One of the most iconic names in the global skincare market, Neutrogena’s marketing strategy is built around the synergy of scientific credibility and broad consumer accessibility.

As a subsidiary of Johnson & Johnson (acquired in 1994), the brand benefits from the global reach and innovation capacity of a healthcare giant, while maintaining its reputation as a trusted dermatologist-recommended brand.

Founded in 1930, Neutrogena initially garnered attention for its oil-free, gentle formulations and has since become synonymous with effective, everyday skincare. From traditional retail to a digital-first approach, the brand’s marketing strategy is a playbook for beauty and personal care brands.

This report is a breakdown of Neutrogena’s business model with a special focus on its Amazon presence.

About the Report

This data-driven brand performance case study aims to analyze Neutrogena’s marketing strategy as observed in Amazon’s Beauty & Personal Care category in 2025. The analysis is based on a combination of sales data, product performance metrics, and market trends for Neutrogena products on Amazon. It specifically looks at top-ranked products, monthly sales volume, category performance trends, and pricing strategies across key product segments.

We will also compare how key products, categories, and pricing strategies have shifted year-on-year to reveal actionable insights on consumer behavior and shifting market trends.

Highlights

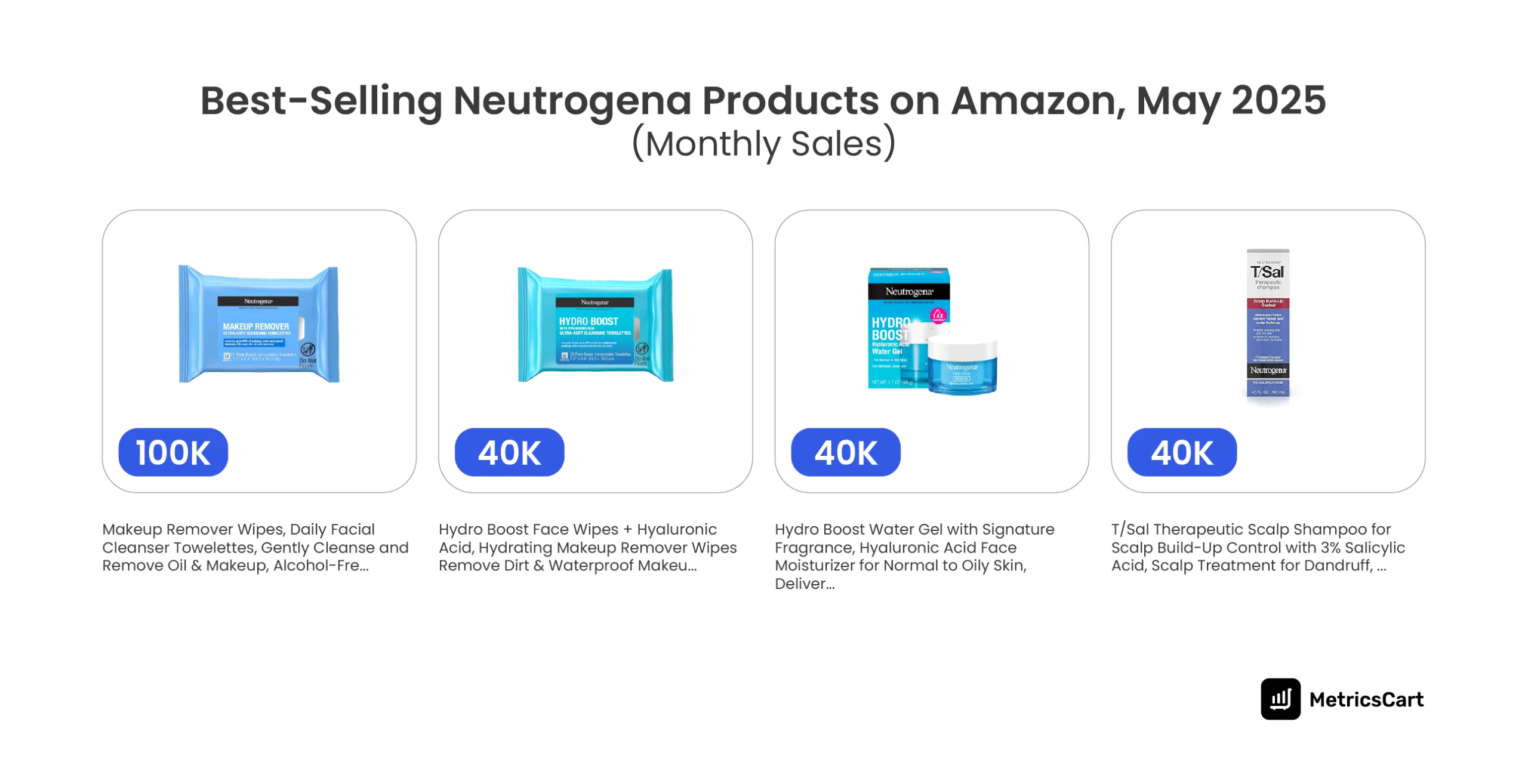

- Neutrogena’s Makeup Remover Wipes continue to dominate Amazon sales with 100K monthly sales.

- The Facial Cleansing Cloths & Towelettes category leads with the highest total monthly sales with 208 K units.

- Sunscreens have climbed from #6 in 2024 to #3 in 2025 in top categories, signaling a shift in consumer priorities toward sun protection and daily skincare.

