Brands offering economy pricing earn profit through economies of scale and with a product mix of high-margin and low-margin products.

According to Adobe Analytics, holiday season spending reached $12.4 billion in 2023. This accounted for 9.6% year-over-year growth. From an economic perspective, consumers look forward to spending big during promotional events and holidays.

However, shoppers still feel the pain of rising prices. To cater to the needs of price-conscious consumers, retailers use economy pricing – a volume-based pricing strategy.

The cost of goods sold is low to appeal to a large customer base. This pricing strategy is commonly used on private labels and no-name goods on the physical and digital shelves.

What is an Economy Pricing Strategy?

Economy pricing is a type of competitive pricing strategy where brands set lower product prices by reducing production costs to

- Attract price-sensitive consumers

- Undercut the competition

In this pricing strategy, brands tend to position their products as a cheaper alternative to competitors. It makes shoppers feel like they are getting a deal price for the product.

Read more: Popular E-commerce Pricing Strategies

How Economy Pricing Works?

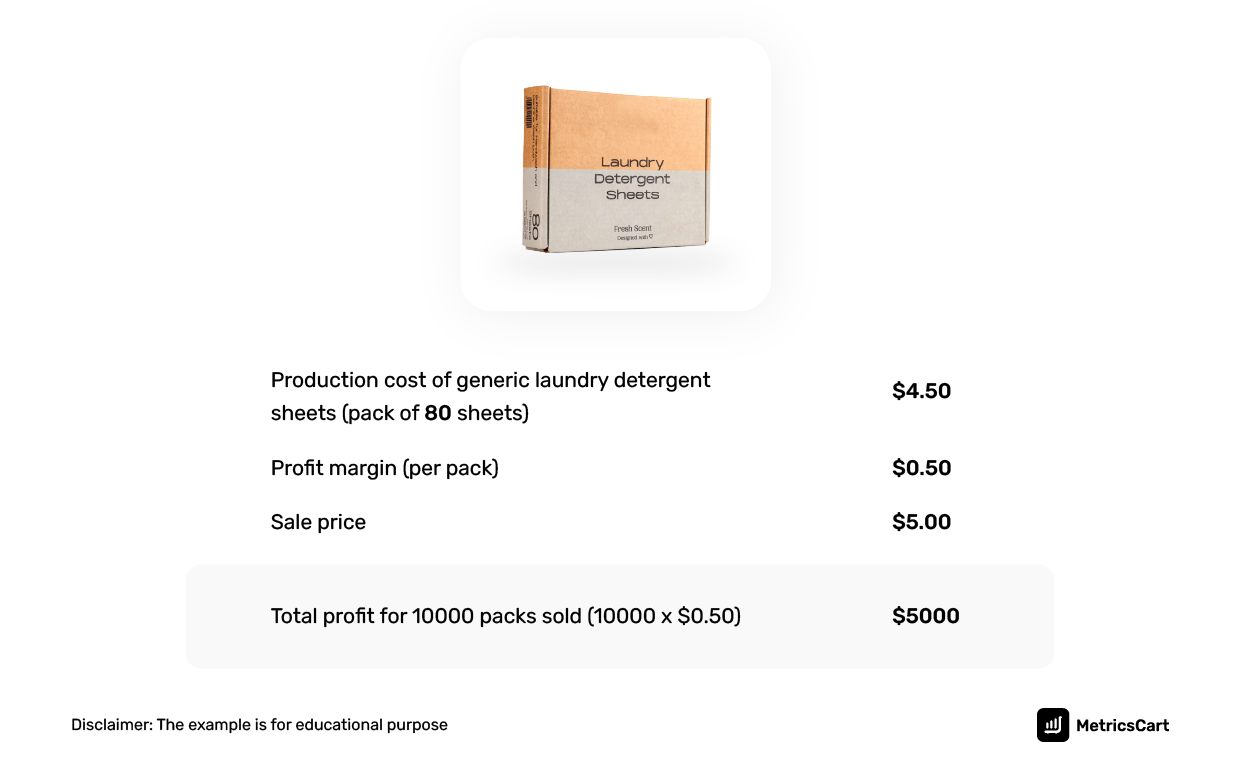

Brands implement this strategy by keeping the production cost as low as possible. In this case, the brands earn profit through economies of scale.

