On a hot afternoon in Delhi, a chilled jeera soda now arrives faster than the time it takes to mix one at home. In Mumbai, students are ordering canned bubble teas between lectures. Across Bengaluru’s gyms, protein-packed cold coffees are becoming a staple favorite.

These small, everyday choices reveal a bigger story: India’s ready-to-drink beverage market is an FMCG category that is undergoing a massive transformation, fueled by the rise of quick commerce.

This article explores the drivers behind this surge; why Indians are reaching for RTDs more than ever, how brands are winning on quick commerce, why these platforms have become the primary growth engine, and what the future of the ready-to-drink market in India looks like.

Why Are Indians Reaching for Ready-to-Drink Beverages?

The rising popularity of RTDs in India is not just about convenience. It reflects deeper lifestyle shifts, aspirational consumption, and cultural rediscovery. From urban professionals looking for quick energy fixes to families embracing packaged ethnic drinks, RTDs are now part of India’s daily rhythm.

Market Size, Growth, and Projections

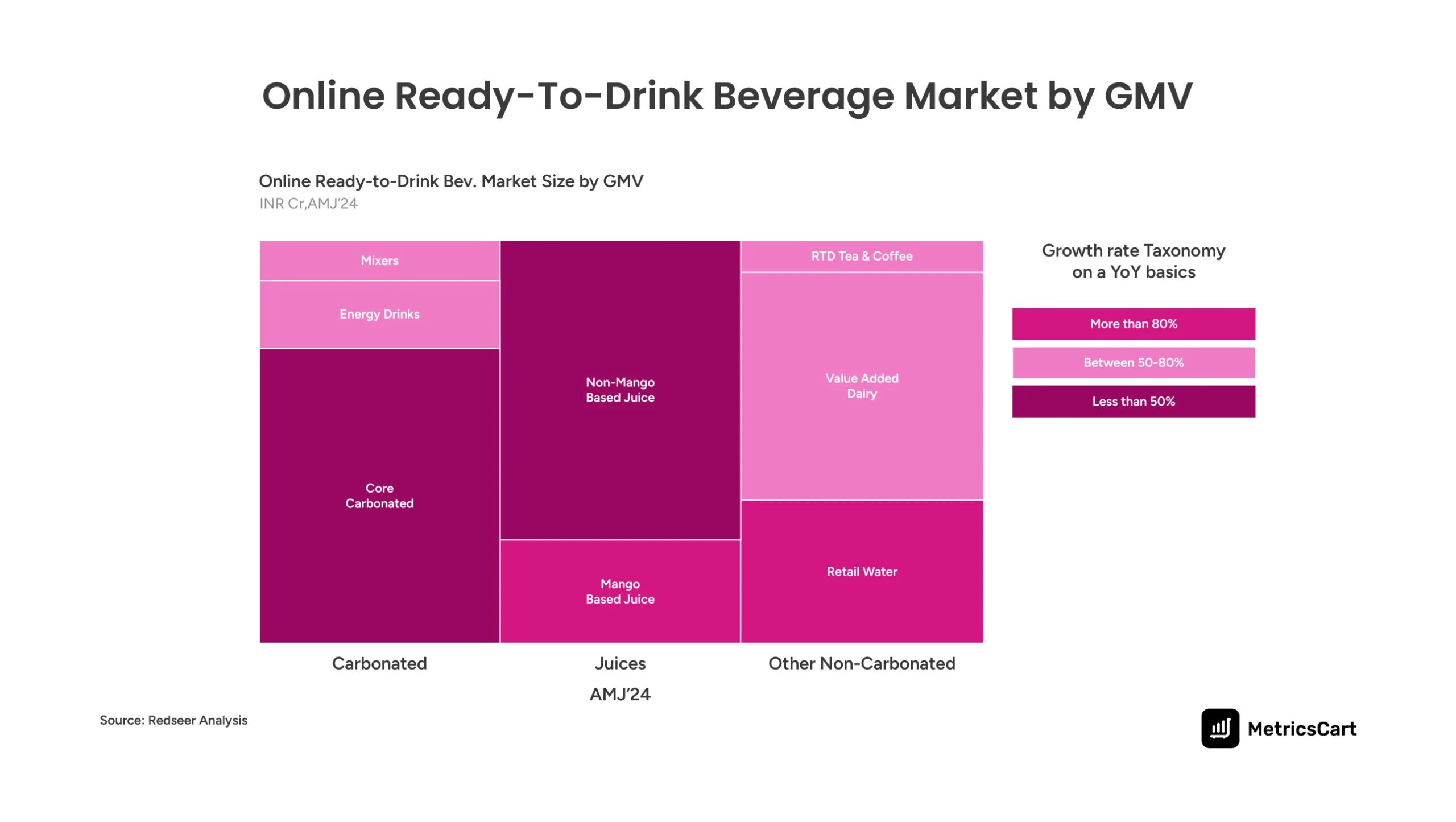

In 2024 alone, online RTD beverage sales in India grew by 52% year-on-year, reaching $121 million in GMV. What’s more striking is that 57% of this growth came from quick commerce platforms like Blinkit, BigBasket Now, Zepto, and Instamart. That’s not just growth; it’s a fundamental reset of how Indians discover, buy, and consume beverages.

Globally, the RTD category is worth $766.7 billion in 2024, with forecasts pointing to $1.23 trillion by 2032.

Key Segments: Carbonated, Non-Carbonated, and Functional RTDs

While carbonated drinks still hold relevance, the real momentum lies elsewhere. Non-carbonated beverages such as juices, iced teas, cold coffees, and flavored waters are growing rapidly, with some categories seeing over 70% growth online in 2024.

Functional RTDs like protein shakes, fortified dairy, and probiotic drinks are also gaining traction, signaling a shift from RTDs as just refreshers to RTDs as lifestyle choices.