- Neutrogena’s Face Serums have lost their spot in the top three categories in 2025, showing a decline in demand.

- Neutrogena’s Makeup Remover Wipes continue to hold high customer ratings, securing their position not only as a best-seller but also as a product with consistent consumer approval on Amazon.

Makeup Remover Wipes Are The Best-Selling Neutrogena Product with 100K Monthly Sales

It’s clear that Neutrogena has continued to capitalize on its core strengths while venturing into emerging areas. Makeup remover wipes remain the undeniable leader with nearly 100K units sold per month, solidifying their place as Neutrogena’s hero product.

This consistent top performance is crucial because wipes, as a consumable item, generate steady, predictable sales. They offer both low cost and high consumer frequency, creating a loyal customer base that continually replenishes their stock.

Following the wipes, Hydro Boost Water Gel and T/Sal Scalp Shampoo each make up around 40K monthly units, reflecting the growing demand for hydration and scalp care, respectively. The increasing popularity of scalp health products can be attributed to skinification of hair, the broader beauty trend that’s increasingly treating the scalp as part of the overall skincare routine.

This shift has given Neutrogena’s marketing strategy a unique advantage with its T/Sal Scalp Shampoo, which now ranks as a major player in the haircare category.

Compared to 2024, Neutrogena’s business model thrives on product diversification while maintaining focus on its core hero products. The strategic positioning of makeup wipes and sunscreens enables Neutrogena to stay relevant to a broad consumer base, ensuring that with category expansion, the foundational products continue to perform reliably.

