About the Report: This report is based on a detailed data study conducted on Walmart’s smart glass category. We have considered key metrics, including top brands, top subcategories, leading sellers, and pricing. For this analysis, we considered 308 products across 30 categories from Walmart’s smart glasses category on March 19, 2025.

Introduction

The global smart glasses market was valued at approximately $7–8 billion in 2024 and is projected to surpass $20 billion by 2030, with a compound annual growth rate of 10–14%.

Smart glasses are emerging as one of the most intriguing frontiers in wearable technology. They blend hands-free functionality with audio, visual, and augmented reality (AR) capabilities.

Once seen as niche gadgets, they are now evolving into mainstream consumer and enterprise tools due to advancements in display miniaturization, AI integration, and fashion-tech collaborations.

Consumers are increasingly drawn to these devices for their convenience, open-ear audio features, and ability to discreetly manage calls, navigation, and notifications on the go.

As this category matures, smart glasses are no longer just about novelty; they’re becoming practical, everyday tools that sit at the intersection of innovation, utility, and style.

Highlights

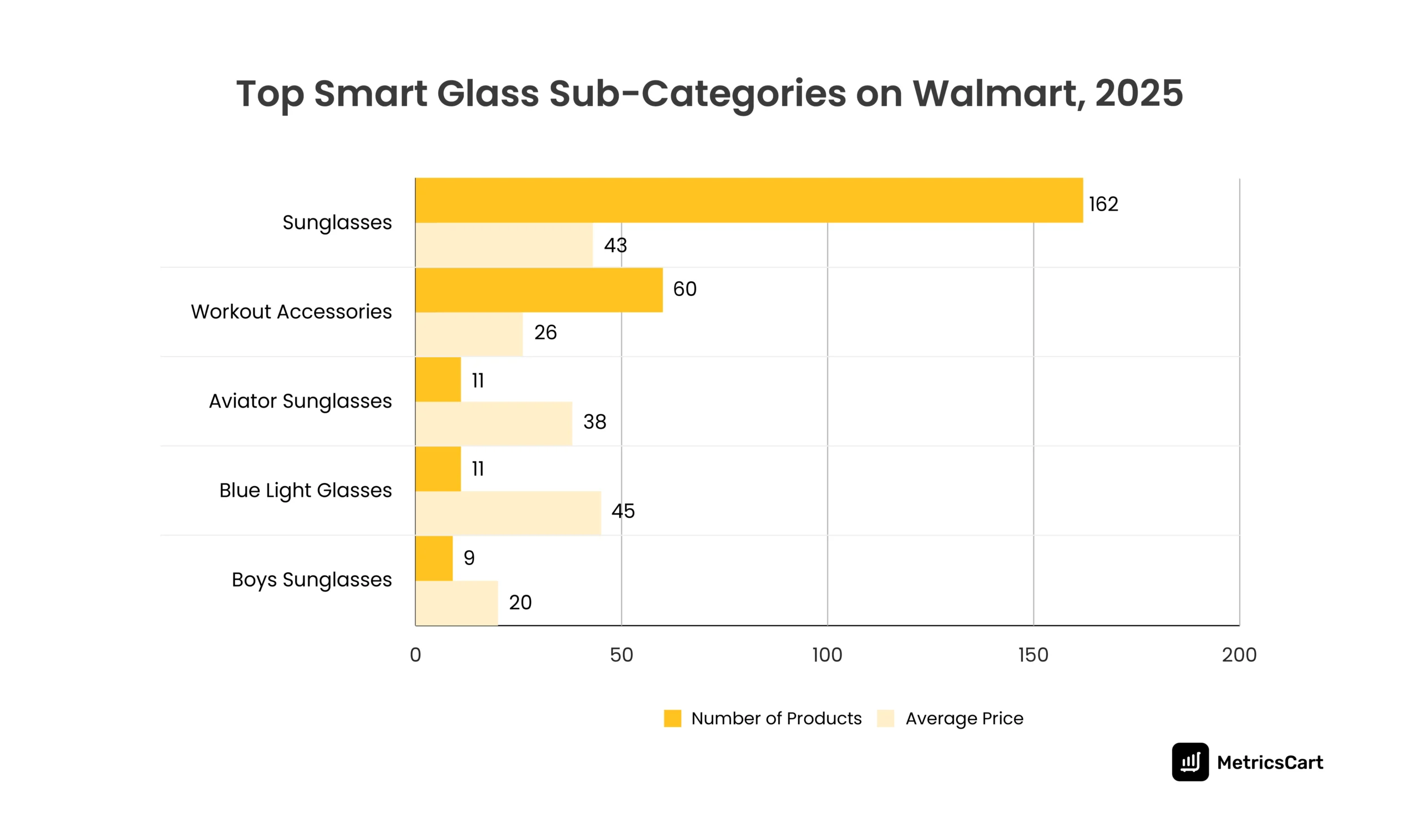

- Sunglasses dominate the smart glass sub-category at Walmart, with 162 products.

- Lucyd and Shellton are the leading smart glass brands on Walmart, with 9 and 8 products respectively.

- The smart glass category on Walmart has a 4.11 average rating from 189 reviews.

- Walmart sells smart glasses for as low as $5.20 to as high as $1,600.

Sunglasses are the Leading Smart Glass Sub-Category on Walmart

The sunglasses category dominates the list with 162 products. It includes a wide range of audio-enabled sunglasses and fashion-centric smart glasses, which offer features like Bluetooth audio or hands-free calling.

The $60 average price indicates that most listings are affordable and entry-level. This suggests Walmart is positioning smart glasses as everyday lifestyle products rather than niche tech devices, which aligns with its mass-market appeal.

This is followed by workout accessories and aviator sunglasses, with 11 products each. The workout accessories include audio sunglasses or AR eyewear meant for runners, cyclists, or gym users. The average price of these products is $26. On the other hand, the average price of aviator sunglasses is $38 and targets fashion-conscious users.

