Choices delight shoppers. Thus, most high-performing companies provide customers with varied models within a brand. However, creating a clever product mix pricing strategy that ensures profitability and competitiveness is challenging.

What is a Product Mix Pricing Strategy?

All company brands under a single umbrella are called its product mix. For instance, Nestlé is a conglomerate with diverse business interests that sells nearly 2000 brands across 186 countries. So, all the brands manufactured or marketed by Nestle and their variations are referred to as Nestle’s product mix.

A product mix pricing strategy is a plan of action that helps set the price of all products within a product mix.

What is the Advantage of Having a Product Mix?

There are two main benefits for companies having a product mix:

- With multiple products selling at various price points, companies can target customers with various preferences

- In case of a crisis that affects a particular product category, the company is better shielded as it can balance the revenue from an alternate product line

READ MORE | Did you know a perfect product mix or assortment strategy maximizes the sales and profit of a company? Here are a few tips on Overcoming Product Assortment Challenges

Understanding Product Mix Dimensions with Examples

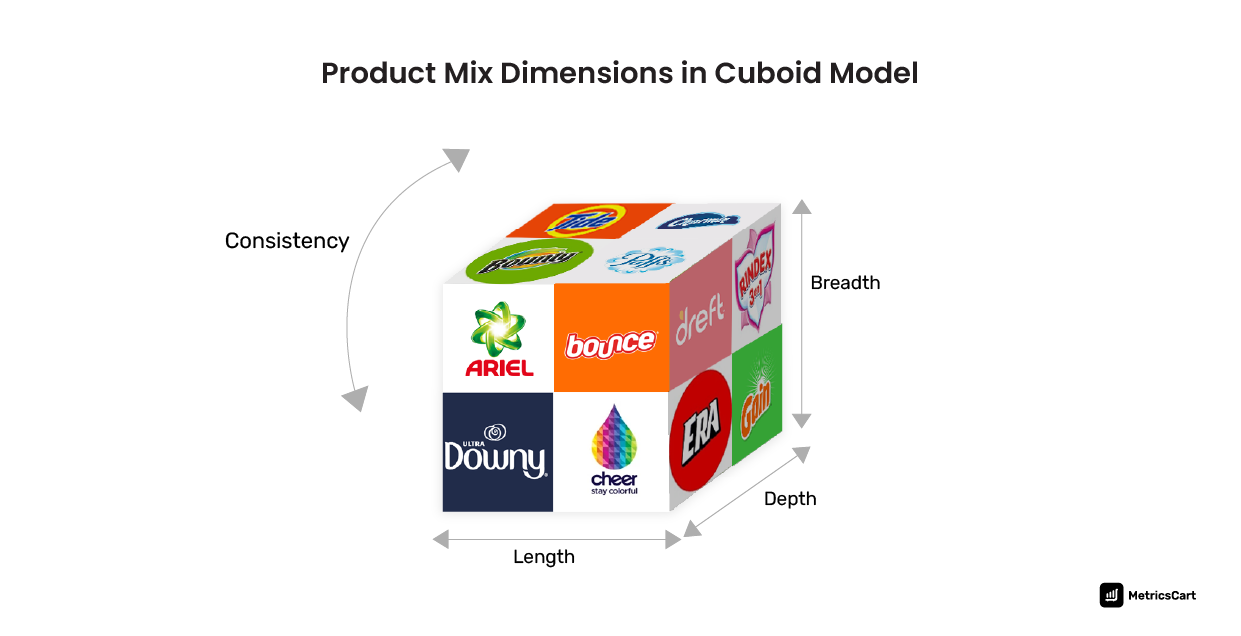

It is vital to understand product mix dimensions to comprehend product mix pricing.

Let’s visualize the product mix as a cuboid. The width, length, and depth are its dimensions. The more the dimensions (categories) relate to each other, the better the consistency.

For instance, Proctor and Gamble (P&G), a US-based multinational CPG company, has Ariel, Era, Tide, Bounty, and many other popular brands within its umbrella.

