In 2025, global e-commerce sales are set to exceed $4.32 trillion, with around 2.54 billion people shopping online. At the same time, quick commerce is booming: the global market is expected to reach $195 billion by year-end, with 600 million users already in 2024.

Most brands in the e-retail space now face a pivotal question: Should you prioritize near-instant delivery or a wide product selection with economical shipping? This question of quick commerce vs. traditional e-commerce defines the strategic divide between these models.

In this blog, we will discuss what quick commerce is, how it differs from traditional e-commerce, and how brands can optimize product visibility, pricing, and content on each platform using data-backed insights.

What Is Quick Commerce?

Quick commerce (Q-commerce) focuses on ultra-fast delivery for small, everyday essentials. It promises near-instant gratification, allowing customers to order items such as snacks, groceries, or medicines and receive them typically within under an hour (often in as little as 15–30 minutes).

What Is Traditional E-Commerce?

Traditional e-commerce is characterized by extensive product catalogs, nationwide (or global) reach, and delivery windows that range from next-day to several days. Retailers like Amazon or online marketplaces list thousands or even millions of products, often leveraging centralized warehouses and distribution centers.

Quick Commerce vs. Traditional E-Commerce: Key Differences

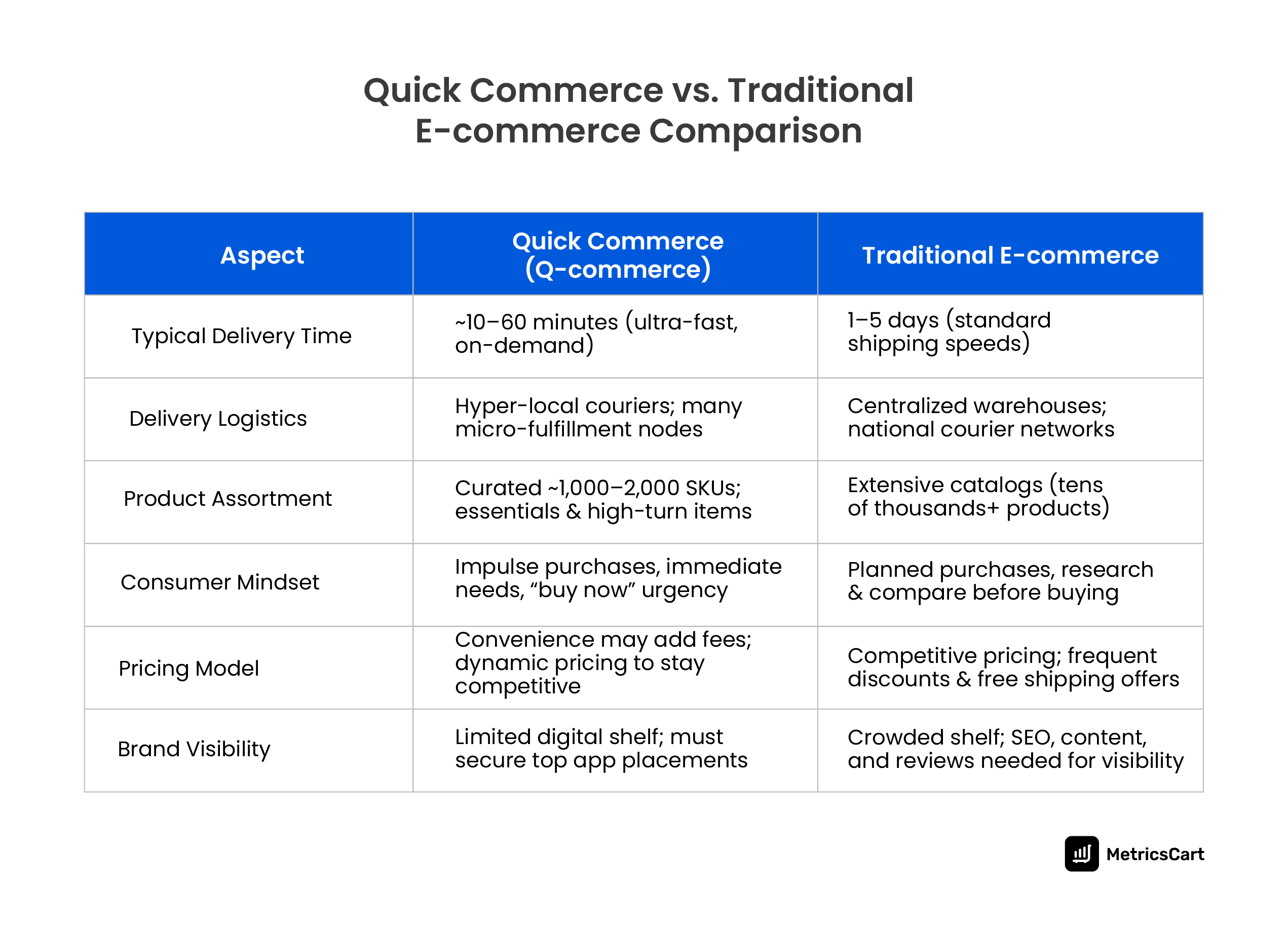

Both quick commerce and traditional e-commerce share the same end goal – serving customers through digital channels – but they operate on vastly different strategies and logistics. Below, we break down the key differences between quick commerce and traditional e-commerce across several dimensions that matter to brands.

Speed and Delivery Logistics

Speed is the hallmark of quick commerce. Q-commerce platforms promise delivery in 10–60 minutes, made possible by dense networks of local couriers and dark stores. The focus is on the last mile: riders or drivers serve a small radius to maximize speed and hit those 15-to-30-minute targets.

In contrast, traditional e-commerce offers relatively slower delivery, usually 1–5 day shipping cycles for standard orders. Large e-commerce operations ship from regional fulfillment centers, optimizing routes for cost and coverage rather than breakneck speed.

For a brand, this difference means that quick commerce can be ideal for urgent, time-sensitive products, such as over-the-counter (OTC) medicines or fresh groceries. In contrast, traditional e-commerce handles broader distribution where immediate delivery isn’t critical.

