About the report: This Digital Shelf Insights (DSI) report takes an in-depth look at Betty Crocker’s marketing strategy and business model on Walmart. Using data from 1,789 products listed as of August 5, 2025, it examines the brand’s pricing patterns, category presence, consumer ratings, seller dynamics, and stock availability. The goal is to reveal how Betty Crocker positions itself on the digital shelf to ensure long-term success and what lessons other CPG brands can draw from its approach.

Introduction

Only a few brands manage to build a legacy that lasts more than a century. Betty Crocker is one of them. Created in 1921 as a fictional homemaker giving baking lessons, Betty Crocker has grown into the most recognized name in the US dessert mixes aisle. According to Statista, Betty Crocker owns the largest share of the category, generating nearly $340 million in annual sales within a $3.9 billion market.

Behind this massive and long-lasting success is a brilliant business model that balances tradition with strategic modernization. Plus, Betty Crocker’s marketing strategy sustains its image of warmth and reliability while also adapting to new retail landscapes and changing consumer behaviour.

Overview of Betty Crocker’s Marketing Strategy

Betty Crocker has maintained leadership in the US baking mixes category by pairing heritage-driven trust with modern retail execution. The success of the Betty Crocker business model lies in disciplined product diversification, strategic pricing, and sustained visibility on high-traffic platforms like Walmart.

Key insights:

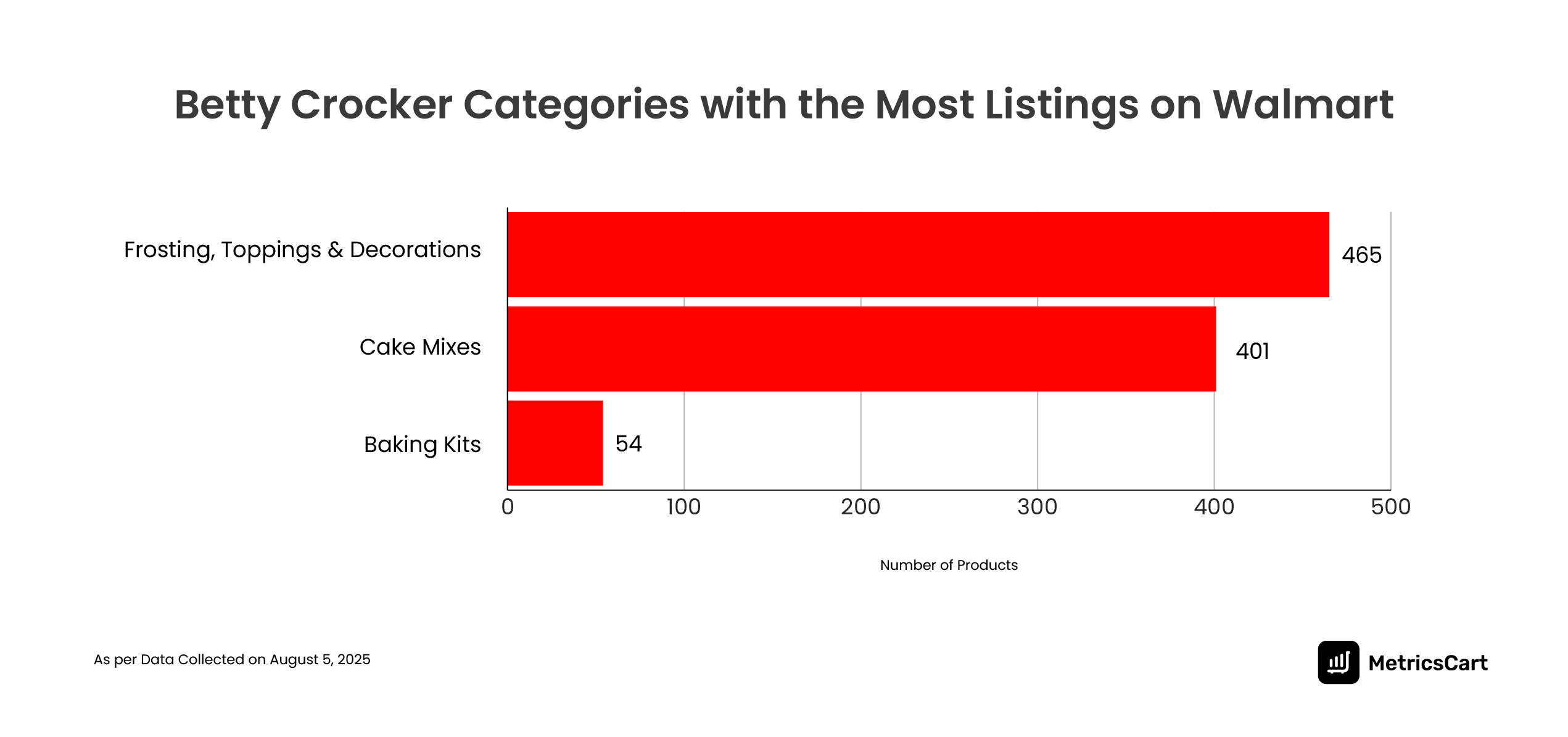

- Extensive product range: As of August 5, 2025, 1,789 Betty Crocker products were listed on Walmart, with the majority in Frosting, Toppings & Decorations (465 items) and Cake Mixes (401 items). These are the core categories that have recurring household demand.

- Pricing segmentation: Products span from $1 single packs to $900 bulk cases, allowing the brand to serve both cost-conscious shoppers and institutional buyers.

- Controlled discounting: Core categories such as Cake Mixes have limited markdowns averaging 5.44%, while seasonal items see discounts of 16–24%, showing strategic price management.

- Consumer engagement: Hero products like the Bisquick Pancake & Baking Mix (2,831 reviews) and Hershey’s Triple Chocolate Fudge Brownie Mix (1,300+ reviews) illustrate consistent consumer satisfaction and strong digital visibility.

- Reliable availability: 95% of listed items remain in stock, underscoring the brand’s robust supply chain and inventory control.

READ MORE | Cracking the Crunch: What Walmart Shoppers Really Think About Kellogg’s

Betty Crocker on Walmart: What the Numbers Show

Walmart offers one of the clearest snapshots of Betty Crocker’s branding strategy. With nearly 1,800 listed products, the brand’s online shelf mirrors its entire marketing strategy, revealing how it achieves dominance without frequent reinvention.

Top Categories

The product lineup of Betty Crocker on Walmart is concentrated heavily in core baking segments. Frosting, Toppings & Decorations lead with 465 items, followed by Cake Mixes (401), which together form more than half of the total listings. These categories reflect the brand’s continued focus on everyday baking staples that drive repeat purchases.

Smaller but high-engagement categories such as Baking Kits (54 items) stand out for their strong consumer response, generating over 20,800 reviews. This indicates a growing preference among online shoppers for convenience-oriented, all-in-one solutions, especially among younger demographics and occasional bakers. The product mix shows that while Betty Crocker remains anchored in traditional baking, it continues to adapt its offerings to emerging consumption patterns, favoring simplicity and speed.

Best-selling Flavors

Flavor variety has always been a hallmark of Betty Crocker’s business strategy. At Walmart, classic flavors dominate. That is, Yellow Cake, French Vanilla, and Butter Recipe Yellow continue to hold steady demand, priced between $8 and $10. These staples align with the brand’s heritage and mass-market positioning.

At the other end of the spectrum are premium or multi-pack flavors, such as Cookie Brownie Mix ($81.02) and Oreo Chocolate ($21.49), catering to bulk buyers and retailers. The presence of both entry-level and premium price points reinforces Betty Crocker’s dual market strategy: delighting everyday consumers while supplying high-volume buyers like bakeries, schools, and restaurants.

