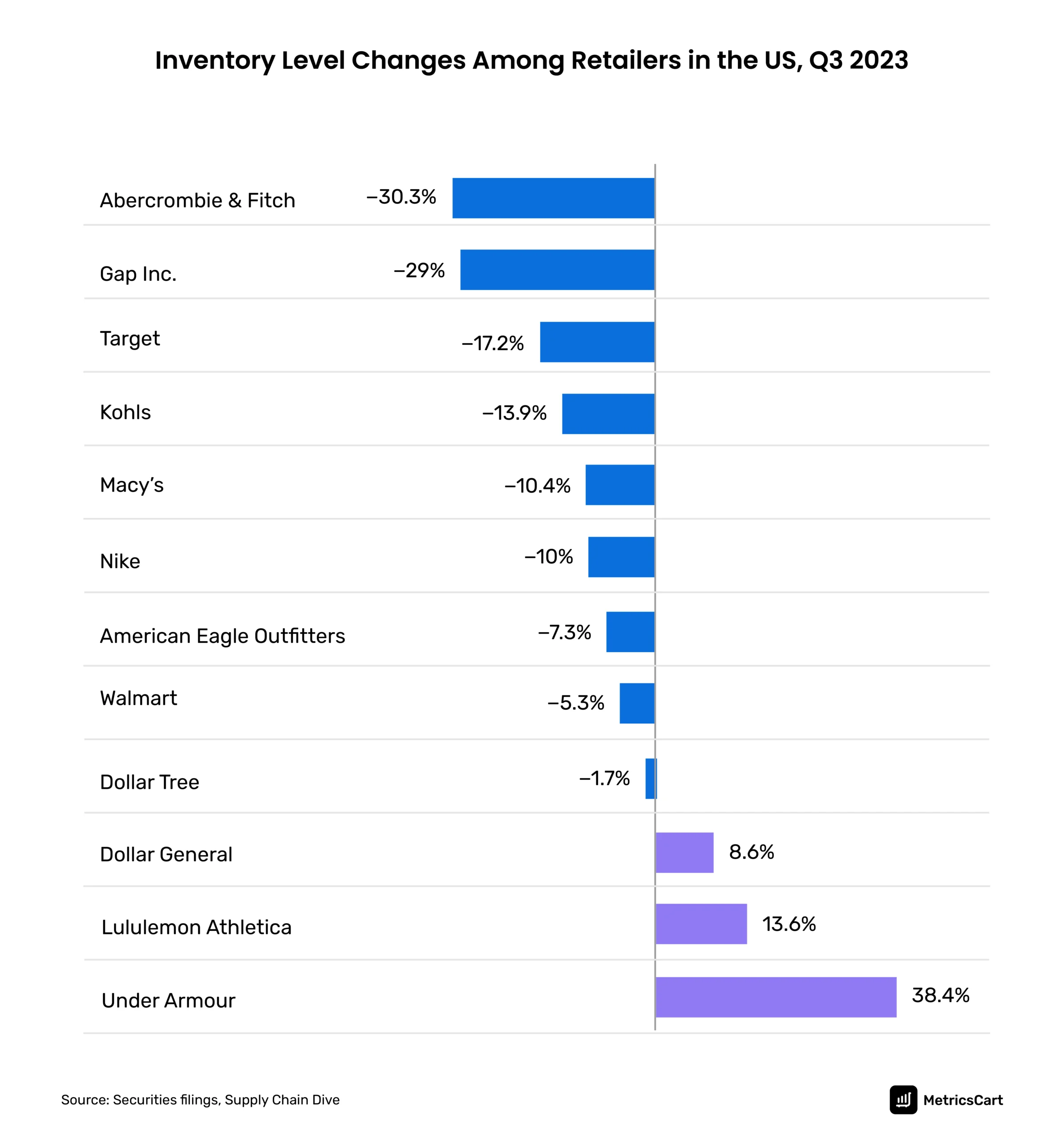

In 2022, many retailers were dealing with peak times of excess inventory. Going into the third quarter of 2023, most of the major players were able to bring down the inventory levels.

According to Supply Chain Dive data, some of the apparel retailers, such as Abercrombie & Fitch, had a year-over-year change at -30.3% in inventory levels, fixing their supply chain challenges.

