Value-based pricing is a strategy where companies set prices based on customers’ perceived value of the product.

The concept of perceived value is not new. It has been around for ages. ‘The Judgement of Paris’, a popular Greek mythological story revolves around the same idea. Three goddesses – Hera, Athena, and Aphrodite – compete for the title of the most beautiful. Each of them promises Paris, the judge of the content, different rewards to sway his decision.

Athena promises him wisdom and skill in battle, Hera offers political power, and Aphrodite, love. Finally, he declares Aphrodite the winner of the contest as he believed love to be the greatest treasure. This ancient tale serves as a reminder that customers readily pay for a product if it suits their needs and preferences.

This article throws light on key aspects of value-based pricing along with a breakdown of tried-and-tested strategies of 3 e-commerce brands implementing this pricing model.

- Value-Based Pricing: An Overview

- Identifying the Right Price Point Using the Value Stick Framework

- Maximizing Value & Increasing Profitability Using the Value Stick

- 3 Examples of E-Commerce Brands Using Value-Based Pricing Strategies

- Advantages of Implementing Value-Based Pricing

- 3 Misconceptions Regarding Value-Based Pricing

- Value-Based Pricing: A Key To Higher Profitability

Value-Based Pricing: An Overview

The price of a product often helps consumers numerically evaluate the value they are getting out of the item. For example, if a consumer is looking to buy a new winter hat, she could place an order from Walmart at $5 or Macy’s at $25. If she only cared about covering her head, a Walmart hat would suffice. She’d probably be more interested in Macy’s if she’s looking for a fashionable accessory.

The above example is a case in point that the consumer’s readiness to pay a certain price depends on different factors. Value-based pricing thus requires companies to accurately determine the true willingness of target consumers to pay for a particular product.

Explore the most popular e-commerce pricing strategies

Identifying the Right Price Point Using the Value Stick Framework

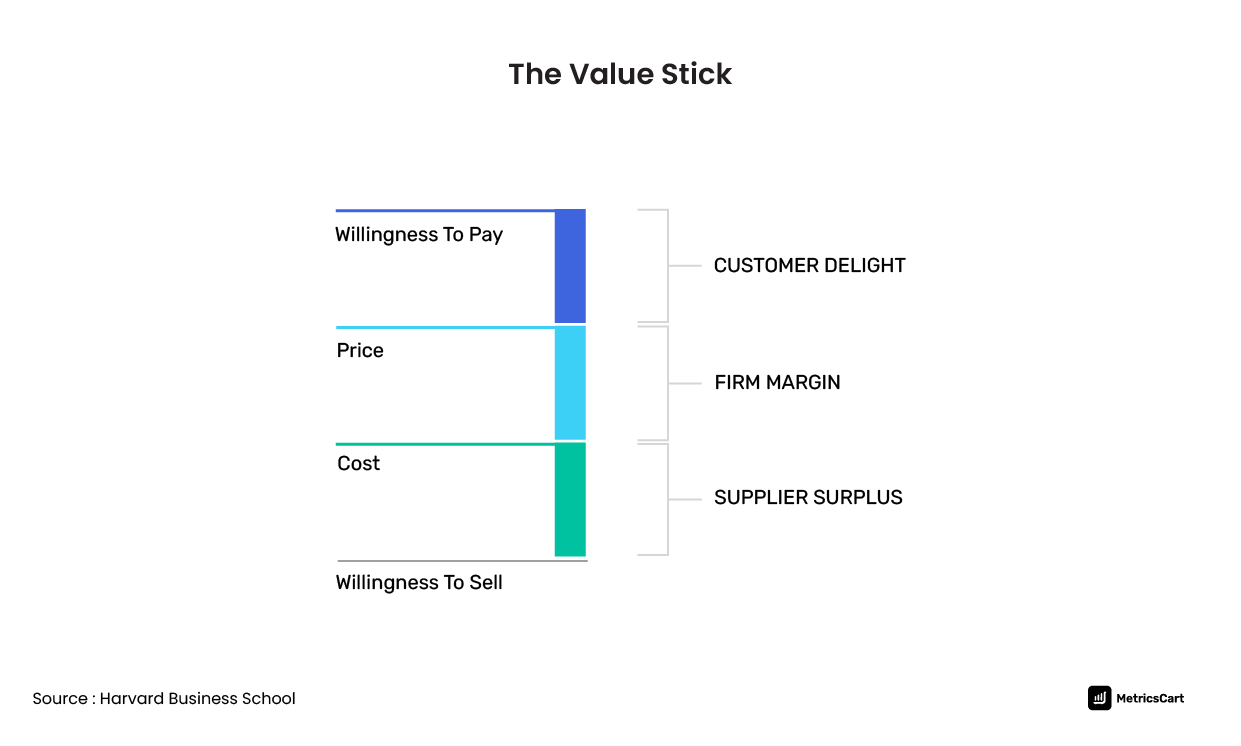

According to Harvard Business School, the value stick framework is an effective way to visualize the different aspects of value-based pricing.

The top of the value stick is called customer’s delight and captures the value received by the end consumer. The middle of the stick is called the firm’s margin and represents the value obtained by the firm. Lastly, the bottom of the stick represents the firm’s suppliers and is called the supplier surplus.

The value stick further comprises four components:

- Willingness to pay (WTP)

- Price

- Cost

- Willingness to sell (WTS)

Willingness to pay

Willingness to pay is the maximum price threshold companies can charge up to for their products. Pricing the product even a few cents higher than this threshold increases the risk of driving away consumers. This can affect your business’s impact in the competitive market landscape, and deter current and potential customers.