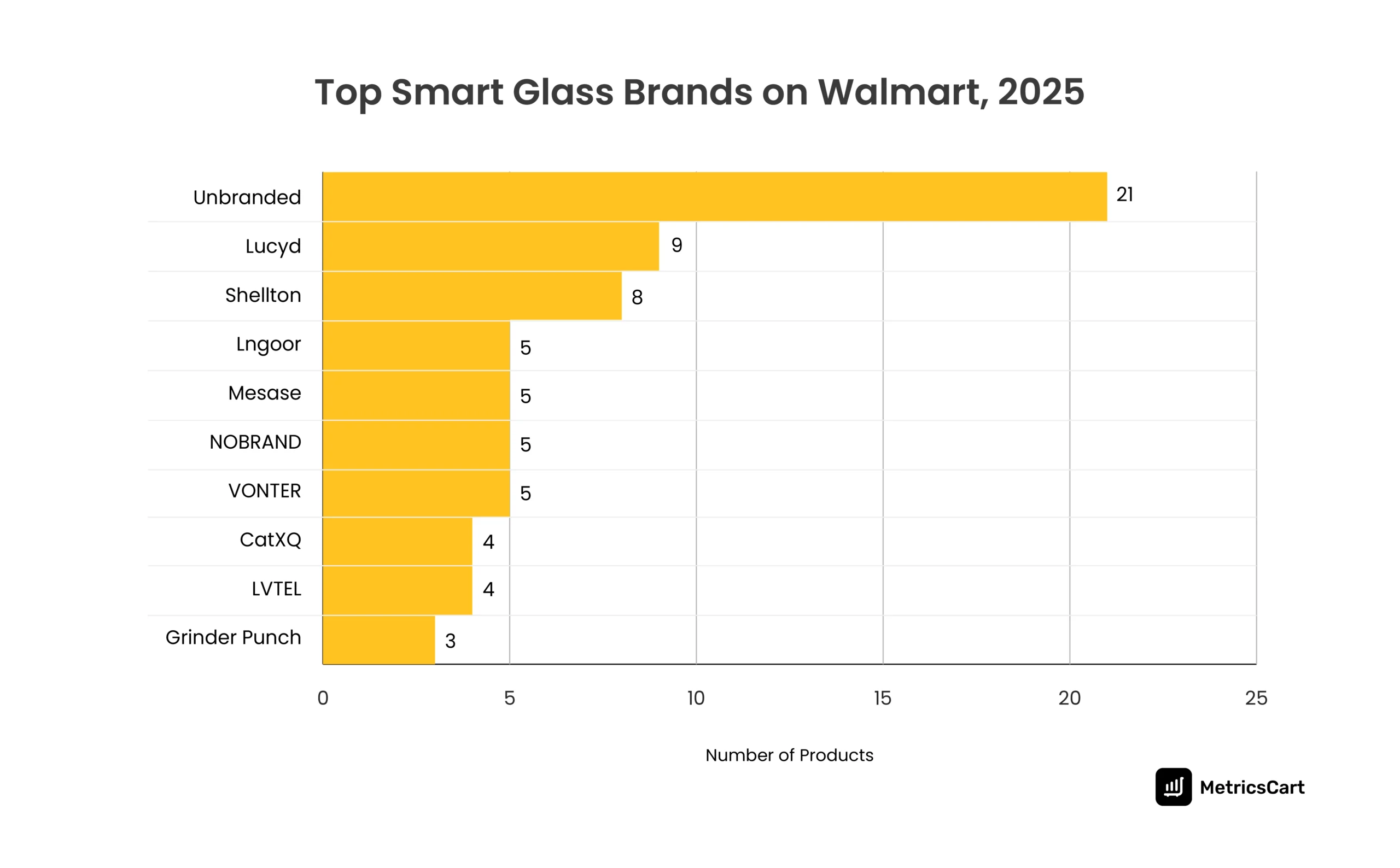

Lucyd and Shellton are the Leading Smart Glass Brands on Walmart

Walmart’s smart glasses assortment is heavily dominated by unbranded products, which account for 21 listings, far surpassing any single brand.

This suggests that a significant portion of the category is made up of generic, private-label, or dropshipped items with limited brand identity. Such a composition may reduce consumer confidence in a product segment that depends on trust in technology and hardware reliability.

Among branded offerings, Lucyd leads with nine listings, followed by Shellton with 8. Lucyd is known for integrating Bluetooth audio functionality with prescription and sun protection features, positioning itself as a credible player in the smart eyewear space. Shellton appears to focus on budget-friendly electronics, offering accessible options for consumers.