Businesses of today are relying on effective inventory monitoring and forecasting to dissuade excess inventory.

[table_of_contents numbered=true]

What is Excess Inventory?

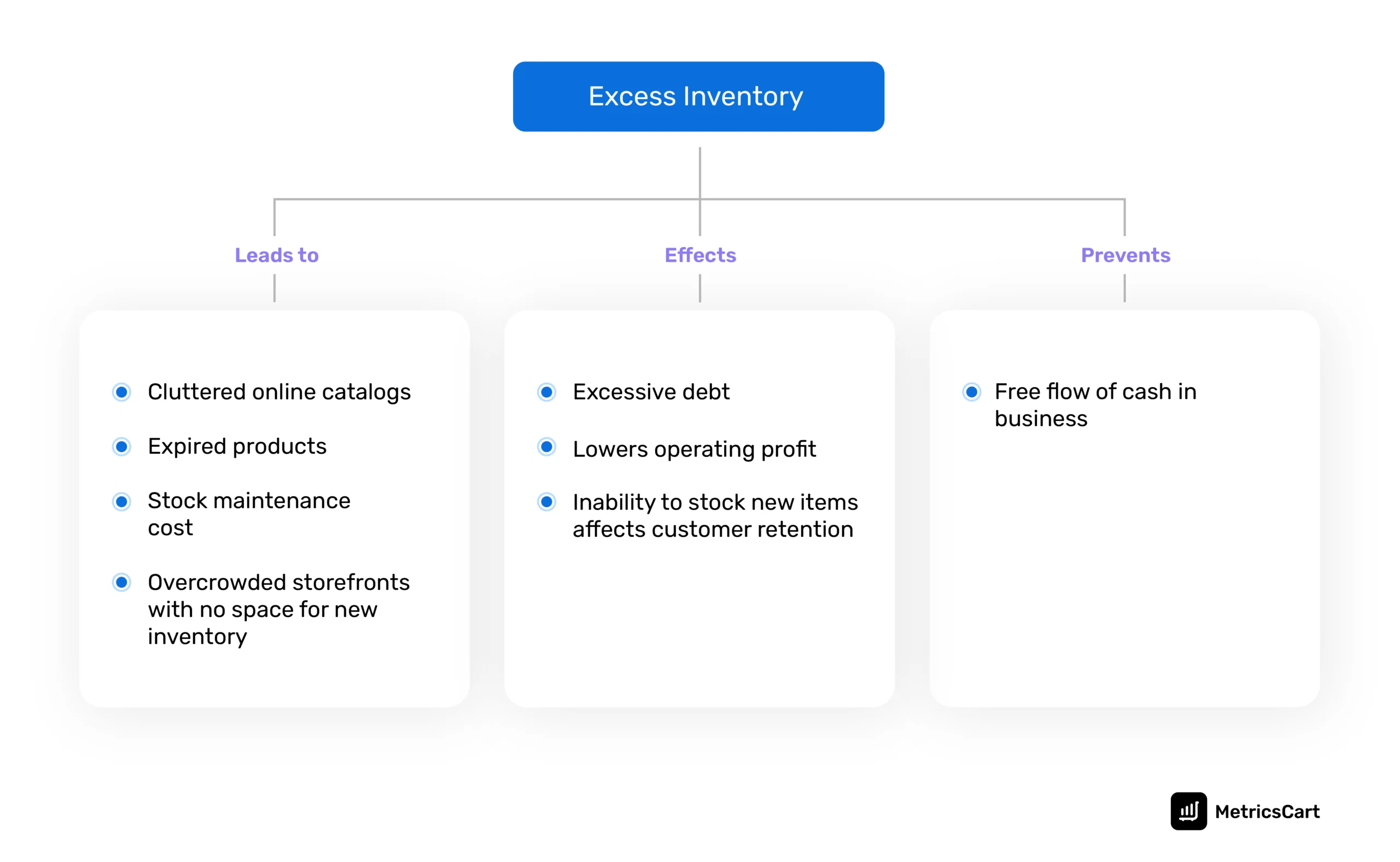

Excess inventory is when a brand or retailer has more units than the market’s demand. This indicates the business has capital tied up to its products, which prevents smooth cash flow.

