About the Report

This report is based on data from 754 chocolate products across Reese’s and Hershey’s listed on Amazon, collected on April 8, 2025. It provides key insights into product assortment, pricing strategies, top-selling products, and customer satisfaction in the online chocolate category.

Introduction

Chocolate is no longer just a seasonal impulse buy; it’s an everyday indulgence, a pantry staple, and increasingly, a digital bestseller.

From zero-sugar miniatures catering to health-conscious buyers to limited-edition assortments for holidays, brands are diversifying SKUs to stay relevant year-round.

The US chocolate market is predicted to reach $28.45 billion by 2025, with a notable shift toward online purchases. Platforms like Amazon have become critical battlegrounds where brands not only compete on flavor but also on assortment breadth, customer ratings, price positioning, and delivery convenience.

Consumers now expect their favorite chocolates to be available in family-size packs, gift formats, and even dietary variants, delivered promptly and at a competitive price.

For giants like Reese’s and Hershey’s, their ability to command share, sustain high ratings, and drive consistent sales on Amazon is a direct reflection of digital strategy strength. The data reveals clear winners and uncovers what it takes to lead in a highly competitive, always-on chocolate category.

Highlights

- Reese’s has the best-selling chocolate on Amazon with 432 products, compared to Hershey’s with 322 products.

- Reese’s dominates sales volume with 1.01M monthly units sold vs. Hershey’s 521.8K.

- Reese’s products have a higher average price of $47.50 than Hershey’s $16.63, signaling a premium positioning.

- Customer ratings are neck and neck, with Reese’s slightly ahead with 4.43 vs. Hershey’s 4.38 out of 5.

READ MORE | Want to know about the Target’s private label brand Good & Gather? Check out our DSI report on Good & Gather on Target: How the Retail Giant Nailed Brand Loyalty.

Top-Selling Reese’s and Hershey’s Products on Amazon

In the last 30 days, up to April 8, 2025, Reese’s sold over 1,018,200 units on Amazon, almost double the number sold by Hershey’s, which sold 521,800 units. This wide sales gap highlights Reese’s dominant position in both volume and variety, with 432 products listed compared to Hershey’s 322.

