Noodles in India are a comfort category that functions as a habit or a quick-fix meal. The same shopper who tops up milk and bread also tosses in a packet of noodles as a basket-filler on quick commerce apps. That’s how current noodle category trends run; built not just on hunger, but instant gratification + flavor curiosity, + convenience.

In Delhi, where hybrid-mode professionals, students, families, and late-night workers lean heavily on quick comfort food, noodles have shifted from a planned household stock-up item to an on-demand impulse buy category.

About the Report

This report analyzes 969 noodle SKUs listed on Instamart across five key Delhi pincodes: Patel Nagar/Karol Bagh (110005), Daryaganj/ITO (110002), Jangpura/Defence Colony (110003), Civil Lines/Kashmere Gate (110006), and Chanakyapuri (110011), between August 1 and August 7.

The analysis covers pricing structures, discount strategies, delivery windows, category segmentation, and brand shelf depth. Let’s uncover noodle category trends on Instamart and provide forward-looking insights for FMCG brands to optimize assortment, pricing strategy, and supply cadence in quick commerce.

Highlights

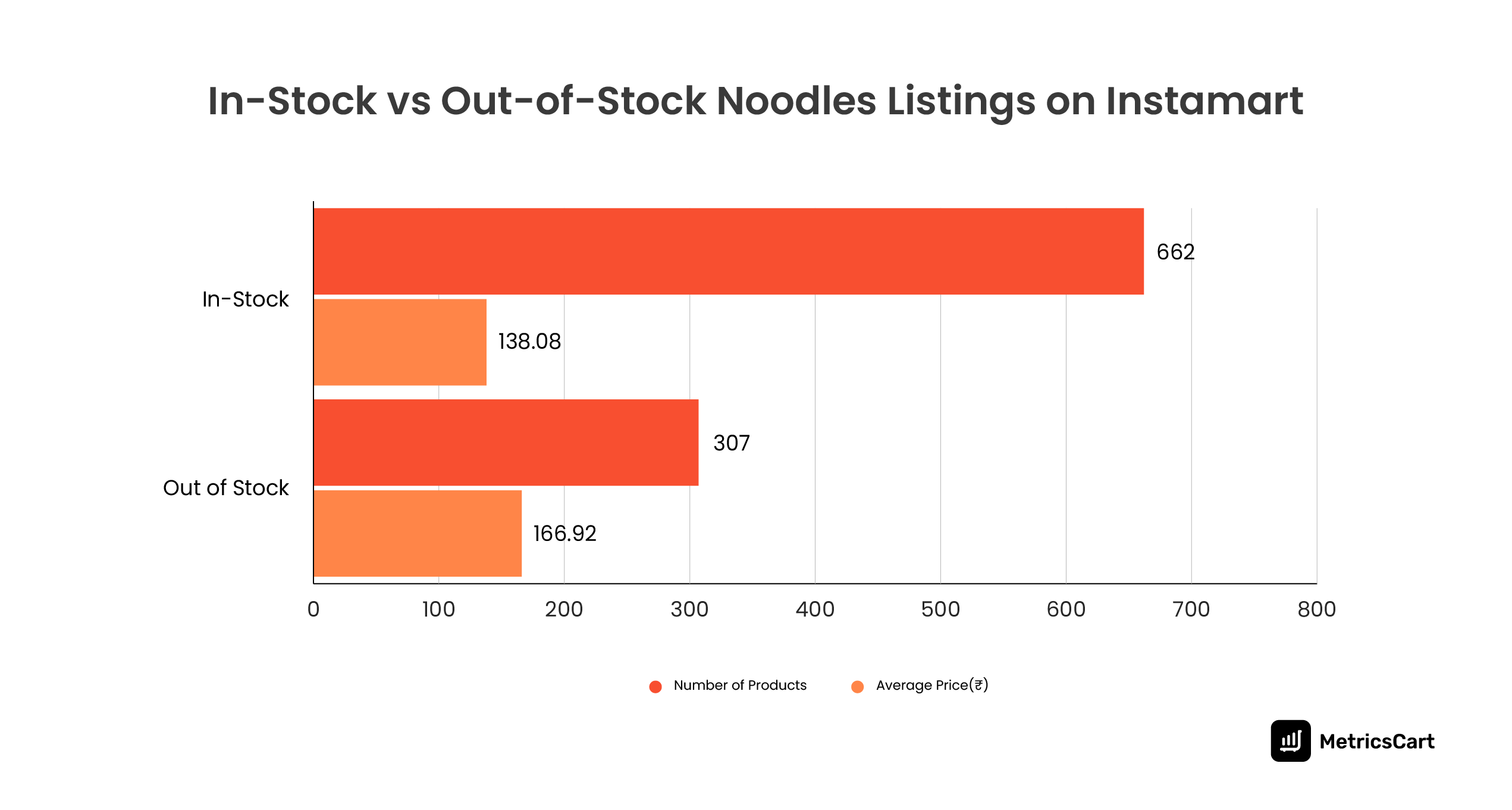

- We tracked 969 noodle SKUs across five key Delhi pincodes on Instamart, with 662 in stock and 307 out of stock, indicating ~32% supply gaps in a fast-turning category.

