About The Report

This report presents a detailed, data-backed study of the chewing gum category on Amazon US. We reviewed performance across key metrics such as sales rank, customer reviews, advertising presence, pricing, product origin, and format for the best bubble gum brands on Amazon. This study is based on data collected on January 22, 2025, across 1010 products and 383 brands.

Chewing Gum Market: The Expanding Bubble

The North American chewing gum market is set to hit $4.68 billion in 2025 and grow at a 3.93% CAGR, reaching $5.68 billion by 2030.

What’s notable is that gums are no longer just about a sweet and fun chew but about fun-ctional chewing! According to Modor Intelligence, 43% of US consumers prefer sugar-free gums of their favorite brands, drawn in by ingredients like xylitol, which promises not only fresh breath but also a healthier mouth.

And where’s this bubble of opportunity expanding? Amazon, of course. It’s the ground zero for brands looking to cash in on shifting consumer preferences. This shift in consumer preferences will ultimately redefine which are the best bubble gum brands on Amazon.

While the classics like bubblegum and mint still hold strong, functional gums (think: energy-boosting, teeth-whitening, focus-enhancing) are popping up everywhere. With consumers hungry for cleaner, healthier options, brands like PUR and Simply Gum are winning big.

Let’s dig deeper into the Amazon gum brands report to explore further.

