Let’s face it—the way people buy groceries has changed forever. With grocery e-commerce sales projected to hit a jaw-dropping $120 billion annually by 2028, grocery shopping is going digital faster than anyone imagined.

Think about it—12.7% of all grocery sales in the U.S. will be online. That’s no small slice of the pie; it’s the future of how people shop for their daily essentials.

The real question is, are you ready to embrace the trends driving this transformation? From voice commerce to sustainable solutions, the innovations reshaping this industry are massive.

This article unpacks the grocery e-commerce technology trends shaping 2026 and shows how an advanced digital shelf analytics tool will help you stay miles ahead of it.

Digital Grocery Ecosystem

The digitalization of grocery shopping has accelerated, with online platforms becoming integral to consumers’ purchasing habits. It has become a necessity for consumer packaged goods (CPG) brands and retailers to reach customers and meet business goals.

Types of Digital Grocery Business Models

The digital grocery sector operates mainly through two business models: delivery and click and collect.

Delivery Model

Grocery delivery involves sending commonly purchased products—such as food, beverages, pet supplies, cleaning products, and personal care items—from grocery stores directly to customers’ homes. In this model, retailers either manage their own deliveries or use third-party platforms for order processing and last-mile delivery.

Click-And-Collect Model

Click and collect is a digital grocery method where a customer shops online and picks up the order at a store, be it curbside, in-store, or from a locker or pickup hub. Many retailers such as Walmart, Target, The Kroger Co., and Albertsons Companies use this approach to complete their grocery orders.

Trends Shaping the Grocery E-Commerce Landscape

The grocery e-commerce in 2026 is characterized by technological advancements and shifting consumer expectations. Embracing these trends is essential for retailers aiming to remain competitive and meet the evolving demands of their customers.

