Let’s start with that question: Why do products priced at $9.99 sell better than those priced at $10, even though the difference is a mere penny?

It’s not about the math or manipulation; it’s about perception. That’s what psychological pricing is all about—a strategy that taps into the way our brains perceive value.

This blog is your ultimate guide, with everything you need to know about psychological pricing explained in detail. Let’s get started!

What Is Psychological Pricing?

Psychological pricing is a strategy that uses pricing techniques to influence consumer behavior and value perception. It’s not about deception but about guiding decision-making in ways that feel natural to the shopper.

The principle is simple: humans don’t think rationally about prices. Behavioral economics shows that people use mental shortcuts, or heuristics, to make decisions quickly and effortlessly.

Imagine seeing two products side by side—one priced at $19.99 and the other at $20. Most people instinctively pick the $19.99 option, not because of the savings (it’s just a penny) but because the brain processes $19.99 as being closer to $19 than $20.

Psychological pricing leverages these shortcuts by molding the customer’s value perception and purchase decisions, driving more conversions and maximizing revenue.

READ MORE| Want to know more about value-based pricing strategies? Check out Everything You Need to Know About Implementing Value-Based Pricing

How Does Psychological Pricing Work?

The science of psychological pricing is rooted in behavioral economics and cognitive psychology. Consumers perceive value differently based on how prices are presented.

Take the classic example of $4.99 versus $5. To the rational mind, the difference is a single penny. But the brain doesn’t see it that way. The leftmost digit of $4.99 registers as $4, not $5, making the price feel significantly lower than it actually is. This “left digit bias” triggers a perception of affordability and value, driving higher sales.

It’s not just about what the numerals are but also how it’s framed. For example, presenting a product as “$20 with free shipping” is more appealing than “$15 plus $5 shipping,” even though the total cost is identical. The “free” tag holds immense psychological power and influences how customers perceive value.

Ultimately, psychological pricing works because it influences how shoppers evaluate options, perceive value, and justify spending. By leveraging these cognitive biases, brands can guide purchase decisions in ways that feel natural and intuitive to the consumer.