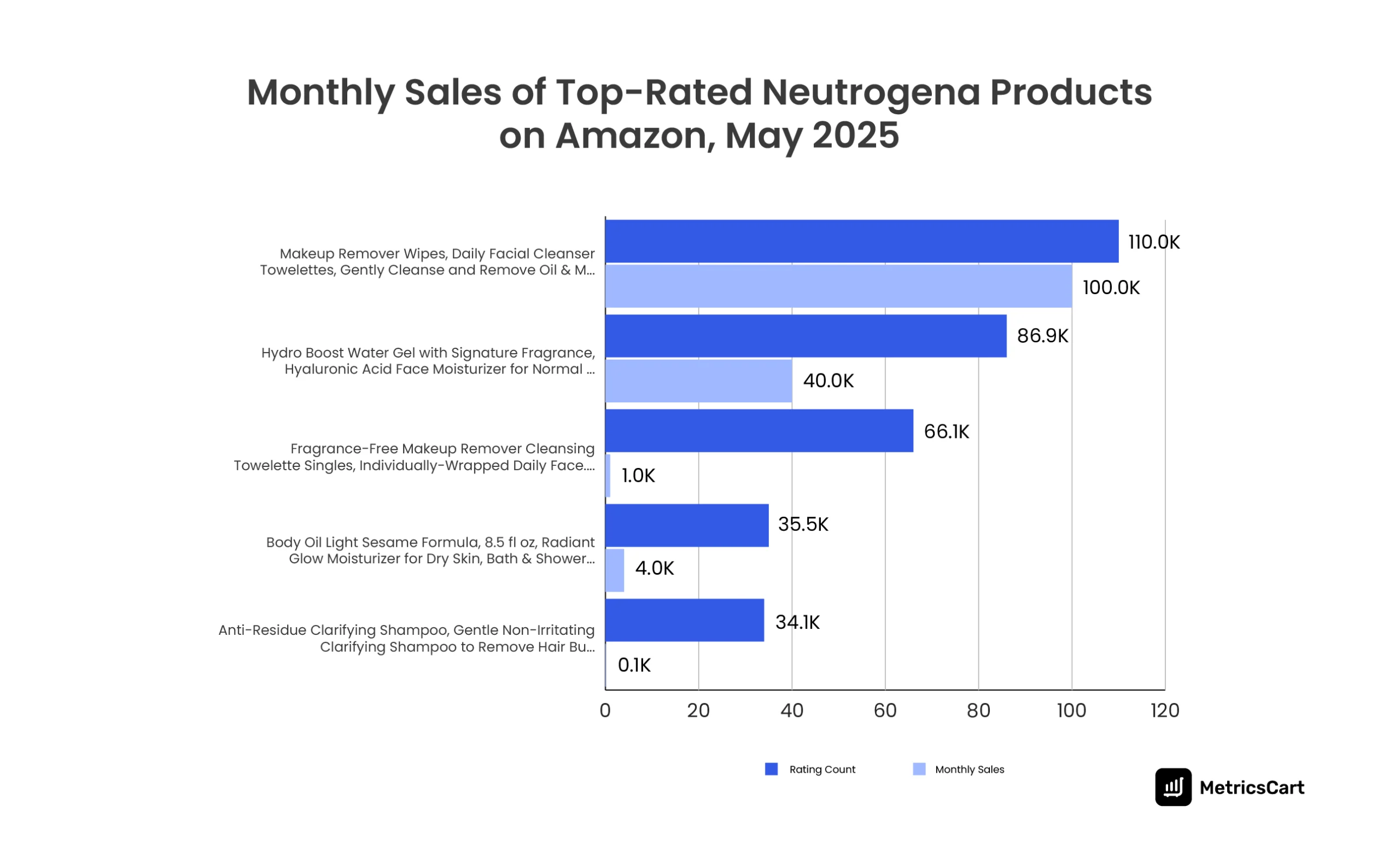

Makeup Remover Wipes Lead Among The Top-Rated Neutrogena Products on Amazon

The Makeup Remover Wipes remain the undisputed leader with an impressive 110K rating count. These wipes are the epitome of convenient, low-barrier skincare, making them a perfect staple for Amazon’s impulse-buy-driven shoppers.

The Hydro Boost Water Gel comes in second among the top-rated Neutrogena products, with 86.9K monthly sales and 66K ratings, showing that Neutrogena’s hydrating products continue to resonate strongly with customers looking for lightweight, daily moisturization.

Notably, the Fragrance-Free Makeup Remover Cleansing Towelettes have also carved out a substantial market, moving 66.1K units per month, despite having only 1K ratings, indicating a steady but niche customer base.

The data shows a trend of consistent demand for core skincare products, with strong performances that extend across multiple emerging segments within the brand’s offering.

The steady sales for wipes, combined with seasonal increases for sun care products and a growing interest in specialized hair care, underline that Neutrogena’s business model is adept at maintaining a balanced portfolio.

With MetricsCart’s ratings and reviews analysis, get detailed insights into brand perception and product performance to enhance your product R&D and brand growth strategy.

READ MORE | Your customer reviews and ratings hold the next big strategy for your brand! Check out Amazon Customer Reviews: Importance and Why Brands Should Consider Amazon Review Monitoring.