The Shift Toward Health, Wellness, and Ethnic Flavors

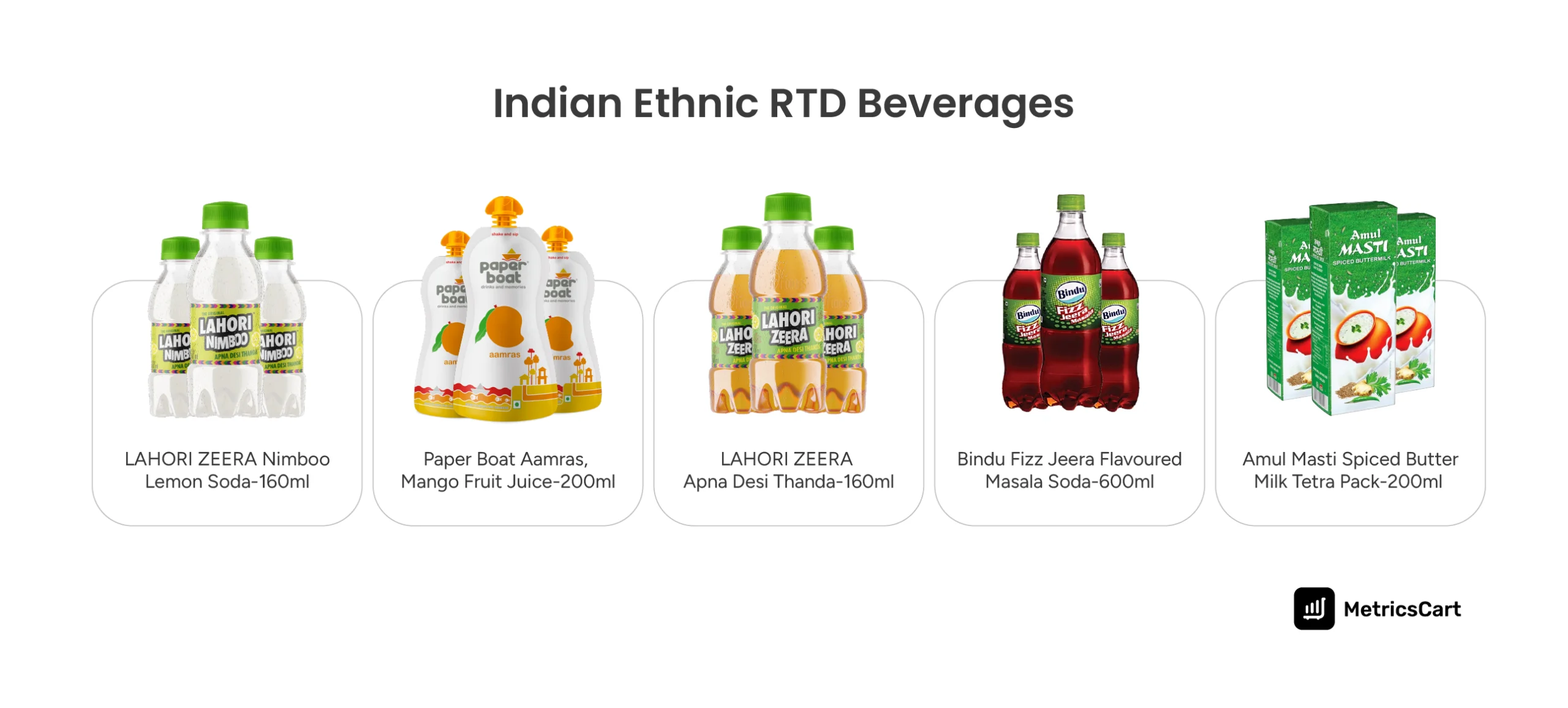

What makes the RTD beverages’ Indian market particularly unique is its dual demand curve. On one end, there’s a push for health and wellness, with consumers demanding less sugar and more nutrition. Coconut water, kombucha, and protein coffees are filling this need. On the other end, there’s a revival of ethnic favorites like jeera soda, aam panna, and masala buttermilk.

Brands like Paper Boat, Lahori Zeera, and Bindu Fizz have shown how nostalgia, when paired with modern packaging and distribution, can compete head-on with multinational cola giants. RTDs in India are not only about modern convenience, they’re about identity and memory, bottled for today’s consumer.

READ MORE | Learn How to Build a Brand on Quick Commerce: A Step-by-Step Guide for E-Commerce and Brand Teams

How Brands Are Winning with RTD Beverages on Quick Commerce?

Quick commerce has turned into the launchpad and battleground for FMCG brands in the RTD category. Unlike traditional retail, where shelf resets and distribution take months, q-commerce allows brands to test and scale faster.

The Ethnic Beverages Comeback: Jeera Soda, Shikanji, and Aam Panna

Ethnic RTDs are among the biggest beneficiaries of this shift. Lahori Zeera, once sold only regionally, leveraged q-commerce platforms for national distribution, scaling rapidly with affordable ₹10 SKUs. Similarly, Bindu Fizz has carved its space as a youth-first challenger brand, positioning itself as a local alternative to Coke and Pepsi.

Innovative Formats: Canned Bubble Tea and Protein Dairy Drinks

Innovation has also taken new forms. Boba Bhai, for instance, launched canned bubble teas on Blinkit and Zepto, tapping into the growing youth bubble tea craze. Their goal: 20% of sales from q-commerce channels within the first year.

