Ever noticed how Uber fares change at different times you open the app? One evening, a short ride might cost $120, but the next morning the same trip drops to $80.

That’s not a glitch or bad luck. It’s called price discrimination, and Uber is not the only one doing it either. Airlines, hotels, streaming platforms, and e-commerce sites all use dynamic pricing to capture as much value as possible from different customers.

In this blog, we’ll explore:

- What is price discrimination, and how does it work

- The different types of price discrimination

- Real-life price discrimination examples

- Steps to implement price discrimination, and more.

If you run a business, work in marketing, or just wonder why prices never seem to stay still, this is for you.

What is Price Discrimination and How Does it Work

Price discrimination is a pricing strategy where a business charges different customers different prices for the same product or service, considering different factors such as location, time, purchase power, etc. Businesses use it as a strategy to capture more of what each buyer is willing to pay, something which economists call consumer surplus.

At its core, price discrimination works by segmenting customers into groups based on certain characteristics. The conditions for price discrimination include:

- Time: Prices change depending on when a customer buys. For example, airline tickets cost more during holidays and weekends compared to weekdays.

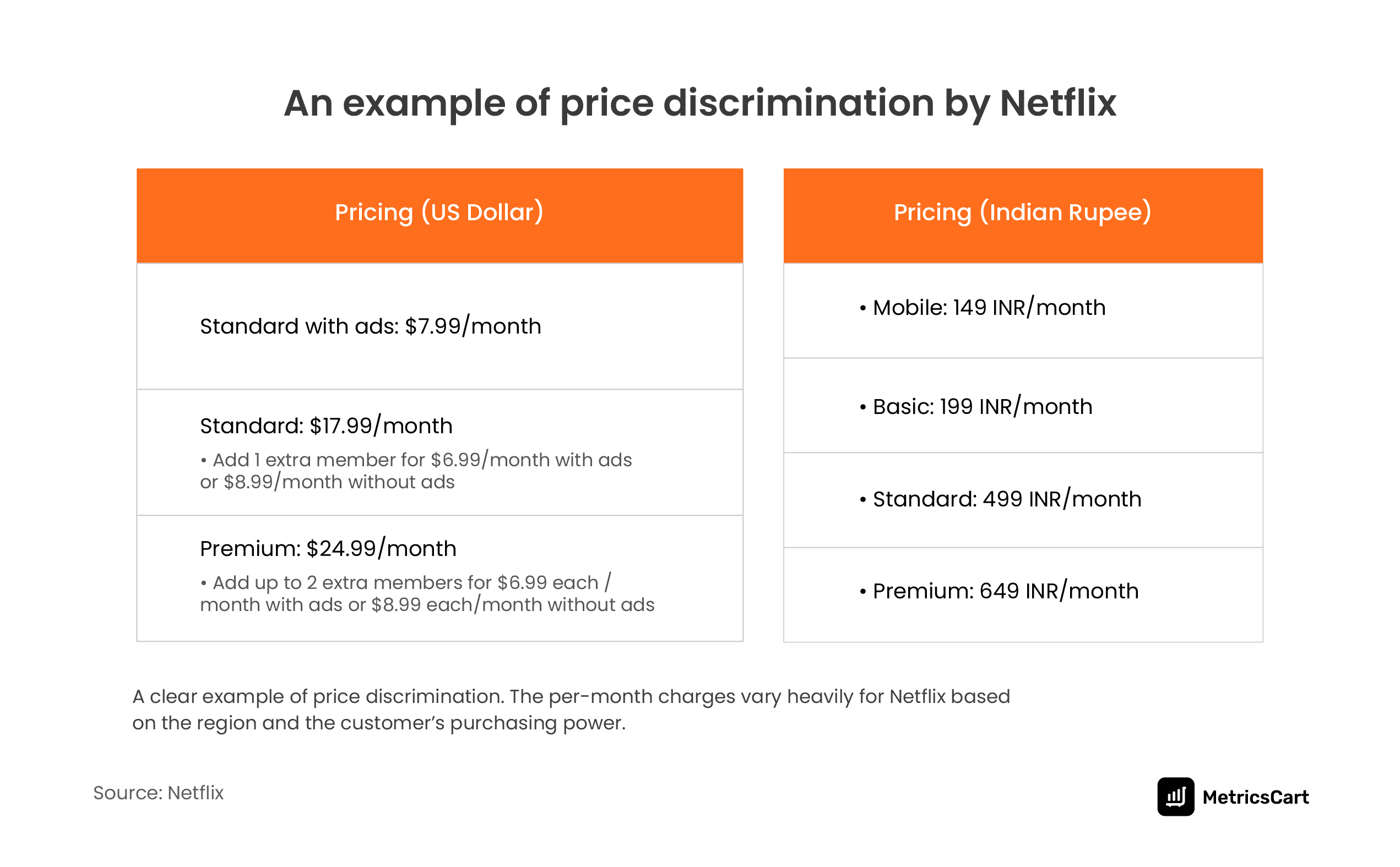

- Location: Prices differ based on geographic regions. Some streaming platforms like Netflix and Spotify charge different subscription fees in the US, India, and Europe, reflecting local purchasing power.

- Customer Type: Businesses charge different prices to different customer groups. Student discounts, senior citizen offers, and loyalty programs are common examples.

- Purchase Behavior: Companies may use past buying behavior to adjust prices. Online retailers track browsing and purchase history to offer personalized discounts or higher prices.

Price discrimination works best when a company can identify these differences and apply them strategically to the right customers, at the right time.

Technology and data analytics have made this much easier today. Algorithms can monitor demand in real time, adjust prices automatically, and even predict what each customer is willing to pay. It can seem unfair on the surface, but from a business perspective, it ensures the company captures value from every customer segment without altering the product itself.