The economy pricing strategy is effective if:

- The brand can consistently appeal to price-sensitive customers

- The brand belongs to a category that is constantly in demand such as CPGs, apparel, home decor, medicines, etc.

- Existing companies introduce a new “budget” range and rely on established demand

Brands implementing economy pricing scrutinize the production costs, marketing budgets, logistics, and any other cost associated with the product to keep the sales price low.

Read more on Everyday Low Pricing Decoded

Economy Pricing vs. Penetration Pricing: What is the Difference?

Both strategies aim at achieving higher sales volume by relying on low prices.

The difference is that economic pricing is a long-term strategy. The brands earn profit by keeping the production costs lower.

On the other hand, penetration pricing is a short-term strategy to increase market share. Once the brands achieve the expected results, the product prices are increased.

Read more on Examples of Penetration Pricing

Retailers offering Economy Pricing vs. Off-Price Retailers

Retailers implementing both strategies manufacture or source goods in huge volumes and target the masses scouting for deals. This helps them to reduce production costs, negotiate a better deal with the suppliers, and attract more footfall into the stores.

Off-price retailers offer high-quality branded merchandise at lower prices than regular retail stores. However, in contrast to economy pricing, the products sell at a discount throughout the year due to:

- End-of-season stock

- Overruns

- Closeouts

- Minor defects

- Excess inventory

TJ Maxx, Marshalls, Burlington, and Ross Dress for Less are a few examples.

On the other hand, economy pricing is associated with stores that sell a budget product line in stores along with high-margin products.

