How did a polarizing shoe become a $4 billion cultural icon?

Crocs did not rise because it followed the rules of fashion. It rose because it broke formation. In an industry that rewards sleek silhouettes and trend-based desirability, Crocs’ marketing strategy doubled down on something far more defensible: emotional permission.

People wear Crocs because they feel allowed to be themselves in them; without curation, without posture, without performance. That psychological contract with consumers now shows up in the most measurable way possible: the brand’s digital shelf footprint.

About The Report

This report analyzes Crocs’ presence on Amazon between August 12 and August 27, 2025. During this time, the platform carried 75,827 Crocs listings, which collectively accumulated 789,490,263 reviews and held an average rating of 4.57.

We’ll see how Crocs’ brand strategy operationalizes into digital shelf dominance with a special focus on pricing, customer satisfaction, ads, and top product categories.

Highlights

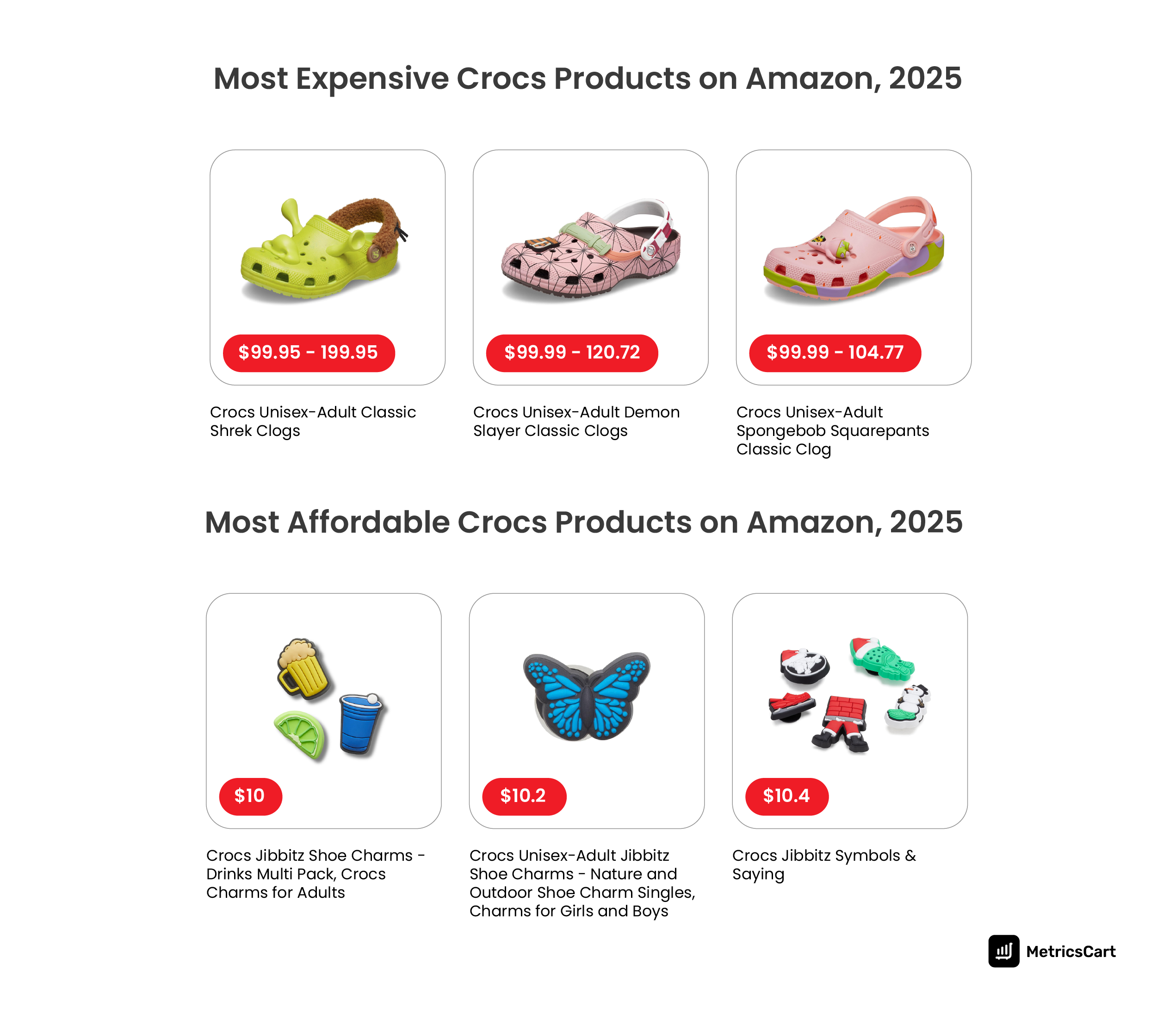

- The most expensive Crocs product on Amazon during the period was the Classic Shrek clog, reaching up to $199.95, showing consumers are willing to pay a premium for popular culture collaborations.

