With approximately 82 million US households owning a pet, the demand for pet products and services has never been higher.

Experts suggest e-commerce to be one of the primary reasons for the increase in pet spending. The overall market size grew by over 100% in the last decade and continues to grow.

In this context, improving online performance and search visibility is essential for brands, as 60% of add-to-cart actions originate from the top four search results.

Major pet product brands are gaining traction by incorporating popular keywords like ‘grain-free,’ ‘low fat,’ and ‘diabetic’ into their product description pages (PDPs) to increase visibility.

An advanced digital shelf analytics solution can help you monitor your product descriptions better by providing insights into your brand health and online performance.

Pet Care Is Gaining Popularity in More US Homes

According to the American Pet Products Association (APPA), there are currently 65.1 million dog owners and 46.5 million cat owners in the US, making dogs the most popular pets by a significant margin.

Treating pets like children or other human companions has also become a developing trend in the US. By 2030, the US pet care market is expected to triple to $261 billion.

In light of the booming pet supplies industry and pet humanization, new market innovations like pet food delivery services, smart pet feeders, GPS trackers, pet cameras, etc., are also gaining traction among consumers.

The pet product industry is projected to reach sales of $150.6 billion by 2024 when compared to $147 billion in 2023. This provides a massive opportunity for the pet e-commerce industry to establish itself on a larger scale in the coming years.

READ MORE | Interested in knowing about the best-selling brands on Amazon? Check out our curated list of Amazon Bestseller Brands.

What’s Driving Growth in Pet Care E-Commerce?

The global CAGR of pet e-commerce is around 12.3% from 2023 to 2024. This increase can be attributed to multiple factors, such as a rise in pet ownership, greater pet health awareness, and an increase in smartphone and internet usage.

However, in the US, it is estimated that around 86% of pet owners prefer to shop online, and the majority of them visit Amazon to look for pet products.

Pet foods and treats form one of the central categories of the pet e-commerce industry’s total sales. Online pet product sales have seen a stark increase in recent years, and Amazon alone offers over 400,000 dog-related products.

According to Statista, Chewy.com recorded the highest total revenue of $11 billion in 2023. Others, like Petco, PetSmart, Walmart, etc., also have a considerable presence in the US pet care retail market.

According to MetricsCart experts, Stella & Chewy’s is a famous pet products brand on Amazon, with 65 products in its lineup. Brands like Royal Canin and Fancy Feast also enjoy a prominent presence, with impressive average ratings of 4.59 and 4.56, respectively.

