According to Statista Market Insights, the overall revenue growth of the US snack industry will be $114.20 billion in 2024. In the second edition of MetricsCart’s Digital Shelf Insights report, our experts have conducted Walmart snack category analysis.

- About the Report

- Methodology

- Key Findings

- Walmart Category Data Analysis: Top Subcategories of Snacks

- Top Snack Brands of Walmart: Great Value Takes the Lead

- Walmart Category Data Analysis: Pricing and Promotion

- Analysis of Walmart Snack Category: Rating and Reviews

- Walmart Category Data Analysis: Stock Availability

- Analysis of Snack Category in Walmart: Sponsored vs Non-sponsored Products

- Analysis of Walmart Snack Category: Eggs and Milk are the Leading Allergens

- Why Use MetricsCart to Conduct Data Analysis and Monitoring?

About the Report

MetricsCart’s Digital Shelf Insights is a monthly report in which our industry experts analyze data for a brand and category. This report covers various brands and subcategories within Walmart’s snack category.

Methodology

For April’s category performance analysis report, we analyzed 1169 different snack items available on Walmart’s digital shelf.

Key Findings

- Crackers are the top snack sub-category at Walmart

- Great Value offers the highest number of snack products

- Snack mixes are the sub-category with the highest discount rates

- The majority of Walmart snack products have a 4-star rating

- Eggs and milk are the most common food allergens found in snacks

Walmart Category Data Analysis: Top Subcategories of Snacks

The 2023 Food and Health Survey states that 72% of participants snack at least once daily. Fruits are the preferred snack in the morning. Meanwhile, savory and salty snacks are most common in the afternoon—with the addition of cookies, cakes, or ice cream in the evening.

Now, let’s look into the various categories and subcategories of Walmart snacks.

Walmart offers 1169 different snack items. They are categorized into food, health and medicine, and baby.

- Food accounts for 98.2%

- Health & medicine account for 1.63%

- Baby accounts for 0.17%

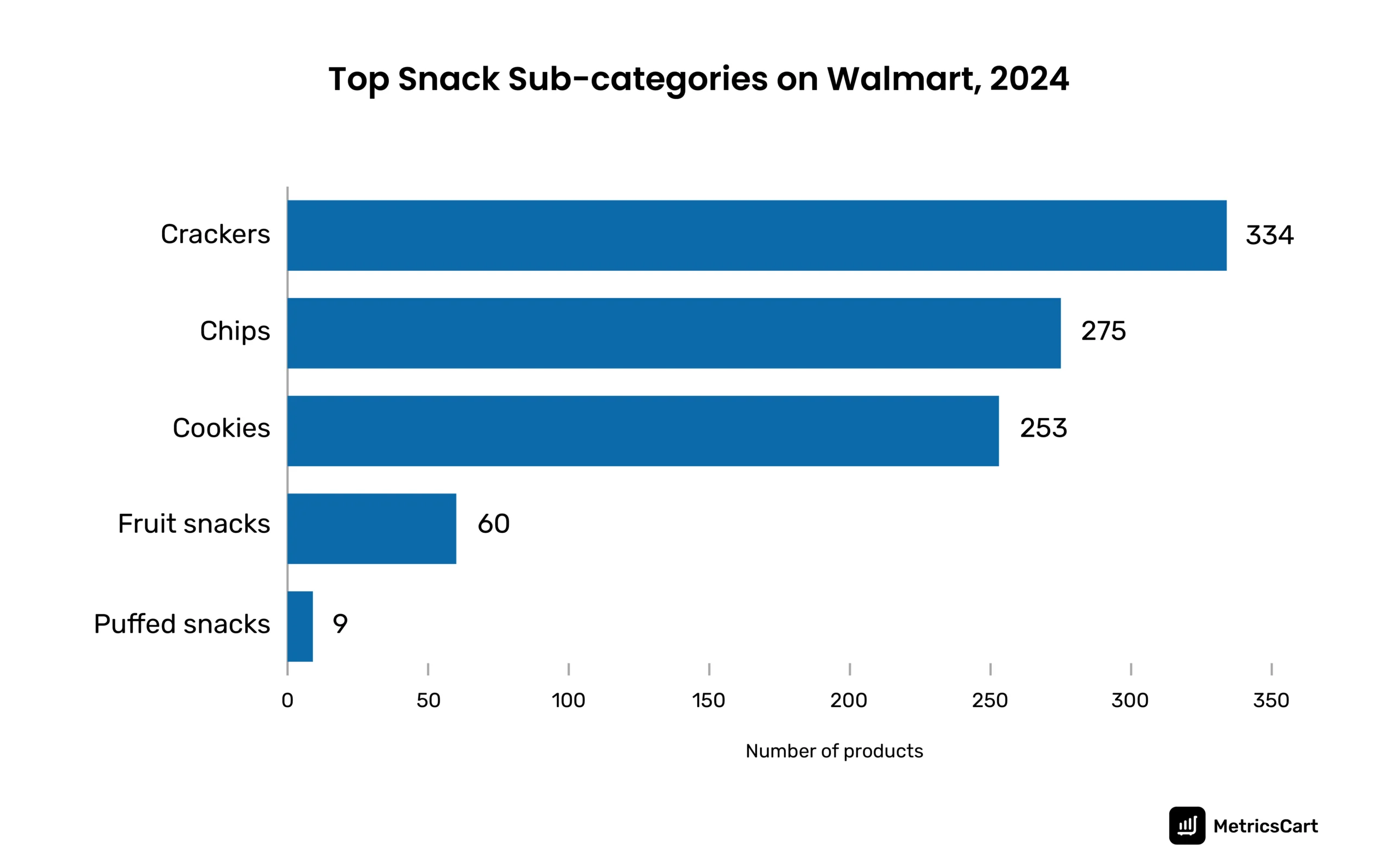

The top snack subcategory is crackers, with 334 products. Some leading cracker brands include Goldfish, Ritz, Great Value, etc.

