The statistics are stark: 85% of new CPG products fail within two years, and nearly 95% of new products don’t hit the mark. In today’s saturated market, it seems like every week a new product is launched, only to disappear without a trace.

Despite millions of dollars poured into marketing, distribution, and product development, many consumer packaged goods (CPG) brands still face a harsh reality: failure.

Let’s zoom in on why CPG brands fail. And more importantly, what can new and emerging brands do to avoid falling into the doom trap? We’ll break down common CPG brand failure reasons and highlight strategies that smart brands are using to scale in 2025.

If yours is a CPG brand that’s stumbling, keep reading to know where exactly you are going wrong and what can be done differently.

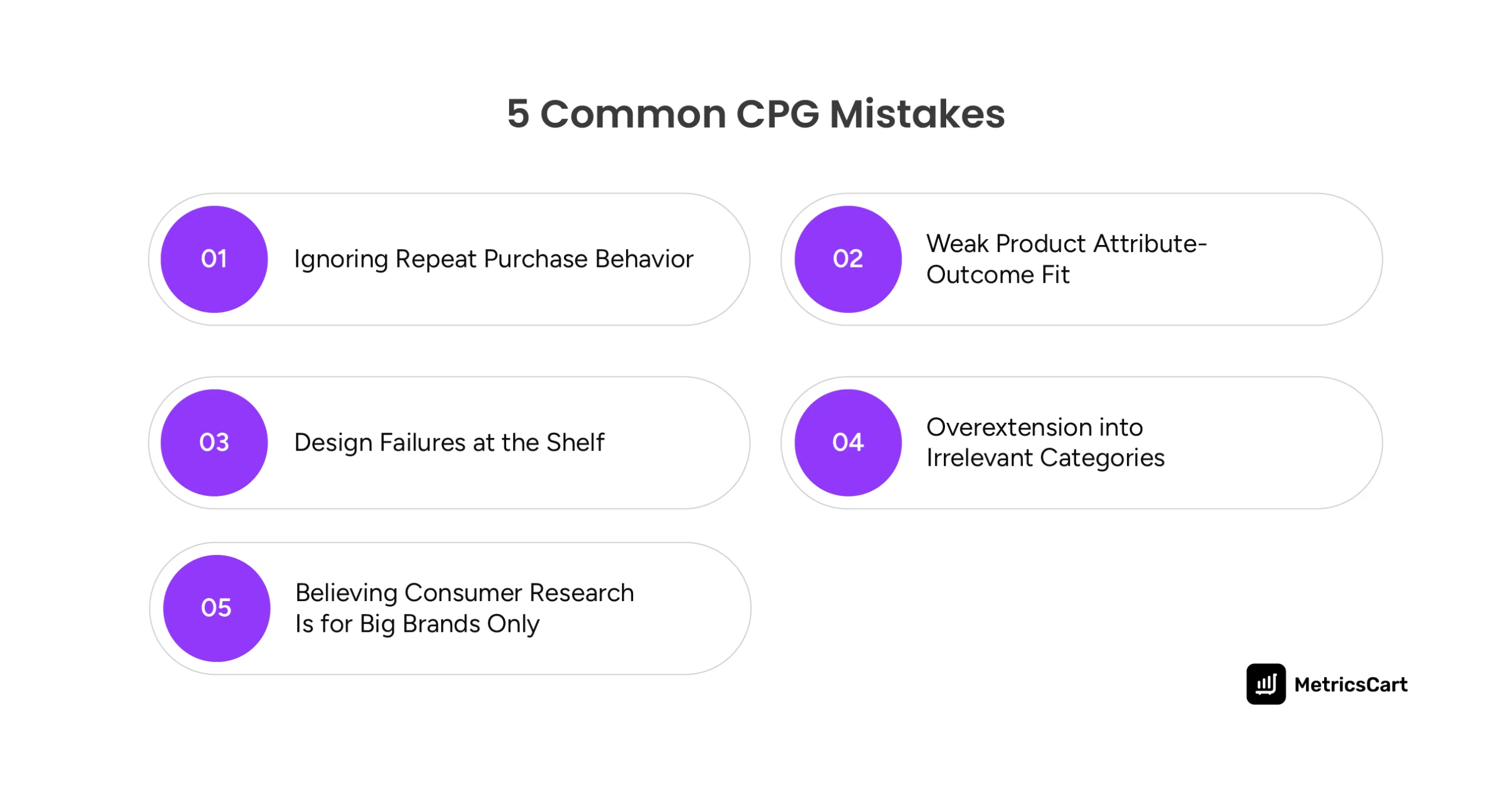

5 Common CPG Mistakes That Kill Growth

Many CPG brands sabotage their growth by repeating preventable errors. These aren’t merely missteps but crucial factors that separate the brands that scale profitably from those that flame out early.