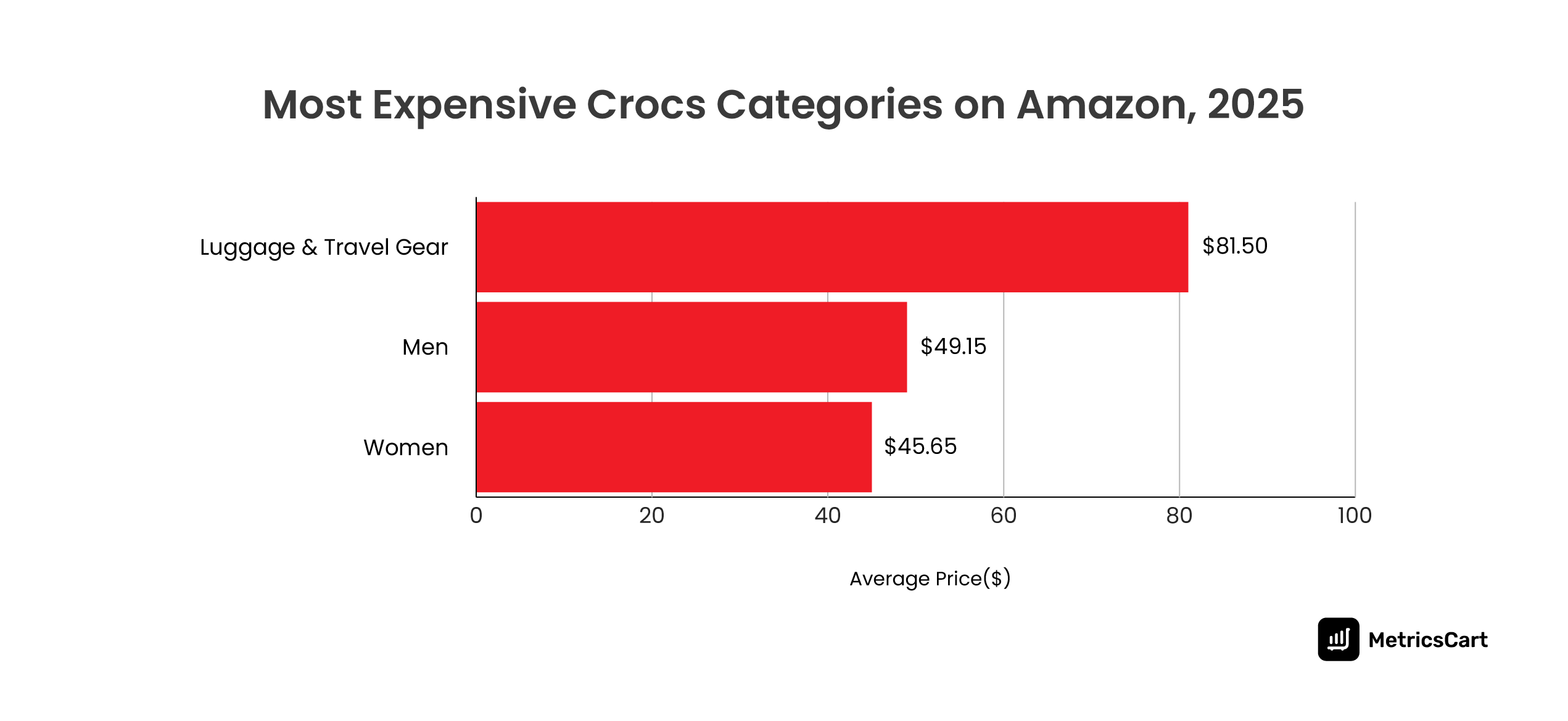

- The priciest category associated with Crocs is Luggage & Travel Gear, averaging around $81.50, confirming that footwear is not the only premium play inside the brand’s ecosystem.