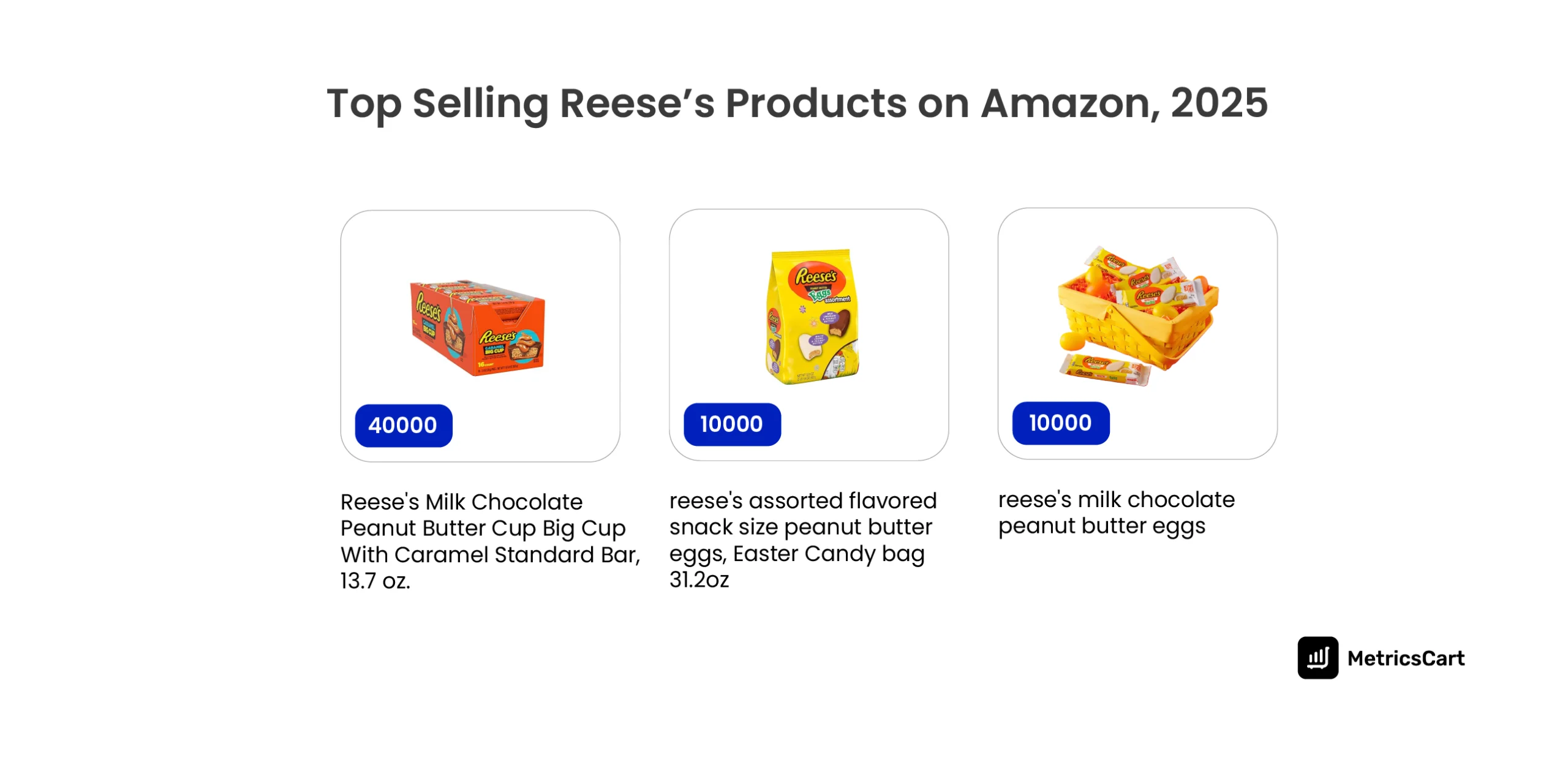

Among top-selling Reese’s products, the Milk Chocolate Snack Size Peanut Butter Cups, Candy Pantry Pack, 13.75 Oz (25 Pieces), stand out with 40,000 units sold, followed by the Assorted Flavored Snack Size Peanut Butter Eggs, Easter Candy Bag, 31.2 Oz, with 10,000 units.

