The 2024 Baby and Child Care Products market report put together by Skyquest indicates emerging economies witnessing a cumulative annual growth rate of 4%. Yet, when it comes to sales in the premium baby product segment, the US leads.

It is increasing awareness among parents regarding baby’s health and hygiene that is fuelling innovation and high demand for baby products.

Steadily, the number of consumers shopping on e-commerce channels such as Amazon are going up. Several customers prefer the convenient subscription-based model to buy diapers. The wide selection and the availability of products at a better price are some of the reasons behind this shift.

About the Report

MetricsCart’s Digital Shelf Insights report is a monthly category analysis conducted on any one of the top e-commerce platforms.

In July, our experts analysed Amazon baby bestsellers in the US. The best selling sub-categories include toiletries, baby safety and convenience related items.

Methodology

The e-commerce category statistics is prepared by our team of data experts. The top 100 bestseller products listed within the Amazon baby products category in July 2024 are considered in this report.

Key Findings

- The baby diaper market is experiencing an increase in online sales

- There is a significant increase in the demand for organic and natural products

- 54 different brands are sold by 23 different sellers on Amazon

- 4.67 is the average customer rating the bestsellers received for baby products

- On Amazon, Pampers Swaddlers size 4 has three feathers on its cap. It is the product with the most number of customer reviews, the best selling brand sold in the diaper category and the top-selling product in the baby category

Baby Toiletry: The Sub-Category with Most Number of Best Sellers on Amazon

Huggies from the house of Kimberly-Clark Corporation and P&G’s Pampers hold a major share in the online retail sales of baby diapers. 7 out of 10 bestseller baby products on Amazon in July 2024 are from these two market leaders.

Pampers Swaddlers diapers take the No.1 position on top-ranked products on Amazon. Second, third, and fourth on the list are non-scented or water-based wipes from Huggies, Pampers and WaterWipes. For products catering especially to babies, consumers today prefer organic, bio-degradable, or plant-based ingredients with sustainable packaging.