Advantages and Disadvantages of Psychological Pricing

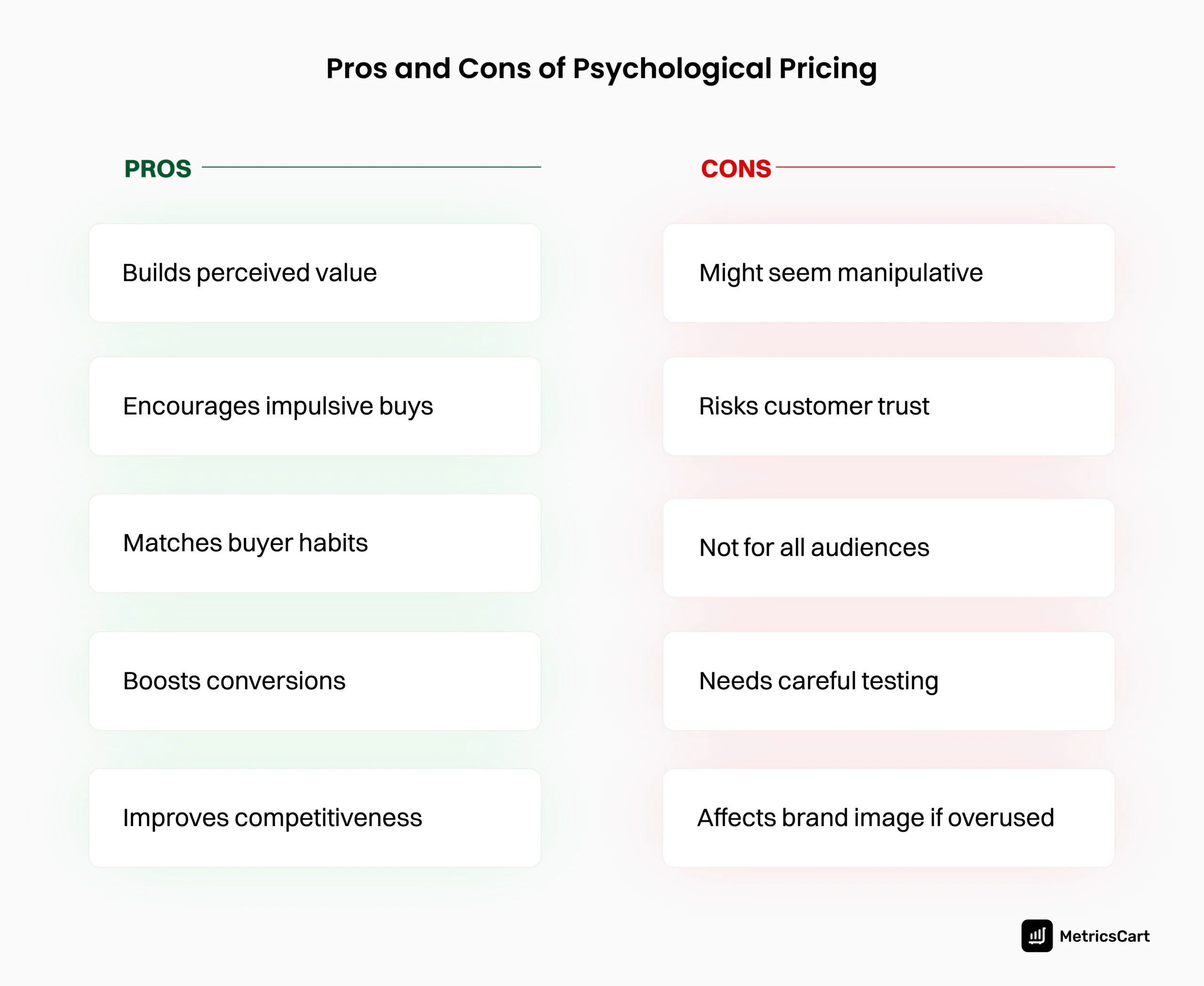

Psychological pricing, when used wisely, can drive sales, create value, and build a competitive edge. However, without careful application, it can backfire and even negatively affect your brand perception.

Let’s have a quick look at the advantages and disadvantages to help you weigh its impact:

Simply put, when applying psychological pricing, you either have to price well or pay the price!

Remember, pricing isn’t just about numbers; it’s a strategic tool to shape how customers perceive your brand.

With MetricsCart’s pricing and promotion solutions, optimize your pricing strategies to stay ahead of the competition.