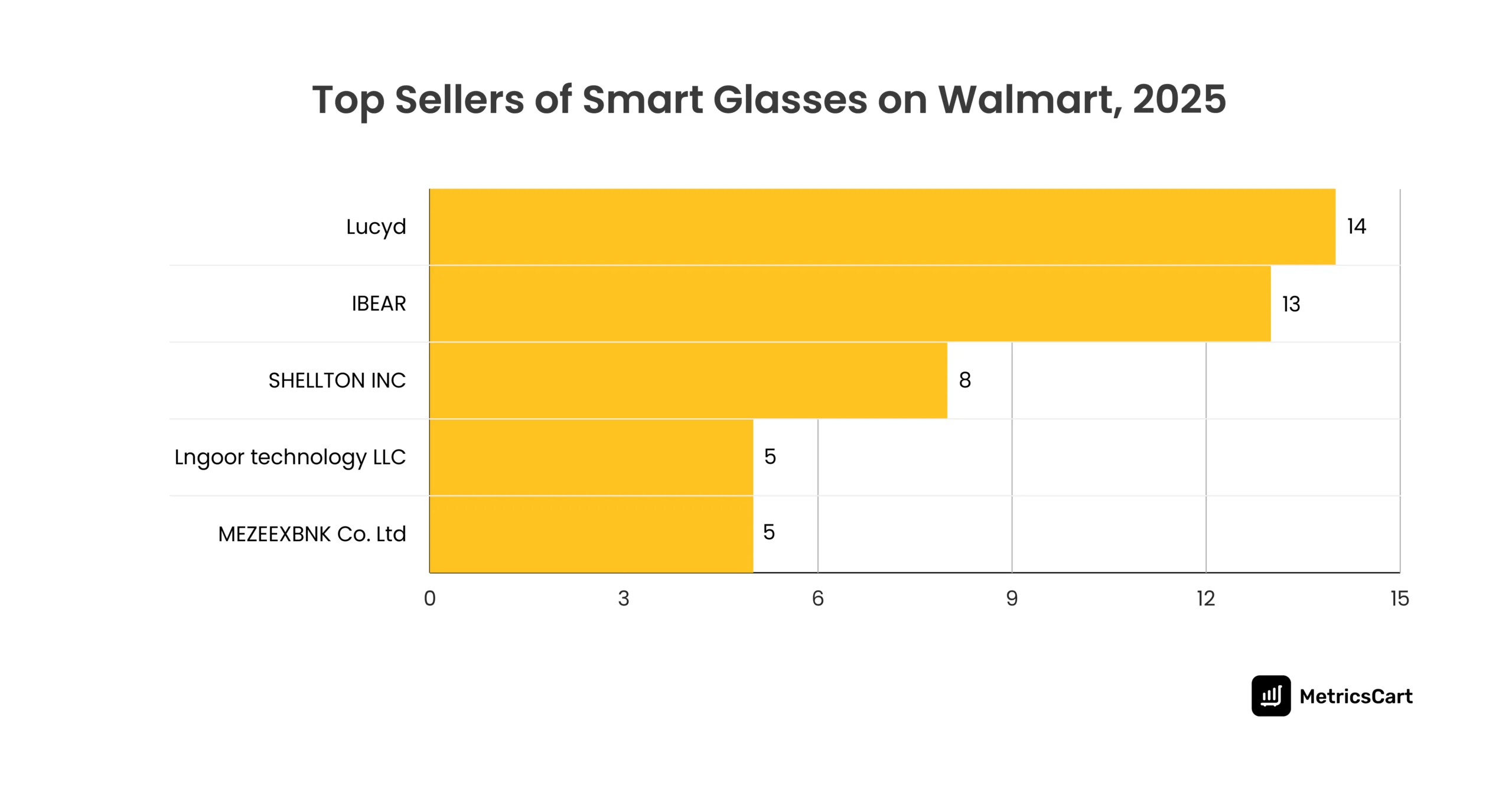

Lucyd and IBEAR are the Top Sellers of Smart Glasses on Walmart

Lucyd stands out as the top seller with 14 products. As a well-known brand in smart eyewear, Lucyd focuses on combining audio functionality with prescription and sun protection, offering tech-integrated but lifestyle-friendly eyewear. Their consistent presence reflects strong brand recognition and investment in Walmart as a distribution channel.

Following Lucyd, we see IBEAR (13 products) and SHELLTON INC (8 products). These brands have adopted a strategy of listing multiple product variations, such as different colors, lens types, and features, to increase visibility and cater to diverse consumer preferences.

