About the report: This report provides an in-depth analysis of Amazon’s protein powder category from September 20 to October 4, examining sales trends, consumer preferences, and performance across 186 brands and 383 products.

Introduction

The protein supplements industry worldwide is expected to reach a projected revenue of $10,802.5 million by 2030, driven by heightened health awareness and increasing consumer interest in fitness.

This has accelerated the trend of adding protein powders into daily diets for weight management, muscle gain, and overall health and wellness.

From elite athletes to casual exercisers, the demand for protein powders spans across diverse consumer segments. Furthermore, the shift toward plant-based lifestyles has fueled the rise of vegan and vegetarian protein powders, adding variety to an already vibrant market.

Highlights

- The top brands of the Amazon protein powder category are Orgain, MuscleTech, and Muscle Milk.

- The average price of protein powder is $48.36.

- The protein powder category on Amazon has a total of 50M reviews and a 4.4 average rating.

- Alpha Gold Nutrition is the most expensive protein powder brand, with an average price of $119.99.

- Optimum Nutrition is the most-reviewed protein powder brand, with more than 11 million reviews.

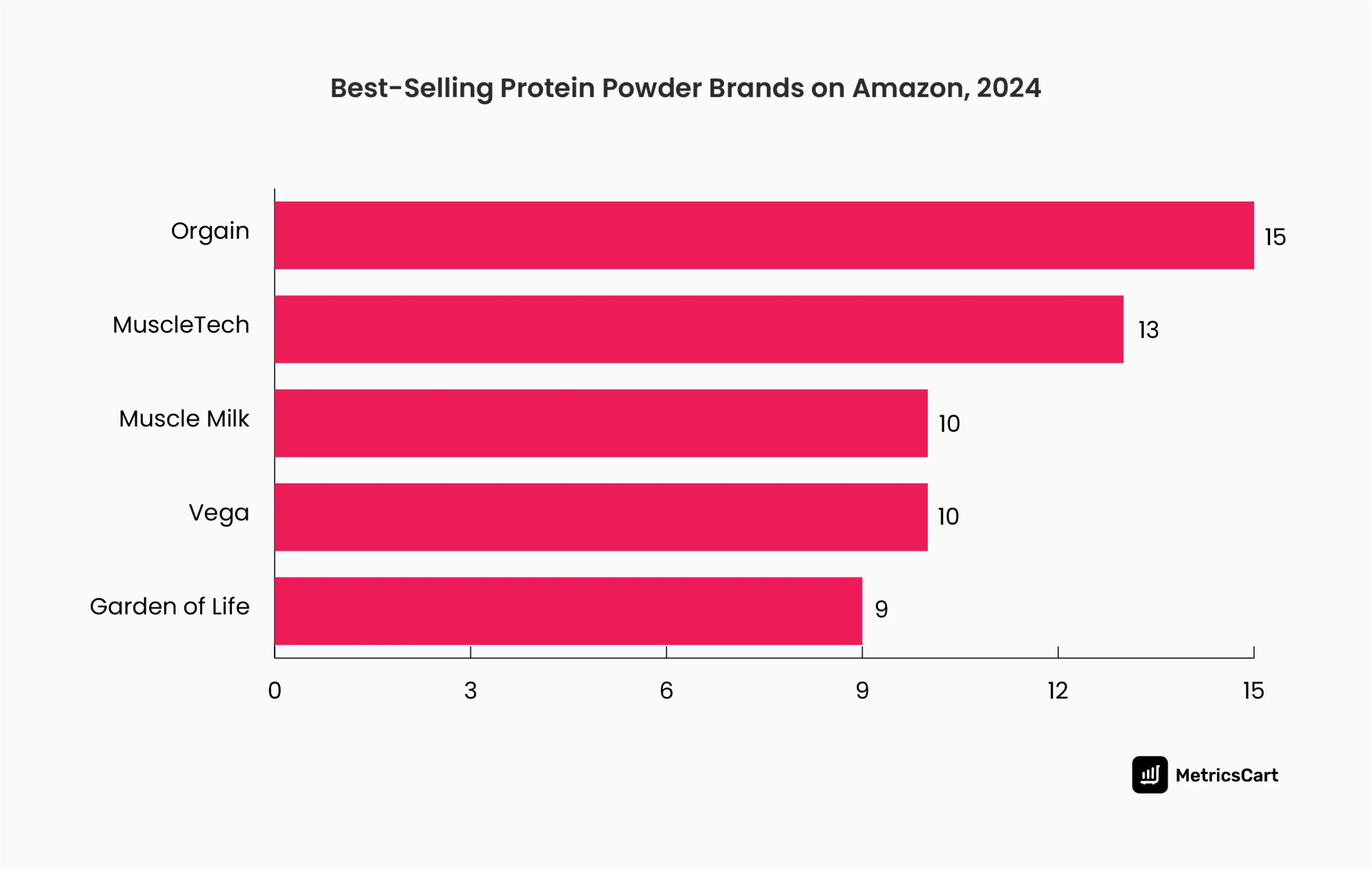

Orgain and MuscleTech are the Best-Selling Protein Powder Brands on Amazon

Orgain and MuscleTech are the top-performing brands with the most number of products listed among Amazon’s best-selling protein powders.

Orgain is the top-performing brand, with 15 products listed among Amazon’s best-selling protein powders. Orgain’s organic and plant-based protein options cater to health-conscious buyers and meet the rising demand for vegan products.

MuscleTech ranks second with 13 products, indicating its strong presence in the performance and sports nutrition segment. They deliver to athletes and fitness enthusiasts seeking performance-driven products.

Muscle Milk and Vega are tied for third place. Both brands have ten products listed among the top sellers.

Muscle Milk specializes in ready-to-drink protein shakes, providing convenience to busy consumers. Its high protein content and balanced nutrition make it a top choice. Conversely, Vega delivers high-quality vegan protein powders for environmentally mindful consumers.