Highlights

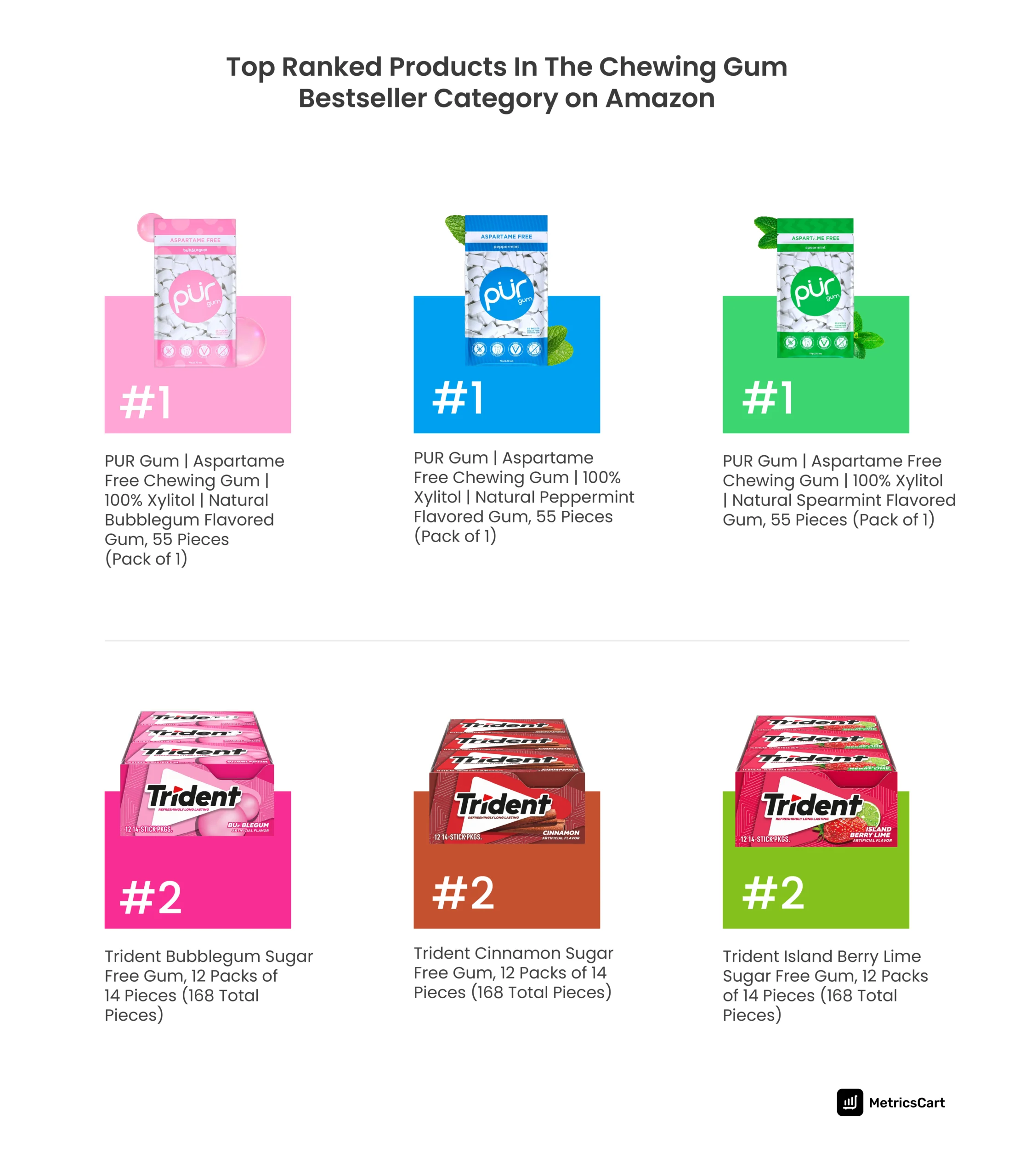

- PUR and Trident lead Amazon’s chewing gum category with first and second bestseller rankings, respectively.

- PUR holds the highest number of customer reviews with 402.4k reviews.

- Trident has the largest number of US-origin SKUs listed.

- Orbit is the most active advertiser with 7 sponsored listings, but lacks top-tier organic performance.

- Sugar-free, xylitol-based gums dominate the top ranks.

PUR And Trident Bagged The Top 2 Bestseller Ranks In The Category for Chewing Gum on Amazon

A close look at the Amazon bestseller rankings reveals that PUR holds a commanding lead, with four products in the #1 rank position.

Its popularity is driven by precise positioning: aspartame-free, sugar-free, and 100% xylitol-sweetened gums that appeal to health-conscious consumers looking to avoid artificial sweeteners.

These attributes are front and center in their product listings, making it easy for customers to choose PUR as a safer daily chew.

Trident follows closely, securing five product slots in the #2 rank position. These include a variety of sugar-free flavors such as cinnamon, tropical twist, and classic bubblegum, typically offered in 12-pack configurations.

Trident’s broad flavor offering and bulk pack size strategy cater to both taste preferences and perceived value, maintaining its foothold among repeat buyers.

READ MORE| Want deeper insights into Walmart’s snack category? Check out Digital Shelf Insights: Walmart Snack Category Analysis.

