About the report: This Digital Shelf Insights (DSI) report provides an in-depth analysis of Banana Boat marketing strategy and business model, focusing on its performance on Amazon and Walmart.

Drawing from MetricsCart’s digital shelf platform, pricing trends, review analytics, and assortment details from 20 August 2025 to 29 August 2025, the report examines Banana Boat’s approach to category leadership, pricing accessibility, consumer trust, and marketplace dynamics.

Introduction

The global sun care products market size was valued at $14.90 billion in 2024 and is projected to reach $22.28 billion by 2032.

The sunscreen category is undergoing a transformation, fueled by the clean beauty movement and the demand for multi-functional products that combine SPF with skincare benefits like anti-aging, hydration, and blue light protection.

Consumers are increasingly adopting reef-safe, mineral-based, and eco-friendly formulations, while the use of plant-based UV filters and eco-certified ingredients continues to expand.

Among the many brands competing in this category, Banana Boat stands as one of the most recognized names worldwide, holding 13% of the market share. Founded in 1978, the brand has long positioned itself as a family-friendly, outdoor-oriented sunscreen, combining accessibility with trusted protection.

In 2025, Banana Boat continues to dominate both Amazon and Walmart, leveraging a mix of trusted formulations, clear branding, and competitive pricing to maintain shelf leadership in an increasingly crowded digital marketplace.

Highlights

- The average price of Banana Boat suncare on Walmart is $53.06, while on Amazon it’s $13.02.

- Amazon drives nearly 8x higher weekly unit sales than Walmart.

- Less than 10% of Banana Boat listings are sponsored across both platforms.

- Sport Ultra SPF 30 Sunscreen Lotion, 8oz, is the most reviewed Banana Boat product on Amazon

- Sport Ultra Sunscreen Spray Twin Pack, SPF 50, 6 oz is the most reviewed Banana Boat product on Walmart.

Behind the Brand: From Beachside Origins to Global Recognition

Banana Boat began as a beachside favorite in Florida and grew into a global brand synonymous with sun protection. Owned by Edgewell Personal Care, the brand was founded in 1976 by Robert Bell, who noticed a gap in the market for effective yet gentle sun protection for families.

Originating from Bell’s passion for safe sun care, Banana Boat quickly became a household name across the US.

How Has Banana Boat’s Marketing Strategy Evolved?

Since its launch, Banana Boat has become one of the most recognizable names in sun care, growing its market share through a marketing strategy centered on innovation, family-oriented branding, and strong retail partnerships.

Its early success stemmed from making SPF protection family-friendly and accessible, turning sunscreen into a daily essential rather than a luxury item.

Banana Boat’s marketing strategy promotes a “fun-in-the-sun for the active family” image, positioning the brand as both reliable and approachable. This message is reinforced through experiential promotions such as sweepstakes, outdoor event sampling, and radio tie-ins, helping the brand stay visible throughout the seasonal suncare cycle.

From TV and beachside campaigns in the 1980s to digital storytelling today, it has consistently marketed around “fun in the sun without fear.” In recent years, Banana Boat marketing has shifted toward:

- Dermatologist-tested and reef-safe positioning

- Family-oriented visuals emphasizing protection for all ages

- Seasonal promotions aligned with travel and outdoor trends

- Product diversification into sport, kids, and after-sun segments

Banana Boat’s long-term success lies in balancing nostalgia with modern wellness trends but on the digital shelf, execution across platforms tells a different story.

Banana Boat Assortment Strategy: Broader on Walmart, Sharper on Amazon

Banana Boat adopts distinct marketplace strategies for Walmart and Amazon, optimizing its product presence based on each platform’s shopper profile and search behavior.