Top 6 Psychological Pricing Strategies

Price Anchoring

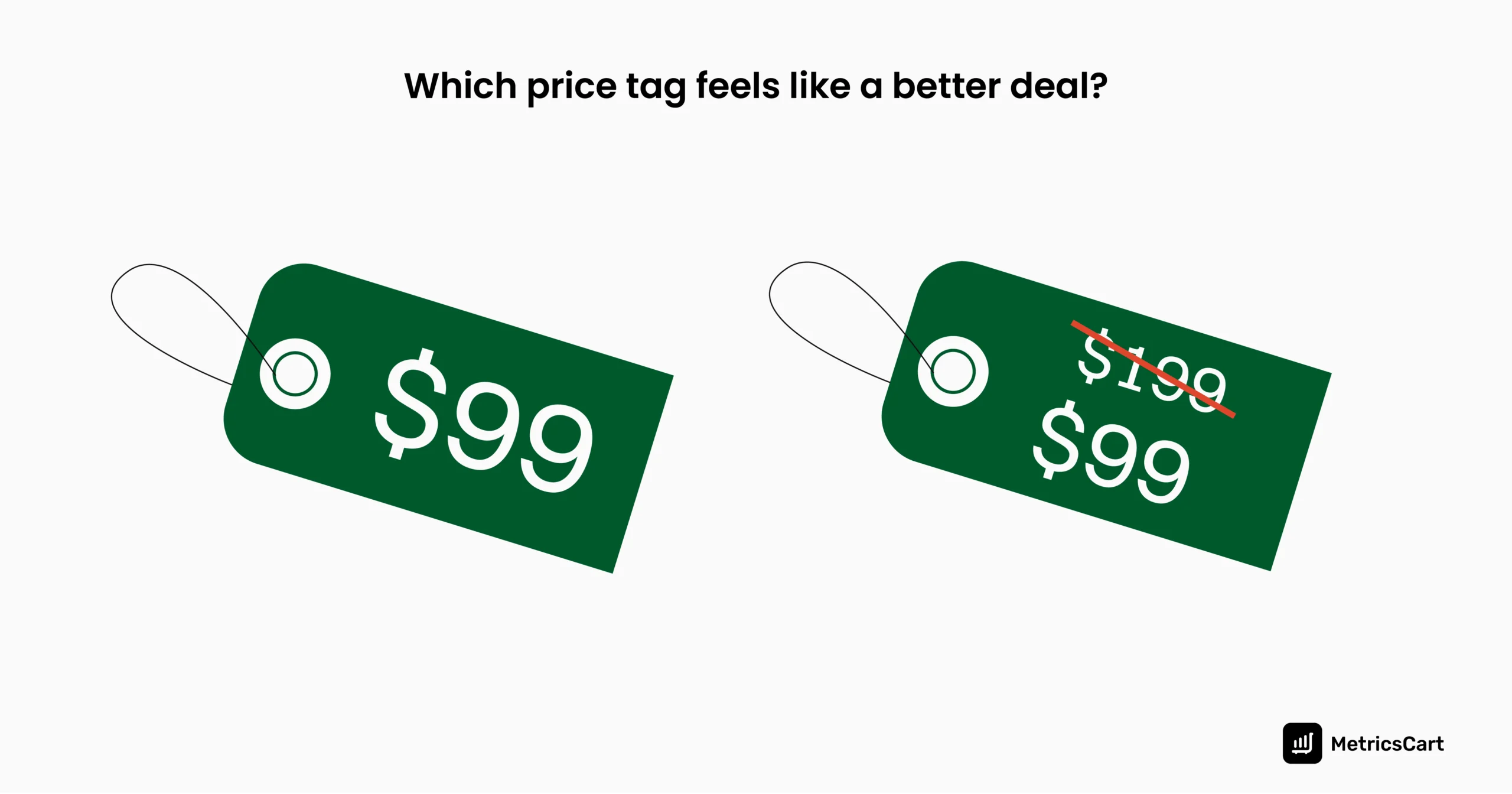

Here’s the thing: people love price comparisons. Price anchoring capitalizes on this by presenting a higher original price next to a discounted one.

Price anchoring sets a mental reference point for shoppers. By displaying a higher original price next to a discounted one, you create the perception of savings, making the final price feel like a bargain.

For example, “Was $199, now $99” immediately makes the discounted price look like a steal. That higher price isn’t just a number; it’s a mental anchor. It tricks the brain into focusing on the savings instead of the actual cost.

READ MORE| Want to know how to price smart on Amazon? Check out Amazon Pricing Strategy Explained: The Ultimate Guide

Charm Pricing

Charm pricing plays with how we process numbers. Prices ending in .99 or .95 create a psychological illusion of affordability.

For example, $29.99 feels much cheaper than $30, even though the difference is just a penny. This is because we tend to read from left to right and anchor on the first digit.

Charm pricing uses this quirk in human perception, making products seem more budget-friendly. This strategy doesn’t just lower perceived cost; it makes customers feel like they’re snagging a bargain.