Meanwhile, brands like Storia are catering to wellness-centric consumers with coconut water and high fruit content shakes. Yoga Bar has also come up with fortified protein shakes and cold coffee brews, aligning with fitness and wellness trends.

FMCG Challenger Brands as Category Leaders

What these stories illustrate is that quick commerce has leveled the playing field. Challenger brands now stand shoulder to shoulder with global giants in consumer searches. Every product launch becomes a live experiment, with conversion data available in real time. In the ready-to-drink market in India, q-commerce is no longer just a channel; it is the ecosystem where these brands are forging strong category leadership.

Why Is Quick Commerce The Growth Engine for RTD Beverages?

The RTD boom in India cannot be understood without quick commerce. These platforms have fundamentally changed why, when, and how consumers buy beverages.

Consumer Behavior and Preferences in RTD on Quick Commerce

Consumers are no longer stocking up on beverages during weekly shopping runs. Instead, they’re making impulse, top-up purchases: a cold coffee mid-workday, a soda late at night, or a lassi after lunch.

With the rise of a hybrid work culture, especially in tier 1 cities, quick commerce has turned beverages into real-time consumption choices rather than pre-planned buys.

In episode 23 of the Digital Shelf Insider by MetricsCart, Yashita Shah, Founder Partner at Online Dukaan, decodes ground-level insights into the explosive rise of quick commerce in India. Watch the full episode here:

Role of Blinkit, Zepto, Instamart, and Other Q-Commerce Channels

These platforms act as curators of consumption, not just logistics players. Through retail media and first-screen placements, they decide which drink gets noticed first. For RTD brands, winning this digital shelf is equivalent to winning premium placement in a supermarket.

