About the report: This Digital Shelf Insights (DSI) report provides a comprehensive overview of the Cold Drinks category on Instamart for the period June 1–15, 2025. The analysis covers 104 products across 53 brands in 8 zip codes in Bangalore, providing a clear picture of the pricing, discounts, and availability trends shaping this fast-moving category.

Introduction

India’s youthful demographics and hot, humid climate have significantly driven demand for ready-to-drink (RTD) beverages, including cold coffees, iced teas, fruit juices, and healthier alternatives.

Notably, RTD beverages have seen a 52% year-on-year increase, hitting around $121 million, with non-carbonated drinks, such as fruit juices and cold coffees, growing over 80%, outpacing core carbonated drinks.

Quick commerce platforms, such as Swiggy Instamart, now contribute around 57% of online RTD beverage GMV, underscoring their central role in changing consumption patterns.

Seasonal and event-driven demand patterns also reinforce the importance of cold beverages on the platform. During India’s scorching summer, Swiggy Instamart reported a 28% surge in orders for cold drinks and juices, highlighting the heightened demand for cooling products in extreme heat.

Highlights

- The average price of cold drinks on Swiggy Instamart is ₹213.58

- The average delivery time of the cold drinks category on Instamart is 12.89 minutes.

- The most expensive cold drink on Swiggy Instamart is Carljung Alcohol-Free Guvée Red Wine, at ₹700.

- Kinley Mineral Water Bottle is the most affordable cold drink on Instamart, priced at ₹10.

- Yu and Alo Frut are the top discounted cold drinks brands on Swiggy Instamart.

Inside Swiggy Instamart’s Cold Drinks Aisle: An Overview

The cold drinks category on Swiggy Instamart has become a key driver of quick commerce demand, catering to a range of needs from daily refreshments to seasonal spikes during India’s scorching summer temperatures.

With consumers increasingly turning to Instamart for instant gratification, variety, and doorstep delivery within minutes, cold beverages, ranging from carbonated soft drinks to juices and ready-to-drink coffees, are at the forefront of this shift.

Between June 1–15, 2025, Swiggy Instamart’s cold drinks category revealed a dynamic mix of assortment, pricing, availability, and delivery performance. The average price of cold drinks on Swiggy Instamart is ₹213.58, with an average delivery time of 12.89 minutes.

Moreover, 53 products remained consistently in stock, available across eight zip codes in Bangalore, highlighting both the variety and reliability within the category. The zipcode-level breakdown uncovers interesting contrasts in delivery efficiency. For example:

- 560066 (Whitefield) achieved the fastest average delivery time, with an impressive 5.3 minutes, with 46 SKUs.

- 560037 (Doddanekkundi) also performed well, with a time of just 6.2 minutes, and 47 products available.

- In contrast, 560084 (Lingarajapuram) recorded one of the slowest delivery times at 18.7 minutes, despite offering the same number of SKUs (46) as Whitefield, indicating potential fulfillment bottlenecks in specific neighborhoods.

- 560041 (Jayanagar) emerged as a product-rich location, offering 61 cold drink SKUs, though average delivery time was relatively higher at 14.9 minutes.

These variations reflect how assortment depth and hyperlocal delivery efficiency shape customer experience in quick commerce. Faster fulfillment in areas like Doddanekkundi and Whitefield suggests stronger last-mile infrastructure, while slower delivery in Lingarajapuram points to challenges in balancing high demand with service speed.

Overall, Swiggy Instamart’s cold drinks category is marked by a wide assortment, competitive pricing, and strong coverage across key Bangalore neighborhoods.