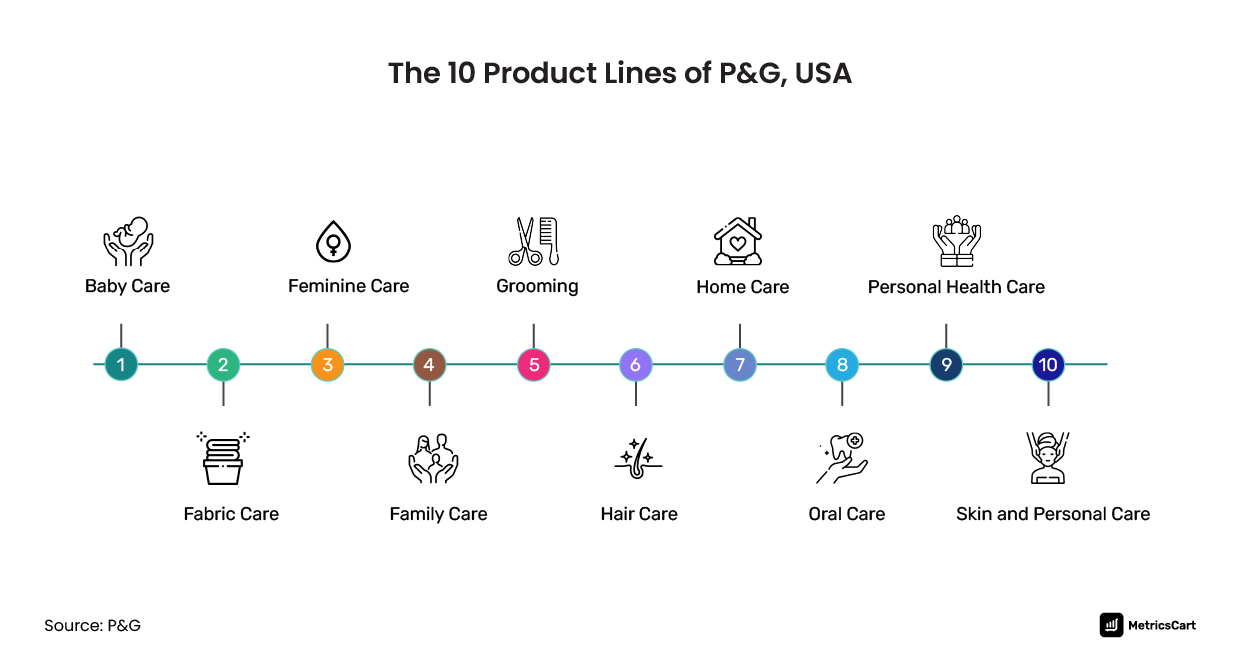

Product Mix Width

P&G manufactures and markets products categorized into 10 product lines. All the product lines belonging to a company are referred to as its product mix width/breadth. As P&G has 10 product lines, its product mix width is 10.

The product mix width of P&G is consistent as all the product lines are related to personal care and hygiene. If the product lines belonging to a company are very different from one another, we say a company’s product mix is inconsistent.

When a company says it is expanding its product mix width, it means they are diversifying into other businesses. Usually, we don’t see small-scale businesses widen their product mix in the initial stages of business.

Product Mix Length

Product line length is the total number of items a company carries within a product line. All product line lengths together form the product mix length.

