Retail media ad spend is expected to hit $179.5 billion globally by the end of 2025.

And, retail media is now the third big wave in digital advertising after search and social. In fact, it’s growing faster than both. eMarketer predicts retail media will account for nearly a quarter of all digital ad spend within the next three years.

And guess what, retail media search, that is, ads placed directly within retailer search results, is now the fastest‑growing slice of that pie.

That means for brands, the competition isn’t just to be there, it’s to be found first.

But here’s the thing no one likes to admit: most brands are overspending in the wrong places. You’ve probably seen it before; two brands with similar budgets, but one dominates visibility while the other barely makes a blip.

And that’s where our focus metric comes in: Share of Search (SOS) for retail media ad spend optimization.

This isn’t just another KPI on your dashboard. Get it right, and you’ll stop blindly allocating money. You’ll know exactly where to optimize retail media budget for maximum impact.

Role of Share of Search in Retail Media

Share of Search is, at its core, a visibility and demand indicator. It measures how much of the category’s branded search traffic belongs to you, which is why it’s invaluable for mastering retail media ad spend.

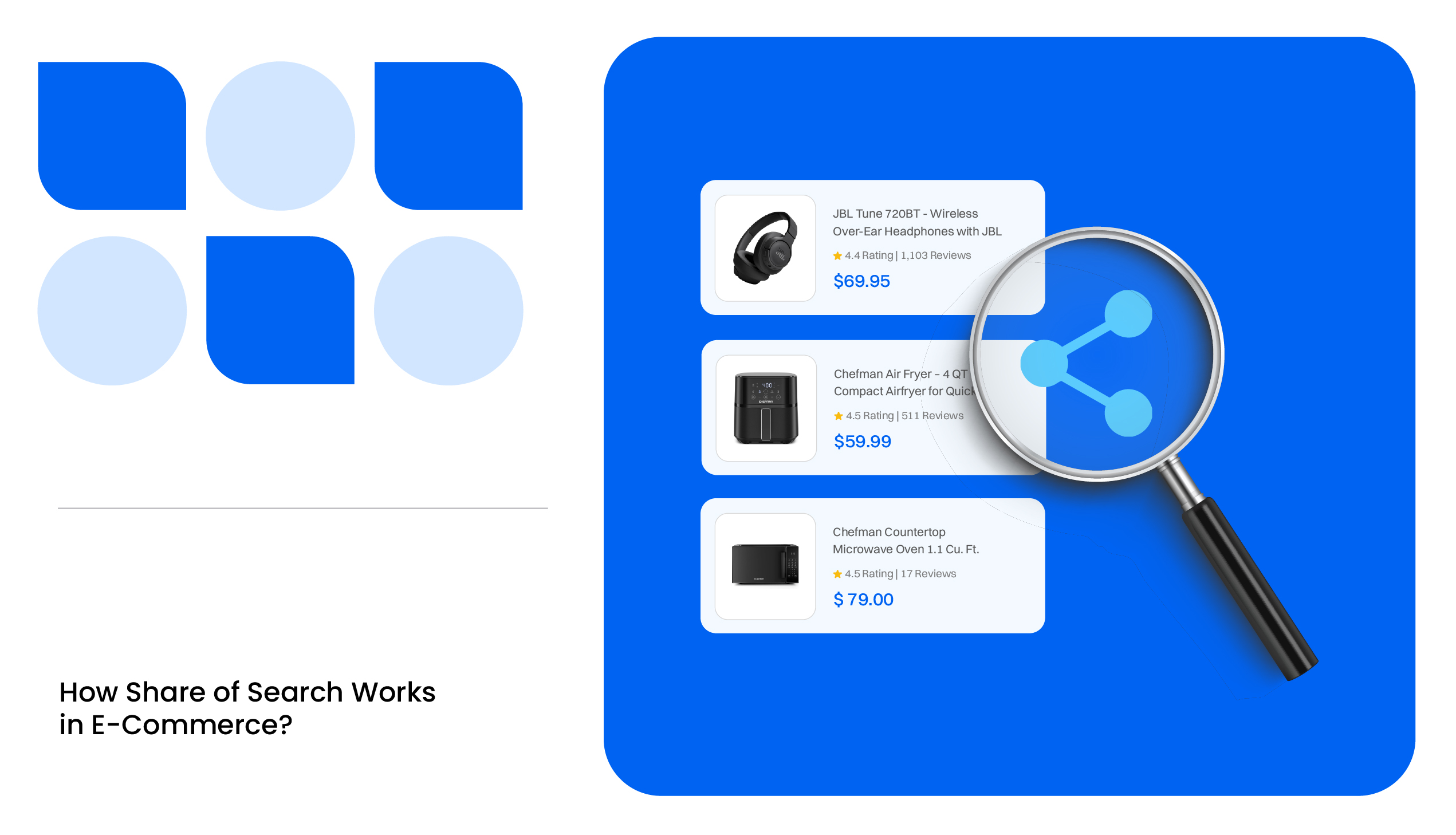

What is Share of Search?

