About This Report

This report examines Nespresso vs. Keurig brand performances in Amazon’s coffee category, providing insights into their product strategies, pricing trends, discounting behavior, customer ratings, and sales performance. We analyzed products listed on Amazon by Nespresso and Keurig between April 4 and April 21, 2025, to compare how each brand engages shoppers and performs on the digital shelf to reveal who is winning in Amazon’s competitive coffee market.

Nespresso vs. Keurig: What’s Brewing In Amazon’s Coffee Category?

The global coffee market continues to thrive, with the single-serve coffee maker segment growing at a rate of 6.65% annually. By 2032, the market is projected to reach $ 1.688 million, fueled by consumer demand for convenience and quality at home.

As at-home coffee culture rises, brands are shifting toward offering quick, customizable, and premium coffee experiences, with coffee makers, capsules, and pods playing a pivotal role. Consumers are increasingly looking for ease, speed, and high-quality brews without leaving their homes.

Among the key players, Nespresso and Keurig stand out, each with distinct strategies. Nespresso focuses on delivering a premium, high-quality coffee experience with its proprietary Vertuo system, designed for coffee lovers who prioritize flavor and sustainability.

In contrast, Keurig offers a wider range of affordable, versatile machines and is known for its K-Cups, catering to a broader audience with diverse preferences. These strategies are shaping how each brand is performing, especially on platforms like Amazon, where pricing, product assortment, and customer reviews play a crucial role.

Let’s look deeper into how Nespresso vs. Keurig are performing on Amazon. From sales trends to pricing strategies, customer satisfaction, and listing performance, we’ll explore the key factors influencing each brand’s success in this competitive category.

Highlights

- Keurig has 7,400 product listings on Amazon vs Nespresso’s 6,296, indicating a wide-reach SKU expansion strategy.

- Nespresso generates nearly 3x more monthly revenue at $45.9M vs Keurig’s $16.4M, suggesting more efficient monetization per SKU.

- Nespresso’s average product price is $74.82, while Keurig’s is $176.14, reflecting a divergence in product mix and pricing model.

- Keurig offers deeper discounts, averaging 8.24% vs Nespresso’s 7.64%, yet its conversion efficiency remains lower.

- Nespresso leads in customer satisfaction, with 60% more 5-star-rated products compared to Keurig.

READ MORE| Want a deeper dive into Amazon’s coffee category? Check out Digital Shelf Insights: Nestlé Dominates Among Amazon’s Coffee Products.

Keurig Has 7400 Product Listings, But Nespresso Earns 3x More Revenue at $45.9M

Keurig has more product listings on Amazon than Nespresso, with 7,400 compared to Nespresso’s 6,296. This suggests a broader assortment strategy, where Keurig aims to capture a larger segment of the market by offering a variety of machines, accessories, and even third-party pods.

The expanded catalog may also allow Keurig to reach more consumer preferences across different price points and needs. However, while Keurig’s larger listing count suggests a greater variety, it doesn’t necessarily correlate with higher sales.

Comparing Nespresso vs. Keurig sales on Amazon, it is clear that despite having fewer listings, Nespresso’s more focused catalog generates nearly three times the revenue of Keurig, earning $45.9M compared to Keurig’s $16.4M.

This indicates that Nespresso’s approach of offering fewer but higher-performing products is more effective in converting consumer interest into revenue. Nespresso’s focus on premium pods and high-quality machines encourages repeat purchases and builds a loyal customer base.

In contrast, Keurig’s broader catalog, although diverse, appears to lack the same level of product concentration and sales efficiency. This highlights the importance of SKU productivity, which is the revenue each listing generates, rather than simply having a larger number of SKUs.

Nespresso’s model of curated, high-demand items has proven more effective at maximizing revenue per listing, despite fewer product options.

Nespresso’s Top-Seller Sells Up to 100K Units/Month and Keurig’s Cap at 20K Units/Month

Nespresso’s top-selling products are its Vertuo capsules, which dominate the market with impressive monthly sales figures. The Nespresso Capsules Vertuo, Melozio, Medium Roast Coffee (10 Count, Pack of 3) and the Variety Pack (30 Count) each sell 100,000 units per month. Additionally, the Double Espresso Chiaro (30 Count) achieves 80,000 units per month. These high numbers reflect strong demand for Nespresso’s consumables.

In contrast, Keurig’s highest-selling products, such as the Keurig 3-Month Brewer Maintenance Kit and the Keurig K-Express Single Serve K-Cup Pod Coffee Maker, achieve far lower monthly sales of 20,000 units. While these products may have a higher price point, they don’t benefit from the same replenishment cycle as Nespresso’s pods.

