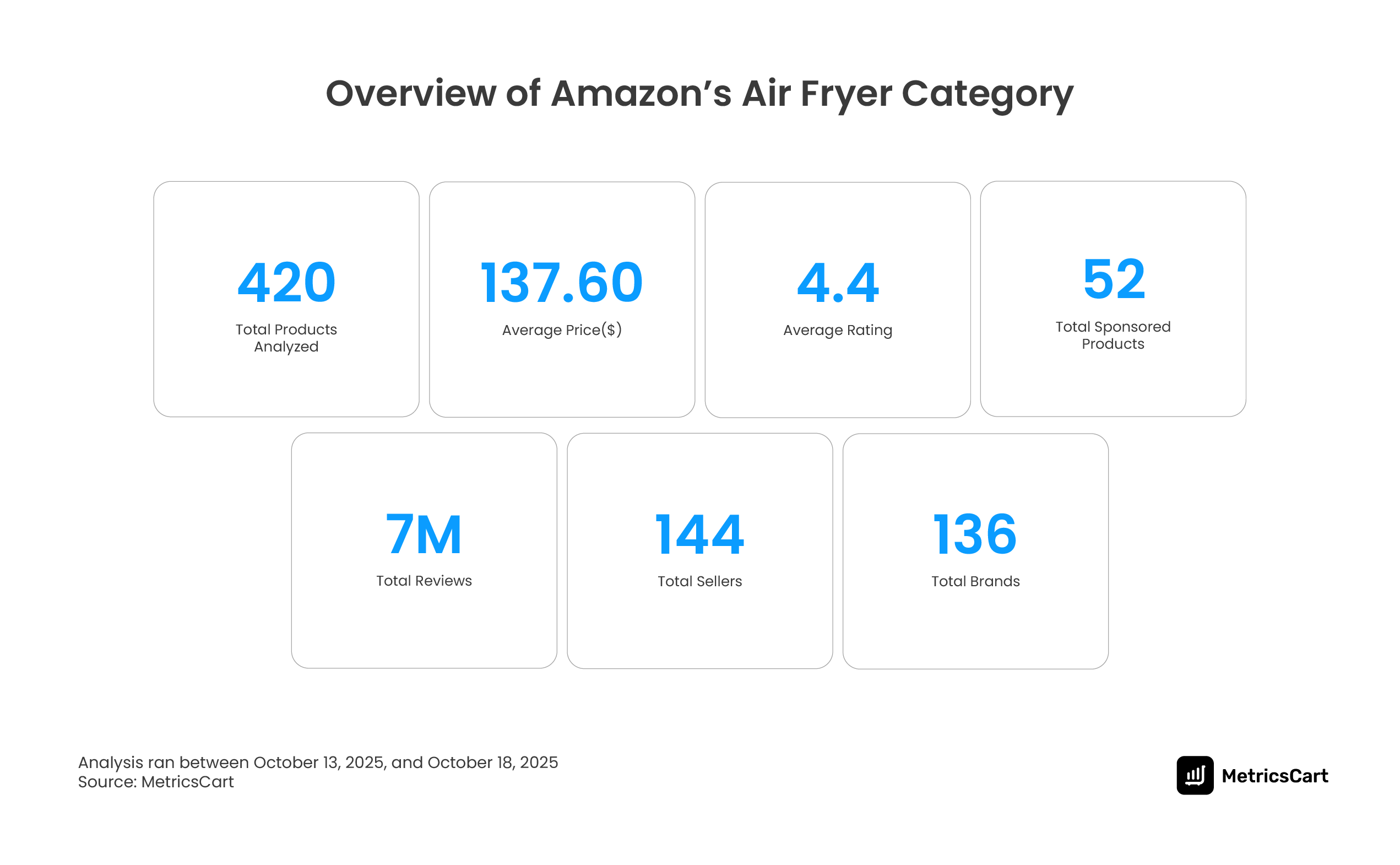

About the report: In this MetricsCart Digital Shelf Insights report, we analyze Amazon’s Air Fryer category between October 13–18, 2025, covering 420 products, 136 brands, 114 sellers, and over 7 million total reviews. This Air Fryer on Amazon report highlights the pricing behavior, brand performance, review dynamics, and seller trends shaping the category.