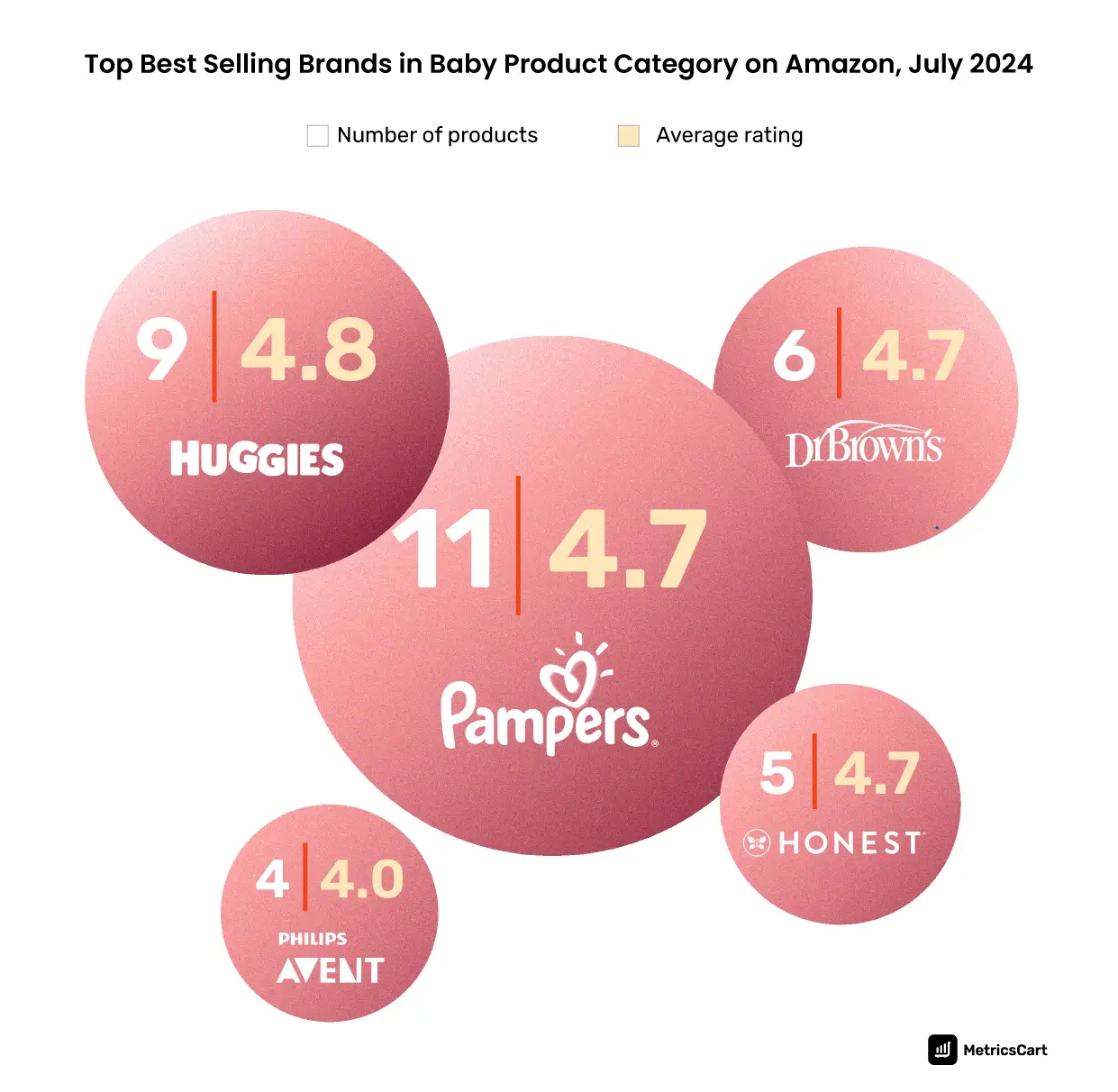

Pampers: No.1 Bestseller Brand in the Baby Category on Amazon

Pampers is the top-selling brand in the Amazon baby category and Huggies is second on the list. 11 variants from Pampers and 9 from Huggies feature among the baby category bestsellers on Amazon. In the third position is Dr. Brown’s. Six of its products are bestsellers and have earned an average rating of 4.7.

Ratings play a crucial role in consumer purchase decisions. Positive ratings serve as social proof for potential customers to trust a product. The average rating of 4.67 that bestsellers received indicate that customers are highly satisfied with their shopping experience of baby products on Amazon. Aquaphor with just 2 bestsellers has received the highest rating score of 4.9.