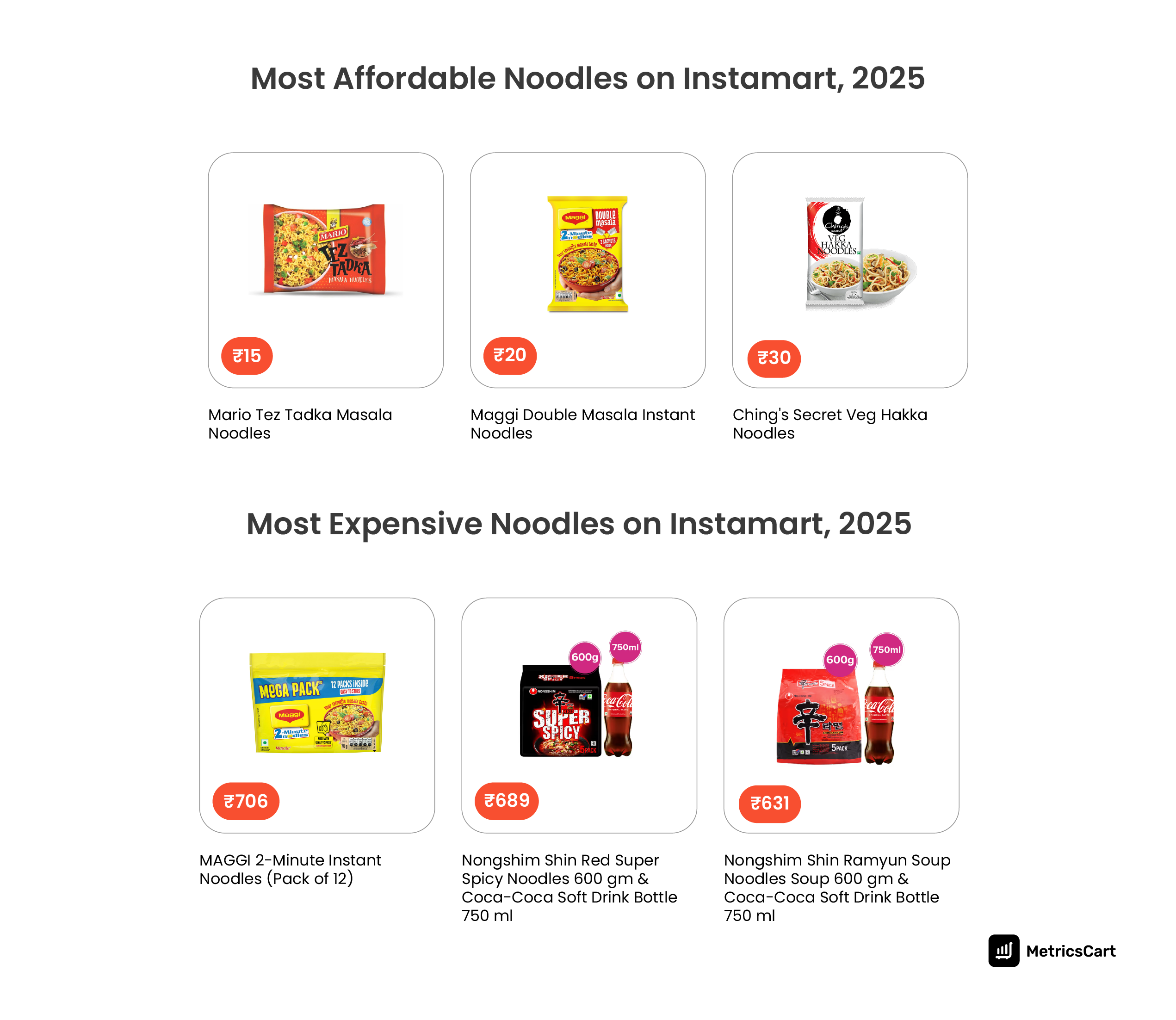

- Prices ranged from ₹15 for entry-level ramen to ₹706 for premium multipacks, showing a broad value-to-indulgence consumption spread.