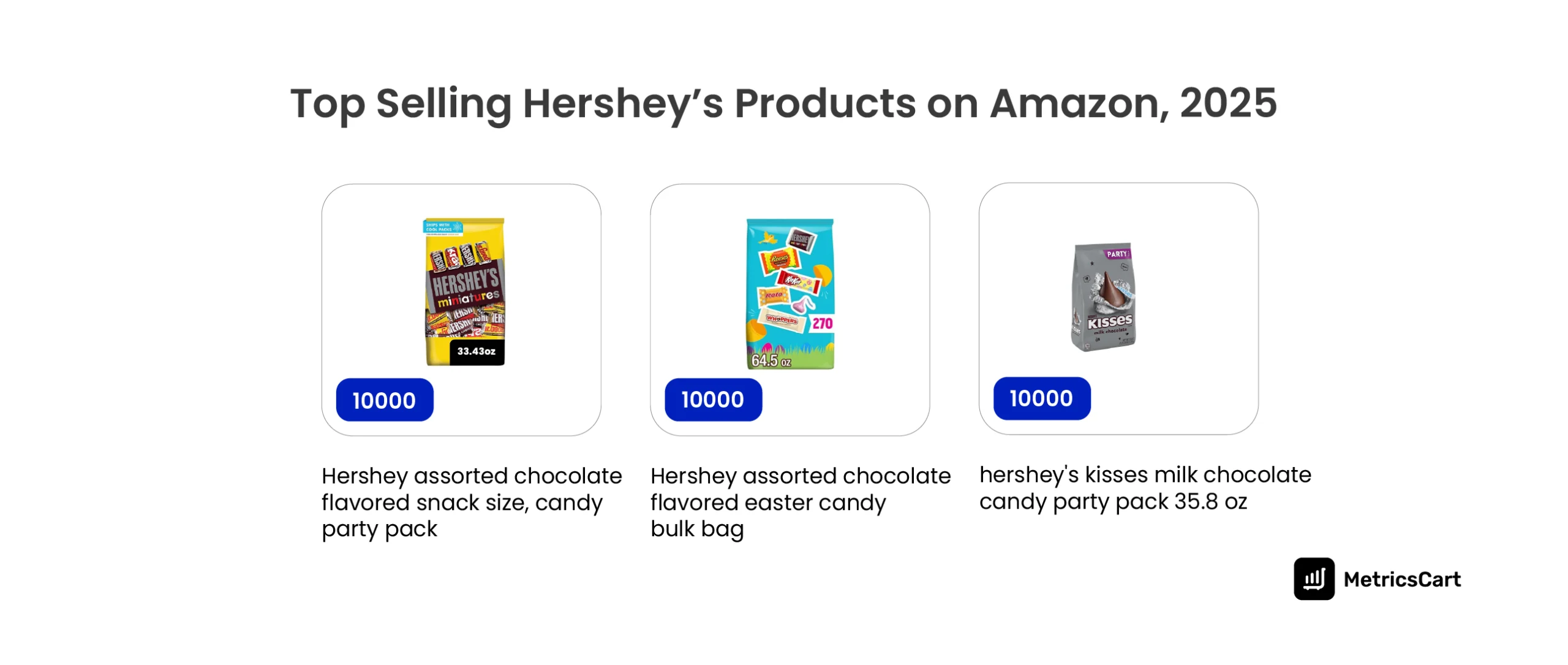

However, the top-selling Hershey’s products include the Assorted Chocolate Flavored Snack Size, Candy Party Pack, 33.43 Oz, and Assorted Flavored, Easter Candy Bulk Bag, 64.5 Oz (270 Pieces), both moving 10,000 units each.

While both brands offer strong seasonal and bulk-pack options, Reese’s scale and product breadth clearly give it the upper hand in Amazon’s chocolate category.