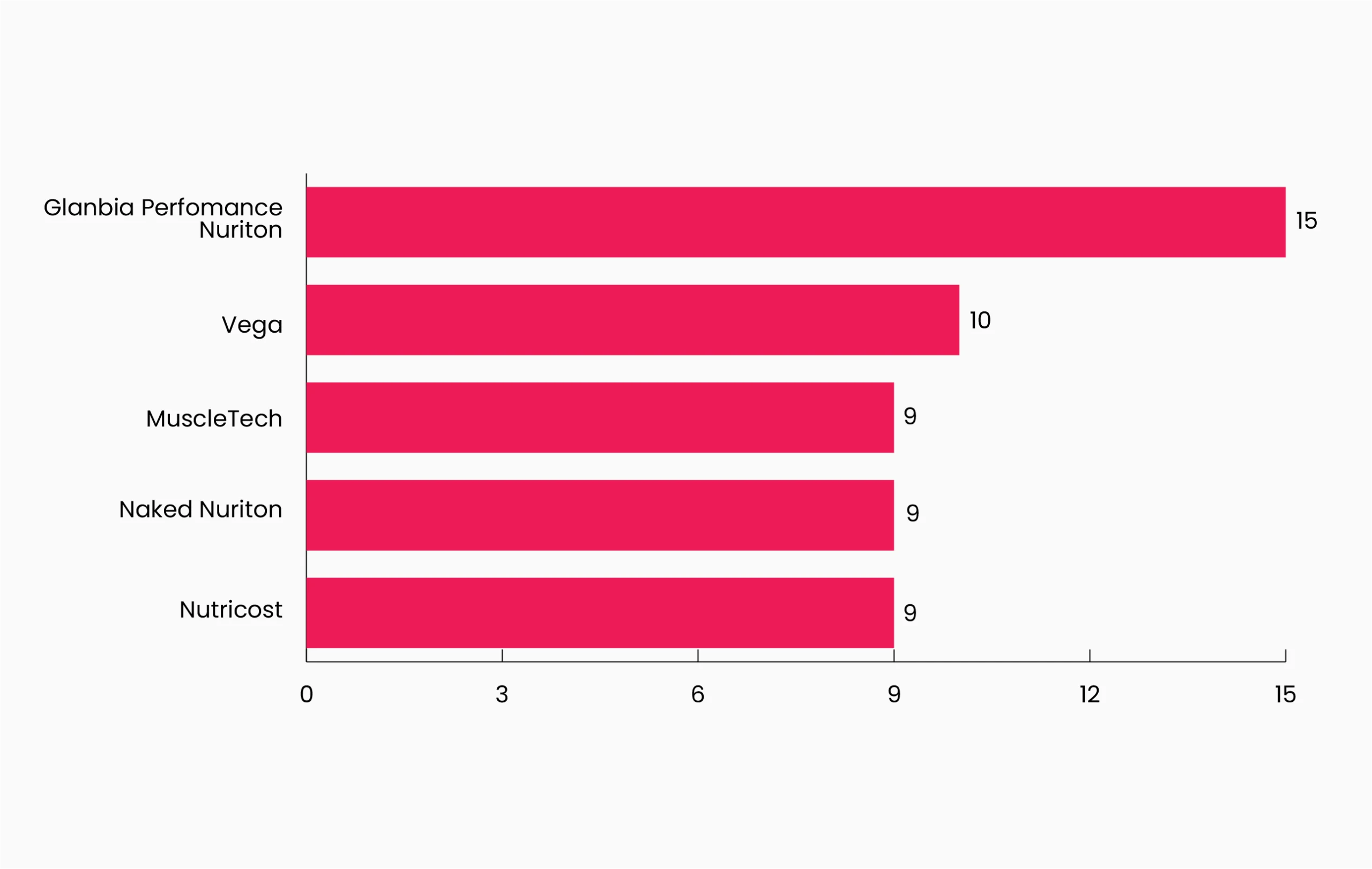

Top Protein Powder Manufacturers on Amazon

Leading manufacturers like Orgain, Vega, and Optimum Nutrition dominate the Amazon protein powder category.

Glanbia Performance Nutrition has the highest number of products listed, with 15 products on Amazon. They own well-known brands such as Optimum Nutrition and BSN, which top the whey protein market.

Vega, with ten products, is the second most prominent manufacturer. Vega’s focus on plant-based proteins aligns with the growing consumer preference for vegan and environmentally friendly options.

MuscleTech, NAKED Nutrition, and Nutricost rank third. Each has nine products in their portfolio.