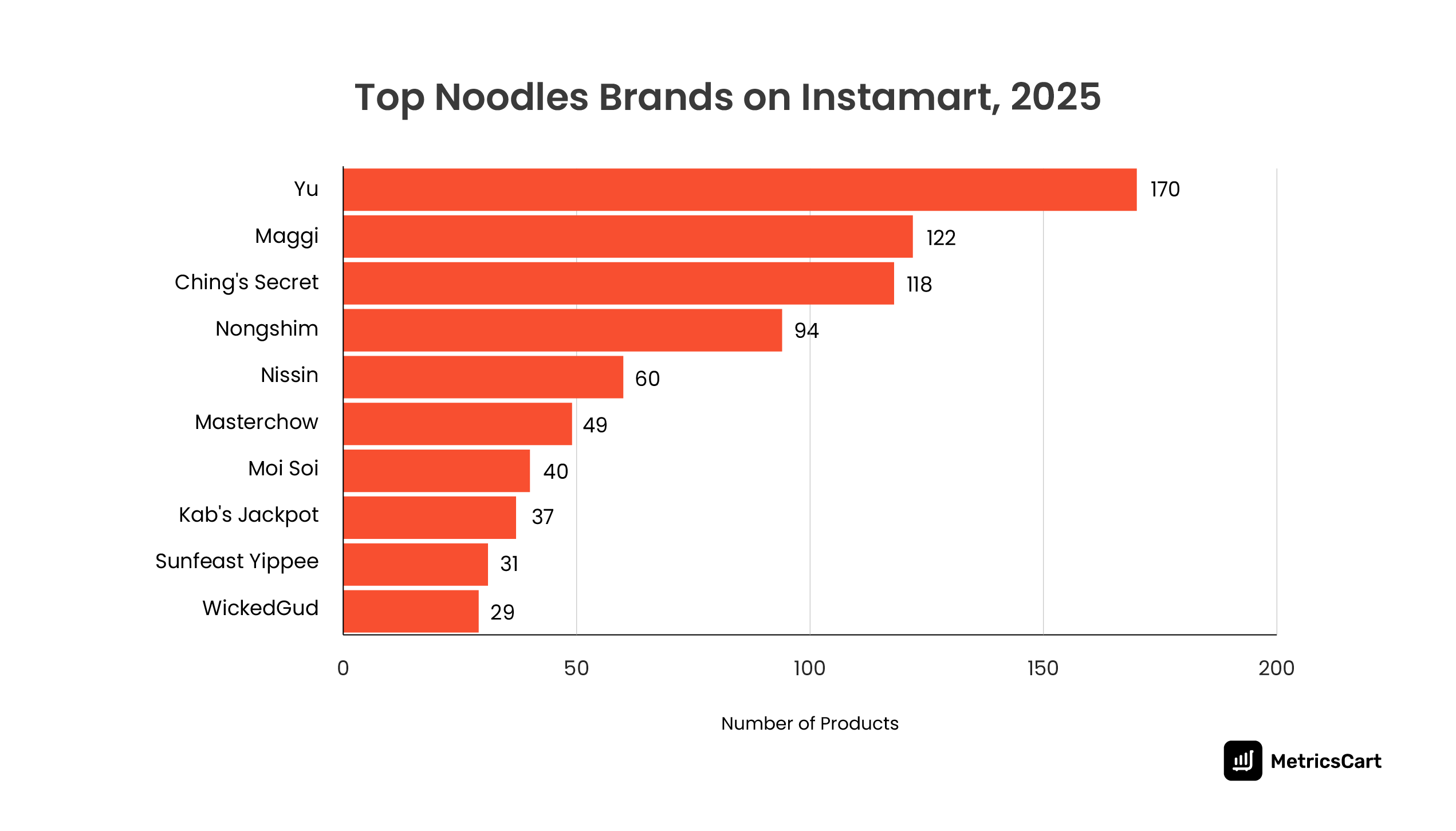

- Yu (170 SKUs), Maggi (122), and Ching’s (118) led assortment depth, while Nongshim (94) and Nissin (60) anchored the premium segment.

