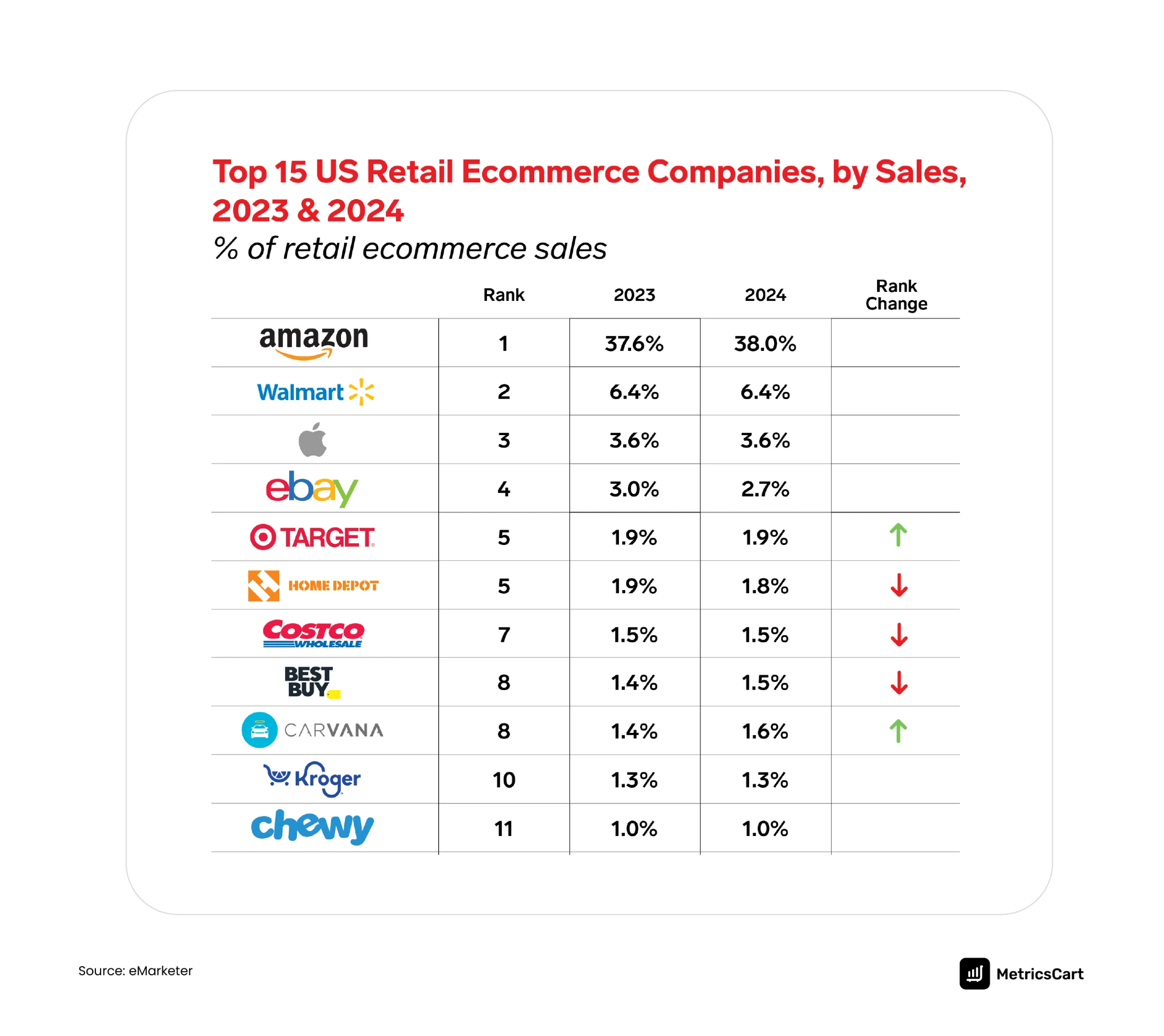

Amazon and Walmart together account for nearly half of US e-commerce sales — Amazon with a roughly 37% share and Walmart with about 7%.