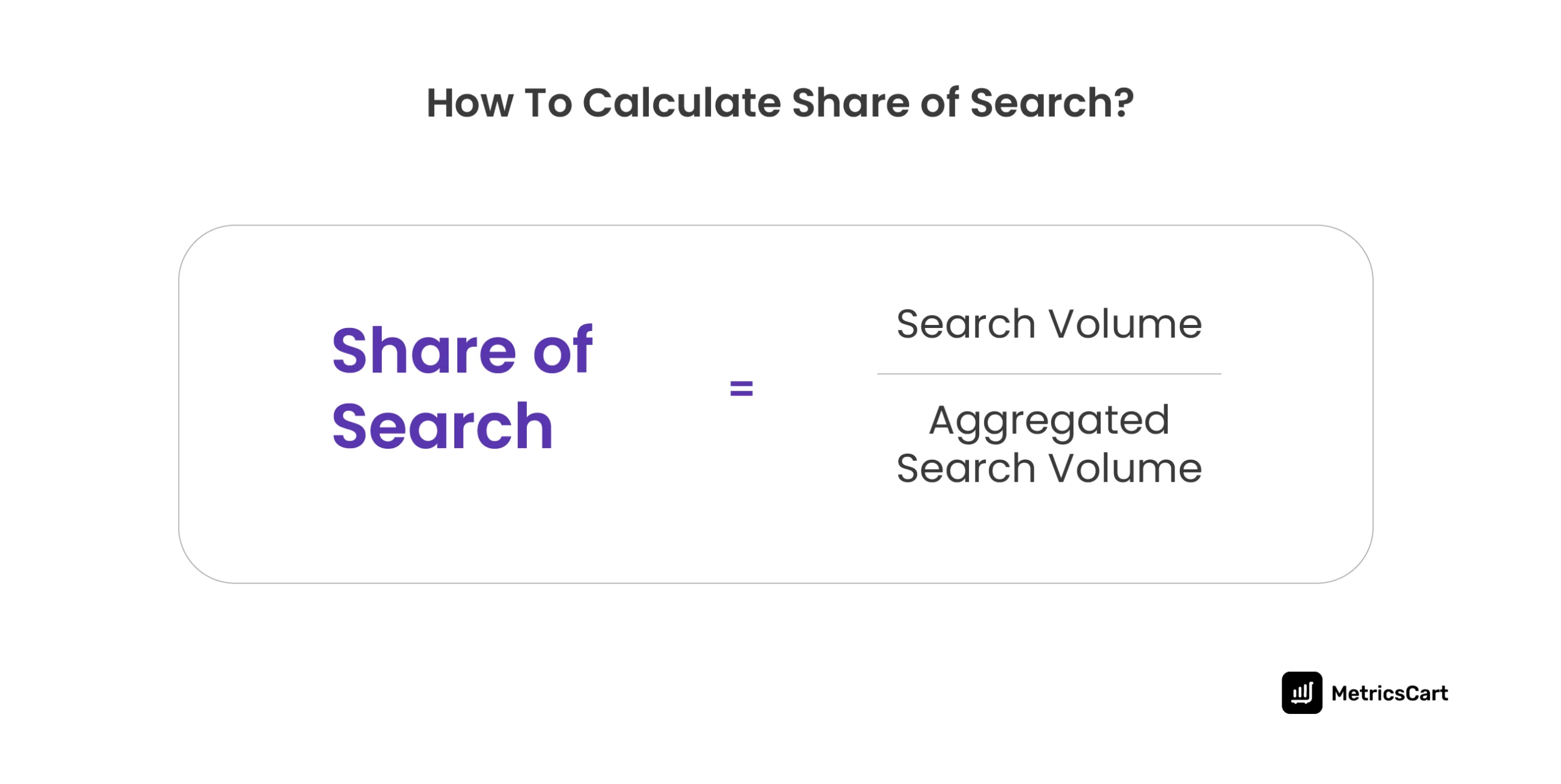

In simplest terms, SOS answers the question:

“Of all the people searching for brands in my category, how many are searching for me?”

For example, if 10,000 branded searches are happening for “sports drink” brands this month and 2,000 of those are for your brand, your SOS is 20%.

Why is that important? Because in retail media, search is the front door to the digital shelf. If your SOS is shrinking, it’s as if fewer shoppers are walking past your aisle in a physical store.

How Does Share of Search Matter In Retail Media Ad Spend?

In a category with 500k monthly branded searches, if your brand only gets 50k of them, your SOS is 10%. But if your ad spend allocation assumes you’re competitive, you may be wasting budget trying to win customers who aren’t even looking for you in the first place.

Share of Search is a clear sign that indicates when you need to shift budget toward visibility growth strategies instead of pouring money into conversion‑focused ads that simply couldn’t scale yet.

Share of Search vs. Share of Voice

While Share of Voice (SOV) measures how much advertising space or impression share a brand captures on platforms, SOS measures consumer interest and the likelihood of conversion. The distinction is important because SOV focuses on ad presence, while SOS focuses on demand and consumer behavior.

Now, you might be wondering that in that case, “shouldn’t Share of Voice be more helpful for retail media ad spend strategy?”. Actually, Share of Search is more predictive in nature, giving you a timely heads-up.

For instance, a brand may have a high SOV because of aggressive ad spending but have a relatively low SOS, indicating that while consumers see their ads, they are not actively searching for the brand. On the other hand, a high SOS with a lower SOV could indicate that while the brand isn’t saturating the market with ads, they still have strong consumer demand and visibility in search results.