Quick commerce’s delivery logistics are all about hyper-local accuracy and agility (small, agile fleets making short trips). At the same time, traditional e-commerce emphasizes scale and efficiency, utilizing national carriers to send packages over longer distances.

Product Range and Inventory Strategy

The product assortment in quick commerce is deliberately narrow and curated. Q-commerce retailers typically stock a compact SKU selection of high-turnover items in each dark store. The inventory is localized and tailored to each neighborhood’s demand.

These micro-fulfillment nodes require tight, real-time inventory management; stock is updated continuously and replenished multiple times a day to avoid running out of popular items.

In contrast, traditional e-commerce carries a broad catalog. A central e-commerce warehouse might hold everything from niche electronics to seasonal apparel, often containing thousands or millions of products that serve a wide geography. Inventory is managed in bulk, with periodic restocking from suppliers, and slight delays in syncing stock levels are acceptable.

For brands, this means that getting onto a quick commerce platform often requires being in the top tier of your category (a “must-have” product) due to limited digital shelf space. Meanwhile, on traditional e-commerce sites, almost any product can be listed, but it competes in a much larger pool.

Consumer Behavior and Purchase Journey

Consumer behavior differs markedly between the two channels. On quick commerce apps, shopping is often impulse-driven and need-based. There is minimal browsing and comparison; purchases tend to be small baskets, spur-of-the-moment decisions. In fact, according to Yashida Shah,

This indicates how Q-commerce encourages “buy now, think later” behavior through convenience and app-based prompts.

On the other hand, traditional e-commerce involves a more deliberate purchase journey. Consumers often research products on sites, read reviews, compare prices, and consider alternatives before clicking “Add to Cart.” They might accumulate a larger basket of items to maximize a single delivery.

In other words, e-commerce shoppers plan more and take more time, whereas Q-commerce shoppers act on immediate needs or wants.

For brands, this means that marketing tactics should differ: quick commerce presents an opportunity to capture incremental sales through timely offers, while traditional e-commerce requires rich content, reviews, and competitive pricing to win the comparison-shopping process.

Pricing and Promotions

The pricing models and promotional tactics in quick commerce can diverge from traditional e-commerce norms. Historically, many quick commerce players charged a premium (about 10–15% higher prices) for the convenience of instant delivery. Small basket orders and high delivery costs meant consumers paid a bit extra, or a delivery fee, for the service.