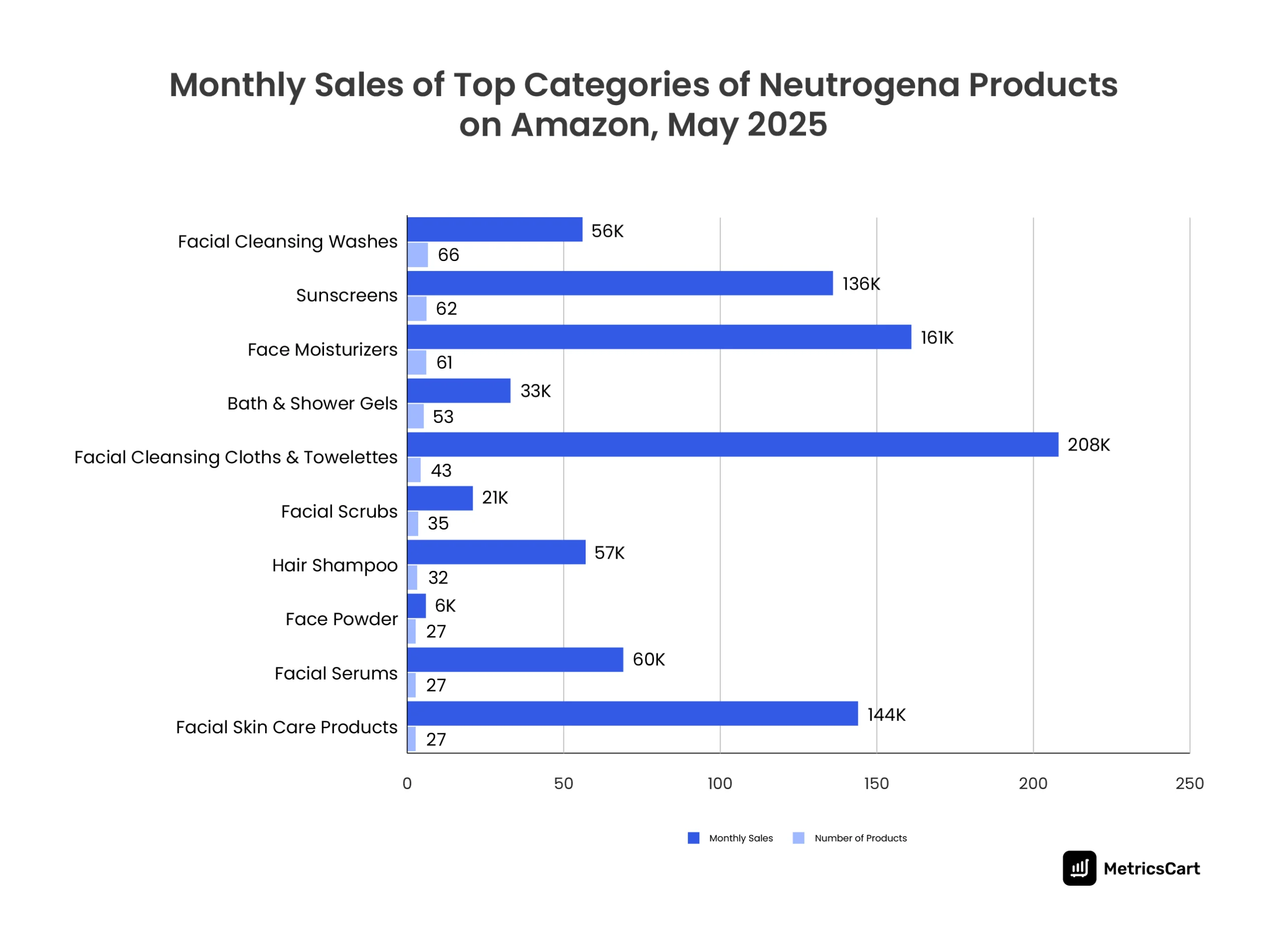

Facial Cleansing Cloths and Towelettes Is The Leading Category of Neutrogena Products on Amazon

Facial Cleansing Cloths & Towelettes lead with 208K units sold per month, underscoring Neutrogena’s dominance in the convenience skincare space.

With 43 products in this category, the brand effectively capitalizes on impulse purchases and replenishable demand, particularly well-suited for a fast-paced, low-commitment shopping environment and consumer behavior on Amazon.

Face Moisturizers follow closely, moving 161K units monthly. This reflects Neutrogena’s ability to maintain strong demand for hydration-focused products, especially with popular lines like Hydro Boost. The Sunscreens category also shows notable growth with 136K units sold per month, driven by rising awareness of daily sun protection and Neutrogena’s marketing strategy to emphasize SPF education.

Hair Shampoo (57K units/month) reflects Neutrogena’s successful expansion into scalp care, while Facial Scrubs (21K units/month) reveal a decline in this category, likely due to consumer preference for gentler exfoliation methods. Face Powder shows weak performance (6K units/month), indicating a broader shift away from traditional color cosmetics in favor of more skincare-driven products.

