Modern retail’s omnichannel nature has given rise to two prominent shopping behaviors: webrooming and showrooming.

The internet has made it easier to make smart purchasing decisions through comparison shopping. According to the 2022 Online Consumer Behavior Global Report, 60% of people surveyed agreed that they compare prices on a few sites before making a purchase.

Let’s examine the challenges webrooming and showrooming pose for each other and probe whether there are any solutions to encourage customers to purchase online without abandoning the cart.

Looking for a cheat sheet on driving up profitability in e-commerce channels? Read How to Increase E-Commerce Sales?

What is Webrooming?

Webrooming is a comparison shopping behavior in which the customer researches online but buys offline. Consumers who show this behavior usually do not indulge in impulse buying. Instead, they research and take time to make a purchasing decision.

To cite an example of webrooming, people may compare the features and the price of home appliances online. However, most home appliance sales in the US still happen offline. Statista forecasts this trend may change from 2024, and online sales of household appliances may grow.

Reasons for an Increase in Webrooming

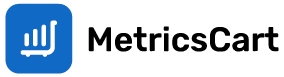

Americans spent $7.071 trillion in retail stores and $1.257 trillion online in 2023.

Some of the reasons that contribute to the increase in webrooming behavior are:

- More retailers adopting e-commerce

- Availability of experiential marketing in stores

- Well-trained sales staff to assist during shopping

- Increase in buy online pickup in store option (BOPIS)

- Instant gratification when buying from physical stores

Webrooming vs. Showrooming

Comparison shopping empowers consumers to make informed choices as it involves researching and comparing similar products or services from various sellers online or offline. Two trends seen in comparison shopping are webrooming and showrooming. Here are the differences:

| Webrooming | Showrooming | |

|---|---|---|

| Definition | Shoppers research online, read reviews, and compare prices to make an informed decision before purchasing. | Shoppers browse through physical stores and inspect products before purchasing. |

| Challenge | After online research, shopper buys from physical shops where they touch and feel the product. | Shoppers buy from online stores where the same product is available for a lower price. |

| Consumer behavior | Consumers’ desires are instantly gratified. Physical stores provide in-person assistance and a sense of trust to shoppers regarding the quality of the products. Easy returns or exchanges are possible. No shipping cost or fear of losing in transit. Customers showing this behavior feel good supporting local businesses and may ask to price match the online price. | Consumers showing this shopping behavior are focused on finding the best value for money. In most cases, they find low prices at online stores or social media shops. Shoppers are ready to bear the delay during the shipping and delivery of goods. |

| How to prevent? | To avoid webrooming and encourage customers to buy online: Engage customers with AR experiences and chatbots to address queries. Extend customer loyalty benefits like faster delivery and no shipping cost. Offer competitive pricing. Ensure product availability and feature ratings and reviews of products. | To avoid showrooming and encourage customers to buy offline: Focus on personalized customer service. Offer customer loyalty perks. Attract customers with in-store deals. Price match with competitor stores having an online presence. Incorporate product ratings and reviews on their own online stores. |

Read more to understand Price Matching: A Retailer’s Perspective

How Do Online Retailers Prevent Webrooming?

Successful retailers do more than deliver customer needs.

Offer Connected Experiences

Kroger’s data analytics subsidiary 84.51°revealed a 97% increase in households using two shopping methods. In an attempt to bridge the gap between online and offline retail, e-commerce retailers have been embracing phygital approach by tapping into augmented reality. Integrating 3D models and AR has helped to a great extent in bringing the in-store experience to online shopping in various categories.

A 2021 survey conducted by Deloitte Digital and commissioned by Snap Inc. revealed that 54% of consumers expect to readily view information about an item when they scan with their phone camera. Additionally, 56% of shoppers agree that AR gives them more confidence about product quality.

In 2017, IKEA was the first retailer in the furniture segment to introduce an AR app called IKEA Place. This app allowed shoppers to place true-to-scale 3D models of furniture within their homes virtually. Today, Companies like Wayfair, Houzz, Target, and Amazon have similar apps.

In the fashion segment, both Amazon and Walmart capitalize on AR-based virtual try-on features that replicate an in-store shopping experience.

Ease the Checkout Process

As the online medium is susceptible to data breaches, retailers must ensure that digital shoppers’ payment gateway and personal data are in safe hands.

Findings from Capterra’s 2022 Online Shopping Survey revealed that 82% of customers had abandoned their carts and decided against making an online purchase because the account registration process was too complicated.

43% of the consumers who participated in the survey added that they prefer e-commerce sites that allow guest checkout instead of mandatory registration.

Optimize the Listings

Optimizing the product pages with detailed product descriptions and high-quality images and having a live chat to answer all the customers’ doubts about the product encourages customers to shop confidently online and reduce returns.

Focus on Personalization

Based on previous order data, online retailers provide a sense of personalization and attention to detail by suggesting certain products to customers and offering the convenience of delivering the items to their doorsteps.

Foster Loyalty

The baby boomer generation is considered the most loyal of all shoppers. They possess a huge amount of disposable income and spend an average of $203 on every online purchase. Yet, they have much stronger ties to shopping in-store than millennials.

Last-mile delivery plays an important role in customers’ decisions about their grocery retailer. There is a growing adoption of buy-online/pickup-in-store (BOPIS) and direct-to-consumer (D2C) services.