Top Sellers

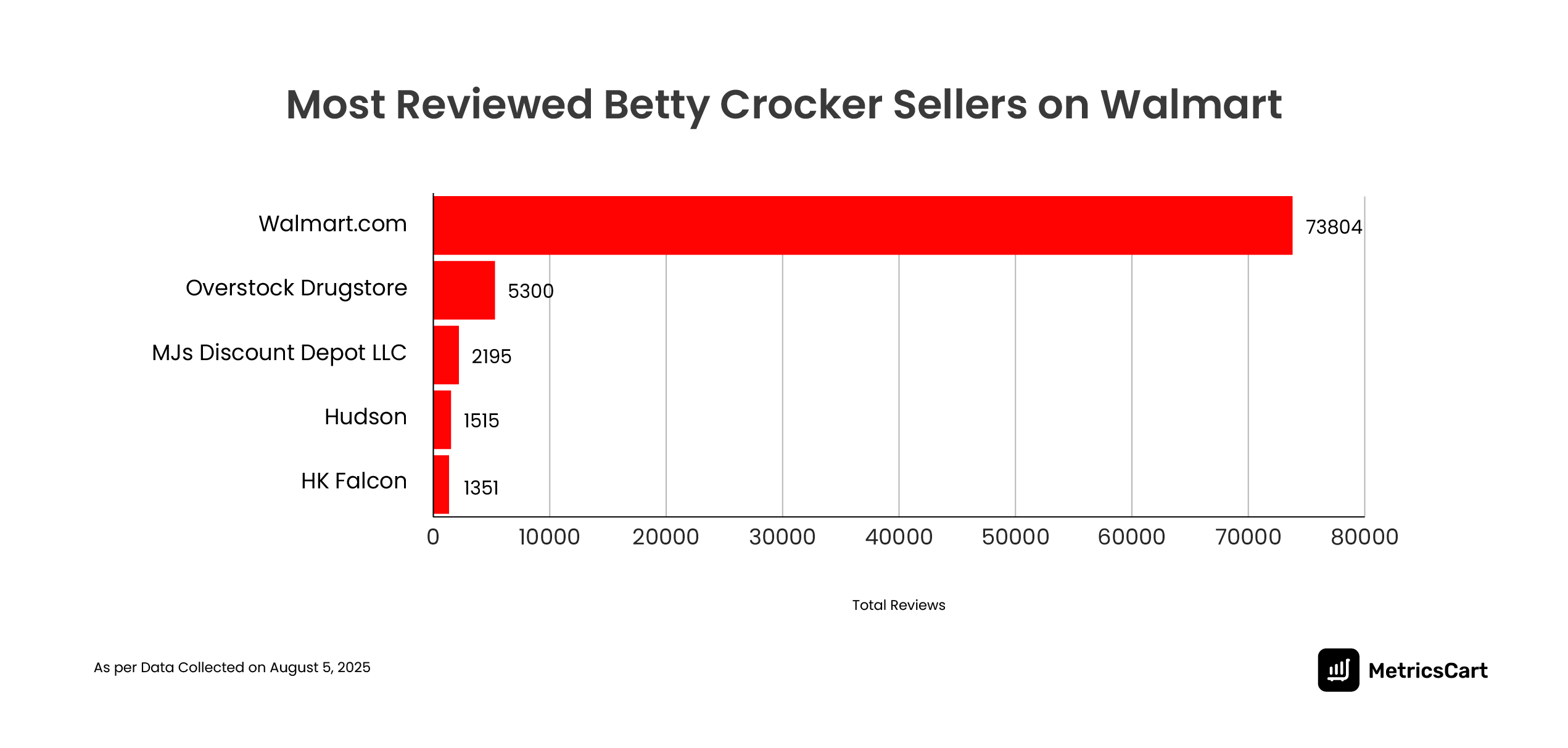

Walmart.com itself dominates sales and visibility, generating over 73,000 reviews for Betty Crocker products. Third-party sellers like Overstock Drugstore, MJ’s Discount Depot, and Hudson contribute smaller volumes but play a significant role in offering discounts and maintaining supply diversity.

Among these, INOV Store LLC stands out with an average discount rate of 33%, signaling an aggressive pricing strategy to attract deal-oriented buyers. This blend of Walmart’s retail muscle and third-party competition ensures broad accessibility, supporting Betty Crocker’s mass-market dominance while catering to value-conscious segments.