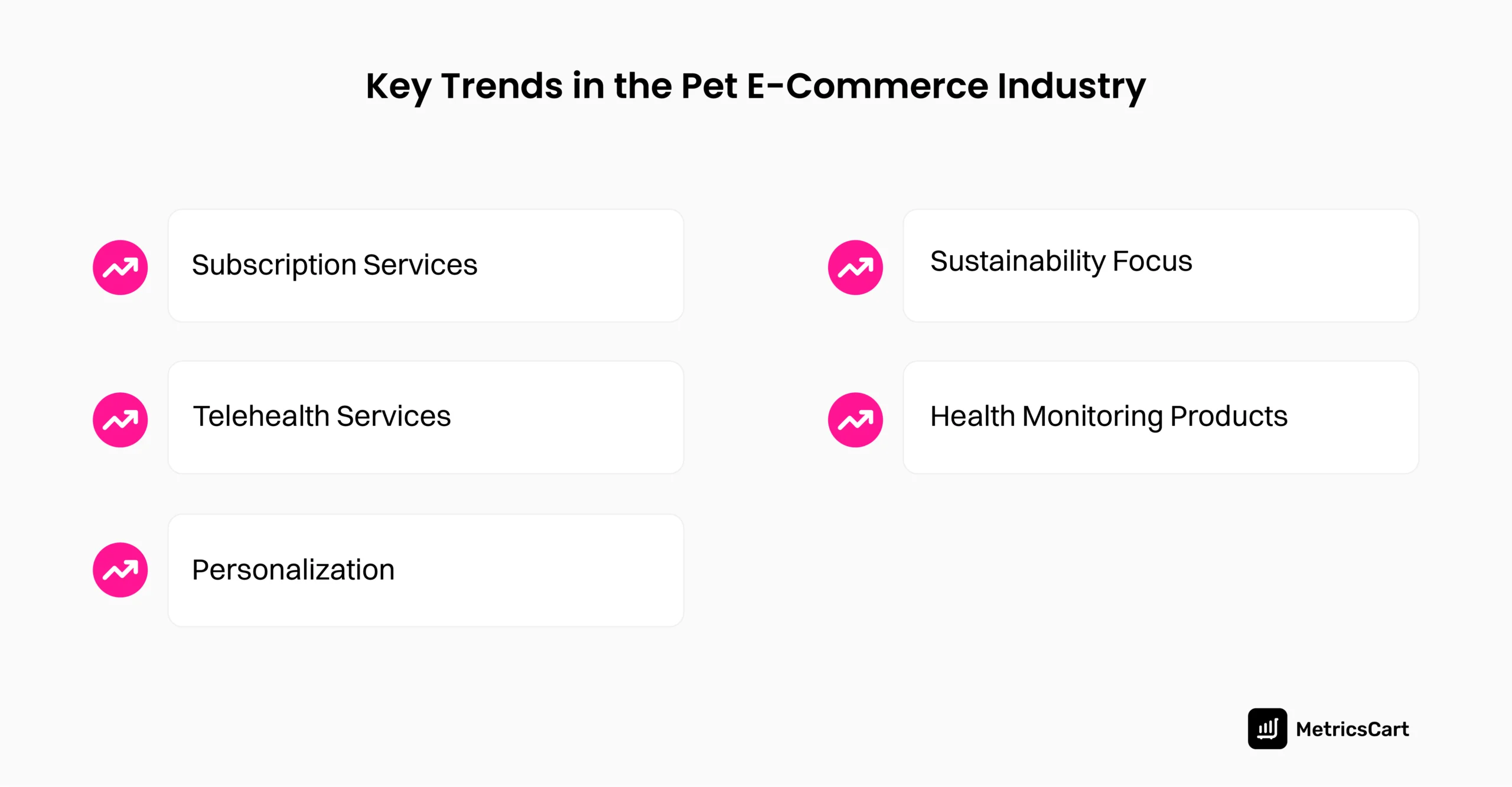

Key Trends Shaping Pet E-Commerce

As pet ownership continues to rise, several pet care e-commerce trends are shaping the future of the e-commerce industry. Brands that capitalize on these trends will be well-positioned to compete in this growing market.

Subscription Services

Subscription-based models for pet products, such as food and toys, are growing in popularity.

Subscription boxes offered by companies like PupJoy, BarkBox, etc., are popular among pet owners due to their quality and comprehensive options.

These services provide tailored boxes that consist of toys, treats, etc. Customers can choose from different subscription boxes according to the preferences of their pet breeds.

Overall, consumers appreciate the convenience of automatic deliveries, and brands benefit from creating long-term customer relationships.

Telehealth Services

Another trend gaining traction is the rise of veterinary telehealth. Pet owners can now consult with veterinarians remotely, thereby saving time and offering quick resolutions for concerns like skin issues, behavioral problems, colds and coughs, post-surgical care, general well-being, etc.

With telehealth services, pets can be assessed in their comfortable environments. This can be especially beneficial for cat owners, as going for a veterinary consultation can be a stressful experience for the pet.

TeleVet, Chewy Connect, etc., provide online veterinary services that make the lives of pet owners and pets easier.

Personalization

Personalized product recommendations can work wonders for pet retailers because pet owners often view pets as family members with specific needs based on breed or health conditions.

For instance, certain dog breeds have allergies to chicken or certain grains, while aged cats frequently develop kidney and urinary issues, requiring tailored diets.