SOS, therefore, acts as a better leading indicator of future sales performance and allows for a more informed and strategic approach to optimizing your budget in retail media marketing.

Let’s understand this in further detail!

How Does Share of Search Shape Ad Spend Strategy?

Share of Search is more than just a metric; it’s a diagnostic tool to optimize retail media budget and improve overall campaign effectiveness.

Retail media networks have become saturated with competitive brands, so using SOS to inform your retail media ad spend strategy can be the difference between overspending and efficiently allocating budget.

An Early Warning for Declining Visibility

One of the most powerful aspects of Share of Search is its ability to provide an early warning signal for shifts in consumer demand. If you start seeing a downward trend in your SOS, it’s a strong indication that visibility is declining, even before sales figures start showing the impact.

SOS often dips before other performance metrics like CTR (click-through rate) and conversion rates, which is why it’s so valuable for predicting future performance. A drop in SOS could indicate that a competitor is gaining ground or that consumer interest in your brand is waning. Addressing the issue early on can help you adjust ad spend or refine campaigns to regain momentum.

To Identify Underperforming Categories

In any category, there are often a few key products or subcategories that drive the majority of search traffic. If you notice that your brand’s SOS is particularly low in these high-volume categories, it’s a clear signal that you need to shift your ad spend to target these areas more effectively.

By tracking SOS across different product lines, you can prioritize investments in underperforming categories that have the potential for high ROAS. Instead of continuing to pour ad dollars into well-performing categories, you can allocate spend to areas that are showing growth potential and need a visibility boost.