Reasons for Excess Inventory

- There are times when a product may experience an unexpected surge in demand resulting in a short-term price increase. It could stem from:

- Supply chain disruption

- Seasonal demand

- Government policy changes

- A temporary trend

- Technological advances

This negative demand shock causes panic buying, leading to supply shortages. Retailers who fall for this “bullwhip effect” may:

-

- Incorrectly forecast demand

- Place magnified orders to manufacturers

- Overinvest in production

- Sellers buy in bulk at discounted rates. When the products don’t sell as expected or if the demand is seasonal, it results in excess inventory.

- Retailers and brands may use outdated inventory management tools to forecast demand.

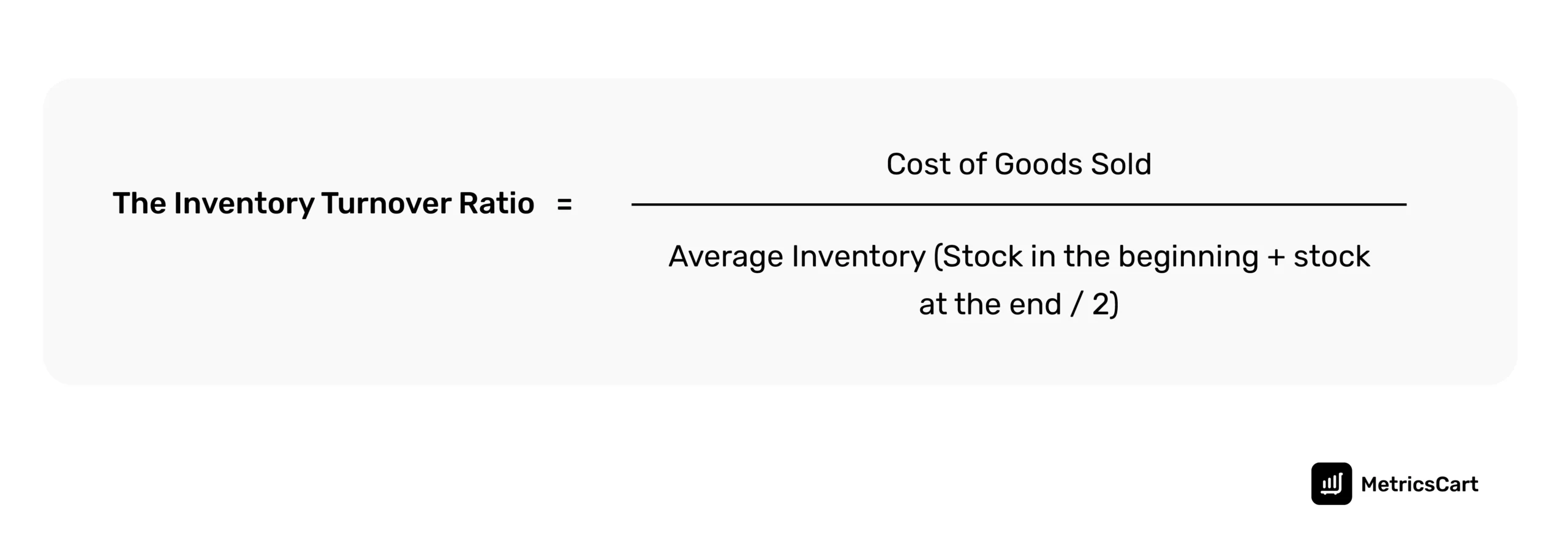

Calculating Excess Inventory Using Inventory Turnover Ratio

Calculating the inventory turnover ratio reveals the need for replenishment or the need to clear surplus inventory off the shelf at the earliest.

Inventory-related factors that affect the profitability of a retailer include:

- Price at which the products sell

- Obsolete inventory that is not receiving enough demand

- SKUs in demand but not in stock

Read more on how out of stock could affect brands and retailers.

How Do Sellers Cash in On Excess Inventory?