FOMO Pricing

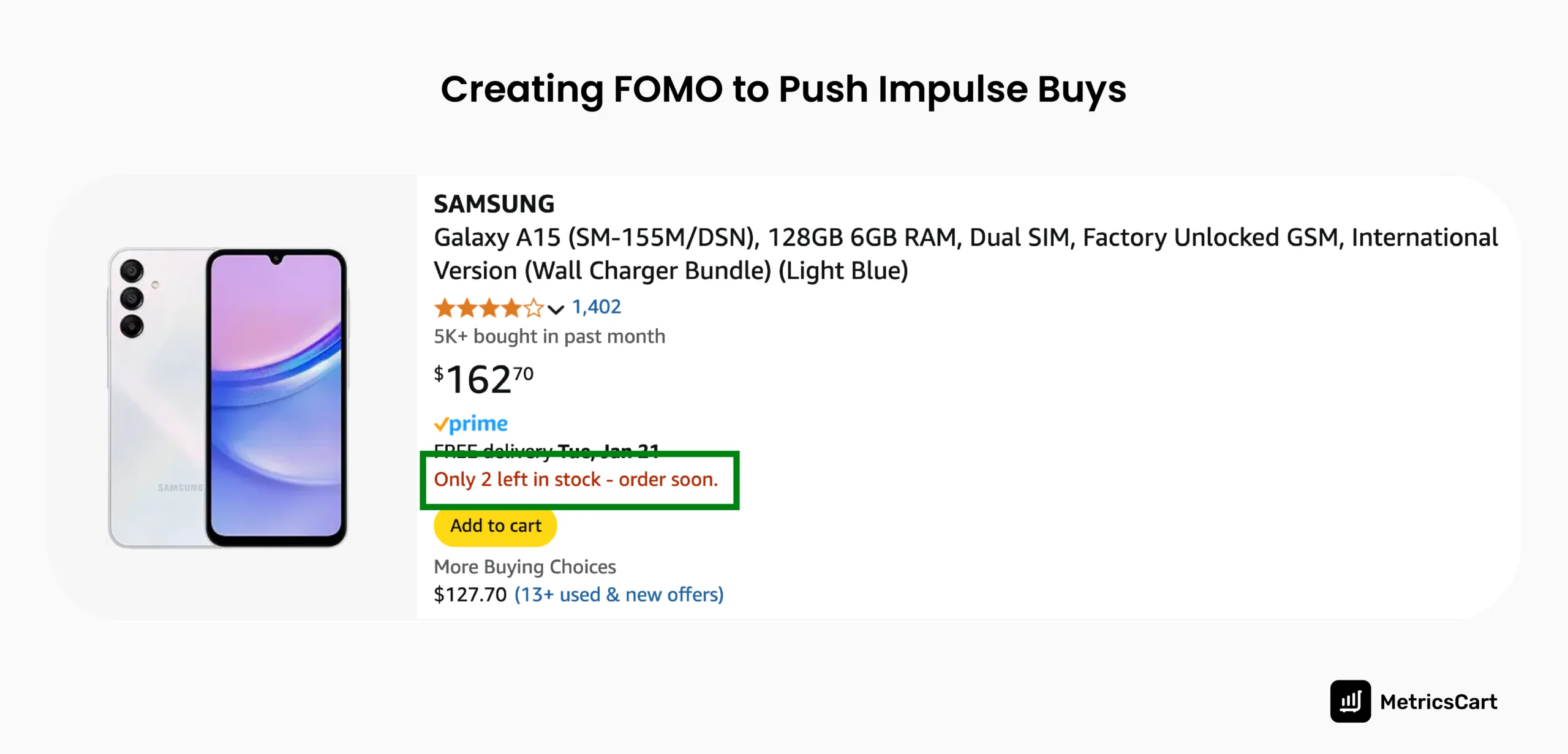

Fear of Missing Out (FOMO) pricing works on an artificially induced sense of urgency. Whether it’s a countdown timer, a “limited stock” alert, or a “Flash Sale: Ends in 24 hours” banner, FOMO taps into customers’ fear of losing a deal.

People don’t want to feel regret, so they’re more likely to make an impulsive purchase when they think the opportunity is slipping away. It not only increases sales; it makes your product feel indispensable in the moment.

Amazon uses this tactic brilliantly with messages like “Only 2 left in stock,” pushing buyers to act fast. It’s about creating that “buy now or cry later” moment.

READ MORE| Want to know how promotional pricing can boost sales? Read What is Promotional Pricing and its Significance?