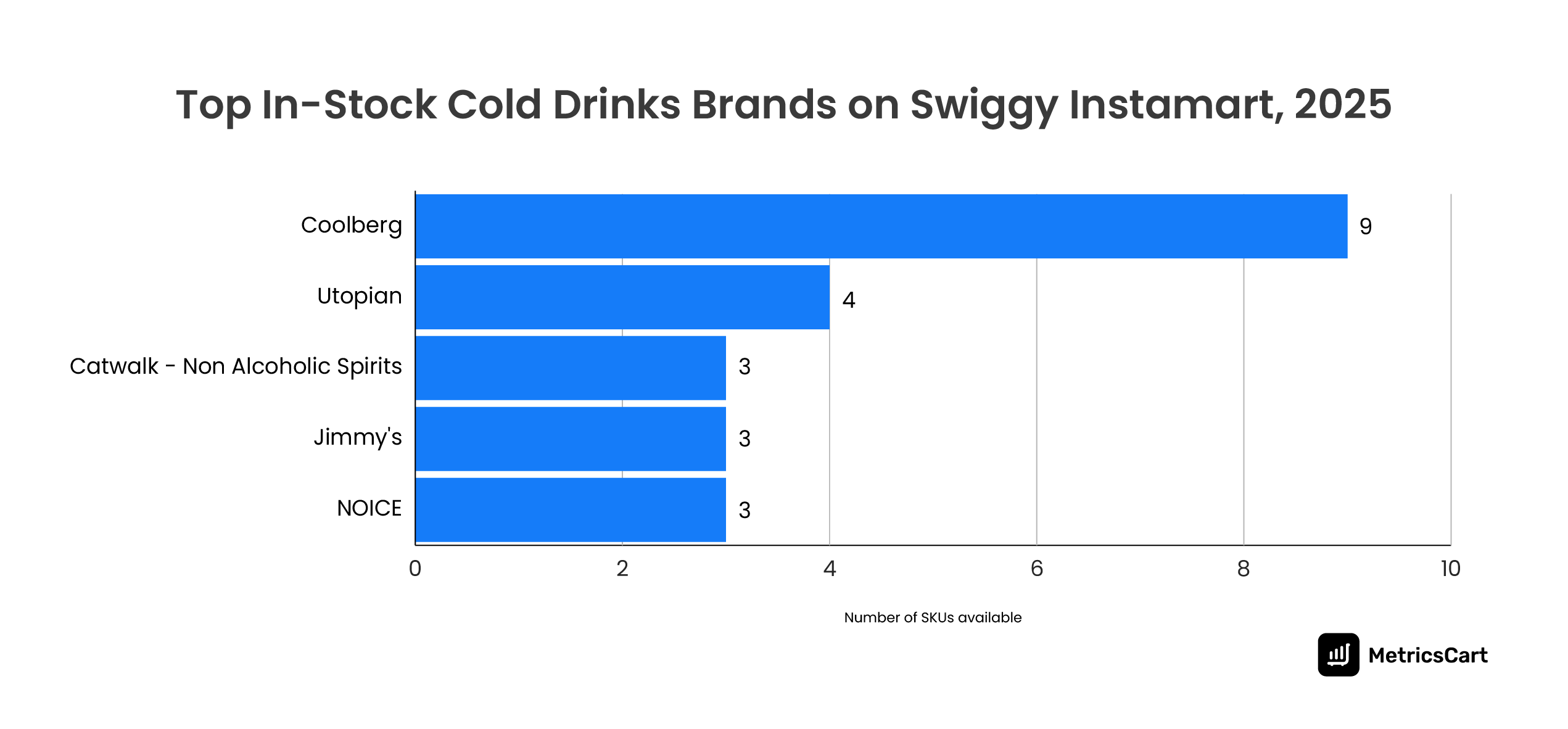

Coolberg and Utopian are the Top In-Stock Cold Drinks Brands on Swiggy Instamart

Among the various brands in the Swiggy Instamart cold drink category, Coolberg and Utopian are the top in-stock brands, with 9 and 4 SKUs consistently available.

Coolberg’s position as the leader reflects the growing popularity of non-alcoholic beers and mocktails. This aligns with broader consumer shifts toward healthier, alcohol-free alternatives, especially in metro markets where young professionals are driving trial and repeat consumption.

Utopian, with 4 SKUs, follows as the second-largest in-stock brand. The brand’s consistent availability suggests a focused assortment strategy, balancing depth (multiple SKUs) with presence across Instamart’s coverage.

There are other emerging players, such as Catwalk, Jimmy’s, NOICE, which is Swiggy’s private label brand, and Raw Pressery, each with 3 SKUs. These brands reflect category diversification from mixers (Jimmy’s), to functional beverages (NOICE), to natural juices (Raw Pressery).

High SKU availability also indicates strong supply chain alignment with Swiggy Instamart, ensuring consumers find the brand when they need it most, which is critical in quick commerce where out-of-stock equals lost sale.