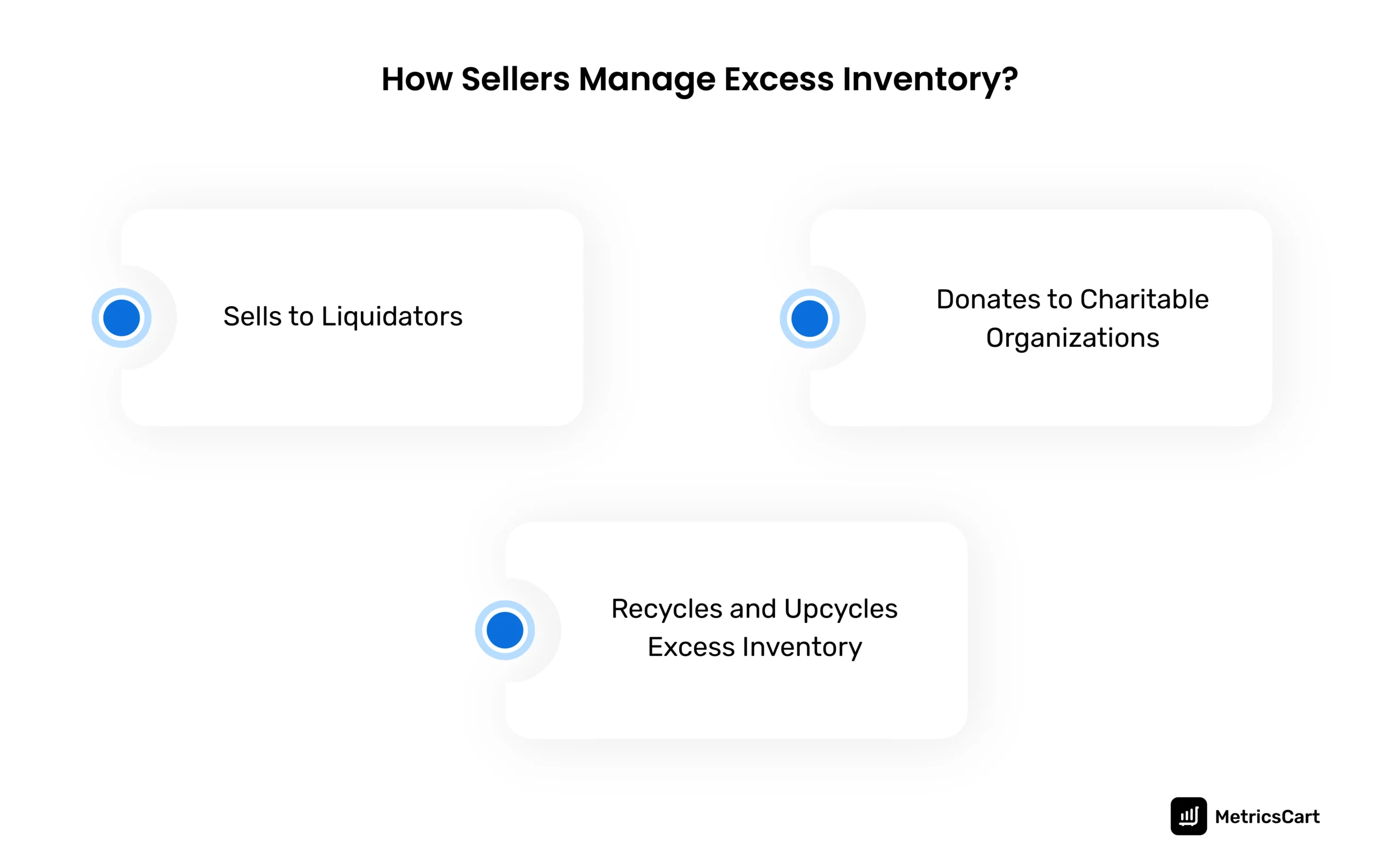

Although getting rid of deadstock by dumping it in landfills is an easier option, there is an increasing number of consumers who seek brands that foster a circular economy norm.

To cater to such buyers, business houses such as Kering, owner of luxury brands Gucci and Balenciaga, have ongoing sustainable initiatives. Gucci announced that the first recycled products of its ‘denim project’ (old jeans are shredded to fiber stage and re-spined into yarns) will be in stores in 2024.

Discounts

To reduce carrying costs and improve cash flow, businesses liquidate inventory by selling to discount stores like TJ Maxx or Best Buy outlets.