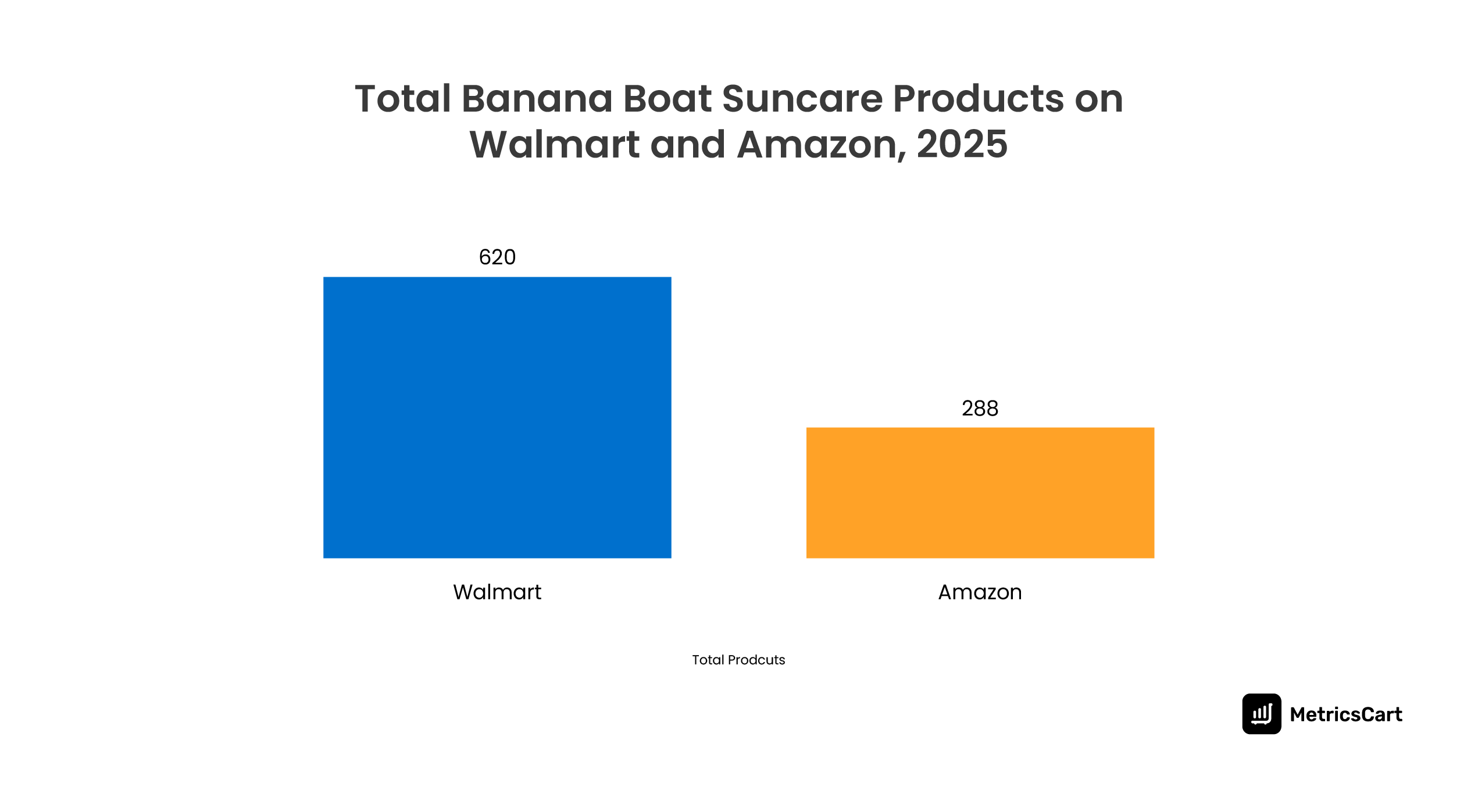

Banana Boat’s product assortment strategy varies across platforms:

- Banana Boat suncare on Walmart hosts 620 Boat products, which is more than double Amazon’s count.

- Amazon lists 288 SKUs, reflecting a more curated product mix.

This distribution highlights Banana Boat’s retail-specific differentiation. On Walmart, Banana Boat takes a broad-portfolio approach, showcasing its full suncare range to niche segments. This helps the brand maintain visibility across diverse seasonal and family-oriented shoppers who rely on Walmart for value-driven purchases.

Conversely, Banana Boat suncare on Amazon has a sharper and performance-led assortment strategy, focusing on top-selling SKUs and variants with consistent demand.

In essence, Walmart acts as Banana Boat’s product assortment anchor, capturing diverse shopper needs through extensive SKUs, whereas Amazon functions as its conversion engine, emphasizing bestseller visibility and faster purchase decisions.