Below are the most common patterns that lead to CPG industry failures:

1. Ignoring Repeat Purchase Behavior

One of the biggest reasons why CPG brands fail is their focus on attracting new customers while neglecting repeat business.

In our Digital Shelf Insider podcast with Dr. James Richardson, the author of Ramping Your Brand, he emphasized that you cannot scale your brand in the CPG industry without repeat purchases.

It’s easy to get caught up in the race to chase new customers and end up burning cash on customer acquisition. But in reality, repeat customers are significantly more valuable. They’re cheaper to retain, and they generate more consistent revenue.

In decoding why a repeat buyer keeps choosing your product lies the key to scaling your CPG brand. Richardson calls it the cheapest and most efficient way to grow a CPG brand.

READ MORE | Curious how shifting consumer behavior is shaping CPG e-commerce growth? Check out Consumer Behavior Shaping CPG E-Commerce Growth

2. Weak Product Attribute-Outcome Fit

A product may look great on paper, but if it doesn’t meet a real need or resonate with consumers, it’s doomed to fail.

This product attribute-outcome fit points out that too many brands release products without fully understanding whether there is genuine demand for them.

Most CPG industry failures are a result of brands not validating product-market fit before scaling. Without a solid fit between the product and the consumer’s needs, your chances of success are slim, no matter how much money you spend on marketing and distribution.

3. Design Failures at the Shelf

In the world of CPG, shelf space is premium real estate. If your product’s packaging doesn’t stand out, it may get lost among thousands of competing items.

According to Dr. Richardson, the importance of packaging and design is often underestimated. Yet, it plays a significant role in purchase decisions. Consumers make decisions quickly, and if your product isn’t eye-catching, it won’t even get a second glance.

In episode 19 of our Digital Shelf Insider Podcast, Dr. James Richardson, founder of Premium Growth Solutions and author of Ramping Your Brand, shares profound insights on how early-stage CPG brands can scale successfully. If you’re building a CPG brand or thinking of starting one, this conversation is packed with critical lessons you need to know! Listen to the full episode here:

Creating an impactful and differentiated packaging design that grabs consumer attention in-store or online is one of the key CPG brand challenges. Packaging design fails directly contribute to disintegrating brand identity and loss of shelf space.

4. Overextension into Irrelevant Categories

Overextending into unrelated categories in an attempt to diversify is among the often-seen CPG brand failure reasons. Most CPG brands rush to diversify and stretch their brands into categories that are irrelevant to their product. This ultimately dilutes their core offering.

While in the initial stages of growing your brand, this velocity trap, as Dr. Richardson calls it, may be tempting, but expanding into irrelevant categories can confuse customers and weaken your brand’s identity.

Dr. Richardson highlights that one of the CPG brand challenges is keeping focus on a core category in a core set of SKUs rather than spreading resources too thinly across unrelated areas.

5. Believing Consumer Research Is Only for Big Brands

Emerging CPG brands often make the mistake of skipping consumer research because they believe it’s only necessary for larger companies with bigger budgets.

Consumer research isn’t only for the industry giants. It is, in fact, smaller brands that often need it more because they have less room for error. Customer feedback analysis is essential for understanding consumer behavior, preferences, and pain points; things that are crucial to either making or breaking a product launch.

If you don’t take the time to understand who your customer is, why they buy, and what problem your product solves, you risk wasting time, money, and shelf space on something the market doesn’t want.

With MetricsCart’s rating and review analysis, decode customer sentiment and spot customer pain points before they become product failures.

What Smart CPG Brands Are Doing Differently

While the failure rate in the CPG space is high, certain brands consistently rise above the noise. These are the ones making deliberate, research-backed moves fueling sustainable growth strategies.

Here’s what you can learn from them to overcome CPG brand challenges:

Start with Fan Research

Smart CPG brands don’t build for everyone; they build for someone. They begin by deeply understanding a small, passionate segment of consumers. You need to understand the people who will love your brand and product before scaling.

Instead of basing decisions on assumptions or broad demographic guesses, successful CPG brands engage in fan research early. They ask:

- Who is already excited about this product or category?

- What are their daily pain points?

- What language do they use to describe the problem the product solves?

- What is the why behind repeat customer buys?