- Men’s footwear commands a slightly higher average price than women’s styles ($49.15 vs $45.65), signaling a stronger willingness to pay in the men’s comfort + utility segment.

- Sponsored Crocs listings carry an 8% higher average price than non-sponsored SKUs, which means promotions are used to amplify mid-premium and premium tiers.

- The lowest-priced segment consists of Jibbitz personalization charms, around $10, reinforcing Crocs’ marketing strategy of building brand attachment through low-friction entry points before upselling.

Why Is Everyone Talking About Crocs Again?

Crocs’ resurgence began with a strategic identity correction. By 2016, the brand was stagnating under the weight of being ugly. The turning point arrived in 2017, when Crocs stopped fighting the perception of being polarizing and instead reframed that polarity as personality.

The company reorganized its brand architecture around the idea that Crocs was not competing in fashion; it was competing in self-expression.

Chief Marketing Officer Heidi Cooley has described this inflection as a moment when Crocs began leaning into what consumers were already doing, using the shoe as a reflection of personal identity, not just utility. That insight became the foundation for the “Come As You Are” platform, which repositioned Crocs from a product people wore to a permission structure people felt.

A big hit, especially among Gen Z, Crocs are a fashion staple catering to the demographic’s aesthetic needs and personal values.

Crocs’ business model analysis reveals that it optimized to be recognized, and that memorability became search equity.

That shift unlocked the three engines that still power the brand today:

- Cultural relevance through collaborations

- Emotional resonance through identity signaling: wearing Crocs says something about you

- Accessibility through price architecture

Crocs’ marketing strategy worked to make it a louder form of self-permission, and modern consumers don’t abandon a brand that reflects them.

Crocs Pricing Architecture: Affordable vs Expensive

Crocs’ pricing strategy is a spectrum of an engineered identity funnel. At the floor of this funnel are the $10 Jibbitz charms, which act as the most frictionless form of brand entry. These are not accessories in the traditional merchandising sense; they are identity tokens.

By allowing someone to own a personalized variation of the brand for the cost of a coffee, Crocs creates emotional participation before economic commitment. A consumer who invests $10 in self-expression is already a Crocs user before they ever buy the shoes.

Especially Gen Z consumers on Amazon find Crocs easy to access in terms of price, comfort, and sustainability. With the rising trend among Gen Z to switch to brands that align with their personal values, Crocs is a classic choice that tends to fulfill their desire for self-expression while catering to their advocacy for sustainable brands.

This is where Crocs differs from typical footwear brands. Most brands require a $40–$100 purchase just to enter the brand world. Crocs lets people join it first, then upgrade later.

On the opposite end of the funnel sit Crocs’ cultural capsules: products like the Classic Shrek clog, which goes as high as $199.95, the Demon Slayer edition that reached $120+, and the SpongeBob edition around $100+.

These are not premium because of material or function; they are premium because they ride the emotional elevation created by fandom, nostalgia, and cultural recognition. They are priced like collectibles, not shoes.

This is the exact dynamic that keeps Crocs simultaneously accessible and desirable, capitalizing on consumer behavior on Amazon.

It allows Crocs to do something very few mass-market footwear brands achieve: sell both mass participation and niche status inside the same product universe. The personalization layer (Jibbitz) builds attachment. The collaboration layer monetizes attachment. And the core clog in the middle bridges both by remaining permanently recognizable.

READ MORE | Gen Z Sustainability Trends: How E-Commerce Brands Can Stay Relevant

It might come as a surprise, but Crocs’ highest-priced category on Amazon isn’t footwear, it’s Luggage & Travel Gear, averaging $81.50. That signals that Crocs’ pricing power is no longer tied only to shoes or collaborations; consumers are paying a premium for the brand, not just the product.

When a consumer buys Crocs-branded travel accessories at nearly double the price of its core footwear tier, it signals that Crocs has transcended shoe status and entered brand utility.

Men’s Crocs average $49.15, slightly higher than women’s at $45.65, which reflects a functional premium: men pay more for utility and durability, while women drive volume through style variety.

Crocs’ marketing strategy analysis across this category spread shows that Crocs has widened its pricing upside beyond footwear and now monetizes identity across lifestyle touchpoints.