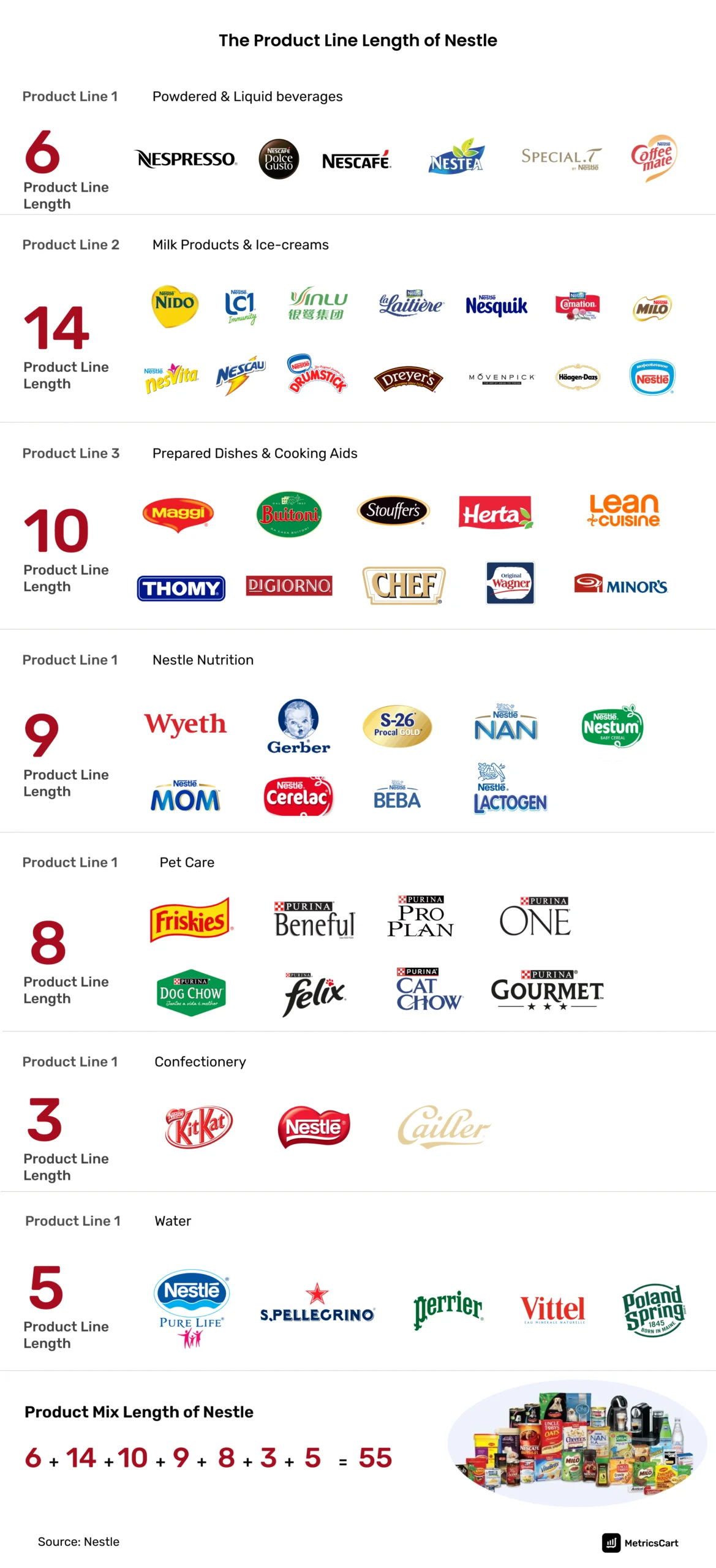

To understand product mix length better, let’s look at the example of Nestle. The company has 7 product lines. The powdered and liquid beverages product line has 6 products, the milk and ice cream product line features 14 branded products, the confectionery product line has 4, and so on. By adding up all the brands included in the 7 product lines, we get Nestle’s product mix length as 55.

Product Mix Depth

All the variants available in a product mix are its depth. The purpose is to target the varied preferences of consumers.