Bundle Pricing

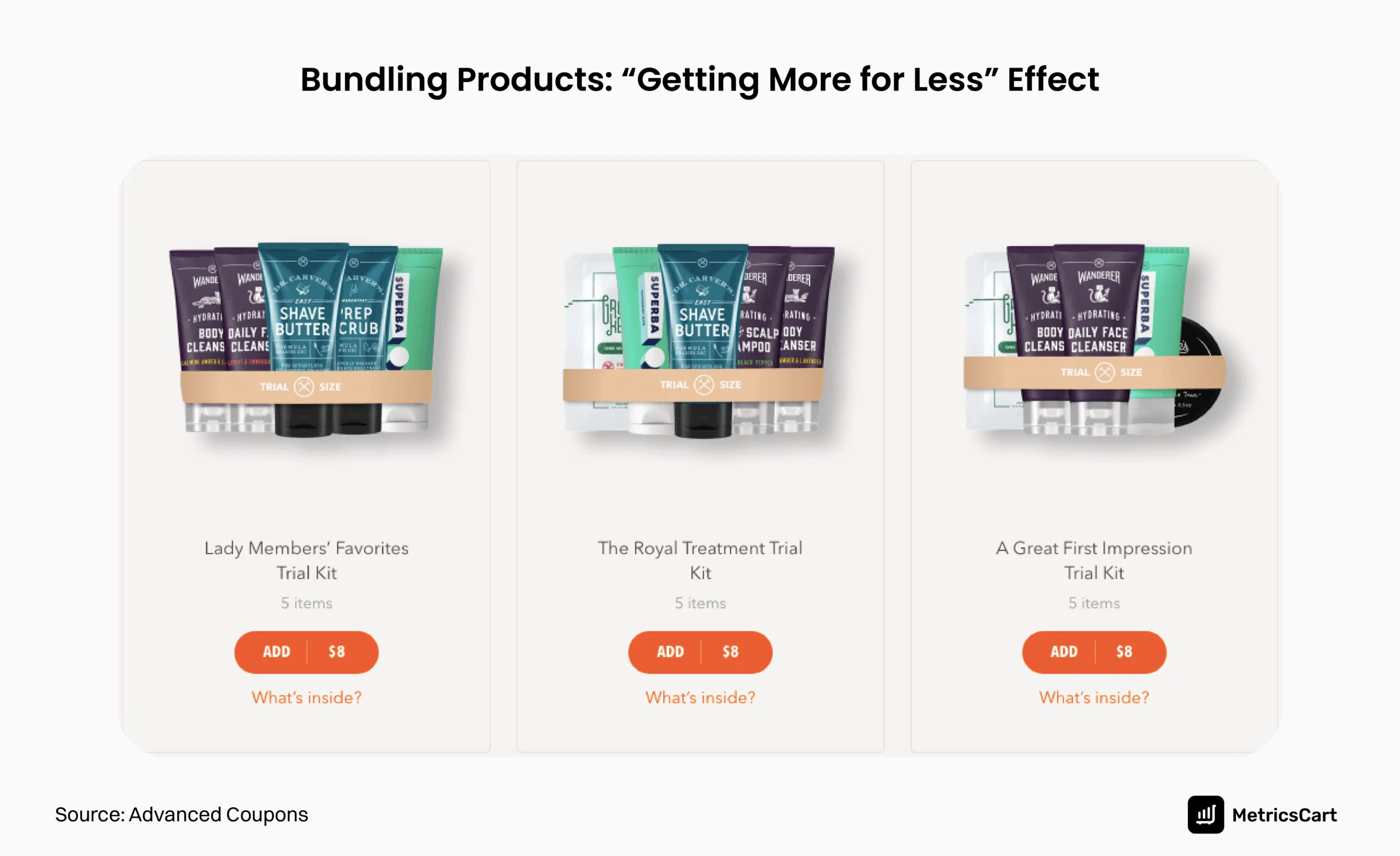

Bundle pricing is grouping products and offering them at a single discounted price; so you encourage customers to buy more. Bundles make customers feel like they’re getting more for less.

For instance, “Buy 2 for $20” feels like a better deal than paying $12 each. The math might not be dramatic, but the psychology is; people love feeling like they’re getting a bargain.

This strategy doesn’t just increase your average order value; it also moves inventory faster while giving customers a reason to spend more. It’s a win-win.