Banana Boat Sales Performance: Amazon Outshines in Demand

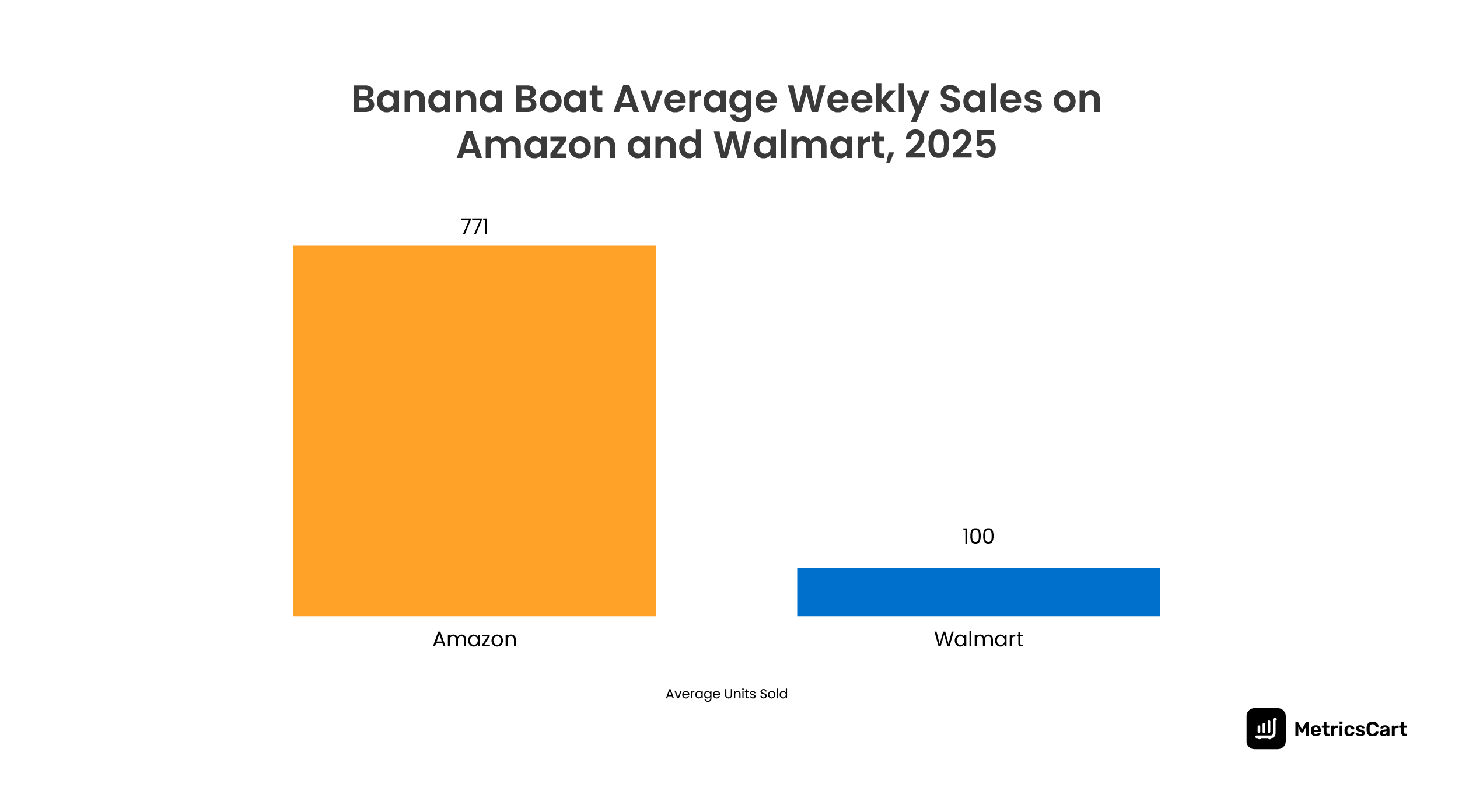

Despite listing fewer SKUs on Amazon, Banana Boat records substantially higher sales on the platform compared to Walmart.

The MetricsCart app shows that during the tracking period between August 20, 2025, and August 29, 2025:

- Amazon: 771 average weekly units sold

- Walmart: 100 average weekly units sold

This indicates that Banana Boat’s Amazon assortment, while leaner, delivers nearly 8x the sales volume of its Walmart lineup.

Banana Boat’s suncare brand strategy signals that Amazon is its demand engine, while Walmart is its reach driver. Maintaining a focused Amazon assortment helps the brand maximize conversions, ratings, and repeat buys. In contrast, Walmart continues to serve as a discovery channel for new customers exploring Banana Boat’s extended product range.

Banana Boat Sponsored vs. Non-Sponsored Listings: Underutilized Ad Potential

While Banana Boat enjoys a strong shelf presence across both Amazon and Walmart, its advertising footprint remains limited, indicating missed opportunities to scale visibility and conversion.

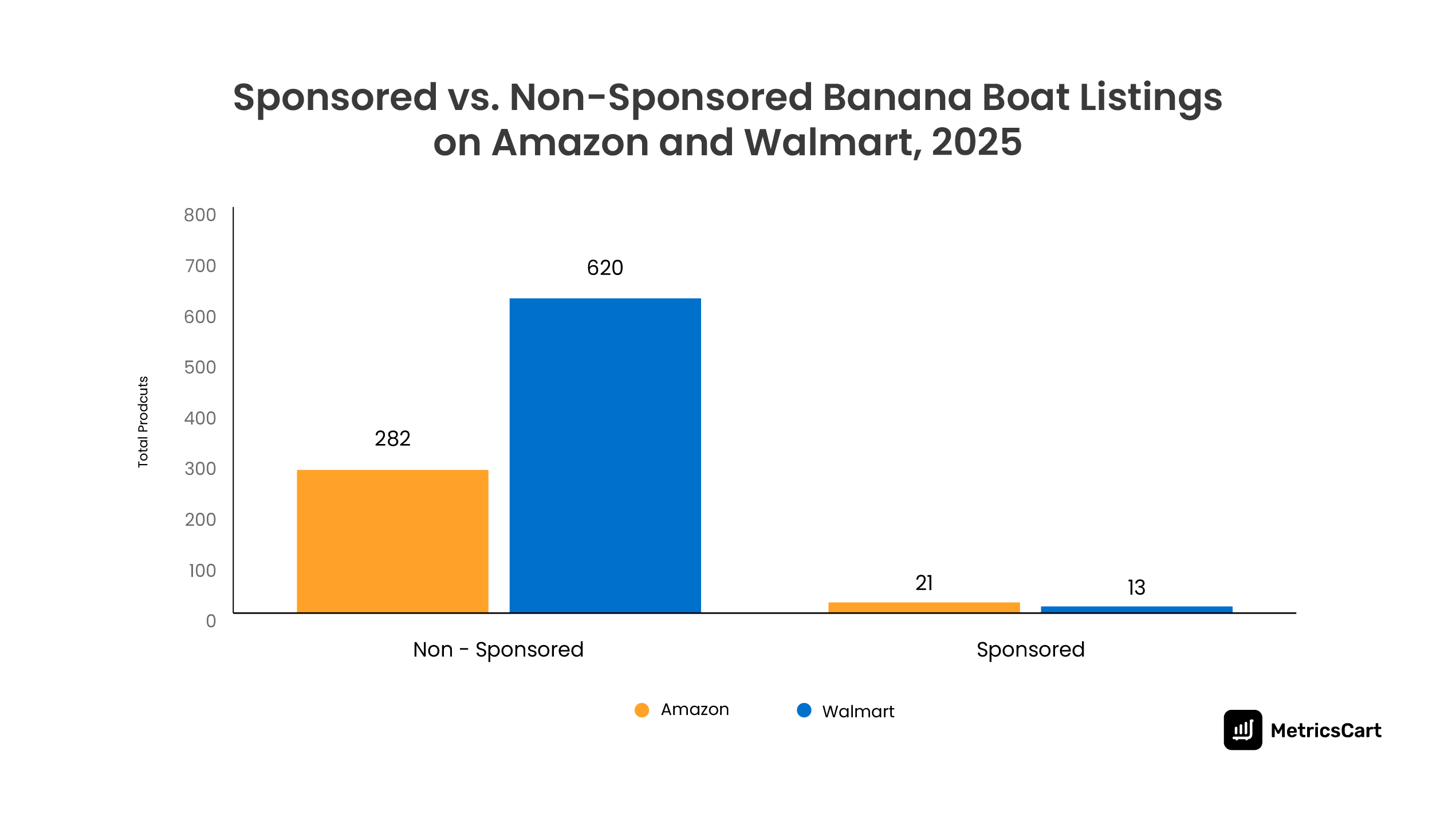

Based on the MetricsCart study, the research team found that Banana Boat suncare on Amazon has 282 non-sponsored listings vs. only 21 sponsored products. On the other hand, Walmart listings contain 620 non-sponsored and 13 sponsored products.