Crackers are generally low in calories, fat, and sodium. When customers choose the right type, crackers can also be a good source of fiber and whole grains. Additionally, they can be enjoyed as a snack or paired with various toppings like nut butter, hummus, etc., to create a more filling and nutritious snack.

This is followed by chips and cookies. The Walmart digital shelf has 275 chip products and 253 cookies.

Top Snack Brands of Walmart: Great Value Takes the Lead

First, let’s look at the brands with the most snack products at Walmart.

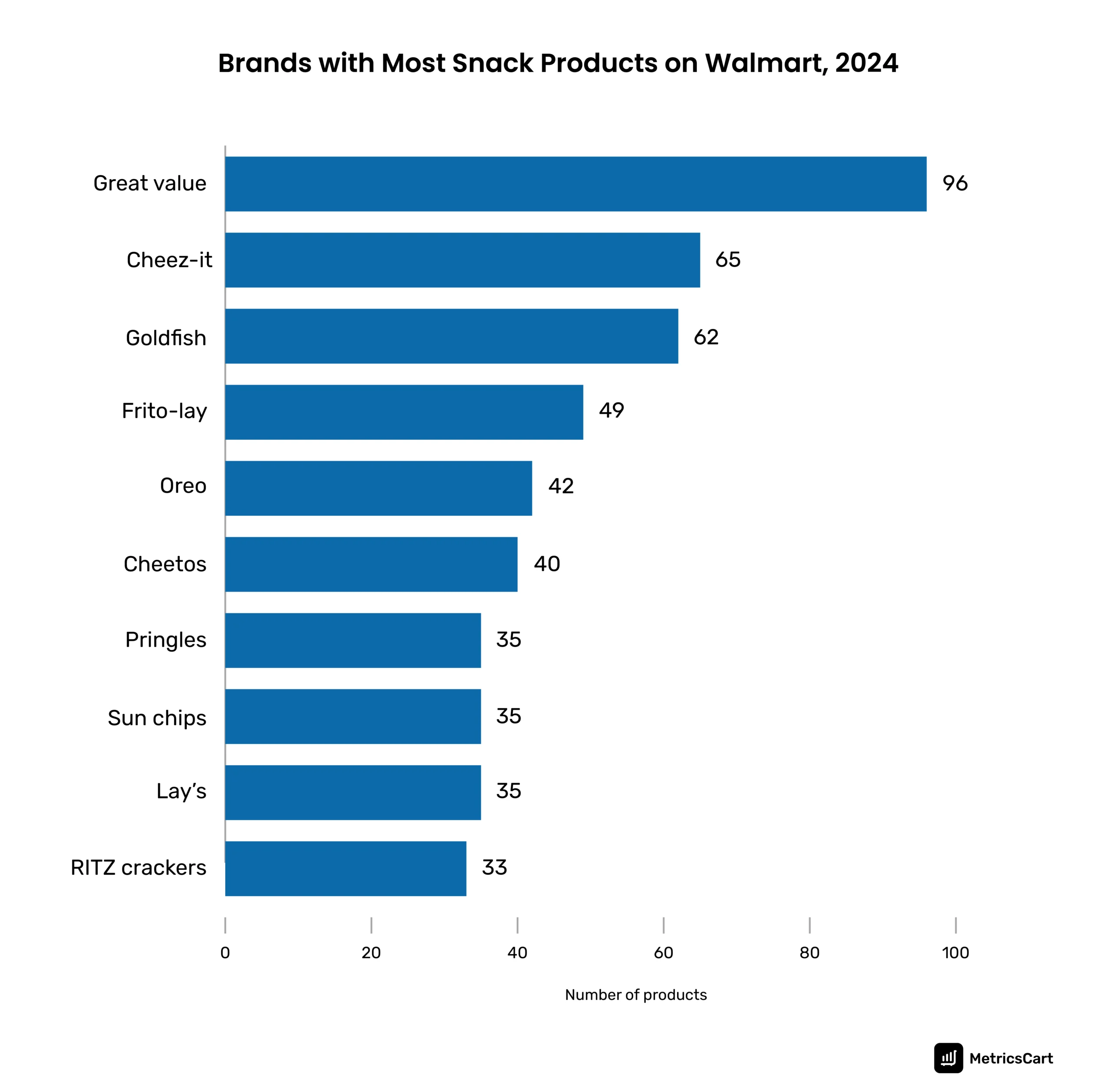

Great Value ranks first on the list of brands with the most products in Walmart’s snack category. Great Value is a private-label brand of Walmart that primarily sells subcategories like snack mixes, crispy rice treats, wafer bars, and crackers. Their products, especially snack mixes and crackers contain iron and have zero grams of trans fat or cholesterol.

This is followed by Cheez-It and Goldfish, which have 65 and 62 products, respectively.

Walmart Category Data Analysis: Pricing and Promotion

The analysis of Walmart snack category shows that most of these products have discounts, with promotional prices being lower than regular prices. For example, Little Debbie Snacks has a discount price of $9.72, while the actual price is $10.88. Similarly, snack cakes have a lower promotional price of $7.08 compared to the $9.41 actual price.