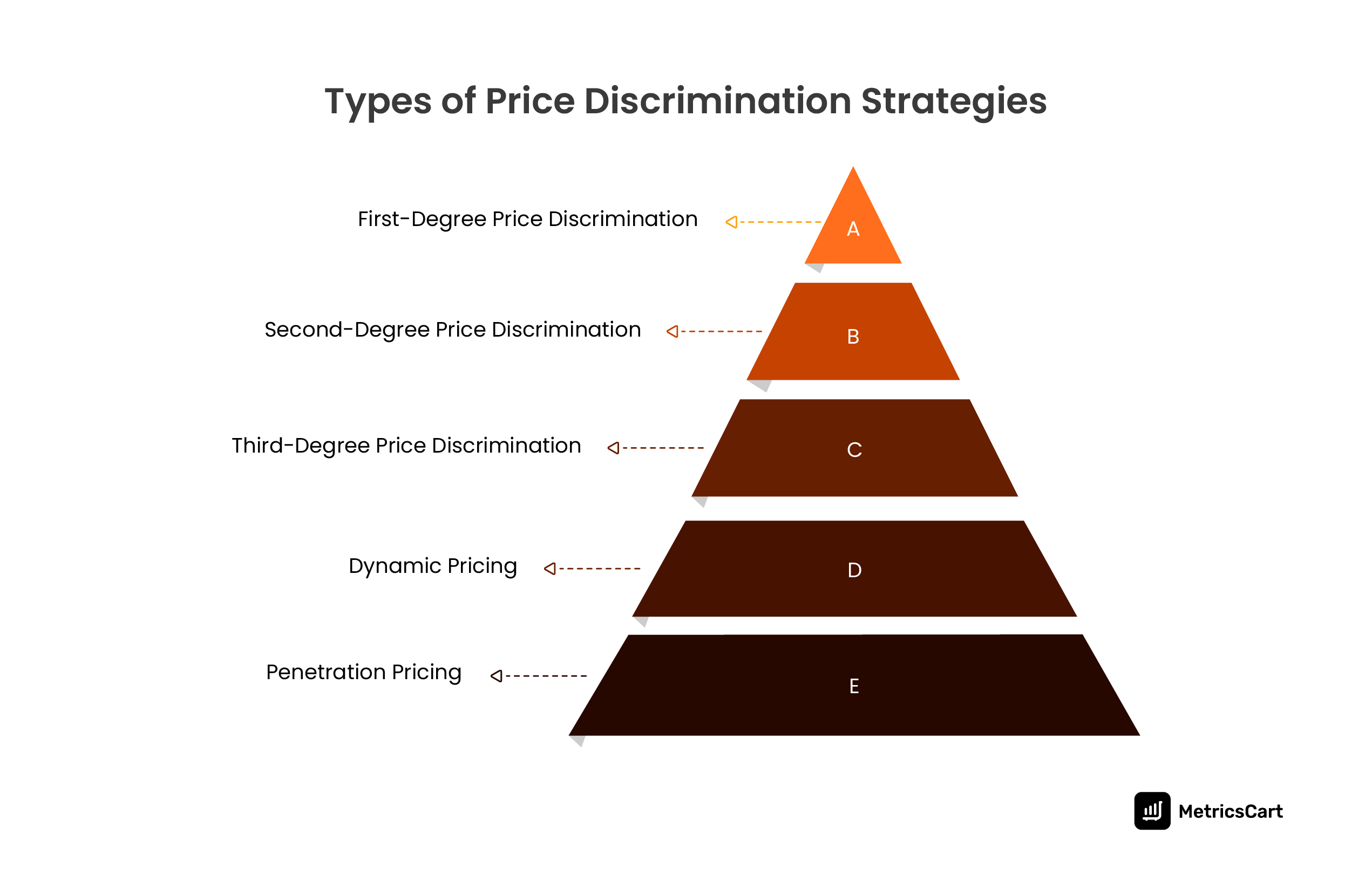

Types of Price Discrimination

Price discrimination comes in different forms, depending on how businesses segment their customers and set prices. Understanding these types of price discrimination helps explain why prices vary so much for the same product or service.

First-Degree Price Discrimination or Personalized Pricing

Also called perfect price discrimination, first-degree price discrimination happens when a company charges each customer the maximum price they are willing to pay. In this model, no two customers pay the same amount.

Luxury car sales, high-end real estate, and some auction sites often use this strategy. It requires detailed knowledge of customer behavior and willingness to pay.

Second-Degree Price Discrimination or Product Versioning

Second-degree price discrimination charges different prices based on the quantity purchased or the version of the product. Bulk discounts, subscription tiers, and versioned software plans are examples.

Customers self-select the price they are willing to pay, making it easier for businesses to capture more revenue without knowing each individual’s maximum willingness to pay.

Third-Degree Price Discrimination or Group Pricing

Third-degree price discrimination segments customers into groups based on identifiable characteristics such as age, location, or occupation.

Student discounts, senior citizen tickets, and regional pricing are common examples. Here, the business sets a standard price for each group rather than customizing for each individual.

Dynamic Pricing