Customer’s delight is the difference between their willingness to pay and the price of the product. When consumers believe they have claimed maximum value from the transaction, it creates goodwill, loyalty and brand enthusiasm.

Price

The firm’s margin is the difference between the production cost and final price. It determines how much value is received by the end consumer.

A reasonable firm’s margin can boost customer delight, build brand loyalty and convert single purchases into repeat ones. Increasing customer retention by 5% can increase profitability by up to 125%. Companies, thus need to find the optimal point on the value stick to achieve customer satisfaction and maximize profits.

Cost

Production costs include physical costs (raw materials) and fixed costs (utilities, rent, etc.) incurred during the manufacturing process. The lower the firm’s cost of production, the higher the value it can share with its target customers.

Willingness to sell

Willingness to sell or accept is the lowest price a firm’s suppliers are willing to receive for supplying raw materials. The difference between the suppliers’ willingness to sell and what they charge a company is called supplier surplus.

Maximizing Value & Increasing Profitability Using the Value Stick

There are four strategies that companies can use to increase their profit margins using the value stick framework.

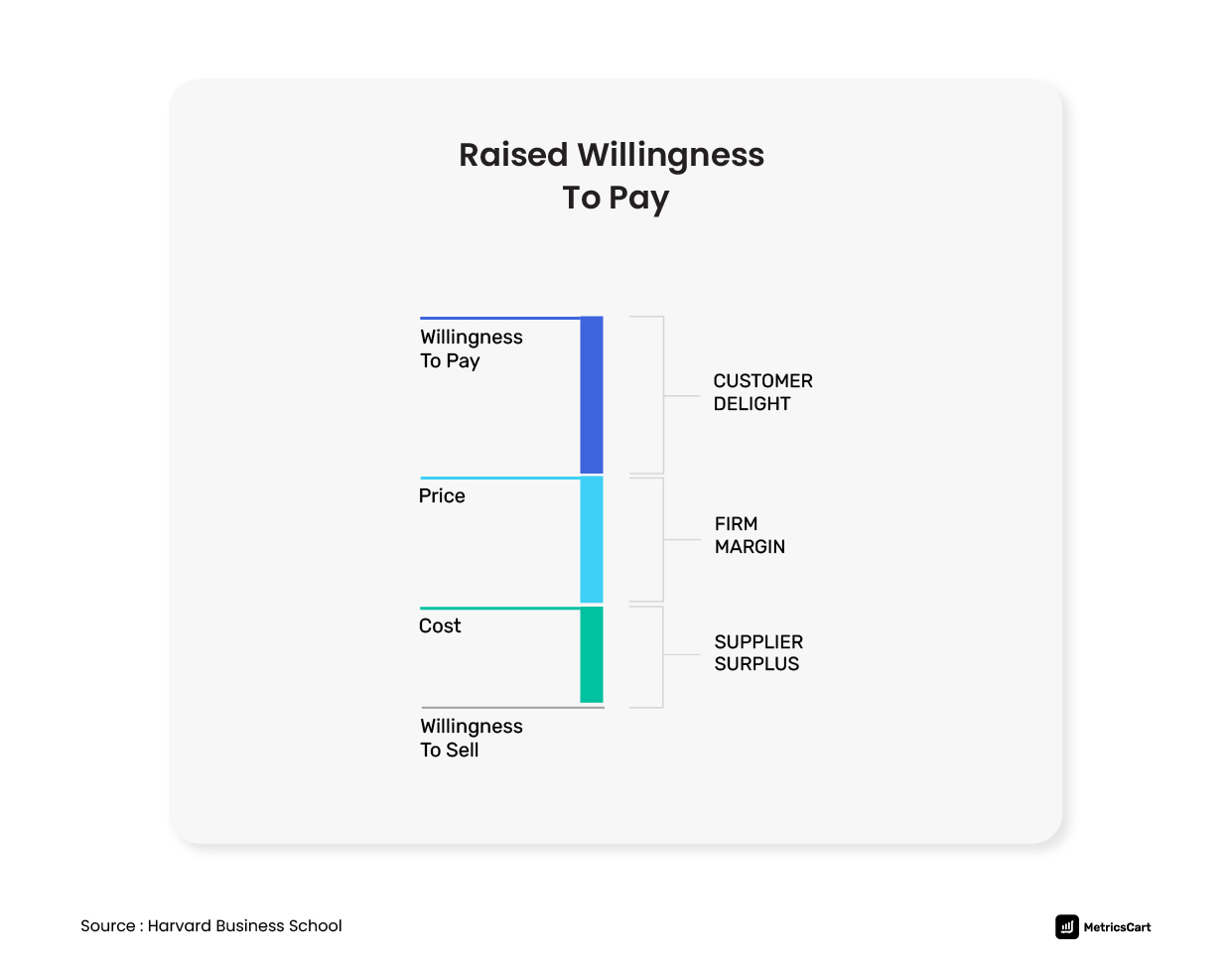

An increase in willingness to pay

An increase in the willingness to pay implies an increase in customer delight. This lets companies raise their prices while increasing potential profits and delivering enough value to keep the customers satisfied.