Conversely, snack items like beef jerky and dried meats, and popcorn do not have any discounts, with their prices being $11.28 and $7.77, respectively.

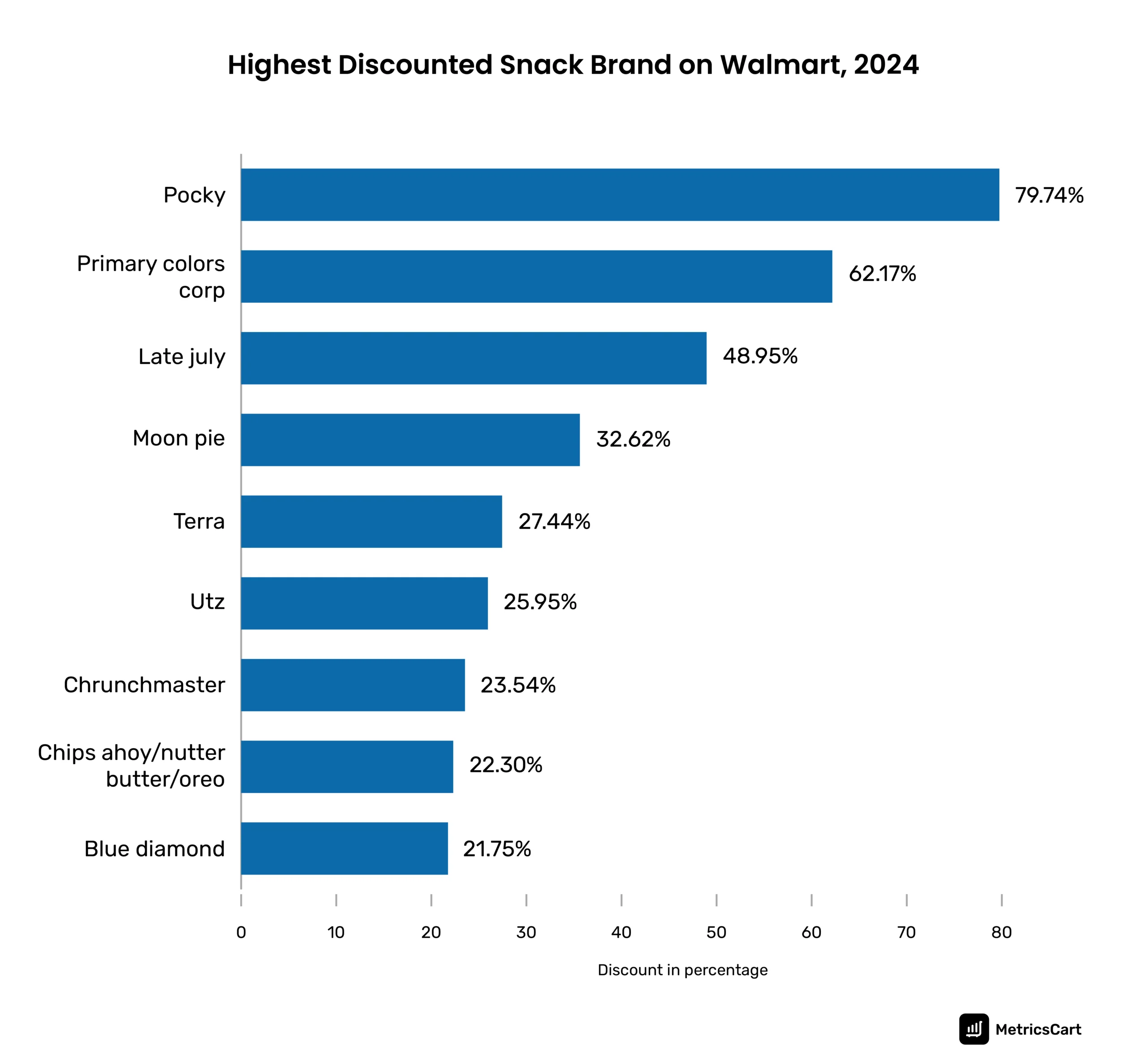

In the category analysis for brands with the highest discounts, Pocky comes first with an average discount of 79.74%. It is a thin stick-shaped cookie, or biscuit dipped in flavors such as chocolate, cookies and cream, strawberry, etc.

This is followed by Primary Colours Corp, which offers a 62.17% average discount compared to Late July’s 48.95%.