Affordable Reese’s and Hershey’s Products

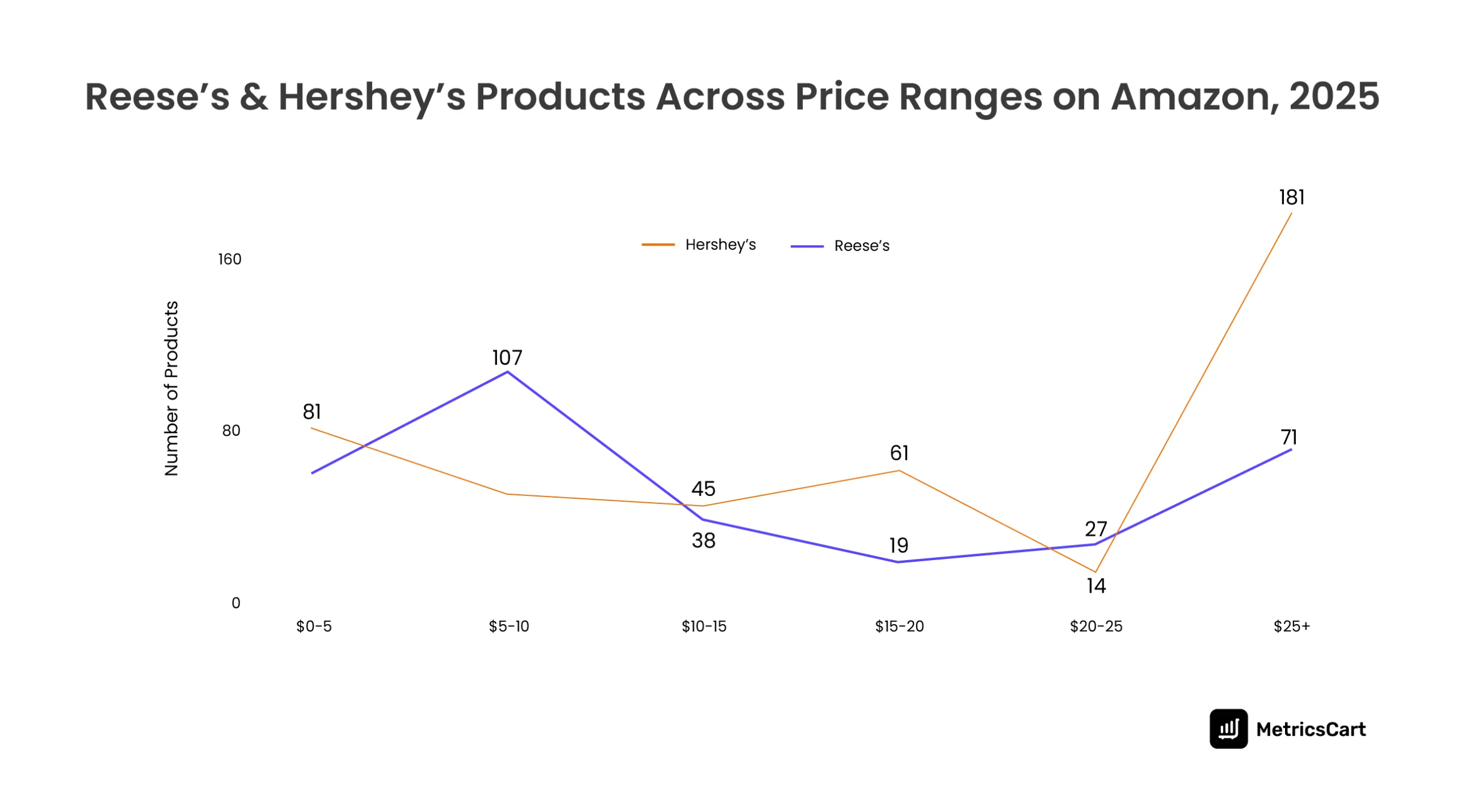

While Reese’s averages a much higher price point of $47.50 compared to Hershey’s $16.63, both brands still offer a few affordable options on Amazon. Reese’s overall pricing strategy leans toward premium-tier products, with a strong presence in the $15–$20 and $25+ ranges.

Hershey’s, on the other hand, caters more to budget-conscious shoppers, with the majority of its listings priced between $5 and $10. This contrast in pricing reflects two distinct brand positions: Reese’s as a premium indulgence, and Hershey’s as an accessible everyday choice.

Hershey’s, on the other hand, caters more to budget-conscious shoppers, with the majority of its listings priced between $5 and $10. This contrast in pricing reflects two distinct brand positions: Reese’s as a premium indulgence, and Hershey’s as an accessible everyday choice.

