About The Report

This data-driven report offers an in-depth look at Zepto’s Electronics and Appliances category as of June 2025. It dives into product listings, brand performance, consumer preferences, pricing, and discount trends to give insights into the shift in consumer tech trends and the emerging patterns in India’s quick commerce electronics market, with a special focus on Zepto’s strategy for electronics and appliances.

What’s Driving the Electronics Boom in Quick Commerce?

Why has quick commerce suddenly taken off for electronics and appliances? Sure, people have always bought groceries and everyday essentials via instant delivery, but now high-ticket consumer tech is seeing the same trend. Why? Convenience. Speed. And, most importantly, the changing behavior of consumers.

Historically, unlike FMCG, buying electronics was a process, especially in India, where for most households, it is an important financial decision. You’d wait for a sale, maybe browse through e-commerce giants, and if you were lucky, get a quick delivery.

However, as we all know, consumer tech is also a sector of impulse buys: a flashy gadget, an upgraded phone, a charger, a new set of headphones – products that we need right now. The shift has been dramatic, especially in the urban landscape.

According to the Consumer Demand 2025 CRI report, for nearly 70% consumers, 10-minute delivery is a key expectation. India’s expanding mobile-first consumer base is now making decisions on the fly and wants instant access to these items, even if that means paying a little extra for the convenience.

Zepto’s strategy for electronics and appliances has made use of this exact behavioral shift. With hyper-local fulfillment, they are perfectly poised to deliver on that expectation in an average of 6.44 minutes. Plus, strategic building of high-ticket trust is driving this surge in electronics purchases.

Let’s get into the data insights to see how Zepto is reshaping electronics retail in India.

READ MORE| The shift in the consumer electronics sector is a wave to watch out for. Check out Future of Electronics in 2025: It Looks Smarter, Greener, And Bigger!

How Many Electronics and Appliances Are Listed on Zepto, and Which Brands Lead?