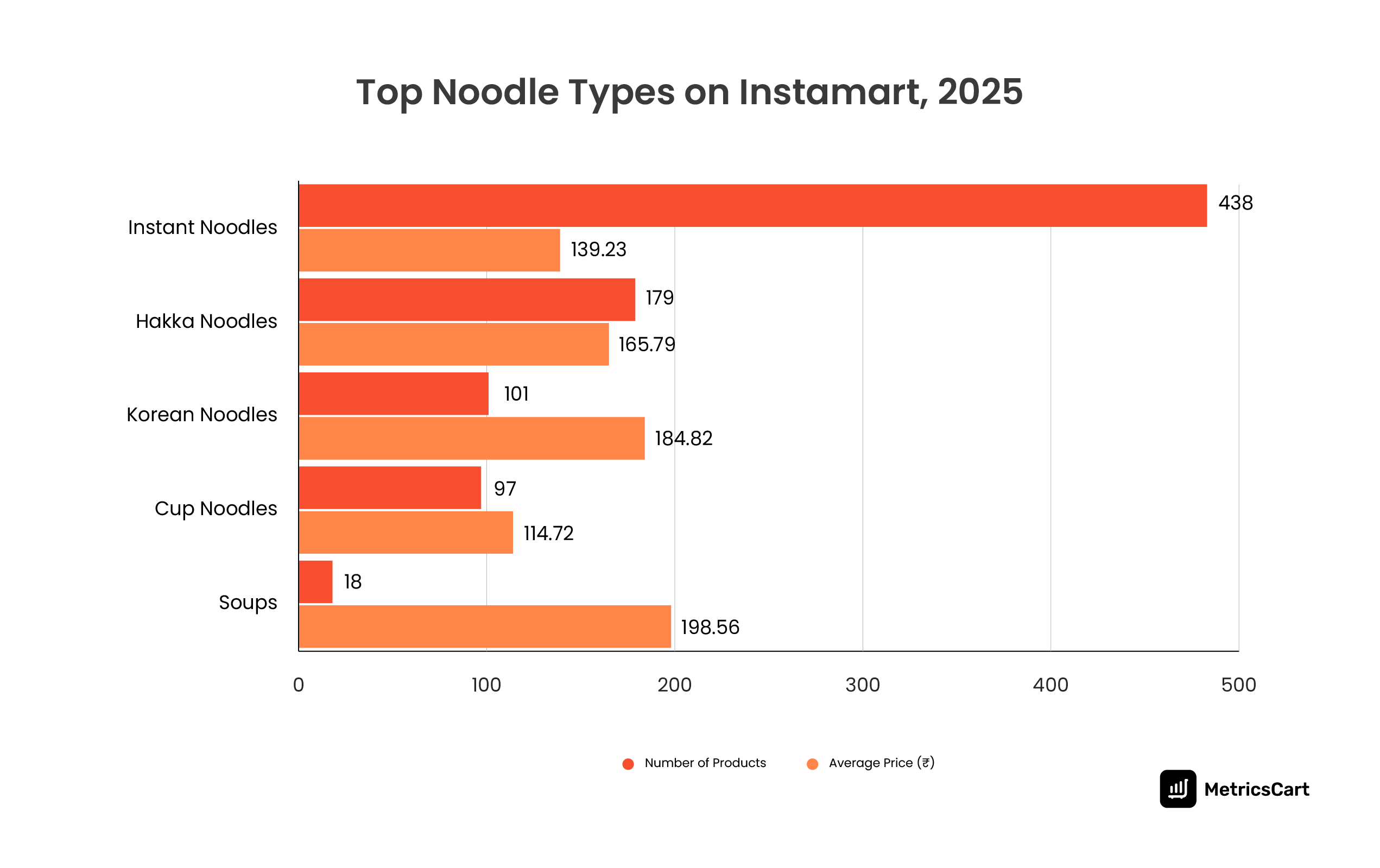

- Instant noodles dominated with 483 listings, followed by Hakka (179), Korean (101), and Cup noodles (97), reflecting layered shopper intent from daily staples to flavor exploration.

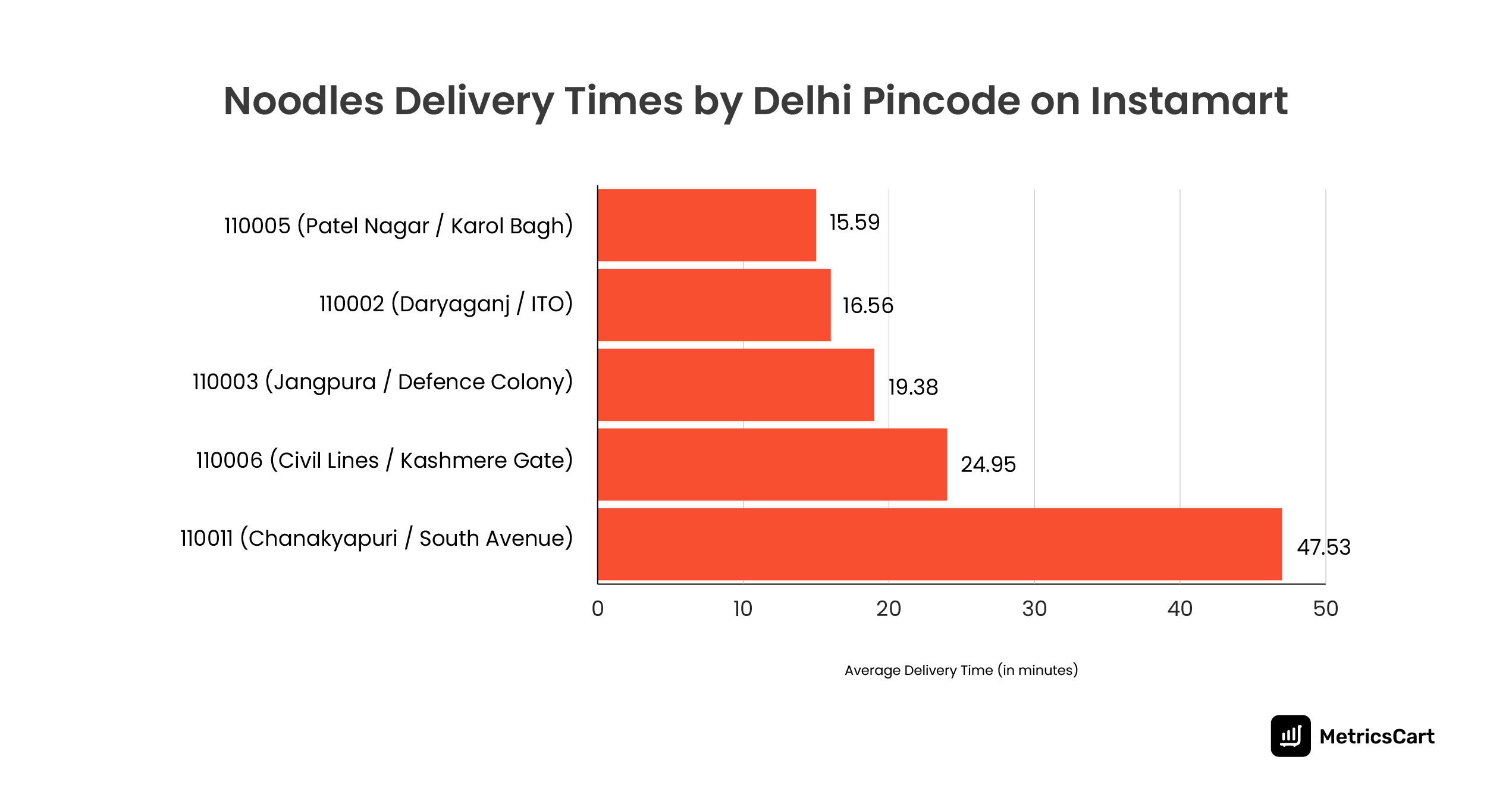

- Delivery times varied sharply, from ~15.6 minutes in 110005 to ~47.5 minutes in 110011, reinforcing the role of speed and locality in driving noodle demand in quick commerce.