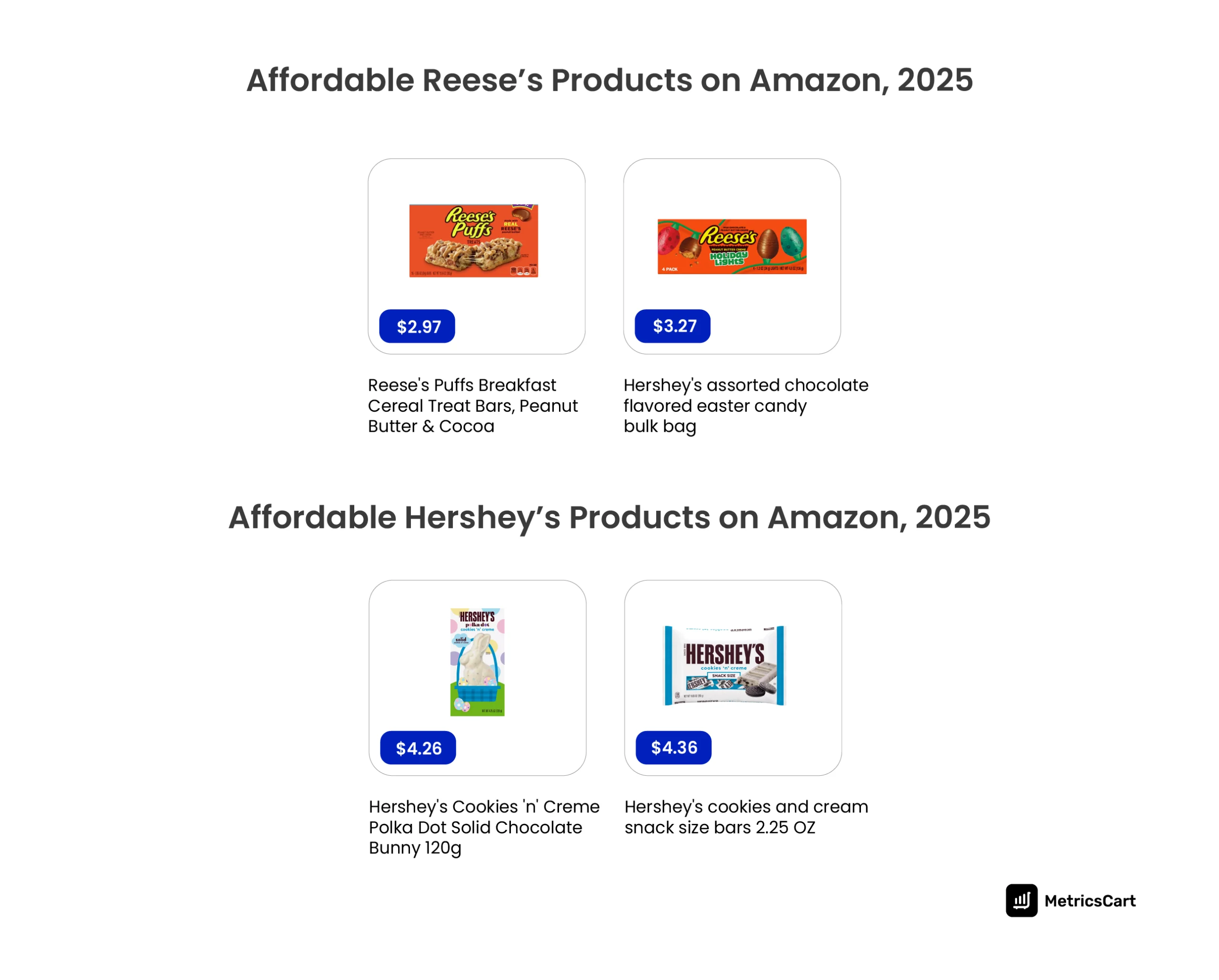

Among Reese’s most affordable items are the Reese’s Puffs Breakfast Cereal Treat Bars, Peanut Butter & Cocoa (8 ct) priced at $2.97 and the Milk Chocolate Peanut Butter Creme Holiday Lights, Christmas Candy Box, 4.8 Oz (4 Pieces) at $3.27, offering low-cost options despite the brand’s premium tilt.

For Hershey’s, the Cookies ‘n’ Creme Polka Dot Solid Chocolate Bunny (120g) at $4.26 and the Cookies ‘n’ Creme Snack Size Bars, 1 Pack of 5, 2.25 Oz priced at $4.36 highlight its strength in value offerings.

Top-Rated Reese’s and Hershey’s Products

Customer reviews reflect strong satisfaction for both brands, with Reese’s averaging 4.43 stars from 1,197,826 reviews, slightly edging out Hershey’s 4.38 stars from 1,070,550 reviews. This marginal lead reinforces Reese’s position as a customer favorite on Amazon.