READ MORE | Want deeper insights into Neutrogena’s performance on Amazon? Go through our Best Neutrogena products on Amazon.com in June 2025 report to know more.

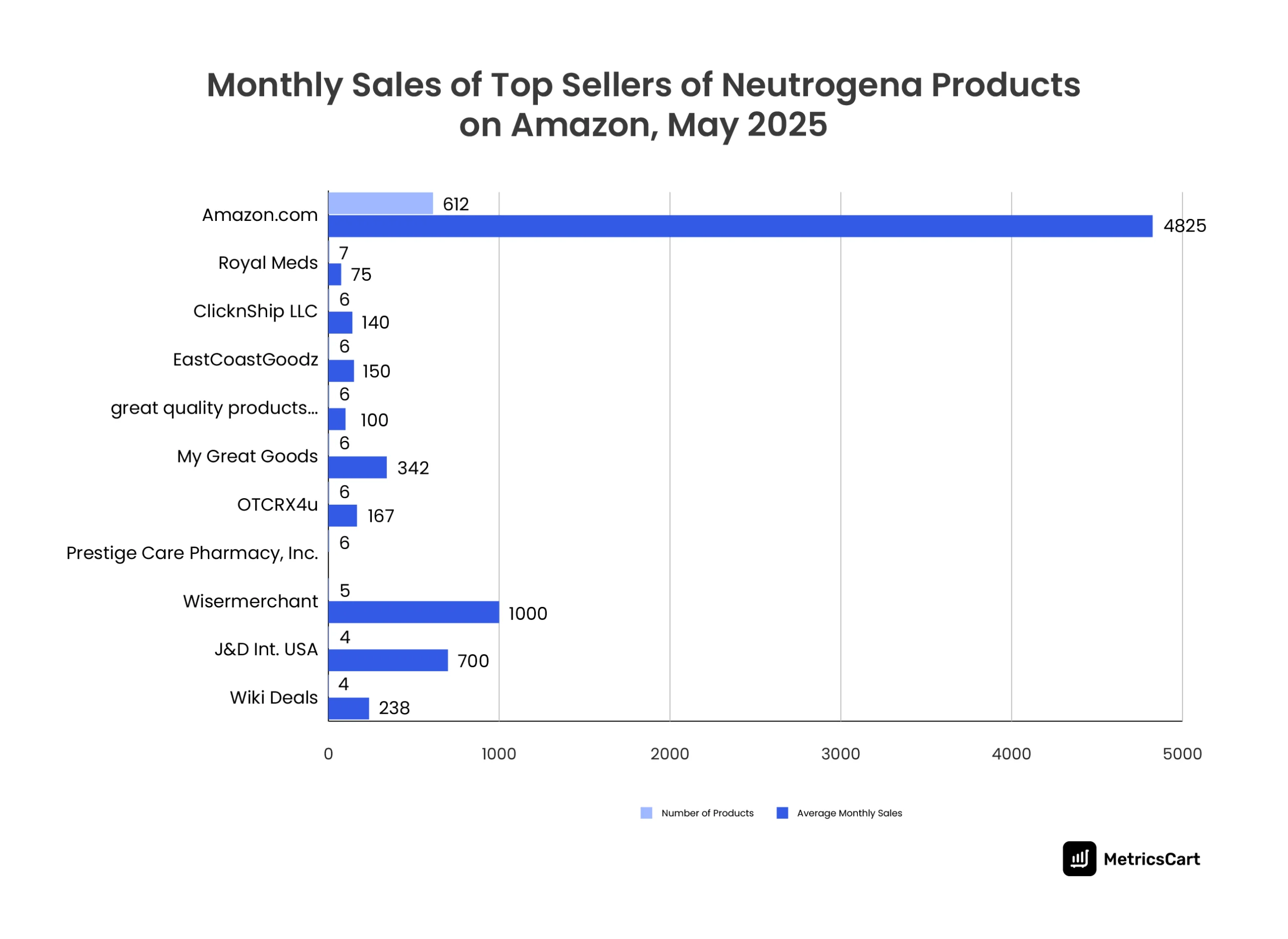

Amazon Is The Top Seller of Neutrogena with 612 Products

The graph reveals that among the top sellers of Neutrogena products on Amazon, Amazon.com overwhelmingly dominates Neutrogena sales, with 612 products and 4,825 units sold per month, illustrating its central role in distribution.