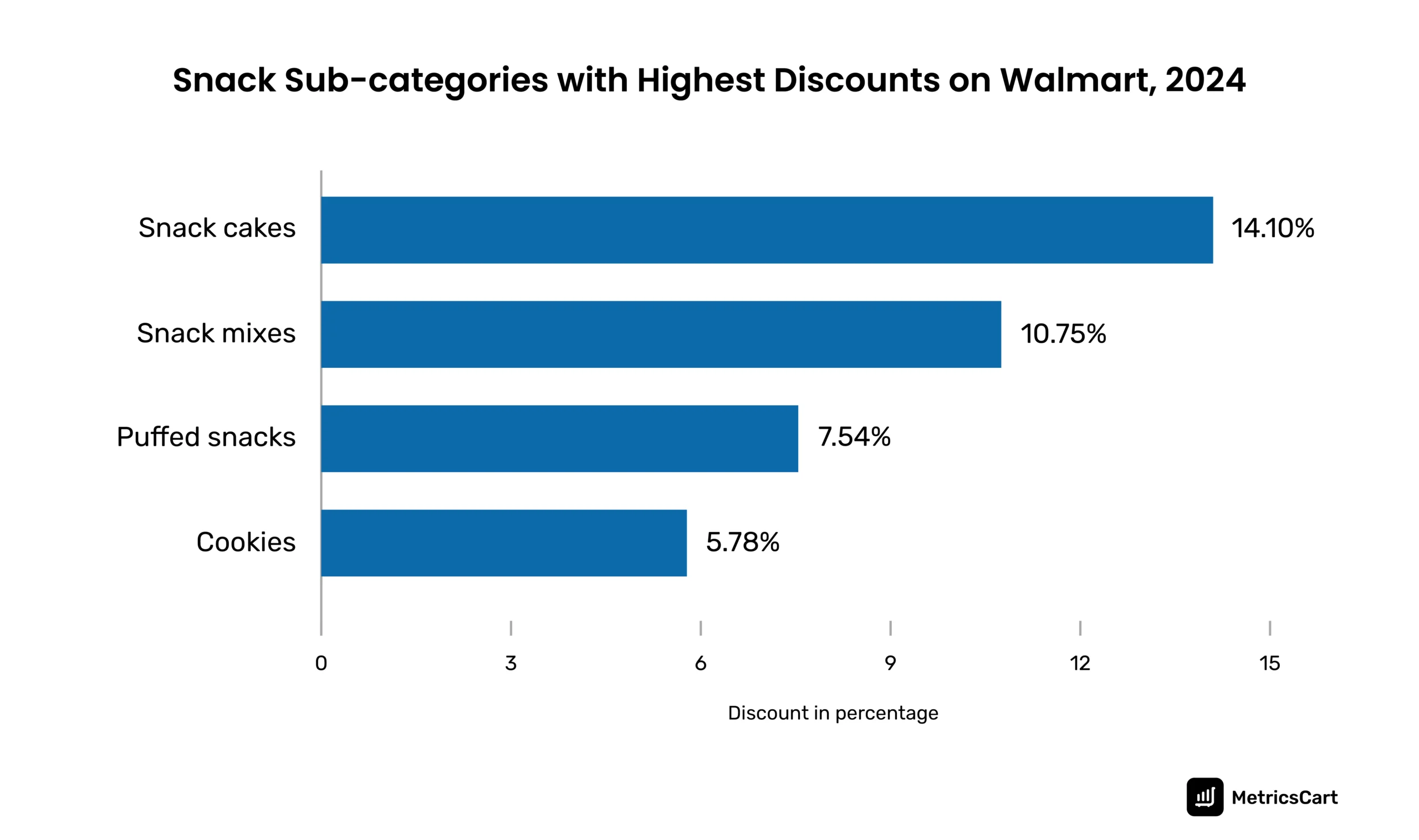

Through the analysis of snack category in Walmart, our experts also identified different sub-categories that offer varied discounts.

The Snack Cakes category leads with an average discount of 14.10%. Snack mixes and Puffed Snacks secure second and third place with discounts of 10.75% and 7.54%, respectively.

Numerous snack brands offer discounts ranging from 20% to 80% to attract new customers. The majority of snack products at Walmart feature discounts between 0% and 20%, totaling 1073 items. This suggests that most snack items have modest discounts.

However, some products have higher discounts, between the following ranges: 20-40%, 40-60%, and 60-80%.

NIQ Snacknomics reveals that nearly 60% of consumers cite affordability as a top consideration when purchasing snacks, given that most spend 5%- 20% of their total food budget on snacks. Thus, products or brands with discounts get sold more compared to the ones with listed prices.

Analysis of Walmart Snack Category: Rating and Reviews

Ratings and reviews provide insights from real customers who have purchased and used the product. Future buyers often rely on these reviews to understand a product before purchasing. Therefore, it is necessary to monitor positive and negative reviews to improve the quality of the products.