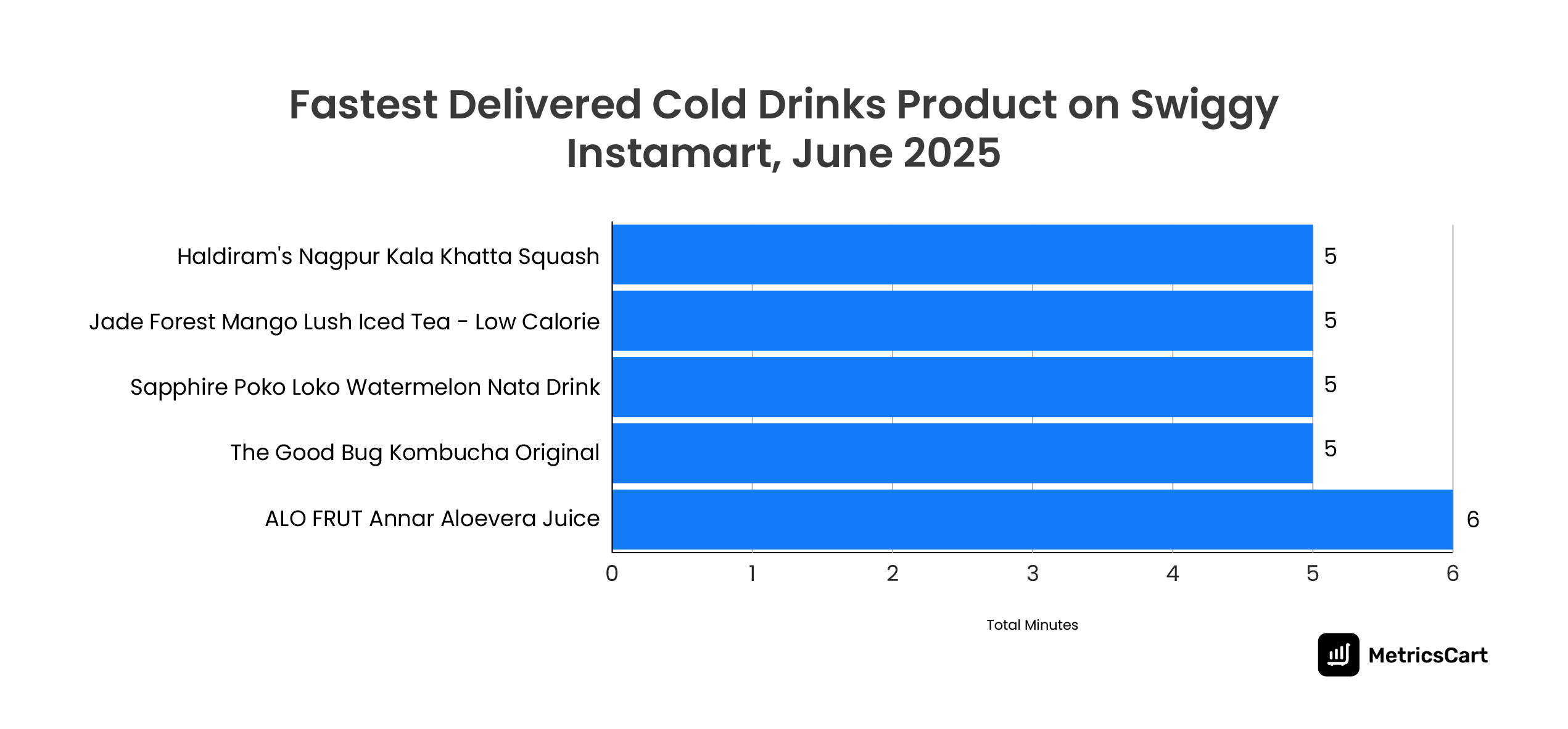

Haldiram’s Nagpure Kala Khatta Squash is the Fastest Delivered Cold Drinks Product on Swiggy Instamart

In quick commerce, speed isn’t just convenience; it’s the core value that drives customer satisfaction and repeat purchases.

Haldiram’s Kala Khatta Squash, Jade Forest Mango Lush Iced Tea, Sapphire Poko Loko Watermelon Nata Drink, and The Good Bug Kombucha lead with 5-minute average deliveries, showing how Instamart prioritizes trending and regional favorites.

In addition, Bisleri Rev Cola, ALO FRUT Aloe Vera Juice, CLEAR Premium Water, Evocus Alkaline Water, and Carljung Red Wine average 6 minutes, reflecting strong stocking due to consistent demand.

Products with high demand and a broader consumer base (like squash, iced teas, and kombucha) are stocked closer to consumers, ensuring ultra-fast delivery. These patterns highlight how dark store stocking decisions are directly shaped by real-time consumer demand, ensuring that both everyday staples and trendy cold drinks reach customers in record time.

Price Trends of Cold Drinks on Swiggy Instamart from June 1, 2025, to June 15, 2025