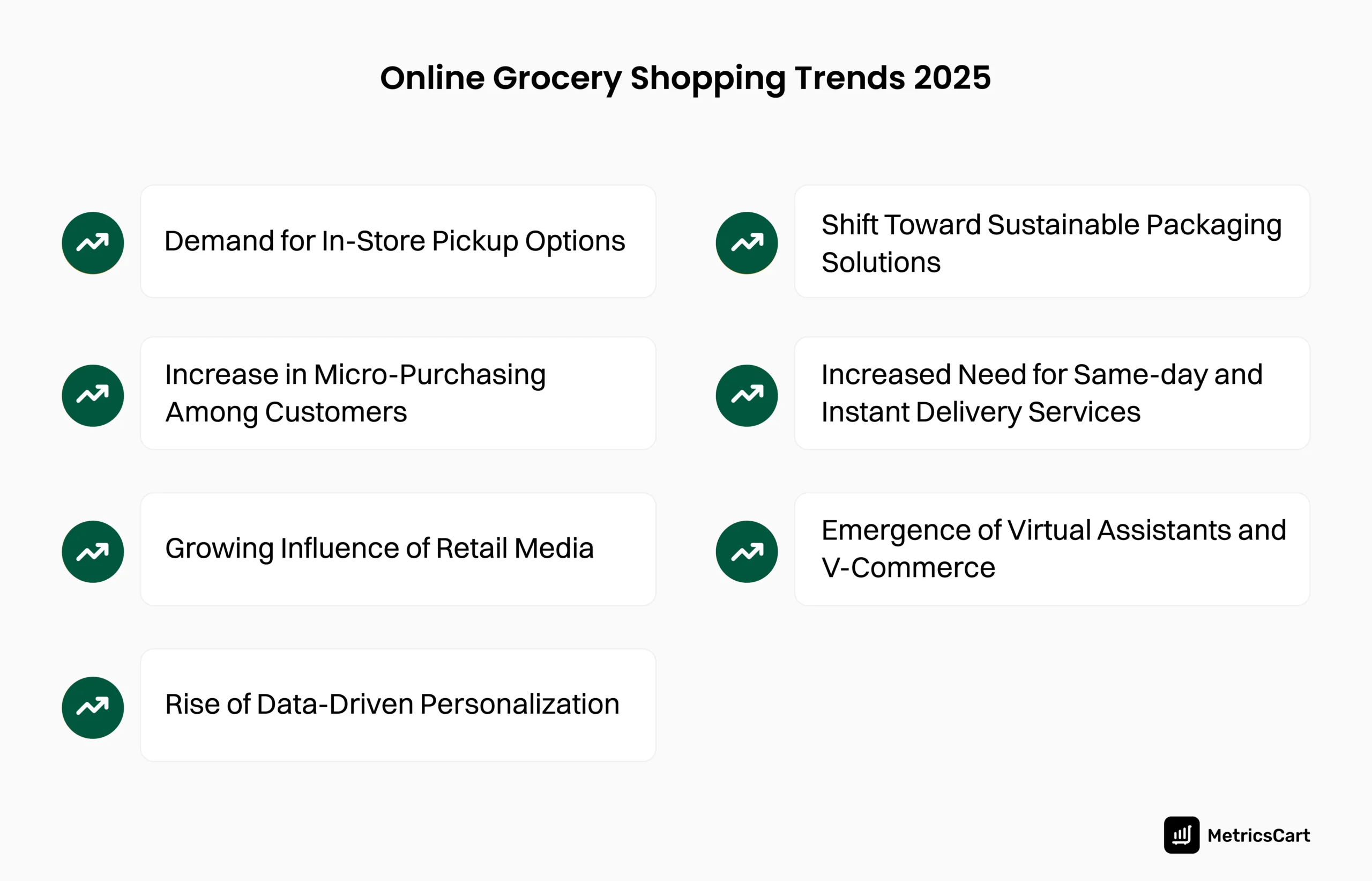

Demand for In-Store Pickup Options

In-store pickup, also known as buy online, pick up in-store (BOPIS), has become a vital part of the hybrid shopping experience, offering consumers the convenience of online shopping without delivery wait times.

According to a January 2024 eMarketer forecast, the preference for in-store pickup among US click-and-collect buyers is projected to reach 67.0% by 2027. The demand for in-store pickup is offering a win-win scenario for consumers and retailers alike.

In-store pickup eliminates the uncertainty of delivery windows and helps customers avoid delivery fees. Customers can also pick up the orders at their convenience, often the same day they make the purchase online.

In addition, in-store pickup helps retailers reduce the logistical and financial burdens associated with last-mile delivery, which is often an expensive part of the supply chain. Since it integrates online and offline operations, in-store pickup creates a cohesive shopping experience, thereby increasing brand loyalty.

Increase in Micro-Purchasing Among Customers

The concept of impulse buying has long been associated with brick-and-mortar stores, but the rise of micro-purchasing is transforming this phenomenon in the digital age.

Micro-purchasing moments are tied to a variety of specific occasions that encourage quick, decisive buying. These include gifting, seasonal events, shopping holidays, social events, etc. With consumers increasingly relying on mobile devices to make quick purchasing decisions, brands and retailers have a unique opportunity to capitalize on these moments.

Brands and e-commerce platforms can use targeted media campaigns and sponsored searches to ensure that your products appear at the top of results during high-intent searches, such as “quick Valentine’s Day gift” or “easy picnic recipes.” This will help brands build awareness, drive conversions, and foster loyalty.

Growing Influence of Retail Media

Retail media is transforming the way grocery e-commerce operates, revolutionizing how products are marketed to consumers. As digital grocery shopping becomes a norm, retail media helps drive sales by integrating advertising directly into the online shopping experience.

Unlike traditional ads, retail media creates a seamless path from discovery to purchase. This is relevant as social commerce gains momentum. By combining shoppable social media content with personalized advertising, online grocery stores can connect with customers more easily.

With technologies like AI and machine learning, e-commerce platforms can analyze a shopper’s behavior, preferences, and demographics to serve tailored recommendations. This doesn’t just improve the shopping experience; it increases engagement, conversion rates, and customer satisfaction.

Rise of Data-Driven Personalization

In 2026, personalized shopping experiences will be at the forefront of grocery e-commerce. A survey conducted by Sapio Research found that consumers find recommendations based on their past actions, preferences shared with the brand, and location-based offers to be the most useful.

