Comfort feels safe. It’s familiar.

You know the dashboard. You know the reports. You’ve used the same MAP monitoring software for years, and the relationship feels stable.

So when someone asks, “How’s your MAP partner?” the answer sounds like: “We’ve been with them a long time… It’s mostly fine.”

But “mostly fine” rarely comes from working with the best MAP monitoring provider. It often comes from routine, not performance.

It is not enough to protect pricing integrity, retailer trust, and margin. Moreover, the online retail environment has changed faster than many legacy MAP providers have. Violators have become smarter. Marketplaces have become harder to track. And price manipulation happens at speeds older systems can’t match.

If your “best” MAP monitoring provider has not kept pace, your brand is exposed even if the relationship feels familiar and comfortable.

MAP Monitoring Moved Forward, Did Your Provider Keep Up?

A few years ago, MAP violation detection was simpler. Amazon and Walmart had weaker anti-bot defenses, fewer unauthorized sellers, and static crawls were enough to catch most issues.

That world is gone.

E-Commerce is Bigger, Faster, and More Price-Sensitive

Retail ecommerce sales worldwide are expected to grow from $6.42 trillion in 2025 to $7.89 trillion by 2028, and steadily shifting consumer spend online. At the same time, shoppers have become more price-sensitive and compare prices across multiple platforms before purchasing.

If your advertised prices spiral downward on even one major marketplace, that pricing is quickly discovered, compared, and used as the benchmark everywhere else. This is exactly why MAP policies exist: they help protect brand value, prevent race-to-the-bottom price wars, and keep retailer relationships healthy.

But a policy is only as strong as the MAP monitoring and enforcement behind it.

Violators Have New Tools Too

Today, brands face:

- Dynamic repricing and AI-driven pricing engines that can adjust multiple times a day.

- Aggressive seller aliasing, where the same seller operates under multiple IDs across marketplaces.

- Marketplace blocking and rate limiting that break basic scraping setups.

- Grey-market sellers who mirror legitimate listings to avoid detection.

Unauthorized third-party sellers can significantly harm brand equity, damage MAP programs, and disrupt relationships with authorized retailers.

If your provider still leans on the same scraping patterns they used in 2017, they are fighting a modern arms race with outdated tools.

Channel Conflict Is Now a Real Business Risk

MAP violations are not just a legal or “brand control” topic. They directly impact commercial relationships. MAP violations lead to channel conflict, where compliant retailers feel undercut and start questioning the value of stocking your products.

If your provider cannot see violators quickly and help you act on them, you are not just losing margin. You are weakening long-term retailer trust.

The Cost of Sticking With Legacy MAP Monitoring Software

If you see minimum advertised price monitoring only as a compliance checkbox, you are likely leaving money and control on the table.

Timeliness: When Detection Lags Behind the Market

When crawls are infrequent and UIs are clunky, it can take days or weeks to move from MAP violation detection to enforcement.

During that delay:

- Repricers copy the lowest advertised price.

- Comparison sites index the new lower price.

- Retail partners call asking why they are being undercut online.

A modern MAP monitoring software can shorten the time-to-resolution(TTR), so violations have less opportunity to spread.

Coverage: Blind Spots That Undermine the Whole Program

Outdated scraping methods struggle against:

- Dynamic HTML and JavaScript-heavy pages.

- Bot detection, IP blocking, and device fingerprinting.

That means they might miss:

- Specific variants or pack sizes on online marketplaces.

- New seller storefronts and marketplace-specific price formats

- Niche marketplaces where unauthorized sellers test low prices first.

Coverage gaps are dangerous because they create a false sense of security. Reports look clean, but MAP violations are occurring that your provider cannot see.

Insight: Not All Violators Are Equal

Without a modern MAP price tracking provider, your team sees long flat lists of violations, but little context:

- Who is a chronic violator versus a one-off?

- Which sellers influence Buy Box behavior the most?

- Which violations lead to measurable price erosion and margin loss?

Unauthorized sellers and price erosion can devalue brands and undermine carefully planned price architectures. You need MAP monitoring tools that do more than “catch violators.” You need ranking, clustering, and historical trend views that show which offenders actually move the market.

Enforcement Impact: Are You Winning or Just Sending Emails?