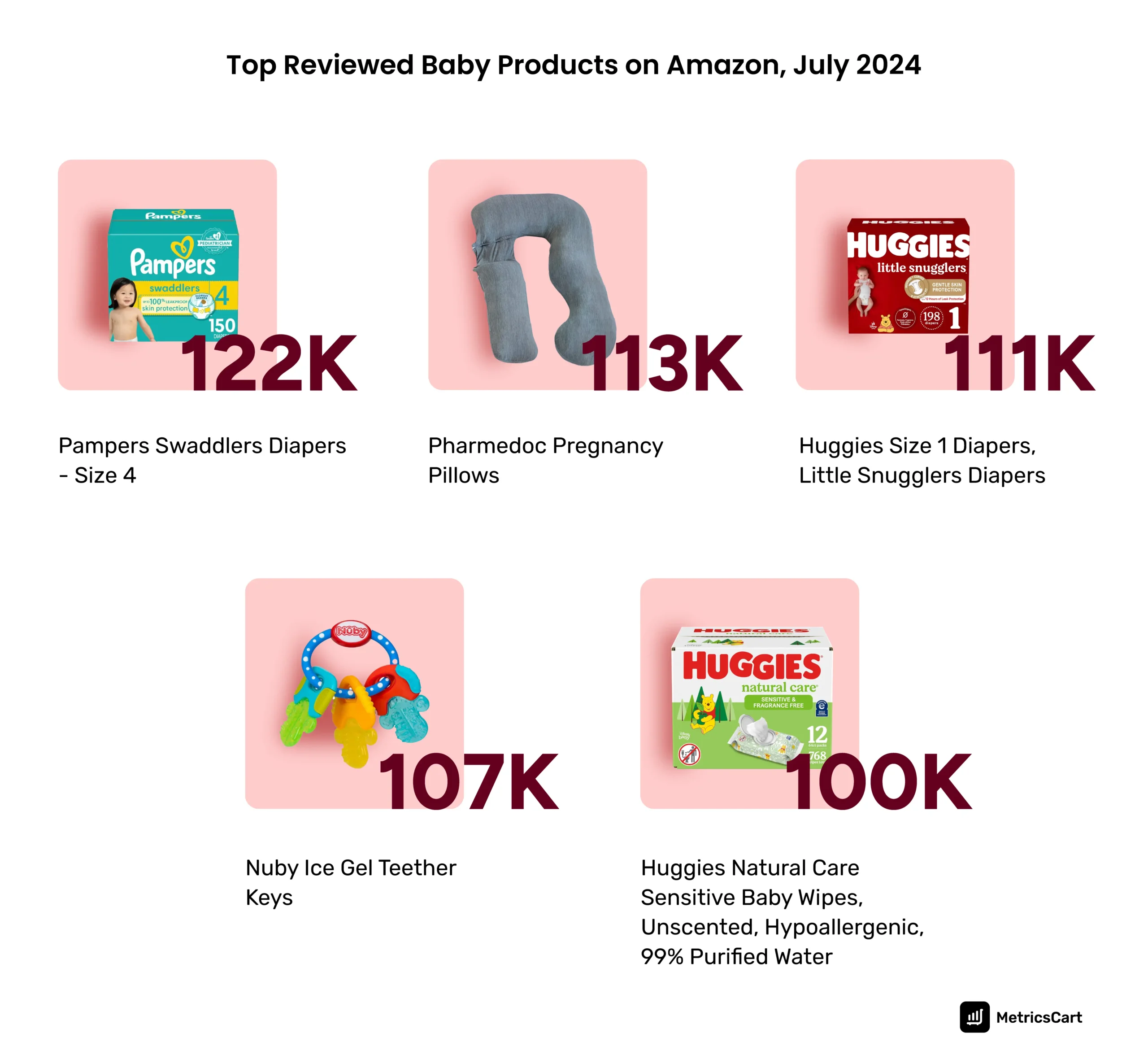

Pampers Swaddlers Leads in Reviews Among Amazon Baby Products

Pampers Swaddlers size 4 is the brand to receive 122K reviews to top the list. Here are some of the features why customers love Pampers Swaddlers as mentioned in Amazon reviews:

- Soft liner and the snug fit

- Wetness indicator

- Excellent absorbency

- Wicks moisture away from baby’s sensitive skin

- Breakproof lowout barrier

Though most reviews are positive, a few cons mentioned in the reviews are:

- Sensitive kids develop diaper rash

- The soft tape is prone to ripping away

With 113K reviews, Pharmedoc pregnancy pillows is second on the list. 67% of them are positive but the rest of them are of mixed opinion. If such brands decide to go for an enhanced customer feedback analysis solution provided by MetricsCart, it can improve their brand reputation management.