Dynamic pricing refers to the process of adjusting the price of a product in real time based on demand, competition, inventory levels, and customer behavior. The same shopper may see a higher or lower price depending on timing, location, device, browsing history, or current market demand. It’s highly effective because it responds instantly to willingness to pay.

Airlines, ride-hailing apps, hotels, and e-commerce platforms use this model heavily because it helps maximize revenue during peak demand and protect margins during slow periods.

Penetration Pricing

Penetration pricing sets an intentionally low price at launch to attract customers quickly, gain market share, and discourage competitors. Brands use it when entering crowded categories where consumer switching costs are low.

In price discrimination, this strategy targets price-sensitive segments first. Early adopters get a lower entry price, creating rapid adoption. Once demand grows and brand loyalty develops, prices typically increase. Penetration pricing helps companies identify and convert low-willingness-to-pay buyers before moving the product toward its long-term value.

Price Discrimination Examples

From Amazon’s dynamic pricing to Adobe’s student discounts, e-commerce giants have mastered the art of charging different customers different prices for the same thing. Here are some examples.

eCommerce Flash Sales

Retailers like Amazon and Walmart run limited-time deals, such as Prime Day or Black Friday, offering massive discounts for short windows. It’s the same inventory, but the urgency manipulates demand and purchase timing.

Loyalty-Based Pricing

Members of loyalty programs like Amazon Prime & Walmart+ often see exclusive prices or early access to sales. The strategy rewards repeat customers but also creates two pricing layers. One for insiders, another for the rest.