Examples of Economy Pricing

Private Labels at Big-Box Retailers

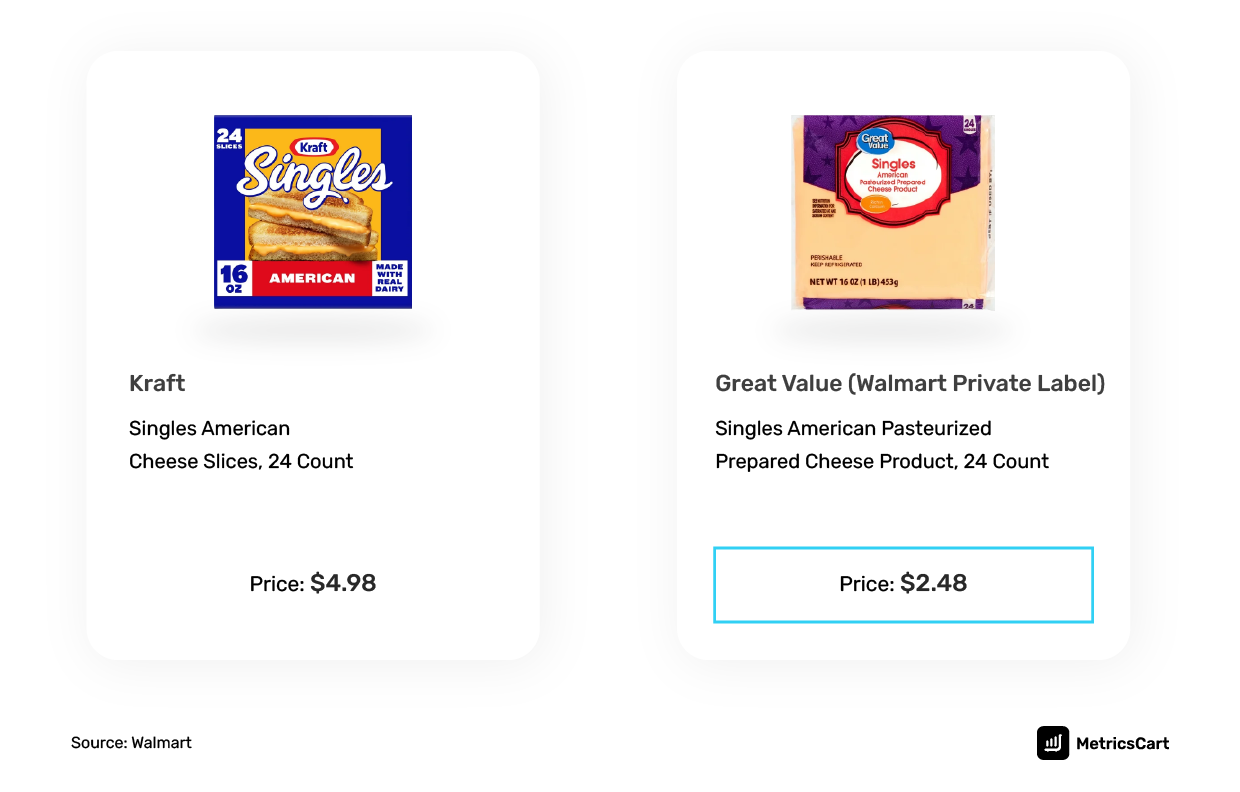

According to Kantar’s Global BrandZ Report, the presence of private labels in a category doubles the perceived price range among shoppers. This gives more room for national brands to extend the value of their offering.

Between 2021 and 2023, the high inflation rates marked a continued change in customer spending behavior.

The class of consumers who place a high premium on quality continue to buy innovative product lines of brands like P&G and Unilever despite price increases.

On the other hand, price-sensitive customers evaluate the price of all products available in a category relative to its perceived value. Often, customers trade down to less-expensive private labels or store-owned brands.

For instance, 24 pieces of Kraft cheese are priced at $4.98 whereas Walmart’s store brand Great Value is cheaper at $2.48.

Read about the Success of Walmart’s Private Labels

White Label Brands and Private Brands Sold at Supermarkets

Private label products are becoming a larger consideration when choosing a store to shop at. There are two types of private brands ie. generic private brands and premium private brands.

Economy pricing strategy is at play for the generic private brands that often sell at one-third of the price of a national brand.