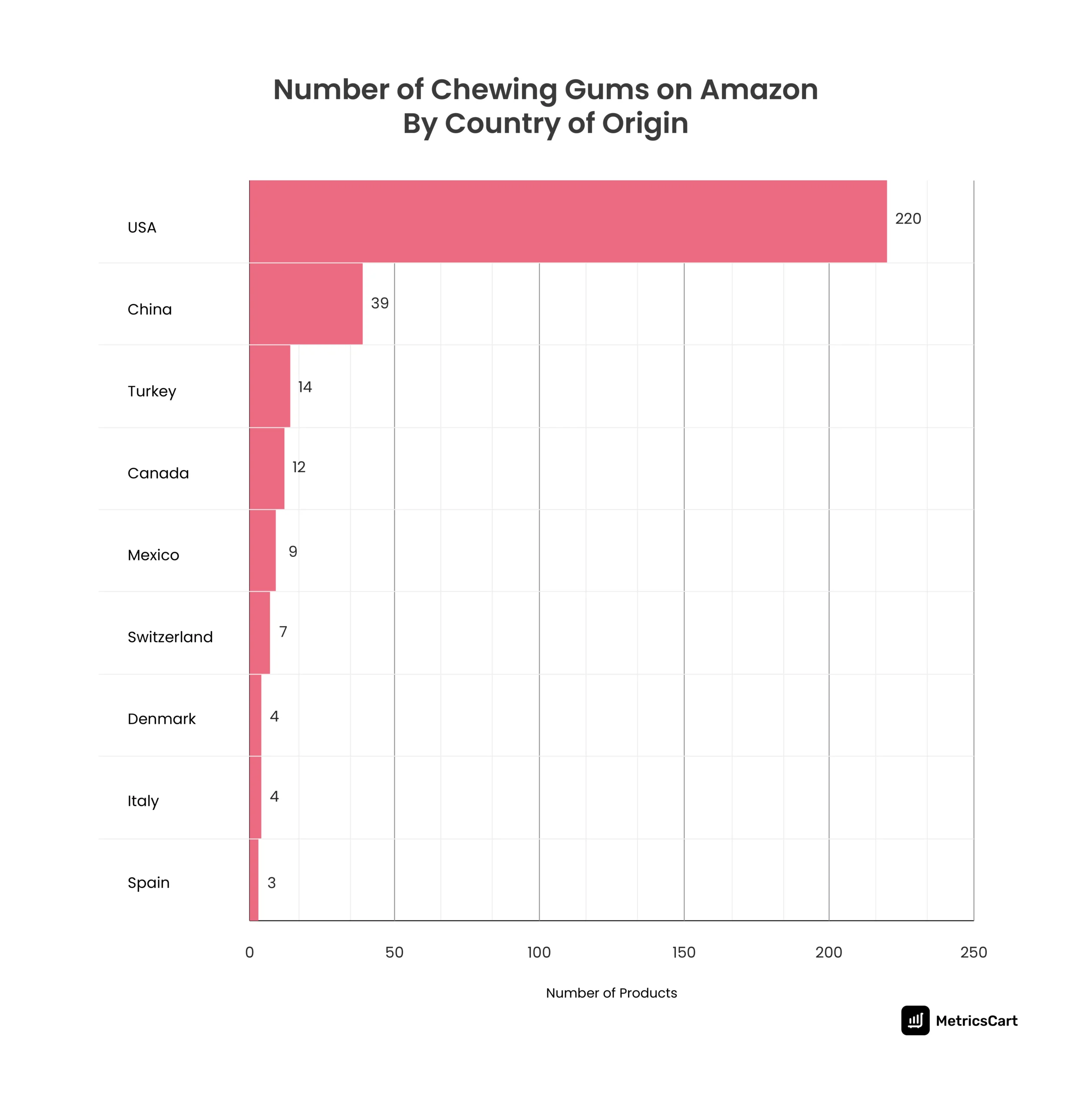

US Origin Brands Dominate the Category, Followed by China and Canada

The majority of chewing gum products on Amazon (220 listings) are of US origin, reflecting domestic brand trust and easier compliance with local regulations.

China ranks second with 39 products, primarily price-focused and private-label offerings that may appeal to budget-conscious shoppers.

Canada, despite having only 12 listings, demonstrates higher efficiency in performance thanks to brands like PUR, proving that brand equity can outweigh sheer volume.

International brands looking to compete in the US market will need to be strategic; competing on price isn’t enough without clear positioning, recognizable benefits, and targeted marketing.