India’s Obsession with Instant Noodles & Instant Delivery

The Indian instant noodle market has been expanding consistently, supported by rising urbanization, dual-income households, and increasing acceptance of convenience-forward products. Noodle market growth analysis indicates that India’s instant noodle segment was valued at $1.95 billion in 2023, driven by rising disposable incomes and growing health awareness.

Within Delhi, the market visibly reflects these structural forces. Traditional masala and atta noodles continue to sustain high-frequency repeat demand, demonstrating strong habitual purchase behavior. However, consumer willingness to purchase premium Korean ramen, no-maida, protein-fortified noodles, and international flavor lines at significantly higher price points indicates a layered demand curve rather than a purely budget-driven one.

Quick commerce amplifies these forces. The ability to satisfy cravings instantly elevates noodles to a crossover category; part comfort food, part snack indulgence, part global flavor occasion.

Let’s look at broad noodle category trends based on the data collected by MetricsCart.

Noodle Category Trends on Instamart

Delhi’s Instamart noodle ecosystem divides into three functional consumer pathways:

First, a solid value foundation where products like Mario and Maggi preserve affordability for everyday consumption. These SKUs ensure the category’s essential role remains intact, securing constant churn and anchoring price expectations.

Second, a rapidly expanding mid-tier driven by new flavors, health narratives, and emerging Indian D2C brands. Here, noodles straddle everyday eating and occasional indulgence, supported by moderate price points and frequent discovery buying.

Third, a growing premium tier dominated by Korean ramen and specialty protein noodles priced above ₹250, signaling a developed indulgence orientation. Notably, premium SKUs frequently went out of stock during the period; a supply-demand imbalance that underscores the sustained appetite for global flavors, not a fleeting trend.

This three-tiered demand dynamic mirrors modern beverage or snacking categories, where staple products maintain volume, innovation retains interest, and premium items elevate margins.

The Price Spectrum: Cheapest vs Costliest Instant Noodles

At the entry point, noodle packs priced at ₹15-₹30, including Mario Tez Tadka, Maggi Double Masala, and Ching’s Veg Hakka, anchor affordability. Interestingly, Slurrp Farm’s no-maida SKU at ₹31 shows health messaging has begun permeating the bottom tier, demonstrating that wellness cues can co-exist within mass-market price points.

At the top of the spectrum, products like Maggi’s 12-pack at ₹706 and Nongshim Shin bundles priced over ₹600 highlight an indulgent, premium behavior that leans on brand equity, flavor authenticity, and experiential appeal. The presence of bundle SKUs (e.g., noodles paired with beverages) reflects a deliberate value laddering and basket-expansion tactic.

The ₹15-₹706 range illustrates a rare category breadth that allows brands to secure high-frequency repeat customers while capturing premium occasions, enabling volume and margin growth simultaneously.