Plus, once only locally available, these FMCG challenger brands find quick commerce as the catalyst for pan-India brand visibility.

SKU Expansion, Trial Packs, and Retail Media Promotions

Quick commerce also offers unlimited shelf space, allowing for SKU diversity and rapid experimentation. A new ₹99 trial pack can be launched in days and tested with live conversion data. Retail media campaigns allow brands to dominate search results and homepage banners, recreating the shelf wars of offline retail in a digital format.

Seasonal Patterns: Lassi, Coconut Water, and Iced Tea Trends

RTD demand on q-commerce is also highly seasonal. Summer months see spikes in buttermilk, coconut water, and aam panna, while iced teas and cold brews remain consistent year-round favorites. Unlike offline retail, q-commerce can adjust assortments instantly, becoming a seasonal amplifier.

Price-per-Litre Dynamics and Impulse Buying Pattern

Smaller packs dominate q-commerce. Though they are more expensive per litre, consumers view them as affordable luxuries. Paying ₹40 for a cold coffee delivered in 10 minutes feels justified, even if it’s pricier than a 1.5L bottle. This pricing model not only fuels impulse buying but also ensures better margins for brands.

READ MORE | Here are the Top 5 Quick Commerce Challenges in India and How to Tackle Them.

Future of RTD Beverages on Quick Commerce India

Clearly, by now, we know that the trajectory for the ready-to-drink beverage market in India is closely tied to the evolution of quick commerce.

According to Redseer, online RTD sales are expected to cross ₹5,000 crore (~$600M) by 2025, with q-commerce driving over 60% of this growth.

Functional RTDs like protein shakes, fortified dairy, probiotic shakes, and yogurts are expected to grow, fueled by younger, health-conscious consumers. Plus, we can also expect a growth in RTD tea and dairy-based drinks with the growing online retail presence.

Sustainability will be another key driver. With rising eco-awareness, consumers will favor brands that adopt recyclable packaging, biodegradable cartons, or resealable bottles. Globally, Asia-Pacific already accounts for over 35% of the RTD market, positioning India to emerge as a regional hub for innovation and scale.

The future of the ready-to-drink market in India will therefore not only be about flavors but also about formats, sustainability, and the ability to move at the speed of consumer demand

Win The Shifting Consumption Culture

The RTD beverages India market is no longer just about quenching thirst; it’s about lifestyle, purpose, and immediacy. From ethnic sodas like jeera and shikanji to modern innovations like bubble teas and protein shakes, RTDs have become part of India’s daily consumption culture. And quick commerce is the engine powering this transformation.

For FMCG brands, the implication is clear: if you want to capture growth in the ready-to-drink beverage market, your strategy must be designed around quick commerce. Winning the digital shelf, investing in ads, leveraging seasonal playbooks, and constantly innovating are no longer optional; they are survival strategies.

At MetricsCart, we specialize in decoding quick commerce performance with pricing intelligence, stock availability, and SERP monitoring across major quick-commerce platforms like Blinkit, Zepto, and Instamart. You can also check out our quick commerce daily trends dashboards to stay up-to-date.

If you want to see how your RTD portfolio is performing in the quick commerce space, get in touch to book a walkthrough today!

Ready To Fuel Your Quick Commerce Growth?

FAQs

According to Fortune Business Insights, the global ready-to-drink beverages market was estimated at $766.69 billion in 2024 and is expected to expand steadily, reaching $804.87 billion in 2025. By 2032, the market is projected to grow to $1,227.81 billion, reflecting a compound annual growth rate (CAGR) of 6.22% over the forecast period.

Any packaged drink designed for immediate consumption without preparation; examples include sodas, juices, iced teas, buttermilk, coconut water, protein shakes, and bubble teas.

They align with India’s urban convenience culture, rising health focus, and the instant gratification enabled by quick commerce platforms.

Many are. Functional RTDs like probiotic dairy, cold brew coffee, and coconut water offer healthier alternatives, though carbonated soft drinks still hold strong mass-market appeal.

The fastest movers include jeera sodas, cold coffees, iced teas, coconut water, protein shakes, and bubble teas.