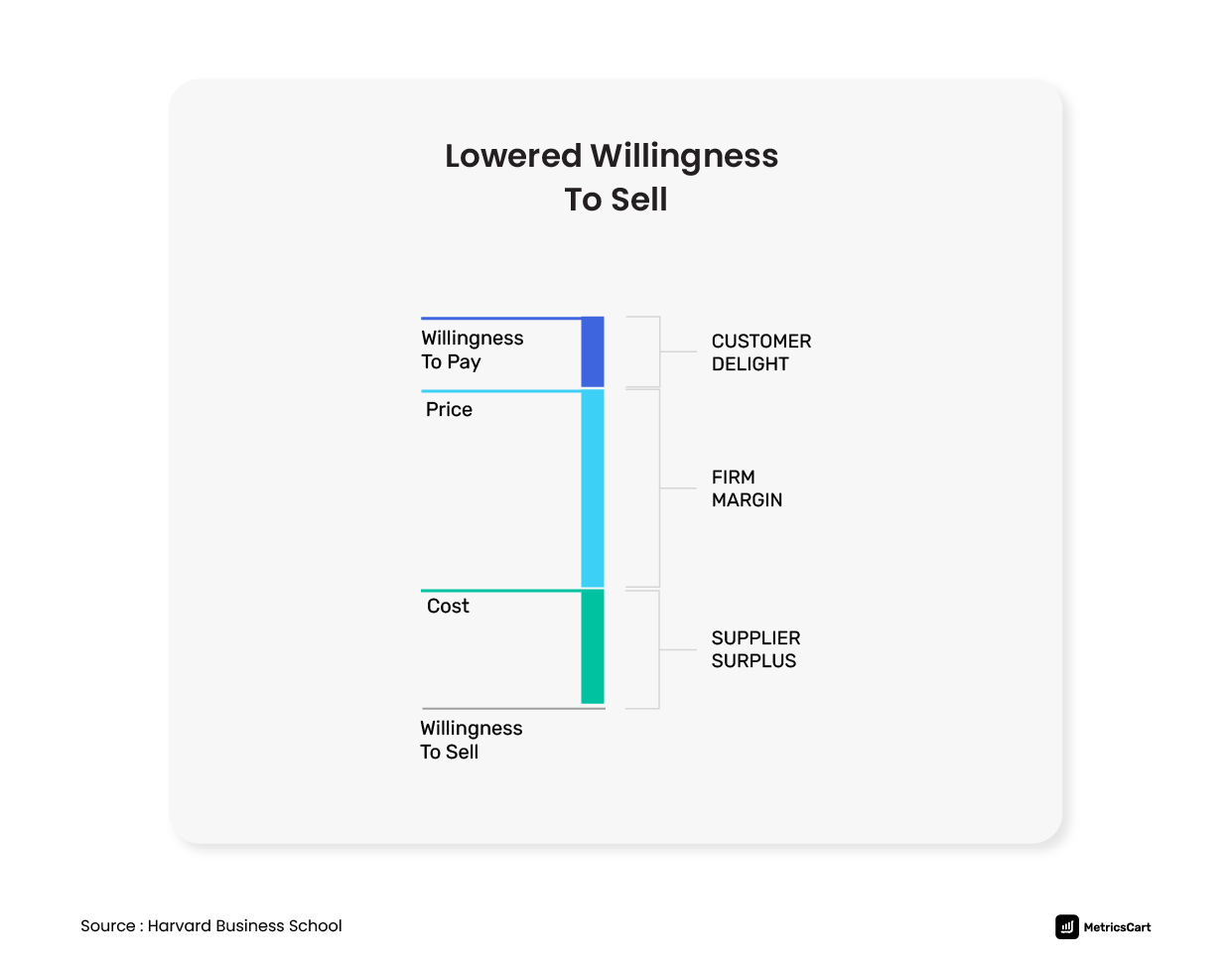

A decrease in willingness to sell/accept

If suppliers are willing to accept lesser prices for their raw materials, this can increase the profit margins for the firms. In addition, firms can also share this value with customers.