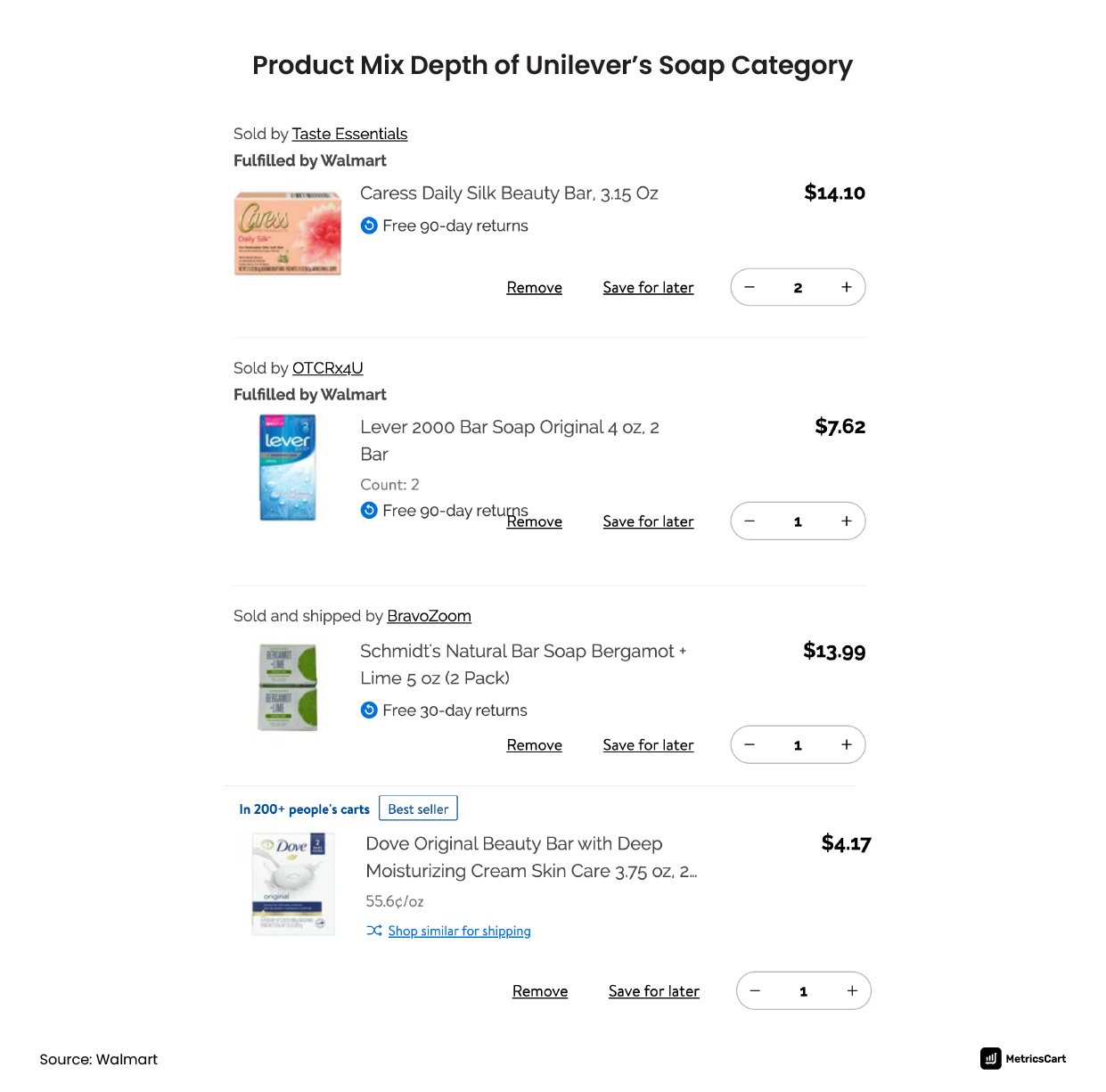

If we delve deeper into the personal care product line of Unilever, the company markets four brands of bathing soaps – Dove, Caress, Lever 2000, and Schmidt’s. These four brands comprise the product mix depth of Unilever’s soap category.

Unilever initially marketed Dove in the premium soap category. Yet, the company did not increase the selling price for quite some time. This is because Dove is among the company’s high-performing brands. The company gets a 6.1% increase in sales and a 3.8% increase in volume from these power brands, including Dove Knorr, Rexona, and Sunsilk.

In the first quarter of 2024, 75% of Unilever’s turnover came from the power brands.

Types of Product Mix Pricing with Examples

Profit-making organizations conduct extensive analyses to fix a selling price or decide on a promotion for a product mix. Each product in an assortment has various degrees of market positioning, competition, features, demand, and production costs.

Arriving at a product price involves two steps:

- Defining the pricing objective of the brand: It could be to gain market share, create a perceived value advantage, maximize revenue, or achieve profitability.

- Aligning business objectives with other key metrics: When brands align their business objectives with market dynamics, competitor pricing, and customer preferences, they devise a well-rounded product mix pricing strategy.

Here are the 5 common types of product mix pricing:

- Product Line Pricing

- Optional Product Pricing

- Captive Product Pricing

- By-product Pricing

- Product Bundle Pricing

Product Line Pricing

Products in a product line may serve a similar purpose and usually sell through the same channel, but they may target consumers from varied economic strata.

To understand product line pricing better, let us take the example of the baby care segment of P&G.

