About The Report: This Digital Shelf Insights report analyzes the insulated water bottle brand Owala’s marketing strategy and business model through its pricing, product, and visibility trends on Walmart. The market intelligence is sourced from the MetricsCart app, profiling Owala’s Walmart digital shelf performance between September 22 and September 28, 2025.

Introduction

Owala is a US-based drinkware brand known for its colorful, leakproof bottles and its signature FreeSip lid, which lets users sip or chug from the same opening. Founded in 2020 by Trove Brands, the company behind BlenderBottle, Owala built its following by turning hydration into a lifestyle category rather than a utility product.

An Overview of Owala’s Marketing Strategy

The reusable bottle market was already saturated with pioneers like Stanley, Hydro Flask, and Yeti when Owala entered the scene. And so, it was not an easy market to win, even though the reusable water bottle market is booming at a 4.6% CAGR and is projected to reach $3.1 billion by 2031.

However, unlike many newcomers, Owala’s branding strategy was not like a standard challenger brand. Instead of competing through heavy discounts or influencer-led hype, Owala took a controlled, data-driven route. This focus on design, pricing discipline, and distribution efficiency is evident from its Walmart portfolio.

Our research team at MetricsCart selected Walmart to observe Owala’s product performance online, given its critical role as a mass-market retail barometer. The resulting retail intelligence from September 22 to 28, 2025, shows that Owala maintained a strong retail presence, consistent pricing, and steady shopper engagement across its listings on the platform.