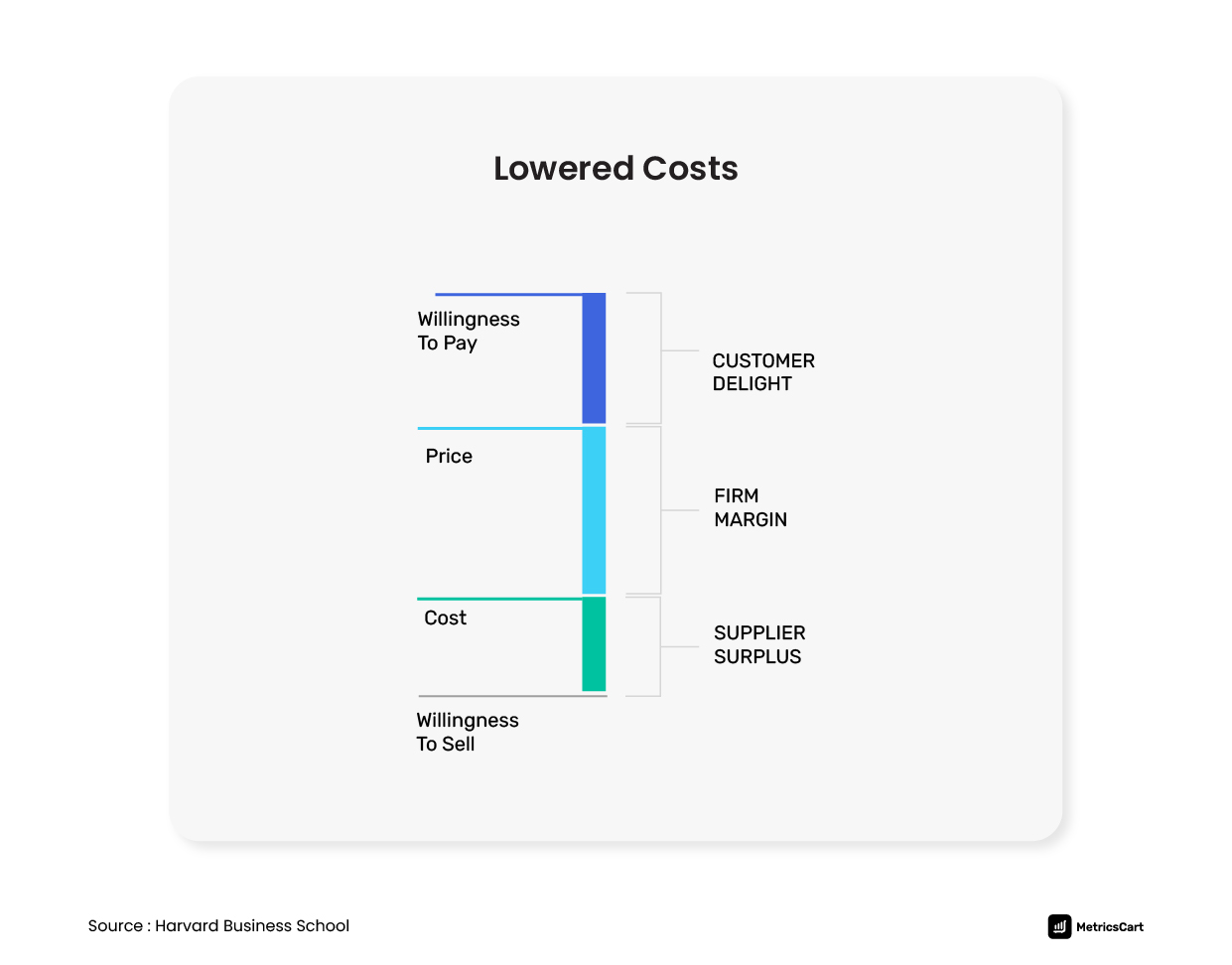

A decrease in costs

Firms can lower their production costs and increase their profit margins. This can be achieved either by optimizing the production process or by reducing the cost of raw materials.

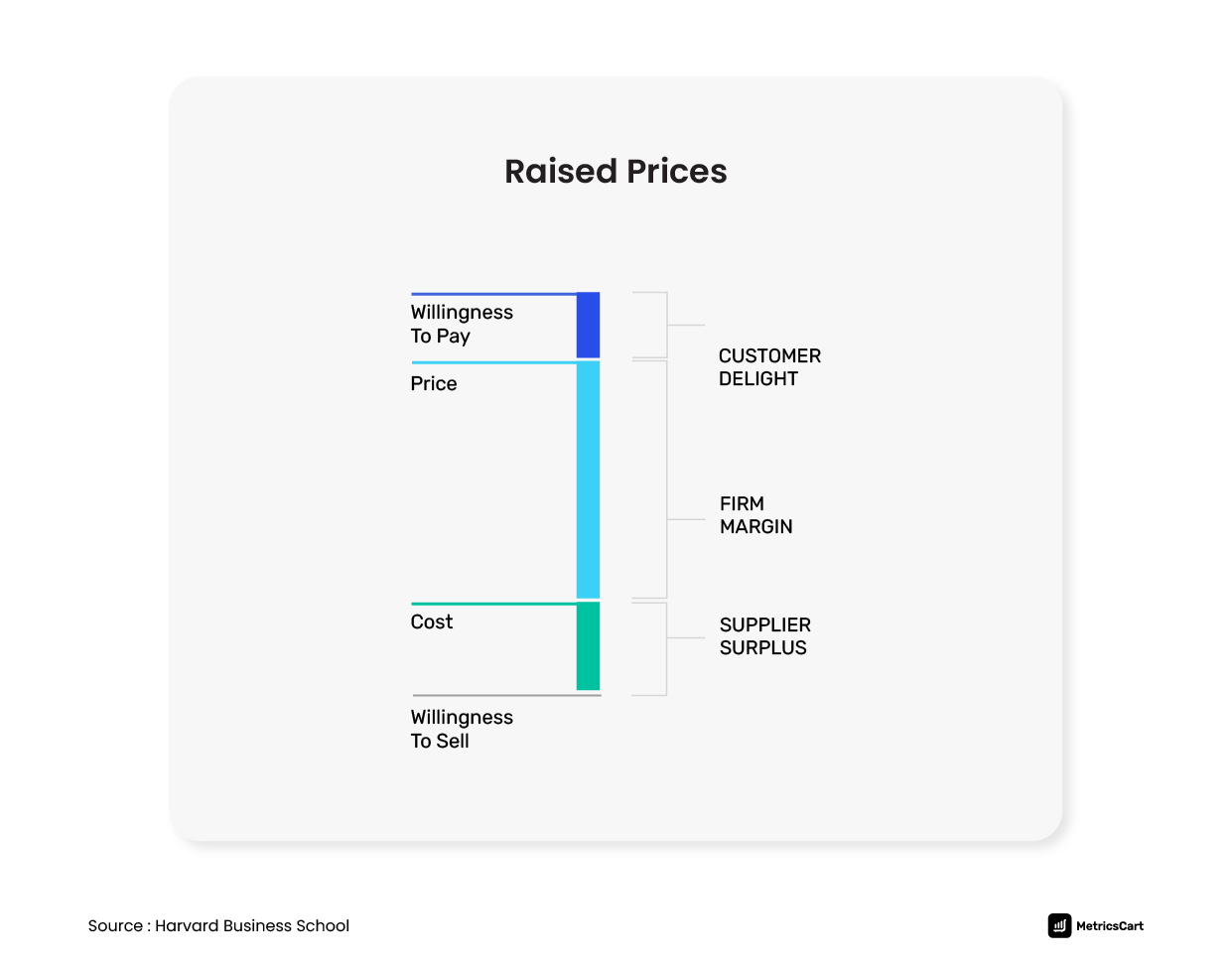

An increase in prices

Increasing product prices can help companies achieve higher profits at customers’ expense. That said, this requires companies to make conscious pricing decisions by carefully monitoring the market conditions and understanding the brand value.