Paying attention to the voice of the customer reduces the guesswork and guides everything from product formulation to messaging.

It builds a strong foundation of loyal customers who can become brand advocates. These early fans often fuel repeat purchases and influence others, which leads to sustainable revenue and a stronger product-market fit.

Obsess Over Your Core Category

Spreading too thin, too fast, is one of the top reasons why CPG brands fail. Winning brands do the opposite. They go deep, not wide.

The top CPG brands expand within their core category first. Rather than chasing every new trend or product type, smart brands:

- Perfect one product or line before moving to the next

- Study the buyer’s habits and needs within that specific category

- Build brand authority where it matters most

According to Richardson, growth isn’t about more SKUs. It’s about nailing a core set of products and relentlessly fine-tuning based on real consumer feedback.

Shoppers don’t buy based on the number of SKUs a brand has. They buy based on whether the product solves a specific problem better than anything else. By mastering one category, brands earn trust, and trust builds lasting customer relationships.

Specialization enables deeper consumer insights, improved shelf presence, and more targeted marketing. It’s a strategic edge in a cluttered market where clarity wins.

Prototype Before You Scale

Scaling before validating is one of the most common CPG mistakes and a fast path to failure. Smart brands take the time to test and iterate.

Effective prototyping means:

- Launching in limited geographies or digital channels

- Testing different versions of the product or packaging

- Gathering real customer feedback in real-world scenarios

It helps identify issues before they become expensive. Whether it’s pricing, taste, usability, or shelf impact, testing small reduces risk and improves your odds when it’s time to scale.

It preserves capital, improves product quality, and makes scaling more efficient. Brands avoid the trap of re-launching or over-correcting after failure.

Invest in Awareness, Not Just Distribution

Distribution gets your product on the shelf. Awareness gets it into carts. Smart brands understand that without consumer pull, shelf space means nothing.

You can’t just flood the market with products and expect people to find them. Investing in building brand awareness is just as critical as expanding distribution channels. Here’s how:

- Build a distinct brand story

- Invest in paid and organic marketing to educate consumers

- Create demand that matches or outpaces their supply

Why does this matter? Consumers won’t buy what they don’t recognize. Brands that prioritize awareness foster connection, brand recall, and preference.

And here’s where data gives you the edge. MetricsCart’s thematic review analysis helps brands identify feedback trends across time, both positive and negative. It highlights recurring themes in customer reviews, such as taste, portion size, packaging concerns, or use-case confusion.

These insights highlight knowledge gaps and give you direct input from your audience: what they like, what they don’t, and what they still don’t understand.

Use this information to refine messaging, update creatives, or launch campaigns that address real consumer questions. That’s how you close the loop between awareness and conversion: by acting on what your customers are already thinking.

Strong awareness supports sustainable, higher velocity, drives word-of-mouth, and improves share of mind. Retailers love brands that bring their own customer base, and those are the brands that stick.

READ MORE | Want to know how top CPG brands are crushing it online? Check out How CPG Brands are Winning on the Digital Shelf?

Final Thoughts

Now that we know why CPG brands fail, it is evident that most CPG brand failure reasons are rooted in the fact that they miss what’s happening on the shelf.

Without a pulse on real-time data on pricing, category competitors, consumer insights, and customer sentiment, brands miss key opportunities, or worse, lose control over how their products are presented and perceived.

MetricsCart helps brands fix that. With a full suite of digital shelf analytics tools, MetricsCart gives you the data you need to compete, grow, and win as a scaling CPG brand.

We deliver insights that drive better decisions. From identifying review trends to benchmarking against competitors and tracking every metric that matters, brands like yours can adapt faster and scale smarter.

Ready To Scale Your Brand and Drive Results? Unlock Your E-Commerce Potential Today!

FAQs

The CPG industry faces challenges like fierce competition, shifting consumer preferences, and pressure to innovate. Brands also struggle with managing supply chains, pricing consistency, and maintaining brand loyalty.

CPG brands often deal with high operating costs, price wars, and the constant need to differentiate in a crowded market. Additionally, supply chain disruptions and rising material costs can further impact profitability.

The biggest challenges in 2025 will likely include adapting to consumer demand for sustainability, competing in an increasingly digital-first marketplace, and balancing product quality with affordability in a global supply chain.

The CPG industry includes products like food, beverages, household goods, and personal care items. These products are typically sold through retail channels, both in-store and online.

New product failure is often due to poor market research, lack of differentiation, misaligned product-market fit, inadequate marketing, and weak consumer demand.