You just sat down with your laptop and logged into a Zoom call. Bam! You realize you’re out of coffee. Or maybe it’s your child’s school project due tomorrow, and you forgot the chart paper. Perhaps it’s your friend’s birthday and you haven’t picked a gift yet. These last-minute scrambles used to send us running to the nearest store, or worse, left us scrambling for alternatives.

Not anymore.

Welcome to the world of quick commerce in India, where a few taps on your phone can solve a crisis before it even becomes one.

Whether you’re in Mumbai, Bengaluru, or Delhi, groceries, snacks, gifts, stationery, and even beauty products can now reach your doorstep faster than your food order. It’s instant gratification at its finest, and it’s reshaping how urban India shops.

The online grocery segment alone witnessed an 80% growth in 2020, reaching USD 2.66 billion. This growing demand, coupled with evolving lifestyles and the desire for convenience, has paved the way for ultra-fast delivery models promising fulfillment within 10 to 30 minutes.

It’s a full-blown revolution sweeping through India’s e-commerce corridors, led by platforms like Blinkit, Zepto, Swiggy Instamart, and BigBasket Now.

And for brands looking to stay competitive in this space, data is everything.

That’s where MetricsCart steps in. Whether you’re tracking SKU performance, optimizing AOV, or refining your packaging strategy for dark stores, MetricsCart provides real-time, actionable insights tailored for brands in the quick commerce ecosystem.

READ MORE | Want to know about the major quick commerce players in India? Check out our blog on Speedy Deliveries: Top Quick Commerce Players in India.

Some Major Pointers for Quick Commerce Rise in India

The quick commerce sector is poised for explosive growth, with projections estimating a jump to USD 5.5 billion by 2025, a staggering 15x increase. Quick commerce is also expected to command 40–50% of India’s online grocery market in the near future, up from 10% currently.

Here are some of the main reasons for the rise of q-commerce in India:

The New Urban Workforce

India’s workforce has evolved. Many professionals in metro and tier one cities are adopting hybrid or full-time work-from-home setups, and consumer behavior has taken a sharp turn toward convenience.

Being closer to home means:

- Increased dependency on quick deliveries for everyday needs.

- Last-minute shopping is becoming more common.

- More impulse orders during work breaks or after hours.

Quick commerce is stepping in as the go-to solution for these hyperlocal, instant needs.

Impulse Buys, Essentials, and Everything in Between

Whether it’s a sudden craving for chocolate, an urgent need for detergent, or a spontaneous decision to order beauty supplies, q-commerce makes impulse shopping effortless.

Interestingly, many purchases, especially in urban India, are unplanned. Almost 70% of consumer spending is on top-ups or impulse buys. Quick commerce taps directly into this mindset, offering immediate fulfillment and reducing the hassle of store visits.

READ MORE | Interested in knowing more about impulse buying? Check out our blog on Decoding Impulse Buying Behavior In E-Commerce: How Retailers Can Incentivize.

Gifts, Games, and Gratitude—On-Demand

Life moves fast, and so do birthdays, anniversaries, and school events. Whether it’s a toy for a child, a quick thank-you gift for a neighbor, or a last-minute festive item, q-commerce platforms are redefining the way we show up for each other.

By offering curated gifting sections and even seasonal SKUs, these platforms make surprise gestures easier than ever.

You can check out the full podcast episode with Yashita Shah here:

Back-to-School Essentials Made Easy

Parents often find themselves in a fix when school supplies run out unexpectedly. From notebooks and pens to chart paper and geometry boxes, q-commerce platforms are stocking up on everything related to kids and school.

These additions not only cater to urgent needs but also help platforms increase cart size and customer retention.

The ₹500 Sweet Spot: Driving Profitability Through AOV

To run a sustainable business model, q-commerce relies heavily on boosting the Average Order Value (AOV). Shah quotes, “Many of these platforms have started delisting products below ₹150 – ₹200 until unless it doesn’t makes sense for them in terms of the volume.”

AOVs of ₹500 or more are considered healthy for operational viability. To achieve this, platforms are:

- Cross-selling complementary items.

- Using smart recommendations.

- Offering bundled deals and discounts.

This data-driven curation ensures customers spend more, without realizing it.

Smart Listings: SKU Curation for Better Margins

Unlike supermarkets with endless aisles, dark stores operate with limited space. Every product listed must pull its weight. That’s why SKUs are:

- Carefully selected based on local demand.

- Positioned to complement other frequently bought items.

- Regularly rotated to maintain freshness and relevance.