Read more: How Can E-Commerce Businesses Benefit From Price Monitoring?

Value-Based vs. Cost-Based vs. Competitive Pricing: A Comparison With Examples

|

Feature |

Value-Based Pricing |

Cost-Based Pricing |

Competitive Pricing |

|---|---|---|---|

|

Pricing strategy |

Based on the customer’s perceived value of the product. Eg: Rolex |

Based on manufacturing costs and a desired profit margin. Eg: Generic brands |

Based on prices set by competitors in the market. Eg: Amazon |

|

Flexibility in pricing |

More flexibility to adjust prices based on customer segmentation. Eg: Gucci |

Less flexibility as prices are primarily dependent on production costs. Eg: Electricity providers |

Moderate flexibility as prices need to adjusted as per competitors’ prices. Eg: Costco |

|

Profit margins |

Higher potential for profits by capturing customer value perception.

Eg: Hermès Birkin |

Moderate profit potential depending on cost structure and margin.

Eg: Local grocery stores |

Profit margins might be affected by pressure from competitors.

Eg: Computer hardware products |

|

Customer price sensitivity |

Customers are less sensitive to price fluctuations if perceived value is high. Eg: Starbucks |

Customers might be price sensitive as cost plays a significant role. Eg: Generic food brands |

Some customers are price sensitive and tend to choose the lowest prices available. Eg: Dollar general |

|

Market differentiation |

Allows differentiation based on unique value proposition. Eg: Nike |

Less scope for differentiation as the price is cost-driven. Eg: Basic food staples |

Less scope for differentiation as the price is cost-driven. Eg: Basic food staples |