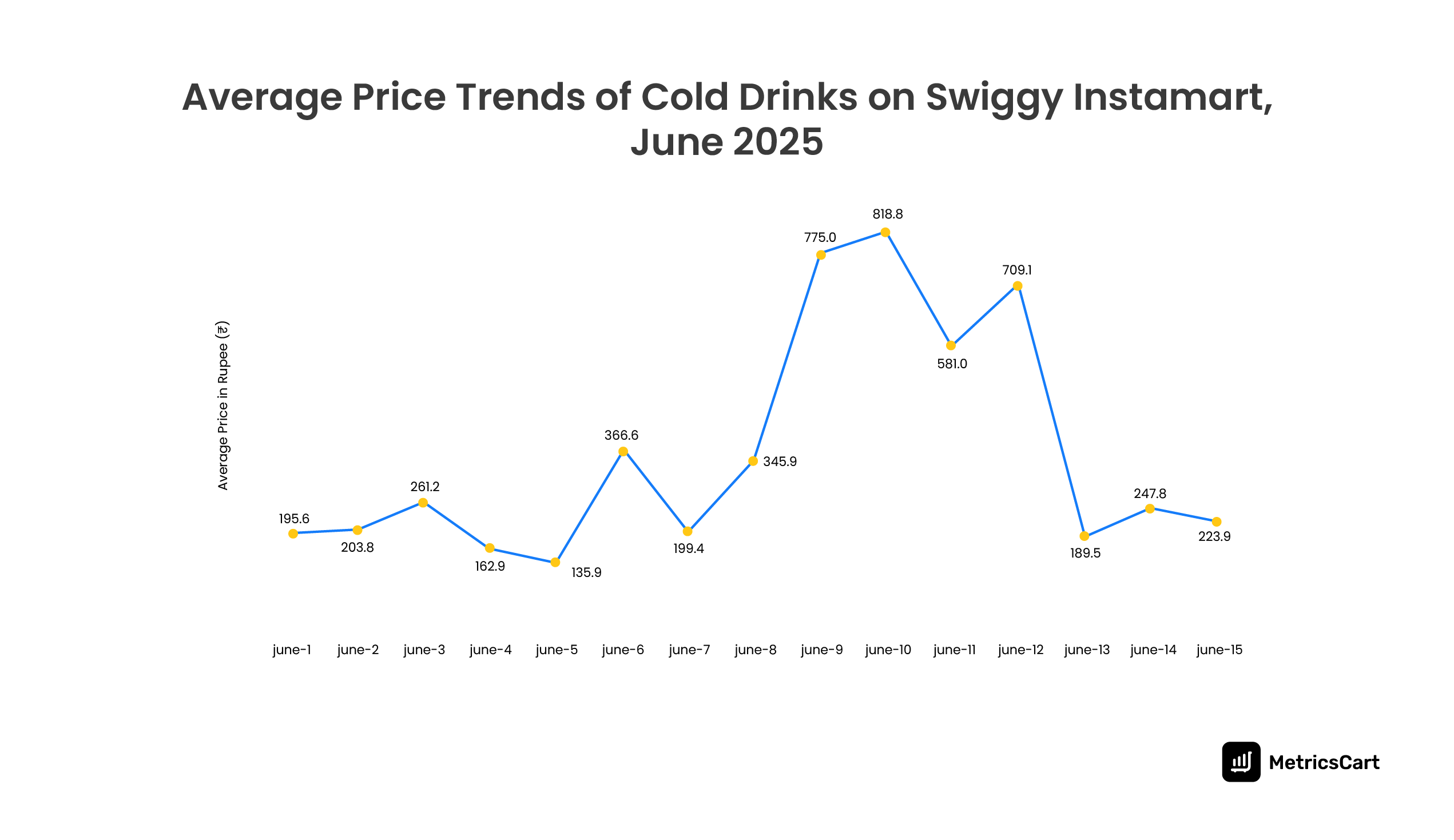

Based on the MetricsCart, the average price of the cold drinks category on Instamart is volatile, indicating that demand is highly seasonal and driven by promotions.

In the first half of June 2025, prices started relatively stable between ₹195–₹261 (June 1–3) but dipped to ₹135.9 by June 5, possibly due to discounts or stock clearances.

A sharp spike occurred on June 6 (₹366.6) and peaked around June 9–10 (₹775–₹818.8), reflecting premium product purchases or supply-demand fluctuations. Premium brands like Evocus (₹383), The Good Bug (₹368), Prime (₹299), and Budweiser (₹274) likely contributed to the price spikes when more premium SKUs were in higher demand or stocked.

After this peak, prices dropped to ₹189.5 on June 13, before stabilizing around ₹223–₹247 towards June 15.

This shows that consumer spending on cold drinks is highly dynamic, influenced by product availability, brand promotions, and changing consumer preferences.

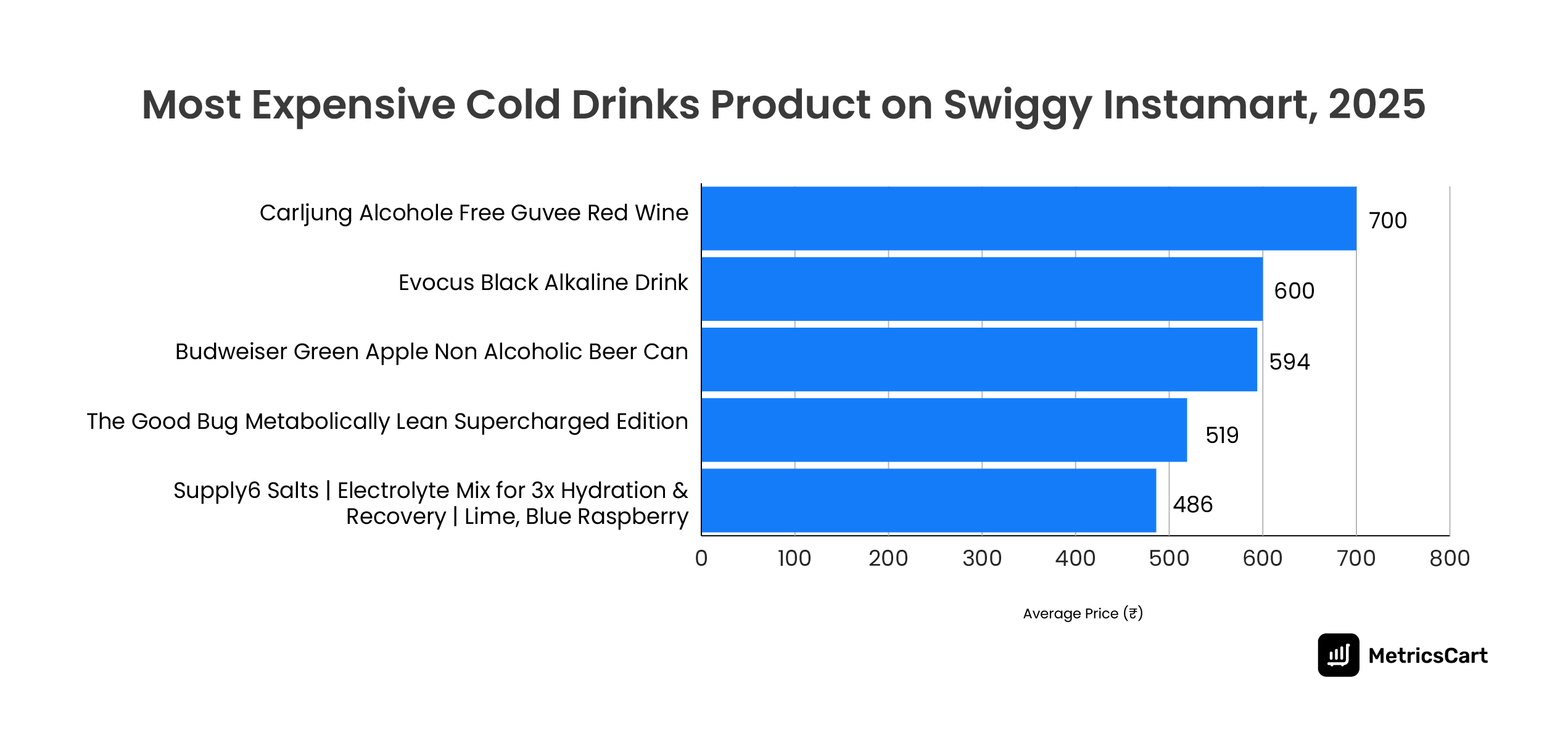

Carljung Alcohol Free Guvee Red Wine is the Most Expensive Cold Drinks Product on Swiggy Instamart

MetricsCart data shows that the cold drinks category on Instamart is moving beyond traditional sodas into premium, health-forward, and lifestyle-driven options.