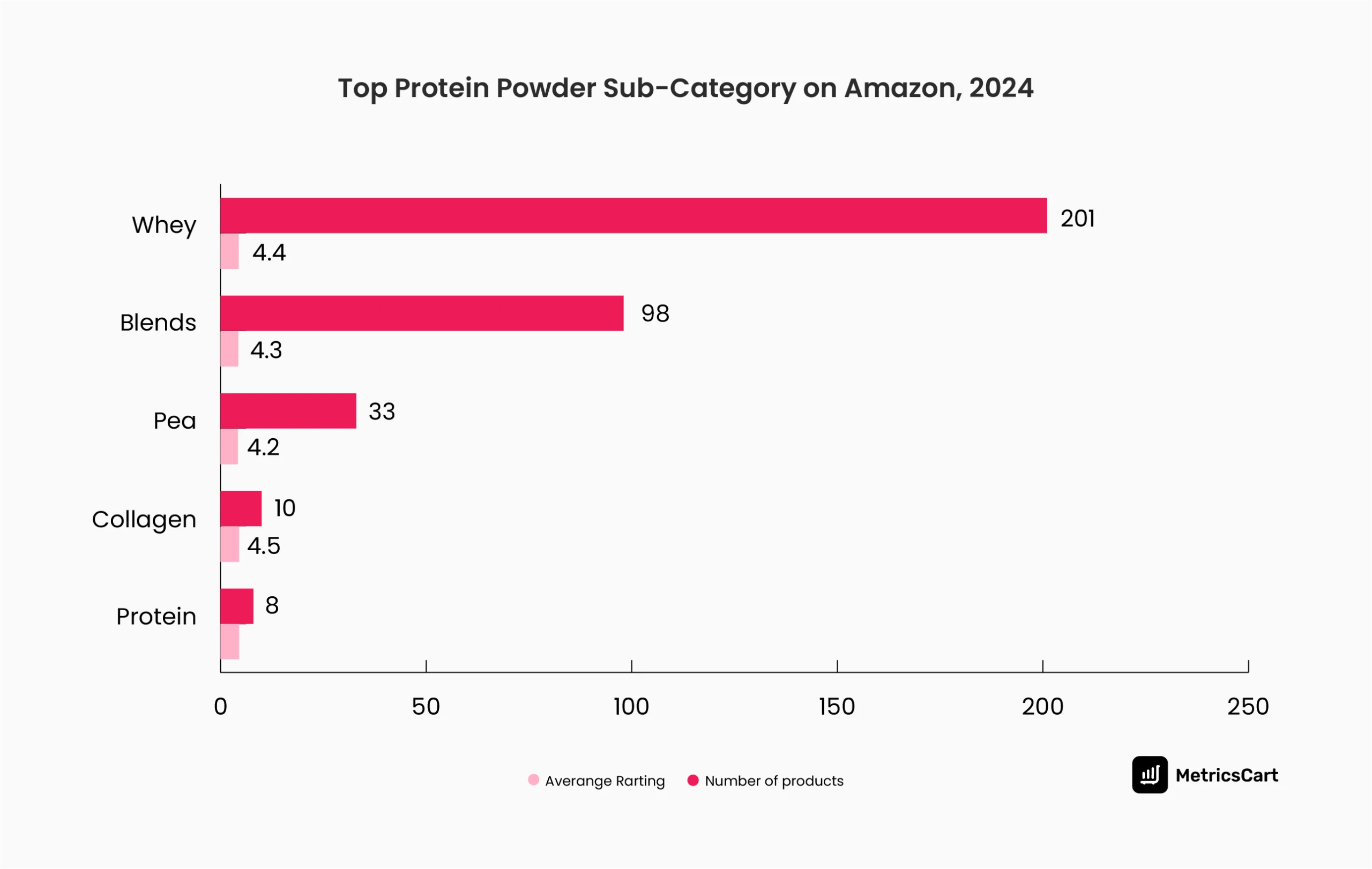

Whey and Blends are the Top Sub-Categories of Amazon Protein Powder Products

Protein powders are divided into 17 unique categories, including whey, plant-based, keto, vegan, collagen, and more.

Whey protein dominates the protein powder category, with 201 products and a 4.4 average rating exceeding any other sub-category. One of the primary reasons for whey protein’s popularity is its highly effective supplement for muscle recovery and general fitness.

Blends are the second-largest category, with 98 products and a high 4.3-star rating, reflecting the appeal to consumers seeking multiple protein sources in one product. Blends often combine whey, casein, and plant-based proteins for balanced nutritional profiles.

With 33 products and a 4.2-star rating, pea protein is the most popular plant-based option, followed by growing sub-categories like rice and collagen.