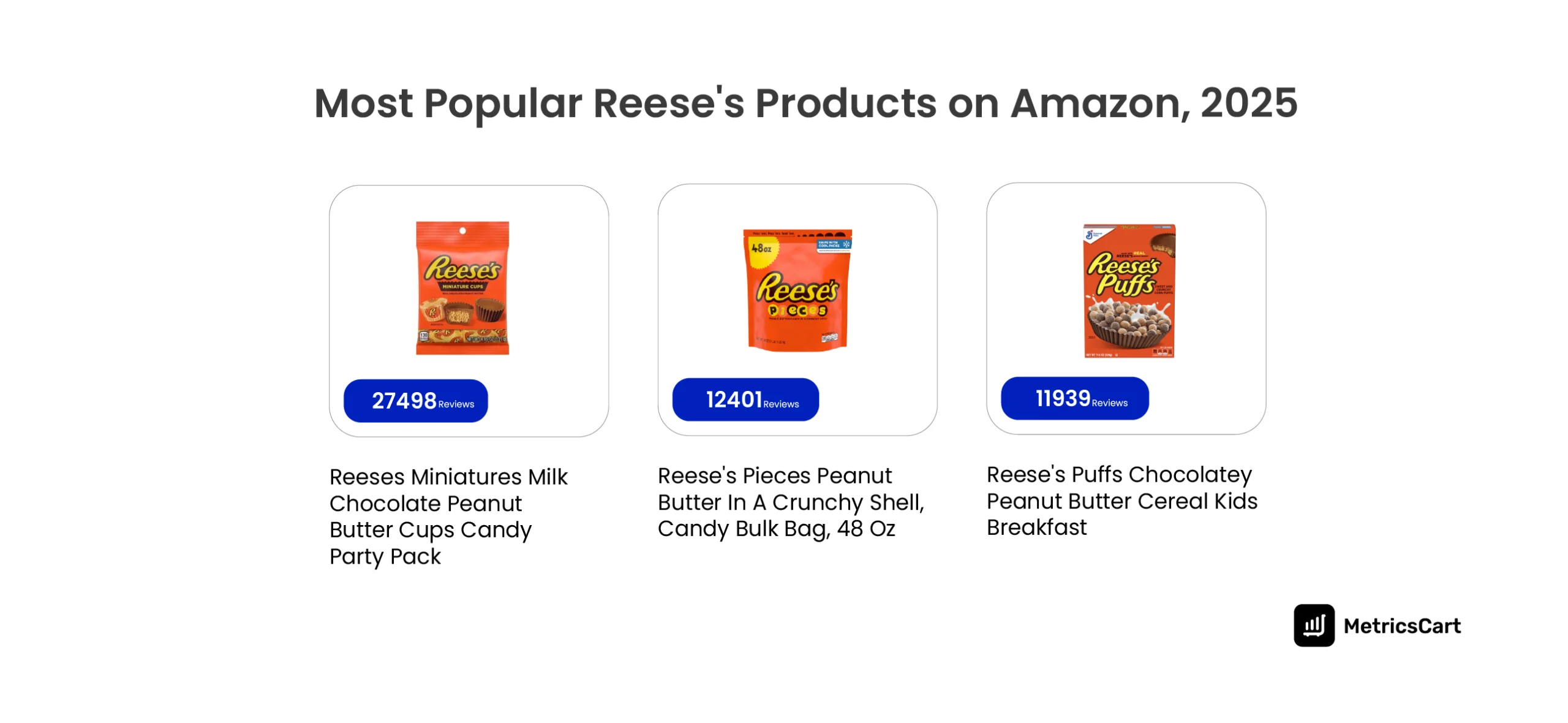

Among the top-rated Reese’s products, the Miniatures Milk Chocolate Peanut Butter Cups, Candy Party Pack (35.6 oz) top the chart with 27,498 ratings, followed by Reese’s Pieces Peanut Butter in a Crunchy Shell, Candy Bulk (48 oz) with 12,401 reviews. These high volumes indicate consistent performance and strong consumer loyalty.