Top Bestseller Baby Products on Amazon

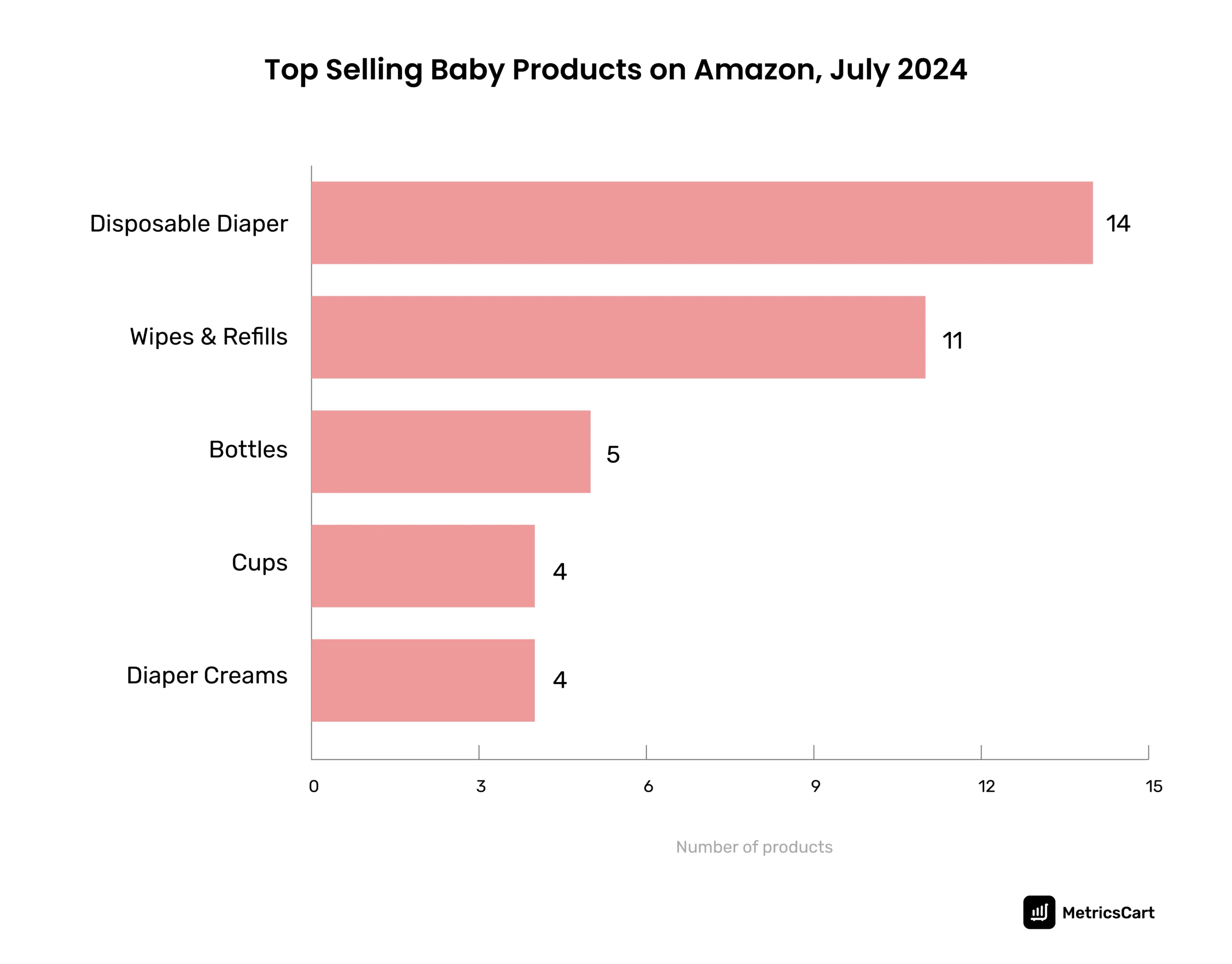

With 14 products, disposable diapers is the top selling product in the baby category. Households with babies may spend over $100 on diapers as this item is considered an essential item on the monthly purchase list even in times of inflation.

According to a Statista market report, the revenue in the US baby diapers market is expected to close at US$7.97 billion in 2024. In the next five years, the market is expected to grow annually at a rate of 2.42%.

Wipes takes the second position with 11 items and in the third position are bottles selling 5 items.