Several other alcohol-free beer and wine brands, such as Budweiser, Heineken, Jacob’s Creek, Coolberg, are in the top 10 most expensive cold drinks on Swiggy Instamart, priced between ₹392 and ₹594.

The most expensive cold drink on Swiggy Instamart is Carljung Alcohol-Free Guvée Red Wine, priced at ₹700, highlighting the growing demand for sophisticated alcohol-free alternatives.

Other premium players include Evocus Black Alkaline Drink (₹600) and The Good Bug Metabolically Lean Supercharged Edition (₹519), both tapping into wellness and functional benefits.

The pricing range (₹384–₹700) signals a tiered market strategy:

- Lifestyle Premium (₹600–₹700): Alcohol-free wines, alkaline waters

- Mid-Premium (₹480–₹520): Functional wellness beverages

- Affordable Premium (₹380–₹420): Non-alcoholic beers and mixers

Swiggy Instamart is curating its cold drinks category to attract urban consumers who see beverages as an extension of health, lifestyle, and identity.

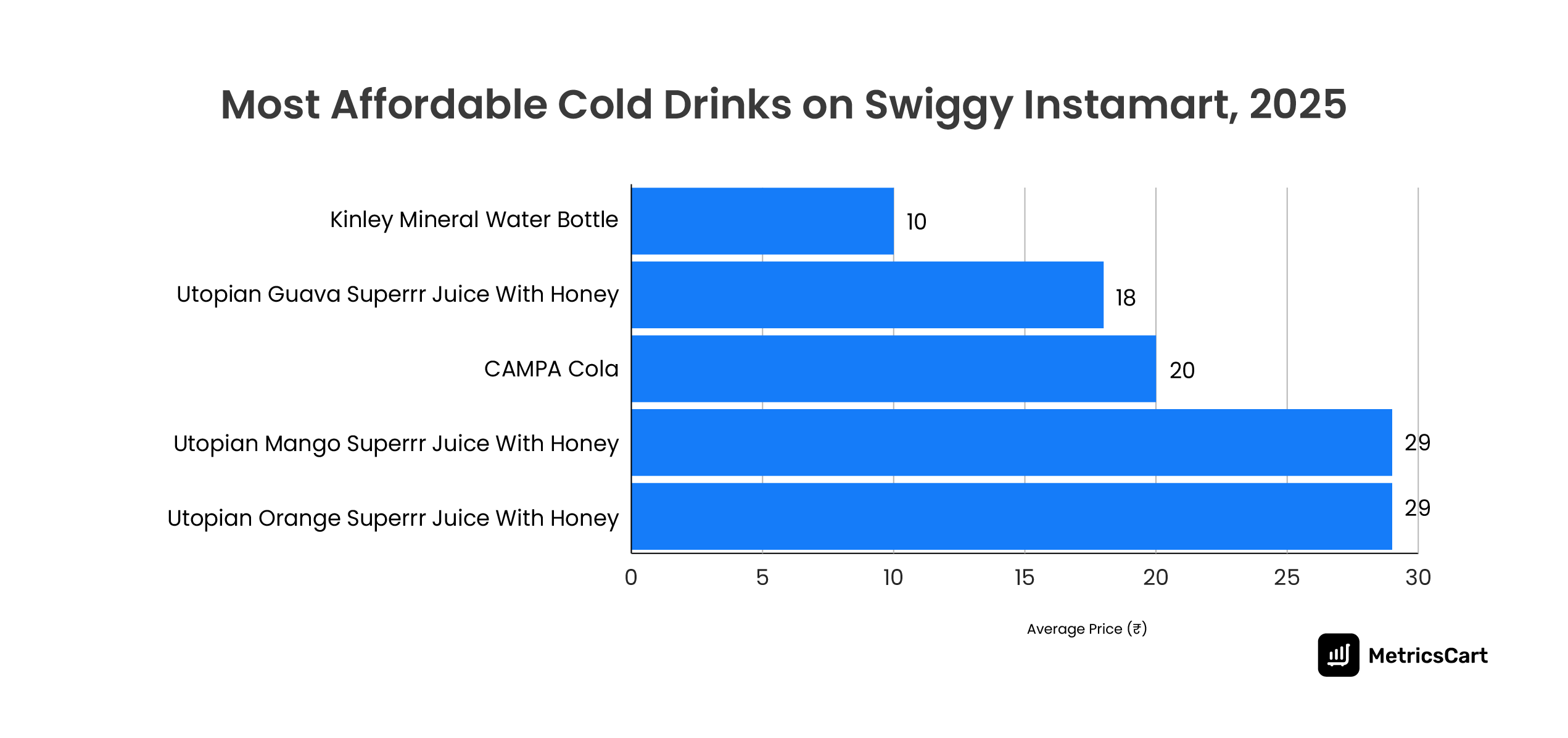

Kinley Mineral Water and Utopian Guava Superr Juice with Honey are the Most Affordable Cold Drinks on Swiggy Instamart

Swiggy Instamart isn’t just catering to premium shoppers; it also has a strong value-first segment in cold drinks, with prices ranging from ₹10 to ₹40.