Smaller third-party sellers, such as Wisermerchant (1,000 units/month) and J&D Int. USA (700 units/month) shows strong sales efficiency with a limited number of products, indicating niche success in specific segments. Other sellers, such as Royal Meds and ClicknShip LLC, show more modest sales, reflecting less market penetration.

This data highlights Neutrogena’s strong reliance on Amazon for visibility and pricing control. However, the high-performing third-party sellers suggest potential collaboration opportunities for expanding reach in specialized markets, without sacrificing brand control.

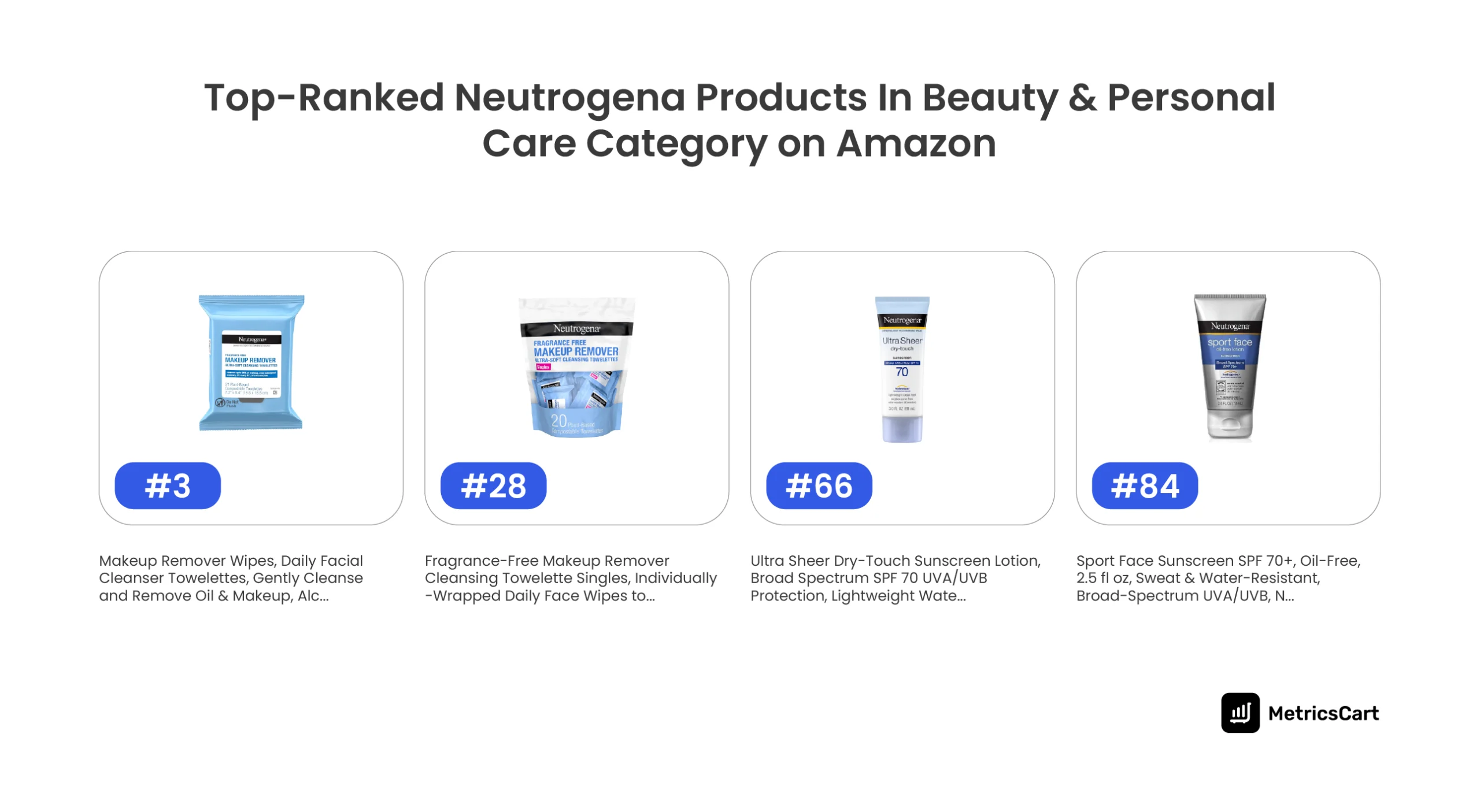

The Top-Ranked Neutrogena Products on Amazon In The Beauty and Personal Care Category

By now, it comes as no surprise that Makeup Remover Wipes claim the #3 spot in the entire Beauty & Personal Care category on Amazon.