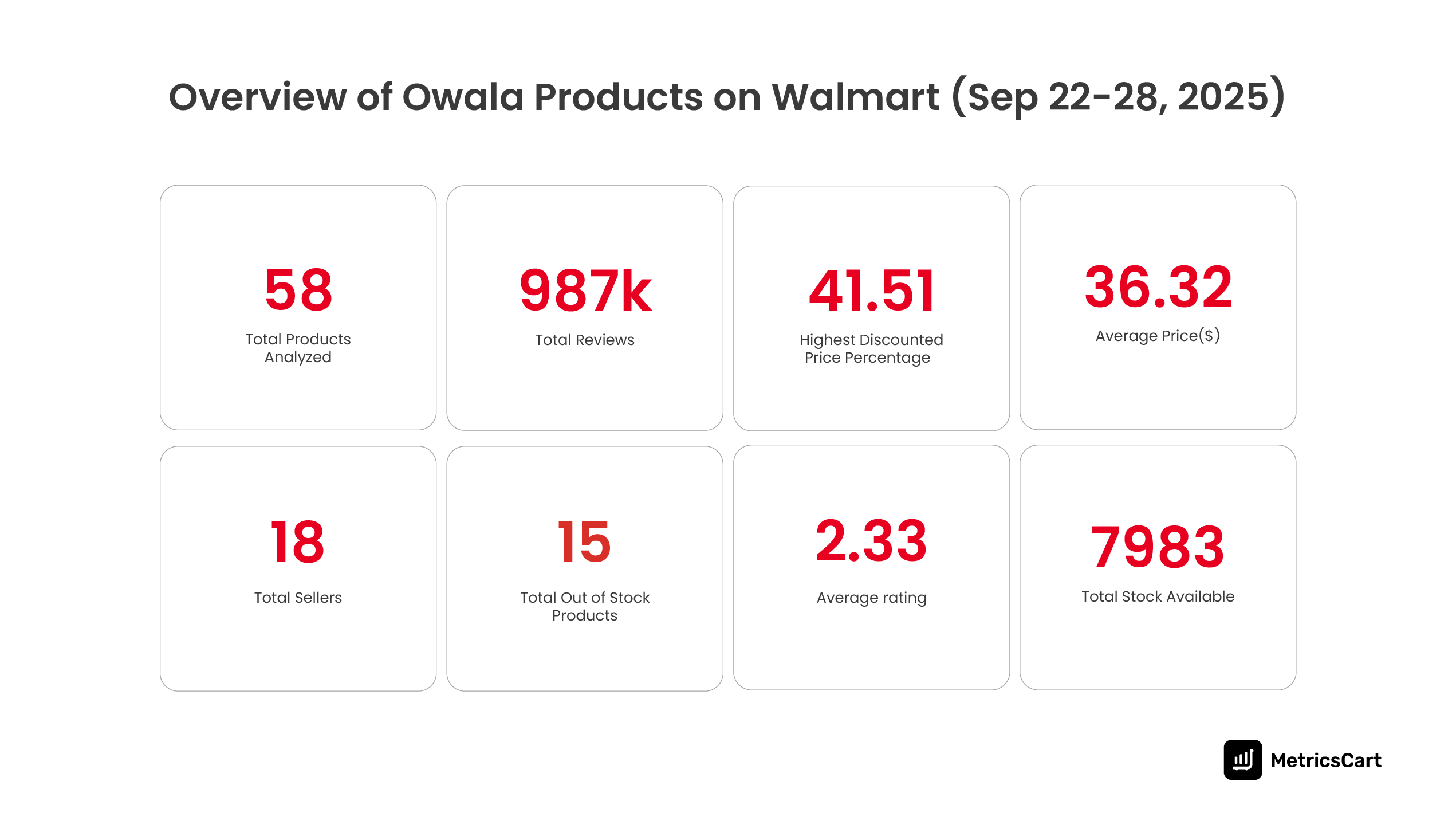

Key Highlights (Sep 22–28, 2025):

- 58 total products were analyzed across Walmart listings.

- 18 total sellers carried Owala products, led by SCRB Supplies, Walmart.com, and Trove Brands LLC.

- Products amassed 9,87,000 total reviews, indicating strong customer engagement.

- The average price is $36.32, positioning Owala in the mid-premium range.

- The highest recorded discount is 41.51%, though most listings remained minimally discounted.

- 15 products went out of stock during the period, indicating strong sell-through rates.

- 7,983 units were still available, indicating timely stock replenishment.