Kinley Mineral Water Bottle, priced at just ₹10, is the most affordable cold drink on Instamart, acting as a traffic driver and reinforcing the value proposition for everyday essentials.

Interestingly, newer players like Utopian Superrr Juices (₹18–₹35 across guava, mango, orange, and litchi variants) dominate this segment. Their positioning of fruit-based products with added honey suggests that affordability is no longer just about colas, but also about accessible wellness-oriented options.

Traditional mass-market beverages such as Campa Cola (₹20) and Bisleri Rev Cola (₹37) ensure that Instamart appeals to a broad consumer base seeking recognizable, low-cost refreshment.

By offering both traditional value beverages and budget-friendly wellness alternatives, the platform captures mass appeal while nudging consumers toward healthier, functional categories.

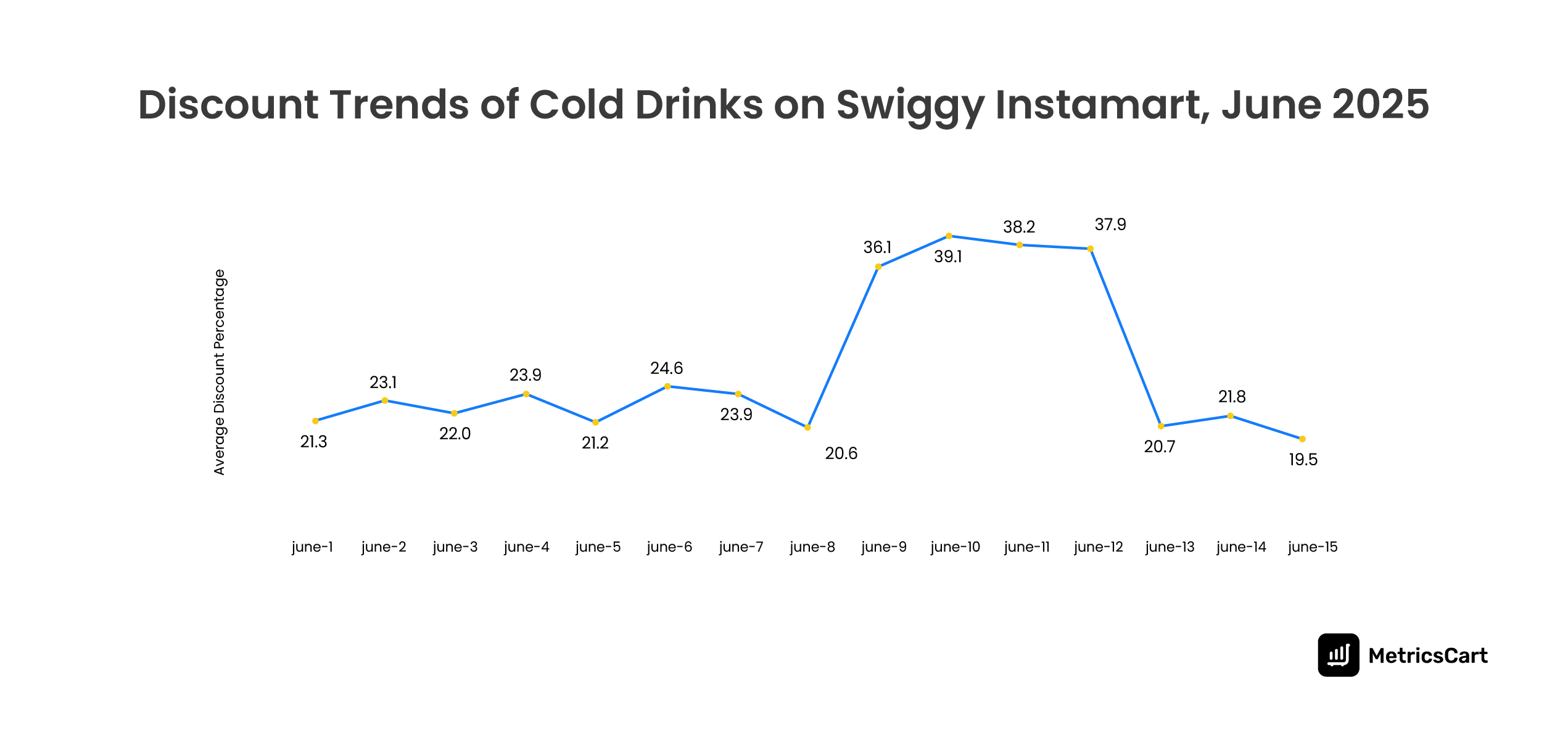

Discount Trends of Cold Drinks on Swiggy Instamart from June 1, 2025, to June 15, 2025

MetricsCart data reveals sharp discount volatility in the cold drinks category over the first half of June.

From June 1–7, discounts stayed in a narrow band of 21–25%, reflecting a stable, everyday value strategy.

A steep jump on June 9 (36.1%) peaked at 39.1% on June 10, sustaining above 37% until June 12. This three-day surge suggests a tactical promotion period to align with weekend demand, counter competitor campaigns, or drive trial for specific SKUs.