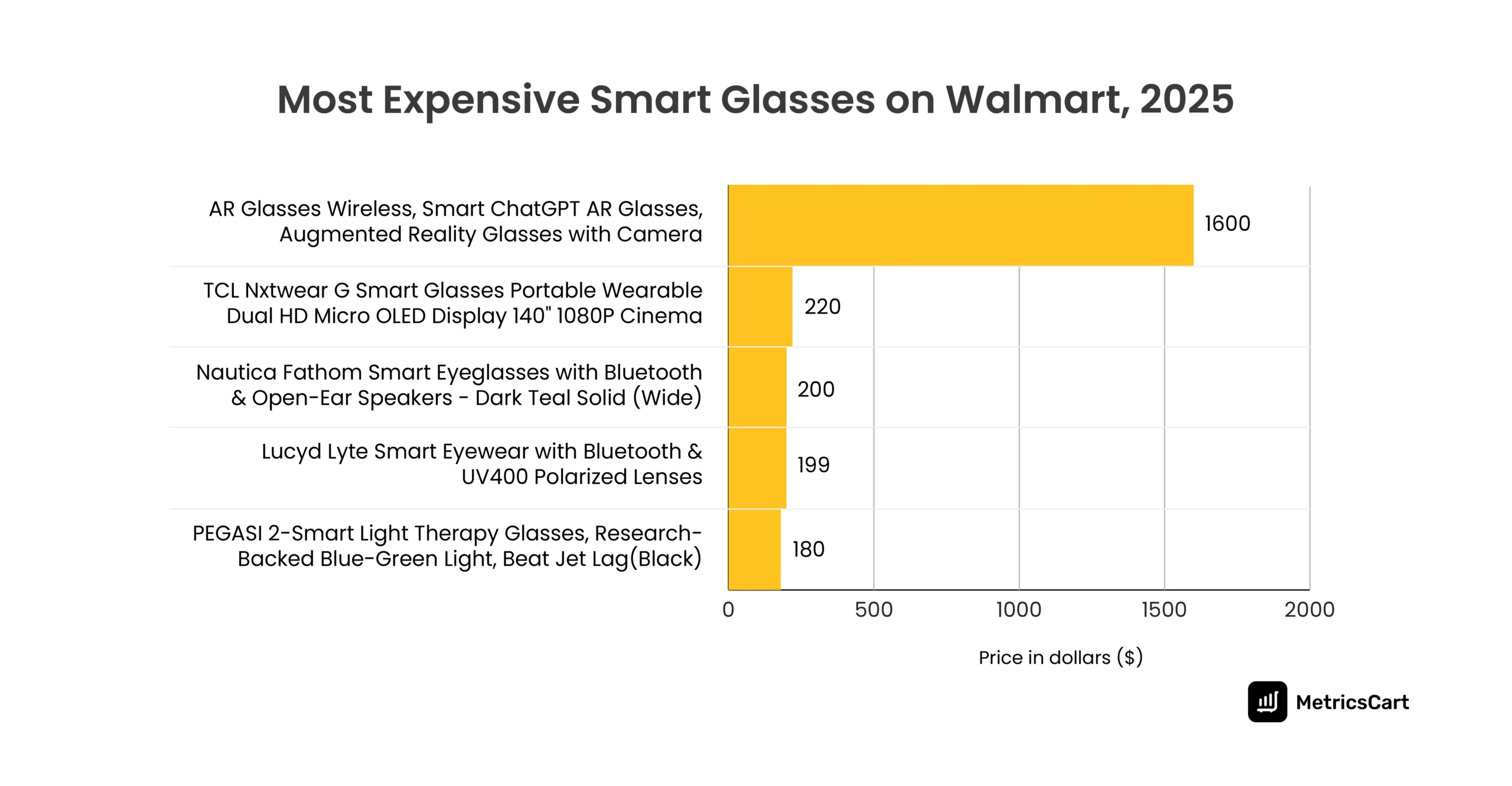

AR Wireless Glass is the Most Expensive Smart Glass on Walmart

The “AR Glasses Wireless, Smart ChatGPT AR Glasses with Camera” is the most expensive at $1,600. This device caters to a niche audience seeking advanced features like AR integration and AI-enabled voice interaction. Its high price point positions it more as a specialty tech gadget than a mainstream wearable.

Excluding this, most high-end smart glasses on Walmart are priced between $150 and $220, pointing to a realistic ceiling for mass adoption.

- TCL Nxtwear G ($220): Positioned as a portable cinema experience with dual HD OLED displays. This is less eyewear and more of a wearable screen device.

- Nautica Fathom & Commander ($150–$200): Nautica’s entries blend style with function, using Bluetooth and open-ear audio.

- Lucyd has four models in this range ($150–$199), including Lyte, Darkside XL, Eclipse XL, and Jupiter XXL. These prices reflect its leadership position and its attempts to offer product variety with incremental tech upgrades.