The Review and Rating Mix

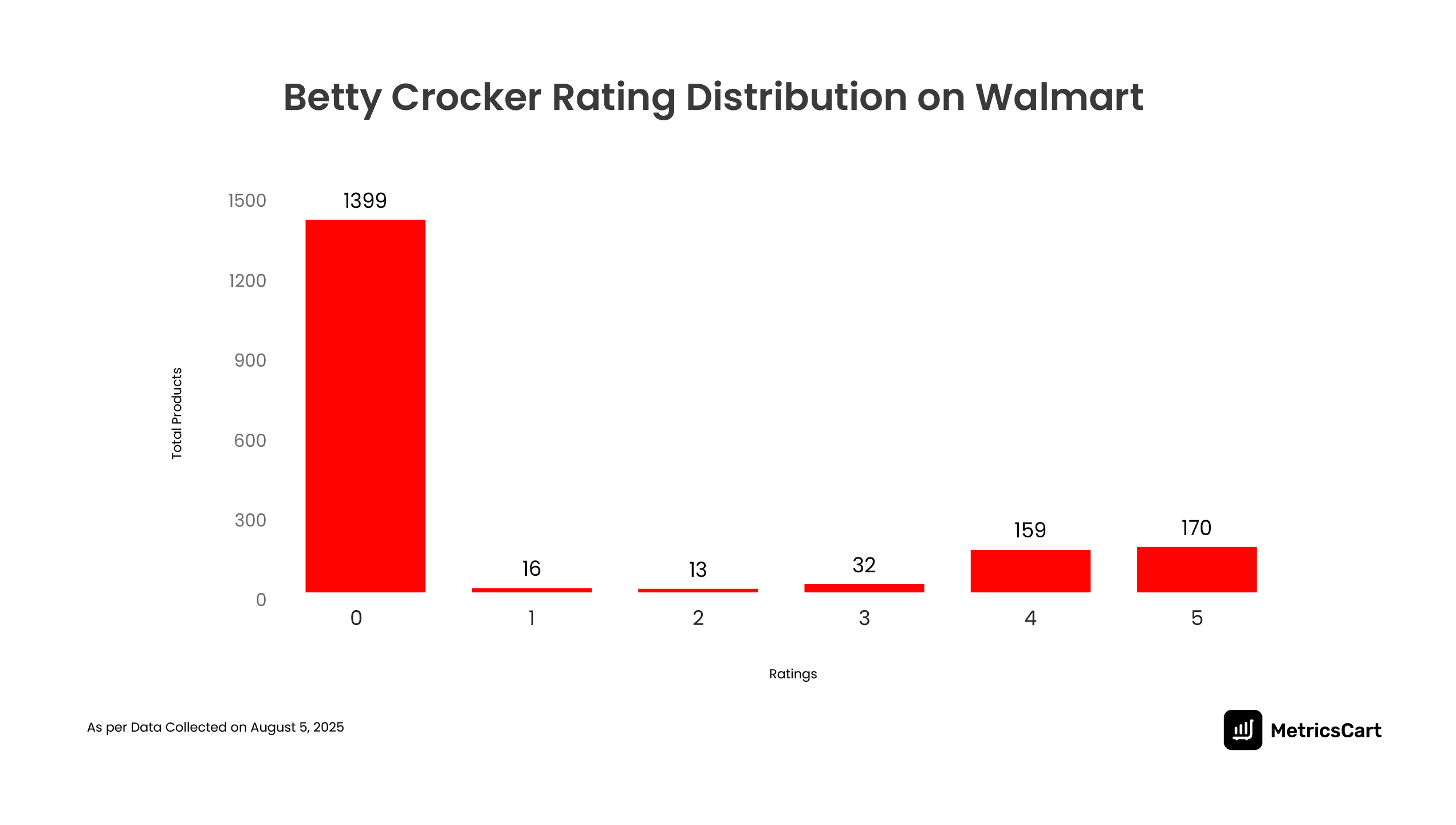

Consumer sentiment toward Betty Crocker products on Walmart is strongly positive. While 1,399 items have no ratings, which is typical for low-engagement categories, the majority of rated listings lean heavily toward positive feedback. 5-star reviews (170) and 4-star reviews (159) significantly outnumber negative ones, reflecting high satisfaction and brand reliability.

The most reviewed product, the (6 pack) Bisquick Pancake & Baking Mix, with 2,831 reviews, underscores how flagship SKUs anchor the brand’s digital presence. Brownie and cookie mixes, including the Hershey’s Triple Chocolate Fudge Brownie Mix and Sugar Cookie Mix, each exceed 1,000 reviews, showing that indulgent, easy-to-prepare items drive engagement and repeat purchase intent.