This tight curation not only optimizes space but also maximizes profitability.

Packaging That Works for Speed and Scale

According to Yashita Shah, packaging strategy is also undergoing adaptive changes in q-commerce. It isn’t just about aesthetics anymore; it’s a core part of the q-commerce ecosystem. Brands are adapting their product packaging to suit:

- Shelf-efficiency in compact dark stores.

- Durability for high-speed last-mile deliveries.

- Barcode visibility for rapid scanning and fulfillment.

Think of it as packaging designed for speed and performance, not just the customer’s eye.

Quick Commerce Trends in India

What began primarily as a grocery and daily essentials delivery model has rapidly morphed into a full-fledged retail channel. Quick commerce platforms in India have significantly broadened their product categories, moving well beyond staples like fruits, vegetables, dairy, and FMCG items.

Today, consumers can order an impressive variety of products, including cosmetics, wellness items, electronics, home décor, personal care products, kitchen gadgets, and even gold during festive times like Akshaya Tritiya; all delivered in under 30 minutes.

This shift is no accident. With millennials and Gen Z driving the bulk of demand, particularly in cities like Bengaluru, Delhi NCR, and Mumbai, there’s a growing appetite for fast, anytime access to everything from grooming kits and Bluetooth speakers to skincare serums and fitness gear.

Moreover, Direct-to-Consumer (D2C) brands are increasingly eyeing q-commerce platforms as strategic partners to reach their urban, time-starved customer base. The speed and visibility these platforms offer allow D2C players to test SKUs and push impulse purchases with minimal logistical friction.

Platforms like Blinkit, Zepto, and Swiggy Instamart now dedicate specific in-app sections to trending electronics, curated fashion, seasonal gifting, and occasion-specific combos.

This level of diversification not only increases Average Order Value (AOV) but also helps build customer stickiness by making the platform a one-stop shop for both planned and spontaneous needs.

READ MORE | How does Zepto’s quick commerce model operate? Check out our blog Inside Zepto’s Business Model: Breaking Down India’s Fastest Growing Quick Commerce Brand.