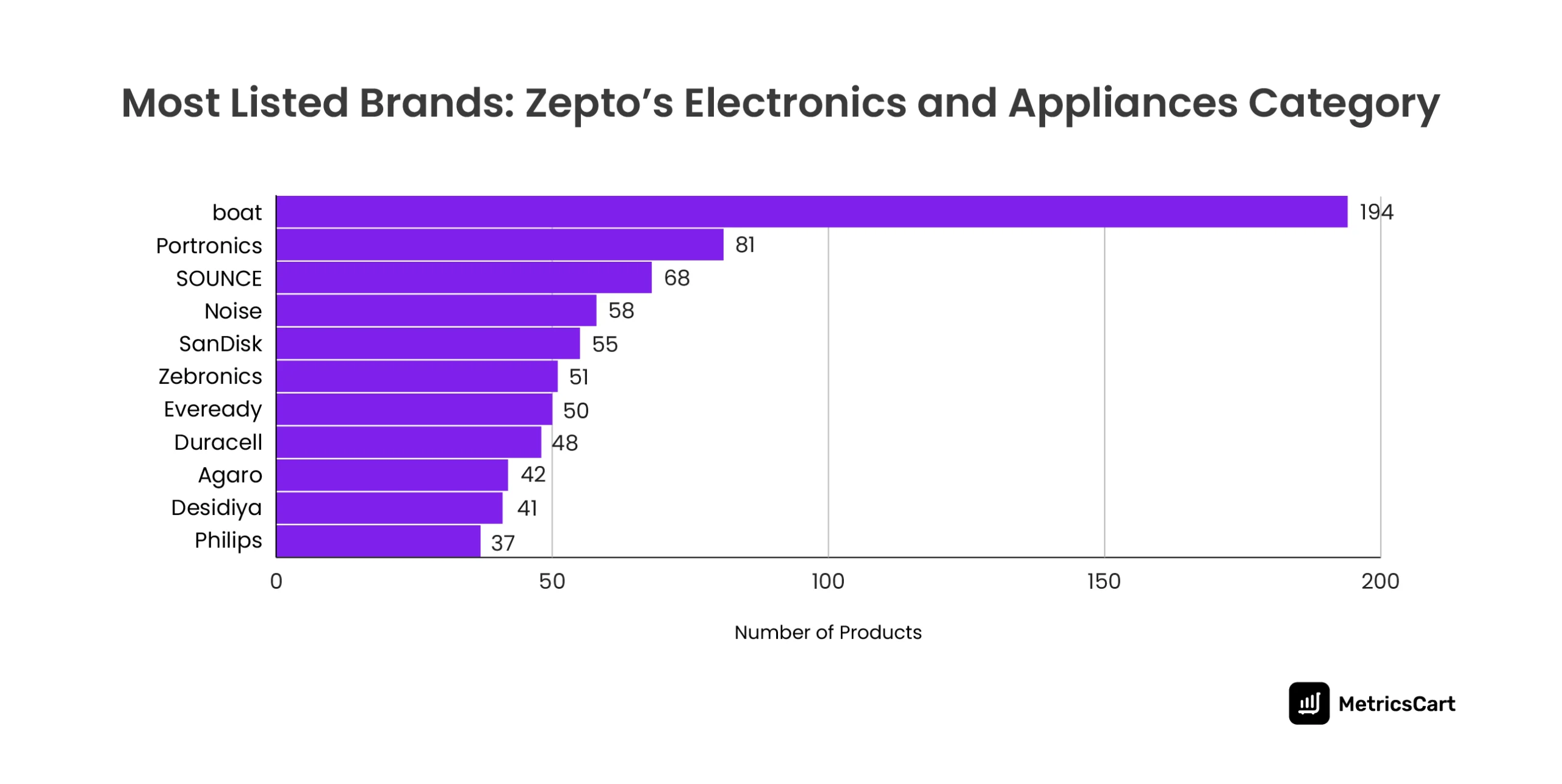

In June 2025, Zepto listed 1,712 electronics and appliance products, showing a significant push into the sector. The platform is clearly capitalizing on consumer demand for affordable, fast electronics and tech essentials.

The dominant presence of Boat on the platform, with 194 products, shows Zepto’s focus on affordable, high-demand electronics.

Boat’s success in the audio accessories category, headphones, earphones, and Bluetooth speakers, fits perfectly into the quick commerce model, where consumers are looking for fast, impulse purchases and convenient solutions.

Zepto’s push into wearables and storage solutions is also evident, with brands like Noise (58 products) and SanDisk (55 products) filling a growing need for smart tech and reliable storage devices.

As urban consumers increasingly seek convenience and speed, these product categories align perfectly with Zepto’s business model to deliver tech essentials.

What’s interesting is that Zepto’s electronics strategy is also supported by established brands like Eveready, Duracell, and Philips, which contribute to its expanding assortment of household names. It speaks of Zepto’s aim to provide trusted and reliable tech to meet both everyday needs and more significant, higher-ticket purchases.

Plus, these brands are frequently sought after for replacements and urgent needs, exactly the kind of high AOV and repeat purchases that quick commerce thrives on.

Stay updated about daily quick commerce trends across platforms with MetricsCart’s quick commerce intelligence dashboards.

Which Are the Top-Rated Electronics and Appliances on Zepto?