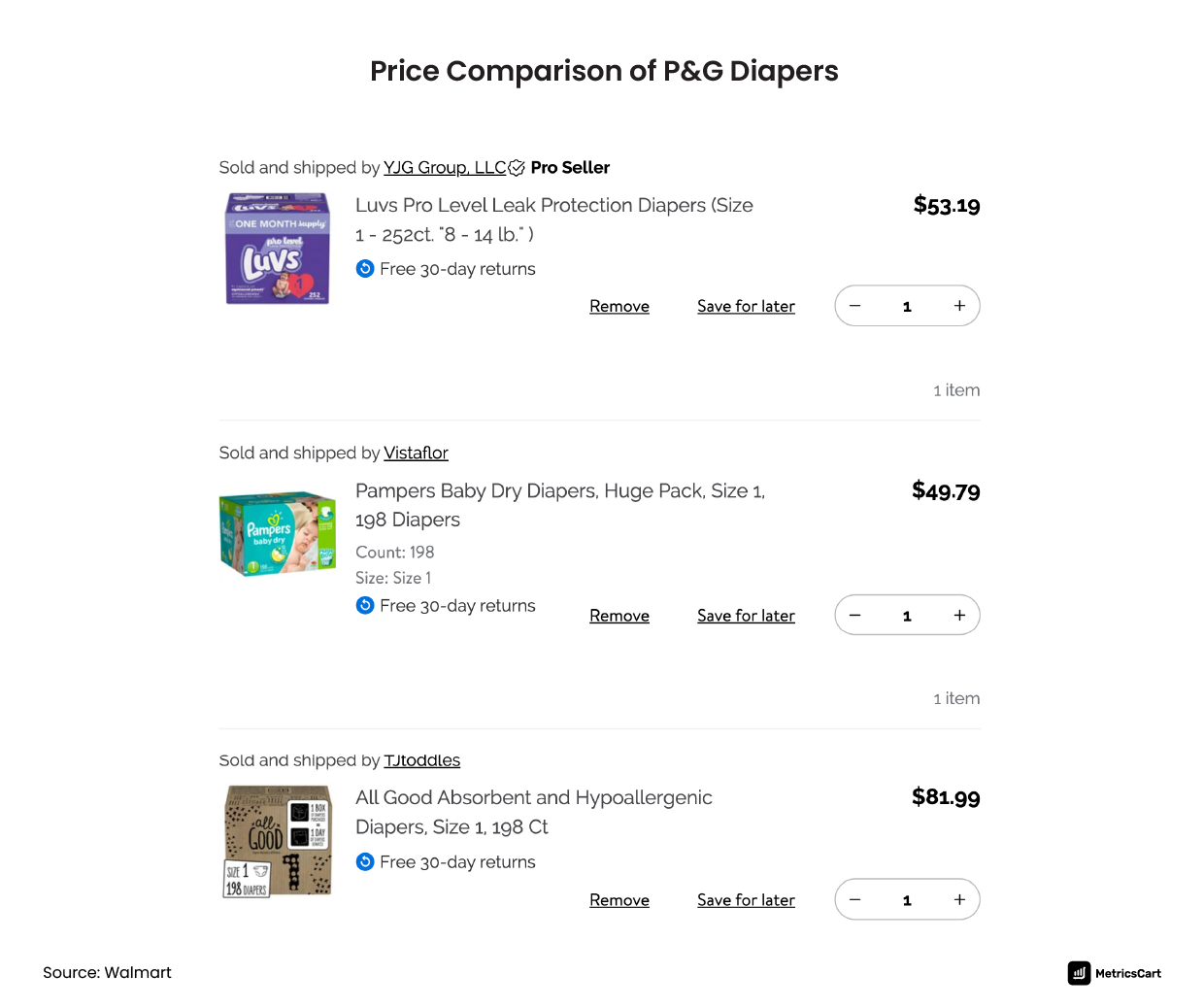

Product Line Pricing Example: P&G Diaper Brands

P&G has a 25% global market share in the Baby Care segment. To begin with, they just had Pampers diapers. Over time, they acquired other brands. Today their product mix depth includes Pampers baby wipes, Pampers Ninjamas pants, Luvs diapers, Charlie Banana reusable cloth diapers, All Good diapers, and All Clean wipes.

All Good hypoallergenic diapers and All Clean Wipes are P&G’s premium products sold exclusively at Walmart. A pack of 198 diapers of size 1 in All Good costs $81.99. At $49.94, Pampers is priced in the mid-range for a pack in the same size. Luvs is P&G’s budget-friendly diaper brand. By paying $53.36, a budget shopper can pick a pack of 252 size 1 Luvs diapers.

Thus, we see P&G uses different price points to differentiate products within a product line as premium, mid-range, or budget-friendly.

Benefits of Product Line Pricing

- Strategic pricing increases the possibility of sales across all customer groups.

- Though the product may serve a similar purpose, the price varies depending on various factors such as the size and type of the packaging, cost of raw materials, shipping, the quality of different fragrances, flavors used, etc.