MAP monitoring software is often judged by its output:

- “We sent 300 notices last month.”

- “We have a standardized escalation ladder.”

But real performance is about outcomes:

- Are total violations for strategic SKUs trending down?

- Are key violators changing behavior after enforcement?

- Are compliant retailers seeing a more stable price environment?

If your “best” MAP monitoring provider cannot help you measure the impact of enforcement over time, you are fighting blind.

A Simple Self-Diagnosis for Your Current MAP Monitoring Provider

Use these questions internally. Answering honestly will reveal whether it is time to re-evaluate:

- How long have we been with our current MAP provider?

If it is 3+ years, what substantial product improvements have we seen beyond cosmetic UI changes? - Has coverage on Amazon and Walmart improved or stagnated?

Are there consistent gaps, missing SKUs, or recurring “technical issues” you have learned to ignore? - Have we discussed anti-blocking and anti-extraction strategies?

Is your provider proactively addressing marketplace defenses, or do they avoid the topic? - Can we clearly see the impact of our enforcement efforts?

Do dashboards show violation trends over time by brand, category, seller, or SKU? - Does our provider prioritize violations for us?

Do they help you focus on chronic or high-revenue violators, or just hand over raw data? - When was the last time we benchmarked our current provider?

Have you seen a live demo of another MAP platform in the last 12 months? - Will our current setup still be effective in 2 years?

If marketplaces tighten controls or quick commerce channels grow, would your provider be ready? - Is our provider keeping up with platform reliability and usability issues?

When we raise technical concerns such as data delays, dashboard limitations, reporting bugs, or feature requests, are they resolved quickly and thoroughly, or do the same issues linger month after month?

If you feel hesitant or uncertain about most of these, you are partnering with a MAP monitoring provider that is behind where your business and category now sit.

A modern MAP monitoring solution should behave less like a reporting tool and more like a control system for your digital shelf.

What does a Best MAP Monitoring Provider Look Like Today?

If you stripped all brand names and logos off the screen, how would you recognize the best MAP monitoring provider? At a minimum, there will be:

- Resilient data collection across Amazon, Walmart, major retailers, and emerging marketplaces, with strategies in place to handle blocking and layout changes.

- High-frequency checks on priority SKUs to capture pricing shifts before they spread.

- Seller identity resolution, tying multiple storefronts and aliases back to the same entity.

- Risk-based scoring of violations, highlighting where margin, brand equity, or retailer relationships are most at risk.

- Enforcement workflows, connecting data to templated notices, escalation paths, and internal collaboration.

- Clear impact analytics, making it easy to show leadership how MAP efforts translate into fewer grey-market sellers, more stable pricing, and healthier channel relationships.

READ MORE | Best MAP Monitoring Software You Should Consider for E-Commerce

Why Brands Can’t Rely on “Mostly Fine” MAP Monitoring Providers Anymore?

There was a time when MAP monitoring didn’t need to be complicated. Prices moved slowly, sellers behaved predictably, and even a basic tool could keep most issues under control. That’s not the world you’re selling in today.

Right now, a single seller can drop the price and influence an entire category within hours. Marketplaces update their systems without warning. Retail partners closely monitor price consistency and expect brands to stay on top of violations. In this environment, “mostly fine” monitoring doesn’t protect you—it exposes you.

That’s why brands need to re-evaluate their MAP provider with fresh eyes. Not to switch for the sake of switching, but to ensure the system you rely on remains the right one for how e-commerce works today.