Their policies don’t just influence consumer behavior; they set the rules for how brands and sellers compete, price, and protect their products online.

Among these policies, price matching is often overlooked but remains one of the most critical levers impacting profitability on the digital shelf. With leading retailers frequently updating—or even removing—their price matching policies, understanding the nuances is more crucial than ever.

To illustrate these dynamics, MetricsCart analyzed the Wetbrush brand colors—Black, Purple Ariel, Moana Teal, and Flowing Coral—over 96 hours across Amazon and Walmart. The goal was to uncover the key differences in how each retailer approaches price matching on Amazon vs. Walmart.

This blog breaks down how Amazon and Walmart handle price matching, why their approaches differ, and what brands must do to stay competitive without sacrificing profitability.

What is Price Matching?

Price matching is a retail policy or practice where a seller or retailer agrees to match a lower price found elsewhere for an identical item. It’s a way to assure customers that they’re getting competitive value, to reduce the urge to shop around, and build trust.

For brands and sellers, price matching can affect how you set MSRP (Manufacturer’s Suggested Retail Price), Minimum Advertised Price (MAP), promotions, and competitiveness.

While many brick-and-mortar retailers still advertise guarantees, Amazon and Walmart rely heavily on algorithmic repricing to stay competitive.

READ MORE | Want to Get an End-to-End Insight on Price Matching? Check out Price Matching Explained: A Retailer’s Perspective

Amazon’s Price Matching Policy

Amazon does not have a formal price-matching policy. Regarding the Amazon pricing strategy, they aim to offer the lowest prices every day.

For this, they employ a dynamic pricing strategy, where prices are constantly adjusted using algorithms that take into account demand, inventory, competition, and other market signals, rather than responding manually to competitor price match requests.

In addition, if a customer finds a lower price elsewhere and asks Amazon to match it, there’s generally no guarantee that they will. They explicitly state they do not offer price matching because they aim to keep their prices competitive automatically.

Based on our analysis of the Wetbrush brand on Amazon, we found that:

- 2P and 3P sellers often match prices with independent online retailers.

- No substantial evidence that Amazon 1P matches prices offered by 2P/3P sellers.

- 2P/3P sellers cutting prices sometimes won the Amazon Buy Box, but not consistently. Other factors, such as seller ratings, fulfillment speed, and delivery promises, also influenced results.

- In one case, a simple product like a hair brush showed Amazon 1P absent from the Buy Box altogether, suggesting the item wasn’t strategically important for Amazon.

Amazon’s price matching is fast, aggressive, and heavily algorithm-driven, but outcomes depend on seller type and category.

Sellers need to be aware that Amazon’s algorithmic pricing and competitor monitoring can affect visibility (e.g., the Buy Box), especially if competing listings elsewhere are much cheaper. While this isn’t a “price match” policy per se, the ripple effects for sellers can be similar.

Walmart’s Price Matching Policy

Walmart’s policy is different, and it depends on whether you are talking about a physical store or Walmart.com. Based on their recent update, if a customer buys an item in a Walmart US. store, Walmart will match the price of the identical item advertised on Walmart.com, subject to restrictions.

Walmart does not match competitor prices (i.e., outside of Walmart) for items on Walmart.com. Also, prices from the marketplace or third-party sellers are excluded. For a match to work, the item must be identical — same brand, model/state, size, etc. Additionally, specific promotions, third-party seller listings, or items in the marketplace are often excluded.

Our analysis showed that Walmart’s buy box wins are slightly different from Amazon’s:

- Walmart 1P consistently owned the Buy Box, even when priced higher.

- 2P and 3P sellers could not win the Buy Box even after slashing prices.

- This suggests that Walmart favors stability, prioritizing its own offer and brand control over the lowest price.