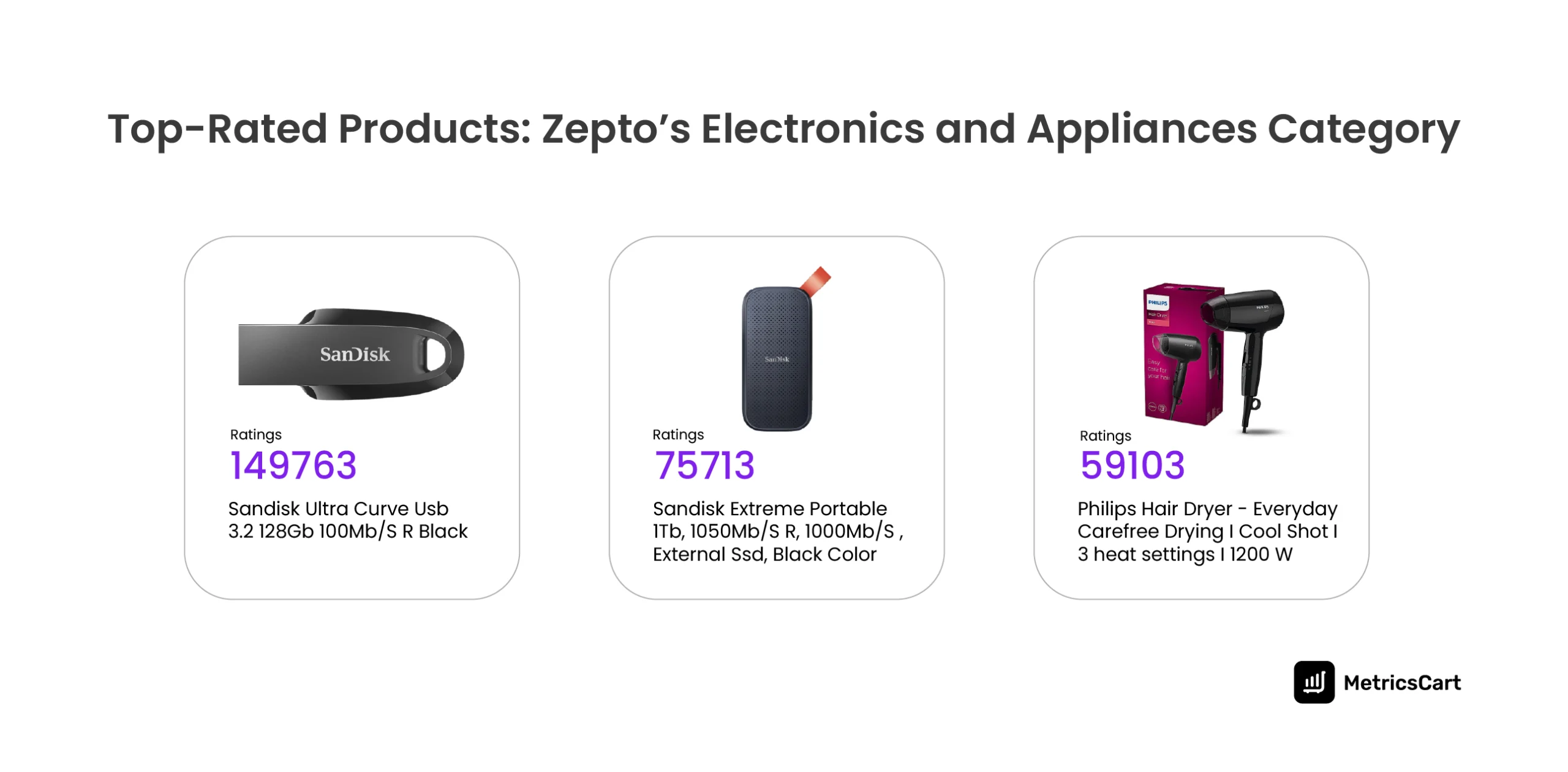

There is a clear dominance of storage solution products like the SanDisk Ultra Curve USB and Extreme Portable SSD, with 149,763 and 75,713 ratings, respectively, in the top-rated electronics and appliances on Zepto.

With rapid digital transformation and corporate-driven lifestyles on the rise, products like SanDisk are meeting an immediate need for storage capacity and performance. These are the kinds of products that get purchased on the spot when someone realizes they need a data backup or a faster storage option, which makes them ideal for Zepto’s quick commerce model.

What’s interesting is that Philips Hair Dryer also made it to the list of top-rated electronics and appliances on Zepto. This indicates the demand for home appliances is gaining momentum in quick commerce. This is particularly true for Tier 1 city consumers, who often need quick replacements for personal care devices or small household appliances.

Urban consumers and households with intuitive app-first habits and rising disposable incomes are looking for products that just work, right out of the box, without delays or issues. When they know they can get a trusted brand like SanDisk or Philips within minutes, they’re more likely to rate it highly and stay loyal to the platform.

Keeping that in mind, let’s take a look at how electronic brands are rated on Zepto.