Introduction

An air fryer is a compact countertop appliance that circulates hot air to cook food with far less oil than traditional frying. One of the popular air fryer brands, Glen, claims it can deliver the crisp texture people want without deep-frying, using up to 80% less oil. Air fryers also boast the ability to replace multiple cooking methods, such as baking, reheating, grilling, and dehydrating, making them a practical choice for busy households.

And for all these reasons, air fryers are becoming increasingly popular in modern kitchens, so much so that the Grand View Research team cites that its market will reach $2.07 billion by 2030.

Highlights of the Air Fryer on Amazon Report

- Nuwave and Ninja are the most popular air fryer brands on Amazon.

- Ninja and Chefman have the top-reviewed air fryers in the category.

- BELLA and Elite offer the most affordable models, priced at $30–$38.

- Cuisinart and Typhur lead the premium range, priced between $191 and $370.

- DEIME, Nuwave, and Typhur invest the most in sponsored placements.

- Amazon Basics stands out as the lowest-priced sponsored brand.

- Amazon.com is the top seller, followed by Amazon Resale.

- The average air fryer price during the period was $137.60.

- Prices dropped to $130 on Oct 14 and peaked at $143 on Oct 16.

- Review activity was highest on Oct 15 and lowest on Oct 13.

Ninja Leads in Both Product Volume and Customer Reviews

The MetricsCart’s air fryer on Amazon report reveals that the brand Ninja performs strongest on two critical metrics. It has one of the largest product catalogs in the category and also holds the highest review volumes among top-rated air fryers.

Ninja lists 23 air fryer products on Amazon during the period between October 13 and October 18, 2025. Only one brand, Nuwave, lists more with 25 products. MetricsCart research team confirms that Ninja consistently appears across multiple price points, capacities, and feature sets, which gives the brand wide visibility across search results.

Ninja also leads the customer review landscape. The Amazon air fryer customer reviews analysis reveals the Ninja 4-in-1 Pro Air Fryer is the most-reviewed air fryer on Amazon, with 386,000 reviews and a 4.7 rating. Two more Ninja models appear in the top review chart.

- Ninja Indoor Grill (Foodi) with 179,000 reviews and a 4.7 rating.

- Ninja AF161 Max XL with 172,000 reviews and a 4.7 rating.

These results show that Ninja performs well across its entire lineup. It is not dependent on one hero SKU. Multiple Ninja models rank among the most trusted products in the category. This combination of 23 active listings and high-volume reviews across several models gives Ninja an unmatched position in Amazon’s air fryer category. It also explains why Ninja consistently appears among the top-selling air fryer brands on Amazon in 2025.

READ MORE | Amazon Reviews: Importance and Why Brands Should Consider Review Monitoring

Pricing Overview: A Wide Spectrum From $30 to Premium Models Near $370

Pricing trends in the air fryer category show how broad and flexible Amazon’s market has become. The air fryer on Amazon report reveals a clear range of products costing from highly affordable entry models at $30 to $38 to premium appliances priced between $191 and $370. This spread allows the category to serve first-time users, budget-conscious shoppers, and home chefs looking for multi-function premium devices.

Across all 420 products analyzed between October 13 and 18, the average price stood at $137.60. This average places the majority of the category in the mid-range, which remains the most competitive tier on Amazon. Mid-range models typically include 4 to 6-quart capacity, digital displays, multiple presets, and reliable build quality, making them the default choice for most households.