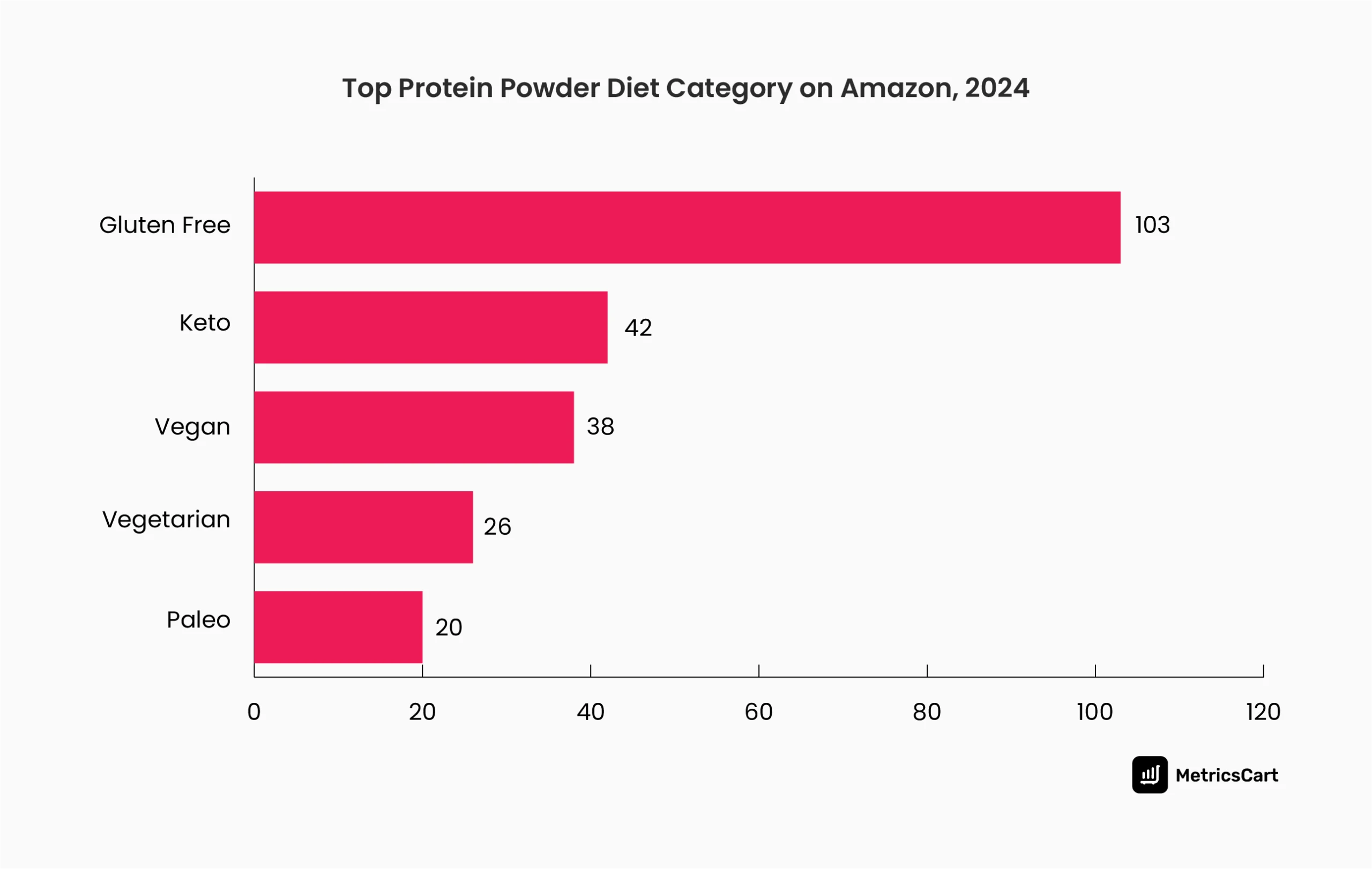

Gluten-Free and Keto are the Top Diet Categories of Amazon Protein Powder Products

With 103 products, gluten-free protein powders lead the diet categories on Amazon. This indicates a strong consumer demand for gluten-free options caused by dietary restrictions such as celiac disease and general preferences for allergen-free products.

Gluten-free protein powders also appeal to health-conscious buyers seeking “clean” and easily digestible formulations.

The keto category follows, featuring 42 products, reflecting its popularity among consumers following low-carb, high-fat diets.

With 38 products, the vegan category ranks third, incorporating pea, rice, and hemp protein as substitutes for animal-based protein, catering to environmentally conscious and animal-free diets.