3 Examples of E-Commerce Brands Using Value-Based Pricing Strategies

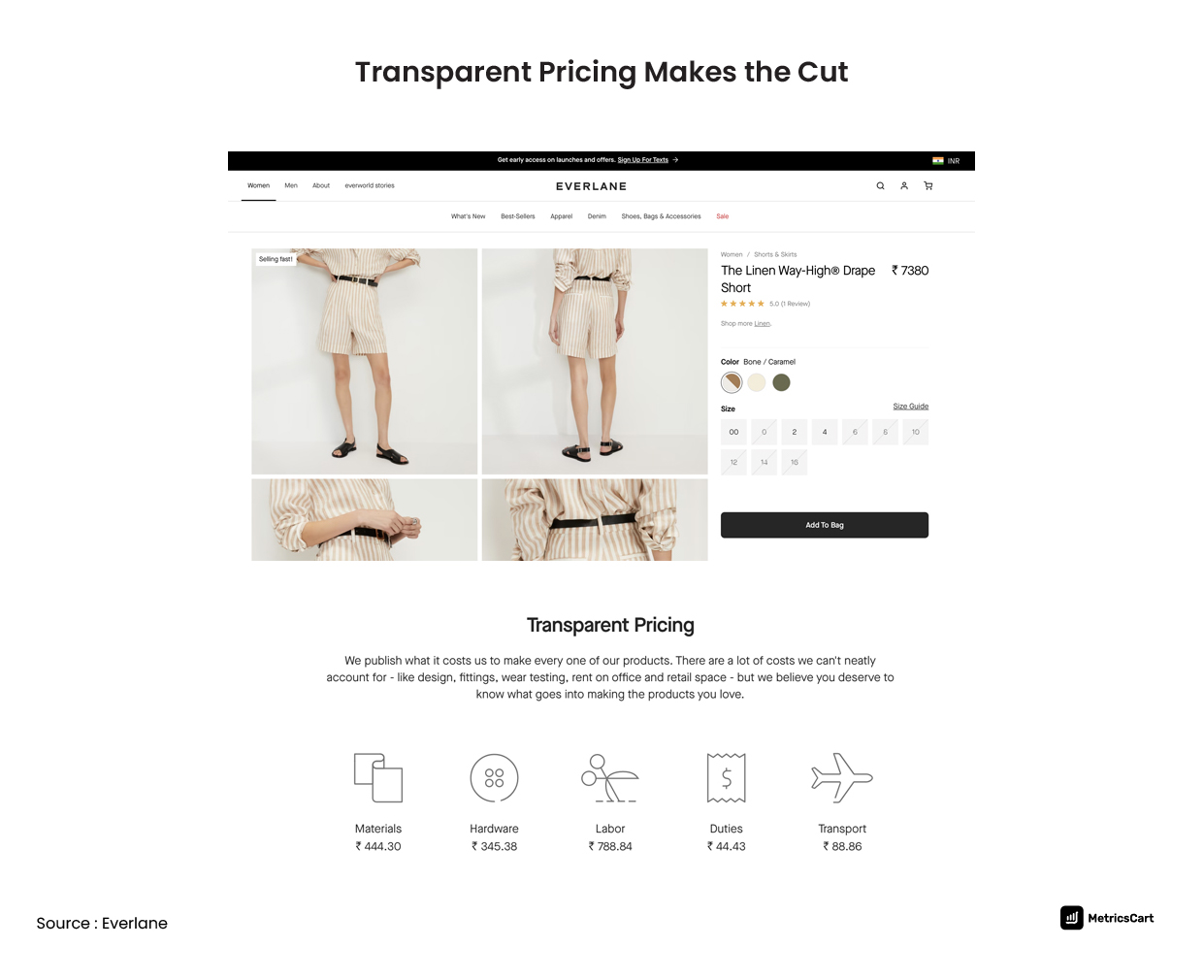

Manufacturing & Business Transparency: Everlane

Everlane, a US-based online clothing retailer employs a radically transparent pricing model. The brand targets millennial shoppers who prefer high-quality products and believe in socially conscious companies. The company, thus, openly communicates about the factories where the clothes are made, actual production costs in terms of money and effort, and their transparent feedback policy.

Despite being priced higher than their actual cost of production, customers feel good about buying from Everlane based on the value they receive from:

- The product itself

- The ethical assurance of providing decent conditions to factory employees

- The experience of making purchases from a company they trust

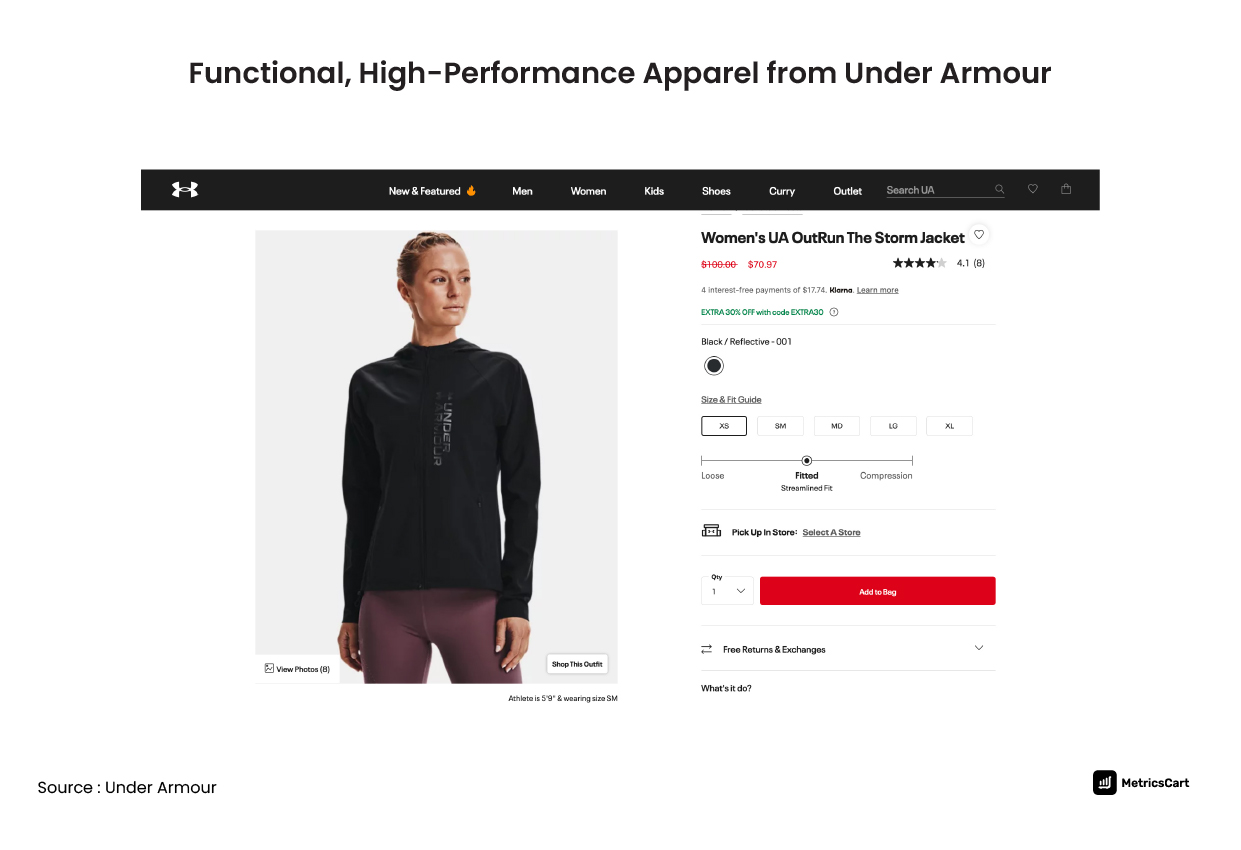

Premium Quality Offerings: Under Armour

Under Armour is a leading online and offline retailer of apparel, footwear, and accessories. The company sells high-quality, innovative products using top-notch fabrics and technology. Typical target customers of Under Armour are athletic and health-conscious. As such, they focus more on the functionality of the products than their design or price.

The brand also communicates the difference its offerings make (in terms of value addition) through successful marketing and technology. This has led to customers associating Under Armour with excellence and value, and hence do not mind paying higher than the industry average for its products.