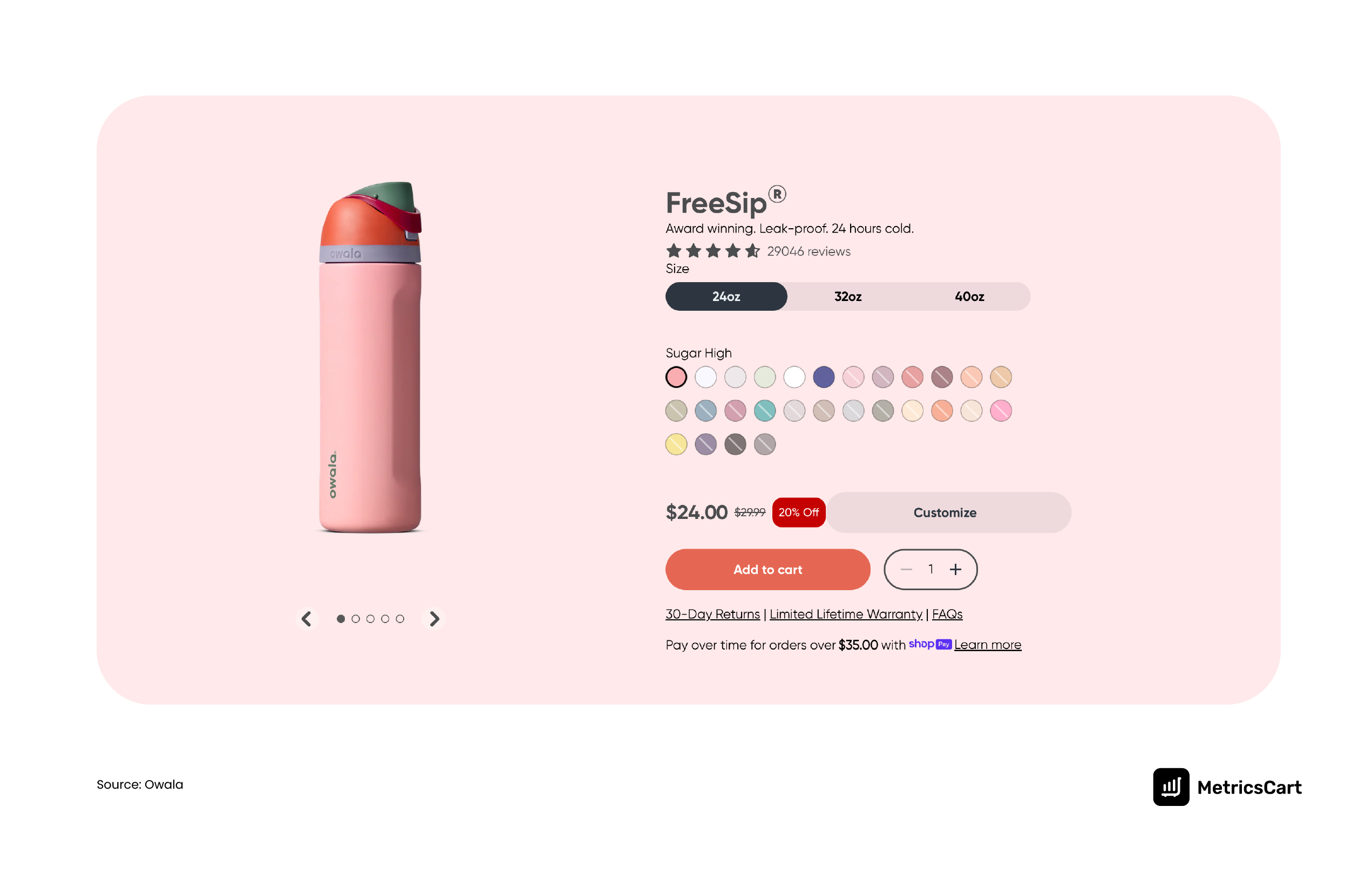

FreeSip Leads the Pack in Reviews and Visibility

Among all products by Owala on Walmart, the FreeSip water bottle clearly leads in visibility and customer engagement. Walmart data shows the FreeSip line received the most reviews across all Owala listings, making it the brand’s most influential SKU.

The FreeSip design has been central to Owala’s success. Its patented lid allows users to sip or chug without removing the cap, combining convenience with aesthetics. This functional innovation, paired with consistent product quality, has helped FreeSip maintain strong ratings and top placement on Walmart.com.

The sustained performance of the FreeSip line highlights how a single hero product can drive visibility, strengthen brand recall, and boost overall category growth for Owala.

READ MORE | How Stanley Dominates Target’s Digital Shelf: A Deep Dive into Prices & Reviews

How Owala Prices Across Sizes and Segments

Owala’s pricing strategy on Walmart reflects a deliberate balance between accessibility and premium positioning. Across the 58 listed products, prices ranged from $35 to $59, with clear segmentation by size, function, and target audience.

Smaller bottles, particularly kids’ and under-20-oz models, form the entry-level tier, offering affordability without sacrificing design or color variety. These SKUs help attract new buyers and encourage repeat purchases for families. At the higher end, single adult bottles are priced between $50 and $59, reinforcing Owala’s premium identity through material quality and insulation performance.

Interestingly, multi-packs appear at the top of Walmart’s product listings but are priced lower per unit, around $30 per bottle. This shows how Owala uses bundled value to drive volume without discounting individual SKUs. Coffee tumblers and mid-size bottles (20–40oz) fall into the mid-range, where most inventory and customer demand concentrate.

This tiered pricing structure allows Owala to compete across multiple consumer segments such as kids, commuters, and fitness users, while preserving its upscale perception.

Instead of cutting prices, the brand uses format and bundle strategies to scale efficiently and sustain strong sell-through rates.

READ MORE | Nespresso vs. Keurig: Who’s Winning the Coffee Category?