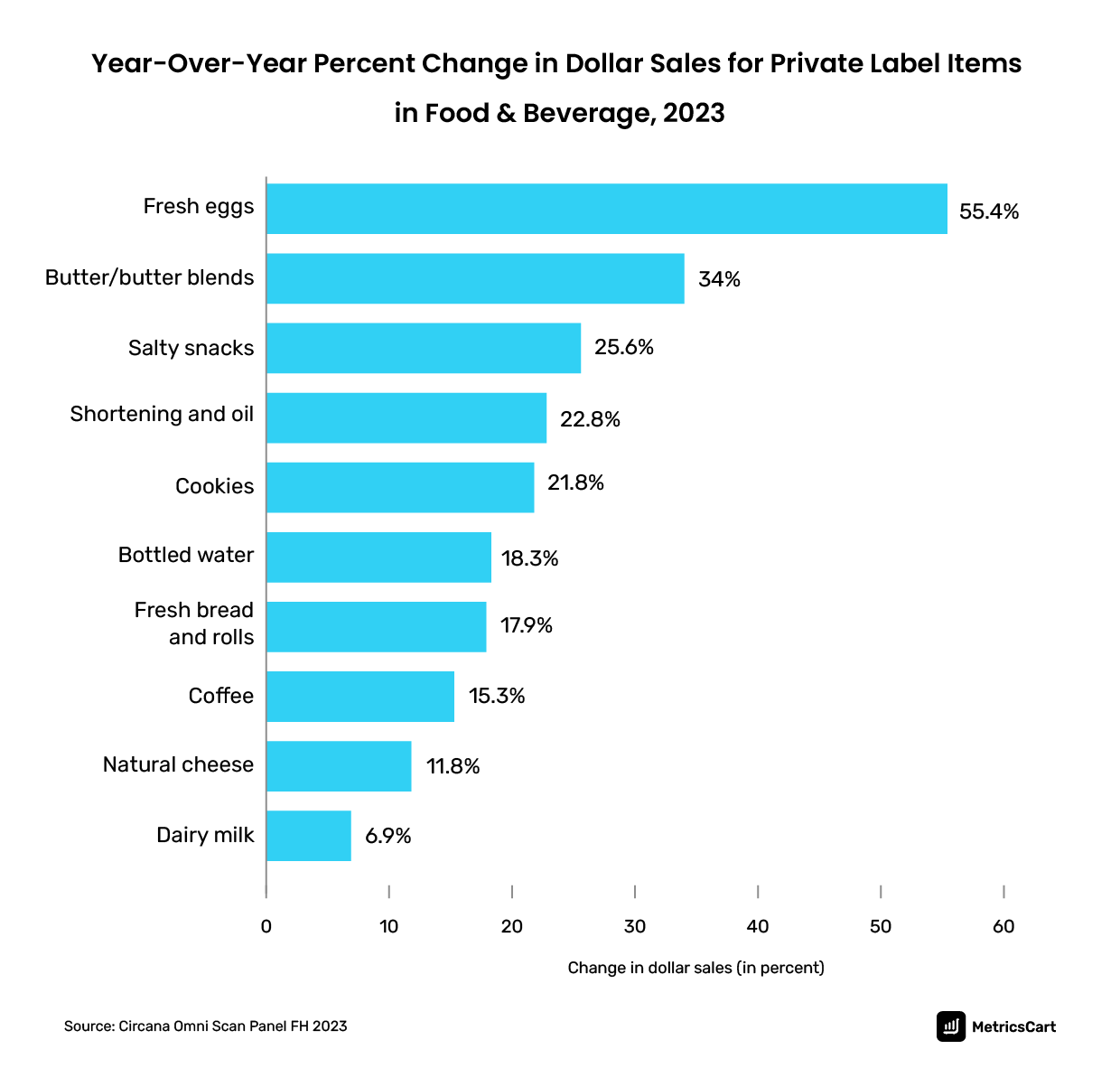

In the FMI report “Power of Private Brands 2023”, the prices of household basics such as groceries are 25% higher when compared to the years before the pandemic. To save money, nearly 40% of those respondents said they’ve begun to buy more store-brand items.

While 90% of the respondents said they are most likely to keep buying private labels even if grocery prices decline only 24% said they plan to buy no-name (white label) brands.

Taking a look at the food and beverage private label items, fresh eggs, butter, and salty snacks are the three categories with the highest sales gain. For instance, Aldi is a favorite among budget-friendly shoppers. Aldi can keep its prices cheaper than many retailers for the following reasons:

- National brands account for just 10% of the product mix. The rest are store-brand products and no-name brands (white labels)

- Aldi has just 2-3 staff at a time. They expect customers to bag their groceries themselves and wheel their carts back to the store after shopping

- Aldi stores have minimalist decoration and are open for just 11 hours to reduce operational costs

- As meat is sourced from regional farms, the company spends less on transportation