Another option brands resort to is selling at marketplaces such as Sourcengine.com or ‘Amazon Warehouse’ where sellers list excess or renewed goods at a discount.

Donation

Sellers who take the service ’Fulfilled by Amazon’ (FBA) program give eligible excess and returned products to charitable organizations.

Recycling

Clothing retailers like R Collective and Shein don’t manufacture textiles. Instead, they source fabric from excess inventory and go by upcycled fashion.

While these are some of the ways retailers and brands cash in on excess inventory, another inventory optimization method is through SKU rationalization.

Industry Examples Of Turning Excess Inventory into Opportunities

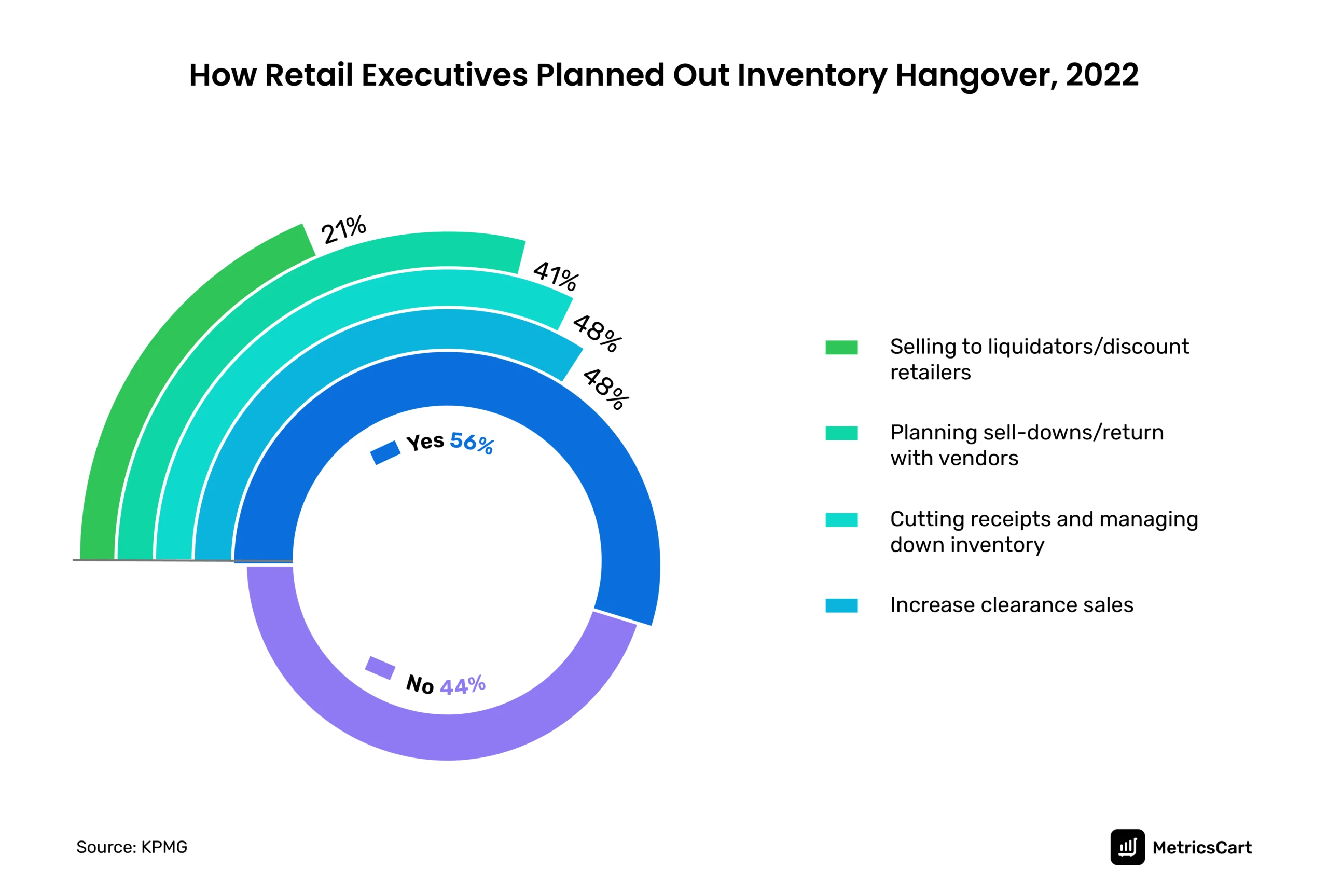

According to a KPMG Consumer & Retail executive outlook survey from September 2022, 56% of retail executives said after the holiday shopping spree, they managed the inventory hangover using the following ways:

Excess Inventory in the Clothing, Shoes, and Jewelry Industry

E-commerce fashion cycles are getting shorter. On average, Shein produces nearly 2,000 to 10,000 new items every day and ships out more than a million packages daily.

Producing new textiles causes greenhouse gas emissions that clock to 1.2 billion tons a year, and deadstock poses financial and sustainability challenges for the fashion industry.

Shein and Temu Follow Just-in-time Inventory Management To Avoid Excess Inventory

Temu and Shein follow an on-demand production (just-in-time) method.

Discount shopping app Temu shares data on items consumers search for and shop on its site with its third-party sellers to:

- Predict trends

- Plan production better

- Reduce the risk of overproducing items that may not be in demand

- Pass cost savings to shoppers

Similarly, Shein follows a fully circular textile supply chain. The retailer connects the dots between data inputs from current trends to viral products and shopper insights to create in-demand designs.

The retailer uses fabrics that are rescued deadstock, forest-safe viscose, and recycled polyester. To avoid accumulating excess fabric liability, Shein places the order for manufacturing only when suppliers place an order.

Off-price Retailers Sell Excess Inventory at Discount Rates

Retail stores such as Burlington, Ross, Shein, and TJ Maxx group follow an off-price retail model targeting value-conscious shoppers.

These stores source high-quality surplus materials, excess inventory, canceled orders, or closeout merchandise from manufacturers or brand-name merchandise and sell it at low prices.

Read on E-commerce Fashion Trends in the US

Excess Inventory in the Consumer Electronics Industry

Industries such as healthcare or aerospace with a demand for electronic components have a stringent approval process.

Large inventory was one of the main culprits responsible for the substantial reduction in gross margin for many original equipment manufacturers and external electronic manufacturers in the last five years.