Which Noodles Brands Lead on Price: Value vs Premium

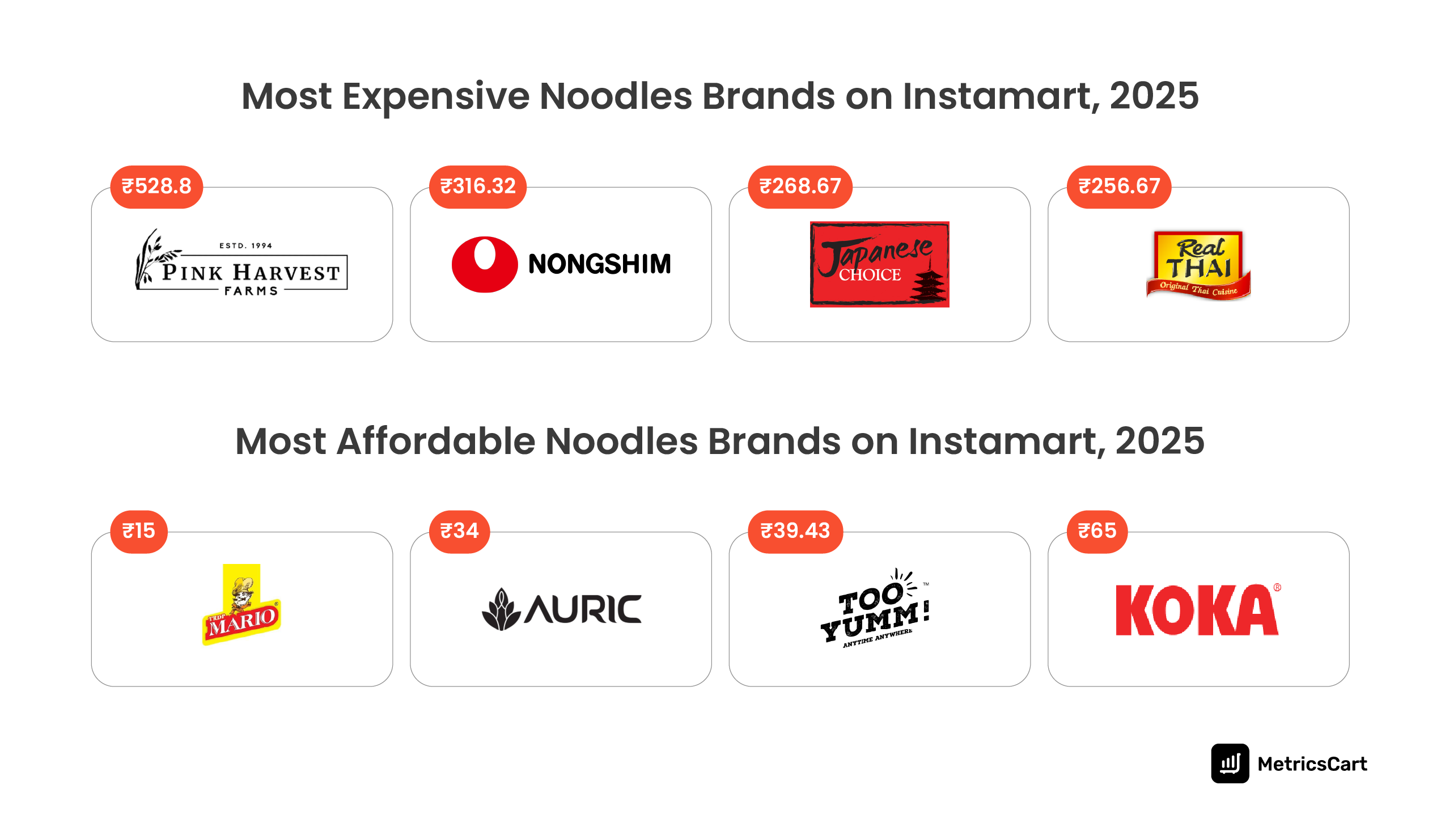

Value-positioned brands such as Mario (₹15), Auric (₹34), and Tops (₹65) target high-frequency purchases and price-conscious buyers. Their pricing logic relies on ubiquity and routine buying behavior, securing an essential footprint and minimizing decision friction.

Conversely, premium offerings from Pink Harvest (₹582.8 average), Nongshim (₹316.32), and Real Thai (₹256.67) cater to aspirational buyers willing to trade up for novelty, global cuisine identity, and protein-rich propositions. This segment operates on taste elevation and wellness narratives, indicating a maturing palate in metropolitan environments going along with global noodle consumption trends.

Together, these two poles show that noodles in Delhi function across daily habits, flavor exploration, and lifestyle alignment.

Which Are The Most Discounted Products in The Noodles Category on Instamart?

