Did you know that US adults spent a jaw-dropping $71 billion on online impulse buys recently? That’s not just a number—it’s a golden opportunity. As a retailer, the big question is, how do you tap into that buying behavior and get customers to choose your brand over everyone else’s?

Here’s the deal: smart businesses don’t just wait for customers to show up—they create irresistible offers that make shoppers say, “I’ve got to buy this right now.” One way to do that? Loss leader pricing strategy.

It isn’t about selling a cheap product and hoping for the best—it’s about creating a ripple effect. You pull people in with an amazing deal, and once they’re in, they buy more, come back, and tell their friends.

It stands out as a proven tactic to drive traffic, boost revenue, and build customer loyalty.

What is Loss Leader Pricing?

Loss leader pricing is a strategy in which a seller marks a product for sale below its market cost to encourage other profitable sales. The primary goal is to sell a product at a loss, but the business expects customers to purchase other items at regular prices, thereby negating the loss.

While loss leader pricing strategy is most often used in retail settings, it can also be effective for e-commerce businesses. Some of the instances where you can use a loss leader pricing strategy in e-commerce are:

- Excess inventory: If you’ve overestimated demand for a product, you can use it as a loss leader. This allows you to liquidate excess inventory while boosting sales of other products.

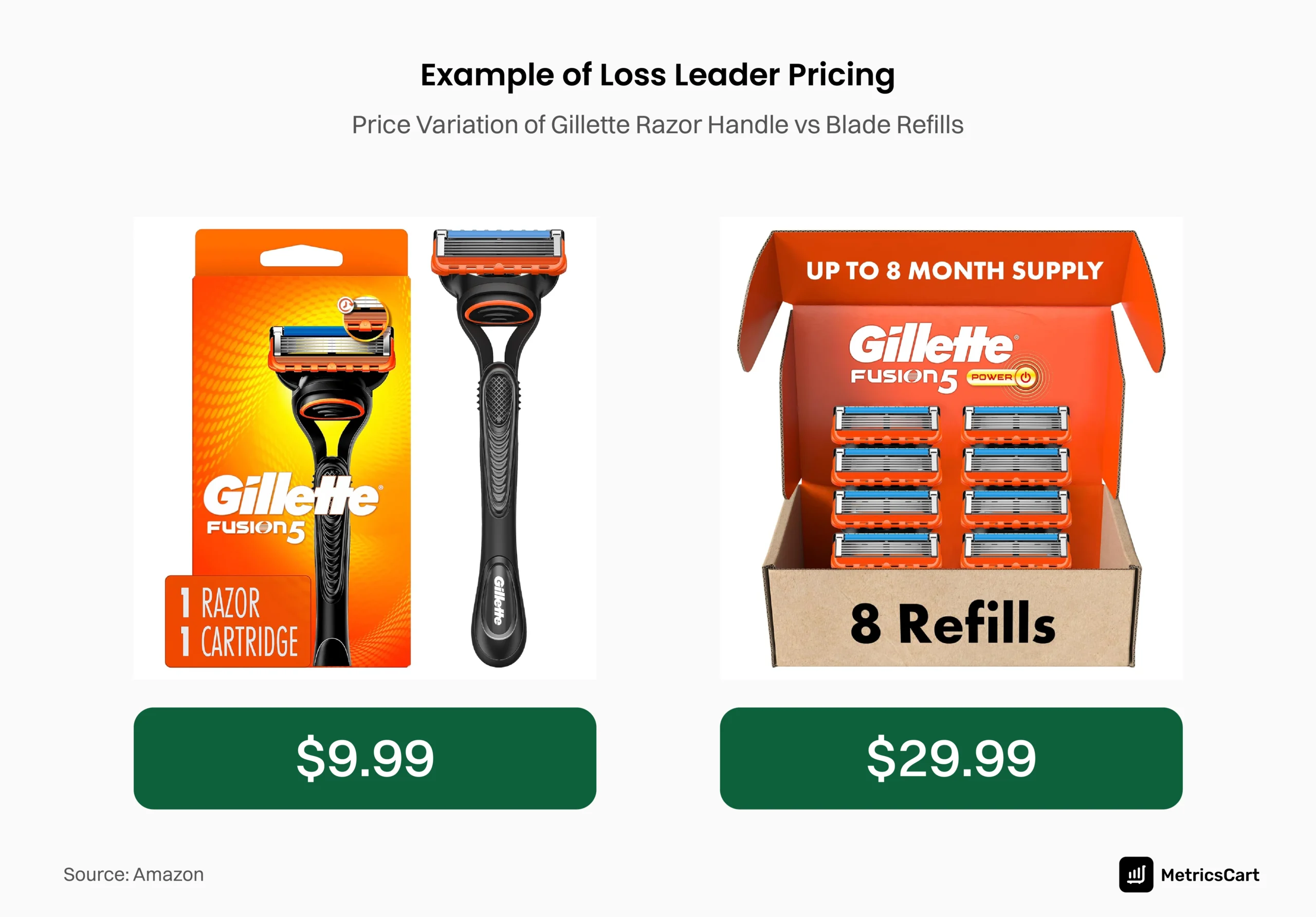

- Consumables and replacement parts: If you sell products that customers can purchase repeatedly, like razor blades, you can offer them at a price below market cost to attract customers. This helps you gain higher profit margins for repeat purchases.