Optional Product Pricing

Companies intentionally separate optional accessories from the main product in optional product pricing.

Optional Product Pricing Example: Tesla car

In the automobile category, the base product of vehicles is sold at a relatively low-profit margin, but the company earns profit by selling attractive add-ons that customers are more likely to purchase.

For example, the base price of Tesla’s Model 3 rear-wheel drive is $43,490, and the fully loaded price is $464,630. The difference between the base and the fully loaded prices is $421,140. The fully loaded price of a model depends on the quality and the type of materials used for fit-outs, the features that most customers demand, and the kind of performance outcome each car gives with the add-ons.

Benefits of Optional Product Pricing

- The company makes extra sales by selling ancillary products.

- The base price gives the impression that a product is cheaper.

Captive Product Pricing

Setting prices for two complementary products where one is the main product and the other is necessary for the functioning of the main product is referred to as captive product pricing. Companies often sell the main product at a low price to entice customers to buy the product in the first place.

Captive Product Pricing Example: Kodak Instant Camera and Photo Paper

Kodak instant print camera is available online at an attractive offer price of $49.99. One can buy 100 sheets of compatible photo papers for the same price. Though the company does not initially have a high profit margin, after 100 snaps, the company profits whenever a customer buys additional photo paper.

Benefits of Captive Product Pricing

- Many customers fall for the attractive price of the main product.

- The company earns profits from the recurring sale of the secondary product required for the proper functioning of the main product.

By-Product Pricing

When a company manufactures a product, it leaves behind some residue. Disposal of this residue is often a concern for manufacturers. Companies find a use for this by-product and earn additional revenue by selling it.

By-Product Pricing Example: Vital

A slaughterhouse sells meat as its main product. Its by-products are the skin and bones of bovines and pigs. Gelatin is derived from collagen, which is naturally found in the skin and bones of animals. Usually, by-products don’t fetch a high price. However, owing to the growing demand for gelatin from the healthcare and food and beverage industries, slaughterhouses increased the price of their waste.

The Benefit of By-Product Pricing

- Manufacturers can save the cost of disposing of the by-product if they discover a utility for such products.

Product Bundle Pricing

In price bundling, multiple items are sold at an appealing cost rather than when bought separately. Bundling is of two types: mixed bundling and pure bundling.

Product Bundling Example: Gillette Razor Sold with Edge Shaving Gel/Blade

In the men’s grooming segment, P&G’s Gillette is the market leader in cartridge razors. P&G prices this product high as customers perceive its offering as high value relative to its competitors. To make more consumers try its less popular product, Edge shaving gel, the company bundles both these products at an attractive price. As a variation, products complementing one another are sold as a package to customers, like razors with compatible refill blades.

Benefit of Bundled Pricing

- Widely used in e-commerce, this strategy helps empty the shelves sooner, especially for low-demand products.

READ MORE | Most profit-making companies use a combination of pricing strategies at various times in a product lifecycle. Dive to know the Best Pricing Strategies for E-Commerce

What are Product Mix Expansion and Contraction?

Most companies reduce (contract) and increase (expand) products in their product line by analyzing business productivity. Brands calculate the profitability ratio by comparing income to sales, assets, and equity.

Product Mix Expansion

Organizations expand their product mix either by:

- Increasing product line length: By adding a product line

- Increasing product line depth: By introducing variations to an existing product

Organizations either innovate a product or acquire a brand to capitalize on a market gap. For example, in addition to innovating new products, P&G has spent over $59.90 billion towards 21 acquisitions, such as Gillette, Ambi Pur, Tampax, etc.

Product Mix Contraction

Not always things go as planned. To regain balance, organizations have to take the difficult decision to eliminate brands from the product mix under two circumstances:

- If the products are not performing well

- If the manufacturing cost is too high and correspondingly, it is not feasible to increase the selling price

P&G has phased out nearly 30 brands and divested about 50 products as they performed below expectations. The company exited the prescription drug, food, and pet category completely.

Companies that monitor their product assortment closely can identify overcrowded and under-represented categories and take action as needed.

In conclusion

Product assortment analytics can be a good tactic to work into your product mix pricing strategy if you are a big player with a multi-channel presence.

The customized dashboard that MetricsCart creates offers the convenience of monitoring prices and product mix performance across marketplaces. Write to us today to experience a demo of our services on the digital shelf.