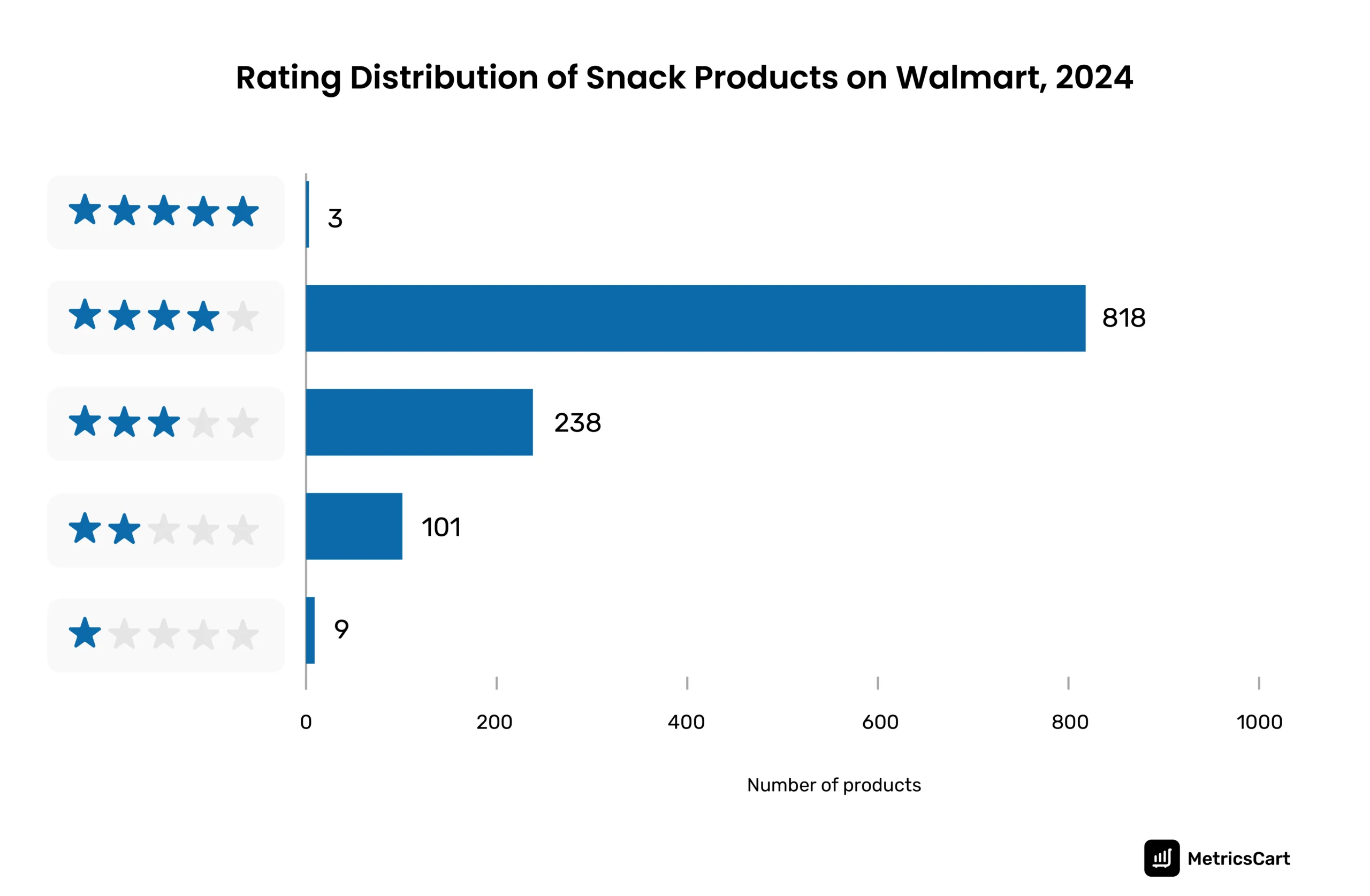

By analyzing the category data, we understand that the majority of snack products in the Walmart snack category are well-received by customers. More than 800 snack products have 4-star ratings, which indicates a high level of customer satisfaction.

Additionally, there are 238 products with 3-star ratings, followed by 101 2-star ratings. This suggests that while most products are rated positively, some fall into the average or slightly below-average range in terms of customer satisfaction.

However, very few products have 1-star ratings, indicating that poorly rated products are rare in Walmart’s snack category.