In both marketplaces, less than 10% of Banana Boat’s catalog benefits from paid visibility. Banana Boat’s lean investment in sponsored placements contrasts with the category norm, where top-performing sun care brands actively leverage ads to secure high-ranking spots in search results.

Banana Boat Pricing Strategy: Accessibility Wins the Shelf

Banana Boat maintains a dual-tier pricing strategy across Amazon and Walmart, reflecting the distinct product mix and shopper behavior of each marketplace.

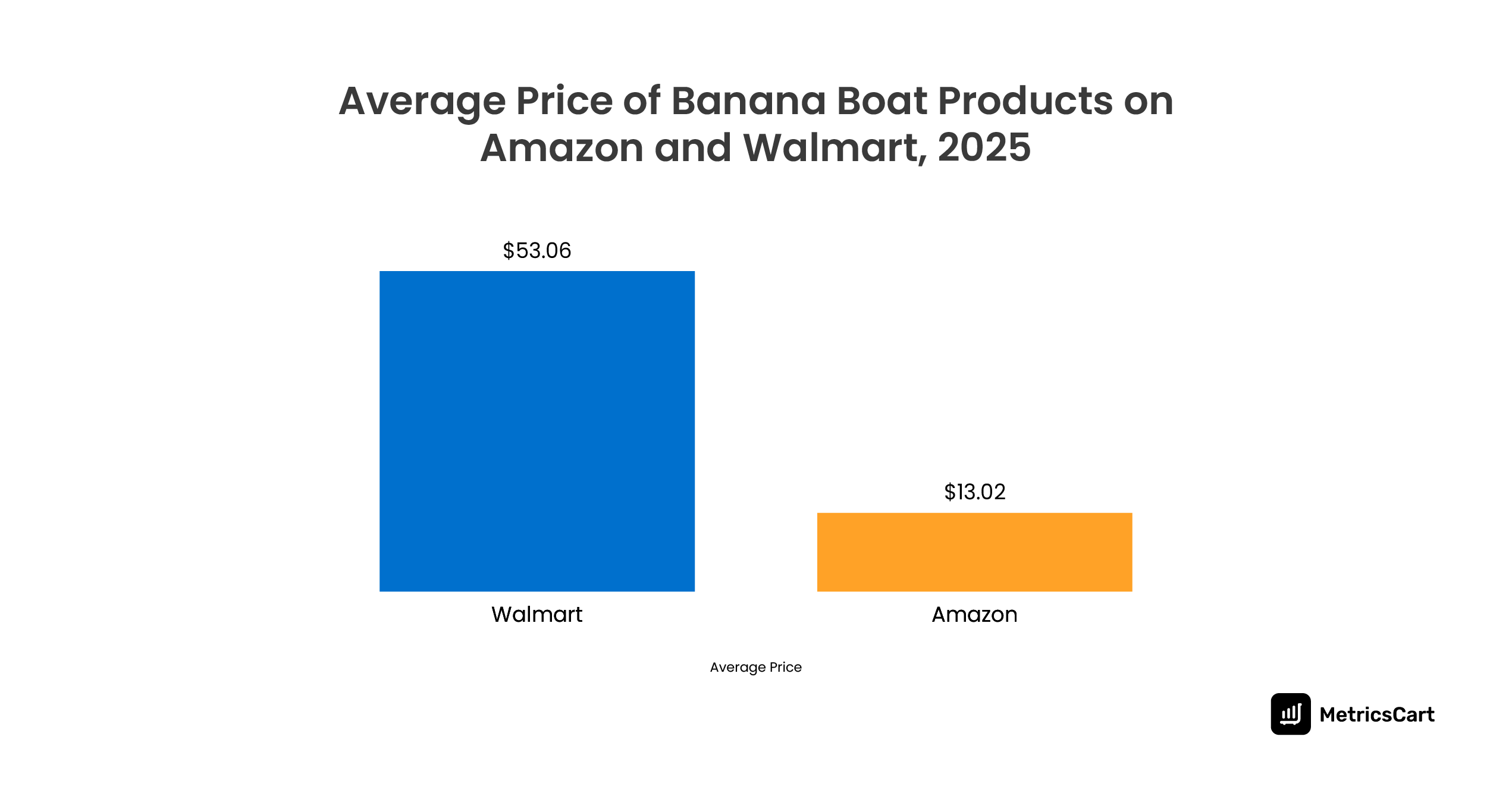

The average price of Banana Boat suncare on Amazon is $13.02, while on Walmart, it is $53.06. This significant price gap highlights how the brand tailors its offering to fit each platform’s role within its overall retail ecosystem.

Banana Boat’s Amazon pricing strategy leans toward accessibility and volume. The lower average reflects a focus on core SKUs positioned for frequent replenishment and competitive price visibility.