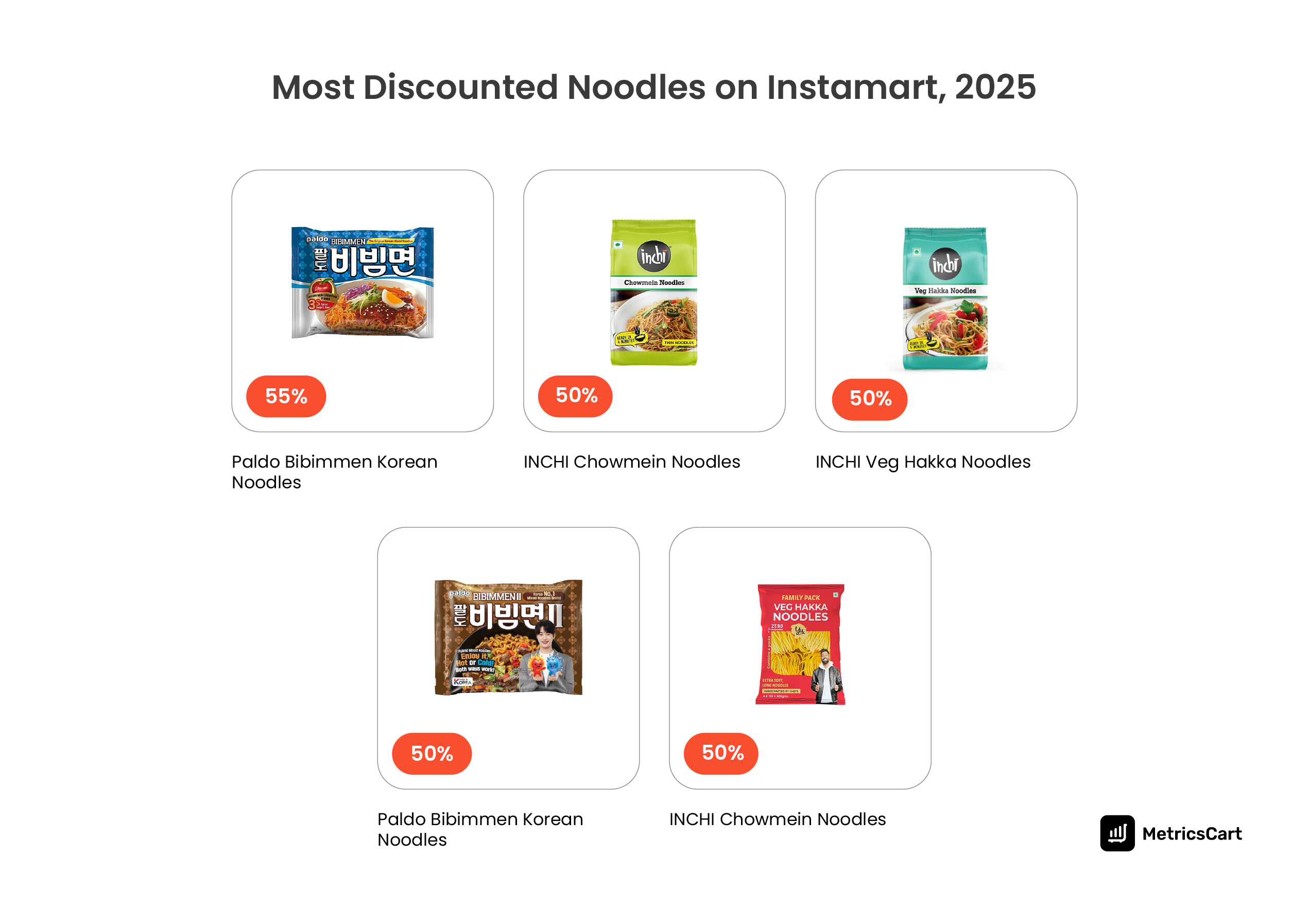

Significant discounting patterns, such as Paldo Bibimmen at 55% and INCHI Veg Hakka at 50%, reveal brands using price elasticity to accelerate trial.

These are not distress-driven discounts but intentional demand-creation tools, designed to gain algorithmic visibility, spike sampling, and build habitual consumption through repeated exposure.

Brands that plan structured promotional cycles tend to seed stronger repeat usage, especially in categories driven by flavor curiosity.

Now, let’s look at it brand-wise.

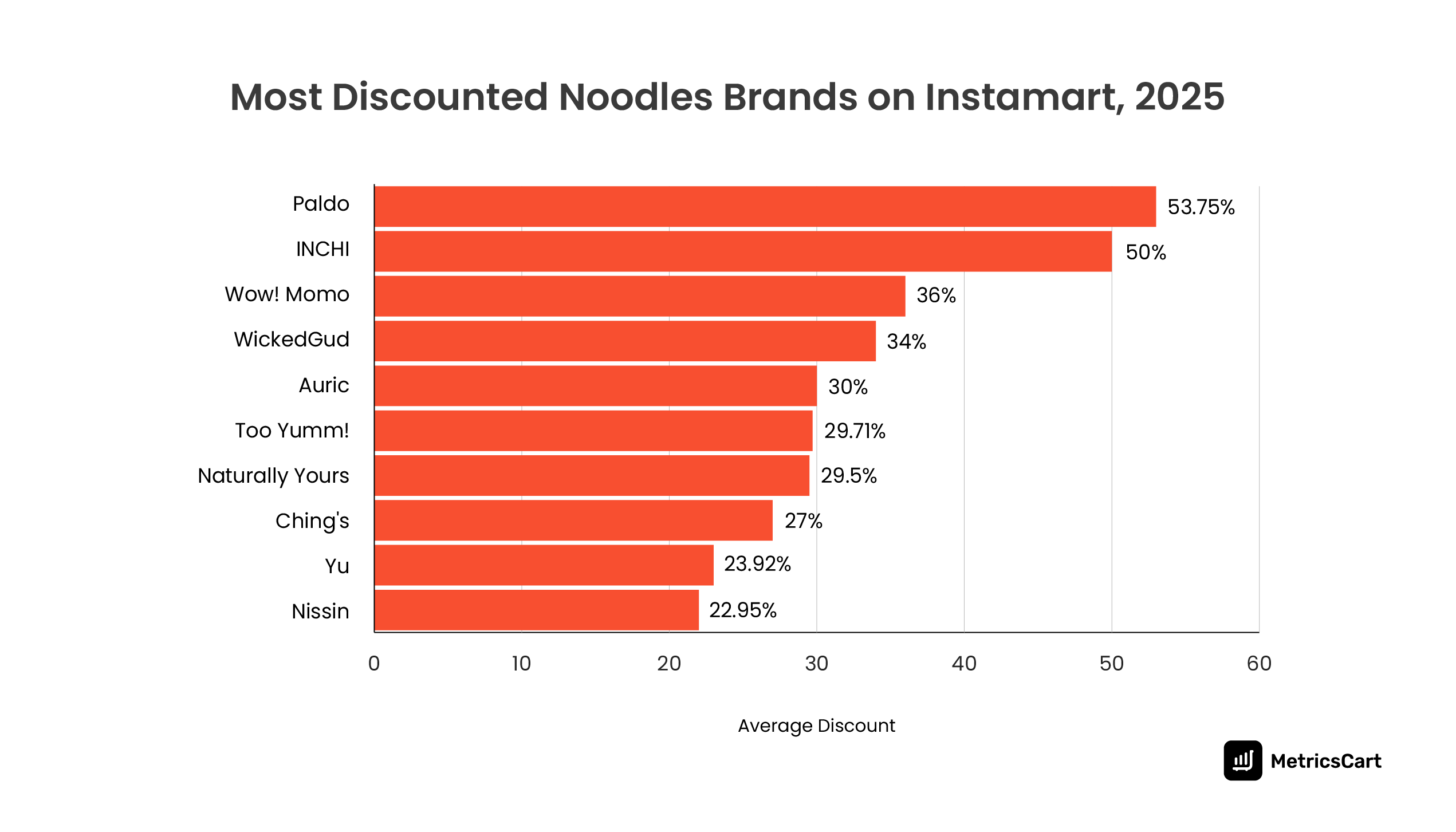

Across the week, Paldo averaged 53.75%, INCHI 50%, Wow! Momo 36%, and Ching’s ~27% in promotional depth. This tiered approach outlines a tactical mix: new entrants purchasing trial at scale, established leaders defending penetration, and QSR-adjacent players converting flavor affinity into retail adoption.