Crocs’ price architecture works because it widens entry at the bottom before elevating the brand at the top.

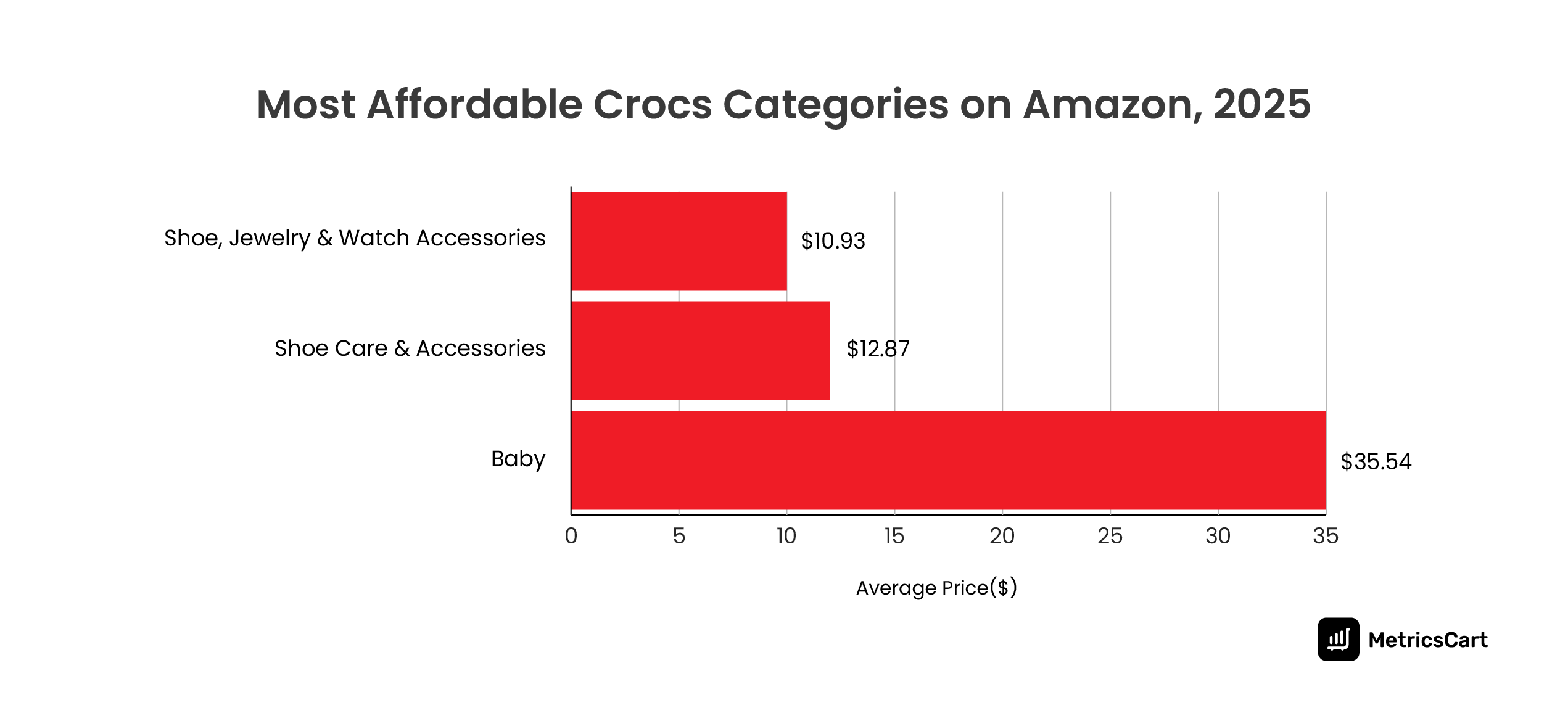

The lowest-priced bands, such as Shoe, Jewelry & Watch Accessories ($10.93) and Shoe Care & Accessories ($12.87), exist to remove hesitation entirely.

The Baby category ($35.54) adds another layer to this effect. When a brand enters the family through children’s products, it transitions from preference to household habit.

That is how Crocs becomes a default, not a discretionary purchase. A parent who buys Crocs for their child is also symbolically endorsing the brand inside their own household, which increases the likelihood of adult adoption or repeat family buying.