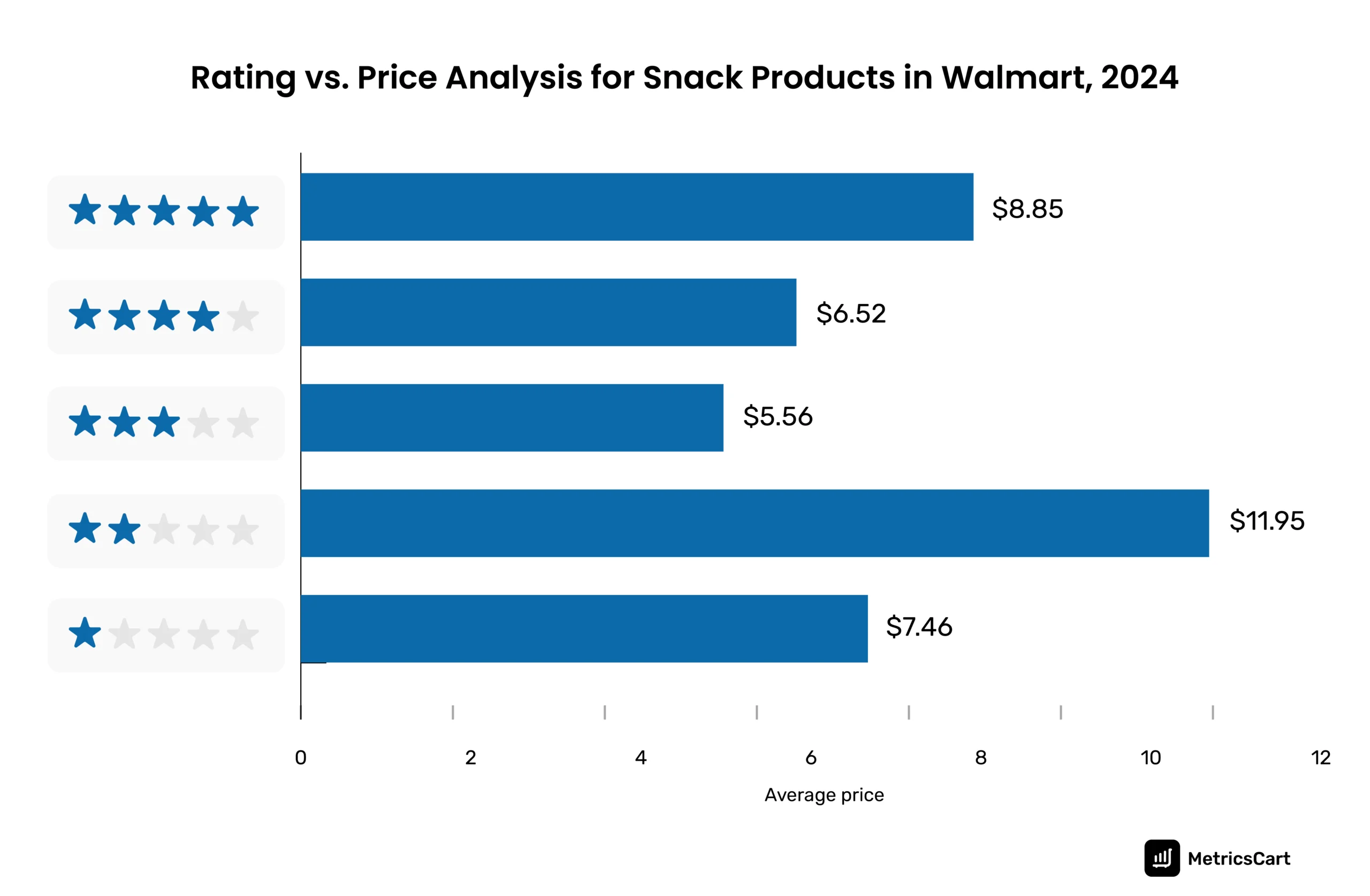

Through this data analysis of Walmart snack category, we have also investigated the correlation between product ratings and prices. This showcases a trend where Walmart snack products with higher ratings tend to have lower prices while those with lower ratings have higher prices.

Products with 3-star ratings have the lowest average price, at $5.56. Following closely behind are products with 4-star ratings, with an average price of $6.52. Given their affordable price range, customers consider them to provide good quality and value, reflected in their ratings.

On the other hand, products with 2-star ratings have the highest average price at $11.95. This is because customers have higher expectations for products with premium prices. When these expectations aren’t met, they receive lower ratings.

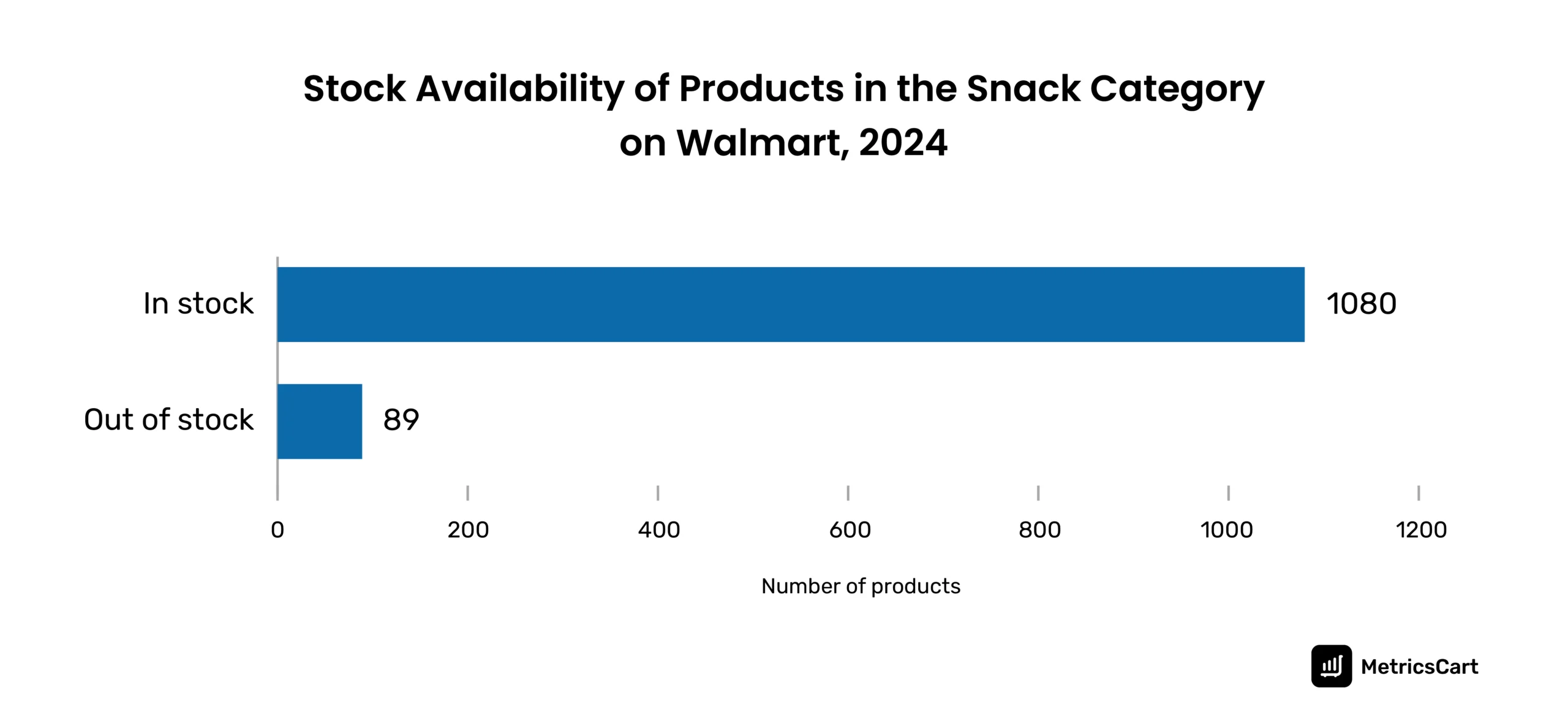

Walmart Category Data Analysis: Stock Availability

When a product is out of stock, it can lead to customer dissatisfaction and revenue loss. Frequent stockouts can also drive customers to other retailers with better inventory availability, resulting in a competitive disadvantage. Therefore, it is important to update, monitor, and maintain the inventory at an optimal level.