Nespresso benefits from repeat purchase behavior; once a consumer buys a Nespresso machine, they are likely to return for capsules continuously, especially given the brand’s exclusive ecosystem. This creates a steady, predictable revenue stream, and Nespresso’s reliance on high-demand, consumable products positions it to benefit from long-term customer loyalty.

Keurig’s top products, primarily machines and maintenance kits, attract fewer repeat purchases, and thus, the brand depends more on initial purchase volume rather than sustained revenue from consumables.

Nespresso’s Average Price Is $74.82 vs Keurig’s $176.14

This gap in Nespresso vs. Keurig price on Amazon directly reflects the product strategy divergence. Keurig’s focus on hardware inflates its average price point, positioning it as a more premium upfront investment. Nespresso, while also selling machines, achieves a lower average price through its volume of lower-cost pods.

This positions Nespresso to attract more first-time buyers, enable more frequent purchases, and ultimately build customer loyalty through usage. For price-sensitive shoppers, this translates to lower friction and higher trial probability.

READ MORE| Your brand needs a smart price intelligence tool to scale up! Read Price Intelligence 101: A No-Nonsense Guide to know more.

Keurig Offers an Average of 8.24% Discount vs Nespresso’s 7.64%

While Keurig offers slightly higher average discounts than Nespresso, this approach doesn’t appear to translate into better sales results. Keurig’s discounting strategy, averaging 8.24%, may seem effective on the surface, especially in a price-sensitive market.

Despite offering higher average discounts, Keurig’s discounting doesn’t yield better returns in revenue. This signals lower elasticity of demand or weaker product differentiation. It also raises the risk of perceived value erosion, especially if buyers associate Keurig with frequent price cuts.

Nespresso’s smaller but more effective discounting strategy reflects stronger brand equity and pricing power. For premium-positioned brands, restrained promotions and value-based pricing often signal confidence in quality and help preserve margin integrity.

Nespresso Has 60% More 5-Star Rated Products Than Keurig

Looking at Keurig and Nespresso ratings on Amazon, Nespresso outperforms with over 3,200 5-star listings compared to Keurig’s 2,011. Breaking this trend are the 4-star listings, where Keurig shines with 5,057 listings and Nespresso maintains 3055.

For Keurig, the presence of more 1- and 2-star listings is concerning and which can be traced to inconsistent quality across a broader assortment and possibly less control over third-party fulfillment. This is a common challenge in marketplaces like Amazon, where many of Keurig’s products are listed by third-party vendors.

Nespresso’s tighter catalog and brand-managed presence help ensure quality consistency and review strength, which are major drivers of Amazon conversions. With fewer SKUs, Nespresso has a stronger ability to control the end-to-end customer experience, from product design and manufacturing to fulfillment and customer service.

This results in fewer instances of quality issues and higher customer satisfaction with over 3000 listings, each with 4-star and 5-star ratings.

With MetricsCart’s rating and review monitoring software, you can gain critical insights into consumer behavior and product development with advanced features like thematic review analysis and customer sentiment analysis.