However, as competition intensifies, Q-commerce platforms have begun aligning their prices with those of traditional e-commerce retailers. Quick commerce apps often still impose minimum order values or delivery fees to protect margins. Still, they may run aggressive promotions on specific items to drive impulse buys.

E-commerce, in contrast, has accustomed consumers to frequent discounts, sales events, and free shipping offers. Moreover, brands participate in major promotional events (such as Cyber Monday or Prime Day) or offer bundle deals online.

Real-time pricing intelligence tools enable brands to adjust prices on both platforms to remain competitive. In short, quick commerce requires a more flexible pricing strategy while traditional e-commerce relies on economies of scale and planned promotions to drive volume.

Brand Visibility and Shelf Space

Despite being digital, shelf space works very differently in quick commerce vs. e-commerce. Quick commerce platforms have a limited digital shelf, as they offer a narrower range of products, and each item’s visibility to shoppers is crucial.

For example, on a Q-commerce app, the interface might show only a handful of options for “milk” or “chips.” This means if your brand isn’t one of the top 2–3 results for that query, it might as well be invisible.

In traditional e-commerce, the digital shelf is theoretically endless, but competition is fierce. A product listing on a large marketplace sits among countless others, so brands must invest in SEO, strong product content, images, and customer reviews to rank high in search results.

The challenge in traditional e-commerce is standing out in a crowded field (through keywords, ratings, etc.). In contrast, in quick commerce, it’s about being present in a tightly curated field.

Both require careful digital shelf management. For e-commerce, this might mean optimizing your Amazon product detail page; for quick commerce, it might involve coordinating with the platform to get your new product listed in all relevant local warehouses and possibly featured in a “suggested items” carousel.

Final Thoughts

Quick commerce vs. e-commerce is not about choosing one over the other, but about aligning each channel to your business goals. Brands should evaluate their product mix and customer needs; for example, a CPG brand might use quick commerce to launch new snack products with immediate trial and utilize traditional e-commerce for bulk packs or long-tail items.

The two models can complement each other; many successful companies employ an omnichannel approach where quick commerce handles the “need it now” situations and e-commerce handles the “plan and stock up” purchases.

This is where MetricsCart helps. We offer a digital shelf analytics tool designed for e-commerce teams, as well as a dedicated quick commerce intelligence software tailored to Q-commerce teams.

For traditional e-commerce, our tool tracks your brand’s search rank, pricing, availability, and content accuracy across marketplaces like Amazon, Target, Walmart, and more. You can identify where you’re losing visibility, which listings need updates, and what’s affecting conversion.

For Q-commerce, we provide quick commerce dashboards designed for platforms like Zepto, Blinkit, Instamart, and others. We monitor SKU availability by location, real-time pricing, and local promotions, helping you resolve out-of-stock issues quickly, maintain compliance, and enhance your visibility on these fast-moving platforms.

In short, MetricsCart gives brand, trade, and content teams the data they need to stay in control across both quick commerce and traditional e-commerce channels.

Want to know how your brand ranks across Q-commerce and e-commerce platforms?

FAQs

Quick commerce refers to ultra-fast online retail services that deliver products within about an hour or less, focusing on immediate needs and small orders. Traditional e-commerce is the standard online shopping model with extensive product ranges and delivery in days rather than minutes.

Traditional e-commerce focuses on wide product variety and delivers in 1–5 days. Quick commerce offers a limited selection of products but delivers them almost instantly.

It depends on the brand’s goals and product category. Quick commerce is better suited for products that are often purchased on impulse or needed at short notice. Traditional e-commerce is better for broader reach and research-based purchases – it’s ideal for selling a wide range of products where customers compare options (e.g. electronics or fashion).

In traditional e-commerce, strategy often centers on optimization: optimizing product listings for search, managing longer-term promotions (like holiday sales), and ensuring efficient fulfillment from central warehouses. In Q-commerce, strategy focuses on speed and local optimization, ensuring your product is stocked in all dark stores. This involves utilizing real-time pricing or promotions to capitalize on impulse buys and monitoring hyper-local demand trends.

They can be, but the gap is closing. Originally, quick commerce providers often charged slightly higher prices or added delivery fees to cover the cost of fast fulfillment. Now, as competition intensifies, many quick commerce platforms have begun offering price parity with traditional e-commerce on many items, relying instead on small fees or subscriptions.