Which Crocs Products are Most-Loved: Top-Reviewed SKUs

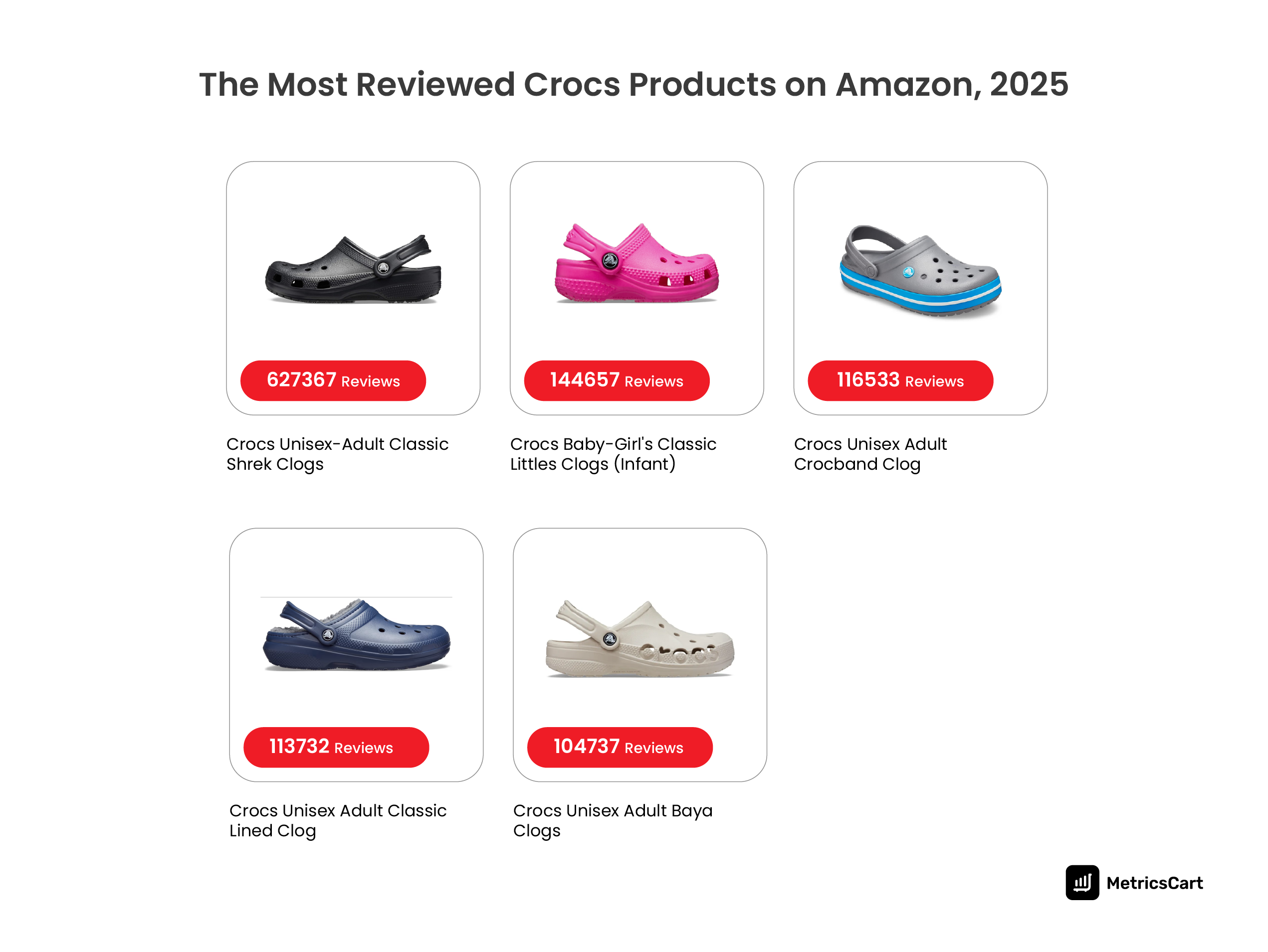

The most-reviewed product on Amazon is the Crocs Classic Clog, with 627,367 reviews, and it is the brand’s cornerstone of recognition. Crocs’ entire growth engine is built around this single, unmistakable silhouette.