The data shows that the majority of snack products, totaling 1080 items, are currently available for purchase at Walmart. However, 89 products are currently out of stock, which may indicate a temporary shortage or high demand for those particular items.

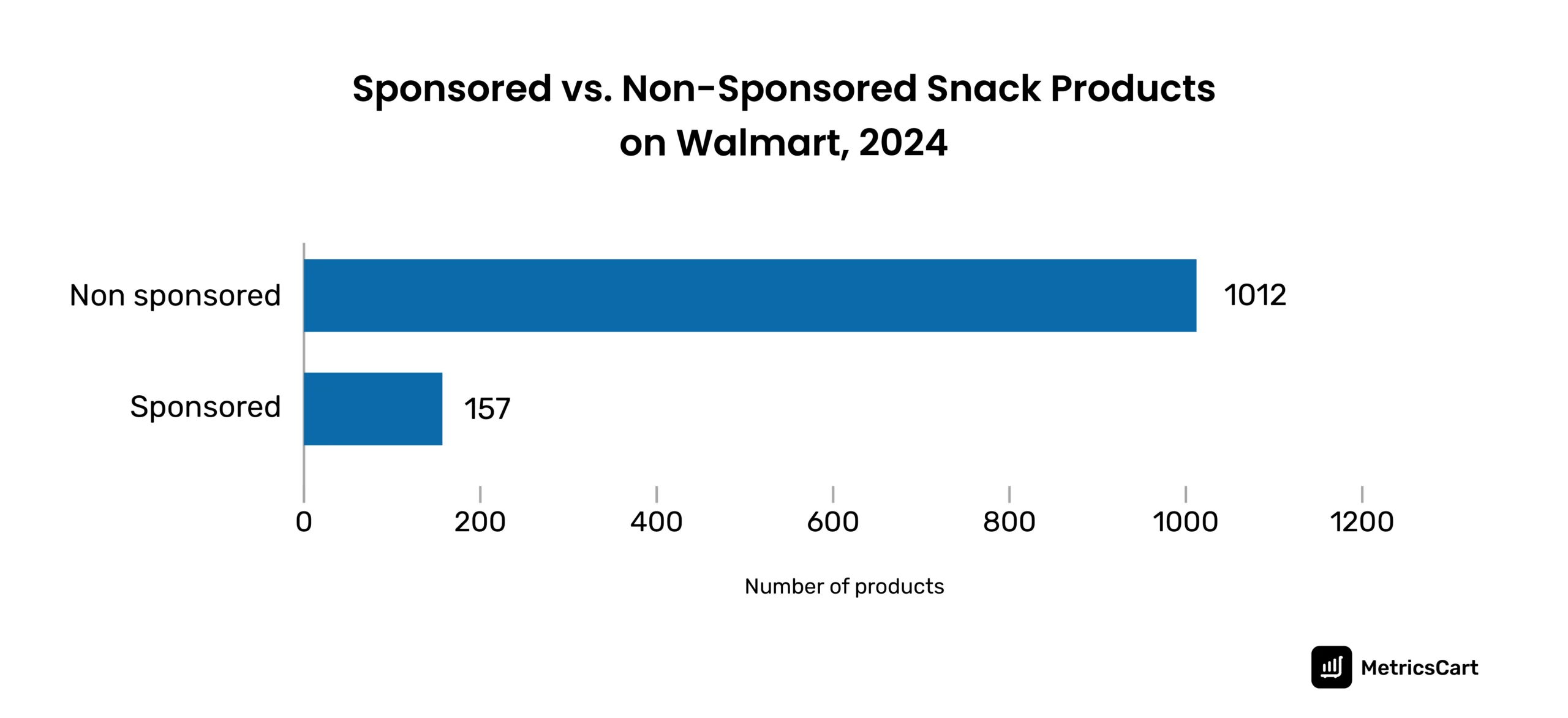

Analysis of Snack Category in Walmart: Sponsored vs Non-sponsored Products

Walmart offers various advertising opportunities through which sellers can create and manage ad campaigns that suit their business budget and objectives.

Walmart Sponsored Products is one such ad opportunity available to brands, marketplace sellers, vendors, and agencies. Sellers can bid for a particular search query and appear on the Search In-grid, Buy Box, and Product Carousel as sponsored products.

To meet eligibility criteria, products must fulfill the following requirements:

- Be in stock on Walmart.com and win the buy box.

- Appear within the top 128 organic search results

- Rank equal to or higher than their organic search ranking

- Belong to the same category as the search query.

- Match at least one non-sponsored product type among the top 20 results

These ads help sellers improve product visibility, maximize profitable SKUs, and stay ahead of the competition.

Out of the total of 1169 products, 1012 products are non-sponsored, and 157 products are sponsored. This suggests that most snack items available at Walmart are not part of any sponsorship.