Low Discounts, High Control: The Premium Pricing Play

Even during promotional cycles, Owala resists the deep markdowns that are common in the hydration segment. For instance, while combo packs or kids’ bottles occasionally see small seasonal discounts, flagship products like the Insulated FreeSip water bottle recorded markdowns as low as 0.6%, signaling confidence in sustained demand. The top-discounted Owala product at Walmart is a 15-pack combo, with a 23.9% discount.

This restraint isn’t accidental. By keeping discounts low, Owala maintains price integrity across retail channels, avoids value erosion, and reinforces its premium image. The data also shows price stability across the week, higher on weekdays and slightly lower on weekends, indicating tactical alignment with buying patterns rather than clearance-driven pricing.

Owala’s “less discount, more demand” approach exemplifies brand discipline. It proves that controlled pricing, when paired with strong product equity, can achieve consistent conversions without compromising long-term value.

READ MORE | How To Choose The Best Pricing Intelligence Tool: 2025 Checklist

How Promotions Align with Stock Cycles

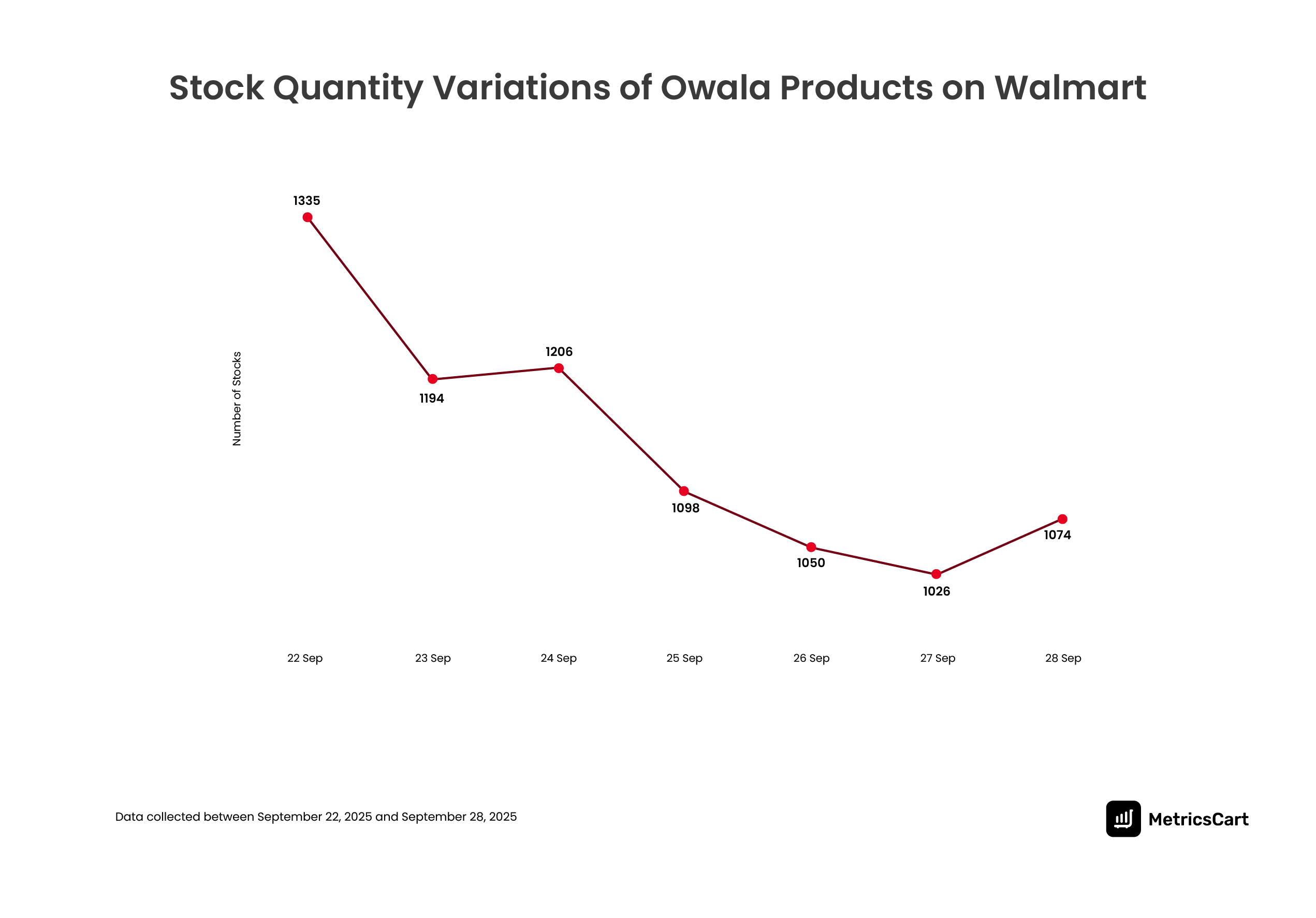

Owala’s promotions are closely timed with stock availability and demand surges. Between September 22 and 28, 2025, Owala’s average price peaked on September 22 and dropped to its lowest by September 28, following the same trend as inventory levels.

As prices decreased over the week, stock levels also fell by nearly 20%, suggesting that promotions or mild discounts were strategically used to accelerate sell-through before replenishment. This approach reflects demand-driven pricing, aligning short-term markdowns with periods of high search interest or restock cycles, rather than relying on blanket sales.

The Role of Walmart.com and Trove Brands in Distribution

Owala’s growth has been shaped by a distribution strategy that blends direct and retail channels efficiently. On Walmart, SCRB Supplies, Walmart.com, and Trove Brands LLC emerged as the top sellers of Owala products, together accounting for the majority of listings during the observation period.

This structure shows how Owala leverages Walmart’s massive online reach while keeping brand oversight through its parent company, Trove Brands, which also owns BlenderBottle. Trove’s established logistics and retail relationships help Owala maintain consistent pricing, quality control, and inventory availability across stores and online channels.