In the second episode of the Digital Shelf Insider Podcast, we sat down with Jennifer Alexander to learn about the importance of personalization, consumer choice, and leveraging tools like ratings and reviews to optimize strategies. You can listen to the full episode at:

Using data from past purchases, browsing history, and stated preferences, grocery platforms can suggest products tailored to individual needs. In addition, they can offer combo offers, discounts, and advertisements to users based on their shopping habits.

This increases the conversion rates and average order value because tailored product bundles and upselling strategies encourage larger purchases.

Shift Toward Sustainable Packaging Solutions

Environmental concerns are currently at the forefront of customer consciousness; as a result, sustainability has evolved from a differentiator to an expectation. Thus, companies are replacing traditional plastic-based packaging with alternatives like paper, compostable materials, etc.

For instance, Amazon Fresh and Walmart Grocery have switched to 100% recyclable paper bags for delivery orders. These materials reduce plastic waste and can be reprocessed into new products.

Apart from this, innovative solutions such as packaging made from seaweed and plant extracts that can be eaten or biodegraded naturally will become a norm in 2026. Moreover, water-soluble packaging that dissolves in water will be used in single-use packaging for food and detergents.

As eco-conscious shoppers continue to grow, companies that embrace sustainability have a better chance of increasing customer loyalty and driving revenue.

READ MORE | Interested in Climate Pledge Friendly Brands on Amazon? Check out Digital Shelf Insights: Best Performing Climate Pledge Friendly Brands on Amazon

Increased Need for Same-Day and Instant Delivery Services

With the growing demand for speed and convenience, grocery retailers need to implement ultra-fast delivery options, often fulfilled within hours of an order. With micro-fulfillment centers strategically located in urban areas, a brand can ensure ultra-fast deliveries, reducing the wait time to mere hours.

Moreover, in 2026, autonomous delivery systems, including drones and self-driving vehicles, are expected to revolutionize last-mile delivery. These technologies promise faster, more cost-effective logistics while reducing reliance on human labor.

Emergence of Virtual Assistants and V-Commerce

Voice assistants like Amazon Alexa, Google Assistant, and Apple Siri are integrated into everyday consumer activities, including grocery shopping. These AI-powered voice assistants enable users to interact with devices using simple voice commands, making the shopping experience more hands-free and efficient.

For example, consumers can ask Alexa to add items to their cart, check the price of groceries, or even reorder items they’ve previously purchased from Whole Foods or Amazon Fresh. If a customer says, “Alexa, add organic bananas to my cart,” the item will be added instantly and ready for checkout.

By leveraging V-commerce, sellers can offer tailored product recommendations, provide personalized pricing, and facilitate quicker purchasing decisions.

Conclusion

Grocery shopping is changing, and technology is leading the charge. In fact, 12.7% of all grocery sales in the U.S. will be online.

“The future of grocery buying is increasingly omnichannel. In-store is still the dominant channel, but the rise of digital is influencing shopping trends in several major product categories.”

– Blake Droesch, Senior Analyst, EMARKETER.

By embracing the trends mentioned above, retailers can meet evolving consumer expectations and thrive in a competitive market. As these trends continue to grow, sellers who adapt early with solutions like MetricsCart will position themselves as leaders in the increasingly tech-driven grocery marketplace in 2026 and beyond.

Drive your Grocery Sales with Real-Time Insights.

FAQs

Grocery e-commerce refers to the online purchase and delivery of groceries and household essentials through digital platforms or apps. It provides consumers with the convenience of shopping from home and choosing delivery or pickup options.

While grocery e-commerce can be profitable, it faces challenges like high delivery costs and thin margins, making scalability essential. Companies focusing on innovations like micro-fulfillment centers and subscription models are improving profitability in the long term.

Key trends include AI-driven personalization, demand for in-store pickup options, sustainable packaging solutions, same-day delivery services, and the rise of voice commerce.

Virtual assistants enable hands-free shopping experiences, allowing consumers to make purchases through voice commands, thereby integrating shopping into daily routines seamlessly.

Sustainable packaging influences consumer decisions, as environmentally conscious shoppers prefer brands that adopt eco-friendly materials, impacting brand loyalty and purchasing behavior.