Linking SOS Changes to Sales and Conversion Performance

SOS is not just a vanity metric; it has a direct impact on conversion rates and sales. A drop in SOS can signal the onset of lower sales, while an increase in SOS often leads to improved conversion rates. This relationship means that SOS serves as an important leading indicator of revenue.

For example, a sudden increase in SOS after a campaign focused on high-visibility keywords could indicate that more consumers are searching for your brand, which in turn, could lead to higher conversion rates and a better return on ad spend. SOS insights should be used to correlate changes with actual sales data, providing brands with real-time feedback on campaign effectiveness.

READ MORE | Your retail media strategy might be flying blind without the right data! Check out Cracking the Code: Digital Shelf Analytics for Next-Level Retail Media Strategy for Brands.

How To Use Share of Search for Retail Media Ad Spend Optimization?

Now, let’s get into how exactly can you use Share of Search to inform your retail media ad spend strategy and sync it with actual consumer demand, ensuring every dollar works harder for your brand.

1. Align Ad Spend with SOS Performance Gaps

The first actionable step when using SOS for retail media optimization is to align your ad spend with SOS performance gaps. When you track SOS, you’re able to see exactly where your brand is either losing visibility or underperforming relative to competitors.

This insight allows you to redirect your budget from high-performing areas where you’re already gaining traction to areas where you’re lagging.

For example, if your brand is dominating in one product category but has a low SOS in another, it’s time to shift some budget toward improving visibility in that underperforming category. By targeting products or categories with lower SOS, you’re focusing your budget on opportunity zones rather than areas where the competition is already saturated.

This approach requires constant tracking and adjustment. Unlike traditional strategies that rely on a “set it and forget it” mindset, SOS-driven optimization allows for a dynamic, fluid ad spend allocation that adapts to shifts in consumer behavior and market conditions.

Practical approach:

- Monitor SOS regularly for different keywords, categories, or product lines.

- Allocate more budget to categories with lower SOS and higher demand potential.

- Adjust bids dynamically based on performance trends to maximize your presence in those high-opportunity areas.

2. Balance Paid and Organic Investments Based on SOS Insights

Many brands often over-rely on paid advertising when they could be optimizing their organic presence. This becomes particularly important in categories where your SOS is high organically but low in paid search. In these cases, shifting some of your budget toward organic initiatives like listing optimizations, SEO, and content creation can help to boost your visibility without the need for increasing paid search spend.

On the flip side, if your SOS is low across the board, and you’re seeing low organic traction, it might make sense to invest more heavily in paid ads to bring attention to your brand and start building that organic momentum. Paid campaigns can help bridge the gap in consumer visibility, while organic improvements ensure long-term, sustainable growth in retail media optimization.

Balancing paid and organic investments is crucial for avoiding overspend while maximizing brand presence.

Practical Approach:

- Assess your organic visibility using SOS and determine if there’s a need to strengthen your presence through SEO and content optimization.

- Invest in paid ads where SOS is low to drive quick visibility gains, then slowly transition to organic efforts once visibility improves.

- Regularly adjust the mix of paid and organic spend based on ongoing SOS data and how it’s impacting performance.

3. Prioritizing Budget Shifts Toward High-Opportunity Keywords

SOS can also help identify high-opportunity keywords that may be under-targeted or underutilized in your current ad strategy. These are typically long-tail keywords or niche search terms that show strong consumer interest but haven’t yet reached the level of competitive bidding. When SOS reveals a gap in consumer searches for a relevant keyword, it signals that there is an untapped opportunity for growth.

For example, if you sell fashion apparel, you might see that a particular subcategory like “sustainable fashion” is gaining momentum in searches, but your SOS is lower than expected. This insight could suggest that you should prioritize these high-opportunity keywords in your campaigns. By adjusting your budget toward niche but highly relevant keywords, you can capture targeted traffic that may lead to higher conversion rates with lower competition.

Moreover, focusing on long-tail keywords often results in lower cost-per-click (CPC) because the competition isn’t as fierce. You’ll be able to capture higher intent users who are specifically looking for the type of products you sell.

Practical Approach:

- Look for keywords with strong consumer demand but low SOS in your campaigns.

