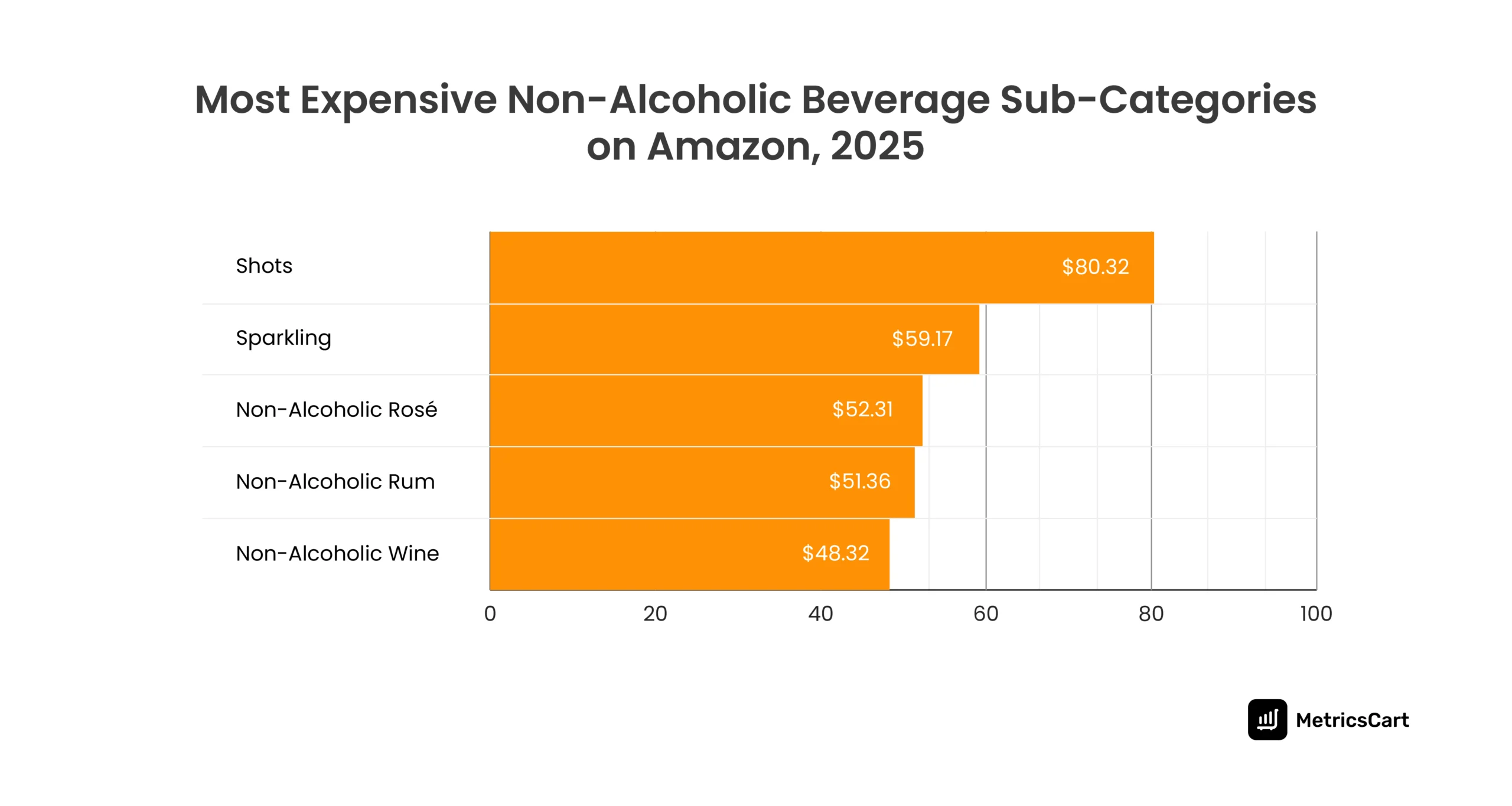

The most expensive non-alcoholic beverage sub-category on Amazon is shots at $80.32. Despite being the smallest unit-size product type, shots are the most expensive on average. This includes functional or wellness shots, such as turmeric, collagen, CBD, or adaptogen blends. These products justify high price tags due to:

- Potent ingredient claims (immunity, stress, energy)

- Small-batch or premium sourcing

- Pack sizes (often bundled in 12 or 30-count multipacks)

Moreover, as we discussed above, shots are also the most heavily discounted category. A high base price, combined with frequent discounting, helps create a value perception while maintaining a premium image.