Post-promotion, discounts reset sharply to the 20–22% zone, hitting a low of 19.5% on June 15. This reversion highlights Instamart’s controlled discounting approach, which utilizes spikes to trigger demand but quickly returns to profitability-focused pricing.

Cold drinks are a high-frequency, impulse-driven category in quick commerce. Such short, high-discount bursts help Instamart capture weekend traffic and seasonal peaks, while the baseline of ~22% discounting ensures consistent value perception without eroding margins in the long term.

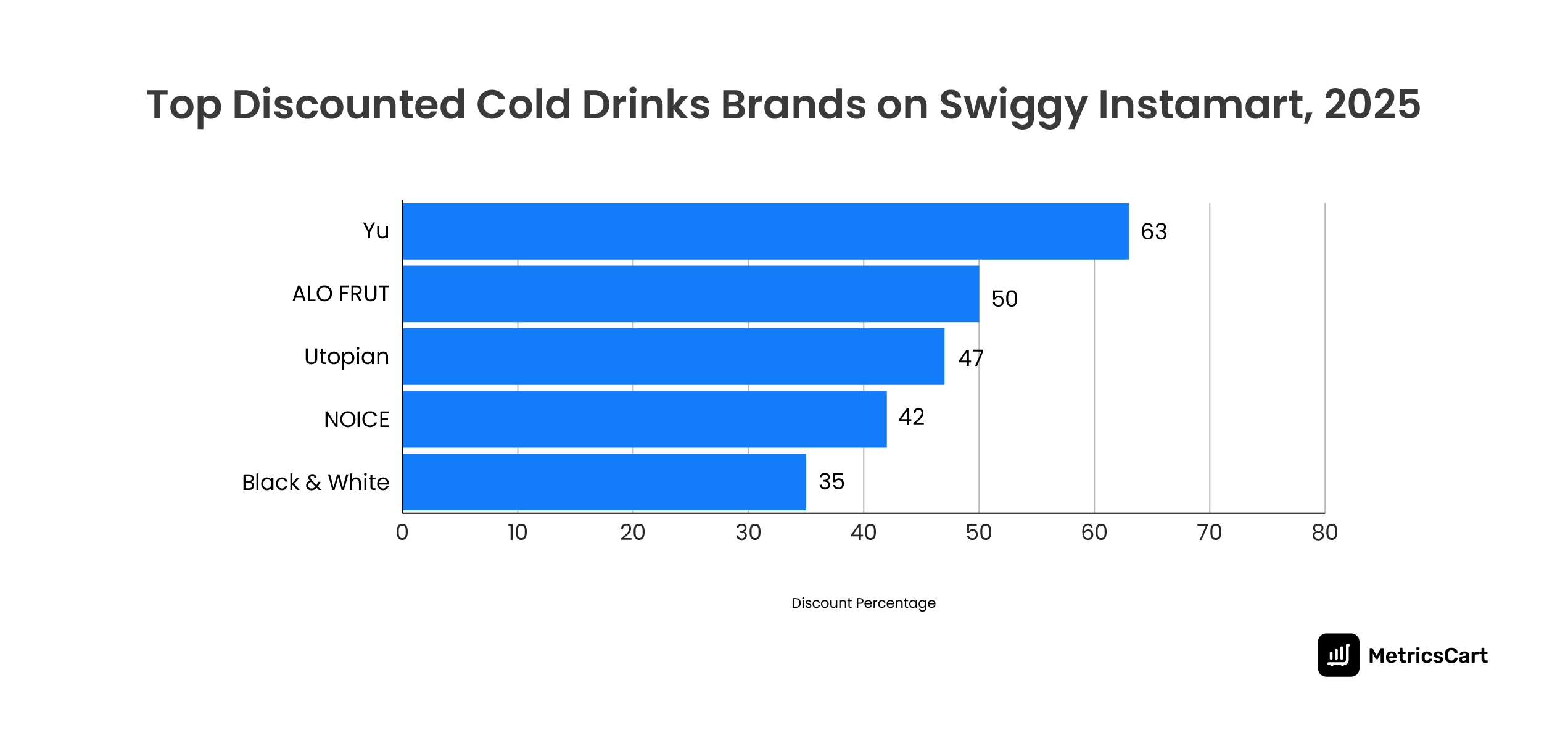

Yu and Alo Frut are the Top Discounted Cold Drinks Brands on Swiggy Instamart

MetricsCart data shows that Yu led discounting in the cold drinks category on Instamart, offering the highest average discount at 63%. ALO FRUT (50%) and Utopian (47%) followed, maintaining their competitive edge through aggressive price cuts.

Mid-tier brands like NOICE (42%) and Black & White (35%) also leaned on discounting, but not as heavily. Meanwhile, smaller players such as The Good Bug (25%), BAB LOUIE & CO. (25%), and Bartisans (24%) maintained more conservative strategies, likely focusing on niche positioning rather than broad reach through discounts.

The trend suggests that in a highly impulsive category like cold drinks on Instamart, brands with deeper discounts secure better visibility and conversion opportunities. Yu’s discount-led push indicates an attempt to capture dominant share, while niche brands are balancing margins with selective discounting to retain premium positioning.