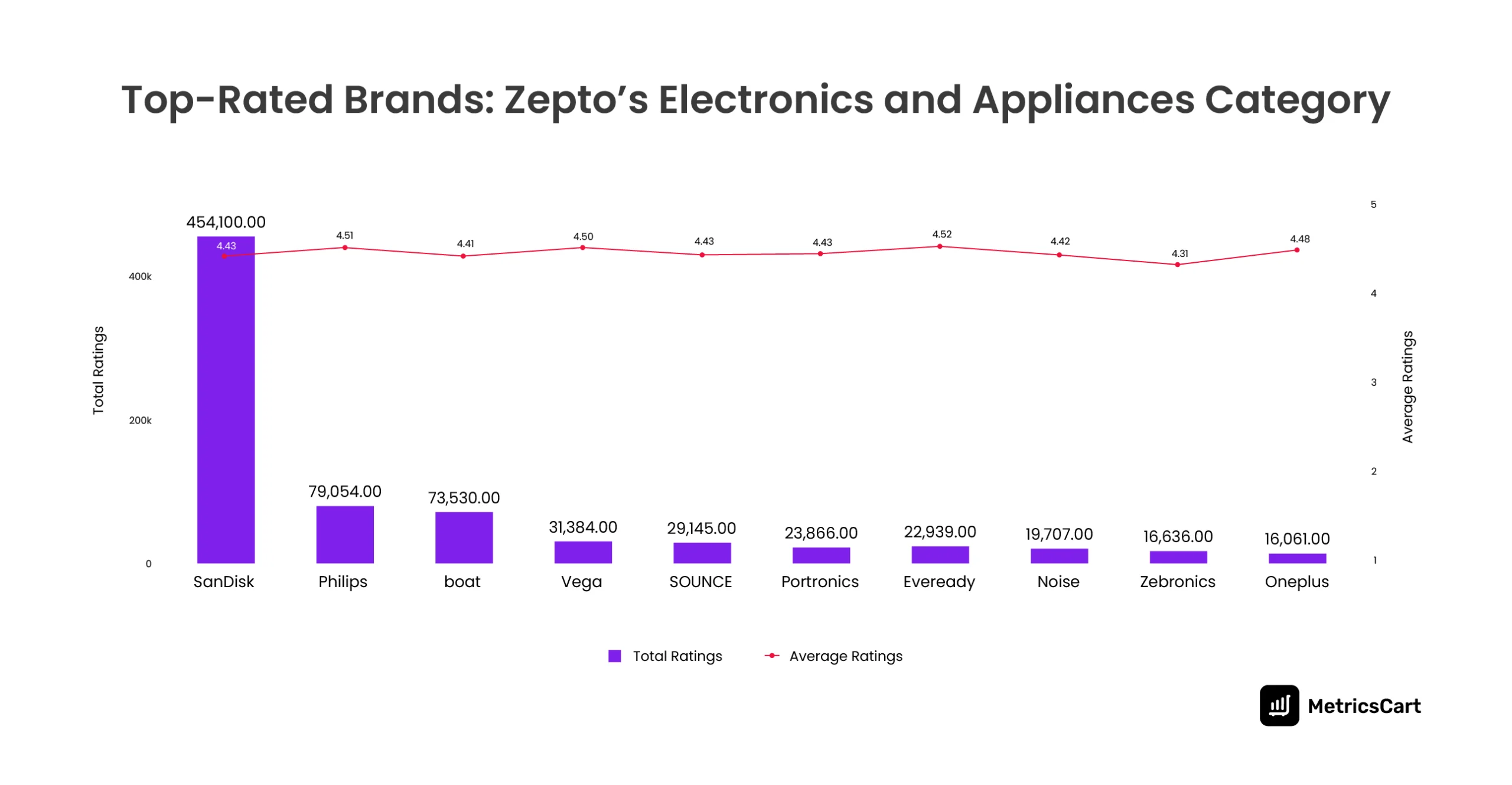

SanDisk stands out with 454,100 total ratings, far ahead of other brands like Philips (79,054) and Boat (73,530) in terms of customer engagement.

However, the evergreen appeal of household brands like Philips shows that Zepto’s appliances strategy isn’t just about tech enthusiasts but also about lifestyle products that consumers can rely on.

The slightly lower ratings for brands like Zebronics and OnePlus, with just over 16,000 ratings, suggest that while these brands are popular, they still have a smaller share in the quick commerce electronics market.

This could be due to smaller product portfolios or a narrower consumer base compared to the more well-known brands like SanDisk and Philips.

READ MORE| Apart from Zepto, Blinkit is another major player in India’s quick commerce boom! Check out How Blinkit Works: Understanding Its Business and Delivery Model.

How Are Electronics and Appliances Priced on Zepto?

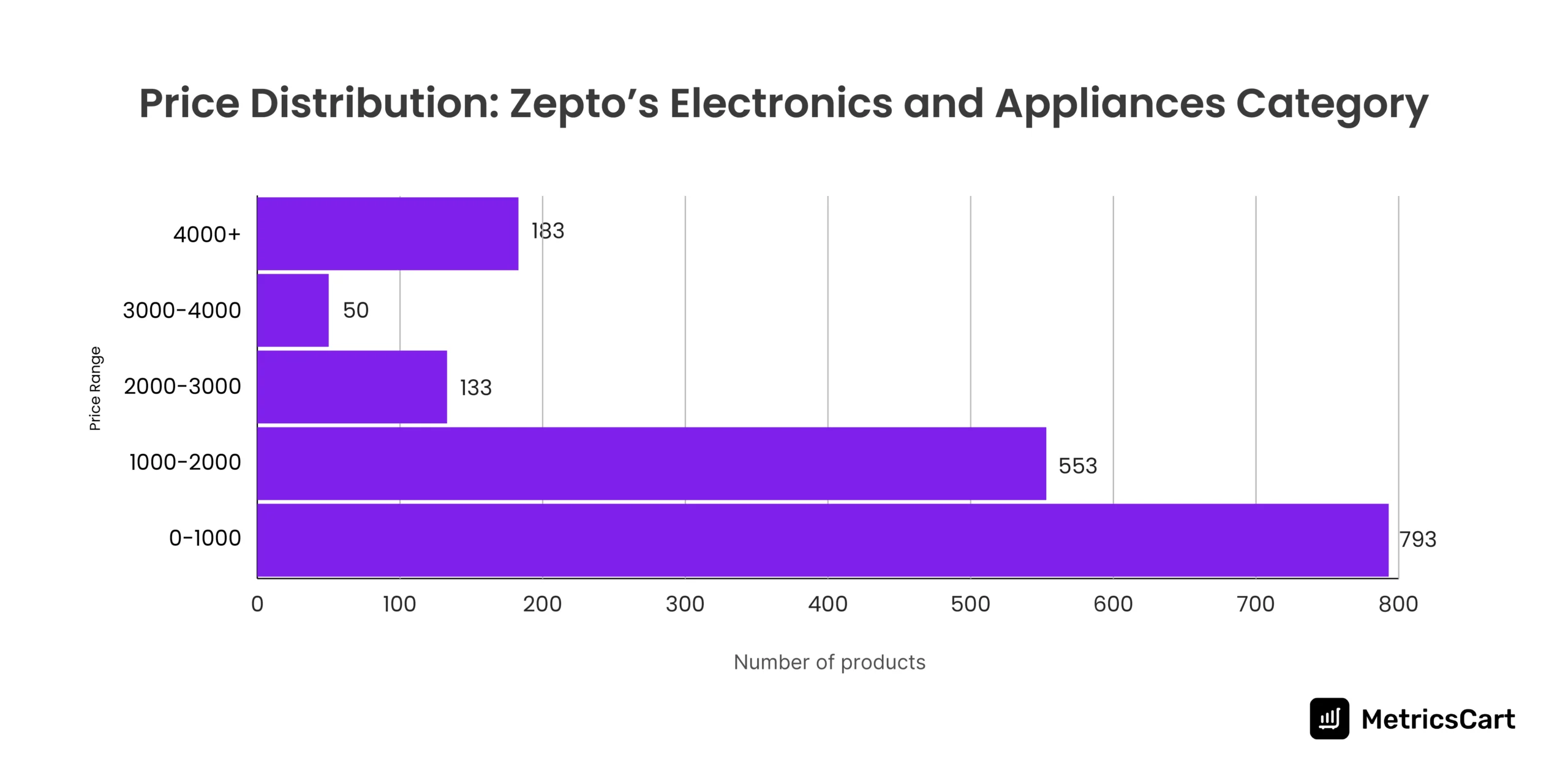

Zepto has made affordability a key pillar of its electronics and appliances strategy with 793 products in the ₹0 – ₹1000 range. On average, the products fall within the ₹1,000–₹2,000 range. This pricing strategy resonates with the broader trend of quick commerce platforms offering accessible pricing for essential electronics.