In contrast, a higher average price of Banana Boat suncare on Walmart indicates a broader mix of multipacks, family bundles, and large-format products. These higher-value SKUs support bulk buying behavior common among family-oriented and seasonal shoppers on the platform.

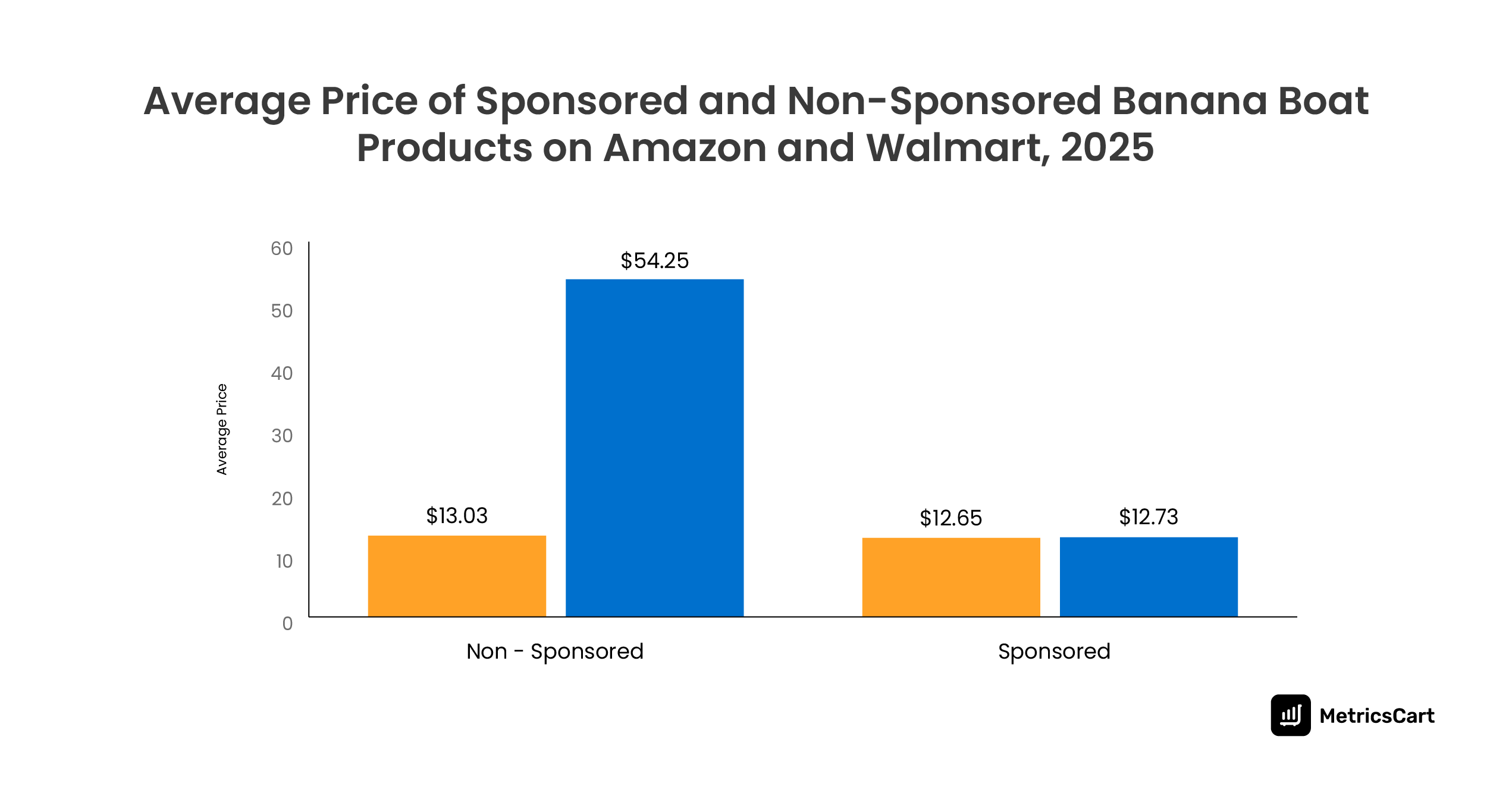

While looking into the sponsored and non-sponsored Banana Boat suncare on Amazon and Walmart, we found out that ad investments are concentrated around affordable, high-velocity SKUs, especially on Amazon.

Banana Boat’s sponsored products cluster around the $12–$13 range on both platforms, suggesting a deliberate focus on mass-market, fast-moving SKUs—such as core sprays and lotions that drive frequent purchases.

The stark contrast appears in non-sponsored listings, where Walmart’s higher average price ($54.25) indicates a heavy presence of premium bundles and multipacks that remain organically listed, with minimal advertising support.

On Amazon, the marginal difference between sponsored and non-sponsored prices signals that pricing alone doesn’t dictate ad selection; instead, the focus is likely on reinforcing existing bestsellers to maintain dominance in search visibility.