- Allocate more budget to these long-tail and niche keywords to capture high-converting traffic.

- Monitor the performance of these keywords and adjust bids to maintain cost-effectiveness.

4. Predict Consumer Behavior and Optimize Campaigns

Share of Search is a predictive metric that can forecast changes in consumer behavior. By tracking SOS over time, you can identify trends in consumer interest before they impact your sales and conversions.

For instance, if you notice that SOS for a particular product category is trending upward, it suggests that consumer demand is rising, and now is the right time to invest more heavily in ad spend.

On the flip side, if SOS is dropping for one of your key categories, it’s an early warning sign that you may need to adjust your campaigns or reallocate budget to prevent a drop in sales.

Practical Approach:

- Monitor SOS trends regularly to understand shifts in consumer demand.

- Increase ad spend proactively when SOS rises, ensuring that you capitalize on the growing interest.

- If SOS drops, consider adjusting your bids or shifting ad spend to higher-performing categories or products.

5. Enhance AI-Powered Product Discovery

AI-powered product discovery is reshaping how consumers find and engage with products. Platforms like Amazon’s Rufus and Google’s AI Mode are at the forefront, utilizing generative AI to interpret natural language queries and present personalized product recommendations.

In Episode 10 of the Digital Shelf Insider podcast, Kiri Masters, founder of Bobsled Marketing (now Acadia), shares her insights on the evolution of retail media, online shopper behavior, and Amazon search optimization. Tune in to the full episode:

Let’s quickly understand the intersection of SoS and AI discovery. A higher SOS suggests stronger brand recognition and relevance. When integrated with AI-driven discovery systems, SOS data can inform and enhance the algorithms that power these platforms.

For instance, if a brand exhibits a high SOS for a particular product category, AI systems can prioritize this brand in search results and recommendations, aligning with consumer interest and intent. Conversely, a low SOS may indicate a need for increased visibility or content optimization to improve AI-driven discoverability.

Practical Approach:

- Ensure product titles, descriptions, and images are clear, detailed, and aligned with consumer search behaviors to improve AI discoverability.

- Regularly track SOS to identify shifts in consumer interest, adjusting ad spend to capitalize on emerging opportunities.

- Understand the factors influencing AI recommendations and personalization, such as semantic relevance and user intent, to tailor ad content accordingly.

READ MORE | Did you know that you can control consumer behavior with retail media? Check out Reshaping Consumer Behavior with Retail Media Networks: What Brands Must Know.

Let’s Wrap Up

Retail media ad spend optimization is not about throwing more money at ads. It’s about making smarter, data-backed decisions before you learn it the hard way (low ROAS and frustration!).

Share of Search provides insights to ensure your ad spend is always aligned with what your customers are actually searching for.

Want to take your retail media game to the next level? MetricsCart’s search intelligence solution provides the right insights you need to track your Share of Search and optimize your ad spend to drive real, measurable growth. Talk to us right away to book a free demo.

Looking to Outshine Your Competitors? Monitor Your Brand With Our Digital Shelf Solutions!

FAQs

One effective way to optimize your media spend is by using Share of Search (SOS) to identify areas where your brand’s visibility is lagging behind competitors. Reallocating your ad spend to these underperforming categories can help you maximize your ROI.

Retail media ad spend is expected to grow significantly, with global ad spend projected to reach $179.5 billion by the end of 2025, making up almost a quarter of all digital advertising spend in the coming years.

ROAS (Return on Ad Spend) is a key metric used to evaluate the effectiveness of ad spend. It measures the revenue generated by each dollar spent on ads. In retail media, tracking ROAS alongside SOS can help you ensure that your spend is aligned with demand and performance.

A good ad spend budget depends on your goals and Share of Search performance. Rather than focusing on a fixed amount, allocate spending based on consumer demand, tracking SOS to identify areas where additional investment will have the most impact.

To optimize your ad spend on Amazon Retail Media, start by tracking SOS for your key products and categories. Shift budget towards keywords and products with low SOS but high potential for conversion. Continuously monitor performance and adjust bids based on real-time data to maximize visibility and ROI.