- Product launches: When you are introducing new products, you can set the initial product price at a steep discount. This enables price-conscious customers to sample the product at a lesser amount before committing to the new item.

Loss Leader Pricing Examples

One of the classic examples of a loss leader pricing strategy is Gillete’s razor and blades. Gillette offers its razor handles at a low price, sometimes even at a loss, to encourage customers to purchase their high-margin replacement blades, leading to sustained profitability.

Another popular example from a major retailer is Nestle’s Nespresso products. The coffee machines and makers are priced attractively low. However, the large volumes of sales from the coffee pods increase their profit margins.

Benefits of Loss Leader Pricing

Implementing a loss leader pricing strategy can bring several advantages for businesses:

Increases Sales Volume

A loss leader pricing strategy can boost retailers’ overall sales (in volume) by bringing more traffic to the business. It also exposes customers to other products that can yield higher profit margins. In most cases, customers will buy additional products based on the perceived savings they made with the loss leader item, thus increasing sales.

Helps in Market Penetration

Loss leader pricing can be especially effective when entering new markets or launching new products. By selling products at a much lower price through penetration pricing, brands can draw customers away from competitors and showcase their latest products. It enables them to break into the market and acquire customers effectively.

Builds Brand Loyalty

When executed well, loss leader pricing can foster long-term relationships with customers. Customers often associate great deals with positive brand experiences. If the quality of the product meets and exceeds expectations, it can create trust and encourage customers to explore other offerings and are likely to remain top-of-mind for future purchases.

Best Practices for Implement Loss Leader Pricing Strategy

To effectively implement a loss leader pricing strategy, consider the following best practices:

Select Appropriate Products

Before implementing a loss leader pricing strategy, you need to identify and define your goals. These can include increasing foot traffic, boosting online sales, and clearing out inventory.

This will help you identify the right products for this strategy. These products should be items that are purchased frequently or enticing enough to attract customers to your store but not so crucial that selling them at a loss will hurt your overall profitability.

Set Competitive Prices

When you are setting the price, you should research how your competitors price similar products and offer a slightly lower price to gain a competitive edge. You can also employ psychological pricing strategies and set the amount at $9.99 instead of $10, which can make your loss leader even more attractive to shoppers.

However, while setting the prices for the loss leader products, you need to ensure that they are low enough to attract customers but not too cheap that they can affect your brand value and profit margins.

Promote the Deal Effectively

Once your loss leader pricing is set, it’s crucial to promote the offer through the proper channels to ensure maximum reach. To create a sense of urgency among customers, you need to highlight the discount’s value and the limited-time nature of the offer.

You can use all available marketing channels to promote your loss leader. This could include online ads, email marketing, social media, etc. In addition, it is vital to highlight the complementary or high-margin products in your promotions to encourage customers to explore more items.

After customers take advantage of your loss leader offer, you can conduct follow-up marketing to encourage repeat purchases. This could be through personalized email marketing, special offers, or loyalty programs designed to keep them coming back.

Monitor Sales and Profit Margins

Continuous monitoring of your strategy’s performance is essential to ensure it is meeting your business objectives. You need to track sales data and profit margins to assess the impact of your loss leader pricing strategy and determine whether your plan is achieving the desired results.

In addition, monitoring metrics like foot traffic, sales volume, and customer acquisition costs enables you to fine-tune the approach and maximize results.

Be Aware of Legal Implications

Loss leader pricing is not universally accepted, and its legality varies by jurisdiction. In some areas, it may be considered predatory pricing if it’s used to undercut competition unfairly.

In fact, loss leader pricing has been completely banned in some US states, including Oklahoma, California, and Colorado. However, in some states, it’s only partially forbidden, and in Oregon, Texas, and New Mexico, it’s legal.

By staying within legal boundaries, you can leverage the strategy without risking fines or reputational damage.

Conclusion

Loss leader pricing is more than just a sales tactic—it’s a powerful tool for growth in the e-commerce industry. Implementing a loss leader pricing strategy requires careful planning, from selecting the right products and setting competitive prices to promoting the deal and monitoring its performance.

When implemented thoughtfully, loss leader pricing can be a game-changer for e-commerce brands. It can help them stand out in crowded marketplaces and secure a competitive edge.

Boost your Pricing Game with MetricsCart.

FAQs

The primary goal of a loss leader pricing strategy is to attract customers by offering a product at a price below its cost. This approach draws attention to the business, encourages purchases of other profitable products, and builds long-term customer loyalty.

In most cases, loss leader pricing is legal. However, in some jurisdictions, it may be considered anti-competitive or predatory pricing, especially if it is used to eliminate competition. Businesses should check local laws and regulations before implementing this strategy.

Yes, small businesses can implement this strategy effectively by carefully selecting low-cost, high-demand products as loss leaders. The key is to ensure that the increased traffic and upselling opportunities compensate for the initial losses.

Businesses should be aware of potential risks like unsustainable losses, attracting bargain hunters who don’t make additional purchases and legal challenges in jurisdictions with strict anti-competition laws. A thorough cost-benefit analysis and strategic planning are essential.

While discounting reduces the price of a product to drive sales, loss leader pricing intentionally prices a product below cost to attract customers to purchase other, more profitable products. The goal is not just sales of the discounted product but to increase overall business revenue.