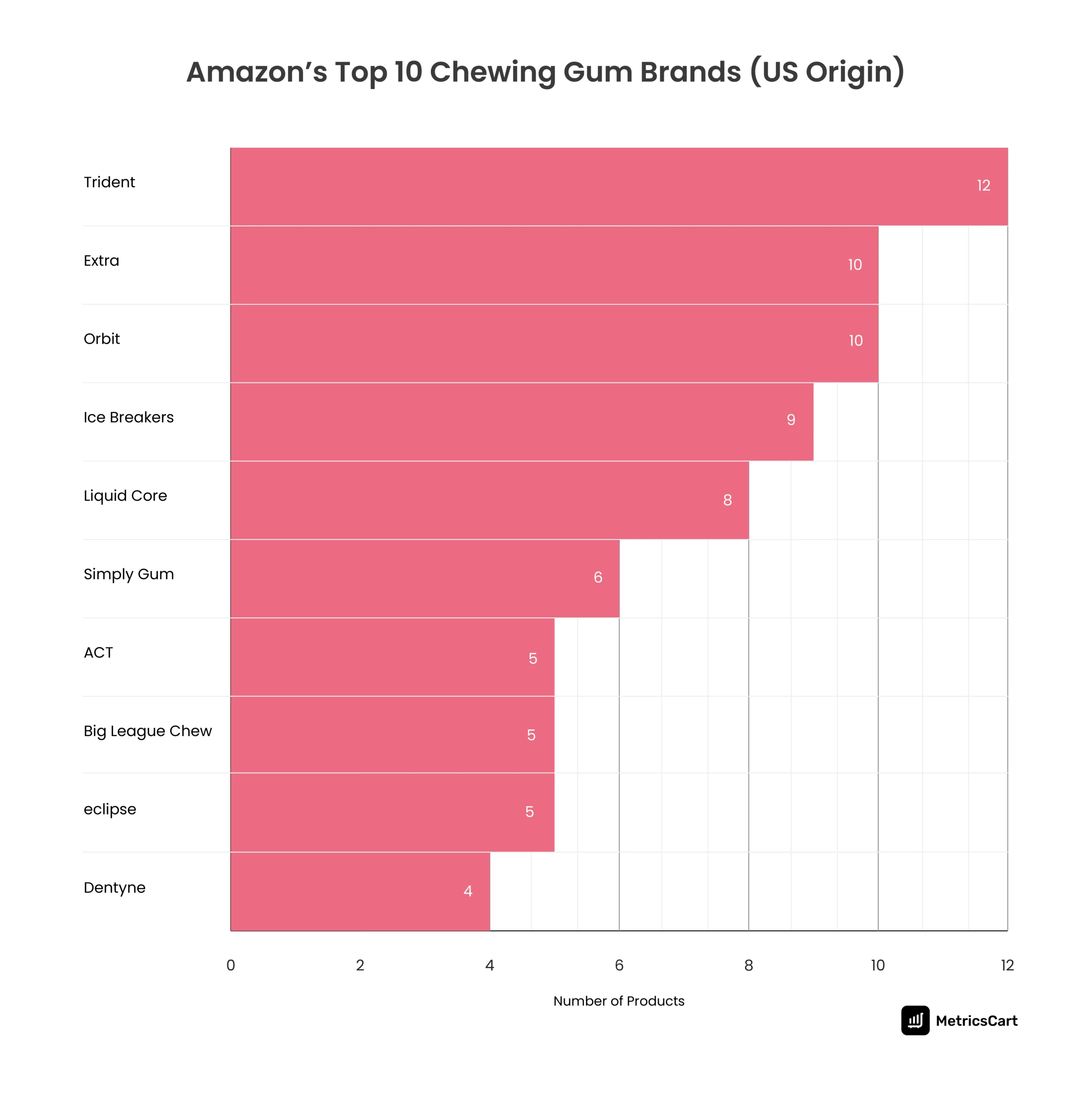

Trident Leads Among Top Chewing Gum Brands On Amazon (US Origin)

Trident leads all US origin brands with 12 SKUs on Amazon. This includes multiple flavors and formats; indicating a deliberate strategy to cover as many shopper intents as possible, from freshening breath to satisfying nostalgic cravings.

Extra and Orbit, each with 10 listings, pursue similar portfolio breadth but with slightly less market penetration.

A wide product assortment increases shelf presence and allows brands to collect more real-time purchase data, which is crucial for optimization. Trident’s SKU strategy clearly prioritizes discoverability and shelf density.