Banana Boat Ratings & Reviews: The Trust Gap Between Amazon and Walmart

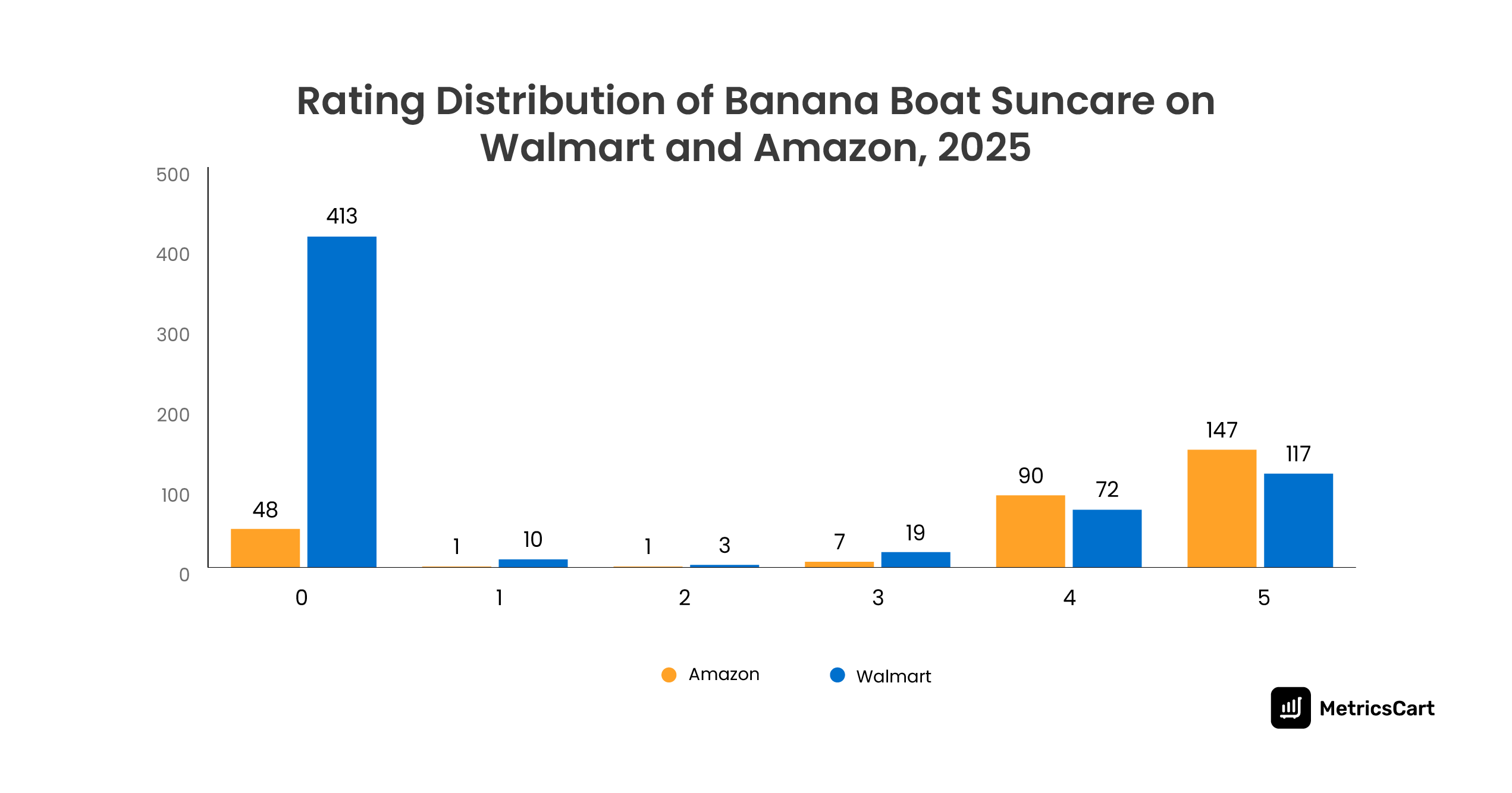

Banana Boat’s review landscape shows a sharp divide between Amazon’s strong consumer engagement and Walmart’s underreviewed assortment. While both platforms feature high-rated products, a significant share of Walmart listings remain unrated—limiting shopper confidence and visibility in search rankings.

On Amazon, Banana Boat’s reviews are more evenly distributed, with the majority of rated SKUs falling in the 4–5 star range, signaling strong shopper trust and consistent satisfaction. This reflects Amazon’s mature review ecosystem, where verified purchases and high engagement levels amplify visibility and conversion rates.

In contrast, Walmart’s catalog has a large number of unrated SKUs (413)—likely driven by its broader assortment strategy. Many of these could be newly listed or low-velocity SKUs that haven’t yet gained shopper traction. This lack of review density reduces discoverability in Walmart’s search algorithms, where ratings are a key factor for ranking and shopper confidence.