Zepto’s strategy for electronics and appliances offers everything from affordable categories like lights, batteries, and small home appliances, to mid-tier categories like smartphones, headphones, and speakers, to premium segments like iPhones and high-end gadgets.

Why does this work? The middle-income consumer base in urban areas seeks a balance between value and quality, which is why, on average, products priced upto ₹2,000 dominate the listings. These segments are price-conscious yet demand quality and reliability, which aligns well with Zepto’s customer-centric model.

Which Brands Have the Least and Most Expensive Electronics and Appliances on Zepto?

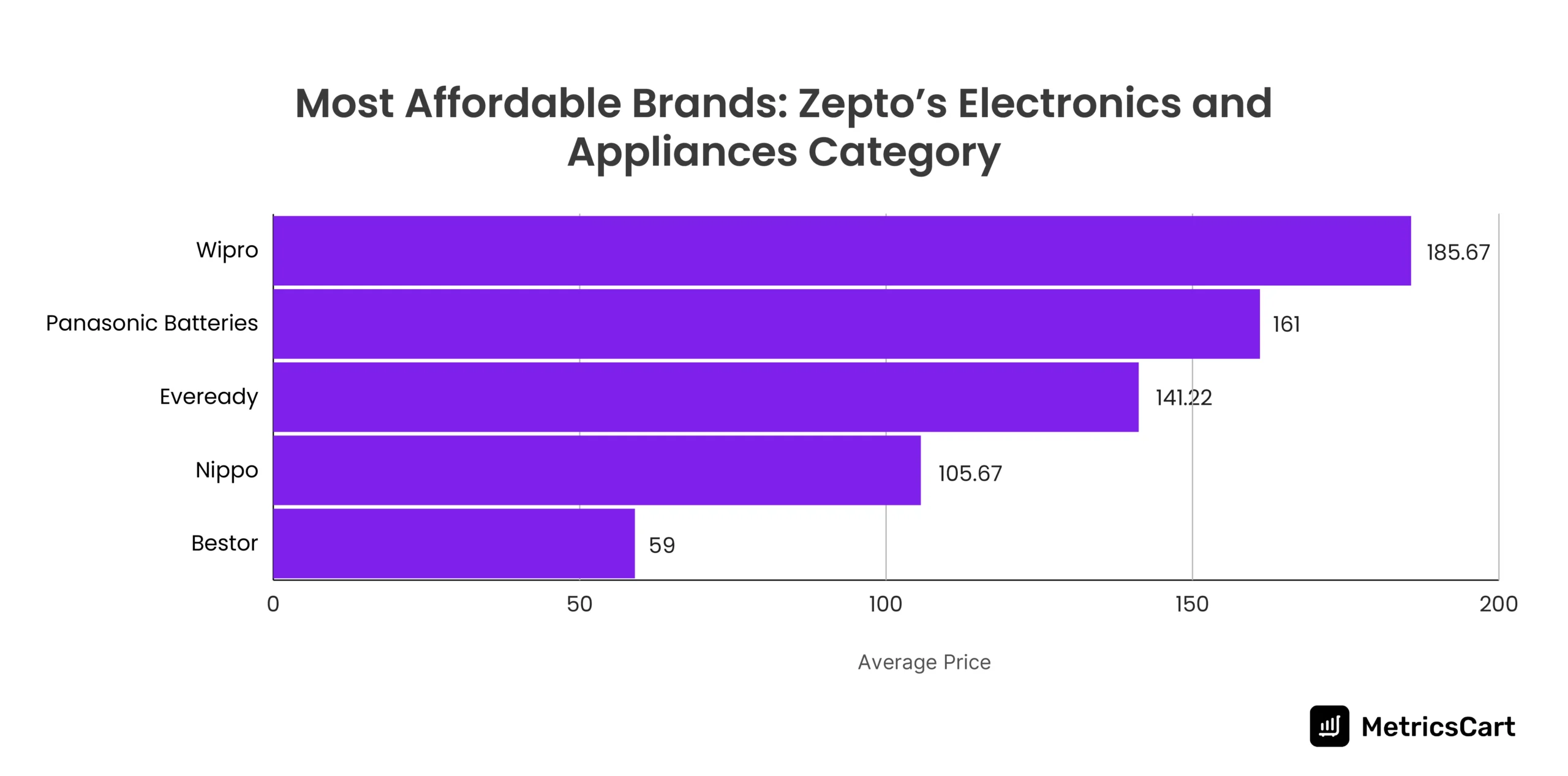

Among the most affordable brands, Bestor leads with the lowest average price of ₹59, and provides affordable essentials like chargers, cables, and accessories. Products like these are extremely popular on quick-commerce platforms because they cater to daily needs and urgent buys.