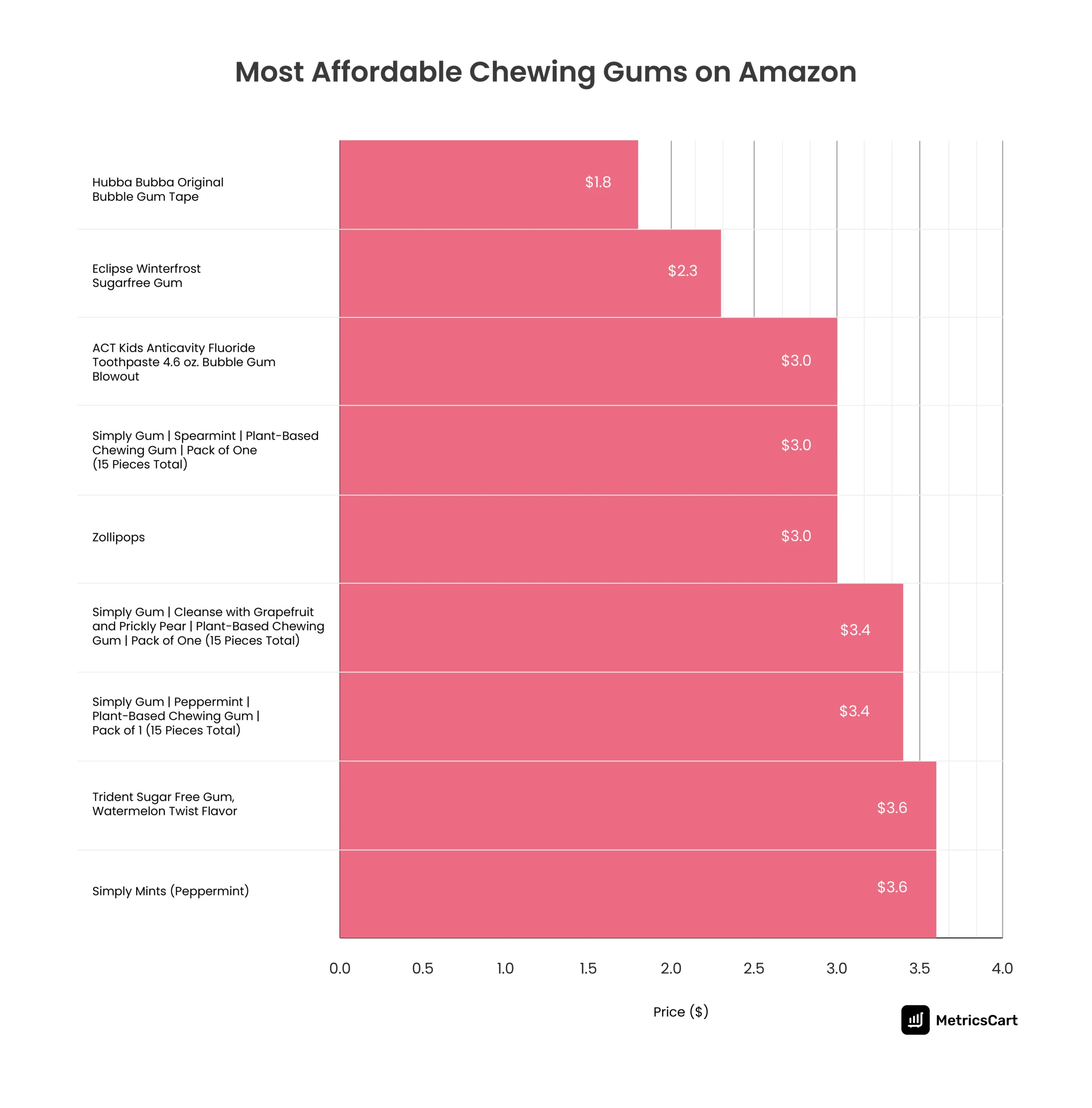

Hubba Bubba Gum Tape and Eclipse Winterfrost Sugarfree Gum Are The Most Affordable Chewing Gums

A classic, nostalgic brand, Hubba Bubba stands out for offering value at $1.8, making it accessible while maintaining its brand appeal.