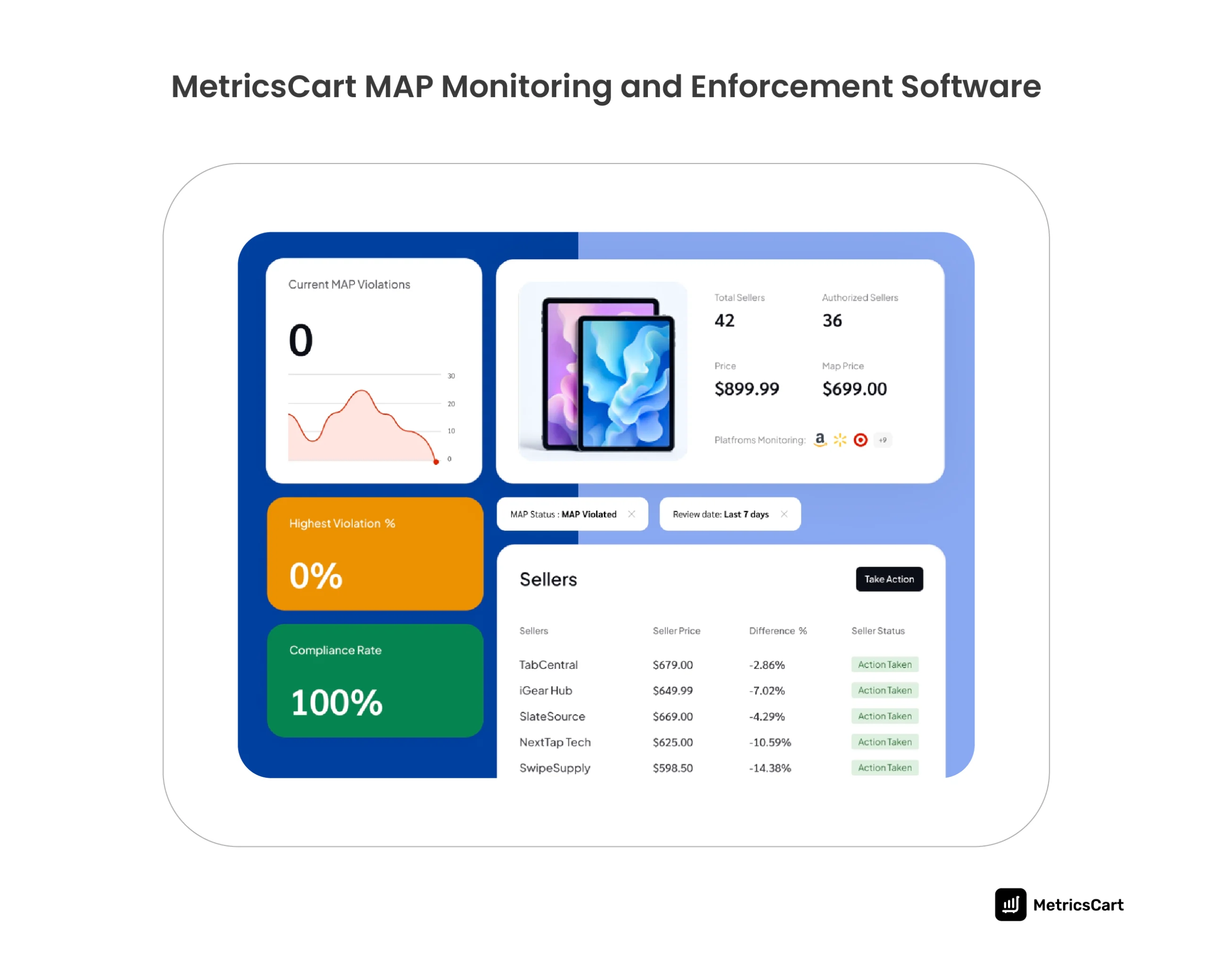

This is where MetricsCart stands out.

MetricsCart’s MAP monitoring software delivers faster detection, stronger marketplace coverage, smarter seller identification, and clearer enforcement insights—so you’re not guessing whether your MAP program is working. You can see it.

Stop MAP Violations and Protect Your Pricing With MetricsCart.

FAQs

The best MAP monitoring software tracks real-time prices across marketplaces, identifies violators quickly, connects multiple seller aliases, and gives brands clear insights to take fast enforcement action.

Marketplaces change fast, pricing shifts happen in minutes, and unauthorized sellers are more aggressive. Good MAP monitoring tools like MetricsCart help protect margins, retailer trust, and long-term brand value.

Modern solutions use AI-assisted detection, stronger crawling infrastructure, better seller ID matching, and higher-frequency checks. Legacy tools rely on slow scheduled crawls and miss fast-moving violations.

Yes. Even compliant retailers can be undercut by unauthorized sellers, repricers, and marketplace-level price changes. Monitoring protects the entire channel, not just one retailer.

Legacy MAP tools often rely on outdated scraping methods, fixed crawl schedules, and limited marketplace coverage. This leads to blind spots on Amazon, Walmart, and niche platforms.