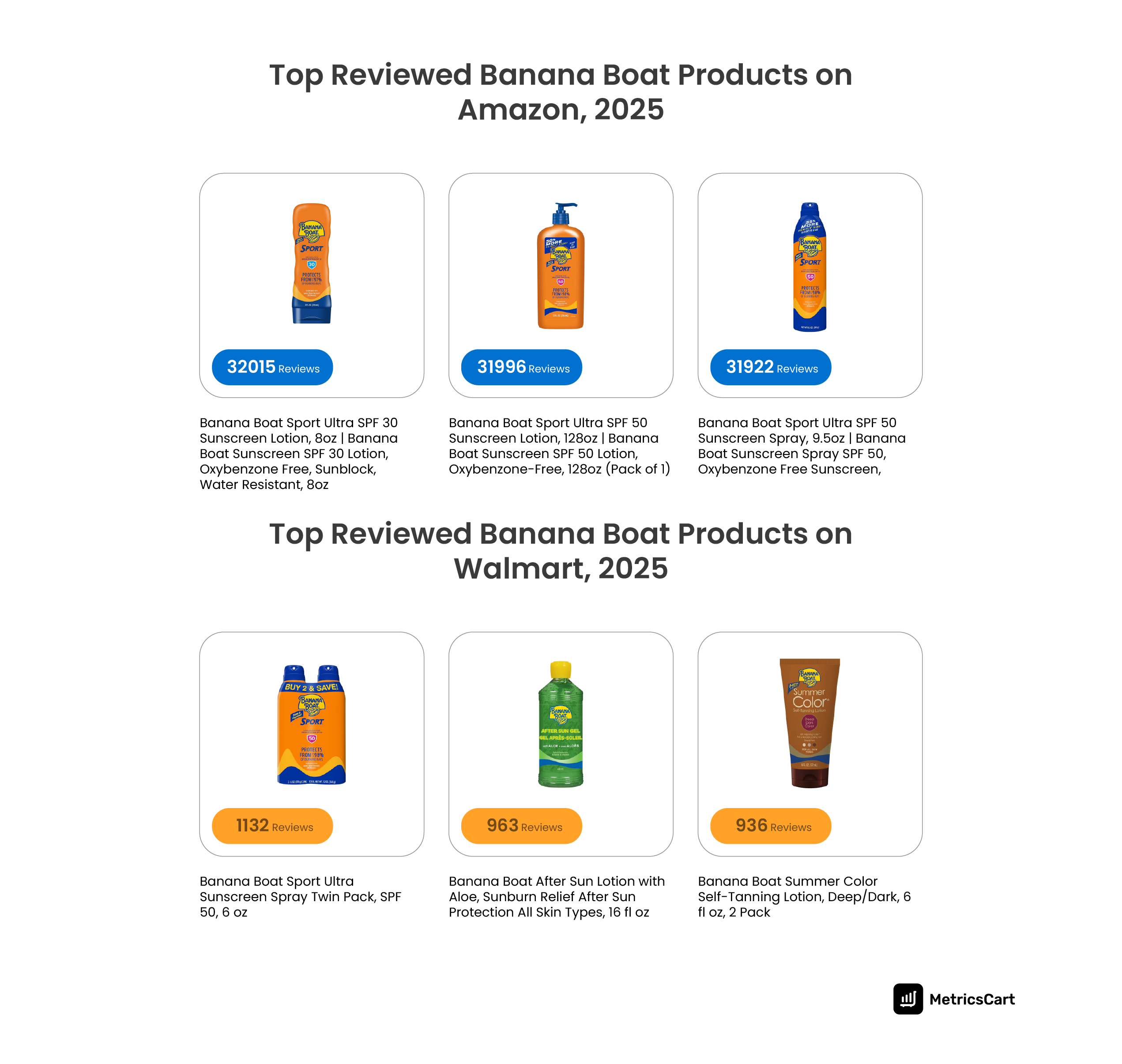

Top Reviewed Products: Sport Ultra Remains the Star on Amazon & Walmart

Banana Boat’s Sport Ultra lineup continues to anchor the brand’s digital shelf visibility across both Amazon and Walmart, driven by consistent shopper trust in its water-resistant, high-performance formulas.

While Amazon leads with exceptionally high review volumes, Walmart’s engagement is steady but more evenly spread across adjacent categories like after-sun care and self-tanning.

The Sport Ultra range dominates Amazon’s review charts, reflecting its stronghold in the outdoor and family-use sunscreen segment:

- Banana Boat Sport Ultra SPF 30 Sunscreen Lotion, 8oz – 32,015 reviews

- Banana Boat Sport Ultra SPF 50 Sunscreen Lotion, 128oz – 31,996 reviews

- Banana Boat Sport Ultra SPF 50 Sunscreen Spray, 9.5oz – 31,922 reviews

The Sport Ultra range consistently leads in shopper engagement, reinforcing Banana Boat’s stronghold in the active lifestyle sunscreen category. On Amazon, high review counts on multiple SKUs of Sport Ultra reflect repeat purchases and strong customer trust.

While total review volumes are lower on Walmart, the Sport Ultra Spray Twin Pack still leads, followed closely by After Sun and Self-Tanning products. This variation underscores Walmart’s broader appeal across sun care subcategories, where consumers seek both protection and recovery solutions.

On the other hand, Walmart’s most reviewed SKUs reveal a more diversified consumer interest, extending beyond just SPF protection:

- Banana Boat Sport Ultra Sunscreen Spray Twin Pack, SPF 50, 6oz – 1,132 reviews

- Banana Boat After Sun Lotion with Aloe, 16 fl oz – 963 reviews

- Banana Boat Summer Color Self-Tanning Lotion, Deep/Dark, 6 fl oz (2 Pack) – 936 reviews

While review volumes are significantly lower than Amazon’s, the variety among top SKUs reflects cross-category strength—from sport sunscreens to after-sun recovery and tanning.

Banana Boat’s reviews show that while Amazon builds scale, Walmart nurtures discovery and category depth—together driving a comprehensive digital shelf footprint.