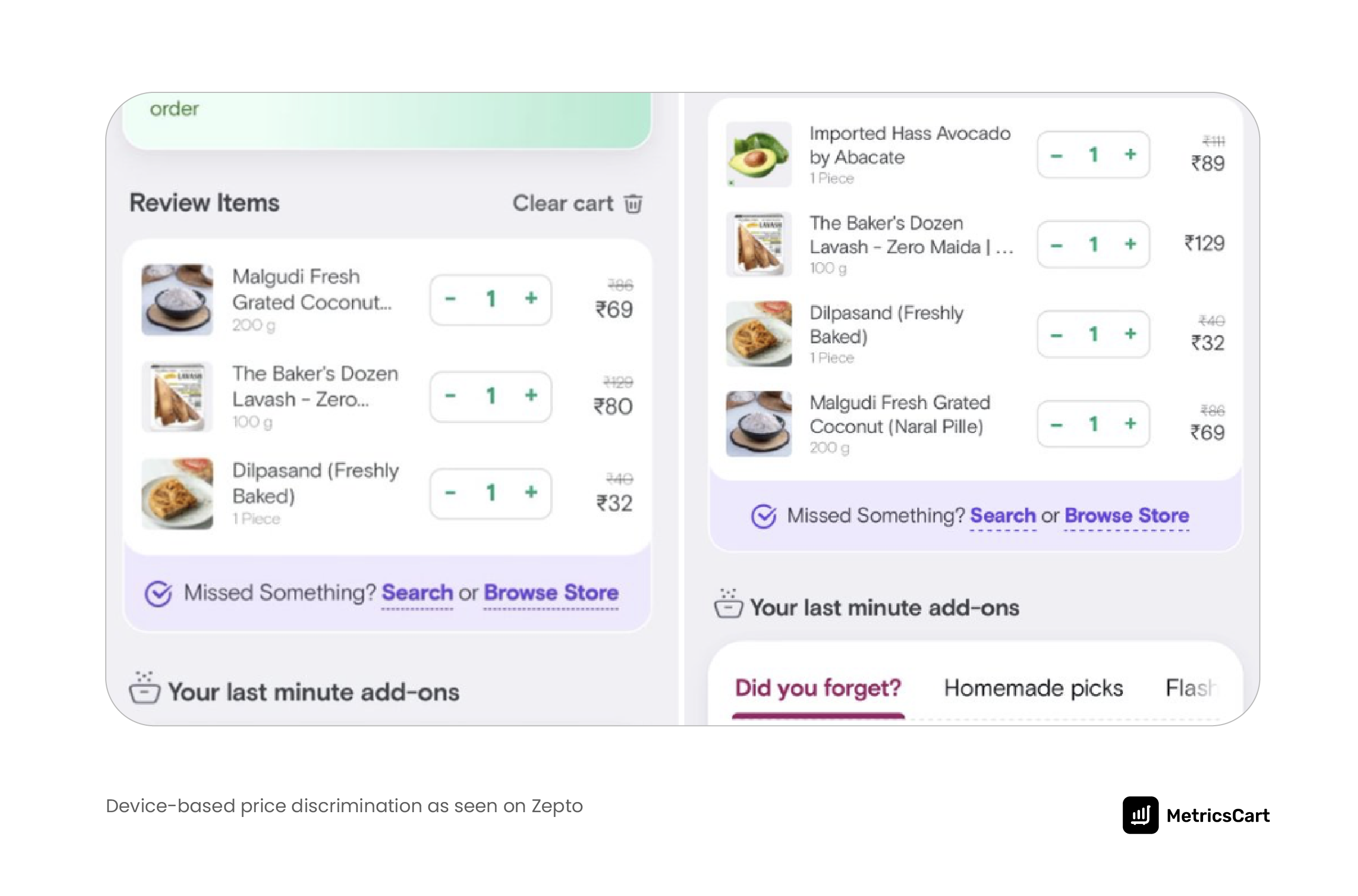

Device-based Price Discrimination

MediaNama, in a 2025 study, tracked 13 grocery items across quick-commerce platforms (Zepto, Blinkit, Instamart). They kept location, brand, and quantity constant, and compared prices on Android vs iOS apps. They found:

- On Zepto and Blinkit, many items were priced higher on iOS than on Android.

- For some products, the iOS price was significantly higher, with no clear cost justification.

- In a few cases, prices were the same, but in most, iOS users paid more.

The study also found that frequent users got lower prices, while infrequent users saw higher ones, which is another layer of segmentation.