Because the Classic Clog is so visually iconic, it does the brand’s marketing passively: it signals identity in public spaces, it is recognizable at a distance, and it lowers the psychological barrier for first-time buyers. One hero SKU sustains brand equity across thousands of variants.

The second-highest reviewed SKU, the Baby-Girl’s Classic Littles Clog, is a perfect extension of this identity-first model. It shows how Crocs is not just a personal purchase but a family adoption brand. When a consumer buys Crocs for their child, they are endorsing Crocs as part of the household’s identity.

The Crocband, Classic Lined, and Baya operate as micro-expansions of the same silhouette halo. Crocband appeals to sporty design preference, Classic Lined appeals to seasonal comfort, and Baya appeals to minimalist variation, but all three rely on the recognition equity of the Classic Clog.

This is entirely by design. Crocs’ marketing strategy is to scale by reinterpreting one hero product into different emotional use-cases. This is why its review distribution is wide but anchored: everything traces back to the same brand root and its symbolic gravity.

With a review management solution like MetricsCart, your brand can unlock deeper insights into customer reviews to fuel your product R&D and marketing strategies.

Category-Level Demand Signals: Most Reviewed Crocs Categories

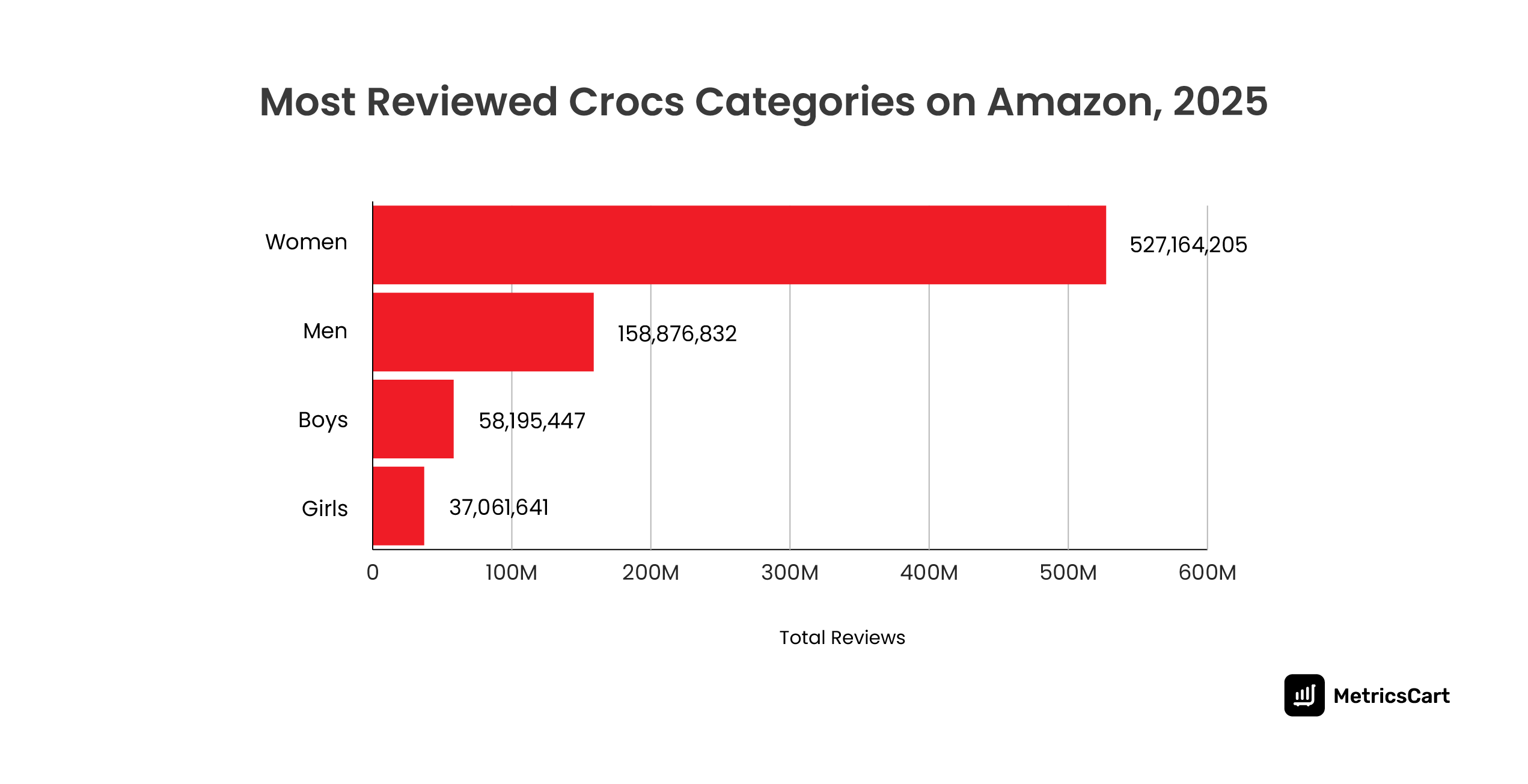

The Women’s category leads by a wide margin with 527 million+ reviews, more than 3x the Men’s category (158 million) and far ahead of Boys (58 million) and Girls (37 million). This shows that Crocs’ marketplace momentum is primarily female-led, which aligns with its positioning around self-expression.

Women over-index in categories where personalization, visual signaling, and identity-based styling matter, which is exactly how Crocs built its comeback strategy. The Amazon review distribution confirms this. When the majority of engagement is concentrated in women’s SKUs, the brand benefits from faster visibility loops and higher organic discoverability.

Men’s Crocs have significantly fewer reviews, but a higher average price. The Boys and Girls categories validate another part of the model, as we discussed before: household-level adoption. Once Crocs enters a household through kids’ products, it shifts from a personal purchase to a normalized brand in the family environment, which increases retention without additional marketing cost.

READ MORE | How To Turn Customer Reviews Into Sales: A Complete Guide

Sponsored vs Organic: Who’s Doing the Heavy Lifting?