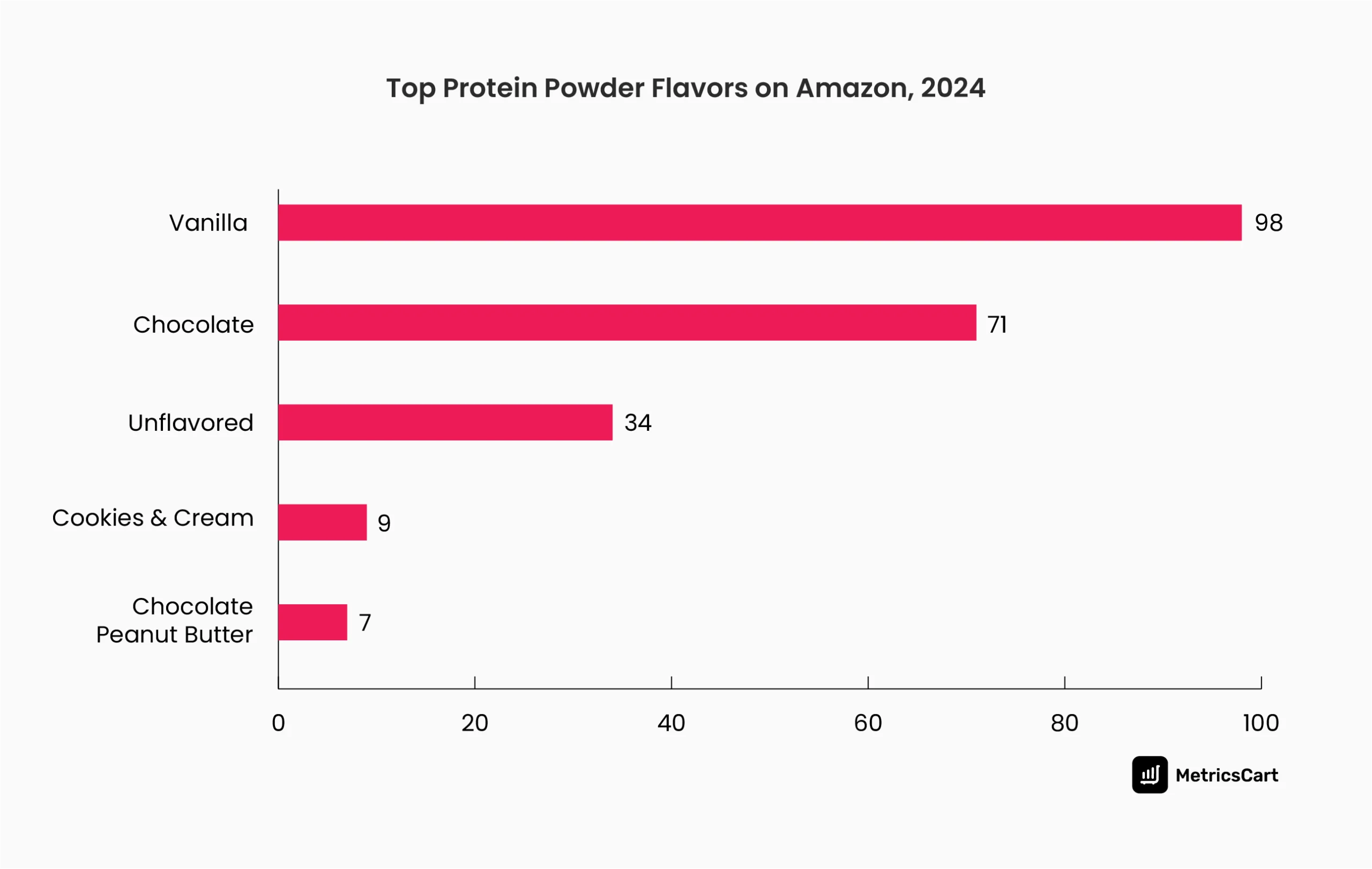

Vanilla and Chocolate are the Top Flavors of Amazon Protein Powder Products

Vanilla and chocolate’s overwhelming dominance as the top flavors of protein powder highlights that most consumers prefer familiar, versatile flavors.

Vanilla leads the chart with 98 products, making it the most widely available flavor in protein powders. Chocolate ranks second with 71 products, reflecting its strong consumer appeal. It’s popular among fitness enthusiasts who want a flavorful post-workout protein shake.

With 34 products, unflavored protein powders hold a notable position. These powders cater to consumers who want pure protein without added sweeteners, artificial flavors, or colors.

They are also popular among individuals who use protein powders as an ingredient in cooking or baking. Unflavored protein powders are a favorite of clean-eating advocates and those with dietary restrictions.

In addition, several flavors have moderate representation, such as:

- Cookies and Cream (6 products)

- Milk Chocolate (5 products)

- Peanut Butter (5 products)

- Caramel (4 products)