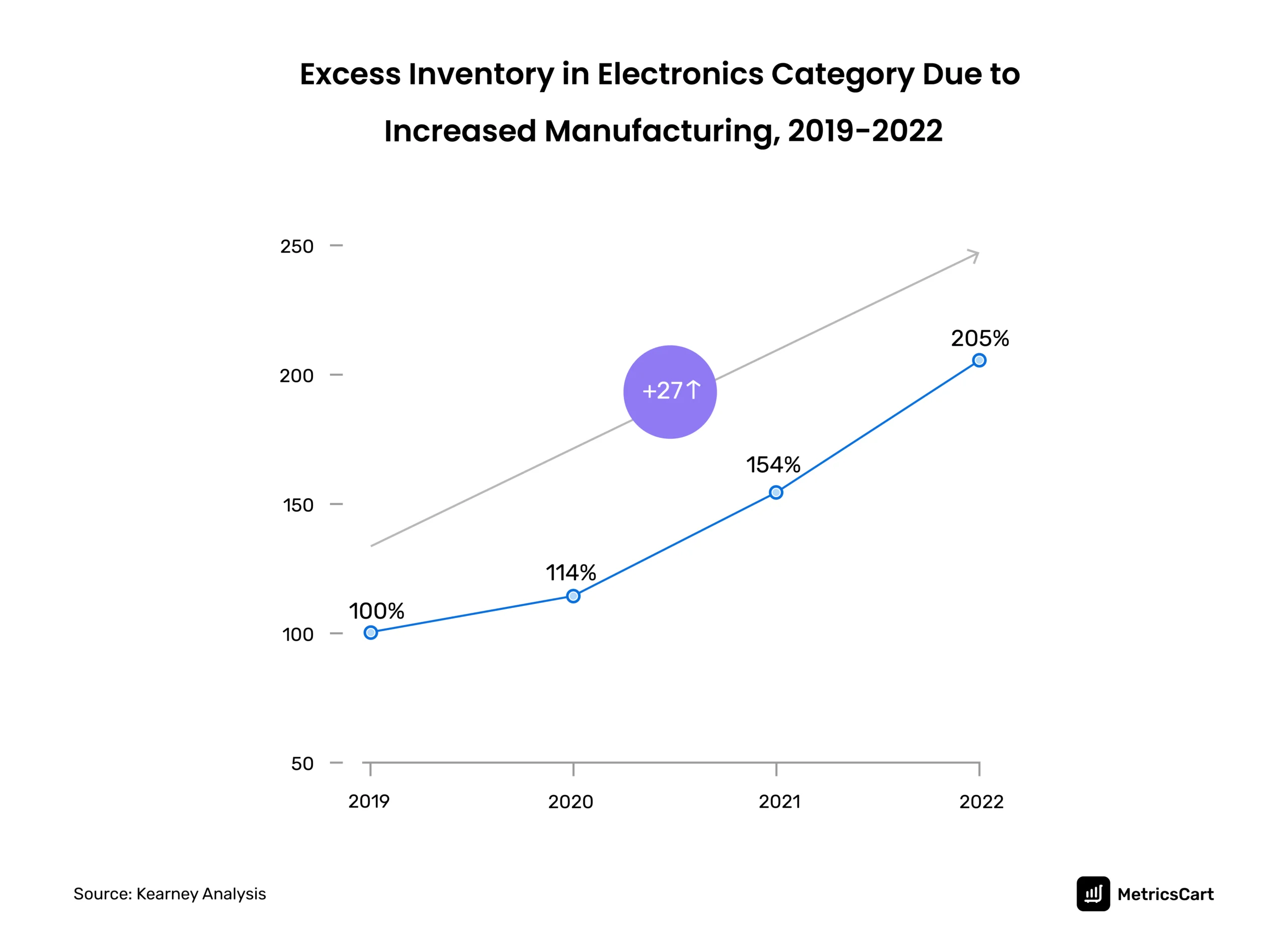

A sudden demand surge for electronic parts between 2019 and 2022 saw a 27% average increase in manufacturing and supply by original equipment manufacturers and external electronic manufacturers.

Moreover, electronic components have a limited shelf life, require specific storage conditions, and decay in performance over time.