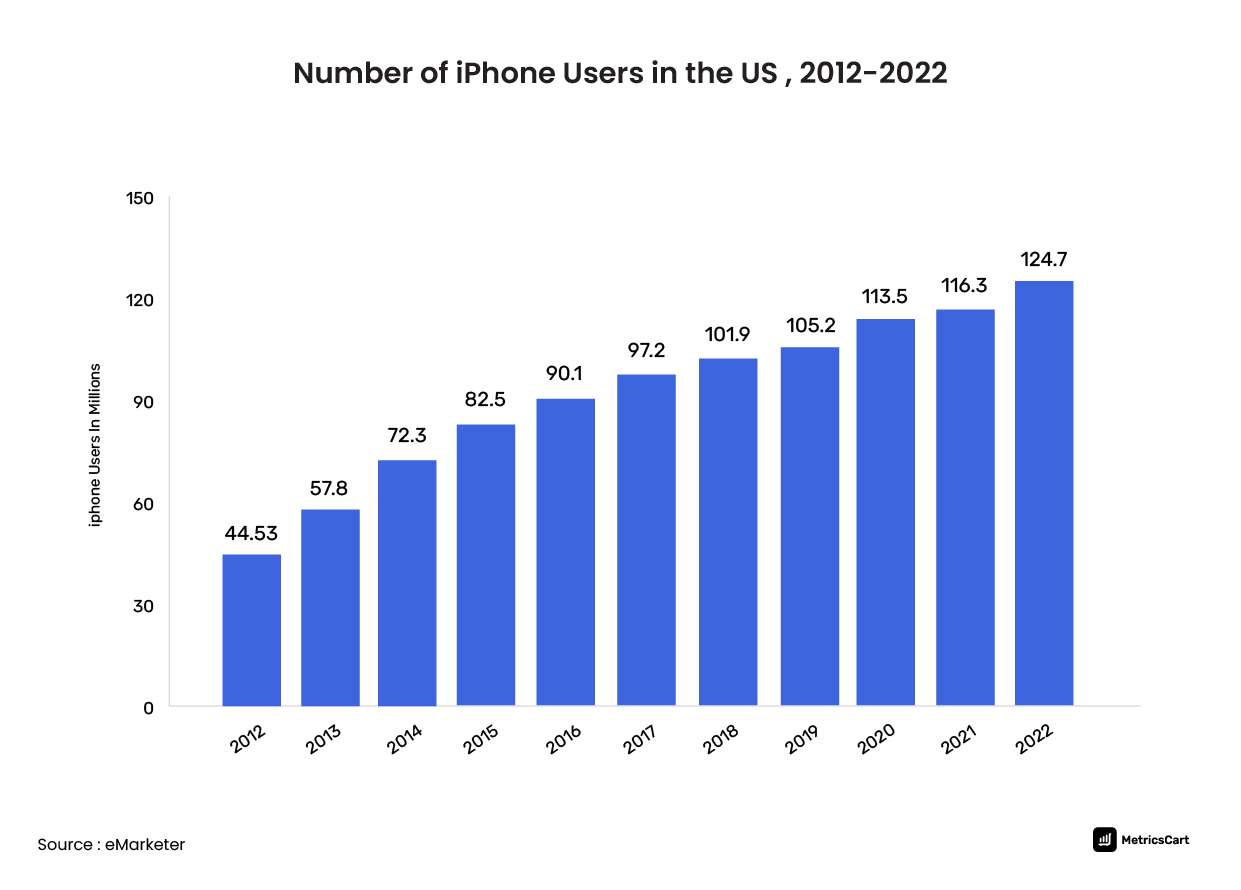

Incredible User Experience: Apple

There are more than 1.8 billion active Apple devices around the world, with over a billion of them being just iPhones. Besides being sleek and aesthetically designed, consumers appreciate Apple products for their ease of use. Apple products also boast a lifespan much higher than other devices in the market.

The company employs a value-based pricing strategy through its product line-up. Despite charging higher prices, Apple has one of the most loyal customer bases in the world. Consumers obtain value from:

- Easy software and hardware integration

- Efficient Apple ecosystem built up through other purchases

- Overall brand and customer experience

Disclaimer: Please note that each of these brands implements several other pricing strategies as well. Most brands execute a mix of pricing models. The right pricing strategy makes all the difference.

Read More: Importance of Choosing the Right Pricing Strategy on Amazon

Advantages of Implementing Value-Based Pricing

Increased customer loyalty

Value-based pricing is primarily a customer-centric approach to pricing while ensuring that your offerings are of top-notch quality. Ideally, this pricing model helps brands align with customers’ needs, increase customer retention and establish long-term relationships with consumers.

Gain insights into customers’ willingness to pay

A crucial part of value-based pricing calculations is to determine the true willingness to pay. The high quality and perceived value of a product likely reduces price sensitivity among consumers. This helps brands execute business strategies with greater awareness of the target market.

Create a positive impact on brand value

When brands price based on the perceived value of their offerings, it enables them to design products based on the knowledge of the features that their customers value the most. Therefore, value-based pricing can potentially drive innovation and increase brand value.

3 Misconceptions Regarding Value-Based Pricing

Misconception 1: Value-based pricing needs brands to determine consumers’ willingness to pay for each and every product feature

Even the simplest of products have multiple features and marketers do not need to evaluate customers’ willingness to pay every time. Instead, they need to find the difference between their products and those in the market in terms of features and assess customers’ valuation of these differentiating features.

Value-based pricing is a strategy where a company calculates and tries to earn the differentiated worth of its product from a particular customer segment.

Rolex, a luxury watch brand, positions its offerings as premium and exclusive timepieces. The brand targets affluent customers who value prestige, exceptional quality, and craftsmanship. The prices of Rolex watches reflect their differentiated worth perceived by the target consumer segment.