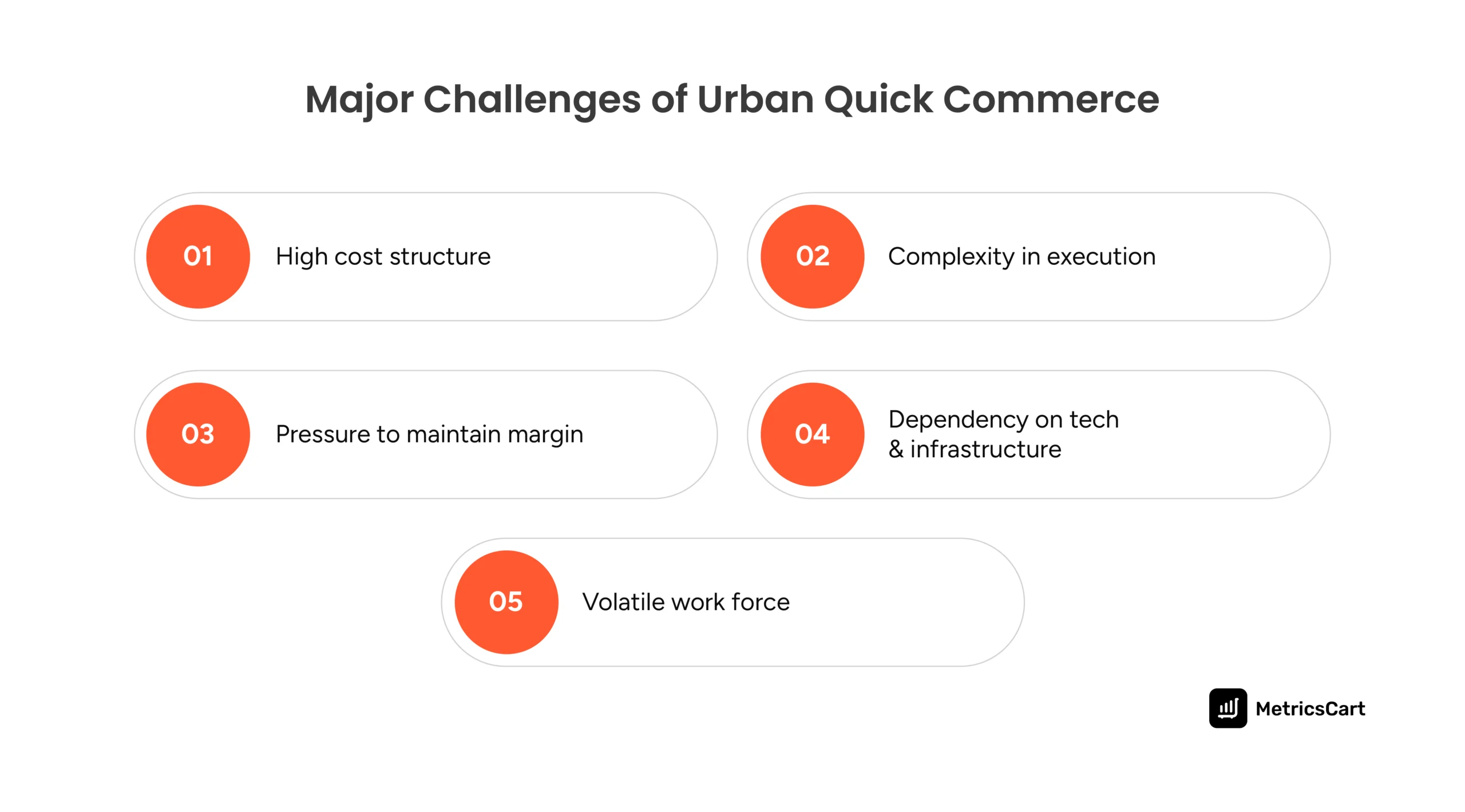

The Operational and Economic Challenges of Quick Commerce

While q-commerce might look like magic to customers, the backend is anything but. Here are some of the key challenges platforms face:

High Cost Structure

The capital-intensive model includes setting up dark stores, 24/7 operations, and gig worker payouts. Even with scale, delivery remains the single most significant driver of income.

Execution Complexity

This is retail with a stopwatch. Every element from sourcing and inventory to logistics needs to work in perfect sync. A single delay can ripple through the entire chain.

Margin Pressure

Despite rising AOVs, profitability remains elusive for many. Platforms depend on brand ads, delivery fees, and data-backed upselling. But even then, they tread on a fine line.

Tech and Infrastructure Dependency

Real-time demand forecasting, route optimization, and inventory checks are crucial. Tech hiccups can lead to missed deliveries, stockouts, and unhappy customers.

Workforce Volatility

Gig workers are the lifeblood of q-commerce, but their availability, retention, and satisfaction are ever-shifting variables.

Yet, for all its hurdles, q-commerce is proving that smart execution and relentless innovation can transform even the most challenging models into scalable success stories.

READ MORE | Interested in knowing how Blinkit’s quick commerce operates? Check out our blog on How Blinkit Works: Understanding Its Business and Delivery Model.

Conclusion

Quick commerce isn’t just a new shopping method, it’s become a lifeline for busy parents, work-from-home professionals, late-night snackers, and anyone juggling a million tasks in a day.

Yes, the road behind the scenes is anything but smooth. From complex logistics to rising delivery costs, the challenges are real. However, so is the determination of platforms like Zepto, Blinkit, and Instamart to get it right.

The future of quick commerce in India lies in its ability to blend speed, convenience, and personalized experiences for the modern consumer.

To meet these sky-high expectations, businesses must use quick commerce intelligence solutions like MetricsCart, which offer real-time insights and advanced analytics. In a hyper-competitive space, it’s not just about delivering fast; it’s about thinking faster.

Ready To Scale Your Brand and Drive Results? Unlock Your Quick Commerce Potential Today!

FAQs

Beyond groceries and daily essentials, quick commerce platforms now offer a wide array of categories including personal care, OTC medicines, pet supplies, home decor, electronics, cosmetics, and D2C lifestyle products. This diversification helps increase average order value (AOV) and customer retention.

Packaging for q-commerce should be compact, durable, and optimized for fast scanning in dark stores. Brands should focus on delivery-resilient designs, easy-to-read barcodes, and shelf-efficient packaging to streamline operations and minimize damage during transit.

Advanced analytics helps platforms track real-time demand, regional trends, and consumer behavior to curate the most profitable and relevant SKUs. Brands can use insights to optimize inventory, forecast demand, and improve product visibility in dark stores.

Key technologies include AI-driven demand forecasting, route optimization software, real-time inventory management, and warehouse automation tools. These innovations ensure ultra-fast delivery timelines and minimal stockouts.

Government initiatives like Digital India, UPI integration, ONDC, and 100% FDI for B2B e-commerce are creating a favorable environment for quick commerce. These policies help expand digital reach, simplify payments, and promote inclusive participation.