Overall, Betty Crocker’s review ecosystem functions as both social proof and search optimization, reinforcing trust among consumers and ensuring strong discoverability across Walmart’s digital shelf.

READ MORE | Reese’s vs. Hershey’s on Amazon: Who’s Winning the Chocolate Game?

Pricing and Discounts: Double-Edged Sword

The pricing structure of Betty Crocker on Walmart reveals a strategic balance between affordability and scale.

At the lower end, more than 400 items fall below $10, catering to everyday bakers and impulse buyers. Products like the Ready to Bake Fudge Brownie Mix ($1.08) and Wednesday Theme Whipped Cream Frosting ($1.21) make it easy for consumers to experiment or restock without hesitation. These low-cost items not only sustain sales volume but also ensure regular brand visibility in Walmart’s search results and promotional placements.

At the other extreme, bulk and wholesale packs dominate the $30+ range, with 521 listings, including institutional-size gluten-free mixes priced near $950 for 96-pack bundles. This reflects Betty Crocker’s ability to serve both B2C and B2B markets under the same retail umbrella, which is rare, especially in the baking segment.

Discounting, however, exposes an interesting tension. Among the most heavily discounted Betty Crocker products on Walmart are several themed and indulgent items. Leading the list is the Wednesday Theme Whipped Cream White Frosting (12 oz), discounted by 87.9%, followed by the Delights Super Moist Carrot Cake Mix (Pack of 2, 13.25 oz) at 83.02%.

The Delights Supreme Chocolate Chunk Brownie Mix (Pack of 2, 18 oz) and Delights Super Moist Party Rainbow Chip Cake Mix (Pack of 2, 13.25 oz) are also marked down significantly, at 77.58% and 76.14% respectively. Rounding out the top five is the Cinnamon Toast Crunch Frosting (16 oz), featuring a 73.57% discount.

While everyday items often see deep markdowns, up to 87%, core categories like Cake Mixes show minimal average discounts of around 5%. Seasonal and themed items, such as Fall Baking and Holiday Cookie Mixes, carry the steepest promotions, with discounts averaging 16–24%. This approach helps clear inventory on time without diluting the perceived value of evergreen products.

The strategy works as both a marketing lever and an inventory control mechanism, ensuring that seasonal spikes in production don’t result in long-term stagnation. Yet, the heavy reliance on markdowns for niche or themed items also hints at overproduction risks in seasonal product lines.

Balancing Bulk and Everyday Bakes

As of August 2025, 1,691 of 1,789 products were in stock, an impressive 95% availability rate. However, the contrast between pricing and stock status reveals an important insight:

- In-stock products average $51.21 (mostly bulk or multi-pack items).

- Out-of-stock products average $3.89, indicating that low-priced items sell out faster.

This suggests a simple but powerful truth: Betty Crocker’s mass appeal thrives at the low end of the price spectrum. Affordable items not only move faster but also likely serve as entry points for newer customers.

By maintaining a steady supply of high-value packs while allowing smaller, fast-selling items to fluctuate in availability, Betty Crocker ensures consistent visibility across price ranges. This mirrors a broader e-commerce principle, anchor pricing, where premium products make affordable ones look even more attractive.

READ MORE | From Pancakes to Profits: Krusteaz Growth Strategy on Walmart

Changing Without Changing: The Betty Crocker Business Model

Betty Crocker is a brand that has perfected the art of controlled evolution. Its marketing strategy hinges on a simple idea: modernize without losing familiarity. The brand continues to sell the same comforting mixes it did decades ago, while embracing contemporary relevance through gluten-free options, co-branded products like Hershey’s brownies, and themed editions that tap into pop culture.

As MetricsCart’s analysis reveals, this combination of disciplined product diversification, strategic pricing, and strong digital visibility enables Betty Crocker to maintain its dominance. By leveraging data-driven insights alongside heritage branding, Betty Crocker shows how legacy brands can thrive in a hyper-digital marketplace while keeping their core identity intact.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Make Your Brand The Category Leader on Walmart Digital Shelf. Get MetricsCart Now.