By maintaining both first-party and third-party seller presence, Owala maximizes exposure while ensuring steady stock movement. This hybrid model strengthens visibility, mitigates supply risk, and keeps the brand’s pricing and presentation uniform across Walmart’s digital shelf.

What Brands Can Learn from Owala’s Business Model

Owala on Walmart offers clear, data-backed takeaways for brands aiming to balance growth with control in competitive marketplaces.

- Price Integrity Builds Trust: Maintaining minimal discounts (below 3%) while sustaining steady demand proves that consistent pricing strengthens consumer confidence and brand value.

- Bundle Smart, Don’t Slash Prices: Owala’s multi-pack pricing, lower per unit but not deeply discounted, shows how brands can increase volume without diluting perceived worth.

- Align Promotions With Stock Movement: Subtle price drops that coincide with restock cycles optimize sell-through and reduce overstocking without relying on broad markdowns.

- Hero Products Drive Discovery: The FreeSip line’s high review volume and visibility highlight how one standout product can lift an entire portfolio’s visibility and conversion.

- Strategic Partnerships Scale Reach: Collaborating with platforms like Walmart.com and leveraging parent-company infrastructure (Trove Brands) enables consistent brand representation and efficient nationwide distribution.

The Last Sip

Owala built momentum in one of the most crowded and competitive spaces through precise pricing, limited markdowns, and consistent demand. The success the brand has achieved in such a short time is a clear testament that discipline wins over discounts. The brand’s focus on function, color, and convenience has helped it turn water bottles into a lifestyle statement rather than just a utility item.

The insights from the MetricsCart app highlight how Owala keeps its average discount below 3 percent, maintains a balanced stock cycle, and leads reviews through its FreeSip line. With Trove Brands managing production and Walmart.com ensuring nationwide reach, Owala has achieved both visibility and stability in value.

If you want to track pricing, inventory, and visibility across retailers in real time, with the same precision for your brand, explore MetricsCart’s Digital Shelf Analytics platform.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Turn Your Retail Data into Competitive Advantage with MetricsCart.