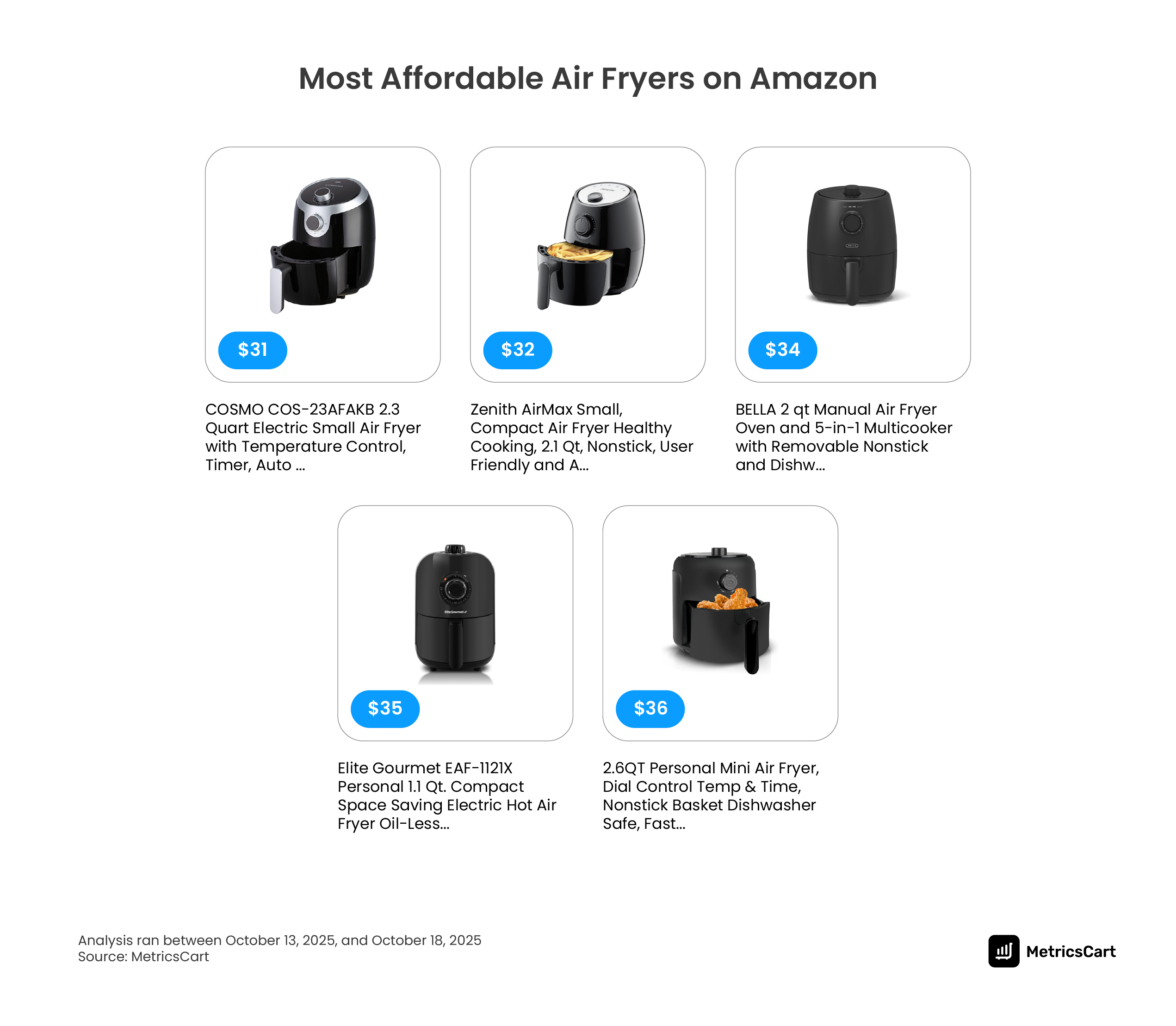

The Most Affordable Air Fryers on Amazon

The lower end of the pricing spectrum is anchored by BELLA and Elite, ranging between $30 and $38, making them the strongest conversion drivers among budget shoppers. These models also maintain strong average ratings. This tells us that in the budget segment, customers value reliability and ease of use more than advanced features.

MetricsCart research shows that these brands appear frequently in Amazon’s high-visibility retail modules such as “Amazon’s Choice” and “Frequently Bought Together,” indicating regular organic demand.