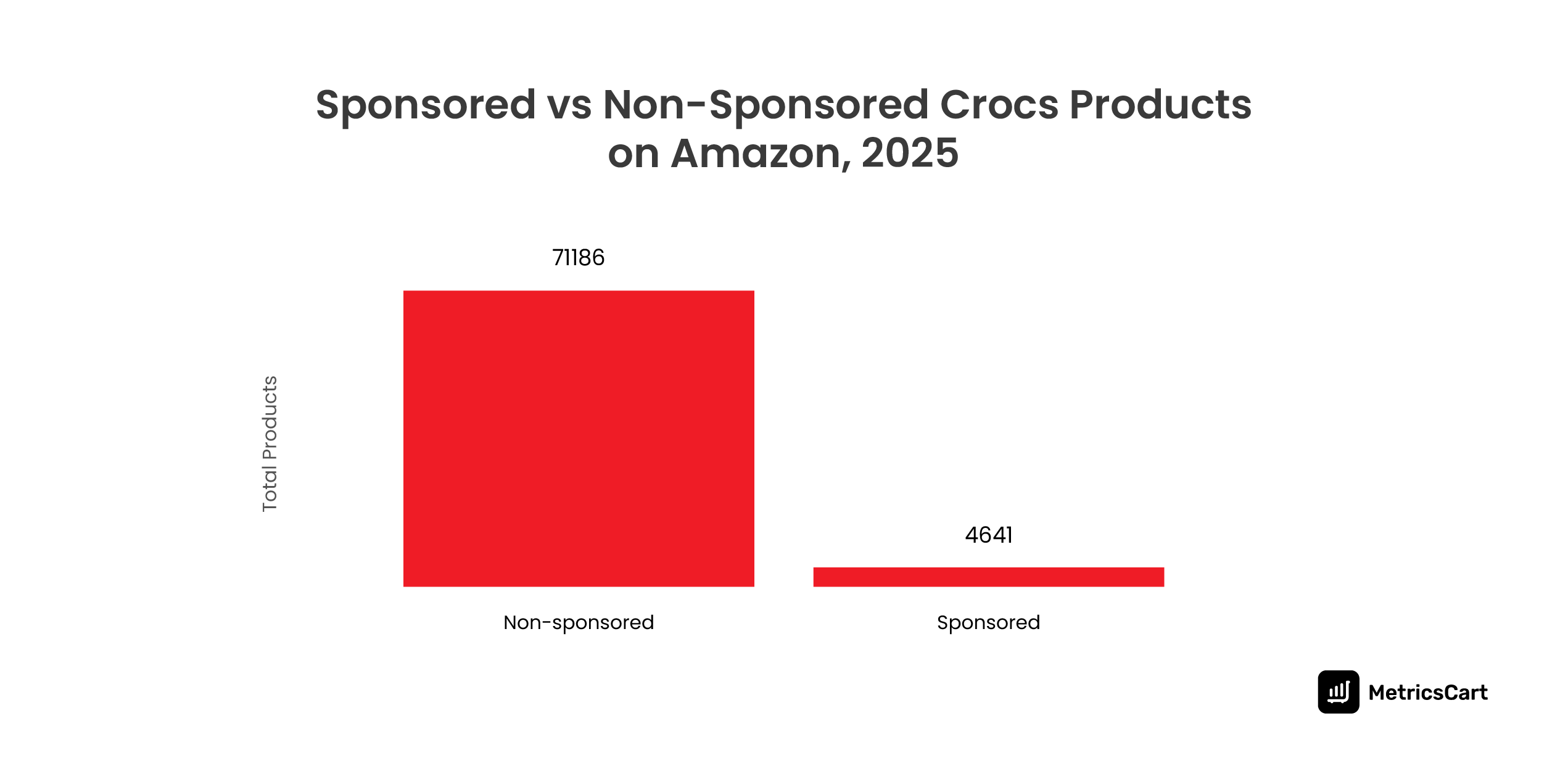

Data collected by MetricsCart shows that 71,186 Crocs listings are non-sponsored, compared to just 4,641 sponsored listings. Crocs relies overwhelmingly on organic visibility, confirming that the brand has built-in demand, so shoppers come looking for it by name.

And, sponsored listings are priced higher (average $46.96) than non-sponsored ($43.39). Crocs’ marketing strategy does not use ads to chase demand; it uses ads to capture higher-margin demand. Organic listings handle acquisition and visibility while sponsored listings selectively lift high-value purchases.

Instead of using ads to introduce the brand to new buyers, Crocs uses ads to upgrade already-interested buyers into higher-value SKUs.

This is why their ratio of sponsored to organic listings is so low; only 6% of Crocs’ Amazon presence requires paid push. The other 94% is pulled by brand gravity.

The marketing work has already been done upstream through pop-cultural relevance and identity-led branding. The marketplace is where that equity converts into revenue.

What’s Working, What’s Holding, and What Could Crack

Crocs’ marketing strategy analysis proves that the brand’s demand is not dependent on discovery machines like ads but on pre-existing intent created outside the marketplace.

The collaborations make this visible. When Crocs partners with Shrek, Demon Slayer, SpongeBob, Hello Kitty, Pringles, Lightning McQueen, or even luxury fashion houses like Balenciaga, it is not chasing trend exposure; it is borrowing audience identity.

Crocs does not need to redesign its hero SKU. Collaborations plug into the clog, which lets the brand capture new cultural equity without R&D overhead or risk of cannibalization and successfully expand into lifestyle categories beyond footwear.