To foster loyalty and appeal to this category, merchants offer:

- A hybrid shopping experience that links online ordering and offline transaction

- An engaging, user-friendly website that offers a streamlined shopping experience

- Exceptional pre and post-purchase customer service

- Dialed-in, personally calibrated interactions

- Competitive Pricing

Read about Understanding Customer Buying Behavior on Amazon in the US

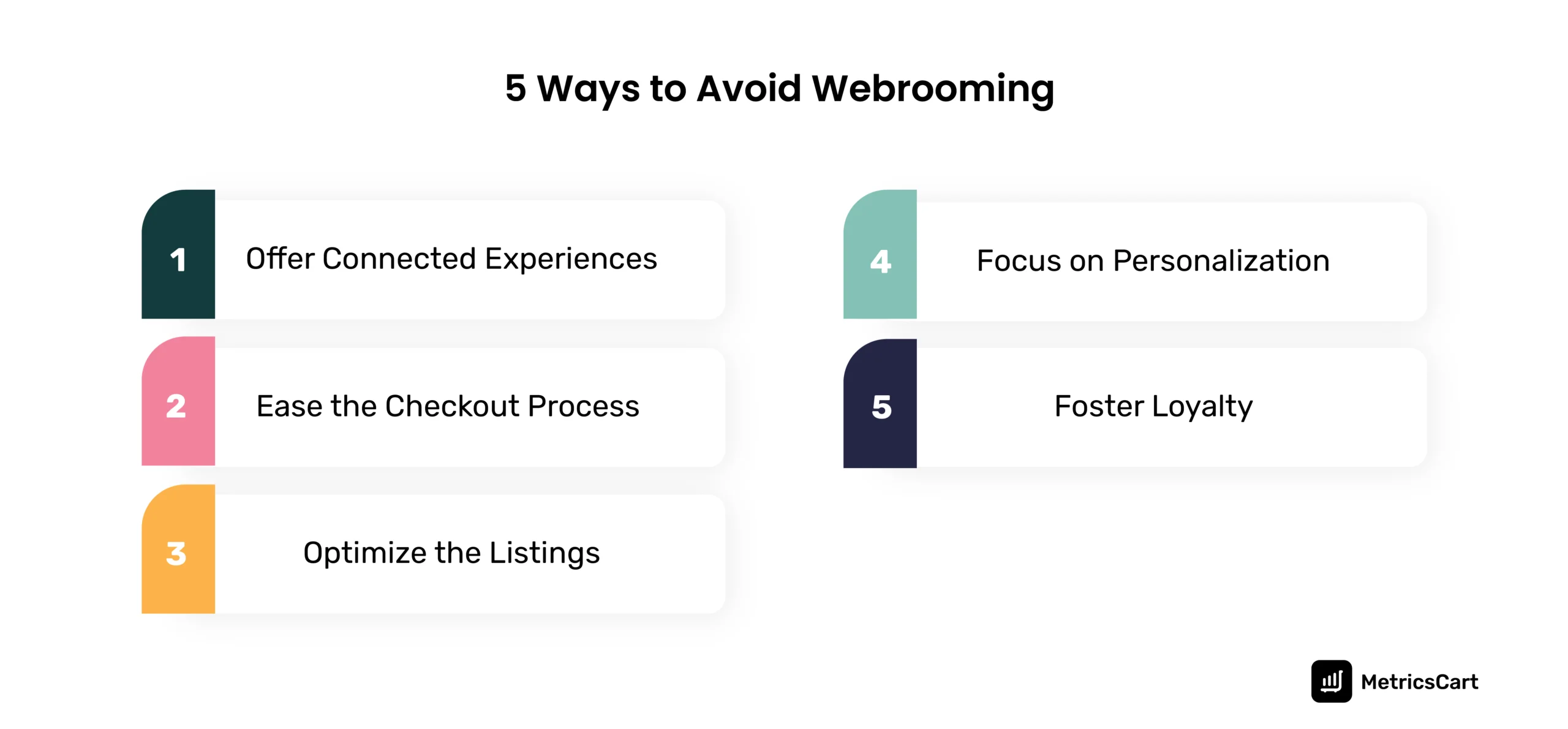

In 2023, clothing, shoes, and food & beverages were the top three popular categories for online purchases in the US.

Retailers selling products, especially in these popular categories, have the upper hand in convincing customers to buy online.

How Digital Shelf Analytics Influence E-Commerce Sales

Digital influence in retail is inseparable from modern retail. It is futile to look for ways to fight modern-day shopper behaviors such as webrooming and showrooming. Instead, for a consistent customer experience, it would be wiser to capitalize on these trends by seamlessly integrating online and offline channels.

Low online price is clearly a differentiating factor from physical stores and encourages showrooming. Businesses can influence consumer behavior and avoid webrooming by leveraging the power of digital shelf analytics. Using MetricsCart’s price monitoring service, retailers can stay competitive by:

- Monitoring competitive pricing of the assortment across multiple channels

- Do competitors’ promotion monitoring to offer the best possible deal or value additions

Schedule a call with a MetricsCart representative to learn our price monitoring capabilities and explore how we can contribute to improving your brand’s e-commerce sales.