The second most expensive category is Sparkling at $59.17. They are often consumed as celebratory or social alternatives to champagne or Prosecco. This category benefits from premium packaging, positioning for adult consumption in social settings, and low competition with strong branding.

Water and Energy Drinks are the Most Reviewed Non-Alcoholic Beverage Sub-Categories on Amazon

The majority of non-alcoholic beverages on Amazon receive 4-star ratings, with 2,646 reviews, followed closely by 5-star ratings, which account for 1,172 reviews. This suggests high satisfaction levels overall. However, the presence of 564 products with 0-star ratings and 43 with 1-star ratings indicates some inconsistency in product quality or fulfillment.

For brands, this reinforces the importance of maintaining product quality, responding promptly to negative feedback, and investing in review generation strategies that accurately reflect the customer experience.

Categories with the most reviews:

- Water: 1,843,123 reviews

- Energy Drinks: 1,545,592

- Soft Drinks: 1,247,258

These results highlight where consumer demand is most concentrated. Water and energy drinks are everyday staples, often bought in bulk and on repeat, factors that naturally lead to more reviews.

According to MetricsCart market intelligence, brands winning in these sub-categories include:

- Water: Sparkling Ice, Propel, LIFEWTR

- Energy Drinks: CELSIUS, Rockstar, Red Bull

- Soft Drinks: Pepsi, Zevia, Mountain Dew

These are legacy or highly visible brands that combine broad distribution, strong brand recognition, and clear value propositions.

Celsius and Sparkling Ice are the Most Reviewed Non-Alcoholic Beverage Brands on Amazon

CELSIUS leads the category in total reviews, with 768,107, closely followed by Sparkling Ice with 554,915. These brands have successfully positioned themselves as leaders in both function and flavor, with clear branding, wide availability, and strong digital presence.

The strong performance of Rockstar, Propel, and LIFEWTR also underscores a key pattern: brands that deliver on hydration and energy tend to earn the most consumer trust and loyalty, primarily when supported by consistent customer experiences.

CELSIUS Assorted Flavors Official Variety Pack is the Most Reviewed Non-Alcoholic Beverage Product on Amazon

The most reviewed products in this category are primarily functional energy drinks and flavored waters.

CELSIUS’s top-selling variety packs and Sparkling Ice’s Black Raspberry beverage each received over 100,000 reviews, signaling strong customer engagement and repeat purchases.

This high volume of reviews reflects two key factors:

- Functional benefits: Drinks promising energy, hydration, or added vitamins are increasingly aligning with consumers’ wellness goals.

- Flavor innovation: Brands that offer diverse and enjoyable flavors are more likely to generate trial and feedback.

Other notable products, such as True Lemon and Propel, suggest a growing interest in convenient, health-oriented hydration options that cater to modern, on-the-go lifestyles.

Conclusion

The non-alcoholic beverage category on Amazon is no longer niche—it’s a dynamic battleground where pricing strategies, premium positioning, and review volumes directly shape brand performance. From $13 powdered drink mixes to $80 functional shots, success depends on knowing which levers to pull.

Consumers today want more than hydration—they expect functionality, transparency, and value. The brands that win are those who track what’s trending, analyze customer feedback, and adapt their digital shelf strategy accordingly.

At MetricsCart, we deliver the insights that matter—real-time discount trends, competitive pricing benchmarks, review sentiment, and digital shelf visibility.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready to optimize your Amazon strategy with precision?