In comparison, the Fragrance-Free Makeup Remover Cleansing Towelettes come in at #28 in the same category, reflecting a strong yet more niche demand for these single-use wipes. This product’s position suggests a loyal but specific customer base, likely driven by individuals who prioritize fragrance-free skincare or prefer individually wrapped options for convenience.

While this ranking isn’t as high as the wipes, it still indicates that Neutrogena has captured a wide segment of consumers looking for targeted solutions in makeup removal.

Moving to sunscreen, Ultra Sheer SPF 70 and Sport Face Sunscreen SPF 70+ occupy #66 and #84 in the bestseller rankings, respectively. Both of these products highlight Neutrogena’s strategic expansion into the sun care category.

The positioning of these sunscreen products, especially in the top 100 of the Beauty & Personal Care category, shows how Neutrogena has tapped into the growing consumer awareness around the importance of year-round sun protection.

Neutrogena’s ability to secure multiple top spots in Amazon’s bestselling category highlights its strong brand equity, its well-executed category penetration into sunscreen, and its market leadership.

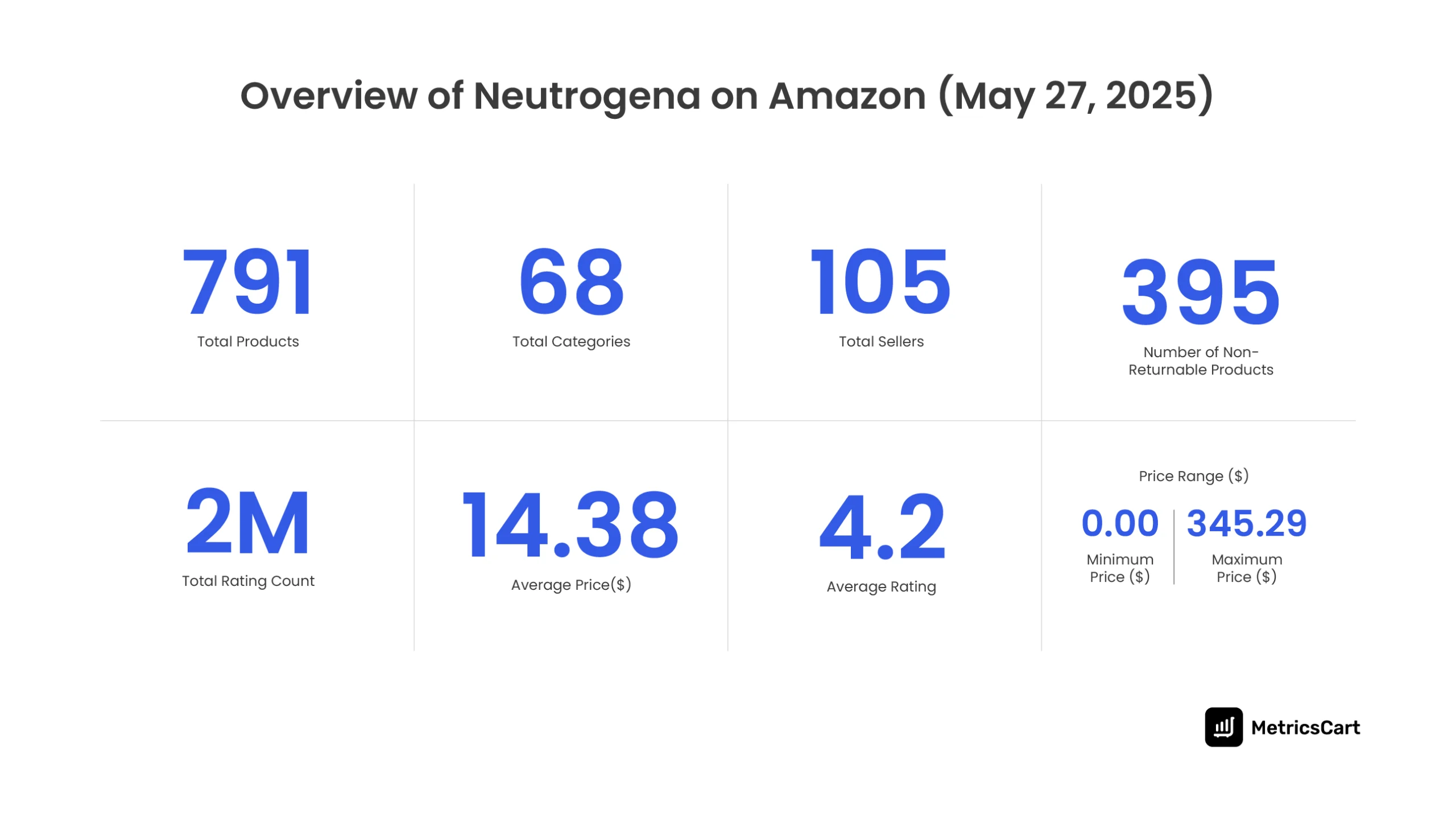

Pricing Strategy of Neutrogena Products on Amazon

Neutrogena’s pricing strategy on Amazon in 2025 strikes a careful balance between affordability and premium offerings, making it accessible to a wide range of consumers.

With an average price of $14.38, Neutrogena targets the mid-tier market, appealing to consumers who are looking for quality skincare without paying premium prices. This positions the brand as a competitive player in the affordable skincare segment, where it remains accessible to budget-conscious shoppers.

With free samples or promotional bundles, a strategy aimed at encouraging trial purchases and customer acquisition, Neutrogena also offers high-end products priced as much as $345.29, likely for luxury skincare kits or bulk purchases, catering to consumers seeking specialized or multi-product solutions.

This pricing range not only ensures that Neutrogena meets the needs of mass-market consumers but also targets the premium skincare market, offering flexibility to appeal to both value-driven and high-end shoppers. This dual approach enables Neutrogena to dominate across various consumer segments and maintain a strong competitive position on Amazon.

READ MORE | Pricing can make or break your e-commerce strategy. Check out Price Intelligence 101: A No-Nonsense Guide to know more.