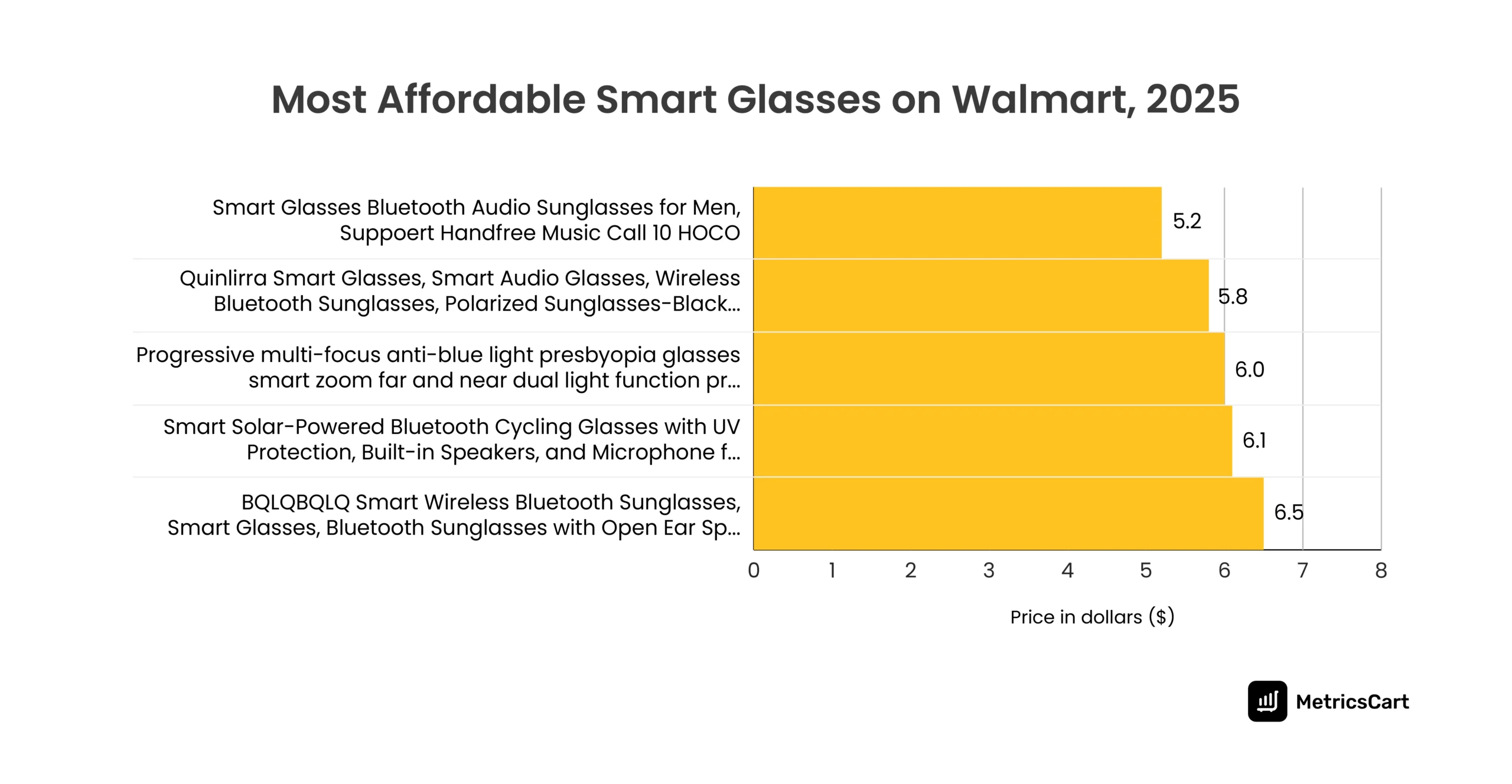

Bluetooth Audio Sunglasses are the Most Affordable Smart Glasses on Walmart

On the opposite end, Walmart’s catalog includes over a dozen listings under $10, most of which are generic or minimally branded. These products include basic features such as Bluetooth audio, UV protection, and anti-blue light lenses, with some even offering solar charging or hands-free call support.

Notable value listings:

- Bluetooth Audio Sunglasses with Calling Support – $5.20

- Quinlirra Wireless Smart Glasses – $5.80

- Anti-fog and anti-blue light variants in the $6–$7 range

This segment appears to be algorithm-optimized rather than brand-led, relying heavily on search-friendly product titles and low price points to drive volume.

Conclusion

Walmart’s smart glasses category is quietly transforming. What began as a space for novelty tech has grown into a price-driven, utility-first category dominated by audio-enabled sunglasses, lightweight designs, and a flood of generic listings.

With prices ranging from $5 to $1,600, the market shows clear signs of polarization between accessible everyday tech and aspirational AR wearables.

But one thing is clear: brand trust and visibility still lag. Most listings lack strong brand equity, leaving room for players like Lucyd to lead by default. For any brand looking to enter or expand, this is an opportunity- a category with high growth potential but low competitive consolidation.

At MetricsCart, we help brands decode this landscape. Our platform delivers SKU-level insights, pricing dynamics, brand share, and review sentiment so you can shape your digital shelf strategy with precision.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready to optimize your Walmart strategy with precision?