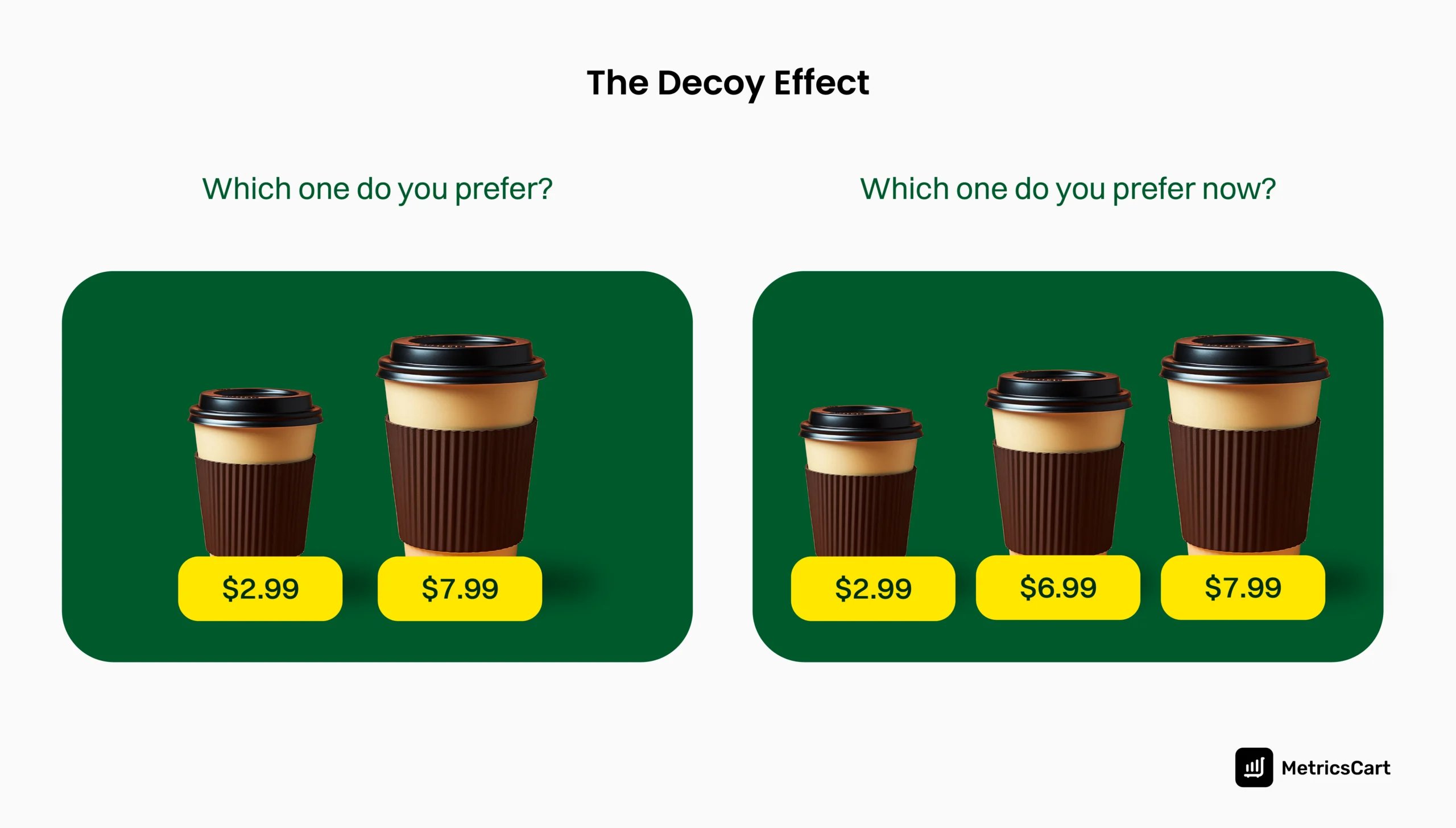

Decoy Pricing

Imagine offering three coffee sizes: small for $2.99, medium for $6.99, and large for $7.99. The medium exists to make the large seem like a no-brainer.

Decoy pricing involves introducing a third, less attractive option to nudge customers toward your most profitable choice. In this case, the medium-sized coffee for $6.99 is the decoy product, making the large one seem like the best deal.

This tactic shifts the focus to the perceived value of the larger option while subtly steering customers’ decisions with an invisible nudge. It’s about making one choice feel like the smartest move.