Neutrogena on Amazon: 2024 vs 2025

While face washes and moisturizers were the dominant products in 2024, with a strong presence in the top-selling categories, 2025 has seen a shift toward more diversified offerings, particularly in the haircare and sun protection segments.

Products like Makeup Remover Wipes and Hydro Boost continue to lead, but sunscreens have significantly grown in popularity, securing a spot in the Top 3 categories for the first time. Additionally, while face serums were a top performer in 2024, they have seen a decline in rankings in 2025, reflecting evolving consumer priorities, such as an increased focus on sun protection and scalp health.

Overall, Neutrogena’s performance has evolved to reflect shifting consumer trends, adapting its product mix to meet rising demands for sun care and scalp treatments, while maintaining its stronghold in hydration and cleansing. This transition highlights the brand’s agility in responding to changing market dynamics, ensuring continued success despite evolving consumer preferences.

The Final Swatch

Neutrogena’s business model shows a clear evolution in its product assortment and consumer focus. The brand has successfully adapted to shifting consumer preferences, solidifying its dominance in skincare while branching into new segments within beauty and personal care.

Neutrogena’s ability to maintain a balanced pricing strategy and stay relevant across premium and mass-market segments has contributed to its sustained growth. However, face serums, a former bestseller, show signs of losing traction, which suggests that Neutrogena’s innovation pipeline should continue to evolve with consumer trends.

As we analyze Neutrogena’s marketing strategy and strong positioning in 2025, it is clear that strategic adaptation to market trends will remain key to maintaining its leadership on Amazon and beyond. The brand’s ability to pivot and embrace new categories, while continuing to deliver high-quality, dermatologist-recommended products, will drive its continued success.

With MetricsCart‘s suite of digital shelf solutions, ranging from price intelligence to customer feedback analysis, get actionable insights and data-driven strategies to elevate your Amazon performance. Start optimizing your brand’s growth today!

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready To Scale Your Brand and Drive Results? Unlock Your E-Commerce Potential Today!