These discount dynamics illustrate a category where trial must be earned, and where pricing levers are strategic tools for long-term mental availability rather than short-term liquidation.

READ MORE | Dark Patterns in Quick Commerce: When Zepto, Blinkit, Instamart & Other Apps Act Sneaky!

Which Are The Top Noodles Brands on Instamart?

Shelf distribution on Instamart shows Yu leading with 170 SKUs, followed by Maggi (122) and Ching’s (118). This breadth indicates Yu’s aggressive multi-format strategy, appealing to varied price bands and consumption roles.

Maggi maintains its status as a foundational staple, ensuring familiarity and consistent replenishment. Meanwhile, brands like Nongshim and Nissin reinforce global flavor adoption, evidencing sustained enthusiasm for Korean ramen rather than speculative hype.

Together, these brand layers confirm that consumers oscillate seamlessly between comfort defaults and adventurous trials, depending on context and impulse strength.

With a quick commerce data solution provider like MetricsCart, your FMCG brand can turn q-commerce signals into the right strategies to capture category leadership on top platforms.

Which Types of Noodles Are Winning Instamart Baskets

Instant noodles continue to anchor the category with 483 SKUs, reinforcing their role as the everyday comfort base for Delhi shoppers. The next layer of demand comes from Hakka noodles and Korean ramen, which sit in the middle of the spectrum and represent exploration-driven consumption, whether it is recreating restaurant-style stir-fried noodles at home or tapping into the global K-flavor trend.

Cup noodles serve highly specific moments: late-night hunger, workplace snacking, hostel living, or days when convenience overrides cooking effort. Meanwhile, soups, although the smallest segment by SKU volume, hold the highest average price, reflecting a premium wellness- and comfort-driven micro-audience willing to trade up for perceived health benefits and cleaner ingredient cues.

With the rise of quick commerce in India, what is important here is the shift in consumer mindset. Noodles in Delhi are no longer purchased only as emergency food; they are treated as a flexible eating format, fitting weekdays and weekends, fast hunger and slow meals, and comfort moods.

This behavioral pattern aligns with global noodle consumption trends, where markets like South Korea, Japan, and Southeast Asia also show a dual demand curve, mass uptake of quick-cook noodles paired with a rapidly rising premium ramen segment, functional noodle lines (high protein, low carb, whole grain), and cup formats optimized for speed and portability.

Delhi’s Instamart data reflects this same layered evolution, suggesting that India is following the instant noodle market trends, shifting from a basic necessity to a multi-occasion, culture-driven convenience food with active premiumization.

READ MORE | Ready-to-Drink, Ready-to-Deliver: How Quick Commerce is Shaping India’s Beverage Market

In-Stock vs Out-of-Stock Reality of Noodles on Instamart

The ~32% out-of-stock rate, coupled with the higher average price of OOS SKUs (₹166.92 vs ₹138.08 in-stock), underscores that premium products face faster sell-outs and require stricter replenishment cycles in high-demand localities.

In quick commerce, stock-outs are not merely lost orders; they are lost category habit opportunities, especially in indulgence-heavy formats. Brands must strengthen forecasting granularity and adopt pincode-level replenishment playbooks.

To keep up with shopper speed and demand during peak windows, quick commerce stock monitoring is a must-have for FMCG brands.

How Fast Does Instamart Deliver Noodles in Delhi?

Delivery speed varied sharply from ~15.6 minutes in 110005 to ~47.5 minutes in 110011. In categories driven by immediate consumption intent, such disparities meaningfully impact conversion probability and repeat loyalty.

Simultaneously, SKU depth peaked in 110006 (239) and 110003 (217), suggesting higher openness to assortment variability and experiment-driven shopping behavior. Meanwhile, 110002 and 110011 showed tighter assortments, aligning with more stable and predictable consumption patterns.

Fast delivery plus assortment flexibility form the ideal equation for maximizing noodle demand; slower regions benefit from reliable stocking of core SKUs.

Beyond the Bowl: What It Really Means for Brands

Delhi’s noodle category trends shelf illustrates a category in evolution; one that sits between everyday necessity and experiential treat. For brands, the implications are clear:

- Build tiered price-pack architectures to service both staple and premium demand streams.

- Run structured promotions to shape trial without eroding long-term brand value.

- Invest in pincode-level inventory discipline to prevent premium OOS-driven revenue loss.

- Monitor delivery performance in food-immediacy categories to safeguard conversion.

- Blend nostalgia and novelty in product strategy; both emotions drive consumption.

To capitalize on global noodle consumption trends locally, brands must recognize noodles not just as food, but also as a fast-moving emotional utility shaped by convenience, timing, cultural curiosity, and comfort.

Understanding this level of real-time category performance and consumer behavior demands real-time intelligence. MetricsCart’s quick commerce analytics platform enables brands to track pricing, discount depth, availability, promo performance, and consumer search shifts across Instamart, Blinkit, and Zepto, down to the pincode and product level.

Move beyond category awareness to category command. Book a MetricsCart demo to operationalize these insights.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Turn Quick-Commerce Signals Into Market Share.