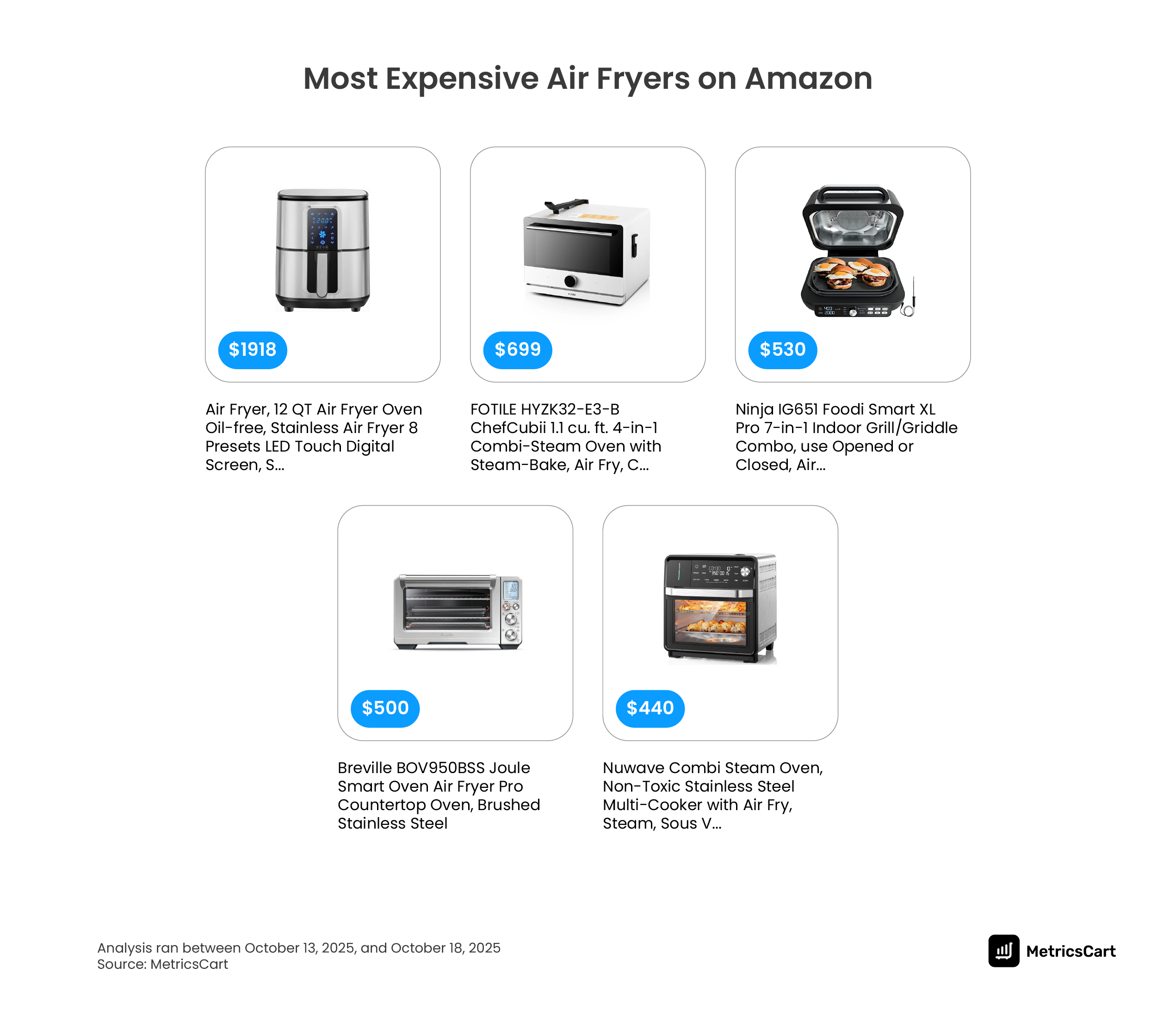

The Most Expensive Air Fryers on Amazon

At the top of the pricing chart, the Metricscart research team identifies Cuisinart and Typhur as the leading premium brands. Their air fryers range from $191 to $370, reflecting advanced design and multi-function capability. Premium models focus on:

- High-capacity dual baskets

- Stainless-steel finishes

- Multi-cooker configurations

- Digital controls and smart presets

- Stronger heating systems and faster cook cycles

These high price points also align with the broader trend seen in the report. Customers looking for premium appliances tend to prefer large-capacity models that replace multiple devices, such as convection ovens, dehydrators, grills, and toasters.