Misconception 2: Value-based pricing leads to guaranteed success if you are smart with pricing

The success of a value-based pricing strategy depends on how smartly the competitors have priced their products. If the market you are competing against has unreasonably low prices, value-based pricing cannot be of any help. For value-based pricing to work efficiently, competitors need to practice intelligent pricing.

Read more: Everything You Need To Know About Competitive Pricing

Dollar Tree, a popular discount retail chain in the US offers a variety of products priced at just $1. Their pricing strategy caters to consumers looking for affordable product options. Brands that employ value-based pricing cannot compete against Dollar Tree’s supremely low prices and convince consumers of the added value in their high prices.

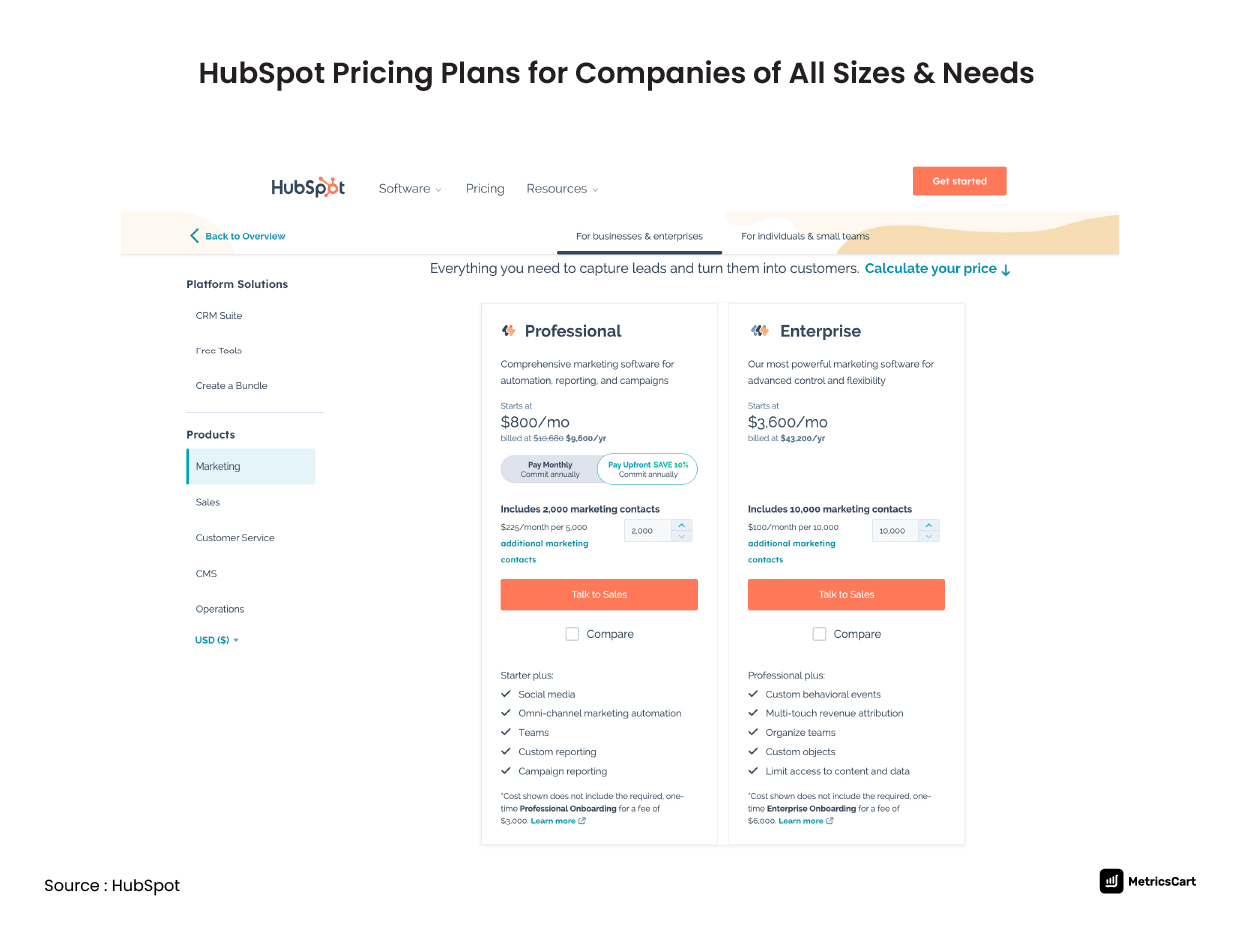

Misconception 3: Brand reputation dominates value-based pricing calculation

The aim of using a value-based pricing model is to assign a dollar value to differentiating features of a product or service. The focus of this exercise is on features that add value to the customer. Notably, brand recognition is not the deciding factor in determining the value of a product.

Hubspot is a popular software used by inbound marketing, customer service and sales professionals. Their pricing plans fit the needs and requirements of businesses of different sizes to primarily deliver value rather than relying completely on brand recognition.

Value-Based Pricing: A Key To Higher Profitability

Research into value-based pricing at MIT Sloan showed that companies require a deep understanding of customer needs and their valuation of a product. However, this pricing model is also heavily reliant on competitors’ pricing. In addition, brands need to have insights into forward-looking price elasticity while identifying the right price that works for you and your customers.

At MetricsCart, you can monitor competitors’ prices, access useful insights from raw data, and much more with a single click! Our automated, hassle-free price monitoring and digital shelf analytics solutions help your brand stay ahead of the curve. What’s more? You can access our free, monthly Amazon bestseller reports that reveal top-performing brands, category ranks, and more. Get in touch with us today and experience the power of data!