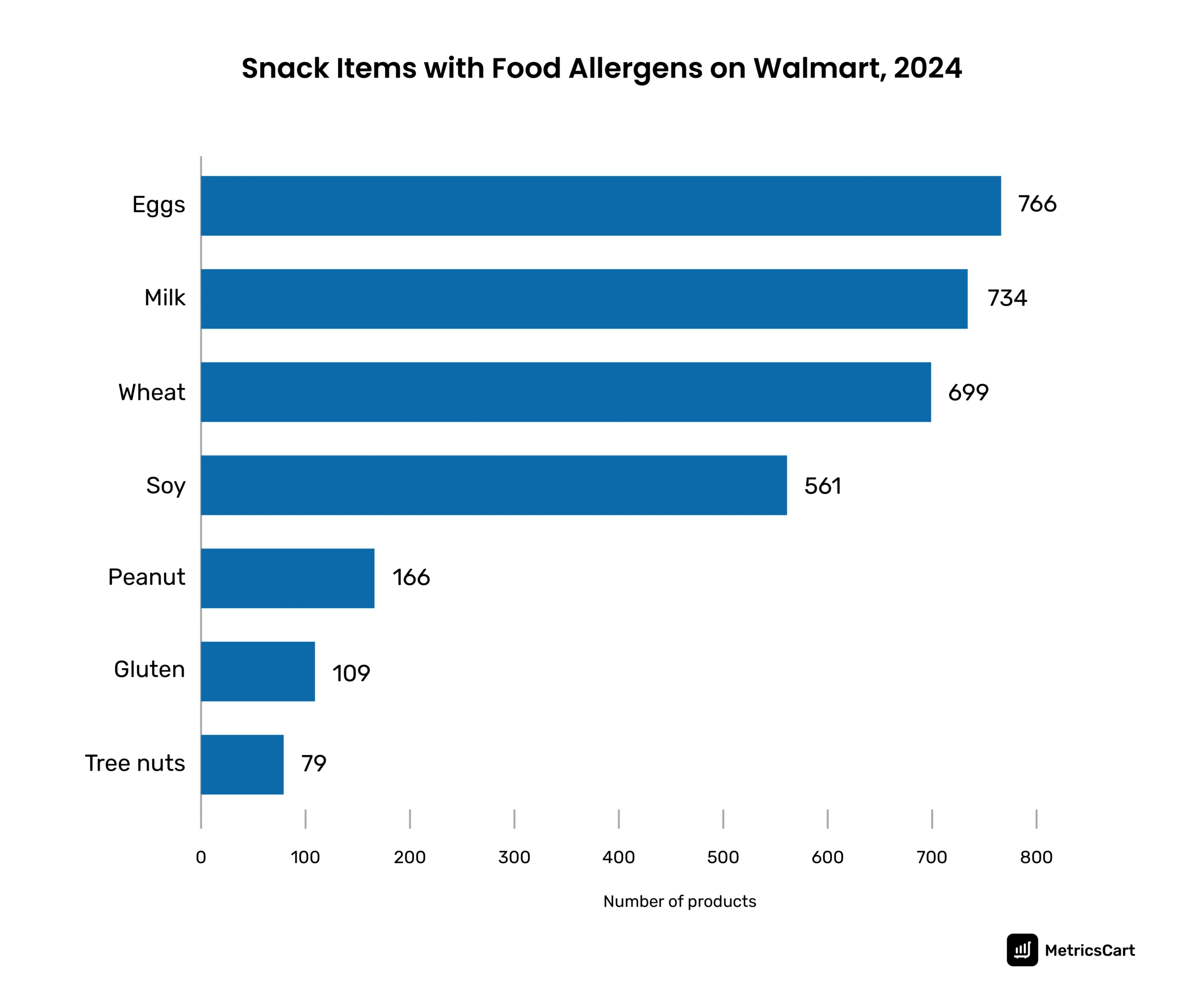

Analysis of Walmart Snack Category: Eggs and Milk are the Leading Allergens

According to Food Allergy Research and Education, 33 million Americans have food allergies, and 51% of them have experienced a severe reaction.

The US Food and Drug Administration has identified nine major allergens: milk, eggs, fish, Crustacean shellfish, tree nuts, peanuts, wheat, soybeans, and sesame. Brands must label the names of any ingredients that are one of the nine major food allergens or contain protein derived from a major food allergen.

Based on the analysis, our experts have identified eggs, milk, and wheat as the primary food allergens present in Walmart snack products.

Present in 766 snack products, eggs top the list as the most common allergen. Following closely behind is milk, found in 734 products, solidifying its position as the second most common allergen in snacks.

Wheat ranks third, being found in 699 products.

This information enables customers to make informed choices and avoid snacks containing allergens. For example, if someone is allergic to milk or other dairy products, they can purchase dairy-free snacks like Nature’s Bakery fig bars, Cybele’s Chocolate Chip Cookies, and more.

In a nutshell, this Walmart data analysis using MetricsCart provides comprehensive insights into various aspects such as subcategories, top brands, pricing, promotions, sponsored products, stock availability, and more. In addition, research by NIQ Snacknomics reveals some of the following trends:

- Total snack prices rose at twice the rate of food inflation

- Snacks with sustainable packaging certifications are sold faster than other snacks

- Smaller pack sizes within indulgent confections and cookies are gaining popularity

- There is a growing prominence for allergy and special diet callouts/labels

Why Use MetricsCart to Conduct Data Analysis and Monitoring?

MetricsCart offers e-commerce market intelligence solutions, specializing in data monitoring and category analysis across online retail platforms. It helps marketplace sellers gain insights into product performance on e-commerce sites and improve the brand’s online visibility.

Whether you’re a brand or a retailer, MetricsCart can assist you with product analysis on the digital shelf and category insights in the e-commerce landscape.

Upgrade your e-commerce game with MetricsCart Digital Shelf Analytics.