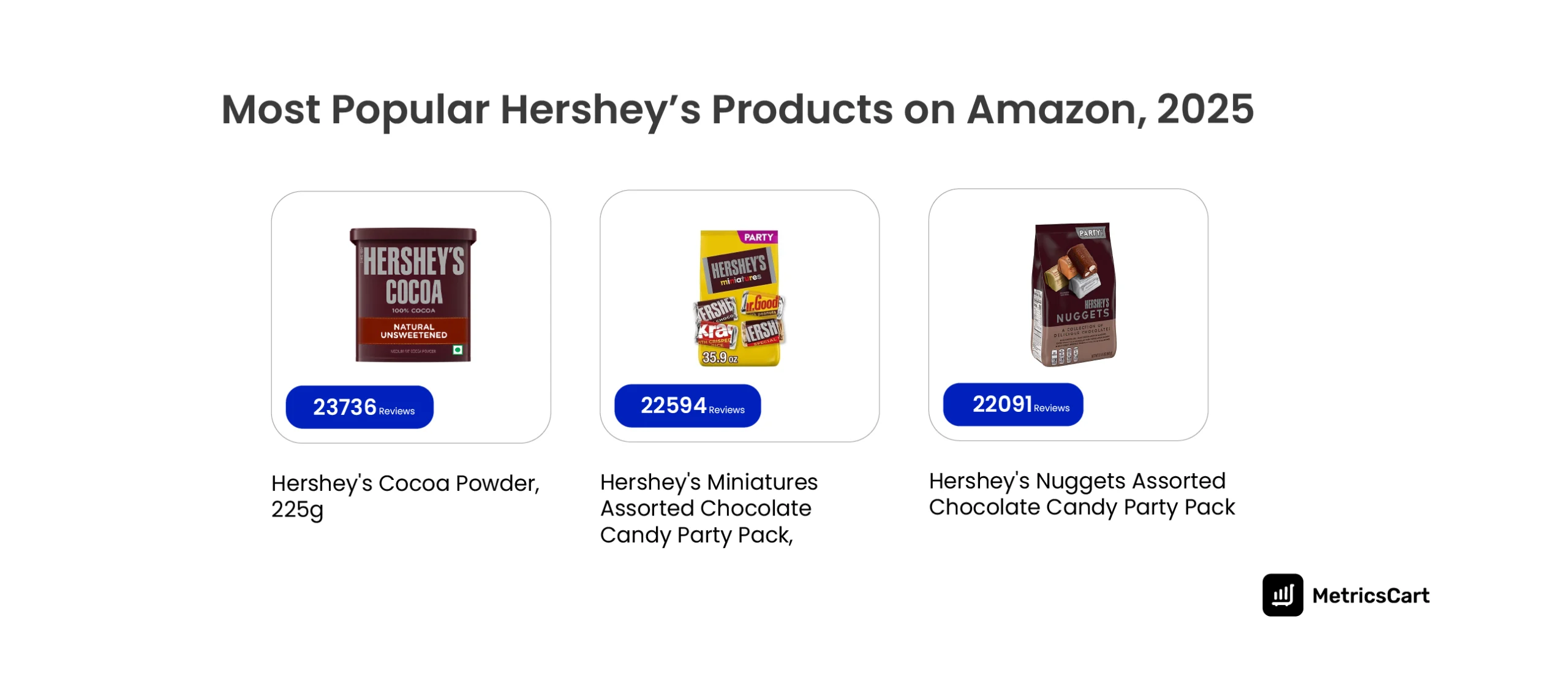

Among the top-rated Hershey’s products, the Cocoa Powder (225g) leads with 23,736 reviews, followed closely by the Miniatures Assorted Chocolate Candy Party Pack (35.9 oz) with 22,594 reviews.

Both brands demonstrate active engagement across their top SKUs, but Reese’s maintains a narrow lead in overall customer satisfaction.

READ MORE | How do non-alcoholic beverages fare on Amazon? Check out our report on What’s Brewing on Amazon: A Data Deep Dive into Non-Alcoholic Beverages.

Conclusion

Reese’s outperforms Hershey’s on Amazon by a clear margin. It offers over 100 more products, sells nearly twice as many units in 30 days, and holds a higher average rating.

Despite carrying a higher average price tag of $47.50, Reese’s continues to win with customers, suggesting that shoppers are willing to pay more for trusted, indulgent favorites.

Hershey’s still competes effectively with budget-friendly SKUs, high-volume staples like KISSES and Cocoa Powder, and consistently solid ratings. Its strength lies in affordability and wide appeal across everyday snacking.

For brands navigating e-commerce, this comparison makes one thing clear: success on platforms like Amazon depends on more than just price. A larger assortment, strong product-market fit, high-volume positive reviews, and a digital shelf analytics partner like MetricsCart are the essentials that drive results for brands.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Your E-Commerce Potential on Amazon Today!