Nippo and Panasonic Batteries, priced between ₹100 and ₹160, offer power solutions for consumers. Batteries are essential household items, and given the demand for regular replacements and instant availability, these budget-friendly brands are a staple on Zepto.

Now, on the flip side, let’s look at the most expensive electronics and appliances on Zepto.

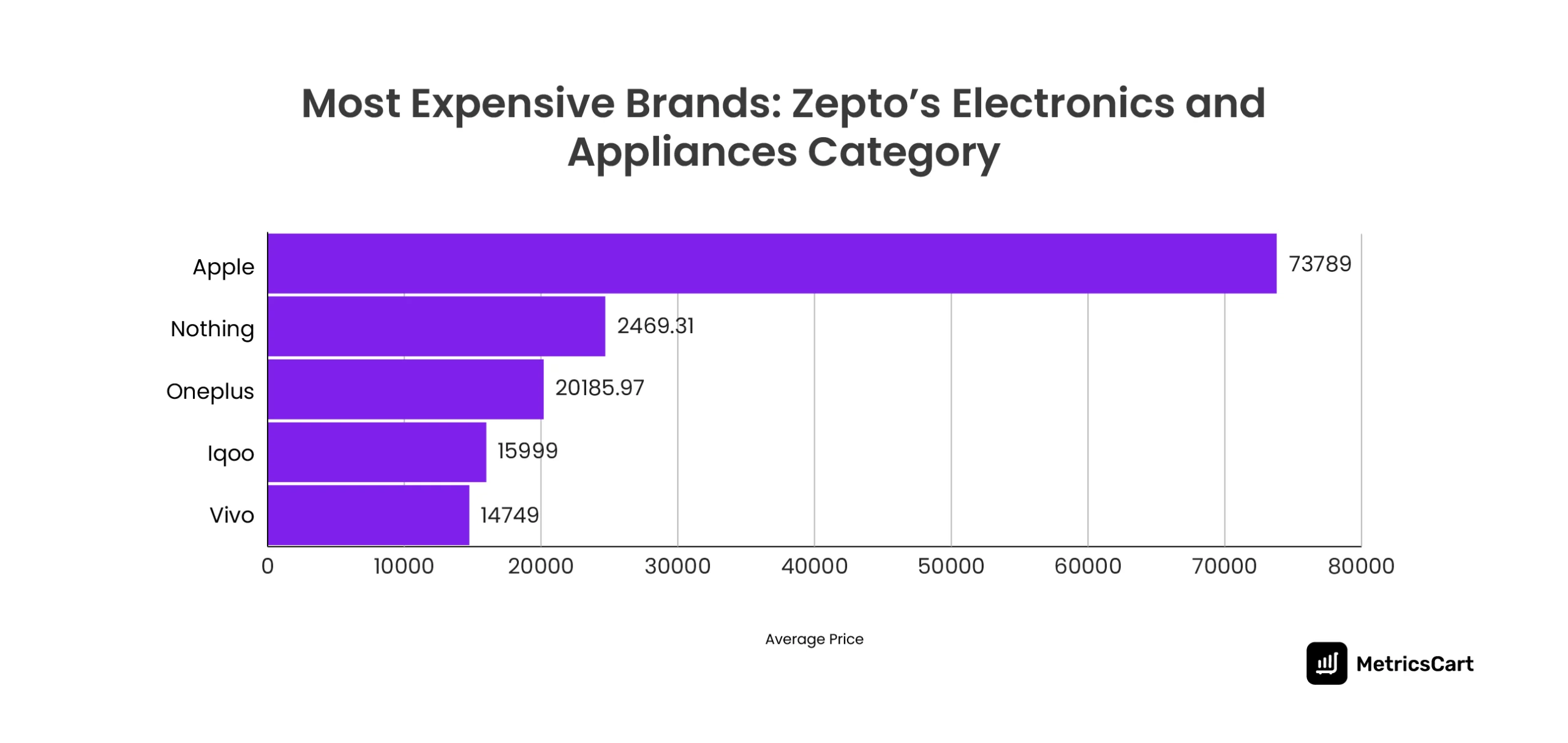

Apple stands out as the most expensive brand on Zepto, with an average product price of ₹73,789, followed by Nothing and OnePlus at ₹ 24,691.31 and ₹ 20,185.97, respectively.

Products like iPhones, AirPods, and iPads are priced high, but they still thrive on Zepto because quick commerce allows customers to get these high-end items within minutes.

In times when consumers expect instant gratification, buying a premium product like an Apple device, knowing it will arrive within minutes, adds significant value to the purchase.

Traditionally, luxury products like Apple devices take time to arrive, sometimes with long shipping windows. Zepto turns this upside down by delivering these products almost immediately. For early adopters and premium buyers, it’s not just about the product; it’s about instant access to what they desire.