This is also why Crocs sustains relevance across demographics. Teenagers arrive through fandoms. Women arrive through self-expression. Men arrive through comfort. Parents arrive through the kids. This is not what we usually call “broad appeal” but rather a multi-entry appeal, which lowers brand fatigue.

What Stand As Risks for Crocs?

The company flagged that US tariffs would cost approximately $40 million in H2 2025 and $90 million annually under current sourcing. With US consumer caution high and tariff impact concentrated there, Crocs’ growth in international markets (where tariffs may differ and penetration remains low) is a strategic hedge.

Another point of concern is losing cultural relevance. The “ugly-shoe” aesthetic that elevated Crocs might be losing cultural momentum, with Crocs’ CEO Andrew Rees acknowledging a shift toward athletic footwear. Crocs needs to persistently refresh cultural resonance.

While Crocs’ marketing strategy is strong, its business model is not immune to global sourcing and macro pressure. Monitoring tariff trends, consumer spending strength, and trend-life of the aesthetic that underpins Crocs’ identity should be central for any brand looking to emulate its marketplace architecture.

MetricsCart helps brands track digital shelf signals that make momentum visible before it shows up in sales reports. From pricing shifts, consumer adoption curves, category-level movement, MAP compliance, and more, MetricsCart’s digital shelf solutions give your brand the strategic visibility to win online!

Book a walkthrough to see how your brand’s performing on the digital shelf!

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready To Take Your Brand Performance to the Next Level?