Other Price Discrimination Examples

Price discrimination isn’t limited to e-commerce. It is everywhere, and some of the biggest brands use it to maximize revenue. Here are a few other real-life examples you’ll recognize:

- Airlines: Airlines constantly adjust ticket prices based on demand, booking time, and customer profile. The same seat on a Delta flight from New York to Los Angeles can cost $250 if booked two months in advance or $450 if booked a week before the flight. Business travelers often pay more than leisure travelers for the same route.

- Ride-Hailing: Uber’s surge pricing is a classic example. A five-minute ride might cost $6 in normal hours, but jump to $18 during peak times or bad weather. Lyft uses similar dynamic pricing to balance demand and supply.

Streaming Platforms: Netflix charges $7.99/month for a standard plan with ads in the United States, but only INR 499 or around $5.68 in India, reflecting differences in local purchasing power. Spotify does the same with regional pricing and also offers student discounts worldwide. Disney+ has different prices for standard and premium plans depending on the country and package.

How to Implement Price Discrimination to Maximize Your Digital Shelf Profit

Price discrimination is a powerful tool for boosting revenue, but it only works when it’s planned carefully. If you’re managing products online, whether on your own e-commerce site or marketplaces like Amazon and Walmart, implementing it strategically can help you maximize profit without alienating customers. Here’s how to do it effectively:

Step 1: Segment Your Customers

The first step is understanding your audience. Not all customers are the same, and their willingness to pay varies. Segment your customers based on location, purchase history, browsing behavior, device type, or demographics.

For example, a repeat buyer who frequently purchases premium products may be willing to pay more than a first-time visitor. By identifying these segments, you can target each group with pricing that matches their value perception.

Step 2: Set Tiered or Dynamic Prices

Once your customer segments are clear, assign different pricing strategies. Tiered pricing involves offering multiple versions of a product or service, such as standard, premium, or bundled packages. Dynamic pricing adjusts costs in real time based on demand, stock levels, or competitor prices.

READ MORE | A Guide to Competitive Pricing

Step 3: Test and Optimize

Price discrimination is not a one-time setup; it requires continuous testing. Run experiments to see how different prices affect customer behavior.

A/B testing can reveal which price points lead to higher conversions and which segments respond best to premium options. Collect data regularly, analyze the results, and refine your pricing strategy to ensure you are capturing the most value from each segment.

Step 4: Communicate Value Clearly

Differentiated pricing only works if customers understand what they are paying for. Clearly highlight the benefits of each price point, such as faster delivery, premium features, or bundled offers.

When customers perceive the added value, they are more likely to accept higher prices without feeling exploited. Brands like Disney+ and Netflix emphasize content or feature differences like ad-free to justify pricing tiers effectively.

How MetricsCart Can Help with Price Discrimination

For brands managing hundreds of SKUs across marketplaces, guessing the “right price for the right buyer” is impossible without reliable visibility into how your products and competitors are priced. MetricsCart gives you that visibility, plus the intelligence to act on it. Using MetricsCart, you can

- Monitor competitor pricing and promotions in real time.

- Analyze customer behavior to identify price-sensitive and premium-paying segments.

- Optimize product listings based on regional performance and demand.

- Track market trends and adjust your strategy with real-time alerts.

- Identify the best-performing SKUs to prioritize for dynamic pricing.

- Detect pricing gaps or opportunities across marketplaces.

- Test different pricing strategies and measure their impact on sales.

Price discrimination might sound complex, but it’s simply about charging different prices to different customers based on demand, behavior, or location. And for businesses, it’s one of the most powerful tools to maximize revenue, improve market segmentation, and capture more value from every customer.

Turn Every Price Point into a Profit Opportunity with MetricsCart

FAQs

Price discrimination is a strategy where a business charges different customers different prices for the same product or service based on demand, behavior, location, or customer type.

Businesses use it to maximize revenue, capture more value from different customer segments, and adjust prices according to demand, willingness to pay, or regional differences.

Yes, small businesses can implement it through tiered pricing, time-based discounts, loyalty programs, or regional pricing using analytics and data tools.

In most cases, yes. Price discrimination is legal as long as it does not violate anti-competition or anti-discrimination laws. Many strategies, like student discounts or loyalty programs, are fully compliant.