Recognizing and catering to these individual needs fosters stronger customer relationships and builds long-term brand loyalty.

Sustainability Focus

Consumers are increasingly demanding sustainable products, and this is no different in the pet industry. Pet owners are seeking out eco-friendly products for their pets, from biodegradable toys to organic food options.

Brands that prioritize sustainability will attract a growing number of environmentally conscious consumers.

Health Monitoring Products

Brands like Whistle Health have created wearable health trackers for pets that provide an overall score of the pet’s health, ranging from food consumption to sleep quality.

The pet care e-commerce market also offers other products, such as smart pet collars, thermometers, monitoring cameras, litter boxes, and interactive toys.

These products are becoming increasingly popular as they make pet owners’ lives stress-free regarding their pets’ health.

READ MORE | Want to know more about growing your e-commerce business? Check out our blog on How to Increase E-Commerce Sales?

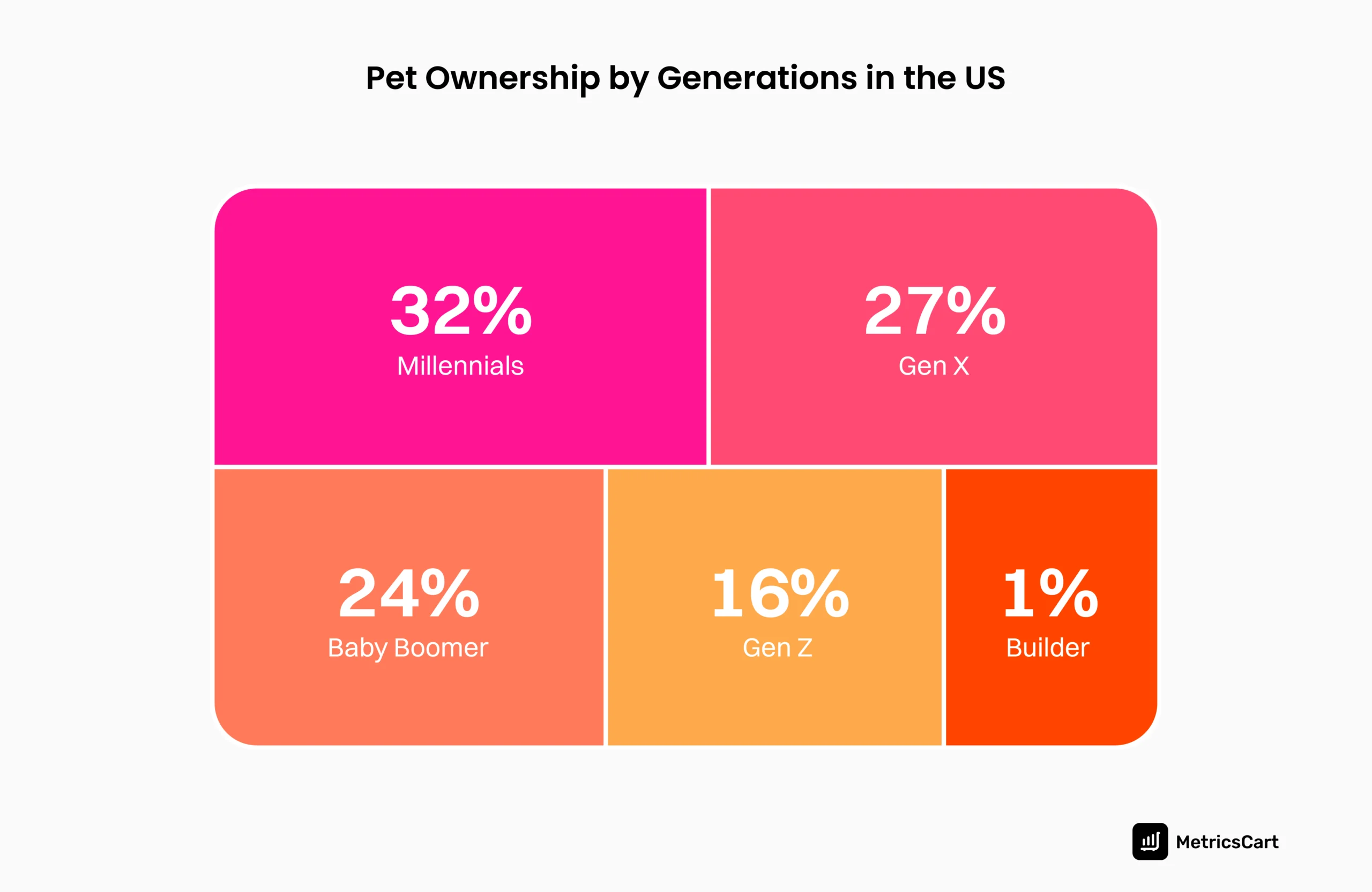

Age Groups That Influence Pet E-Commerce in the US

Pet care brands must be attuned to the unique preferences of different age groups as each generation approaches pet ownership and shopping differently.

Millennials

Millennials are the largest group of pet owners, covering over 32% of total pet owners, and are known for their willingness to invest in premium products.

For this generation, shopping for pets is an extension of their own lifestyle choices. They prioritize products that are organic, eco-friendly, and sustainable.

They also embrace subscription models for products like pet food and supplies, which offer both convenience and peace of mind and ensure they never run out of essentials.

Generation X & Baby Boomers

Gen X comes in second with 27%, and Baby Boomers follow closely behind with 24%. They have been loyal customers for years and tend to spend more on traditional pet care services, such as veterinary care.

However, they are increasingly turning to e-commerce platforms for pet products.

As these older generations become more comfortable with online shopping, brands have a unique opportunity to cater to their preferences with user-friendly platforms and personalized recommendations.

Generation Z