An Insight into Huggies vs. Pampers Diapers

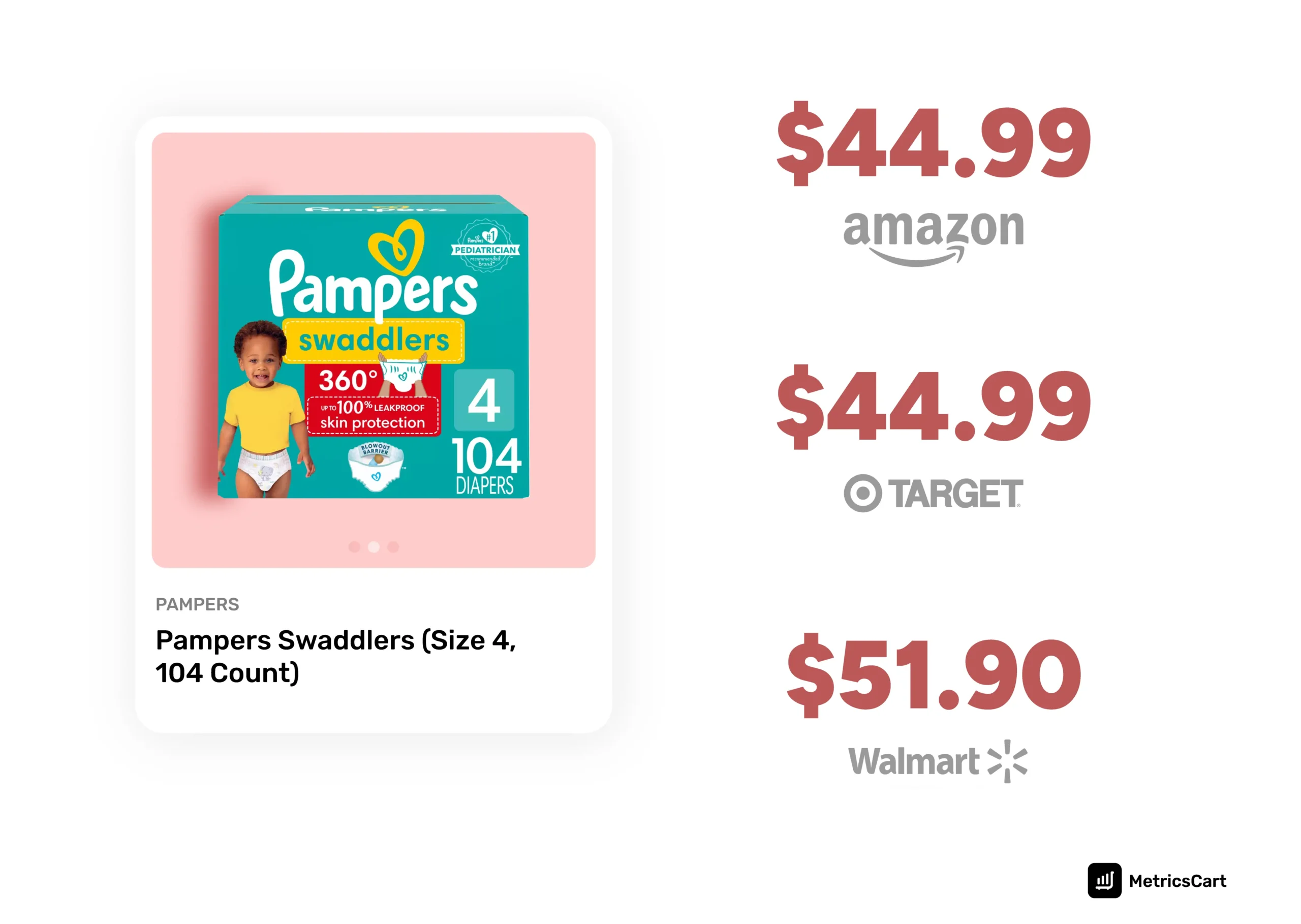

The two most popular disposable diaper brands Huggies and Pampers are similar in features. However, when comparing the price per unit, Pampers is at least a few cents cheaper on Amazon and Target than on Walmart, whereas the price of Huggies is more or less consistent across channels.