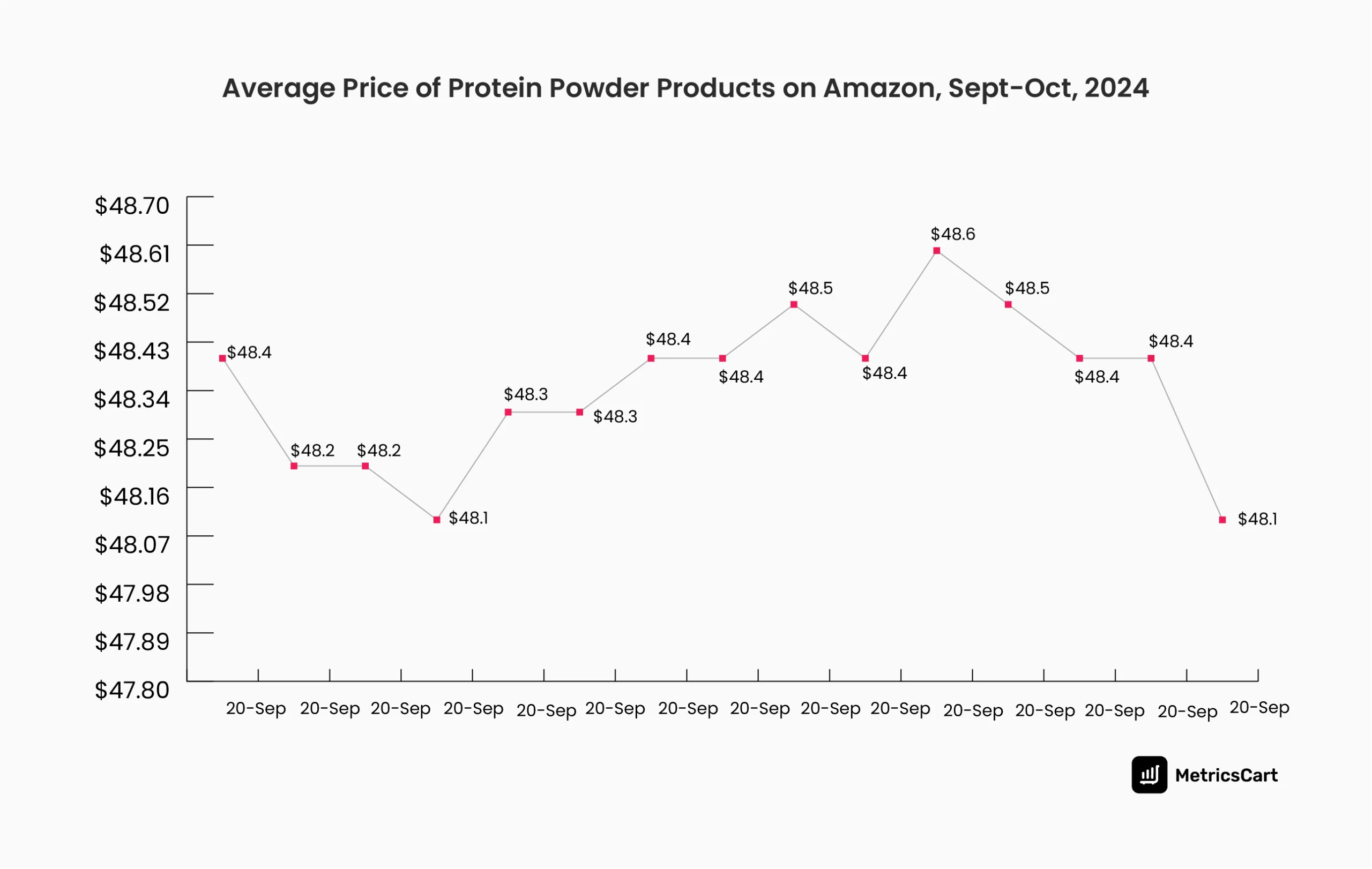

Price Trends Under Amazon Protein Powder Category

The average price of protein powders is $48.36, striking a balance between affordability and premium offerings. Top-priced brands like Alpha Gold Nutrition and Natural Force show that there is demand for high-performance, specialized protein powders while more affordable options continue to thrive.

The average price of protein powder products fluctuates between $48.1 and $48.6 throughout the observation period from September 20 to October 4.

On September 20, the average price starts at $48.4, dropping slightly to $48.2 by September 21 and remaining steady on September 22. From September 23 to September 29, the average price gradually increases, rising from $48.2 to $48.5.

The highest average price, $48.6, occurs on September 30, 2024.

After the peak on September 30, the average price drops slightly to $48.4 by October 1, stabilizes at $48.5 on October 2, and returns to $48.4 on October 3.

On October 4, the average price had a sharp decline to $48.1, the lowest point in the period.

Based on the analysis conducted by MetricsCart, despite minor fluctuations, the average price remains relatively stable, centering around the $48.3–$48.5 range, highlighting pricing consistency in the protein powder category.

READ MORE | Wondering Why Price Monitoring is Important? Check out Competitor Price Monitoring Solution for E-Commerce