Despite not being sugar-free, its price and playful tape format are strong selling points, especially for parents buying fun options for kids.

The affordability and unique packaging likely play a significant role in this product’s success in the budget-conscious segment.

Eclipse Winterfrost makes a strong case for value in the sugar-free gum segment. At $2.3, it offers consumers a functional option that addresses both price sensitivity and health-conscious needs.

As sugar-free gum continues to rise in popularity, especially for consumers looking for oral health benefits, this product strikes a balance between affordability and value. It appeals to a broader, health-focused audience without sacrificing taste or functionality.

With MetricsCart’s ratings and review monitoring, you can turn negative feedback into brand loyalty, respond strategically, and start building goodwill today.

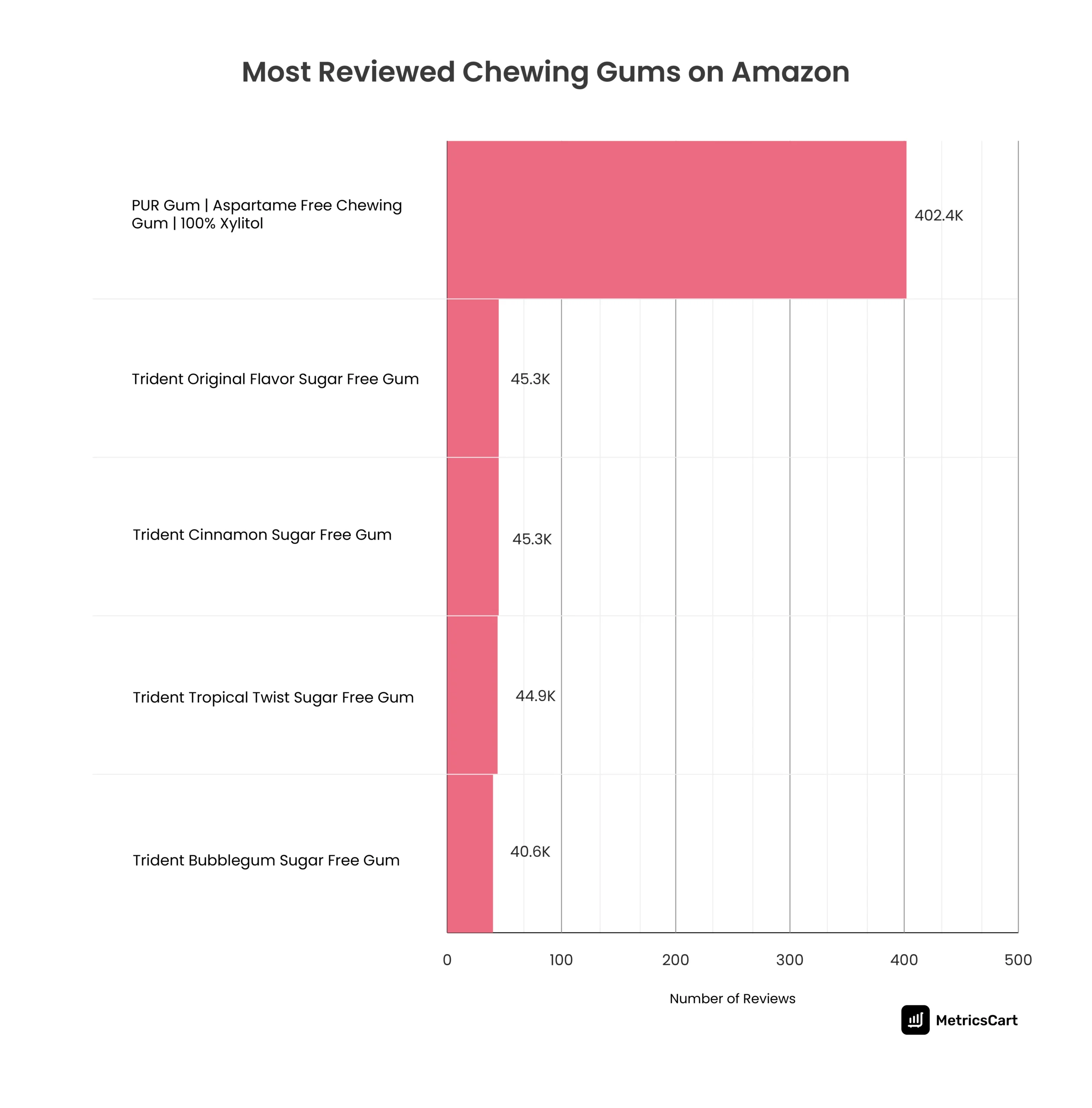

PUR Gum Leads In Customer Engagement with 402.4K Reviews

PUR Gum is the undisputed leader in Amazon’s chewing gum category, with a staggering 402.4K reviews, which is far ahead of any other product.

To put this in perspective, the next highest Trident Original Flavor Sugar Free Gum, which comes in at 45.3K reviews, is more than 8 times lower than PUR. This massive gap in reviews is a testament to PUR’s strong consumer following and brand loyalty.

PUR’s health-focused positioning is a key factor. With its 100% xylitol-based and aspartame-free formula, it is a go-to choice for those concerned with oral health, as xylitol is often associated with better dental benefits.

The product’s alignment with these consumer values has likely contributed to its high review volume, reinforcing trust and promoting repeat purchases.

READ MORE| Wondering how to win more reviews on Amazon? Check out How To Get Reviews on Amazon: The Essential Guide.