No wonder Pampers Swaddlers size 4 is the best overall pick on Amazon. The key competitor in this product line for Pampers is Huggies ‘little movers’ size 4.

Overall, both Huggies and Pampers are good diaper brands. The positive reviews of both brands rank them for high absorption, wetness indicators, long hours of leak protection, flexibility, and sturdy fastening straps. Yet, Huggies Little Movers diaper is positioned at a slightly higher price. In July, Amazon Huggies movers were available at $ 0.43/unit in comparison to the $0.37/unit for Pampers swaddlers.

As most customers tend to compare prices, it was revealed through reviews that many customers find Amazon as the preferred e-commerce platform to buy diapers as that’s where most competitive prices are found.

Product Line Length of Huggies and Pampers Diaper

The product line of both Huggies and Pampers includes baby wipes and six diaper brands. In addition, Pampers sells disposable bibs by the name Bibsters.

| Product Line Length | Huggies | Pampers |

| Newborn infants | Little Snugglers | Swaddlers, Baby Dry |

| Older infants/Toddlers | Little Movers | Cruisers, Baby Dry |

| LeakLock diapers | Snug & Dry | None |

| Overnight diapers | Overnites | None |

| Toilet training | Pull Ups | Easy Up |

| Bedwetting | Goodnites | Underjams |

Pampers probably takes the voice of the customer seriously. In June 2023, Pampers released Pampers Swaddlers size 8 for newborns weighing 46 pounds and as a result, the product received many positive reviews for the same.

READ MORE | Want to Know Why Brands Create Variants Within a Product? Ready through Product Mix Pricing Strategies Explained with Examples