While Millennials dominate the pet e-commerce space, Gen Z, known for their tech-savvy and reliance on social media, can’t be overlooked. With a stake of 16% in the overall pet owner population, Gen Z is influenced by peer recommendations and online trends when choosing pet products.

Brands that have a solid digital presence, particularly on platforms like Instagram, TikTok, and YouTube, are more likely to win over this generation.

Additionally, Gen Z values interactive and personalized shopping experiences, and they expect brands to engage them with innovative marketing strategies.

The remaining 1% is the Builder generation (born before 1946), which is the most negligible minority in the pet ownership group.

READ MORE | Interested in knowing more about Gen Z shopping habits? Check out our blog on Decode How Gen Z Shops on Amazon: Supercharge Your Brand’s Sales Today

Conclusion

As pet ownership continues to grow in the US, the pet care e-commerce market offers significant opportunities for brands to tap into this expanding sector.

Categories of pet health focused on particular breeds and age groups, as well as pet insurance, are also gaining prominence in the US as pet humanization is becoming a popular trend.

So, it’s clear that digital commerce plays a crucial role in shaping the future of pet care.

Customer’s online purchasing behavior and choices are heavily dependent on the kind of service that brands and retailers are able to provide.

Staying up-to-date with the preferences of different age groups, from Millennials to Gen Z, ensures long-term success in this rapidly evolving market.

With the right digital shelf strategy like MetricsCart, your brand can scale in this competitive landscape and meet the rising demand from pet owners who are eager to provide the best for their pets.

Ready To Take Your Brand Performance to the Next Level?

FAQ

Brands can improve their visibility by utilizing digital shelf analytics to optimize product listings, monitor pricing, and track customer reviews for better engagement and higher search rankings.

As consumers become more environmentally conscious, there is growing demand for eco-friendly pet products, making sustainability a critical factor in attracting Millennials and Gen Z pet owners.

Personalized recommendations based on customer preferences or previous purchases can significantly increase customer engagement and retention, helping brands more effectively cater to specific pet needs.