Zepto’s electronics strategy stands out for its dynamic pricing model, which effectively caters to both high-end electronics buyers and budget-conscious consumers. It caters to small AOV frequent replacements to high-ticket luxury buys, maintaining a price diversity and making sure every price point has a compelling offering.

Who’s Offering the Biggest Discounts, by Brand and by Product?

On Zepto, where speed and convenience reign supreme, offering high discounts on electronics and appliances creates a powerful impulse-buy mechanism that is incredibly effective.

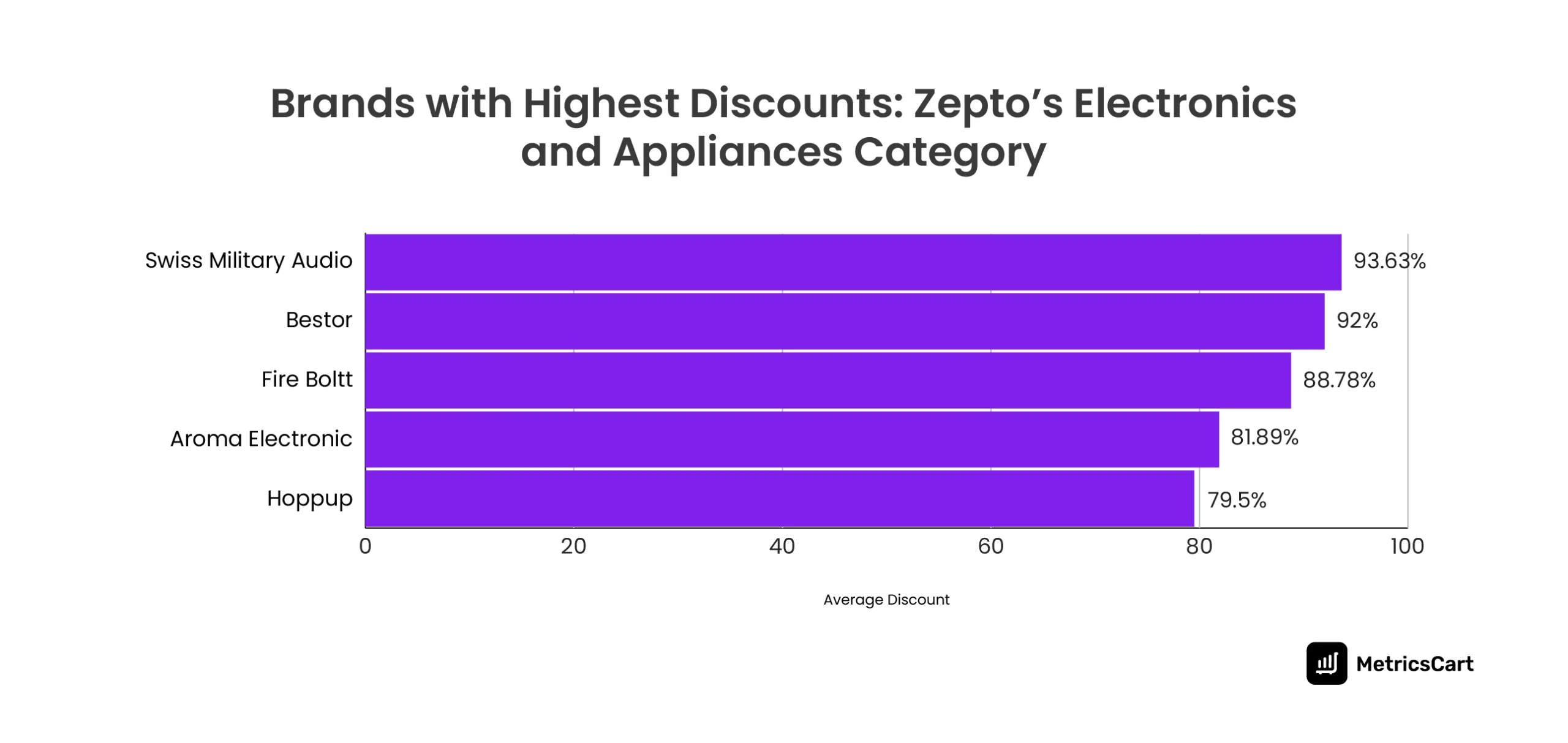

Looking at the data, Swiss Military Audio stands out with a massive 93.63% average discount, making it the biggest discount player in Zepto’s electronics and appliance category. This is followed by Bestor, with a strong 92% discount, and Fire Boltt, at 88.78%.