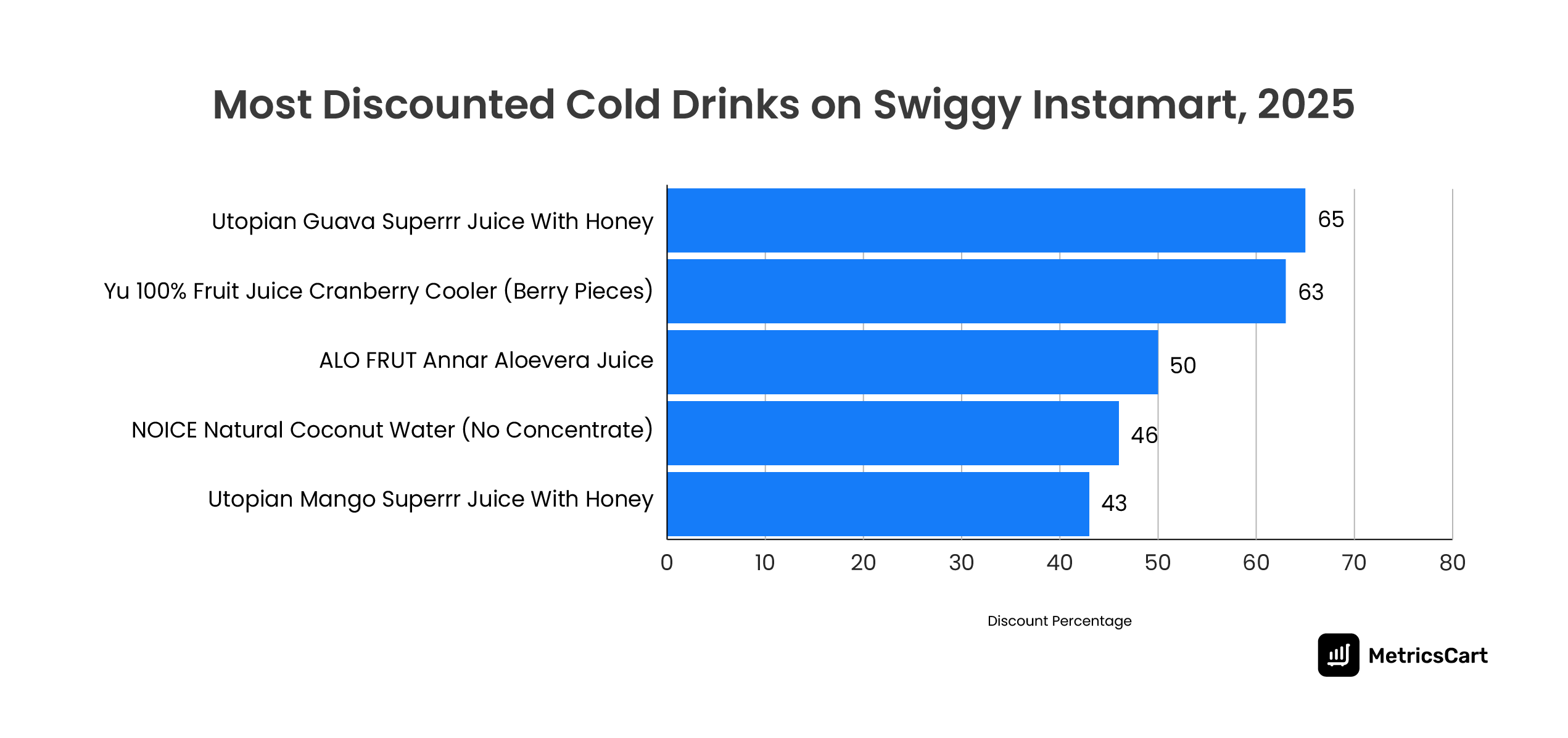

Utopian Guava Superrr Juice with Honey is the Most Discounted Cold Drink on Swiggy Instamart

Utopian’s Guava Superrr Juice With Honey recorded the highest discount at 65%, closely followed by Yu’s Cranberry Cooler at 63%. This aggressive discounting suggests a deliberate effort by both brands to capture visibility in a category where impulse purchases are prevalent.

ALO FRUT (50%) and NOICE Coconut Water (46%) also feature prominently, balancing value-driven appeal while retaining some pricing strength. Utopian’s multiple SKUs (Mango, Litchi, Orange juices) fall in the 41–43% discount range, suggesting a portfolio-wide strategy to build trial and repeat purchases across flavors.

The trend underlines that in Swiggy Instamart cold drink categories, brands with high promotional intensity secure a stronger share of digital shelf visibility and impulse conversions.

Final Thoughts

Cold drinks on Instamart reflect more than just thirst-quenchers; they capture how consumers shop for convenience, indulgence, and value in real time. From affordable ₹10 sodas to premium functional beverages, the category is shaped by assortment breadth, rapid availability, and tactical discounting that drives impulse as much as loyalty.

Whether it’s traditional cola brands maintaining their share through ubiquity or newer entrants winning trials with innovation and health cues, the digital shelf clearly rewards products that balance visibility, price, and trust.

For brand managers, agencies, and category leads, these insights extend beyond SKUs and discounts; they offer a window into shifting preferences, demand cycles, and the strategies that drive conversions in quick commerce.

At MetricsCart, we turn Instamart and other quick commerce data into actionable insights — helping brands uncover opportunities they didn’t know they had, strengthen their marketing mix, and guide product development with confidence.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Want To Skyrocket Your Quick Commerce Sales?