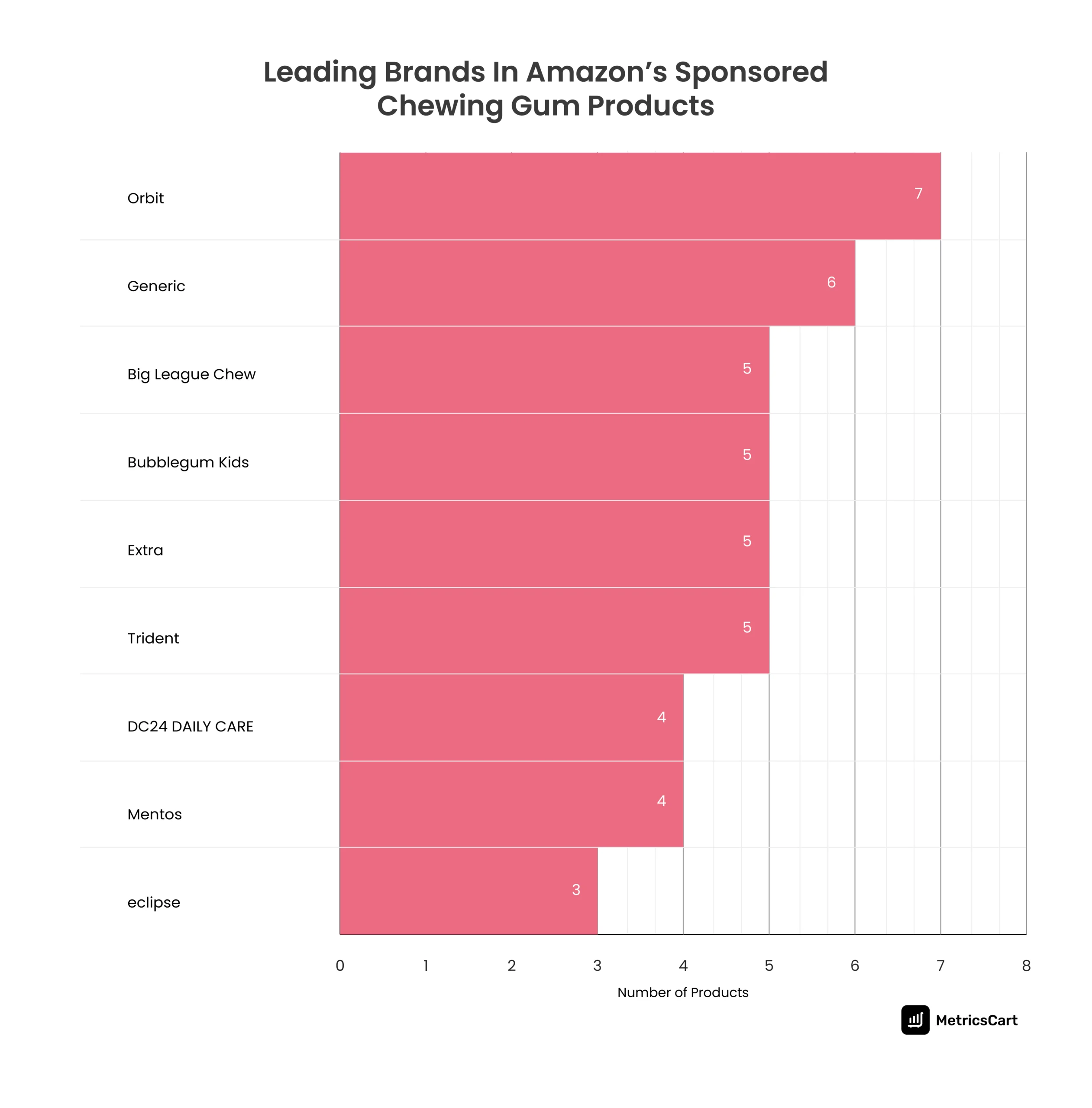

Orbit and Big League Chew Are Brands with the Most Sponsored Products

Orbit tops the list for sponsored ad placements with seven SKUs promoted, while Big League Chew follows with five. However, neither brand appears among the top sellers or highest-reviewed products.

This highlights a common disconnect: aggressive ad spend without corresponding product performance. If ads aren’t supported by high-quality listings, competitive pricing, and strong reviews, the investment is unlikely to yield long-term results.

For Orbit, the takeaway is to align its advertising with products that have better conversion potential to improve chewing gum sales on Amazon.

Most Top-Ranked Products Are Sugar-Free, Xylitol-Based, and Come in Bulk

A clear trend among bestsellers is the shift toward sugar-free gums with xylitol. Consumers are prioritizing clean labels and looking for alternatives that don’t compromise oral health.

Bulk packaging is another success factor. Whether it’s Trident’s 12-pack boxes or Ice Breakers’ 40–100 count bottles, shoppers gravitate toward value. These formats also signal convenience and long-term usage, which play well in a marketplace driven by subscription and bulk-buying consumer behavior on Amazon.

Flavor remains a key driver of preference and repeat purchase. Mint variants dominate (peppermint, spearmint, wintergreen), followed by bubblegum and cinnamon. These flavors are tied to both freshness and nostalgia, two strong purchase motivators.

While fruit or novelty flavors make occasional appearances, they typically don’t outperform the core options. Brands looking to innovate should avoid straying too far from these staples unless they are targeting a niche segment or offering added functional benefits.

Conclusion

The chewing gum category on Amazon is evolving, and staying ahead means adapting to shifting consumer preferences.

Health-conscious trends, functional ingredients, and value-driven offerings are becoming essential to success. The brands that thrive will be those who stay connected with what today’s shoppers want and use data to drive smarter strategies.

At MetricsCart, get in-depth, data-backed insights tailored to your brand’s needs. Get in touch today for the right digital shelf solutions for result-oriented e-commerce strategies to grow your brand online!

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Ready To Take Control of Your Brand Performance? Strategize With Our Digital Shelf Solutions!