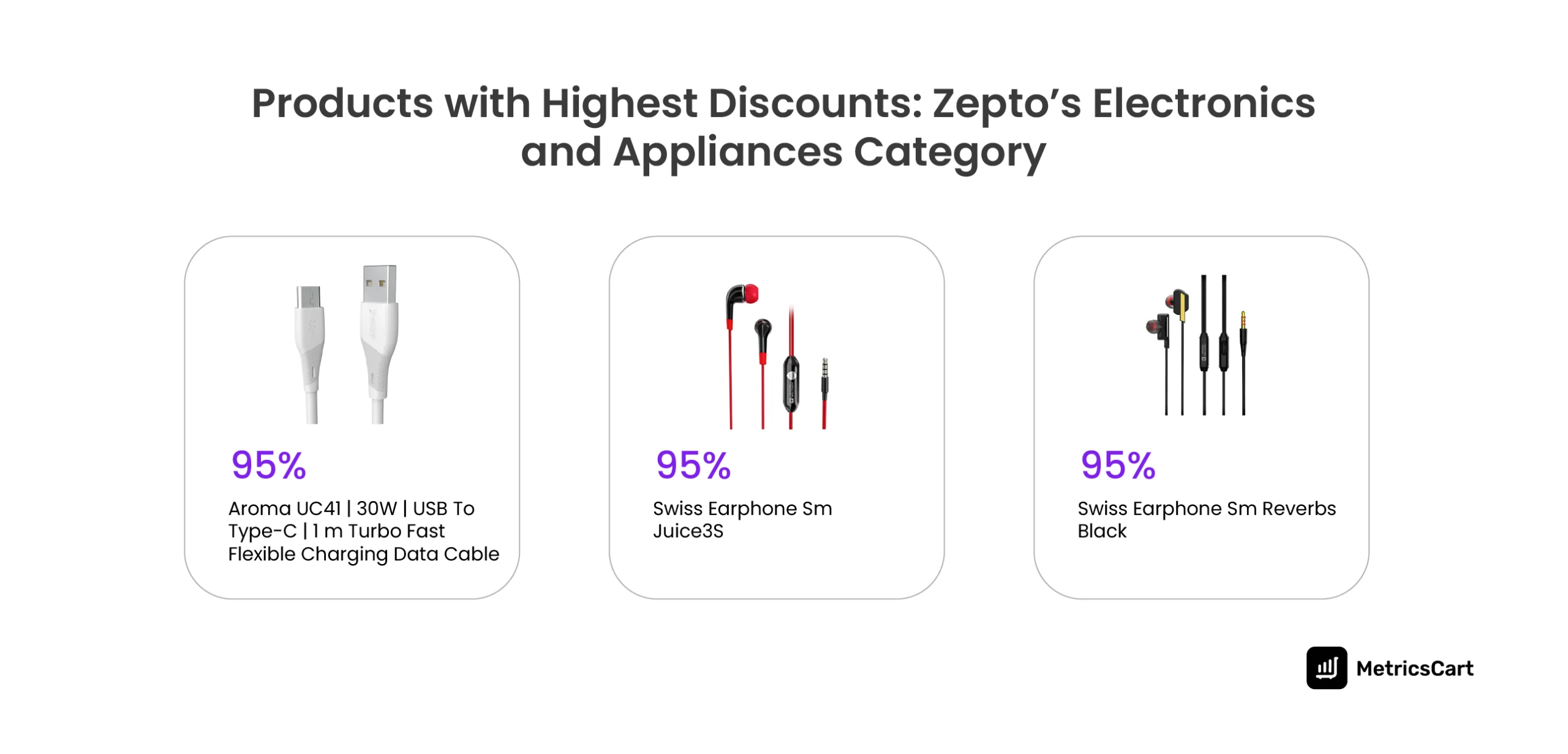

Let’s have a quick look at the highest discounted products in the category:

It’s clear that Zepto’s discounting strategy is working effectively to attract price-sensitive buyers, but there’s a lot more behind it than just offering a cheap deal. Deep discounts like these create an immediate urgency for consumers, compelling them to purchase products they may not have considered otherwise.

This discount-driven approach in Zepto’s strategy for electronics and appliances thrives on the psychology of instant gratification. By combining high discounts with ultra-fast delivery, Zepto creates a unique value proposition that appeals to both budget-conscious buyers and those seeking quick solutions for everyday tech needs.

Additionally, it helps build a larger, more diverse customer base by increasing product trials and brand awareness. For lesser-known brands, deep discounts serve as an entry point to attract customers who may otherwise overlook their products, while high-frequency purchases of low-cost essentials like headphones and chargers ensure continuous engagement.

Conclusion

By now, you can see it written on the wall: “Quick commerce is the future of consumer electronics.” We’ve long crossed the threshold where speed and convenience aren’t just perks, they’re expectations. Consumers no longer want to wait days for a phone charger or new headphones; they want them now, and they want them fast.

Zepto’s strategy for electronics and appliances has proven that the combination of affordable pricing, big discounts, and ultra-fast delivery creates an experience consumers can’t resist. But it’s not just about being fast; it’s about understanding that instant gratification is now a key part of the buying decision for electronics.

If yours is an electronics and appliances brand, here’s the big question: How quickly can you adapt to this new shopper speed?

MetricsCart’s quick commerce intelligence delivers the insights you need to understand shifting pricing trends, track competitor ad performance, and real-time inventory updates to adjust your strategy for instant shopper gratification. Make sure your brand is ready to meet shopper needs at shopper speed.

Don’t Wait, Accelerate! MetricsCart Powers Your Quick Commerce Growth With Data That Delivers Results.