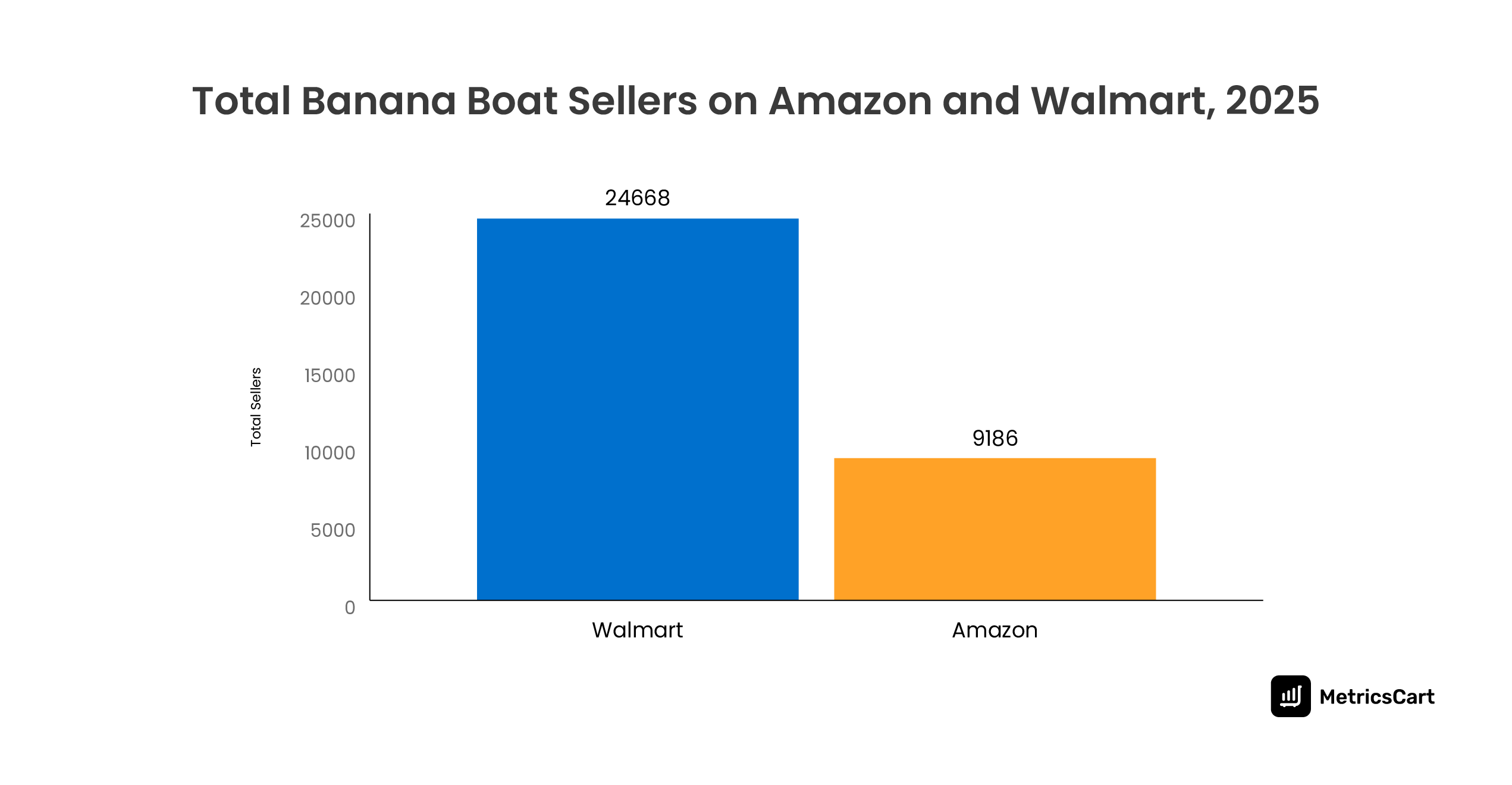

Banana Boat Seller Ecosystem: Retailer-Owned Listings Dominate Trust

Banana Boat’s listings are primarily controlled by retailer-owned entities such as Amazon.com and Walmart.com, reflecting consumer preference for official channels.

Third-party sellers contribute minimally—often limited to bundle offers or discounted bulk packs. This structured ecosystem helps Banana Boat maintain pricing integrity, stock accuracy, and brand credibility across platforms.

From Heritage to High Performance: The Road Ahead for Banana Boat

Banana Boat’s success lies in balancing accessibility with reliability: a formula that has kept it relevant for nearly five decades.

- Pricing Strategy: Affordable yet premium perception; minimal discount dependency.

- Product Range: Seasonal diversity with consistent bestsellers like Sport Ultra SPF 50.

- Consumer Trust: High engagement and loyalty among Amazon consumers.

- Brand Narrative: Family-oriented, safety-driven, and heritage-backed storytelling.

- Digital Shelf Strength: High organic ranking, though ad expansion could amplify reach.

This combination allows Banana Boat to maintain a dominant share in mass suncare while staying adaptable to evolving digital retail trends. By combining category expertise, consistent pricing, and trust-driven branding, Banana Boat continues to define what sun protection looks like for today’s omnichannel consumer.

With better ad strategy execution and proactive review management, the brand is well-positioned to remain the go-to sunscreen choice across both Amazon and Walmart.

What can CPG Brands Learn from Banana Boat Marketing Strategy?

Banana Boat proves that longevity in CPG doesn’t come from nostalgia; it comes from balance. The brand combines heritage-driven trust with data-backed precision across pricing, assortment, and reviews.

On Amazon, a focused lineup of top-rated Sport Ultra SKUs fuels visibility and conversions. On Walmart, a broader range strengthens household reach and seasonal relevance. Together, these strategies keep Banana Boat shining across every shelf—physical and digital.

For CPG brands, here’s the playbook:

- Keep pricing consistent while maintaining a premium perception.

- Tailor assortment depth by platform—focus for Amazon, expand for Walmart.

- Use reviews as both credibility and conversion tools.

- Invest in sponsored visibility to complement strong organic presence.

- Track digital shelf data continuously to align with shopper intent.

If you’re looking to build a brand that lasts like Banana Boat, MetricsCart helps you do just that.

Use MetricsCart to monitor pricing, assortment, and reviews in real time—and turn your data into decisions that drive long-term growth.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready To Take Control of Your Brand Performance?