Looking further into the Amazon air fryer sales trends, even at higher prices, these models maintain consistent conversion because shoppers perceive them as long-term, multi-purpose investments.

Midweek Pricing Behavior and Market Sensitivity

The MetricsCart research also highlights how pricing fluctuates throughout the week. Prices dropped to $130 on October 14, which was the lowest point in the observed period. Prices peaked at $143 on October 16, reflecting a $13 difference within just a few days. These shifts indicate:

- Dynamic pricing based on competitor changes

- Possible midweek promotions

- Algorithmic adjustments tied to search demand

- Retailers testing Buy Box strategies

Such price sensitivity shows that brands must carefully time promotions and sponsored activity to align with periods of higher engagement.

READ MORE | Types of Promotional Pricing Explained with Examples

Amazon Search Placement: Visibility Crowding Intensifies

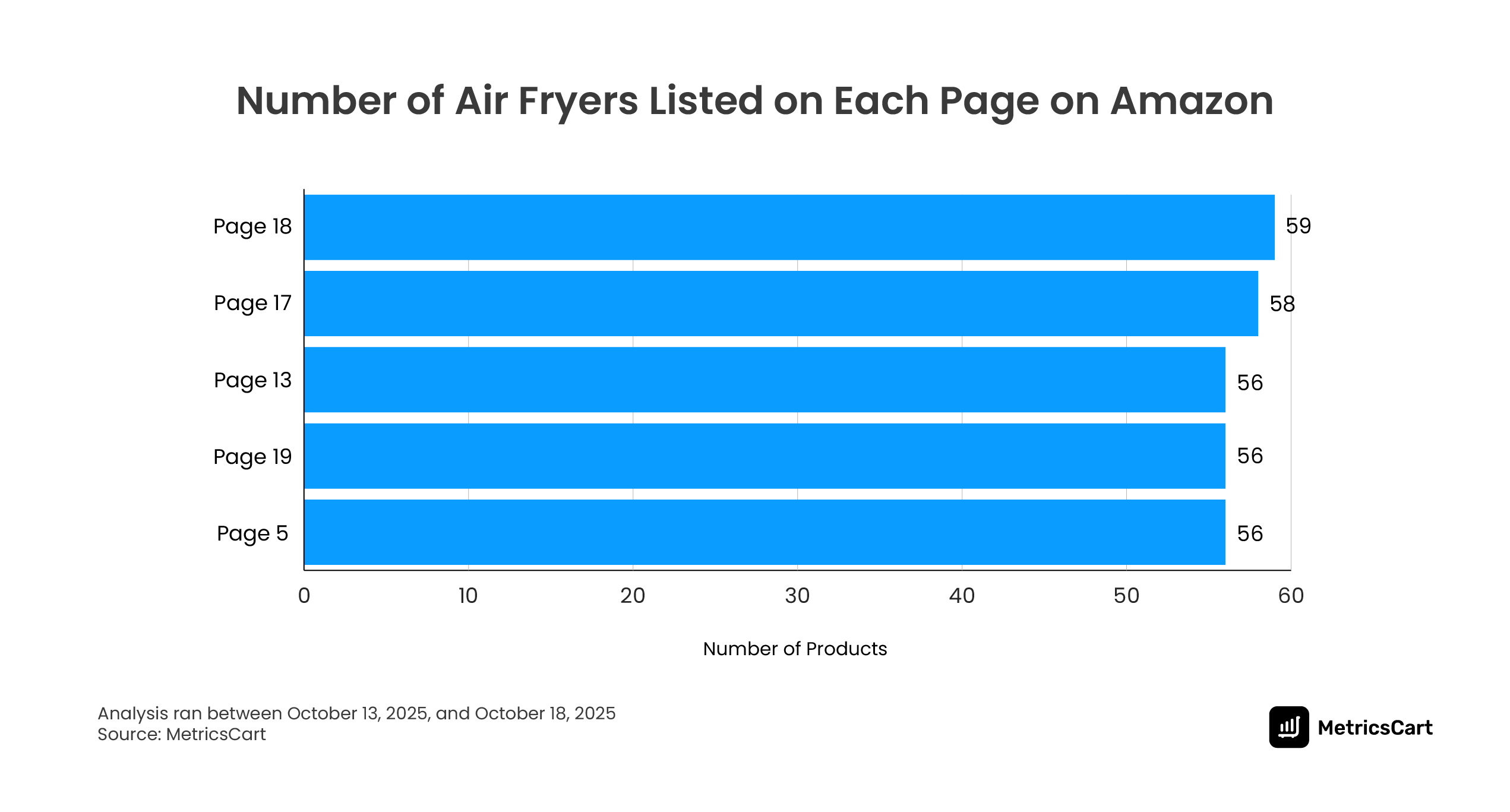

The Air Fryer on Amazon report by MetricsCart shows how crowded the category has become, and the search results reflect this directly. With 420 air fryers competing for visibility during October 13 to 18, 2025, the search pages are packed with listings that fight for top placement.

The first three pages each display 34 to 36 products, which means high-intent shoppers already face a heavy decision load before scrolling further. By contrast, pages 17 and 18 show 58 to 59 products each, which confirms that many listings are pushed deep into the search results where customer engagement drops sharply

This distribution creates a visibility choke point for brands. Only products that maintain a strong mix of reviews, optimised pricing, competitive features, and sponsored activity can maintain placement within the top three pages.

For brands without this mix, breaking into the upper pages becomes increasingly difficult because customer behaviour on Amazon is heavily top-loaded. Most shoppers do not move beyond the first few pages, and the likelihood of discovery declines rapidly after page three.