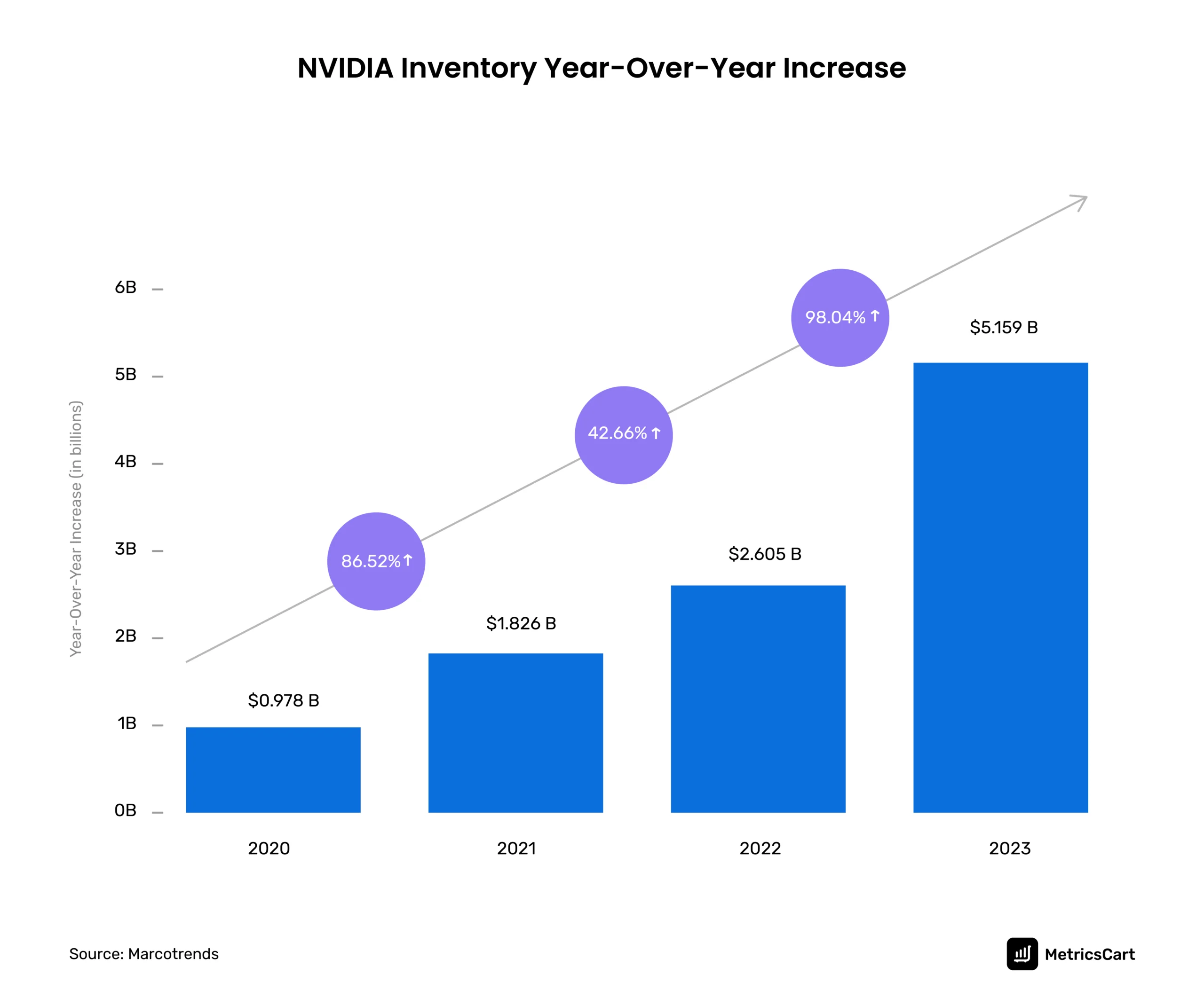

NVIDIA Incentivises Retailers to Clear the Shelves

NVIDIA commanded a 2-3x price on eBay when the market experienced a shortage of graphics cards and chips during the pandemic. Later, when the supply chain disruption phased out, Nvidia entered the market with many products The product was then sold at MSRP and below to make way for new-generation model launches.

The company’s CEO, Jensen Huang, said, “We found ourselves with excess inventory.”

Productive Outlets That Resells Electronic Inventory

When brands change their minds after placing orders with original component manufacturers like TSMC, the company may agree, but the brands have to pay a certain price for it. Some companies refuse to cancel already placed orders.

There are online marketplaces and third-party liquidation companies that help sellers list obsolete inventory for potential buyers to see. Digital marketplace for electronic components such as Sourcengine allows companies to sell their excess stock and recoup maximum returns.

To offload excess and keep returned consumer electronics out of landfills, Best Buy opened a retail outlet exclusively for such products. In addition, there are discontinued stock and refurbished items sold at a discount in their outlet stores.

Managing Excess Inventory in the CPG Segment

Some of the common inventory challenges that CPG brands experience:

- Double-selling due to lack of real-time visibility into sales and availability of inventory

- Lack of historical insights to drive strategic decisions

- Using a manual process that is time-consuming and subject to error

For perishable goods, retailers use ‘First-In, First-Out’ as an inventory management method. The method prioritizes the sale of items in the order they are received to reduce waste.

For packaged goods, the First Expiring, First Out (or FEFO) method ensures items with the nearest expiration date are sold first. This extends the shelf life of the inventory still in stock.

Unilever Tackles Excess Inventory With Pricing Intelligence Platforms

Unilever uses digital discounting and pricing intelligence platforms to optimize its slow-moving and obsolete goods. It redirects excess inventory and discontinued products to value-chain stores in the US.

Read on How CPG Brands Manage Their Share of Shelf?

Monitoring Inventory To Prevent Margin Erosion

Companies that monitor real-time product availability on e-commerce channels get access to:

- In-depth view of quantities in the assortment of self and competitors

- Best selling price point and shipping rate details

- Anticipate demand for products better

- Maintain the right levels of stock

- Preserve profit margins

Reach out to MetricsCart today for assortment and availability monitoring to avoid excess inventory and stock-out situations.