US Parents Spending High on Baby Products

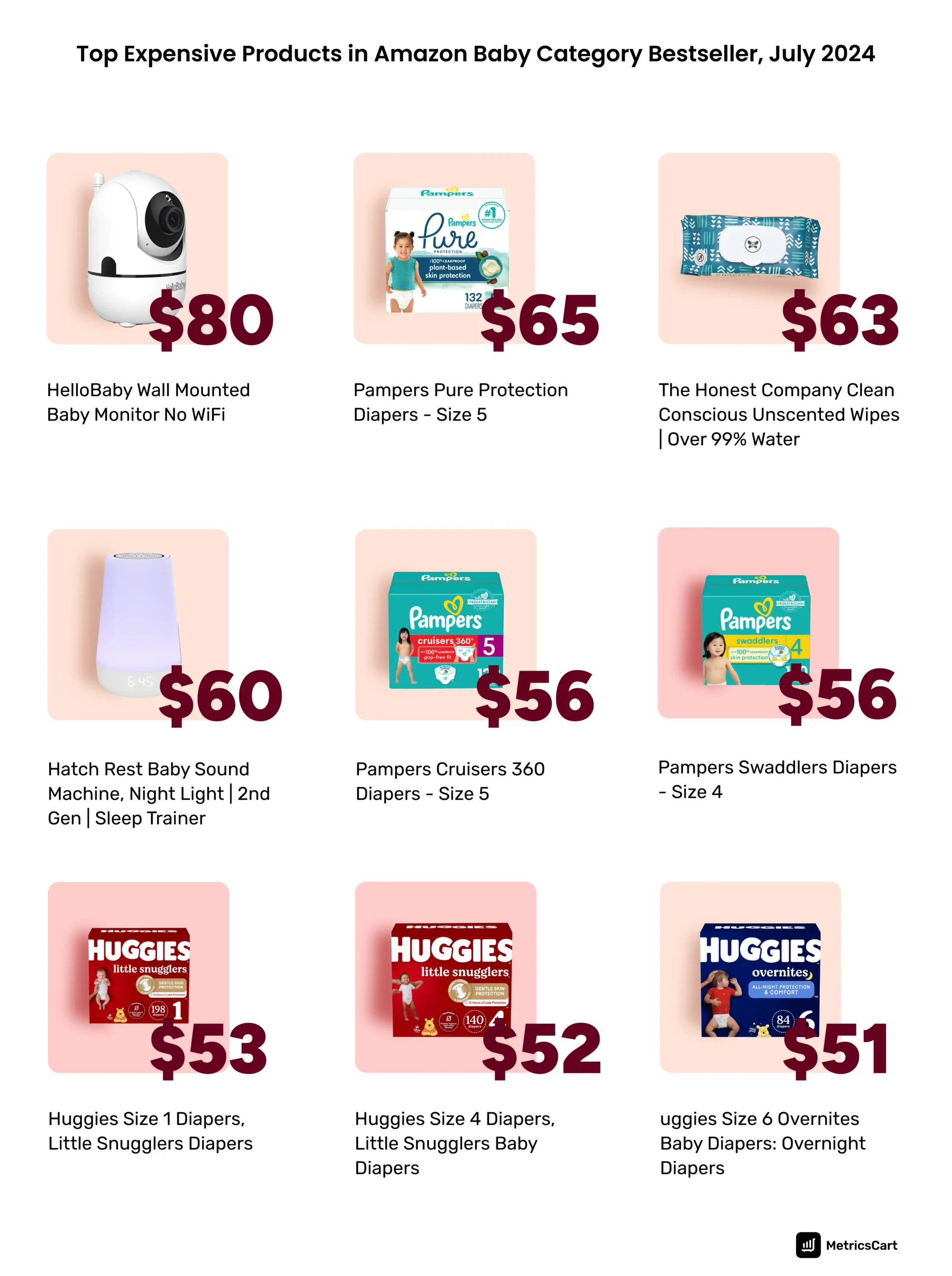

Though the sales of baby products is growing in the Asia Pacific at a CAGR of 6.7% owing to rise in birth rates, it is consumers in the US and Canada who are willing to pay a higher price for high-quality, utility-driven, premium comfort baby products.

At $80, HelloBaby video baby monitor is the most expensive bestseller in the baby product category on Amazon in July 2024. Pampers pure protection diaper enhanced with shea butter liner, hypoallergenic, and fragrance free, is second on the list, followed by unscented, pure water wipes from the Honest company.

Overview of Baby Product Category

New entrants in the baby care products market face high entry barriers due to:

- Stringent laws that regulate the manufacturing and marketing of baby care products

- Significant investments in research & development and development

- Strict rules and procedures during clinical trials

Probably, this is the reason not many private label brands of Amazon were spotted among the bestsellers in the baby category. Instead, Amazon is the top seller of most best selling products on Amazon. Of the 100 bestsellers, 73 products are sold by Amazon.

To address concerns about chemical exposure, various innovations were seen in the baby category products in the recent past. BPA-free plastics and use of organic fabrics are the two steps in this direction.

There is a surge in demand for organic products with natural ingredients due to evolving consumer preferences. Numerous baby product manufacturers are making significant investments in developing novel products with natural materials and focusing on providing these products at competitive prices.

Make Smart Strategic Decisions with MetricsCart’s E-Commerce Category Report

By the end of 2024, the revenue generation of the baby product category in the US is estimated to be US$0.48 billion as per Statista report. The organic baby products serve as a lucrative opportunity for brands thinking of expanding their business.

The Pampers Swaddlers example mentioned above, is a snippet of review monitoring summary and data integration from marketplaces.

To receive actionable insights on customizable dashboards with in-depth theme and sub-theme analysis, brands can choose enhanced customer feedback analysis solutions that MetricsCart provides.

For similar e-commerce market intelligence insights on best-selling products on Amazon, kindly write to us and let us know your availability to discuss your requirements.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.