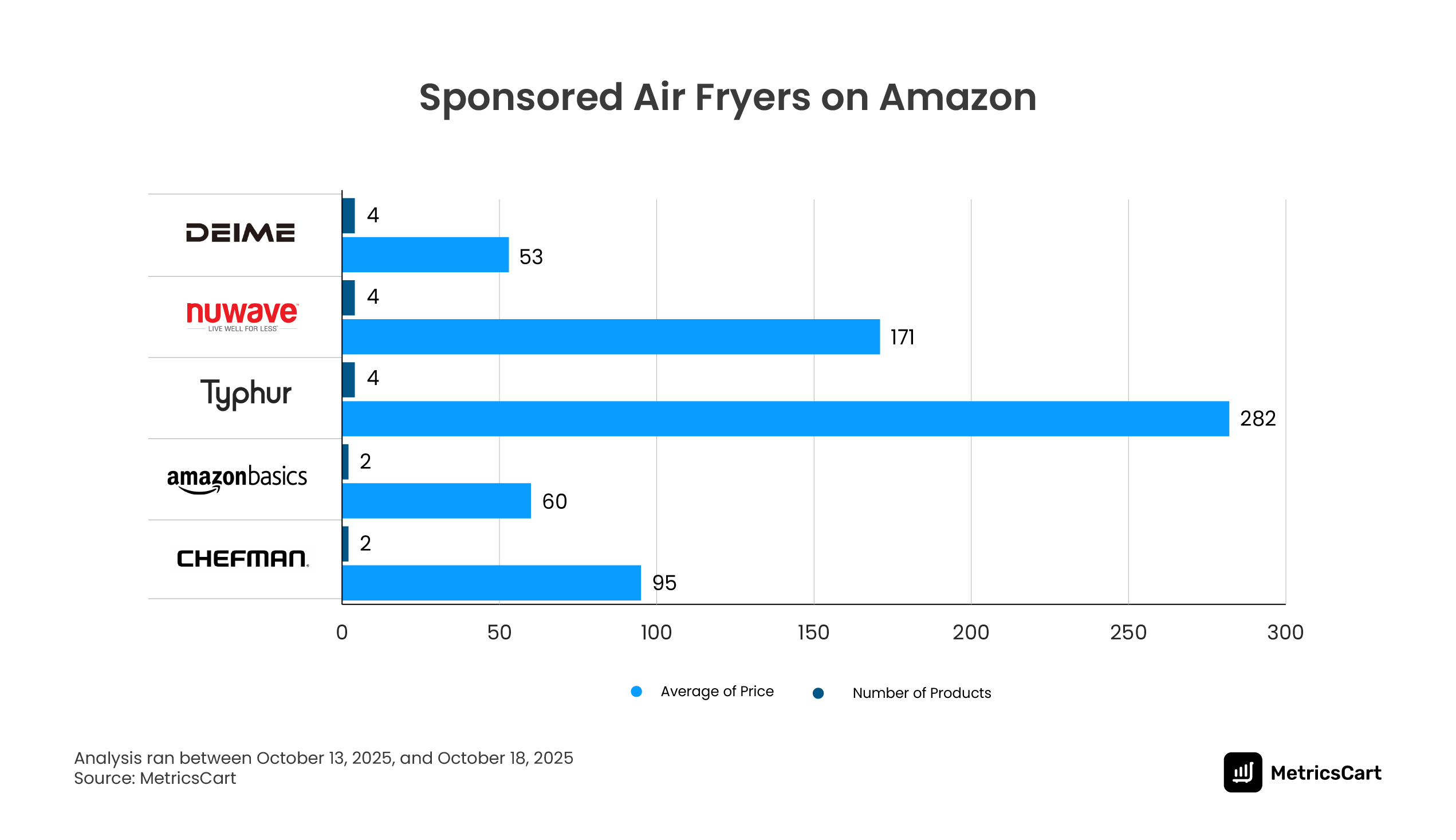

Sponsored Activity: DEIME, Nuwave, and Typhur Invest the Most

The report shows a clear pattern in ad spend and sponsored visibility. DEIME, Nuwave, and Typhur appear most frequently in sponsored placements. The competition for premium visibility is intense, and these brands are paying to stay in front of high-intent customers.

Three insights stand out:

- Typhur is buying its way into the premium conversation.

With fewer SKUs but high-price models, Typhur relies heavily on advertising to push discoverability. - Nuwave protects its category share with ads.

With 25 SKUs, Nuwave uses sponsored placements to ensure prominent visibility across search patterns. - DEIME competes through affordability.

With average pricing near $62, DEIME uses ads to capture value-focused customers who filter by price or rely on Amazon’s “Top Rated Under…” widgets.

Seller Landscape: Amazon.com and Amazon Resale Lead Distribution

Amazon’s influence extends beyond being a marketplace; it is also the leading seller of air fryers in this category. The report shows:

- Amazon.com is the top seller, holding a significant portion of the listings

- Amazon Resale, which includes renewed or refurbished items, is the second-largest seller

This dual presence helps Amazon maintain tight control over product availability, pricing consistency, and customer satisfaction.

Other sellers, such as Meco Innovations and DEIME Inc., play niche roles:

- Meco Innovations lists premium models at around $210

- DEIME Inc focuses on budget-friendly air fryers at around $62

The mixture of Amazon-owned and third-party sellers ensures a healthy mix of price tiers, product options, and competitive pressure, which ultimately benefits consumers.

Conclusion

The air fryer market on Amazon thrives on its ability to cater to diverse consumer needs, ranging from budget-friendly compact models to high-end, feature-packed appliances.

Brands like Nuwave, Chefman, and Ninja lead the way by addressing affordability, versatility, and quality. As the market continues to grow, innovation in design and technology will remain key to capturing consumer attention and loyalty.

MetricsCart can create similar customized, in-depth reports tailored to specific requirements, providing insights into Amazon’s best-seller rankings, customer feedback, and pricing trends.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Track Your Amazon Success with MetricsCart.