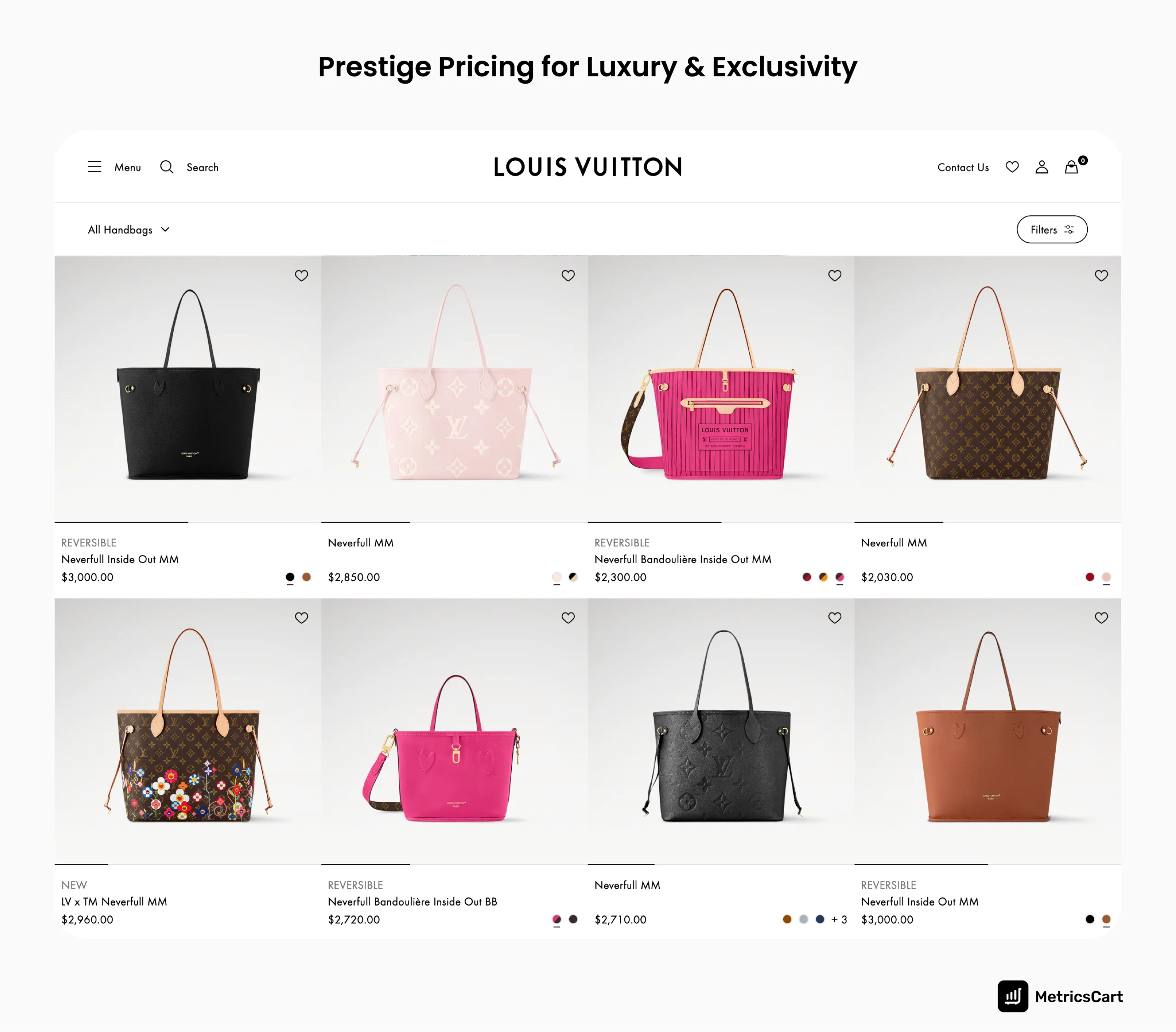

Prestige Pricing

Higher prices don’t always scare customers away. Sometimes, they attract them. Prestige pricing says, “This product is worth it.” It flips the affordability narrative to signal luxury and exclusivity.

A watch priced at $5,000 isn’t just a timepiece; it’s a status symbol. By pricing high, you convey superior quality and rarity. This strategy works best for premium brands that want to attract customers who equate high prices with high value.

If your brand is all about luxury, let your prices reflect it. With MetricsCart’s price monitoring software, set the right pricing strategy for your business growth.

Wrapping Up

While reading, did you realize that you, too, have often fallen prey to psychological pricing tactics? So you know, it works!

Psychological pricing isn’t just a gimmick; it’s a proven strategy rooted in consumer psychology. When used correctly, it can transform how shoppers perceive your brand and increase your bottom line. The key is to experiment, analyze, and dynamically refine your pricing tactics.

Now, it’s your turn, but don’t know where to start? Get started with MetricsCart, which offers automated price monitoring and real-time insights for competitive pricing strategies that fetch sales.

Get Ahead and Stay Ahead. Unlock E-Commerce Success Now!

FAQ

Psychological pricing is used to influence consumer perceptions and encourage purchases by making prices appear more attractive or affordable.

Brands use 99 cents because it creates the perception of a lower price by focusing on the leftmost digit, making $9.99 feel closer to $9 than $10.

Brands use psychological pricing to drive sales, increase perceived value, and align pricing with customer behaviors for better conversions.

A psychological barrier is a price point that consumers resist crossing, such as $10, where $9.99 feels significantly cheaper despite the minimal difference.

Amazon uses strategies like charm pricing ($19.99 instead of $20) and urgency tactics (e.g., “Only 2 left in stock”) to drive impulse purchases and boost sales.