Read more on Price Anchoring Explained with Examples

Generic Drugs in Pharmacies

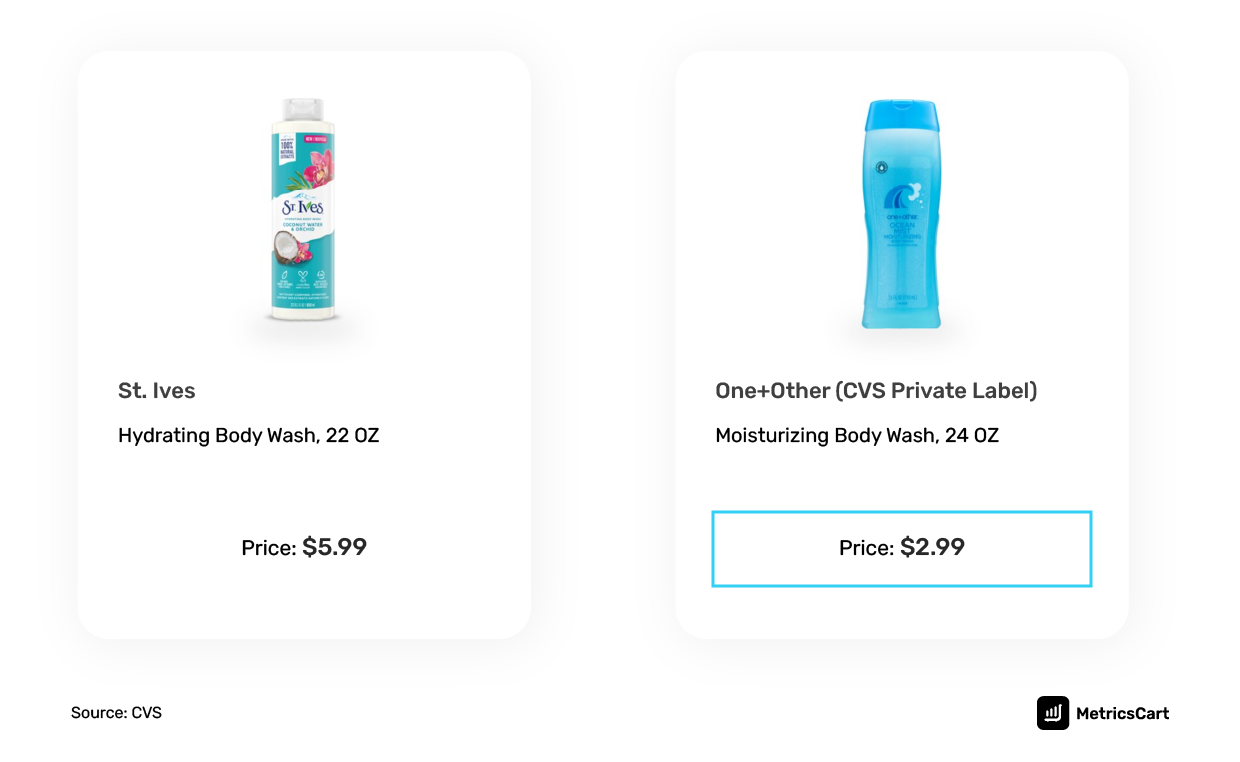

CVS Pharmacy Inc.

Customers visit CVS as they have more than medicines on their shelves. As early as 1972, CVS introduced America’s first refillable private-label shampoo. Today, their private label “One+other” includes over 200 personal care products.

Besides national brands, CVS Pharmacy offers low prices on generic drugs.

Amazon Pillpack

According to Amazon, 150 million Americans take medication every day. Pillpack by Amazon offers simple pharma solutions to customers by

- Managing on-time refills

- Making single-serve packs with the date and time of consumption

- Offering a wide selection of generic and brand medications

- Working directly with doctors and insurance companies

- Offering full-service pharmacy services 24/7

Customers can save up to 80% off on generic medications and 40% off on branded medicines when they pay without insurance. Customers can compare the difference in prescription costs for their medications with an insurance co-pay, without insurance, and with a Prime discount and choose accordingly.

Explore The Success Behind Amazon Private Labels

Brandless: A Case Where Economy Pricing Went Wrong

Brandless, a CPG company, launched its online operation in 2017 with a direct-to-consumer (DTC) model. It manufactured and sold everyday basics priced at flat $3 per item.

Although Brandless experimented with brick-and-mortar and subscription models, they were unsuccessful in attracting repeat buyers. Finally, in 2020, Brandless wrapped up its business and sold off the company.

What Went Wrong for Brandless?

According to the reports from The Drum, though they claimed to be selling generic products at a flat $3, it created a distinct identity just like a brand would do. And, speaking about the failure of Brandless, the company’s former CFO Evan Price said, “We weren’t able to compete competitively in today’s DTC market, but I’m confident the next great brands of tomorrow will be built from this experience.”

Moreover, citing a reason for Brandless’s failure, Fran Cassidy, head of the Cassidy Media Partnership, added, “Brandless products did not differentiate itself except in terms of cheap pricing which has an effect only during recessions.”

In a fiercely competitive online market, there is no room for costly mistakes. Using MetricsCart’s price monitoring services, brands can anticipate their competitors’ pricing moves and decide on pricing strategies for their products.