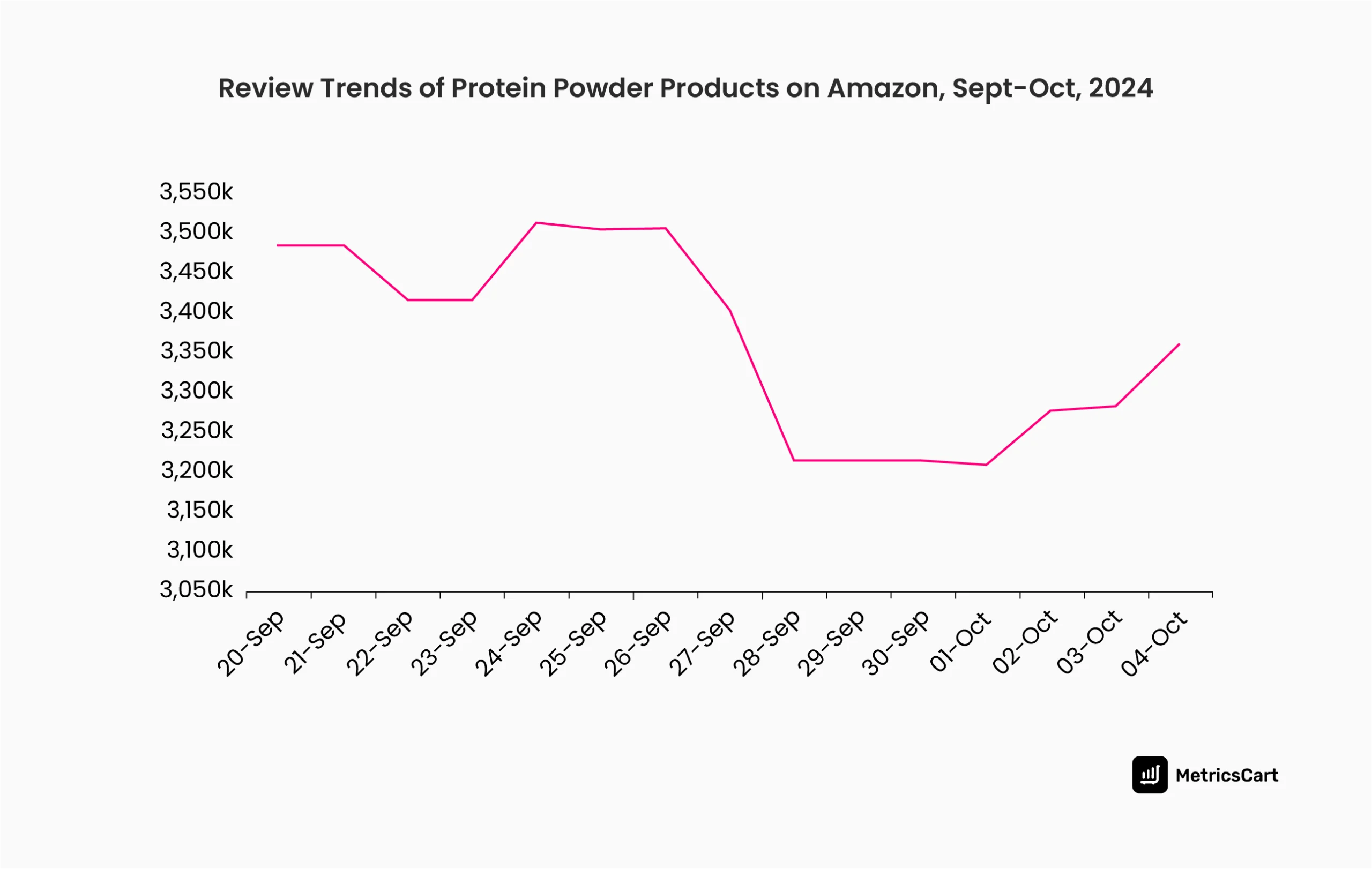

Review Analysis of Amazon Protein Powder Category

The staggering 50 million reviews and 4.4 average ratings demonstrate high consumer trust and engagement with protein powder products.

Our experts highlight that brands with a large review base, such as Optimum Nutrition and Orgain, benefit from strong visibility and social proof, which drives sales. With 11,354,348 reviews, Optimum Nutrition is the most-reviewed brand under the protein powder category in Amazon.

The number of reviews starts at around 3.5 million on September 20 and remains relatively stable through September 21.

From September 22 to September 25, the number of reviews climbs from 3.45 million to a peak of approximately 3.55 million. This increase could be attributed to heightened consumer activity, potentially driven by promotions or increased purchases during this time.

Between September 26 and September 28, reviews drop significantly from 3.55 million to approximately 3.15 million, the lowest point on the chart.

From September 29 to October 2, reviews stabilize at around 3.2 million. On October 3, reviews begin to rise again, climbing to approximately 3.25 million by October 4.

READ MORE | Want to Improve Amazon Reviews? Dive into Amazon Reviews: Importance and Why Brands Should Consider Review Monitoring

Conclusion

The best protein powders on Amazon are characterized by a diverse range of products that cater to varying consumer preferences and dietary needs.

The detailed analysis conducted by MetricsCart reveals the dominance of leading brands like Orgain and MuscleTech, the popularity of whey protein, and the influence of dietary trends such as gluten-free and keto options.

MetricsCart can generate similar detailed reports tailored to specific needs, offering comprehensive data on Amazon best-seller rank data, customer reviews, and pricing trends.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready To Take Your Brand Performance to the Next Level?