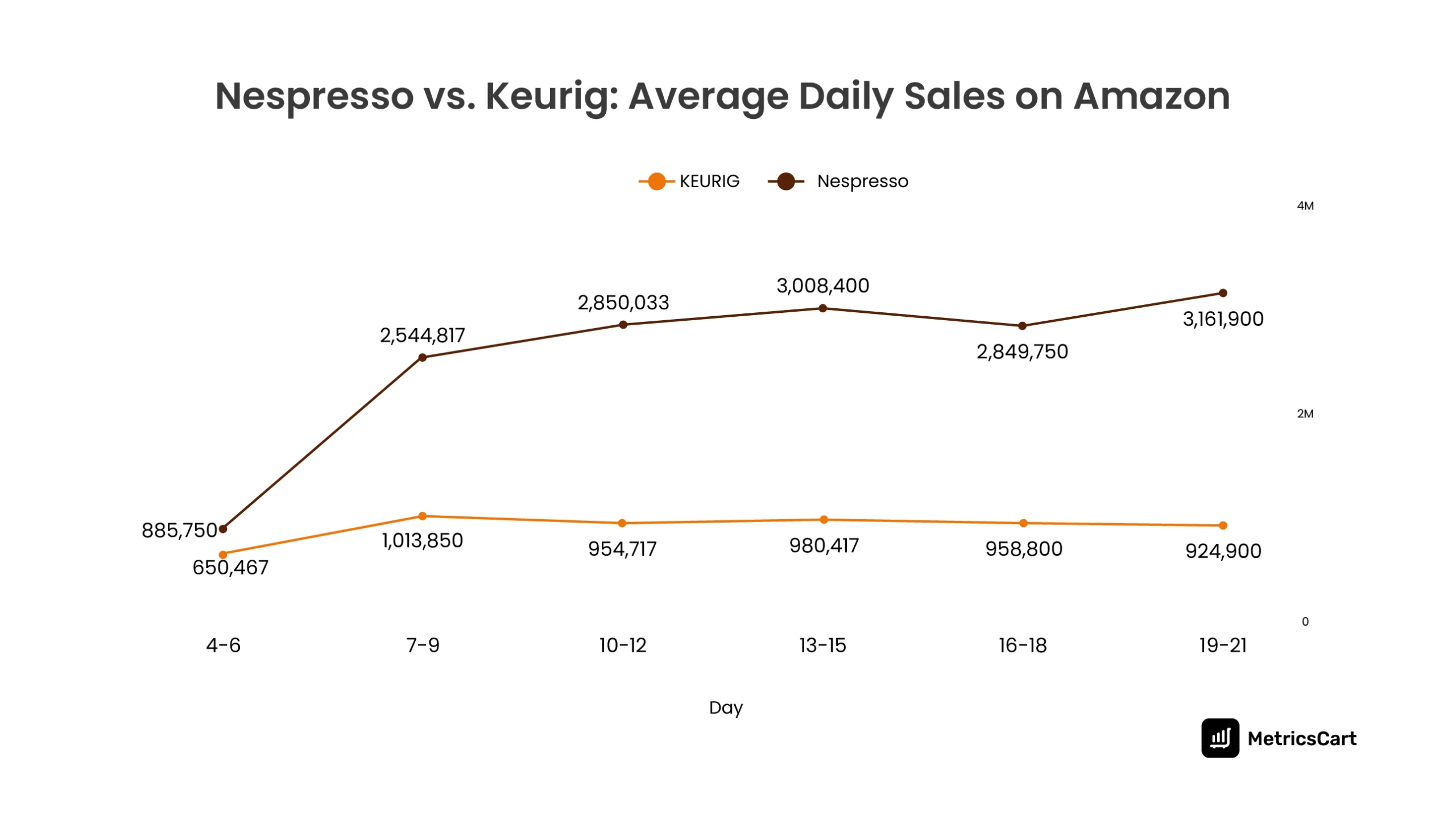

Nespresso Daily Sales Rose from $885K to $3.16M; Keurig Stayed Flat at Around $950K

Daily sales trends underscore brand momentum. Nespresso not only started stronger but also built sales steadily throughout the 17-day period, nearly quadrupling its average daily revenue. This suggests strong promotional alignment, replenishment cycles, and customer satisfaction effects.

Keurig’s flat trendline, hovering just below an average of $1M/day, indicates either market saturation or weak promotional leverage. Brands aiming to sustain growth on Amazon must focus not just on peak campaigns but on building repeat-driven, momentum-based demand.

READ MORE| What’s driving Amazon’s grocery and gourmet bestsellers? Check out From Nespresso to Core Power: Amazon Grocery & Gourmet Bestsellers

Nespresso vs. Keurig: The Final Brew

The comparison of Nespresso vs. Keurig on Amazon highlights two distinct e-commerce playbooks.

Nespresso excels in depth, efficiency, and customer lifetime value, generating higher revenue through a smaller yet more effective catalog and strong repeat behavior. Nespresso has successfully leveraged its consumable-based model, driving repeat purchases and strong brand loyalty.

The ability to create a consistent, premium experience has also helped establish Nespresso as a high-quality brand in the eyes of consumers, reflected in its significantly higher number of 5-star ratings.

In contrast, Keurig’s breadth-first approach, with a larger assortment of products, leads to a more diluted impact. While Keurig’s wide range of machines, accessories, and third-party pods allows for greater market reach, its reliance on upfront machine sales limits its ability to generate sustained revenue from repeat purchases.

For marketplace brands, the takeaway is clear: optimize for recurring value, not just catalog size. Prioritize product quality, invest in SKU-level performance over scale alone. Additionally, product quality and customer satisfaction are crucial for sustainable growth, as they directly influence conversion rates and brand reputation.

Conclusion

This Nespresso vs. Keurig report is a wake-up (and smell the coffee) call for brands. In today’s competitive digital marketplace, winning isn’t about having the most listings; it’s about having the right strategy. Focusing on product quality, repeat sales, and customer loyalty is the key to driving sustainable growth.

This is where MetricsCart can help. By providing actionable insights into pricing trends, market positioning, competitor performance, product performance, and customer feedback analysis, MetricsCart empowers brands to optimize their digital shelf strategy.

With real-time analytics, stay ahead of competitors by focusing on the metrics that matter most for sustained growth. Ready to optimize your Amazon strategy? Get in touch with MetricsCart today and start driving smarter, data-backed decisions for your brand’s success.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready To Scale Your Brand and Drive Results? Unlock Your E-Commerce Potential Today!