Walmart protects its Buy Box for its 1P offers, even if prices are higher. For 3P sellers, competing purely on price is far less effective than on Amazon.

|

Aspect |

Amazon |

Walmart |

|

Customer Price Match Policy |

Ended in 2016 |

Limited, applies mostly in-store |

|

Algorithmic Pricing |

Aggressive, real-time, competitor-driven |

Conservative, favors 1P stability |

|

1P Role |

Competes with 2P/3P, but not always prioritized |

Dominates Buy Box regardless of 2P/3P price cuts |

|

Buy Box Dynamics |

Price + seller rating + Prime + delivery speed |

Strong preference for Walmart 1P |

How Does Price Matching on Amazon and Walmart Impact Brands and Sellers?

For Brands

- Risk of Margin Erosion: On Amazon, price wars can quickly eat into margins if MAP is not enforced.

- MAP Compliance: Amazon’s price-chasing algorithms often trigger MAP violations, forcing brands into reactive monitoring.

- Controlled Environment at Walmart: Walmart’s preference for 1P offers provides brands with more stability but limits their competitive flexibility.

For Sellers

- On Amazon: Lowering prices can improve Buy Box chances, but margins shrink. Winning also depends on ratings, Prime eligibility, and shipping performance.

- On Walmart: Competing on price is often futile if 1P holds Buy Box. Sellers must differentiate through assortment, availability, or exclusive SKUs.

Beyond Amazon and Walmart: Other Retail Developments on Price Matching

Price matching is not static. Other retailers are adjusting their policies in response to margin pressure:

- Target: Recently ended price matching with Amazon and Walmart, signaling a shift away from unsustainable competitive matching.

- Best Buy: Narrowed its policy to fewer categories, especially electronics.

- Specialty Retailers: Many are quietly de-emphasizing price guarantees, focusing instead on loyalty programs or exclusive bundles.

This signals a broader industry trend: retailers are realizing that blanket price matching can undermine their profitability.

Strategic Takeaways for Brands and Sellers

Amazon and Walmart may appear similar from the outside, but their price-matching policies differ sharply. Amazon’s algorithms create a fast-moving, hyper-competitive environment that pressures sellers into price cuts. Walmart, on the other hand, shields its 1P presence and prioritizes reliability over raw competitiveness.

For brands and sellers, the lesson is clear: treat these platforms differently. You can implement the following practices:

- Monitor Pricing Daily: Both platforms update dynamically, so static tracking is ineffective.

- Use MAP Enforcement Tools: Brands must actively enforce agreements to avoid downward spirals.

- Segment Strategies by Platform: Aggressive repricing on Amazon, brand-led stability on Walmart.

- Prioritize Buy Box Criteria: Ratings, fulfillment, and shipping speed are as important as price.

Want to Track Real-Time Pricing Trends Across Amazon And Walmart?

FAQs

No, Amazon no longer offers a customer-facing price match policy. Instead, Amazon relies on dynamic pricing algorithms to adjust product prices in real-time based on competitor pricing.

Yes, Amazon 2P and 3P sellers often match prices with independent retailers. However, Amazon’s algorithms and seller metrics (ratings, delivery time, fulfillment) also play a role in determining who wins the Buy Box.

Walmart prioritizes its 1P (first-party) offers for Buy Box ownership, even when prices are higher than 2P or 3P sellers. This is due to Walmart’s focus on brand control, reliability, and stability over the lowest price.

Yes, Target ended its price-matching policy with Amazon, Walmart, and other third-party retailers, effective July 28, 2025. The company made this change to avoid the strain of competing with large retailers’ fluctuating prices, signaling a broader trend where retailers are stepping back from price matching

Walmart offers a price adjustment policy, but it’s limited. If the price of an item drops within a specific time frame after purchase (usually 7-14 days), you can request a price adjustment for the difference, but this policy does not apply to items bought from third-party sellers.